Amgen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

Amgen's robust pipeline and strong market presence present significant strengths, but understanding their full competitive landscape, including potential threats and opportunities, is crucial for strategic decision-making.

Discover the complete picture behind Amgen's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Amgen's extensive R&D and innovation capabilities are a cornerstone of its strength, built on a deep understanding of advanced science and technology. The company excels in areas like genetic and protein engineering, which are crucial for creating novel human therapeutics.

This commitment is underscored by significant financial investment. Amgen poured a record $6.0 billion into R&D in 2024, marking a substantial 25% jump from the previous year. Furthermore, the company projects R&D expenses to rise by approximately 20% in 2025, demonstrating a clear strategy to bolster its late-stage pipeline and maintain a robust pipeline of potential first- or best-in-class medicines.

Amgen's strength lies in its extensive and diversified portfolio of approved products. The company had 14 blockbuster products, each exceeding $1 billion in sales, exiting 2024. This broad market presence across key therapeutic areas like oncology, nephrology, inflammation, and cardiovascular diseases significantly de-risks its revenue streams.

Amgen boasts a significant global commercial footprint, ensuring its innovative medicines reach patients across the globe. This extensive reach is a key strength, enabling widespread access to its vital therapies.

The strategic acquisition of Horizon Therapeutics in late 2023 substantially bolstered Amgen's global presence, opening doors to new markets and therapeutic areas, especially in rare diseases. This expansion is already showing results, with the acquired portfolio generating $4.5 billion in sales during 2024.

Robust Patent and Intellectual Property Portfolio

Amgen's competitive edge is significantly bolstered by its robust patent and intellectual property portfolio, which safeguards its groundbreaking biologic medicines. This proprietary manufacturing process for biologics, coupled with extensive clinical knowledge, erects substantial regulatory barriers for rivals, making it challenging to duplicate Amgen's intricate products.

This strong intellectual property acts as a crucial protective barrier around its most profitable assets. For instance, as of early 2024, Amgen held thousands of active patents globally, with key biologics like Enbrel and Humira (through its biosimilar program) having patent protection extending well into the late 2020s and beyond for certain formulations and indications.

- Proprietary Biologics Manufacturing: Amgen's unique methods for producing complex biological drugs are a key differentiator.

- High Regulatory Hurdles: The difficulty in replicating Amgen's sophisticated products creates a significant advantage.

- Extended Market Exclusivity: Patents on core products like Enbrel and its biosimilar portfolio provide long-term revenue protection.

- Global Patent Holdings: Amgen maintains a vast network of patents across major pharmaceutical markets worldwide.

Advanced Manufacturing and Supply Chain

Amgen's commitment to advanced manufacturing and supply chain excellence is a significant strength. The company is making substantial investments to bolster its production capacity and ensure efficient delivery of its innovative therapies.

This strategic expansion is crucial for meeting the increasing global demand for Amgen's biologic drugs. For instance, the opening of its new, highly automated manufacturing facility in New Albany, Ohio, in late 2023, represents a major step forward in its operational capabilities.

Furthermore, Amgen's planned $1 billion expansion of its manufacturing campus in Durham, North Carolina, is set to significantly increase its biologics drug substance manufacturing capacity. This expansion, expected to be completed in phases through 2027, underscores the company's dedication to a resilient and scalable supply chain.

- Ohio Facility: Opened a state-of-the-art, highly automated manufacturing site in New Albany, Ohio, in late 2023.

- North Carolina Expansion: Announced a $1 billion investment to expand its manufacturing campus in Durham, North Carolina, aiming to boost biologics drug substance capacity.

- Scale and Efficiency: These investments are designed to enhance Amgen's ability to produce complex biologics at scale, ensuring product availability for patients.

Amgen's robust R&D engine, fueled by a significant increase in investment, positions it for future growth. The company's commitment to innovation is evident in its substantial R&D spending, with $6.0 billion allocated in 2024 and a projected 20% increase for 2025, prioritizing its late-stage pipeline.

What is included in the product

Delivers a strategic overview of Amgen’s internal and external business factors, highlighting its strong product pipeline and R&D capabilities while acknowledging competitive pressures and patent expirations.

Offers a clear, actionable framework to identify and address Amgen's strategic challenges and opportunities.

Weaknesses

Amgen's revenue stream shows a notable concentration, with a few blockbuster drugs carrying a significant portion of its financial weight. While newer products like Repatha and TEZSPIRE are showing robust growth, contributing to Amgen's overall expansion, the company is simultaneously navigating sales declines in established franchises.

This erosion in older drugs, such as Enbrel and Prolia, is largely attributed to the increasing pressure from biosimilar competitors and the natural cycle of patent expirations. For instance, Enbrel's U.S. sales saw a decrease in the first quarter of 2024, reflecting these market dynamics.

Consequently, Amgen's financial performance remains highly sensitive to the success and market longevity of these key revenue drivers. Any adverse developments impacting these top-selling medicines could disproportionately affect the company's overall financial health and growth trajectory.

Amgen's significant investment in research and development, while crucial for future growth, also presents a considerable financial burden and inherent risk. The company anticipates its non-GAAP R&D expenses to increase by roughly 20% in 2025, signaling a heightened commitment to advancing its late-stage drug candidates.

The lengthy and costly nature of pharmaceutical development means that setbacks such as clinical trial failures or unforeseen safety concerns can result in substantial financial write-offs and impede the timely introduction of new therapies to the market.

Amgen is vulnerable to patent expirations on its established products, which opens the door for biosimilar competitors. This trend is particularly evident with expected impacts on XGEVA and Prolia sales in the latter half of 2025. The ongoing decline in Enbrel sales further illustrates this challenge.

The loss of market exclusivity due to biosimilars directly impacts Amgen's revenue streams. To counteract these revenue erosions, the company must consistently invest in and bring new innovative therapies to market, a crucial strategy for sustained growth.

Regulatory and Reimbursement Pressures

Amgen, like other major biopharmaceutical companies, faces significant regulatory and reimbursement hurdles. The biotechnology sector is inherently subject to rigorous oversight, and there's a growing trend of governments and insurance providers pushing for lower drug prices. This can directly affect Amgen's top line and overall profitability.

A prime example of this pressure is the Inflation Reduction Act (IRA) in the United States. Starting in 2026, the IRA allows Medicare to negotiate prices for certain high-cost prescription drugs. While the initial list of drugs for negotiation in 2026 does not include any of Amgen's current blockbuster products, the legislation sets a precedent for future negotiations that could impact Amgen's revenue streams for products launched in the coming years.

These external pressures translate into tangible financial risks. For instance, increased price negotiations or unfavorable reimbursement decisions can lead to a reduction in the net selling prices Amgen receives for its medicines. This could potentially offset the gains made through increased sales volumes, thereby dampening overall revenue growth and profitability.

- Regulatory Scrutiny: The biopharmaceutical industry operates under strict FDA and EMA regulations, requiring substantial investment in research, development, and compliance.

- Pricing Pressures: Government bodies and private payers are increasingly demanding lower drug prices, directly impacting Amgen's net revenue per unit.

- Inflation Reduction Act (IRA): This US legislation enables Medicare to negotiate drug prices, potentially reducing Amgen's revenue from affected therapies in the future.

- Reimbursement Challenges: Securing favorable reimbursement from insurance providers is critical for market access and can be a complex and lengthy process.

Limited Presence in Certain Geographic Markets

Amgen's global reach, while significant, is notably concentrated in established markets like the United States, Europe, and Canada. This can present a weakness as emerging markets, particularly in Asia and Latin America, are experiencing rapid growth. While Amgen is actively pursuing expansion in these regions, its market penetration there may still lag behind competitors with more established international networks, potentially capping its overall market share and future growth.

For instance, Amgen's revenue breakdown for 2023 showed a substantial portion still derived from its key North American and European markets. While specific figures for emerging market penetration are proprietary, industry analysis suggests that competitors with diversified global strategies may be better positioned to capitalize on the faster growth rates observed in regions outside of Amgen's core territories. This limited presence in certain high-growth geographies could hinder its ability to fully leverage global demand for its innovative therapies.

Amgen faces significant revenue concentration, with a few key drugs like Enbrel and Prolia historically driving a large portion of its sales. While newer products are growing, the decline in sales of established franchises due to biosimilar competition and patent expirations poses a substantial risk. For example, Enbrel's U.S. sales declined in Q1 2024, highlighting this vulnerability.

The company's substantial R&D investments, while essential for future pipelines, also carry inherent risks. Clinical trial failures or safety issues can lead to significant financial write-offs and delays in bringing new therapies to market. Amgen's projected 20% increase in non-GAAP R&D expenses for 2025 underscores the scale of this ongoing investment and associated risk.

Furthermore, Amgen is susceptible to pricing pressures and regulatory challenges, including the impact of the US Inflation Reduction Act (IRA). While Amgen's current products are not directly targeted for Medicare price negotiation in 2026, the IRA sets a precedent that could affect future revenue streams from newly launched therapies.

Amgen's global presence is heavily weighted towards North America and Europe, potentially limiting its ability to fully capitalize on the rapid growth in emerging markets. Competitors with more diversified international strategies may gain an advantage in these high-growth geographies, capping Amgen's overall market share expansion.

What You See Is What You Get

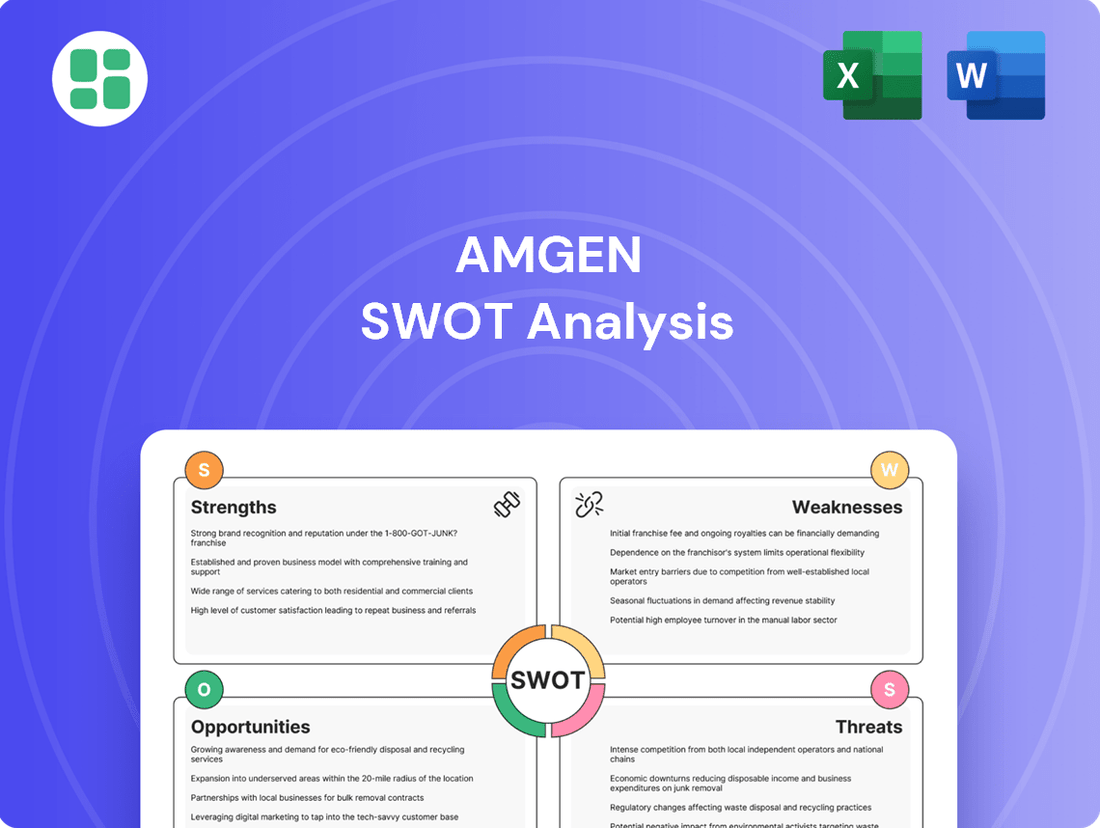

Amgen SWOT Analysis

This is the actual Amgen SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. The preview showcases the core strengths, weaknesses, opportunities, and threats that Amgen faces in the biopharmaceutical industry.

The preview below is taken directly from the full Amgen SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Amgen's strategic landscape.

This is a real excerpt from the complete Amgen SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights to your specific needs.

Opportunities

Amgen's strategic pipeline expansion into new therapeutic areas presents a significant growth opportunity. The company is actively developing promising candidates in high-demand fields such as obesity and cardiometabolic conditions, oncology, and rare diseases.

With potential first- or best-in-class medicines in its pipeline, Amgen is well-positioned to address unmet medical needs. For instance, MariTide for weight loss and Olpasiran for cholesterol are both projected to achieve blockbuster status, indicating substantial market potential.

This focus on innovative treatments in expanding markets, like the projected $100 billion global obesity market by 2030, allows Amgen to diversify its revenue streams and capture significant market share in these lucrative areas.

Amgen's strategic acquisitions, exemplified by the $27.8 billion acquisition of Horizon Therapeutics in 2023, continue to be a significant opportunity. This move not only expanded Amgen's presence in rare diseases but also provided access to key products like Tepezza and Krystexxa, which are expected to contribute substantially to future revenue streams.

The company actively seeks licensing partnerships and smaller, targeted acquisitions to strengthen its drug pipeline and explore new therapeutic areas. For instance, in early 2024, Amgen announced a collaboration with Generate Biomedicines to develop novel protein therapeutics, highlighting its commitment to leveraging external innovation.

Furthermore, Amgen benefits from collaborations with academic centers and other biotech firms. These partnerships allow Amgen to tap into cutting-edge research and development, potentially accelerating the discovery and commercialization of breakthrough therapies, thereby enhancing its competitive edge in the biopharmaceutical landscape.

Amgen stands to gain substantially from ongoing progress in biotechnology, particularly in genetic and protein engineering. These advancements pave the way for more precise and effective therapeutic targets. For instance, the company's focus on areas like bispecific antibodies, which leverage sophisticated protein engineering, positions it well to capitalize on these scientific leaps.

The integration of artificial intelligence across Amgen's operations offers a powerful avenue for growth. AI can significantly speed up the identification of promising drug candidates and streamline the complex process of clinical trial design and execution. By leveraging AI, Amgen aims to reduce the time and cost associated with bringing new medicines to market, a critical factor in maintaining a competitive edge in the pharmaceutical industry.

In 2024, the biopharmaceutical sector saw substantial investment in AI-driven drug discovery, with many companies reporting accelerated timelines for preclinical research. Amgen's strategic investments in this area are expected to yield tangible results, potentially leading to a more robust pipeline and faster commercialization of innovative treatments, further solidifying its market position.

Growth in Emerging Markets

Amgen is well-positioned to capitalize on the expanding healthcare needs in emerging markets. Latin America and Asia, in particular, represent significant opportunities due to their large and growing populations with increasing access to healthcare. For instance, the Asian biopharmaceutical market is projected to reach over $200 billion by 2025, driven by rising incomes and a greater focus on chronic disease management.

These regions often have a substantial number of patients who could benefit from Amgen's innovative therapies and biosimilars, many of whom are currently underserved. By tailoring its market entry strategies and product offerings to local needs, Amgen can tap into this vast potential. The company's established portfolio, including treatments for conditions like osteoporosis and cardiovascular disease, aligns well with the demographic and epidemiological trends in these developing economies.

Key opportunities include:

- Expanding market penetration in high-growth Asian economies: Countries like China and India are witnessing rapid increases in healthcare spending, creating demand for advanced medical treatments.

- Leveraging biosimilar opportunities in Latin America: As patent cliffs approach for some blockbuster drugs, Amgen can introduce its biosimilar versions to price-sensitive markets.

- Developing localized commercial strategies: Adapting marketing, distribution, and pricing to suit the unique characteristics of each emerging market can accelerate adoption and revenue generation.

- Partnering with local entities: Collaborations with local pharmaceutical companies or healthcare providers can facilitate market access and regulatory navigation.

Personalized Medicine and Companion Diagnostics

The growing emphasis on personalized medicine presents a significant long-term opportunity for Amgen. This approach focuses on tailoring treatments to a patient's unique genetic makeup and disease characteristics, promising more effective therapies. Amgen's established strengths in genetic and protein engineering are perfectly suited to capitalize on this evolving healthcare landscape.

Developing companion diagnostics alongside its groundbreaking therapeutics is a key strategy to unlock this opportunity. These diagnostics can identify patients most likely to respond to a specific treatment, thereby enhancing efficacy and improving patient outcomes. This integrated approach also opens up new and substantial revenue streams for the company.

- Tailored Treatments: Personalized medicine aims to match therapies with individual patient profiles, increasing treatment success rates.

- Amgen's Expertise: The company's deep knowledge in genetic and protein engineering directly supports the development of personalized therapies.

- Companion Diagnostics: Integrating diagnostic tools with treatments can optimize patient selection and treatment effectiveness.

- New Revenue Streams: The development and sale of companion diagnostics, coupled with targeted therapeutics, can create diversified income sources.

Amgen's strategic pipeline expansion into new therapeutic areas, particularly obesity and cardiometabolic conditions, presents a significant growth opportunity, with MariTide for weight loss projected to achieve blockbuster status. The company's $27.8 billion acquisition of Horizon Therapeutics in 2023 further bolsters its rare disease portfolio with key products like Tepezza and Krystexxa. Leveraging advancements in AI for drug discovery and development, as seen in the broader biopharmaceutical sector's investment trends in 2024, promises accelerated timelines and cost efficiencies.

Amgen is well-positioned to capitalize on expanding healthcare needs in emerging markets, with the Asian biopharmaceutical market projected to exceed $200 billion by 2025. The company can also leverage biosimilar opportunities in price-sensitive Latin American markets. Furthermore, Amgen's expertise in genetic and protein engineering directly supports the growing trend of personalized medicine, with the integration of companion diagnostics creating new revenue streams and enhancing treatment efficacy.

Threats

Amgen faces a significant threat from intensifying competition within the biotechnology sector. Established pharmaceutical giants and agile emerging biotechs are all aggressively pursuing market share, especially in high-demand areas like oncology and metabolic disorders. This crowded landscape can put downward pressure on drug pricing and make it harder for new Amgen therapies to gain widespread adoption.

The sheer number of players means Amgen must constantly innovate and differentiate its offerings. For instance, in 2024, the oncology market alone is projected to reach over $250 billion, a space where Amgen has considerable investment but also faces formidable rivals like Roche and Bristol Myers Squibb. This intense rivalry necessitates substantial R&D spending and strategic marketing to stand out.

Governmental drug pricing policies present a notable threat to Amgen. Increased scrutiny, particularly in the United States and Europe, could lead to stricter regulations. For instance, the Inflation Reduction Act's provisions for mandatory price negotiations on high-revenue drugs could directly impact Amgen's profitability and future revenue projections, especially for blockbuster products.

Amgen faces the persistent threat of clinical trial failures, a common hurdle in biopharmaceuticals. For instance, in 2023, numerous promising drug candidates across the industry stumbled in late-stage trials, leading to billions in lost R&D investment. This inherent risk means substantial capital poured into research for a new therapy could be written off if efficacy or safety benchmarks aren't met.

Furthermore, regulatory delays pose a significant challenge. In 2024, the FDA and other global health authorities continue to scrutinize new drug applications rigorously. Unexpected requests for additional data or prolonged review periods can push back product launches, directly impacting Amgen's revenue forecasts and its ability to capture market share for innovative treatments.

Economic Downturns Affecting Healthcare Spending

Economic downturns pose a significant threat to Amgen. Recessions can cause governments, insurers, and individuals to cut back on healthcare spending. This directly impacts the demand for Amgen's innovative therapies and potentially leads to intensified pricing pressures. For instance, during periods of economic contraction, healthcare budgets are often scrutinized more heavily, which could affect reimbursement rates and market access for high-cost biologic drugs.

Furthermore, a weakened economy can restrict Amgen's ability to secure capital for crucial research and development initiatives or strategic acquisitions. This financial constraint could slow down the pipeline of new treatments and limit expansion opportunities. In 2023, while Amgen reported strong revenue growth, the broader economic climate remains a watchpoint, with many analysts forecasting slower global GDP growth for 2024 and 2025, which could translate into more cautious healthcare spending patterns.

- Reduced Demand: Economic slowdowns can lead consumers and healthcare systems to delay or forgo treatments, impacting sales volumes for Amgen's portfolio.

- Pricing Pressure: Governments and insurers facing budget constraints may push harder for lower drug prices, squeezing Amgen's profit margins.

- Capital Access: A challenging economic environment can make it harder and more expensive for Amgen to raise funds for R&D, clinical trials, and potential M&A activities.

- Impact on R&D Investment: Reduced financial flexibility might force Amgen to re-evaluate or scale back its long-term research investments, potentially affecting future growth drivers.

Intellectual Property Litigation and Challenges

Amgen is consistently exposed to the threat of intellectual property litigation, particularly concerning its key drug patents. Generic and biosimilar companies actively challenge these patents, aiming to bring lower-cost alternatives to market sooner. For instance, Amgen has faced significant legal battles over patents for its blockbuster drug Enbrel, with competitors seeking to introduce biosimilars.

The financial implications of losing patent protection can be substantial. Successful challenges can lead to rapid revenue declines as cheaper versions capture market share. This was evident with the anticipated impact on sales of drugs like Repatha and Enbrel, where patent expiry or successful challenges by biosimilar competitors could significantly reduce revenue streams. In 2023, Amgen continued to navigate these complex legal landscapes, with ongoing litigation impacting the long-term revenue projections for several of its key biologics.

- Patent Challenges: Amgen faces ongoing legal threats from biosimilar and generic manufacturers challenging patents on its blockbuster drugs.

- Revenue Erosion: Successful patent challenges can accelerate the entry of lower-cost alternatives, directly impacting Amgen's revenue from key products.

- Competitive Position: The outcome of IP litigation significantly influences Amgen's market share and competitive standing in the biopharmaceutical industry.

- Legal Costs: Defending its intellectual property involves substantial legal expenses, diverting resources that could otherwise be invested in research and development.

Amgen's reliance on a few key blockbuster drugs makes it vulnerable to patent expirations and biosimilar competition. For example, the loss of exclusivity for drugs like Enbrel and Neulasta has already impacted revenue streams, and ongoing patent challenges for other products, such as Repatha, continue to pose a threat. In 2023, the market for biosimilars continued to grow, with analysts projecting further expansion, intensifying the pressure on originator biologics.

The company also faces significant threats from evolving regulatory landscapes and potential government intervention in drug pricing. Policies like the Inflation Reduction Act in the U.S., which allows Medicare to negotiate prices for certain high-cost drugs, could directly affect Amgen's profitability. Furthermore, the increasing scrutiny on drug development costs and market access by global health authorities adds another layer of complexity and potential risk.

Intensifying competition within the biotechnology sector, driven by both established players and nimble startups, presents a constant challenge. Amgen must continually innovate and differentiate its therapies in crowded therapeutic areas like oncology and immunology, where R&D investment is high and the pace of scientific advancement is rapid. This competitive pressure necessitates substantial ongoing investment in research and development to maintain market leadership.

Economic downturns can also impact Amgen by reducing healthcare spending and increasing pricing pressures from payers. A weakened economy may lead to tighter budgets for healthcare systems and consumers, potentially affecting demand for Amgen's innovative, often high-cost, treatments. For instance, slower global GDP growth projections for 2024 and 2025 could translate into more cautious healthcare expenditure.

SWOT Analysis Data Sources

This Amgen SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive market research reports, and expert industry forecasts. These sources provide a well-rounded and accurate view of Amgen's current position and future potential.