AMMO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

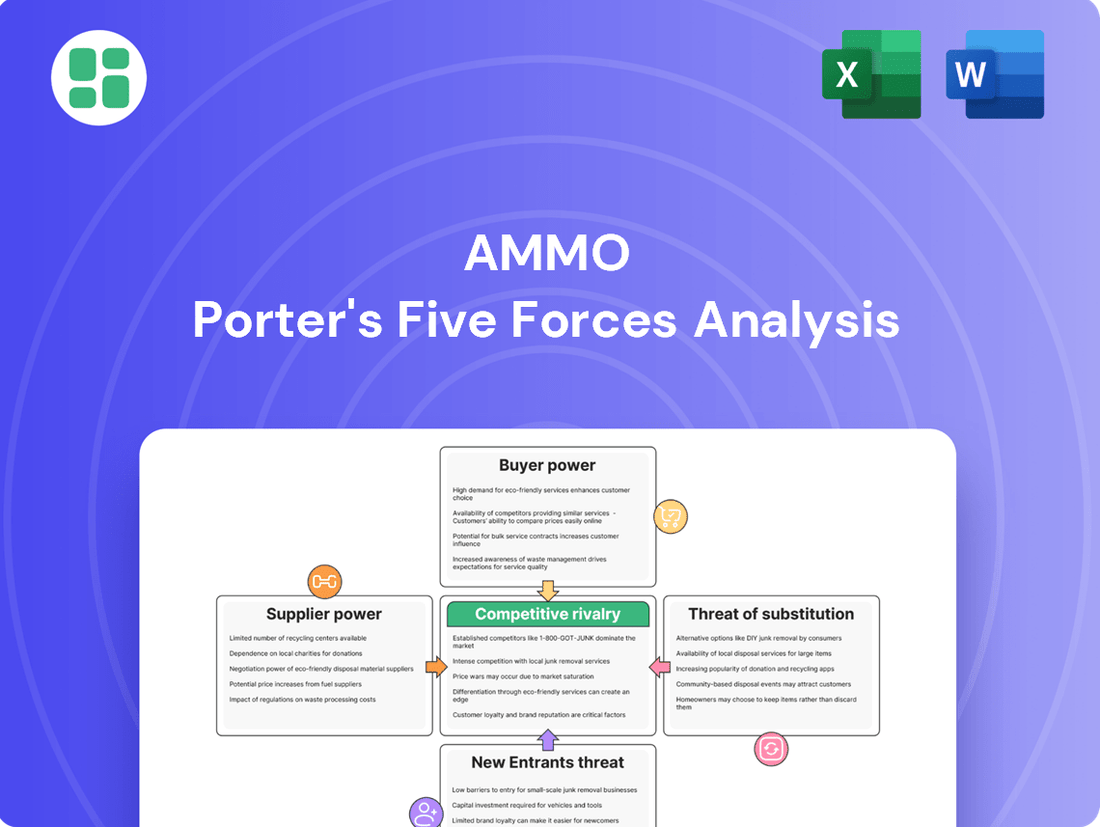

AMMO's competitive landscape is shaped by the interplay of five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any strategic decision-making within the ammunition industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AMMO’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

AMMO, Inc. faces significant supplier power due to its reliance on essential raw materials like copper, lead, and propellants. For instance, copper prices, a key component in many ammunition rounds, saw volatility in 2024, with the commodity trading around $8,000 to $10,000 per metric ton at various points throughout the year. These price swings directly affect AMMO's cost of goods sold.

The availability of these critical inputs is further challenged by global supply chain issues and increasing demand from sectors such as electronics and renewable energy. This heightened competition for raw materials can give suppliers more leverage, allowing them to dictate terms and potentially increase prices, thereby squeezing AMMO's profit margins.

The ammunition sector often faces challenges due to a concentrated supplier base for critical components like primers and specialized propellants. For instance, in 2024, the market for certain high-purity chemical precursors used in gunpowder production remained dominated by a handful of global manufacturers.

This limited supply chain means that disruptions, such as a facility closure by a key primer manufacturer, can swiftly lead to shortages and price hikes. The remaining suppliers, knowing the industry's dependence, gain considerable bargaining power, influencing terms and availability for ammunition producers.

Geopolitical tensions, like those seen in Eastern Europe, significantly impact ammunition supply chains. International sanctions imposed on certain nations can disrupt established trade flows, compelling manufacturers to seek alternative sourcing and production locations. This political instability can bolster the bargaining power of suppliers operating in unaffected regions or those possessing robust, diversified manufacturing capabilities. For instance, in 2023, the global defense industry saw increased demand for ammunition, with some suppliers in countries not subject to sanctions experiencing significant order backlogs and price leverage.

Technological Advancements in Components

Suppliers who invest in and develop advanced propellant and casing technologies, or sustainable production procedures, may gain increased bargaining power. AMMO, Inc. would need to adapt to these advancements to remain competitive, potentially increasing reliance on these innovative suppliers.

For instance, if a key supplier develops a new, more efficient propellant that significantly boosts projectile performance, AMMO might find itself compelled to adopt it, even if it means higher costs, to maintain its product's market edge. This technological leap could shift the supplier's leverage considerably.

- Technological Innovation: Suppliers developing cutting-edge propellant or casing technology can command higher prices and dictate terms.

- Adaptation Necessity: AMMO's need to integrate these advancements to stay competitive increases its dependence on such suppliers.

- Competitive Edge: Failure to adapt to supplier-driven technological improvements could put AMMO at a disadvantage in the ammunition market.

Supplier Consolidation

Supplier consolidation is a significant factor impacting the bargaining power of suppliers for companies like AMMO, Inc. As mergers and acquisitions continue to reshape the ammunition industry, the number of independent component manufacturers is shrinking.

This trend toward fewer suppliers means that remaining suppliers may gain increased leverage. With less competition among themselves, they are better positioned to negotiate terms and influence pricing for essential components. For instance, in 2023, the defense sector saw several notable M&A activities, which could have ripple effects on component sourcing down the line, potentially increasing costs for ammunition producers.

- Reduced Supplier Competition: Mergers and acquisitions consolidate the supplier base, leading to fewer options for ammunition manufacturers.

- Increased Pricing Power: With fewer suppliers, remaining entities can command higher prices for raw materials and components.

- Dictating Terms: Consolidated suppliers may have greater influence in setting payment terms, delivery schedules, and other contractual conditions.

- Impact on AMMO, Inc.: This dynamic directly affects AMMO, Inc.'s cost of goods sold and operational flexibility.

AMMO, Inc.'s bargaining power with its suppliers is weakened by the essential nature of its raw materials, such as copper and propellants, whose prices saw fluctuations in 2024, with copper trading between $8,000 and $10,000 per metric ton. A concentrated supplier base for critical components like primers, dominated by a few global manufacturers in 2024, further amplifies supplier leverage. Geopolitical instability and industry consolidation, including mergers and acquisitions in 2023, also contribute to fewer sourcing options and increased supplier pricing power for AMMO.

| Factor | Impact on AMMO | Supporting Data/Trend |

|---|---|---|

| Raw Material Dependence | Increased cost of goods sold, reduced profit margins | Copper prices ranged from $8,000-$10,000/metric ton in 2024 |

| Supplier Concentration | Limited negotiation power, potential for shortages | Few global manufacturers dominate primer supply (2024) |

| Geopolitical Factors | Disrupted supply chains, reliance on alternative sources | Increased demand and potential price leverage for unaffected suppliers (2023) |

| Industry Consolidation | Fewer sourcing options, stronger supplier terms | Notable M&A activity in defense sector (2023) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to AMMO's unique position in the ammunition industry.

Visualize competitive intensity with a dynamic, interactive dashboard, instantly highlighting key threats and opportunities.

Customers Bargaining Power

AMMO, Inc. serves a wide range of customers, including law enforcement, military, sport shooters, and those focused on self-defense. This variety in its customer base helps to spread out demand, meaning no single group of customers holds excessive sway over the company.

The company's ownership of GunBroker.com further diversifies its revenue streams and customer interactions. This platform connects AMMO with a vast number of buyers and sellers, diluting the bargaining power of any individual customer segment and reinforcing AMMO's market position.

Civilian demand for ammunition, influenced by trends in recreational shooting and personal protection, adds a significant commercial layer to the market beyond government contracts. This consumer-driven demand can lead to swift shortages, as seen in periods of heightened public interest or concern.

When manufacturers face elevated component costs concurrently with a downturn in civilian demand, it can create substantial pressure on their profitability and operational stability. For instance, in early 2024, while demand remained robust for certain calibers, some manufacturers reported increased lead and copper prices, impacting their pricing strategies and margins.

Government and military entities wield considerable bargaining power due to their capacity to award massive contracts, often dictating terms and pricing. For instance, in 2023, the U.S. Department of Defense's procurement spending reached hundreds of billions of dollars, a significant portion of which could be directed towards ammunition. This concentrated demand allows these agencies to negotiate favorable prices, impacting the profitability of suppliers like AMMO, Inc.

Price Sensitivity in Civilian Market

Civilian customers, including recreational shooters and those seeking self-defense options, demonstrate a notable degree of price sensitivity, particularly concerning widely used ammunition calibers. For instance, the average retail price for a box of 9mm ammunition saw fluctuations throughout 2024, with some reports indicating an increase of 5-10% compared to early 2023 levels due to persistent supply chain pressures.

This price sensitivity means that significant cost increases, whether stemming from raw material shortages, increased manufacturing expenses, or new regulatory compliance burdens, can directly impact consumer purchasing behavior. When prices climb, consumers may either scale back their purchases or actively seek out less expensive alternatives, potentially impacting sales volumes for ammunition manufacturers.

- Price Sensitivity: Recreational and self-defense civilian segments are price-conscious, especially for common calibers.

- Impact of Cost Increases: Higher ammunition prices due to supply chain or regulatory issues can lead to reduced consumer spending.

- Consumer Behavior: Customers may decrease purchase frequency or switch to more affordable ammunition brands or calibers.

GunBroker.com's Marketplace Dynamics

AMMO, Inc.'s ownership of GunBroker.com offers a direct-to-consumer avenue, which can diminish customer bargaining power by presenting a vast selection of firearms and related accessories. This integrated model allows AMMO to capture more value and potentially control pricing, as seen in GunBroker.com's consistent transaction volume. In 2023, GunBroker.com facilitated millions of transactions, underscoring its significant market presence.

However, the platform's reliance on active user participation means buyers' satisfaction remains paramount. Features that enhance a buyer's purchasing power, such as competitive pricing and a broad inventory from various sellers, can still exert influence. For instance, if alternative online marketplaces offer significantly better deals or a more user-friendly experience, customers may shift their preference, thereby increasing their bargaining leverage.

- Direct-to-Consumer Channel: AMMO's ownership of GunBroker.com provides a direct sales platform, potentially reducing customer power by offering a wide product range.

- Marketplace Insights: The platform offers valuable data on consumer preferences and purchasing behavior, enabling AMMO to tailor offerings and pricing strategies.

- Buyer Engagement: While AMMO benefits from direct sales, the platform's success hinges on buyer satisfaction and features that empower purchasing decisions, such as competitive pricing and diverse inventory.

- Competitive Landscape: The presence of alternative marketplaces and the ease with which buyers can compare prices and products mean that customer bargaining power is not entirely negated.

The bargaining power of customers for AMMO, Inc. is influenced by both large institutional buyers and the broader civilian market. Government and military contracts represent significant volume, allowing these entities to negotiate favorable terms due to their substantial purchasing power. For example, in 2023, defense procurement spending highlights the scale of these negotiations.

Civilian consumers, particularly in recreational shooting and self-defense, exhibit price sensitivity. Fluctuations in the price of common calibers, such as 9mm ammunition, in 2024 illustrate how easily consumer behavior can shift based on cost. This sensitivity means that increased manufacturing or material costs can directly impact AMMO's sales volumes as consumers seek alternatives.

AMMO's ownership of GunBroker.com provides a direct sales channel, potentially mitigating individual customer bargaining power by offering a wide array of products. However, the platform's success relies on buyer satisfaction, meaning competitive pricing and diverse inventory remain crucial factors that can empower buyers if alternative marketplaces offer superior value.

| Customer Segment | Bargaining Power Factors | Impact on AMMO |

|---|---|---|

| Government/Military | Large contract volumes, ability to dictate terms | Potential for lower margins on large deals, but guaranteed demand |

| Civilian (Recreational/Self-Defense) | Price sensitivity, availability of alternatives, consumer trends | Vulnerability to price wars, need for competitive pricing, demand fluctuations |

| GunBroker.com Users | Access to broad marketplace, ability to compare prices, platform user experience | Opportunity for direct sales, but need to maintain competitive offers and user satisfaction |

Same Document Delivered

AMMO Porter's Five Forces Analysis

This preview showcases the complete AMMO Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the ammunition industry. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, providing actionable insights without any placeholders or surprises. You can confidently download and utilize this comprehensive report to understand market dynamics and strategic positioning.

Rivalry Among Competitors

The ammunition industry, though showing signs of consolidation, remains notably fragmented with a wide array of participants. This includes major defense conglomerates alongside smaller, niche producers, all vying for market share. For companies like AMMO, Inc., this dynamic necessitates a constant focus on innovation and operational efficiency to stay ahead.

This competitive landscape means that pricing pressures can be significant. For instance, in 2023, the global ammunition market was valued at approximately $13.5 billion, with projections indicating steady growth, but this growth is contested by numerous suppliers.

AMMO, Inc. faces intense competition from major global players like General Dynamics, Northrop Grumman, BAE Systems, and Rheinmetall AG. These established giants boast substantial financial resources, extensive manufacturing infrastructure, and significant existing market share, creating a formidable competitive landscape.

Competitive rivalry in the ammunition market is intense, fueled by constant product innovation. Companies are pushing boundaries with new propellant and casing technologies, developing non-lethal options, and improving training ammunition. This drive for advancement means firms must continuously invest in research and development to stay ahead.

Differentiation is key, with manufacturers focusing on superior performance, enhanced accuracy, and increasingly, environmental sustainability in their product offerings. For instance, companies are exploring biodegradable materials for casings and cleaner-burning propellants. This focus on unique selling propositions helps them capture market share amidst fierce competition.

The global ammunition market was valued at approximately $13.5 billion in 2023 and is projected to grow, indicating a dynamic environment where innovation directly impacts a company's competitive standing. Major players like Vista Outdoor and Olin Corporation are heavily invested in R&D to maintain their edge.

Geopolitical Tensions and Defense Spending

Heightened geopolitical tensions worldwide are significantly fueling competition within the defense sector. Nations are prioritizing the modernization of their munitions inventories and bolstering overall defense capabilities, leading to increased government spending. This surge in demand, while beneficial for manufacturers, intensifies the competition for lucrative defense contracts.

Global defense spending saw a notable increase, reaching an estimated $2.44 trillion in 2024, according to the International Institute for Strategic Studies. This rise directly translates to accelerated competition among defense contractors vying for a larger share of these expanded budgets.

- Increased Defense Budgets: Global military expenditure reached approximately $2.44 trillion in 2024, up from $2.24 trillion in 2023.

- Focus on Modernization: Nations are investing heavily in advanced weaponry and ammunition to counter evolving threats.

- Contract Competition: Manufacturers face intensified rivalry for government contracts related to munitions production and upgrades.

- Technological Advancement Race: Companies are compelled to innovate rapidly to meet the demand for cutting-edge defense solutions.

Marketplace Competition (GunBroker.com)

AMMO, Inc.'s GunBroker.com platform contends with a dynamic competitive landscape beyond traditional ammunition sales. Other online marketplaces catering to firearms and shooting sports enthusiasts actively vie for user engagement and transaction volume. This digital competition directly impacts GunBroker.com's ability to capture and retain market share, a critical factor for AMMO, Inc.'s overall financial health.

The online marketplace for firearms and related goods is robust, with several established players and emerging platforms. For instance, GunBroker.com is a significant player, but it faces competition from sites like Armslist.com, which also facilitates peer-to-peer sales of firearms, and various niche forums and auction sites. The success of these competitors hinges on factors such as user experience, breadth of inventory, and commission structures.

- Market Share Dynamics: GunBroker.com, a leading online marketplace for firearms, faces direct competition from platforms like Armslist.com, impacting AMMO, Inc.'s digital revenue streams.

- User Acquisition Costs: Acquiring and retaining users in the online firearms marketplace requires significant investment in marketing and platform development to stay competitive.

- Platform Features: Competitors offering streamlined user interfaces, enhanced search functionalities, and potentially lower transaction fees can draw users away from established platforms.

- Regulatory Environment: Changes in online sales regulations for firearms can also create competitive advantages or disadvantages for platforms operating within this space.

The ammunition industry is characterized by intense rivalry, driven by a blend of large defense contractors and specialized producers. This competition is further amplified by the ongoing global focus on military modernization, with nations significantly increasing defense budgets. For instance, global military expenditure reached approximately $2.44 trillion in 2024, a substantial rise that fuels demand but also intensifies the battle for contracts and market share.

Companies like AMMO, Inc. must continuously innovate to differentiate themselves. This includes developing advanced propellant technologies, improving casing materials, and exploring non-lethal or training ammunition options. The global ammunition market, valued at around $13.5 billion in 2023, sees major players such as Vista Outdoor and Olin Corporation heavily investing in research and development to maintain their competitive edge.

| Competitor | Key Strengths | Market Focus |

|---|---|---|

| General Dynamics | Financial resources, extensive infrastructure | Defense systems, munitions |

| Northrop Grumman | Technological innovation, broad defense portfolio | Aerospace, defense electronics, munitions |

| BAE Systems | Global presence, diverse product lines | Aerospace, defense, security, information technology |

| Rheinmetall AG | European market strength, advanced manufacturing | Automotive, defense, ammunition |

| Vista Outdoor | Consumer and defense markets, brand recognition | Sporting goods, ammunition |

| Olin Corporation | Chemical manufacturing expertise, ammunition division | Chemicals, ammunition |

SSubstitutes Threaten

The increasing demand for eco-friendly and non-lethal ammunition represents a significant substitute threat. As environmental awareness grows, consumers and governments are favoring lead-free and biodegradable alternatives, potentially siphoning demand away from conventional ammunition. For instance, by 2024, the global market for non-lethal weapons, which includes some forms of non-lethal ammunition, was projected to reach over $8 billion, indicating a substantial and growing alternative.

Directed Energy Weapons (DEWs) like lasers and high-power microwaves are emerging as potential substitutes for traditional ammunition, particularly in countering threats such as drones. For instance, the U.S. Army's DE systems have demonstrated effectiveness, with programs like the High Energy Laser Mobile Tactical Vehicle System (HEL MTVS) showcasing its capability. This represents a long-term threat to conventional munitions manufacturers as these technologies mature and become more cost-effective.

Advancements in training technologies, particularly in realistic simulation and virtual reality, pose a growing threat of substitution for traditional live-fire ammunition. These technologies can replicate combat scenarios with high fidelity, potentially reducing the reliance on physical rounds for certain training objectives. For instance, the US Army's investment in advanced simulators aims to decrease live-fire training hours, impacting ammunition demand.

Alternative Self-Defense Methods

For civilian self-defense, a range of non-firearm alternatives exists, such as tasers and pepper spray. These less-lethal options provide consumers with different ways to protect themselves, potentially diverting some demand from traditional ammunition. For instance, the market for personal defense sprays saw significant growth, with sales estimated to reach over $1 billion globally by 2023.

While these substitutes do not directly replace ammunition for firearms, they do offer alternative means of personal protection. This can impact a segment of AMMO, Inc.'s customer base who might opt for these less-lethal devices instead of purchasing firearms and ammunition. The availability of accessible and often less regulated self-defense tools presents a competitive force.

- Non-Firearm Alternatives: Tasers, pepper spray, and other less-lethal devices offer alternative personal protection methods.

- Market Impact: These substitutes can divert potential customers from the ammunition market, affecting demand for AMMO, Inc.'s core products.

- Consumer Choice: Consumers seeking self-defense may choose these alternatives due to perceived ease of use, legality, or lower cost compared to firearms.

Drones and Autonomous Systems

The increasing integration of drones and autonomous systems into military operations presents a growing threat of substitution for certain traditional airborne ammunition. These unmanned aerial systems (UAS) are not only platforms for delivering munitions but are also evolving to perform reconnaissance and strike missions that previously relied on manned aircraft and their associated ordnance.

For instance, the U.S. Department of Defense's Fiscal Year 2024 budget request included significant investments in drone technology, highlighting a strategic shift. While specific figures for ammunition substitution are not directly itemized, the overall trend indicates a potential reallocation of resources away from certain conventional munitions as drone capabilities expand.

- Evolving Warfare Tactics: The battlefield is increasingly leveraging unmanned platforms for precision strikes and surveillance, potentially reducing reliance on traditional airborne munitions in some scenarios.

- Technological Advancements: Drones are becoming more sophisticated, capable of carrying diverse payloads and operating in complex environments, directly challenging the utility of some conventional ammunition types.

- Budgetary Shifts: Defense spending priorities are reflecting this technological evolution, with substantial allocations towards drone development and procurement, which could indirectly impact demand for legacy ammunition systems.

The threat of substitutes for traditional ammunition is multifaceted, encompassing technological advancements and alternative personal protection methods. Emerging technologies like directed energy weapons and sophisticated drone systems offer new capabilities that could reduce reliance on conventional munitions in certain military applications. Furthermore, non-lethal alternatives and advanced training simulations present substitutes for civilian and military sectors, respectively, impacting overall demand.

| Substitute Category | Examples | Potential Impact | 2024 Market Data/Projections |

|---|---|---|---|

| Non-Lethal & Eco-Friendly | Lead-free, biodegradable rounds; Tasers; Pepper spray | Reduces demand for conventional ammunition in civilian and some law enforcement contexts. | Non-lethal weapons market projected over $8 billion (2024); Personal defense spray market >$1 billion (2023). |

| Directed Energy Weapons (DEWs) | Lasers; High-power microwaves | Potential to replace traditional munitions for specific threats like drones. | Ongoing U.S. Army DE system development (e.g., HEL MTVS). |

| Advanced Training Technologies | Virtual reality simulators; Realistic combat simulations | Decreases reliance on live-fire ammunition for training purposes. | U.S. Army investment in simulators to reduce live-fire hours. |

| Unmanned Systems (Drones) | Autonomous strike drones; UAS platforms | May reduce demand for certain airborne munitions as drones perform strike and surveillance roles. | U.S. DoD FY2024 budget includes significant drone technology investment. |

Entrants Threaten

The ammunition manufacturing sector demands significant upfront capital. Establishing a production facility involves acquiring specialized, high-precision machinery, securing land, and constructing or retrofitting buildings, easily running into tens or hundreds of millions of dollars. For instance, building a new, state-of-the-art ammunition plant can cost upwards of $100 million, creating a formidable hurdle for aspiring competitors.

The ammunition industry is deeply entrenched in a web of stringent regulations, demanding rigorous compliance with manufacturing standards, safety protocols, and environmental mandates. These existing barriers already make entry challenging for potential new players.

New environmental and workplace safety regulations, such as updated lead exposure guidelines, can dramatically escalate compliance costs. For instance, in 2024, the Environmental Protection Agency (EPA) proposed stricter regulations on lead dust, which could require significant capital investment in new equipment and processes for ammunition manufacturers, acting as a substantial deterrent to new entrants.

The threat of new entrants in the ammunition market, particularly concerning technical expertise and R&D, is significantly high. Developing and manufacturing high-performance, reliable ammunition requires substantial investment in research and development. For instance, AMMO, Inc. invests heavily in its proprietary technologies, especially for its high-margin rifle cases, setting a high bar for newcomers.

New companies entering this space would need to replicate or surpass this level of technical proficiency and innovation. This includes mastering complex manufacturing processes, ensuring stringent quality control, and staying ahead of evolving ballistic technologies. The substantial upfront capital required for advanced R&D facilities and skilled personnel acts as a considerable barrier, deterring many potential entrants from challenging established players.

Established Supply Chains and Distribution Networks

Established ammunition companies benefit from deeply entrenched supply chains and distribution networks. These existing relationships with raw material suppliers and extensive channels to market are significant barriers for newcomers. For instance, major defense contractors often have long-term agreements for critical components, making it difficult for new entrants to secure consistent and cost-effective inputs.

New entrants would face considerable hurdles in replicating these established networks. Building the trust and infrastructure required to access reliable raw materials and to efficiently distribute products across diverse customer segments, from law enforcement and military to the civilian market, demands substantial time and investment. In 2023, the global defense market was valued at over $2.2 trillion, highlighting the scale of competition and the importance of established market access.

- Established Relationships: Existing players have long-standing ties with key raw material providers, ensuring supply stability.

- Distribution Hurdles: Newcomers must invest heavily to build out national or international distribution capabilities.

- Market Access: Penetrating markets like government contracts or large retail chains requires proven track records and existing networks.

- Cost Disadvantage: Without scale and established logistics, new entrants often face higher per-unit costs for materials and distribution.

Brand Loyalty and Reputation

Brand loyalty in the ammunition sector is a significant barrier to entry. Established companies have cultivated reputations for quality and reliability, fostering deep trust among core customer bases like sport shooters and military procurement. For instance, in 2024, brands like Federal Premium and Hornady continued to dominate market share due to decades of proven performance.

Newcomers face the daunting task of not only matching product quality but also investing heavily in marketing and endorsements to build comparable brand recognition and customer allegiance. This process can take years and substantial capital, making it difficult to displace incumbents.

- Established brands possess decades of proven reliability, fostering strong customer loyalty.

- New entrants require significant investment in marketing to build trust and market acceptance.

- Reputation for quality is paramount, especially for military and competitive shooting segments.

- In 2024, market leaders continued to leverage their established brand equity to maintain premium pricing.

The ammunition industry presents substantial barriers to new entrants due to high capital requirements for specialized machinery and facilities, often exceeding $100 million for a modern plant. Stringent regulations, including evolving environmental and safety standards like those proposed by the EPA in 2024 regarding lead dust, further increase compliance costs and investment needs. Additionally, the significant R&D investment by established players like AMMO, Inc. in proprietary technologies creates a high bar for technical expertise.

Established companies also benefit from deeply entrenched supply chains and distribution networks, making it difficult for newcomers to secure reliable raw materials and market access. For example, long-term agreements with defense contractors for critical components are common. The global defense market's value, exceeding $2.2 trillion in 2023, underscores the scale of competition and the importance of these established channels.

Brand loyalty is another major hurdle, with companies like Federal Premium and Hornady maintaining strong market positions in 2024 due to decades of proven reliability. New entrants must invest heavily in marketing and endorsements to build comparable brand recognition and customer trust, a process that can take years and significant capital.

Porter's Five Forces Analysis Data Sources

Our AMMO Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from reputable financial analysts.