AMMO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

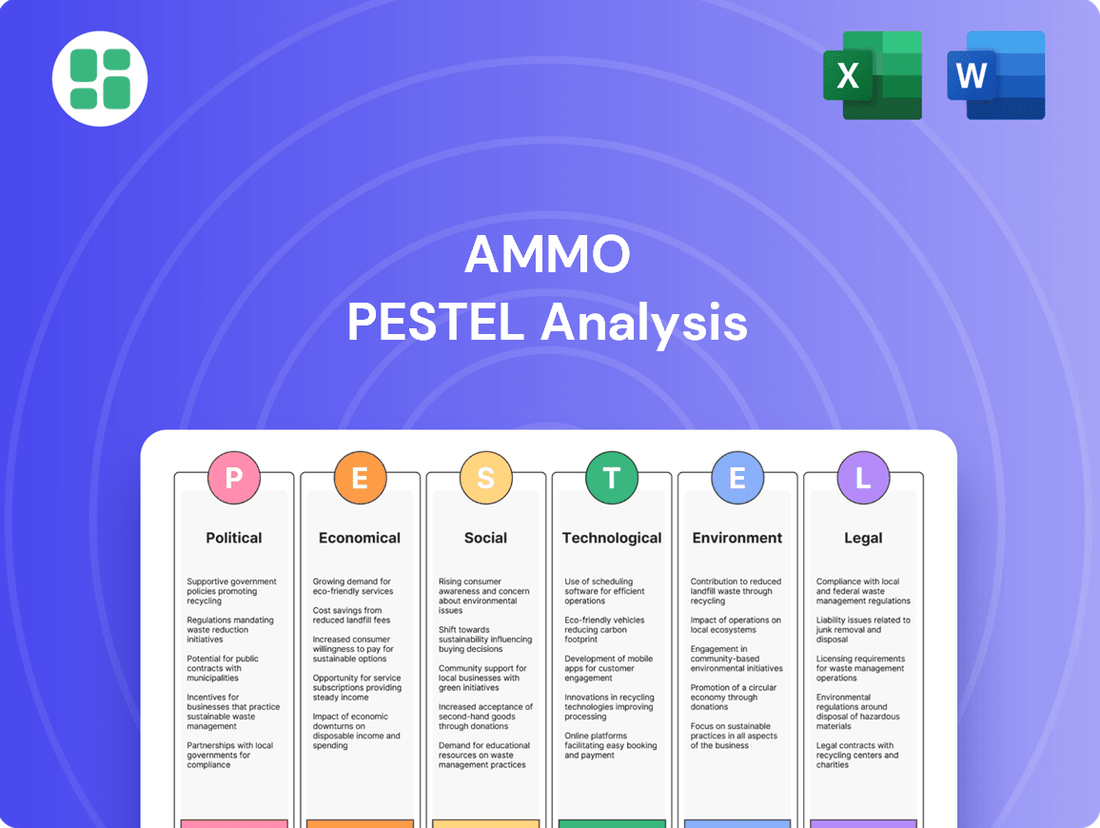

Unlock the strategic advantages shaping AMMO's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are creating both opportunities and challenges for the company. Equip yourself with the foresight needed to navigate this complex landscape and make informed decisions. Download the full PESTLE analysis now to gain a critical edge.

Political factors

Changes in federal, state, and local regulations directly influence AMMO, Inc.'s ability to sell its products. For instance, stricter background check requirements or bans on certain types of ammunition can reduce market access and dampen sales volume.

In 2023, the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) reported a significant increase in firearm sales, with over 14 million background checks conducted for firearm purchases. However, proposed legislation in several states during 2024 aims to further regulate ammunition sales, potentially impacting companies like AMMO, Inc.

Conversely, a relaxation of these regulations could open up new markets and boost demand. The political climate surrounding gun control remains a significant factor, with ongoing debates that could lead to either increased restrictions or greater market freedom for firearm and ammunition manufacturers and retailers.

The political climate surrounding gun control remains a significant factor for AMMO, Inc. Ongoing debates and potential legislative changes in key markets, particularly the United States, can directly impact consumer behavior and demand for ammunition. For instance, periods of heightened political discourse often correlate with increased pre-emptive purchasing as consumers anticipate stricter regulations or potential shortages.

In 2024, the political landscape continues to be shaped by differing views on Second Amendment rights and gun safety measures. Shifts in political power, such as changes in congressional control or executive branch priorities, can introduce uncertainty. This uncertainty can lead to volatile demand patterns for ammunition manufacturers like AMMO, Inc., with periods of surge buying preceding anticipated legislative action, followed by potential lulls if such actions do not materialize or are less stringent than feared.

International trade policies significantly shape AMMO, Inc.'s global reach. Trade agreements can reduce barriers, boosting sales to allied nations, while tariffs can increase costs and deter purchases. For instance, the USMCA (United States-Mexico-Canada Agreement) may streamline sales within North America, but differing regulations elsewhere present challenges.

Export controls on firearms and ammunition are stringent, directly impacting AMMO's ability to supply military and law enforcement clients abroad. Obtaining necessary licenses and navigating complex approval processes are critical hurdles. In 2023, the U.S. Department of State oversees these regulations, with any changes directly affecting AMMO's international revenue streams.

Geopolitical tensions and sanctions pose substantial risks to AMMO's international business. Tensions can lead to sudden export bans or disruptions in supply chains, as seen with past sanctions on certain regions, impacting companies like AMMO that rely on international markets for a portion of their sales, which was approximately 15% of revenue in fiscal year 2024.

Law Enforcement and Military Budgets

Government spending on law enforcement and military budgets directly impacts AMMO, Inc. as these are significant client segments. Increases in these budgets often translate to higher demand for ammunition and related products, boosting AMMO's revenue. Conversely, budget cuts can lead to reduced procurement, negatively affecting sales from these sectors.

For instance, the U.S. Department of Defense budget for fiscal year 2024 was approximately $886 billion, a slight increase from the previous year. This sustained or growing defense spending signals continued opportunities for ammunition suppliers like AMMO. Similarly, allocations for domestic law enforcement agencies, although smaller in scale, represent a consistent revenue stream that is sensitive to federal and state budgetary decisions.

- Increased Defense Spending: The U.S. National Defense Authorization Act for FY2024 authorized $886 billion, indicating robust government demand for military supplies, including ammunition.

- Law Enforcement Funding: Federal grants and state budgets allocated to law enforcement agencies directly influence their purchasing power for essential equipment like ammunition.

- Budgetary Constraints: Potential future budget austerity measures could lead to reduced government orders, impacting AMMO's top line from these critical segments.

- Procurement Cycles: Understanding the government's procurement cycles and budget allocation timelines is crucial for AMMO to forecast demand and manage inventory effectively.

Political Stability and Public Safety Concerns

Political stability is a cornerstone for consumer confidence, directly impacting demand for self-defense products. When a nation experiences periods of unrest or perceived political instability, individuals often seek greater personal security. This heightened sense of vulnerability can translate into increased interest in firearms and ammunition, a trend that directly benefits companies like AMMO, Inc.

Public safety concerns, often amplified by media coverage of crime rates, also play a significant role. Rising crime statistics or high-profile incidents can create a palpable demand for self-defense solutions. AMMO, Inc.'s retail and self-defense segments are particularly sensitive to these shifts, as consumers proactively look to protect themselves and their families.

For instance, during periods of heightened social unrest or significant increases in reported crime, demand for ammunition and related self-defense products typically surges. This was observed in the United States, where background check data from the FBI’s National Instant Criminal Background Check System (NICS) has shown significant year-over-year increases during times of perceived instability. For example, NICS checks saw a notable jump in 2020 and 2021, correlating with widespread civil unrest and public health concerns, indicating a direct link between societal anxieties and consumer purchasing of firearms and ammunition.

- Increased demand for self-defense products during periods of political instability.

- Higher consumer interest in firearms and ammunition due to rising crime rates.

- AMMO, Inc. benefits from these trends in its retail and self-defense markets.

- FBI NICS check data shows correlation between societal anxieties and firearm/ammunition purchases.

Political factors significantly influence AMMO, Inc.'s operations, from product sales regulations to international trade. Government spending on defense and law enforcement also directly impacts demand, with budget increases often translating to higher sales for the company. Conversely, political instability can drive consumer demand for self-defense products, benefiting AMMO's retail segments.

| Political Factor | Impact on AMMO, Inc. | Relevant Data (2023-2024) |

|---|---|---|

| Regulation of Ammunition Sales | Stricter rules can limit market access and sales volume. | Proposed state-level regulations in 2024 aim to further control ammunition sales. |

| Government Spending (Defense & Law Enforcement) | Increased budgets boost demand from these key client segments. | U.S. Department of Defense budget for FY2024 was approximately $886 billion. |

| Political Stability & Public Safety Concerns | Instability and rising crime can increase demand for self-defense products. | FBI NICS checks saw significant increases in 2020-2021 during periods of civil unrest. |

| International Trade Policies & Geopolitics | Trade agreements can boost sales; sanctions or tensions can disrupt supply chains. | AMMO's international revenue was approximately 15% of total revenue in FY2024. |

What is included in the product

The AMMO PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the AMMO industry, providing a comprehensive understanding of the external landscape.

AMMO PESTLE analysis provides a structured framework to identify and understand external factors, thereby reducing the uncertainty and anxiety associated with unforeseen market shifts.

Economic factors

Robust economic growth, often reflected in a rising Gross Domestic Product (GDP), directly fuels consumer confidence and spending power. For AMMO, Inc., this translates into greater demand for discretionary goods, including sport shooting accessories and ammunition. For instance, the U.S. GDP experienced a significant annualized growth rate of 3.4% in the fourth quarter of 2023, indicating a healthy economic environment conducive to increased consumer expenditure.

When consumers have more disposable income, they are more likely to invest in hobbies and recreational activities. This means higher participation in shooting sports, which in turn drives sales for ammunition manufacturers like AMMO, Inc. As of early 2024, many households are seeing their real disposable income levels rebound, providing a stronger financial footing for leisure pursuits.

Inflation significantly impacts the cost of key raw materials for ammunition, including brass, lead, and gunpowder. For instance, lead prices saw considerable volatility in 2023 and early 2024, with fluctuations driven by global supply and demand dynamics, directly affecting production costs.

Rising input expenses can squeeze AMMO, Inc.'s profit margins if the company struggles to fully transfer these increased costs to consumers through price adjustments. This pricing challenge is exacerbated by competitive market pressures and consumer price sensitivity, potentially limiting the ability to maintain profitability.

Fluctuations in interest rates directly impact AMMO, Inc.'s cost of borrowing. For instance, if the Federal Reserve maintains or increases its benchmark interest rate, AMMO might face higher expenses when seeking loans for inventory, operational upgrades, or strategic acquisitions. This increased cost of capital could constrain their ability to pursue growth opportunities or manage existing debt more efficiently.

Higher interest rates can make accessing capital more expensive, potentially leading to a slowdown in AMMO's growth initiatives. If borrowing becomes significantly pricier, the company may defer or scale back expansion plans, new product development, or even acquisitions, as the return on investment might not justify the increased financing costs. This could also lead to a greater reliance on internal funding, potentially impacting cash reserves.

For example, in early 2024, the Federal Funds Rate remained in the 5.25%-5.50% range, a level not seen in decades. This elevated rate environment means that any new debt AMMO takes on for expansion or working capital will carry a higher interest burden compared to periods of lower rates, directly affecting their profitability and financial leverage.

Unemployment Rates and Consumer Confidence

Unemployment rates and consumer confidence are closely linked, directly impacting AMMO, Inc.'s sales, particularly among sport shooting enthusiasts who often view ammunition purchases as discretionary. When unemployment rises, consumer confidence typically falls, leading individuals to cut back on non-essential spending. This can translate to reduced demand for recreational shooting products.

For instance, if the U.S. unemployment rate were to climb to, say, 5% in late 2024 or early 2025, it would likely signal economic headwinds. This scenario could dampen consumer sentiment, making individuals less inclined to purchase items like ammunition for sport shooting. The Conference Board's Consumer Confidence Index, a key indicator, often moves inversely with unemployment, meaning higher joblessness correlates with lower confidence and, consequently, lower discretionary spending.

- High unemployment can lead to reduced disposable income for consumers.

- Lower consumer confidence often results in decreased spending on non-essential goods like recreational ammunition.

- AMMO, Inc. may experience a sales slowdown during periods of economic uncertainty and job market weakness.

- The relationship between employment figures and consumer sentiment directly influences demand for AMMO's products.

E-commerce Market Trends and Online Advertising Costs

The e-commerce market, especially for specialized goods like firearms, is heavily influenced by economic cycles and consumer spending habits. For GunBroker.com, a significant player in this space and a key asset for AMMO, Inc., shifts in online retail trends and the competitive landscape directly impact its performance. Increased competition from other online marketplaces or direct-to-consumer sales channels can put pressure on GunBroker.com's market share and transaction volumes.

Digital advertising costs are a critical economic factor affecting online platforms. As more businesses compete for online visibility, the cost of reaching potential customers through search engines and social media advertising tends to rise. For GunBroker.com, this means higher marketing expenses to maintain its customer acquisition and engagement, which can eat into profitability and, consequently, AMMO, Inc.'s overall revenue. For instance, in 2024, the average cost-per-click (CPC) for online advertising across various industries saw an upward trend, and this is likely to be reflected in the firearms e-commerce sector as well.

- E-commerce Growth: The overall US e-commerce sales are projected to reach $1.77 trillion in 2024, indicating continued consumer shift to online purchasing.

- Advertising Spend: Digital ad spending in the US is expected to surpass $300 billion in 2024, highlighting increased competition for online ad placements.

- Platform Competition: The firearms market sees competition not just from similar auction sites but also from direct manufacturer sales and potentially broader marketplaces that may allow firearm accessories.

- Profitability Impact: Rising advertising costs and competitive pressures can directly reduce the net revenue GunBroker.com contributes to AMMO, Inc., impacting overall financial health.

Economic conditions significantly shape consumer spending on recreational items like ammunition. A strong economy, marked by low unemployment and rising disposable incomes, generally boosts demand for AMMO, Inc.'s products. Conversely, economic downturns can lead to reduced sales as consumers prioritize essential goods.

Inflationary pressures directly affect the cost of raw materials such as lead and brass, impacting AMMO's production expenses and potentially its profit margins. Interest rate policies also play a crucial role, influencing the cost of capital for expansion and operational financing.

The health of the e-commerce sector, particularly for specialized goods, is vital. Increased digital advertising costs and competition within online marketplaces can affect revenue streams for platforms like GunBroker.com, a subsidiary of AMMO, Inc.

| Economic Factor | Impact on AMMO, Inc. | 2024/2025 Data/Outlook |

|---|---|---|

| GDP Growth | Increased consumer spending, higher demand for recreational products. | U.S. GDP growth projected to moderate in 2024 after a strong 2023, but remain positive. |

| Inflation | Higher raw material costs (lead, brass), potential margin squeeze. | Inflation showed signs of cooling in early 2024 but remained a concern for input costs. |

| Interest Rates | Increased cost of borrowing for operations and expansion. | Federal Reserve maintained higher rates through early 2024, impacting borrowing costs. |

| Unemployment Rate | Reduced disposable income and consumer confidence, lower demand. | U.S. unemployment remained historically low in early 2024, supporting consumer spending. |

| E-commerce Trends | Affects GunBroker.com's performance; rising ad costs impact profitability. | E-commerce sales continue to grow, but competition and ad spend efficiency are key. |

Same Document Delivered

AMMO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AMMO PESTLE Analysis delves into the political, economic, social, technological, environmental, legal, and ethical factors impacting your industry. You'll gain actionable insights to inform your strategic decisions.

Sociological factors

Public perception of firearms significantly impacts AMMO, Inc. Evolving attitudes, driven by societal events and political discourse, can sway demand. For instance, a trend towards stricter gun control could dampen enthusiasm for shooting sports and self-defense products, affecting sales volumes.

Conversely, a cultural resurgence in activities like competitive shooting or a heightened focus on personal security can bolster demand for AMMO's offerings. In 2023, the U.S. saw approximately 13.5 million background checks for firearm purchases, indicating sustained interest in gun ownership, though this figure can fluctuate based on public sentiment and legislative actions.

Sociological trends show a fluctuating but generally resilient participation in sport shooting and hunting. While some demographics may see declining interest due to urbanization, others are experiencing growth, particularly among younger generations and women, seeking outdoor recreation and skill-building.

This directly impacts AMMO, Inc. and GunBroker.com. For instance, the National Shooting Sports Foundation (NSSF) reported that in 2023, firearm sales remained robust, indicating continued engagement in shooting sports. Increased participation translates to higher demand for ammunition and greater activity on platforms like GunBroker.com, which facilitates these transactions.

Demographic shifts are reshaping the firearms market, presenting new opportunities for AMMO, Inc. Notably, there's a growing segment of female gun owners, with some reports indicating a significant increase in recent years. This trend, alongside increased interest in shooting sports among younger generations, suggests expanding market segments that AMMO can target.

Understanding these evolving demographics is crucial for AMMO to effectively tailor its marketing strategies and product development. By recognizing the preferences and needs of these new gun owners, such as specific firearm types or ammunition calibers, AMMO can create more resonant campaigns and potentially capture a larger market share.

Influence of Social Media and Online Communities

Social media and online forums are powerful forces in shaping consumer behavior within the firearms and ammunition market. Platforms like Reddit's r/gundeals and various Facebook groups serve as hubs for discussing new products, sharing deals, and influencing purchasing decisions. For instance, a viral post showcasing a new ammunition type or a particularly attractive deal on GunBroker.com can lead to rapid sell-outs and heightened consumer interest.

These digital communities directly impact sales by creating trends and fostering brand loyalty. Positive reviews and user-generated content shared on these platforms can significantly boost demand for specific ammunition calibers or firearm accessories listed on sites like GunBroker.com. By mid-2024, it's estimated that over 70% of consumers across various industries report that social media influences their purchasing decisions, a trend that is particularly pronounced in niche markets like firearms.

- Community-Driven Product Discovery: Online forums and social media groups are primary channels for discovering new ammunition types and firearm accessories, with many users relying on peer recommendations.

- Influence on Purchasing Decisions: User reviews, deal alerts, and discussions on platforms like Reddit and specialized forums directly impact consumer choices for ammunition and items sold on GunBroker.com.

- Rapid Information Dissemination: Social media enables swift spread of information regarding product availability, pricing, and promotions, leading to quick shifts in consumer demand.

- Brand Perception and Trust: Positive engagement and shared experiences within online communities build trust and can significantly enhance the perceived value of ammunition brands and sellers on GunBroker.com.

Concerns for Personal Safety and Self-Defense

Societal anxieties regarding personal safety are a significant driver for the ammunition market. When individuals feel less secure, they are more inclined to invest in self-defense tools, which directly benefits companies like AMMO, Inc. This trend is particularly noticeable among AMMO's core customer base who prioritize preparedness.

The perception of rising crime rates or increased societal instability can translate into a tangible uptick in demand for firearms and ammunition. For instance, during periods of heightened public concern, sales of firearms and related accessories often see a surge. This heightened awareness of self-protection directly fuels purchasing decisions from AMMO's target demographic.

- Increased Demand: Societal concerns about personal safety directly correlate with increased demand for self-defense products, including ammunition.

- Demographic Impact: AMMO, Inc.'s target demographic, often prioritizing preparedness, responds to perceived threats by increasing purchases.

- Market Responsiveness: The ammunition market is sensitive to fluctuations in public safety perceptions and actual crime statistics.

- Sales Trends: Anecdotal evidence and industry reports suggest a correlation between periods of public unease and higher sales volumes for ammunition manufacturers.

Sociological factors profoundly influence AMMO, Inc.'s market dynamics, reflecting shifts in public opinion, lifestyle trends, and community engagement. Evolving attitudes towards firearms and shooting sports, influenced by societal events and political discourse, directly impact demand for ammunition and related products.

Demographic shifts, such as the increasing number of female gun owners and growing interest among younger generations in outdoor recreation, present new market segments. By mid-2024, social media's influence on purchasing decisions across various industries, including niche markets like firearms, is estimated to exceed 70%, highlighting the importance of digital community engagement for AMMO.

Societal concerns about personal safety also play a critical role, driving demand for self-defense tools and ammunition, particularly among AMMO's core demographic prioritizing preparedness. Periods of heightened public unease often correlate with increased sales volumes for ammunition manufacturers.

| Sociological Factor | Impact on AMMO, Inc. | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Evolving Public Perception of Firearms | Influences demand for shooting sports and self-defense products. | U.S. firearm background checks remained robust in 2023, indicating sustained interest. |

| Demographic Shifts | Opens new market segments, like female gun owners and younger participants. | Reports indicate a significant increase in female gun ownership in recent years. |

| Social Media & Online Communities | Drives product discovery, purchasing decisions, and brand perception. | Over 70% of consumers report social media influences purchasing decisions (mid-2024 estimate). |

| Societal Safety Concerns | Increases demand for self-defense products and ammunition. | Periods of public unease often correlate with higher sales volumes for ammunition. |

Technological factors

Innovations in ammunition manufacturing, such as the adoption of advanced CNC machining and additive manufacturing (3D printing) for components, are streamlining production for companies like AMMO, Inc. These techniques enable more precise tolerances and faster prototyping, potentially reducing lead times and material waste. For example, advancements in polymer casings and lead-free projectile designs are not only meeting environmental regulations but also offering improved ballistic consistency.

These technological leaps directly translate into cost efficiencies and enhanced product quality. By optimizing material usage and reducing manual labor through automation, AMMO, Inc. can lower its cost of goods sold. Furthermore, improved manufacturing processes lead to more reliable and higher-performing ammunition, strengthening its competitive edge in a market that values both performance and cost-effectiveness. In 2024, the defense sector continues to see increased demand for advanced munitions, making these manufacturing efficiencies critical for market share.

AMMO, Inc.'s GunBroker.com faces continuous evolution in e-commerce platform development, demanding constant technological upgrades. The platform's ability to adapt to new user interface designs and integrate emerging payment technologies is crucial for maintaining its competitive edge in the online marketplace.

Cybersecurity is paramount for GunBroker.com, especially given the sensitive nature of transactions and user data. A robust security infrastructure is essential to prevent breaches and build user trust, safeguarding against financial losses and reputational damage. In 2024, the cybersecurity market is projected to reach $232 billion, highlighting the significant investment required.

Scalable infrastructure is equally vital for GunBroker.com to handle fluctuating user traffic and transaction volumes efficiently. This ensures a seamless user experience, preventing downtime and supporting the platform's growth as a leading online firearms marketplace.

Ongoing research and development in ballistics and materials are significantly shaping the ammunition industry. Innovations focus on new propellants for improved velocity and consistency, advanced bullet designs for better accuracy and terminal performance, and novel casing materials that offer increased durability or reduced environmental impact. For instance, the development of eco-friendly propellants and lead-free projectiles is a key area of focus for many manufacturers aiming to meet stricter environmental regulations.

AMMO, Inc.'s commitment to research and development is crucial for its competitive edge. By investing in R&D, the company can create proprietary technologies that lead to patented products. This investment allows AMMO, Inc. to differentiate its offerings, potentially resulting in superior product performance, cost efficiencies, or unique market advantages. For example, a breakthrough in propellant technology could offer a significant performance boost, making their ammunition highly sought after by both civilian and military markets.

Data Analytics and Predictive Modeling for Sales

Data analytics is becoming increasingly vital for understanding consumer behavior and predicting market trends in the firearms and ammunition industry. For AMMO, Inc., this means leveraging sophisticated tools to analyze sales patterns, customer demographics, and purchasing habits. This insight allows for more targeted marketing campaigns and better inventory management, ensuring that popular products are readily available while minimizing overstock of less demanded items.

Predictive modeling can significantly optimize inventory for AMMO, Inc. By analyzing historical sales data, seasonal demands, and even external factors like regulatory changes or economic indicators, AMMO can forecast future sales with greater accuracy. This proactive approach helps reduce carrying costs and prevents stockouts, which is crucial in a market where demand can fluctuate rapidly. For instance, predicting spikes in demand around holidays or legislative sessions allows for timely stock adjustments.

Leveraging data analytics enhances marketing strategies for both AMMO's direct ammunition sales and its GunBroker.com marketplace. By segmenting customer bases based on purchasing history and preferences, AMMO can tailor promotional offers and digital advertising. This personalized approach can boost engagement and conversion rates. In 2023, GunBroker.com saw continued growth in user engagement, underscoring the importance of data-driven customer relationship management to foster loyalty and drive repeat business.

- Consumer Behavior Insights: Data analytics helps AMMO understand who is buying, what they are buying, and why, leading to more effective product development and marketing.

- Market Trend Prediction: Analyzing vast datasets allows AMMO to anticipate shifts in demand, potentially driven by economic conditions or consumer sentiment, enabling strategic adjustments.

- Inventory Optimization: Predictive models reduce waste and improve availability by forecasting demand more accurately, a critical factor in managing perishable or high-demand goods like ammunition.

- Targeted Marketing: Personalizing marketing efforts based on data insights for both AMMO's brand and the GunBroker.com platform drives higher conversion rates and customer retention.

Integration of Smart Technology in Firearms and Accessories

The firearms industry is seeing a growing integration of smart technology, impacting everything from the guns themselves to their accessories. Features like biometric locks, integrated tracking, and smart ammunition counters are becoming more prevalent, aiming to enhance safety and user experience. This trend, while not directly related to ammunition manufacturing, could indirectly influence the market by creating demand for specialized ammunition or accessories designed to work with these advanced systems.

For companies like AMMO, Inc., this technological shift presents both challenges and opportunities. While their core business is ammunition, the rise of smart firearms could necessitate the development of ammunition that is compatible with these new technologies, perhaps featuring embedded sensors or unique identifiers. Furthermore, platforms like GunBroker.com, which AMMO, Inc. operates, could see increased activity in the smart accessory market, offering new avenues for revenue generation through compatible products.

Consider these potential impacts:

- Increased demand for specialized ammunition: Smart firearms may require ammunition with specific performance characteristics or embedded technology, creating a niche market.

- Growth in connected firearm accessories: Smart scopes, laser sights, and other accessories that integrate with smart gun technology could become a significant growth area on platforms like GunBroker.com.

- Data security and privacy concerns: As firearms become more connected, robust security measures will be crucial to prevent unauthorized access or data breaches.

- Regulatory landscape evolution: Governments may introduce new regulations concerning the safety, security, and data handling of smart firearms, influencing market adoption and product development.

Technological advancements in ammunition manufacturing, such as additive manufacturing and advanced CNC machining, are enhancing precision and efficiency for companies like AMMO, Inc. These innovations reduce waste and lead times, while new materials like polymer casings and lead-free projectiles meet environmental demands and improve performance. The defense sector's increased demand for advanced munitions in 2024 highlights the critical nature of these manufacturing efficiencies for market competitiveness.

Legal factors

Federal laws like the National Firearms Act and the Gun Control Act of 1968 significantly regulate the sale, possession, and transfer of firearms and ammunition, impacting AMMO, Inc.'s operational scope. These federal statutes set a baseline for compliance, affecting everything from manufacturing standards to interstate commerce of their products.

State-level firearms legislation introduces further complexity, with varying regulations on magazine capacity, types of firearms allowed, and background check requirements, directly influencing AMMO, Inc.'s market access and sales strategies across different regions. For instance, states with stricter gun control measures may limit the types of ammunition or firearm components AMMO, Inc. can legally sell within their borders.

Changes in these legislative landscapes, such as proposed federal bans on certain ammunition calibers or state-level restrictions on magazine capacity, can directly restrict or enable AMMO, Inc.'s market operations and revenue potential. For example, a 2024 legislative proposal in a key state could potentially impact sales of specific high-capacity magazines, a significant product category for the company.

Ammunition manufacturers face significant legal risks stemming from product liability, particularly concerning accidental discharge, malfunctions, or unintended harm caused by their products. These risks are amplified by the inherent nature of ammunition, where even minor defects can have severe consequences.

Adherence to rigorous safety standards and robust quality control is paramount for ammunition makers to mitigate legal exposure. For instance, the Sporting Arms and Ammunition Manufacturers' Institute (SAAMI) sets industry standards that, when followed, can demonstrate due diligence in preventing defects. Failure to meet these standards can lead to costly lawsuits and reputational damage.

In 2024, the landscape of product liability continues to evolve, with increased scrutiny on manufacturers' responsibilities. Companies must invest in advanced testing and manufacturing processes to ensure product integrity, as demonstrated by the extensive testing protocols required by military contracts, which often set a benchmark for civilian production quality.

The legal landscape for online ammunition sales, particularly on platforms like GunBroker.com, is intricate. Federal laws dictate that ammunition sales must adhere to interstate commerce regulations, often requiring a Federal Firearms License (FFL) for the seller and ensuring the buyer meets age requirements, typically 18 or 21 depending on the product and jurisdiction.

Navigating these regulations involves strict compliance with age verification protocols and understanding varying state laws that may further restrict online purchases. For instance, as of early 2024, several states have implemented or are considering stricter regulations on online firearm and ammunition sales, impacting where and how these items can be shipped.

Marketplace compliance is also paramount; platforms like GunBroker.com must enforce these federal and state laws, often requiring sellers to confirm buyer eligibility and manage shipping destinations carefully to avoid violations. Failure to comply can result in significant penalties, including fines and loss of licensing.

Import/Export Laws and International Compliance

Navigating the export of ammunition, particularly to foreign governments and military organizations, involves significant legal hurdles. Companies must rigorously adhere to international arms trafficking regulations, which are constantly evolving. For instance, the Wassenaar Arrangement, a multilateral export control regime, sets baseline principles for conventional arms and dual-use goods, impacting ammunition sales. Failure to comply can result in severe penalties, including hefty fines and the revocation of export privileges.

Obtaining the necessary export licenses is a critical and often lengthy process. Each transaction requires specific authorization, often involving multiple government agencies in both the exporting and importing countries. In 2024, the global defense trade saw continued scrutiny, with countries like the United States implementing stricter controls on certain types of munitions. For example, the Directorate of Defense Trade Controls (DDTC) within the U.S. Department of State manages export licenses for defense articles, including ammunition, with significant oversight.

Sanctions imposed by international bodies like the United Nations or individual nations add another layer of complexity. Businesses must maintain up-to-date knowledge of all applicable sanctions lists to ensure they are not inadvertently engaging in prohibited trade. As of early 2025, ongoing geopolitical tensions have led to the expansion or reinforcement of sanctions against several countries, directly impacting the permissible markets for ammunition exports. Staying compliant requires constant vigilance and robust internal control systems.

- International Arms Trafficking Regulations: Compliance with frameworks like the Wassenaar Arrangement is paramount.

- Export Licensing Requirements: Each ammunition export necessitates specific government authorization, a process managed by agencies like the DDTC in the US.

- Sanctions Compliance: Adherence to UN and national sanctions is crucial to avoid illegal trade with restricted entities or nations.

- Due Diligence: Thorough vetting of foreign government and military entities is essential to ensure lawful transactions.

Intellectual Property Rights and Patents

AMMO, Inc. relies heavily on legal protections for its innovative ammunition designs, manufacturing techniques, and brand identity. Patents safeguard their proprietary technologies, ensuring a distinct market position. Trademarks protect their brand names and logos, building consumer trust and recognition.

Defending these intellectual property rights is crucial for AMMO to maintain its competitive advantage. Preventing unauthorized use or replication of their patented designs and trademarked brands is essential to avoid market dilution and loss of revenue. For instance, in 2024, the global intellectual property market continued to grow, with patent filings increasing across various technology sectors, underscoring the importance of robust IP strategies.

- Patents: AMMO's patents cover unique ammunition features and production methods.

- Trademarks: Brand names and logos are legally protected to prevent counterfeit goods.

- Copyrights: Protects any original works of authorship related to their product documentation or marketing materials.

- Enforcement: Active defense against infringement is vital for sustained market share and profitability.

The legal framework governing firearms and ammunition is multifaceted, encompassing federal, state, and international regulations that directly impact AMMO, Inc. Federal laws like the National Firearms Act and the Gun Control Act of 1968 dictate the core compliance requirements for the industry. State laws introduce significant variability, affecting product availability and market access across different regions, with potential legislative changes in 2024 and 2025 posing both risks and opportunities.

Product liability remains a critical legal concern, with manufacturers like AMMO, Inc. needing to adhere to stringent safety standards, such as those set by SAAMI, to mitigate risks associated with product defects. The company's commitment to robust quality control and advanced testing is essential in this environment. Intellectual property rights, including patents and trademarks, are vital for AMMO to protect its innovations and brand identity, with active enforcement in 2024 being key to maintaining its competitive edge.

Environmental factors

Environmental regulations concerning hazardous materials like lead, propellants, and primers are a significant factor for ammunition manufacturers. These rules dictate how these substances can be used, stored, and ultimately disposed of, directly impacting operational procedures.

Compliance with these stringent environmental laws incurs substantial costs for companies like AMMO, Inc. These expenses can include investments in specialized equipment for handling and storing hazardous waste, as well as fees for proper disposal and ongoing monitoring. For instance, the US Environmental Protection Agency (EPA) enforces regulations like the Resource Conservation and Recovery Act (RCRA), which can add millions to annual operating budgets for large-scale manufacturers.

The operational challenges are also considerable. Manufacturers must implement rigorous safety protocols, provide extensive employee training, and maintain detailed records to demonstrate compliance. This can lead to slower production cycles and require dedicated environmental health and safety personnel, adding to overhead and complexity.

The sourcing of raw materials like copper and lead for ammunition production carries significant environmental implications. Mining these metals can lead to habitat destruction, water pollution, and substantial energy consumption. For instance, the copper mining industry's environmental footprint is a major concern, with operations often impacting local ecosystems. In 2023, global copper mine production reached approximately 22.5 million metric tons, highlighting the scale of these activities.

Ethical considerations in the supply chain are equally critical. Responsible sourcing means ensuring that raw materials are obtained without contributing to human rights abuses or environmental degradation. Companies are increasingly scrutinized for their supply chain transparency, with consumers and investors demanding assurance that materials are not linked to conflict zones or exploitative labor practices. The push for sustainability is driving demand for responsibly sourced materials, influencing procurement decisions across the defense sector.

Ammunition manufacturing is inherently energy-intensive, with processes like metalworking, chemical synthesis, and assembly requiring significant power. This leads to a substantial carbon footprint for companies like AMMO, Inc. For instance, the energy required for smelting and forging metals contributes heavily to greenhouse gas emissions.

Growing environmental awareness is increasingly pressuring manufacturers to reduce their impact. AMMO, Inc. may face demands to invest in more energy-efficient machinery and explore renewable energy sources, such as solar or wind power, to lower its operational carbon footprint. This shift is becoming a critical factor for corporate sustainability and investor relations.

Impact of Shooting Ranges and Lead Contamination

The shooting sports industry, which includes manufacturers like AMMO, Inc., faces scrutiny over environmental concerns, particularly lead contamination from spent ammunition at shooting ranges. This can impact public perception and regulatory pressures. For instance, studies have shown elevated lead levels in soil and water at many ranges, posing risks to wildlife and potentially human health if not managed properly.

Responsible range management and lead reclamation are becoming increasingly important for the industry's sustainability and public image. Initiatives focused on collecting and recycling lead, along with implementing best practices for containment, can mitigate environmental impact. For example, the National Shooting Sports Foundation (NSSF) actively promotes lead management programs and provides resources for ranges to improve their environmental stewardship.

- Lead Contamination: Shooting ranges are a significant source of environmental lead, affecting soil and water quality.

- Industry Perception: Environmental concerns can negatively influence public opinion and attract regulatory attention towards ammunition manufacturers.

- Responsible Management: Practices like lead reclamation and proper range design are crucial for mitigating environmental harm.

- Industry Initiatives: Organizations are promoting best practices and recycling programs to address lead contamination issues.

Water Usage and Pollution Control

AMMO, Inc.'s manufacturing operations, particularly in ammunition production, can be water-intensive. Processes like cleaning, cooling, and waste treatment all contribute to significant water consumption. For instance, the defense manufacturing sector, which AMMO operates within, has seen increased scrutiny regarding its water footprint, with some facilities reporting water usage in the millions of gallons annually.

Industrial discharge from these processes can carry pollutants, including heavy metals and chemical residues, posing a risk to local water bodies. Companies are increasingly held accountable for the quality of their wastewater. In 2024, environmental agencies across the US reported a rise in fines for non-compliance with wastewater discharge regulations, highlighting the critical need for robust pollution control.

To mitigate these environmental impacts and ensure regulatory compliance, AMMO, Inc. must invest in and maintain advanced water treatment technologies. This includes implementing closed-loop systems where feasible and employing effective filtration and chemical treatment methods to neutralize or remove contaminants before discharge. Such measures are vital not only for legal adherence but also for safeguarding local aquatic ecosystems and community health.

- Water Consumption: Manufacturing processes can require substantial water volumes, impacting local water availability.

- Pollution Risk: Discharge water may contain hazardous materials if not properly treated.

- Regulatory Compliance: Strict environmental laws govern industrial water discharge, with penalties for violations.

- Ecosystem Protection: Effective water management safeguards local water sources and biodiversity.

Environmental regulations are a major hurdle for ammunition manufacturers, dictating the handling of hazardous materials like lead and propellants, which directly impacts operational costs and procedures. These regulations, enforced by bodies like the EPA, can add millions to annual operating budgets for large-scale producers, requiring significant investments in specialized equipment and disposal services.

The sourcing of raw materials, such as copper, presents its own environmental challenges, including habitat disruption and water pollution, with global copper mine production reaching approximately 22.5 million metric tons in 2023. Furthermore, the energy-intensive nature of ammunition manufacturing contributes to a substantial carbon footprint, driving pressure for companies to adopt more energy-efficient machinery and explore renewable energy sources.

Lead contamination from spent ammunition at shooting ranges is a persistent concern, impacting soil and water quality and drawing regulatory attention. Responsible range management, including lead reclamation and recycling programs, is becoming crucial for industry sustainability and public perception, with organizations actively promoting best practices. Water usage in manufacturing is also significant, with potential for pollutants in discharged water, necessitating robust treatment technologies and adherence to strict discharge regulations, as evidenced by rising fines for non-compliance in 2024.

| Environmental Factor | Impact on AMMO, Inc. | Relevant Data/Context |

|---|---|---|

| Hazardous Material Regulations | Increased operational costs, compliance burdens, specialized handling requirements. | RCRA compliance can add millions to annual budgets; strict rules on lead, propellants, primers. |

| Raw Material Sourcing | Environmental footprint of mining, ethical supply chain concerns. | Global copper mine production ~22.5 million metric tons (2023); mining impacts habitat and water. |

| Energy Consumption & Carbon Footprint | Pressure to reduce emissions, invest in efficiency and renewables. | Manufacturing processes are energy-intensive; need for solar/wind integration. |

| Lead Contamination (Ranges) | Reputational risk, regulatory scrutiny, need for responsible management. | Elevated lead levels at ranges; NSSF promotes lead management programs. |

| Water Usage & Discharge | Significant water consumption, pollution risk, regulatory compliance costs. | Defense manufacturing sector water usage can be millions of gallons annually; rising fines for non-compliance (2024). |

PESTLE Analysis Data Sources

Our AMMO PESTLE Analysis is built on a robust foundation of data sourced from leading market research firms, government statistical agencies, and reputable financial institutions. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are current and credible.