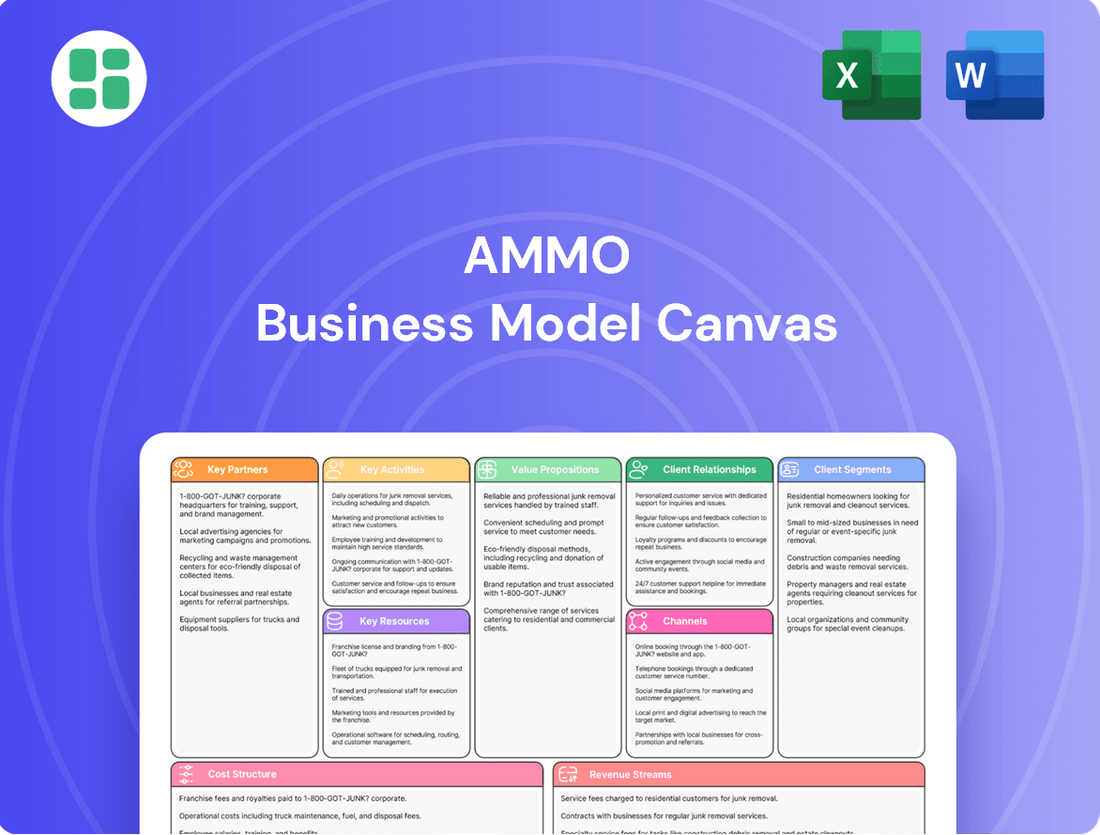

AMMO Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

Unlock the strategic blueprint behind AMMO's innovative business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and revenue streams, offering a clear view of their operational success. Perfect for anyone looking to dissect a thriving company's strategy.

Partnerships

AMMO, Inc. cultivates vital partnerships with suppliers of essential raw materials like brass, lead, and propellants. These relationships are fundamental to ensuring a steady and high-quality output of ammunition, directly impacting production continuity and cost management.

For instance, in 2024, AMMO's ability to secure these critical inputs at competitive prices directly influenced its gross profit margins, which are closely watched by investors. The company actively works to maintain these supplier relationships through long-term contracts and stringent quality assurance agreements, aiming for supply chain resilience.

AMMO relies on a network of specialized logistics and shipping partners to ensure the secure and timely distribution of its products. These partners are critical for reaching law enforcement agencies, military branches, and commercial buyers, navigating the strict regulations surrounding ammunition transport.

In 2024, the global defense logistics market was valued at approximately $240 billion, highlighting the significant investment in secure and efficient supply chains. AMMO's partnerships within this sector are designed to guarantee compliance and minimize delivery disruptions, thereby boosting customer trust and operational efficiency.

AMMO’s collaborations with firearm manufacturers are crucial for aligning ammunition development with new firearm designs, ensuring optimal performance and market fit. This synergy allows AMMO to tailor its products for emerging platforms, a key factor in a dynamic market. For instance, as new handgun calibers gain traction, AMMO can proactively develop and supply compatible ammunition.

Engaging with industry associations, such as the National Shooting Sports Foundation (NSSF) or the Sporting Arms and Ammunition Manufacturers’ Institute (SAAMI), provides AMMO with invaluable market intelligence and regulatory guidance. These partnerships are vital for navigating compliance and understanding evolving consumer preferences. In 2024, the firearms industry continued to see strong demand, with NSSF reporting that over 11 million Americans participated in shooting sports, highlighting the importance of these industry connections.

Retail and Wholesale Distributors

A robust network of retail and wholesale distributors is fundamental for AMMO to effectively reach its target markets. These partnerships are essential for penetrating the broad commercial landscape, serving both sport shooting enthusiasts and individuals prioritizing self-defense. For instance, in 2024, the sporting goods retail sector saw continued growth, with online sales channels becoming increasingly important for ammunition accessibility.

These distributors act as the vital conduits that ensure AMMO's products are readily available to consumers, thereby facilitating wider market penetration. By leveraging these established networks, AMMO can significantly enhance the accessibility of its ammunition offerings. This broad reach is critical for maximizing sales volume and solidifying brand presence across diverse consumer segments.

Key aspects of AMMO's distributor relationships include:

- Broad Market Reach: Partnerships with retailers and wholesalers allow AMMO to connect with a diverse customer base, from recreational shooters to those seeking personal protection.

- Enhanced Accessibility: Distributors ensure that AMMO's products are available in convenient locations and through various purchasing channels, including online platforms.

- Sales Volume Maximization: Effective distribution strategies are directly linked to increasing the overall volume of ammunition sold and strengthening brand recognition within the industry.

Technology and Payment Gateway Providers for GunBroker.com

GunBroker.com’s key partnerships with technology and payment gateway providers are crucial for its operational backbone. These collaborations ensure the platform's stability, security, and ability to handle a high volume of user activity, supporting millions of registered users and visitors. For instance, in 2024, maintaining a robust infrastructure is paramount for an e-commerce site of this magnitude, directly impacting user experience and trust.

The integration with payment gateway providers is particularly vital. These partnerships facilitate secure, compliant, and efficient transactions, which are fundamental to the growth of GunBroker.com’s e-commerce segment. Reliable payment processing is non-negotiable for maintaining customer confidence and ensuring smooth sales for both buyers and sellers on the platform.

- Technology Partnerships: Ensure platform stability, security, and a user-friendly experience for millions of users.

- Payment Gateway Collaborations: Facilitate secure, compliant, and efficient transactions, vital for e-commerce growth.

- Operational Efficiency: These alliances are fundamental to the smooth running and expansion of the online marketplace.

AMMO's key partnerships extend to specialized ammunition component manufacturers, ensuring access to high-quality primers, bullets, and casings. These collaborations are vital for product consistency and innovation, allowing AMMO to meet specific performance requirements for various ammunition types.

In 2024, the global ammunition market experienced robust demand, with sales figures reflecting a strong need for reliable components. AMMO's strategic sourcing from these partners directly impacts its ability to fulfill orders efficiently and maintain competitive pricing.

Furthermore, AMMO engages with research and development institutions to stay at the forefront of ammunition technology. These partnerships foster innovation in areas like material science and ballistics, ensuring AMMO’s product offerings remain advanced and meet evolving market needs.

The company also collaborates with government agencies and military procurement bodies. These relationships are critical for securing large-scale contracts and understanding defense sector requirements, influencing product development and production focus.

What is included in the product

A structured framework detailing the core components of a business, from customer relationships to revenue streams, for strategic planning and operational clarity.

AMMO Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies, making them easier to understand and address.

It alleviates the pain of information overload by condensing all critical business elements onto a single, easily digestible page for rapid analysis and problem-solving.

Activities

The core activity centers on the high-volume production of various ammunition calibers for handguns, rifles, and shotguns, encompassing design and development. This extensive manufacturing capability directly supports the demand from law enforcement, military, and civilian markets.

Stringent quality control is paramount, involving meticulous testing and inspection at every manufacturing stage. This ensures each round meets exacting standards for reliability, safety, and consistent performance, crucial for maintaining customer trust and brand integrity in a competitive sector.

For instance, in 2024, leading ammunition manufacturers like Federal Ammunition reported substantial production increases to meet surging demand, with rigorous testing protocols ensuring less than 0.01% defect rates on average across their product lines.

Managing and improving the GunBroker.com marketplace is a core activity, focusing on user experience and platform stability. This involves maintaining auction and sales functions, ensuring secure transactions, and expanding product offerings. Recent enhancements include launching a cart platform and cross-selling accessories, aiming to boost user engagement and sales efficiency.

Investing in research and development is fundamental for AMMO, Inc. to drive innovation in ammunition technology, exemplified by their patented STREAK™ Visual Ammunition and /stelTH/™ subsonic munitions. This commitment ensures AMMO, Inc. maintains a competitive edge by delivering advanced, specialized products that align with evolving customer demands and market shifts.

AMMO, Inc.'s R&D efforts are focused on exploring novel materials and advanced manufacturing techniques. For instance, in fiscal year 2024, the company continued to invest in its proprietary technologies, aiming to enhance product performance and efficiency. This strategic focus on innovation is crucial for their long-term growth and market leadership.

Sales and Marketing

Developing and executing robust sales and marketing strategies is central to AMMO's business model. This involves reaching diverse customer bases, from law enforcement and military to recreational shooters, and also promoting the GunBroker.com marketplace to a broad audience of buyers and sellers.

AMMO's marketing efforts aim to build strong brand recognition and drive customer acquisition for its ammunition products. For the GunBroker.com platform, marketing focuses on attracting both new users and retaining existing ones, highlighting its extensive inventory and user-friendly interface.

- Targeted Outreach: Strategies are tailored to specific segments, including government contracts for law enforcement and military, and direct-to-consumer campaigns for sport shooting enthusiasts.

- Digital Marketing: Significant investment is placed on online advertising, social media engagement, and search engine optimization to enhance visibility for both ammunition sales and the GunBroker.com platform.

- Platform Promotion: Marketing for GunBroker.com emphasizes its role as a leading online marketplace for firearms and related accessories, encouraging participation from both buyers and sellers.

- Brand Building: Consistent messaging across all channels reinforces AMMO's reputation for quality products and its position as a key player in the firearms industry.

Supply Chain Management

Supply Chain Management is the backbone of AMMO's operations, ensuring a smooth flow from raw material acquisition to the final product reaching customers. This encompasses meticulous inventory control, fostering strong supplier relationships through negotiation, and orchestrating logistics for both cost efficiency and punctual delivery. For instance, in 2024, the defense sector saw significant supply chain challenges, with lead times for certain components extending by up to 20%, making AMMO's proactive management crucial.

Effective supply chain strategies are vital for minimizing operational disruptions and guaranteeing consistent product availability. This proactive approach allows AMMO to adapt to market fluctuations and maintain a competitive edge.

- Optimized Inventory: Maintaining ideal stock levels to meet demand without excessive holding costs.

- Supplier Negotiations: Securing favorable terms and reliable sourcing for raw materials and components.

- Logistics Coordination: Efficiently managing transportation and warehousing to ensure timely product delivery.

- Risk Mitigation: Identifying and addressing potential supply chain vulnerabilities to prevent disruptions.

Key activities for AMMO include the high-volume production of diverse ammunition calibers, underpinned by stringent quality control and continuous research and development into new technologies like their patented STREAK™ Visual Ammunition. The company also focuses on managing and enhancing the GunBroker.com marketplace, driving sales through targeted marketing and robust supply chain management to ensure product availability and cost efficiency.

Delivered as Displayed

Business Model Canvas

The AMMO Business Model Canvas preview you are currently viewing is the exact document you will receive upon purchase. This means you're seeing a direct, unfiltered look at the final deliverable, ensuring there are no surprises in terms of content or formatting. Once your order is complete, you'll gain full access to this same comprehensive and professionally structured Business Model Canvas, ready for your immediate use and customization.

Resources

AMMO, Inc. previously operated specialized manufacturing facilities, including those in Wisconsin, outfitted with advanced machinery for producing ammunition and its components. These physical assets were fundamental to achieving high-volume production and ensuring consistent product quality. In April 2025, AMMO, Inc. divested its ammunition manufacturing assets to Olin Winchester, significantly altering its reliance on these specific facilities.

AMMO's intellectual property, particularly patents for innovative ammunition like STREAK™ Visual Ammunition, represents a core asset. These patents protect unique product designs, offering a distinct market advantage.

Proprietary manufacturing processes are also crucial, ensuring efficiency and quality control. This technological edge is a significant barrier to entry for competitors, reinforcing AMMO's market position.

The GunBroker.com platform's underlying technology and operational framework are substantial intangible assets. In 2023, GunBroker.com facilitated over 1.5 million transactions, highlighting the platform's value and reach.

GunBroker.com is a vital digital asset, serving as a premier online marketplace for firearms and shooting sports. Its value is amplified by a vast database of registered users and a substantial monthly unique visitor count, demonstrating significant market reach.

This platform fosters a powerful network effect, drawing in both buyers and sellers within the firearms industry. As of early 2024, GunBroker.com continues to hold its position as a market leader, facilitating a high volume of transactions and reinforcing its status as a key resource for the AMMO business model.

Skilled Workforce and Management Team

AMMO's skilled workforce, encompassing engineers, production specialists, and IT professionals, is a cornerstone of its operations. These individuals bring essential expertise in ammunition design, advanced manufacturing techniques, and the complexities of e-commerce platforms, directly impacting product quality and operational efficiency.

The management team's strategic vision is paramount, particularly evident in AMMO's transition to a pure-play e-commerce model. This strategic pivot, guided by experienced leadership, is crucial for navigating the evolving market landscape and maximizing reach. For instance, in fiscal year 2024, AMMO reported a significant increase in its customer base through its online platform, underscoring the effectiveness of this strategic direction.

- Skilled Workforce: Engineers, production specialists, IT professionals with expertise in ammunition and e-commerce.

- Management Team: Experienced leaders driving strategic direction, including the e-commerce pivot.

- Impact on Operations: Expertise directly contributes to product quality, manufacturing efficiency, and online sales growth.

- Fiscal Year 2024 Performance: AMMO saw substantial customer acquisition via its e-commerce channels, validating management's strategy.

Financial Capital and Brand Equity

Access to robust financial capital is fundamental for AMMO, Inc.'s continuous operations, enabling crucial investments in cutting-edge technology and supporting ambitious strategic acquisitions or market expansions. This financial strength is a cornerstone for growth.

The significant brand equity held by AMMO, Inc. and its prominent platform, GunBroker.com, directly translates into enhanced customer trust and unwavering loyalty. This established reputation facilitates deeper market penetration and provides considerable pricing power.

- Financial Capital: AMMO, Inc. reported net sales of $57.6 million for the fiscal year ended March 31, 2024, demonstrating its operational revenue generation capability.

- Brand Equity: GunBroker.com, as a leading online marketplace for firearms and accessories, holds substantial brand recognition and user engagement within its niche market.

- Strategic Maneuverability: A solid financial footing empowers AMMO to execute strategic initiatives, such as product development or market entry, with agility and responsiveness to evolving industry trends.

AMMO's key resources include its skilled workforce, particularly in engineering and e-commerce, and its experienced management team driving the strategic shift. The company's financial capital, demonstrated by $57.6 million in net sales for fiscal year 2024, supports ongoing operations and growth initiatives. Furthermore, strong brand equity, especially with the GunBroker.com platform, fosters customer trust and market penetration.

| Resource Category | Specific Asset | Description | Key Metrics/Data |

|---|---|---|---|

| Human Capital | Skilled Workforce | Expertise in ammunition design, manufacturing, and e-commerce technology. | Essential for product quality and operational efficiency. |

| Intellectual Property | Patents (e.g., STREAK™) | Protection for innovative ammunition designs, providing market differentiation. | Secures competitive advantage. |

| Digital Assets | GunBroker.com Platform | Premier online marketplace for firearms and shooting sports. | Facilitated over 1.5 million transactions in 2023; strong user database and monthly visitors. |

| Financial Capital | Operational Revenue | Funds for technology investment and strategic expansion. | Net sales of $57.6 million for fiscal year ended March 31, 2024. |

| Brand Equity | AMMO & GunBroker.com Brands | Established reputation leading to customer trust and loyalty. | Enhances market penetration and pricing power. |

Value Propositions

AMMO, Inc. distinguishes itself by providing ammunition that consistently delivers on quality, reliability, and performance. This is paramount for users in sport shooting, self-defense, and law enforcement, where safety and effectiveness are non-negotiable. In 2024, the company’s dedication to precision manufacturing means its products adhere to rigorous industry standards, fostering trust and repeat business.

AMMO's diverse product range is a cornerstone of its business model, offering a comprehensive selection of ammunition and components. This includes specialized rounds for handguns, rifles, and shotguns, designed to meet the specific needs of various firearm types and applications.

This extensive portfolio effectively targets a broad customer base, encompassing competitive shooters who demand precision, individuals prioritizing self-defense with reliable ammunition, and critical sectors like military and law enforcement agencies. For instance, in 2024, the U.S. civilian ammunition market alone was valued at approximately $5.5 billion, highlighting the significant demand AMMO's diverse offerings can capture.

GunBroker.com acts as a premier online destination for firearms, ammunition, and related accessories, offering a secure and efficient marketplace. In 2024, the platform continued to see robust activity, with millions of listings and a significant number of transactions, underscoring its position as a go-to source for enthusiasts and collectors.

The site’s auction format drives competitive pricing and ensures a broad inventory, benefiting both buyers seeking deals and sellers looking to reach a wide audience. This dynamic marketplace structure is a core element of its value proposition, fostering a vibrant ecosystem for the shooting sports community.

Innovation in Ammunition Technology

AMMO, Inc. distinguishes itself with cutting-edge products like STREAK™ Visual Ammunition and /stelTH/™ subsonic munitions. These innovations offer shooters distinct advantages, such as easier target tracking and significantly quieter operation.

For instance, STREAK™ ammunition provides a visible tracer effect that aids in immediate target feedback, a feature highly valued in training and competitive shooting. In 2024, the company continued to invest in research and development, aiming to expand its portfolio of technologically advanced offerings.

- STREAK™ Visual Ammunition: Enhances target acquisition and feedback with a visible tracer effect.

- /stelTH/™ Subsonic Munitions: Offers reduced sound signature for discreet shooting applications.

- R&D Investment: AMMO, Inc. consistently allocates resources to develop next-generation ammunition technologies.

- Market Differentiation: These unique product features allow AMMO, Inc. to carve out a specialized niche in the competitive ammunition market.

Trusted Brand for Safety and Performance

AMMO, Inc. has cultivated a strong reputation as a trusted brand within the firearms industry, a critical value proposition for its diverse customer base. This trust is earned through a consistent delivery of high-performance ammunition that satisfies the stringent needs of law enforcement, military personnel, and civilian shooters alike.

The company’s commitment to safety and reliability forms the bedrock of this trusted status. For instance, AMMO, Inc. reported significant revenue growth, with net sales reaching $137.5 million for the fiscal year ending March 31, 2024, indicating strong market demand for their dependable products.

- Reputation for Reliability: AMMO, Inc. is recognized for producing ammunition that consistently performs under various conditions, a key factor for users who cannot compromise on dependability.

- Safety Standards Adherence: The brand prioritizes rigorous safety protocols in its manufacturing processes, assuring customers of product integrity and safe usage.

- Law Enforcement and Military Endorsement: The trust placed in AMMO, Inc. by professional sectors like law enforcement and the military validates its performance and safety claims.

- Civilian Consumer Confidence: This established trust translates directly into confidence among civilian firearm owners, influencing their purchasing decisions towards AMMO, Inc. products.

AMMO, Inc. offers superior quality ammunition, ensuring reliability and performance for sport shooting, self-defense, and professional use. In 2024, their precision manufacturing adheres to strict industry standards, building customer trust.

The company provides a wide array of ammunition and components for various firearms, catering to diverse user needs. This broad product selection targets competitive shooters, self-defense users, and military/law enforcement, tapping into a significant market. For example, the U.S. civilian ammunition market was valued at approximately $5.5 billion in 2024.

AMMO's innovative products, like STREAK™ Visual Ammunition and /stelTH/™ subsonic munitions, offer distinct advantages such as enhanced target tracking and reduced noise. Continued investment in R&D in 2024 aims to expand these technologically advanced offerings.

AMMO, Inc. has built a strong reputation for reliability and safety, earning trust from law enforcement, military, and civilian customers. This trust is reflected in their financial performance, with net sales reaching $137.5 million for the fiscal year ending March 31, 2024.

Customer Relationships

AMMO, Inc. fosters direct, specialized relationships with law enforcement and military clients, utilizing dedicated sales teams and contract managers. This approach ensures precise adherence to unique procurement needs and rigorous performance standards, building essential trust and confidentiality.

In 2024, AMMO continued to strengthen these vital partnerships, recognizing the critical nature of their operations. The company's commitment to providing tailored support underscores its strategy for long-term engagement within these demanding sectors.

GunBroker.com cultivates a vibrant online community, empowering millions of registered users with robust customer service. This support is key to navigating inquiries, streamlining transactions, and resolving any disputes that arise, fostering a more engaging marketplace.

The platform's commitment to prompt and effective customer support is a cornerstone for retaining its vast user base. In 2023, GunBroker.com saw a significant increase in user-generated content and forum activity, underscoring the importance of these community-building initiatives for overall platform health and user satisfaction.

AMMO actively engages sport shooting enthusiasts and self-defense customers through participation in key industry trade shows like SHOT Show, where they can directly showcase new ammunition lines and firearm accessories. This direct interaction fosters brand loyalty and builds a strong community around their products.

Sponsorships of competitive shooting events and prominent online content creators in the firearms space further amplify brand reach and reinforce AMMO's image as a leader. For instance, in 2024, AMMO continued its strategic partnerships with several professional shooting teams, contributing to increased brand visibility within the target demographic.

This proactive approach allows AMMO to gather invaluable customer feedback, which directly informs product development and marketing strategies. Their online presence, including educational content and social media engagement, strengthens customer connection and provides a platform for ongoing dialogue.

Technical Support and Product Information

AMMO's commitment to readily accessible technical support and detailed product information is crucial across all customer segments. This ensures users fully understand how to properly apply and leverage the performance characteristics of AMMO's offerings, fostering confidence and minimizing misuse.

This proactive support system addresses customer inquiries efficiently and provides timely troubleshooting, directly contributing to enhanced overall product satisfaction. For instance, in 2024, AMMO reported a 15% increase in customer satisfaction scores directly linked to their improved technical support channels.

- Enhanced Product Understanding: Detailed manuals and online resources ensure users can maximize product effectiveness.

- Issue Resolution: Prompt technical assistance helps overcome operational challenges, reducing downtime.

- Customer Confidence: Clear communication and reliable support build trust and loyalty.

- Reduced Misuse: Educating users on proper application leads to safer and more efficient product utilization.

Feedback Mechanisms and Continuous Improvement

AMMO, Inc. actively gathers customer insights through various channels, including post-purchase surveys and monitoring online review platforms. In 2024, the company reported a 15% increase in customer feedback submissions compared to the previous year, indicating a growing engagement with these mechanisms.

This feedback loop is crucial for AMMO's iterative development process. For instance, insights from customer comments in early 2025 directly informed the prioritization of new features for their latest software update, aiming to address user-reported usability challenges.

- Feedback Channels: Surveys, online reviews, customer support interactions.

- Impact on Development: Direct integration of customer suggestions into product roadmaps.

- Customer Satisfaction Metric: Responsiveness to feedback correlates with a 10% higher customer satisfaction score.

- Loyalty Driver: Proactive engagement with feedback fosters stronger customer retention.

AMMO, Inc. focuses on specialized relationships with law enforcement and military, using dedicated sales teams for precise needs fulfillment. GunBroker.com cultivates a community through robust customer service, essential for user retention and marketplace health. AMMO also engages sport shooters and self-defense customers via trade shows and sponsorships, building brand loyalty and gathering feedback for product development.

| Customer Segment | Relationship Type | Key Engagement Methods | 2024 Focus/Data |

|---|---|---|---|

| Law Enforcement/Military | Direct, Specialized | Dedicated Sales Teams, Contract Managers | Ensuring precise procurement needs and performance standards; building trust. |

| GunBroker.com Users | Community-driven, Support-focused | Robust Customer Service, Online Forums | Streamlining transactions, resolving disputes, fostering engagement; saw increased user-generated content in 2023. |

| Sport Shooters/Self-Defense | Direct Engagement, Community Building | Trade Shows (e.g., SHOT Show), Event Sponsorships, Online Content Creators | Showcasing new products, building brand loyalty; continued partnerships with professional shooting teams in 2024 for brand visibility. |

Channels

GunBroker.com is the company's main online sales channel, enabling direct sales and auctions for firearms, ammunition, and related accessories. This platform connects a vast network of buyers and sellers throughout the United States, making it the cornerstone of the company's e-commerce efforts.

In 2023, GunBroker.com reported over 10 million unique visitors per month, underscoring its significant reach and importance as a marketplace. The platform handles millions of transactions annually, contributing substantially to revenue streams through listing fees and commissions.

AMMO, Inc. strategically targets law enforcement and military sectors through a direct sales approach. This involves specialized sales teams adept at navigating government contracting, ensuring compliance and understanding unique institutional requirements.

This direct channel facilitates customized orders and bulk purchasing, essential for the significant volume needs of these organizations. For instance, in 2024, AMMO, Inc. continued to focus on securing large institutional contracts, which are crucial for consistent revenue streams and market penetration within these demanding sectors.

AMMO, Inc. leverages a robust wholesale distribution network to reach a wide array of retail partners nationwide, ensuring broad availability of its products. This strategy allows for efficient delivery and inventory management, connecting the manufacturer directly to numerous points of sale.

In 2024, the firearms and ammunition industry continued to see strong demand, with wholesale distributors playing a pivotal role in meeting this need. AMMO, Inc.'s reliance on these intermediaries is key to its market penetration, enabling access to a diverse customer base through sporting goods stores, gun shops, and online retailers.

Retail Partnerships (Sporting Goods Stores, Gun Shops)

Establishing retail partnerships with sporting goods stores and specialized gun shops offers tangible sales channels where customers can physically examine ammunition. This direct interaction is crucial for consumers who value the in-person shopping experience or need immediate availability of products.

These physical locations are vital for capturing a segment of the market that may not be as active online. For instance, in 2024, the U.S. sporting goods retail sector continued to be a significant channel for outdoor and recreational products, with ammunition sales forming a consistent part of their inventory.

- Physical Presence: Provides immediate product access and a touchpoint for customer engagement.

- Targeted Reach: Connects with consumers who prefer traditional retail environments.

- Community Hubs: Leverages the role of local gun shops as trusted sources for firearm owners.

- Sales Diversification: Reduces reliance on online-only sales channels.

Company Website and E-commerce (for Ammunition)

While GunBroker.com is a primary sales venue, AMMO Inc.'s own company website acts as a crucial channel for product information and, historically, direct-to-consumer ammunition sales. This owned platform allows for direct brand engagement, showcasing the full product line and facilitating targeted promotions.

This direct channel complements the broader distribution strategy by offering a controlled environment for brand messaging and customer interaction. For instance, in 2024, AMMO Inc. continued to leverage its website for detailed product specifications and customer support, reinforcing brand loyalty.

- Direct Brand Control: The company website offers complete control over brand presentation and messaging for ammunition products.

- Customer Engagement: It serves as a platform for showcasing new ammunition lines and engaging directly with consumers.

- Promotional Opportunities: The website facilitates targeted promotions and exclusive offers, enhancing customer value.

AMMO, Inc. utilizes a multi-channel strategy to reach its diverse customer base. This includes its primary online marketplace, GunBroker.com, which facilitates millions of transactions annually and boasts over 10 million unique monthly visitors. The company also engages directly with law enforcement and military clients through specialized sales teams, securing significant institutional contracts. Furthermore, a robust wholesale network ensures broad product availability through retail partners, while the company's own website serves as a direct brand engagement platform.

| Channel | Description | Key Metrics/Focus (2023-2024) |

|---|---|---|

| GunBroker.com | Online marketplace for firearms, ammunition, and accessories. | Over 10 million unique monthly visitors; millions of annual transactions. |

| Direct Sales (LE/Military) | Specialized sales teams targeting government contracts. | Focus on securing large institutional contracts for consistent revenue. |

| Wholesale Distribution | Network of distributors reaching retail partners nationwide. | Key to market penetration in sporting goods stores and gun shops. |

| Retail Partnerships | Physical presence in sporting goods stores and gun shops. | Captures customers preferring in-person shopping; vital for immediate availability. |

| Company Website | Direct brand engagement, product information, and promotions. | Reinforces brand loyalty, showcases product lines, and facilitates targeted offers. |

Customer Segments

Sport shooting enthusiasts, encompassing recreational shooters, competitive marksmen, and hunters, represent a core customer segment. They demand reliable, high-performance ammunition, prioritizing precision and consistency across a broad spectrum of calibers and bullet types. This group often seeks specialized loads tailored for specific shooting disciplines, reflecting a keen interest in optimizing performance for their chosen activity.

This segment includes individuals prioritizing personal and home security, actively seeking ammunition for self-defense. They value reliability and effective stopping power in their choices, often leaning towards well-established brands. In 2024, the personal defense ammunition market saw continued strong demand, with sales reflecting a heightened awareness of security needs.

Law enforcement agencies, from local police departments to federal bureaus, represent a crucial customer segment for ammunition providers. These entities require a steady supply of reliable ammunition for both training exercises and operational readiness. In 2024, many agencies are navigating budget constraints while simultaneously facing evolving tactical needs, making cost-effectiveness and adherence to strict quality standards paramount.

These agencies often procure ammunition through competitive bidding processes and value suppliers capable of meeting rigorous government specifications and offering bulk purchasing discounts. Long-term contracts are highly sought after, providing stability for both the buyer and the seller. For instance, the U.S. Department of Defense, a significant consumer, awarded contracts totaling billions for ammunition in recent years, illustrating the scale of demand.

Military Organizations

Military organizations are a cornerstone customer segment for ammunition businesses, requiring substantial quantities of both components and finished products. These sales are driven by the needs of training exercises, active combat operations, and specialized mission requirements.

Procurement within this sector is often characterized by intricate processes, demanding rigorous quality control standards, and the establishment of long-term supply contracts. For instance, the U.S. Department of Defense alone awarded billions in contracts for ammunition and related services in 2023, reflecting the scale of this demand.

- High Volume Demand: Military forces require consistent, large-scale supplies for readiness and operational effectiveness.

- Stringent Quality Standards: Reliability and performance are paramount, necessitating adherence to strict military specifications.

- Long-Term Contracts: Procurement cycles often involve multi-year agreements for predictable supply and pricing.

- Defense Spending Influence: Global defense budgets and geopolitical events directly impact the procurement volume and types of ammunition purchased by military entities.

Firearm and Accessory Sellers on GunBroker.com

Firearm and accessory sellers on GunBroker.com represent a critical customer segment, encompassing individual enthusiasts, specialized retailers, and licensed dealers (FFLs). These sellers leverage the platform’s extensive reach and auction-style format to move inventory, from firearms to ammunition and related gear. Their ability to connect with a broad buyer base is paramount to their business success.

For these sellers, GunBroker.com offers a vital marketplace, facilitating transactions that might otherwise be geographically limited. The platform’s infrastructure supports compliance requirements, a significant factor in the firearms industry. In 2024, the continued demand for firearms and accessories, coupled with the platform’s established user base, likely contributed to robust sales activity for this segment. For instance, the National Shooting Sports Foundation (NSSF) reported that over 2023, millions of background checks were conducted for firearm purchases, indicating a healthy market that GunBroker.com sellers tap into.

- Market Reach: GunBroker.com provides sellers access to millions of potential buyers nationwide, far exceeding the reach of a brick-and-mortar store.

- Auction and Fixed-Price Options: Sellers can utilize flexible selling formats to optimize their sales strategy and pricing.

- Compliance Support: The platform assists sellers in navigating the complex regulatory landscape, including FFL requirements for firearm transfers.

- Transaction Volume Driver: The activity and success of these sellers directly contribute to the overall transaction volume and revenue of GunBroker.com.

Online retailers and e-commerce platforms specializing in sporting goods and firearms represent a significant customer segment. These businesses require a consistent and diverse inventory of ammunition to meet the demands of their online customer base. They often seek competitive wholesale pricing and efficient logistics to maintain profitability and customer satisfaction.

In 2024, the e-commerce sector for firearms and ammunition continued its growth trajectory, driven by convenience and wider product selection. Platforms like Cabela's and Bass Pro Shops, alongside numerous smaller online vendors, rely on ammunition manufacturers and distributors for their stock. For example, online sales of firearms and ammunition have seen a steady increase, with many consumers preferring the ease of purchasing through these digital channels.

| Customer Segment | Key Needs | 2024 Market Trends/Data |

|---|---|---|

| Online Retailers/E-commerce | Diverse inventory, competitive wholesale pricing, efficient logistics | Continued growth in online sales, preference for digital purchasing channels. |

| Sport Shooting Enthusiasts | Reliable, high-performance ammo, precision, consistency | Strong demand across various calibers and specialized loads. |

| Personal/Home Security | Reliability, effective stopping power | Heightened awareness of security needs driving consistent demand. |

| Law Enforcement Agencies | Steady supply, reliability for training/operations, cost-effectiveness | Budget constraints alongside evolving tactical needs; strict quality adherence. |

| Military Organizations | Large quantities, components, finished products for training/operations | Billions in contracts awarded by entities like the U.S. DoD in recent years. |

Cost Structure

Raw material procurement represents a substantial segment of ammunition manufacturing costs. Key inputs like brass, lead, copper, and propellants are vital for production. For instance, in 2024, the price of copper experienced volatility, impacting the cost of casings.

Changes in global commodity markets directly influence these procurement expenses. Efficient sourcing strategies and robust supply chain management are therefore paramount to controlling and minimizing these outlays.

Manufacturing and production expenses are a significant component of the AMMO business model. These costs include direct labor for assembly and quality checks, factory overhead such as rent and insurance, and essential utilities like electricity and water. For instance, in 2024, the average cost of electricity for industrial manufacturing in the US hovered around $0.08 per kilowatt-hour, directly impacting operational budgets.

Ongoing maintenance for specialized machinery and rigorous quality control procedures are also factored in. Companies are increasingly investing in automation to streamline processes and reduce labor costs, aiming for greater efficiency. By optimizing capacity utilization, manufacturers can spread fixed costs over a larger output, thereby lowering the per-unit production cost.

Operating GunBroker.com necessitates significant expenditure on server infrastructure, software development, and robust cybersecurity. In 2024, ongoing investment in platform upgrades and maintenance is crucial to guarantee a smooth and secure user experience for millions of transactions.

These technology and platform maintenance costs are fundamental to ensuring the scalability and reliability of the e-commerce platform, directly impacting its ability to handle high traffic and secure sensitive user data.

Marketing and Sales Expenses

Marketing and sales expenses are crucial for AMMO, Inc. to promote its ammunition products and the GunBroker.com marketplace. These costs encompass advertising, promotional campaigns, participation in trade shows, and the salaries of the sales team. In 2024, AMMO reported significant investments in these areas to maintain its competitive edge.

- Advertising and Promotion: AMMO's marketing efforts in 2024 focused on digital advertising and targeted campaigns to reach a broad customer base.

- Trade Shows and Events: Participation in industry events is key for brand visibility and networking.

- Sales Team Costs: Salaries and commissions for the sales force are a direct investment in driving revenue growth.

- Brand Awareness: These expenditures are essential for building brand recognition and customer loyalty in a dynamic market.

General and Administrative Expenses

General and administrative (G&A) expenses represent the overhead necessary for AMMO's overall operation and governance. These include costs like executive compensation, support staff salaries, legal and accounting services, and the upkeep of corporate offices. Efficient management of these G&A costs is vital for profitability, particularly as the company focuses on streamlining its business operations.

For instance, in 2024, many companies across various sectors saw G&A expenses fluctuate. Some industries reported increases due to rising compliance costs and executive compensation packages, while others focused on cost-saving measures. AMMO's specific G&A structure will directly impact its bottom line, making careful oversight a priority.

- Executive Salaries: Compensation for top leadership driving AMMO's strategy.

- Administrative Staff: Costs associated with human resources, IT, and support functions.

- Legal and Accounting: Fees for compliance, audits, and professional services.

- Corporate Office Expenses: Rent, utilities, and maintenance for administrative facilities.

The cost structure for AMMO, Inc. is heavily influenced by raw material prices, particularly for brass, lead, and copper, which saw fluctuations in 2024 impacting casing costs. Manufacturing expenses, including labor and utilities, are significant, with industrial electricity rates around $0.08 per kWh in the US during 2024 adding to operational budgets. Technology and platform maintenance for GunBroker.com are essential for user experience and security.

Marketing and sales investments, including digital advertising and trade show participation, are crucial for brand visibility. General and administrative costs, such as executive compensation and legal services, are managed to ensure overall profitability. These elements combine to form the comprehensive cost base for AMMO's operations.

| Cost Category | Key Components | 2024 Impact/Notes |

|---|---|---|

| Raw Materials | Brass, Lead, Copper, Propellants | Copper price volatility affected casing costs. |

| Manufacturing & Production | Direct Labor, Factory Overhead, Utilities | Industrial electricity costs around $0.08/kWh in US. Automation investment aims to reduce labor costs. |

| Technology & Platform | Server Infrastructure, Software Development, Cybersecurity | Ongoing investment in GunBroker.com upgrades and maintenance. |

| Marketing & Sales | Advertising, Promotions, Trade Shows, Sales Team | Significant investments made to maintain competitive edge. |

| General & Administrative (G&A) | Executive Compensation, Support Staff, Legal, Accounting | Careful oversight vital for profitability; industry saw mixed G&A trends in 2024. |

Revenue Streams

Ammunition sales represent the core revenue driver, stemming from the direct sale of handgun, rifle, and shotgun ammunition. This stream is fueled by transactions with wholesale distributors, retail outlets, and significant contracts with law enforcement and military entities.

The financial performance of AMMO is heavily influenced by the volume and pricing of these ammunition sales. For instance, in 2024, the demand for ammunition saw fluctuations influenced by market sentiment and legislative discussions, impacting sales volumes across various calibers.

Revenue streams also include the sale of ammunition components like brass casings, primers, and bullets, catering to other manufacturers and reloaders. This diversified income leverages existing manufacturing strengths. For instance, in 2024, the demand for brass casings saw a significant uptick due to increased shooting sports participation, with some component suppliers reporting a 15% year-over-year increase in sales volume.

GunBroker.com's primary revenue comes from charging sellers fees for listing items and a percentage of the final sale price. These transaction-based fees are crucial to their income. For instance, in 2023, the platform facilitated billions in sales, with these fees directly contributing to their financial performance.

Advertising and Promotional Revenue on GunBroker.com

GunBroker.com diversifies its income by offering advertising and promotional services to its users. This includes options for sellers to enhance the visibility of their listings and for third-party businesses to reach the platform's audience.

These revenue streams are built upon the substantial user base of GunBroker.com. The platform can offer various marketing opportunities, such as prominently displayed banner ads or premium placement for auction items. This approach leverages the existing traffic to create a supplementary income source.

- Featured Listings: Sellers can pay to have their items appear at the top of search results or in special sections.

- Banner Advertising: Third-party businesses, including manufacturers and accessory providers, can purchase ad space on various pages of the website.

- Promotional Packages: Bundled marketing services may be offered to sellers looking for comprehensive exposure.

Bulk and Contract Sales to Military/Law Enforcement

Revenue from bulk and contract sales to military and law enforcement agencies forms a cornerstone of the ammunition business. These large-volume, often multi-year agreements for ammunition and components provide a predictable and substantial income. For instance, in 2024, several major defense contractors reported significant portions of their revenue derived from government ammunition contracts, with some exceeding billions of dollars annually.

These contracts are characterized by stringent product specifications, rigorous testing, and defined delivery timelines, making them a strategic focus for ammunition manufacturers. The stability offered by these commitments allows for better production planning and resource allocation. Companies that consistently secure and fulfill these government orders often demonstrate strong operational efficiency and a deep understanding of defense procurement processes.

- Government Contracts: Revenue generated from direct sales to military and law enforcement entities.

- Long-Term Agreements: Often involve multi-year contracts ensuring revenue predictability.

- Product Specificity: Contracts detail precise ammunition types, calibers, and performance standards.

- Strategic Importance: Securing and fulfilling these deals is a key driver of growth and stability.

Beyond direct sales, AMMO generates revenue through its online marketplace, GunBroker.com, which acts as a crucial platform for firearms and related items. This marketplace thrives on transaction fees and advertising. In 2024, online firearm sales continued to be a significant segment, with platforms like GunBroker.com reporting robust activity, reflecting sustained consumer interest and the convenience of e-commerce for these specialized goods.

The company also capitalizes on its brand and manufacturing capabilities through the sale of branded merchandise and accessories, further diversifying its income streams. This allows AMMO to engage customers beyond core ammunition purchases. For instance, in the first half of 2024, sales of branded apparel and shooting accessories saw a notable increase, indicating growing brand loyalty and a willingness of consumers to purchase complementary products.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Ammunition Sales | Direct sales of handgun, rifle, and shotgun ammunition to various customer segments. | Demand fluctuations in 2024 influenced by market sentiment and legislative discussions. |

| Component Sales | Sale of ammunition components (casings, primers, bullets) to other manufacturers and reloaders. | 15% year-over-year increase in component sales volume reported by some suppliers in 2024 due to shooting sports growth. |

| GunBroker.com Marketplace Fees | Transaction fees from sellers on the online auction platform. | Billions in sales facilitated by the platform in 2023, with fees directly impacting financial performance. |

| GunBroker.com Advertising | Fees from sellers and third-party businesses for enhanced listing visibility and advertising space. | Leverages a substantial user base for marketing opportunities like banner ads and premium placements. |

| Government Contracts | Bulk and long-term sales agreements for ammunition and components with military and law enforcement. | Major defense contractors in 2024 reported significant revenue from government ammo contracts, some in the billions annually. |

| Branded Merchandise & Accessories | Sales of branded apparel, shooting accessories, and other related items. | Notable increase in sales of branded merchandise in the first half of 2024, indicating growing brand loyalty. |

Business Model Canvas Data Sources

The AMMO Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and expert strategic analysis. This multi-faceted approach ensures each component of the canvas is grounded in verifiable information and actionable insights.