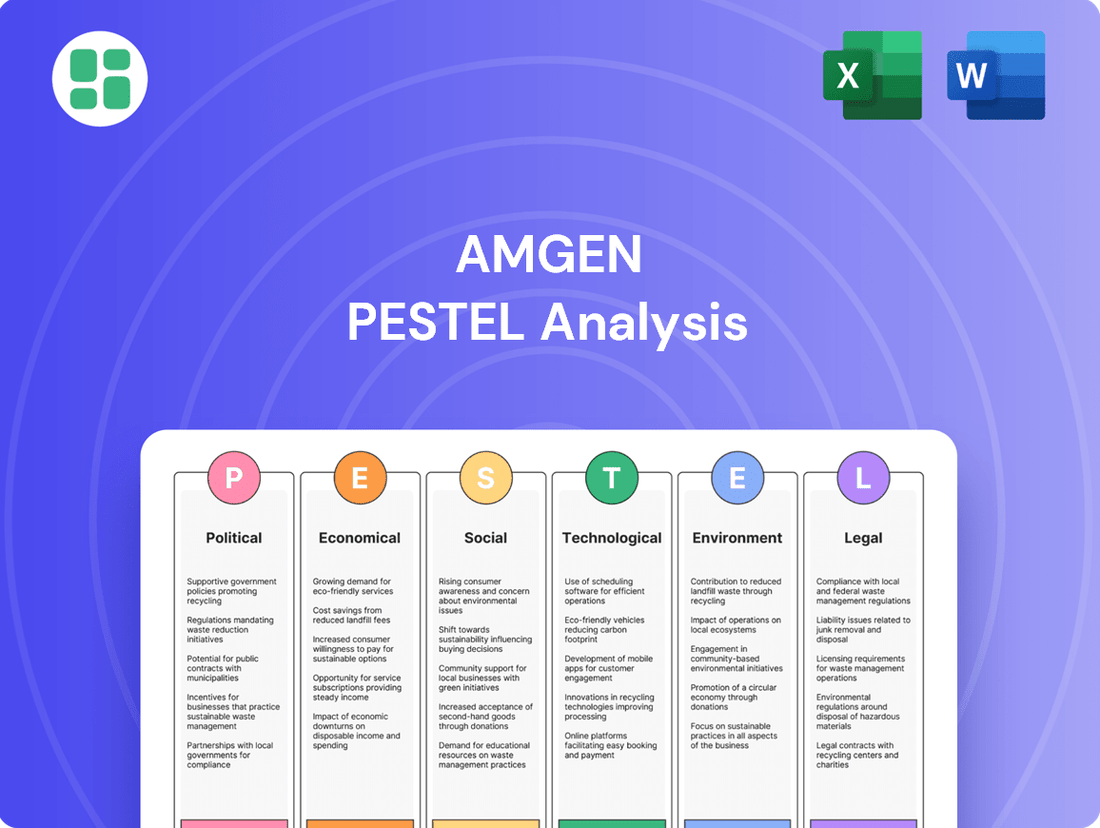

Amgen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

Amgen operates within a dynamic global landscape, constantly influenced by political shifts, economic fluctuations, societal trends, technological advancements, environmental regulations, and legal frameworks. Understanding these PESTLE factors is crucial for navigating the biopharmaceutical industry. Our comprehensive PESTLE analysis provides Amgen with a strategic roadmap to anticipate challenges and capitalize on opportunities. Download the full version now to gain actionable intelligence and stay ahead of the curve.

Political factors

Government policies, especially in the U.S., are a major factor for Amgen's financial performance. The Inflation Reduction Act (IRA) is already impacting drug pricing, and future administrations, including a potential Trump administration, are likely to maintain this focus on cost reduction. This continued pressure on drug prices directly affects Amgen's revenue streams and necessitates strategic adjustments to its pricing models.

President Biden has specifically called for prescription drug price reductions by September 2025, directly targeting major pharmaceutical companies like Amgen. This directive underscores the government's commitment to making medications more affordable, which will likely require Amgen to re-evaluate its pricing strategies and potentially accept lower margins on certain products.

The regulatory environment, overseen by agencies like the U.S. Food and Drug Administration (FDA) and international counterparts, is a critical determinant of Amgen's market access and product approval timelines. For 2024 and looking into 2025, evolving FDA guidance, especially concerning the integration of artificial intelligence in drug discovery and the stringent requirements for gene therapies and biologics, will significantly influence Amgen's research, development, and manufacturing strategies.

Stricter enforcement and new mandates for biologics manufacturing, including real-time quality monitoring, are anticipated to elevate operational expenditures. For instance, the FDA's increased focus on data integrity and advanced manufacturing techniques, which will likely intensify in 2025, could necessitate substantial investments in process upgrades and compliance measures for Amgen's extensive biologics portfolio.

Amgen's extensive global reach, serving roughly 100 countries, makes it highly susceptible to shifts in international trade policies and geopolitical stability. For instance, the ongoing discussions and potential implementation of acts like the BIOSECURE Act, which targets collaborations with specific Chinese biotechnology firms, could significantly disrupt Amgen's R&D partnerships and necessitate a re-evaluation of its global supply chain and manufacturing strategies. These geopolitical tensions can directly impact the cost and availability of raw materials and finished products, influencing Amgen's operational efficiency and market access.

Patent and Intellectual Property Protection

Political decisions and international agreements on intellectual property rights significantly shape Amgen's operating environment. The World Intellectual Property Organization (WIPO) plays a key role in setting global IP standards, impacting how Amgen protects its novel biologics and therapeutic discoveries.

The strength and enforcement of patent laws directly influence Amgen's ability to maintain market exclusivity, a critical factor for recouping its substantial research and development investments. For instance, the average cost to develop a new drug can exceed $2 billion, making robust patent protection essential for profitability.

Developments in biotech patent law, including evolving interpretations of patentability for gene-editing technologies, are vital for Amgen's competitive edge. Ongoing litigation and policy discussions around these areas can create both opportunities and risks for the company's future pipeline and existing product portfolio.

- Global IP Treaties: Amgen relies on international agreements like the TRIPS Agreement to safeguard its innovations across different markets.

- Patent Litigation Trends: Monitoring and adapting to patent challenges, particularly in rapidly advancing fields like CRISPR, is crucial for Amgen's R&D strategy.

- Government R&D Incentives: Political support through tax credits and grants for biotechnology research can bolster Amgen's innovation pipeline.

Public Health Initiatives and Funding

Government-led public health initiatives and funding significantly shape the landscape for biopharmaceutical companies like Amgen. For instance, increased government focus on preventive care and disease management, particularly in areas like cardiovascular health and oncology, can directly benefit Amgen. In 2024, many governments are prioritizing investments in research and development for chronic diseases, a core area for Amgen's product portfolio.

These initiatives can translate into direct opportunities. For example, expanded screening programs for conditions like osteoporosis or certain cancers, where Amgen has established therapies, can drive demand. Conversely, a reallocation of public health funding away from Amgen's key therapeutic areas, such as nephrology or inflammation, could present challenges, requiring strategic adjustments in R&D and market focus.

Amgen's commitment to addressing high unmet medical needs, including oncology, nephrology, inflammation, and cardiovascular diseases, positions it to capitalize on these public health priorities. For example, the US National Institutes of Health (NIH) allocated approximately $47.4 billion in funding for medical research in fiscal year 2024, with substantial portions directed towards cancer and cardiovascular research, aligning with Amgen's strategic interests.

Government policies, particularly regarding drug pricing and healthcare access, directly influence Amgen's revenue and strategic decisions. The Inflation Reduction Act (IRA) continues to exert pressure on drug costs, a trend expected to persist through 2025, potentially impacting Amgen's profitability. President Biden's directive for prescription drug price reductions by September 2025 further emphasizes this regulatory focus on affordability.

The regulatory landscape, managed by bodies like the FDA, dictates market access and product approval timelines. Evolving FDA guidance in 2024 and 2025, especially concerning AI in drug discovery and advanced biologics, will shape Amgen's R&D and manufacturing strategies. Stricter mandates for biologics manufacturing, including real-time quality monitoring, are anticipated to increase operational costs for Amgen.

Geopolitical factors and international trade policies significantly affect Amgen's global operations. The BIOSECURE Act, for instance, could disrupt R&D partnerships and supply chains, impacting the cost and availability of materials. Political decisions on intellectual property rights, guided by organizations like WIPO, are crucial for Amgen's protection of its innovations and market exclusivity, which is vital given the over $2 billion average cost of drug development.

Government-backed public health initiatives and funding present both opportunities and challenges for Amgen. Increased investment in chronic disease research, a core area for Amgen, aligns with public health priorities. For example, the NIH's projected $47.4 billion in medical research funding for fiscal year 2024, with significant allocations to cancer and cardiovascular research, directly benefits Amgen's strategic interests.

What is included in the product

This Amgen PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the biopharmaceutical giant.

It provides actionable insights for strategic decision-making by detailing how these external forces present both challenges and opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making the Amgen PESTLE Analysis a readily accessible tool for strategic discussions.

Economic factors

The global economic climate significantly impacts how much is spent on healthcare. Even with some economic headwinds, the biotechnology sector is anticipated to expand considerably. In 2025, global medical costs are expected to stay elevated, reaching an estimated $9.25 trillion worldwide.

This consistent increase in healthcare expenditure creates a positive environment for companies like Amgen, which focus on developing advanced medical treatments. The projected high spending signals sustained demand for innovative pharmaceuticals and therapies.

Inflationary pressures directly impact Amgen's bottom line, potentially driving up costs for raw materials, manufacturing processes, and research and development initiatives. For instance, increased costs in the pharmaceutical supply chain can squeeze profit margins.

Rising interest rates can significantly affect Amgen's cost of capital. This makes borrowing more expensive, potentially slowing down investments in crucial areas like new drug development, strategic acquisitions, or expanding manufacturing capabilities.

Despite potential economic headwinds, Amgen demonstrated robust financial health in 2024, generating $10.4 billion in free cash flow. The company also increased its dividend, signaling confidence in its ability to manage costs and continue investing in growth.

Governments and healthcare payers worldwide continue to exert pressure on drug pricing, aiming to curb rising healthcare expenditures. This economic reality directly impacts pharmaceutical companies like Amgen, influencing their revenue streams and profitability.

In 2024, Amgen reported robust volume growth across its portfolio. However, this was counterbalanced by a decline in net selling prices for certain key products. For instance, while specific figures vary by product and region, the trend of realizing lower prices on a per-unit basis is a notable economic headwind.

The increasing prevalence of biosimilars further intensifies this pricing pressure. As more affordable alternatives enter the market, they often compel originator companies to adjust their own pricing strategies to remain competitive, thereby affecting overall revenue generation.

Research and Development Investment Trends

Amgen's commitment to innovation is evident in its significant R&D spending, a critical driver for its future success in the competitive biotechnology landscape. The company's investment reached a new high of $6.0 billion in 2024, marking a substantial 25% increase. This surge underscores Amgen's dedication to advancing its pipeline and developing groundbreaking therapies.

While the broader biotechnology funding environment has become more discerning, capital remains available for programs demonstrating strong potential, especially in cutting-edge areas like advanced therapies and oncology. This trend suggests that well-positioned research initiatives can still attract significant investment, benefiting companies like Amgen that are focused on high-impact areas.

- Record R&D Investment: Amgen allocated $6.0 billion to research and development in 2024, a 25% year-over-year increase.

- Pipeline Advancement Focus: This increased investment signals a strong commitment to accelerating the development of new drugs and therapies.

- Biotech Funding Landscape: Overall funding in the biotech sector, though more selective, continues to be robust for promising projects in advanced therapies and oncology.

- Competitive Edge: Sustained R&D investment is vital for Amgen to maintain its leadership position and competitiveness in the rapidly evolving biopharmaceutical industry.

Exchange Rate Fluctuations

As a global biopharmaceutical company with operations in roughly 100 countries, Amgen is significantly exposed to exchange rate fluctuations. Changes in currency values directly affect the translation of international sales and expenses into Amgen's reporting currency, typically the US dollar. For instance, a stronger US dollar can make Amgen's products more expensive in foreign markets, potentially dampening demand, while a weaker dollar can boost reported international revenues.

These currency movements are a critical factor in Amgen's financial performance. In 2023, Amgen reported that foreign exchange rates had a negative impact on its total revenues. The company noted that unfavorable currency movements reduced its reported revenue by approximately $200 million for the full year 2023 compared to the prior year. This illustrates the tangible effect of currency volatility on its bottom line.

- Global Reach, Local Impact: Amgen's presence in approximately 100 countries means its financial results are a composite of many currencies.

- Revenue Translation Effects: Fluctuations in exchange rates directly alter the US dollar value of revenues earned in other countries.

- Profitability Sensitivity: Beyond revenue, operating expenses incurred internationally are also subject to currency translation, impacting overall profitability.

- 2023 Impact: Unfavorable currency movements negatively impacted Amgen's total revenues by an estimated $200 million in 2023.

Economic factors play a crucial role in Amgen's performance, influencing everything from healthcare spending to pricing pressures. Global medical costs are projected to reach $9.25 trillion by 2025, indicating a robust market for innovative therapies. However, Amgen faces economic challenges such as inflation impacting R&D and manufacturing costs, and rising interest rates affecting its cost of capital.

Despite these headwinds, Amgen demonstrated financial strength in 2024, generating $10.4 billion in free cash flow and increasing its dividend. The company experienced strong volume growth in 2024, though this was offset by declining net selling prices for some products, a trend exacerbated by the increasing prevalence of biosimilars.

Amgen's commitment to innovation is underscored by a record $6.0 billion investment in R&D in 2024, a 25% increase, signaling a focus on advanced therapies and oncology. Furthermore, currency fluctuations presented a challenge, with unfavorable exchange rates reducing Amgen's reported revenue by approximately $200 million in 2023.

What You See Is What You Get

Amgen PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Amgen provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into Amgen's market landscape and potential challenges or opportunities.

Sociological factors

The world's population is getting older, which is a major trend. By 2050, it's projected that nearly 1 in 6 people globally will be over 65, a significant jump from 1 in 11 in 2015. This demographic shift directly fuels demand for treatments in areas where Amgen is a leader, like cancer, heart disease, and bone conditions.

As lifespans extend, chronic and age-related diseases become more common. This creates a larger pool of patients who can benefit from Amgen's innovative therapies. For instance, the global burden of cardiovascular diseases, a key focus for Amgen, continues to rise, with an estimated 17.9 million deaths annually according to the WHO.

Amgen's diverse portfolio, covering General Medicine, Rare Disease, Inflammation, and Oncology, is particularly well-positioned to address the health needs of an aging demographic. The increasing prevalence of conditions like osteoporosis, affecting millions worldwide, presents ongoing opportunities for Amgen's bone health treatments.

Increased public health awareness, particularly concerning chronic diseases, is a significant sociological factor. For instance, by early 2024, global awareness of conditions like cardiovascular disease and cancer continued to rise, driving demand for innovative treatments. This heightened awareness directly influences patient choices and expectations from companies like Amgen.

Patient advocacy groups are increasingly powerful, acting as a collective voice to push for better drug access and affordability. These organizations, often funded by a mix of individual donations and grants, actively lobby governments and engage with pharmaceutical firms. Their influence can steer research and development towards addressing unmet medical needs, a key area for Amgen's strategic focus.

Amgen's commitment to improving patient lives by translating scientific discoveries into therapies directly responds to these sociological trends. By early 2024, Amgen was actively engaged in developing treatments for areas with high patient advocacy, such as rare diseases and oncology, reflecting the impact of these groups on shaping R&D pipelines.

Societal shifts towards sedentary lifestyles and processed food consumption are directly impacting the prevalence of chronic diseases. For instance, the World Health Organization reported that in 2022, approximately 1 in 8 people globally lived with obesity, a significant increase that directly impacts the market for treatments like Amgen's MariTide, which targets cardiovascular risk factors often associated with obesity.

These evolving health landscapes necessitate a proactive approach from pharmaceutical companies. By monitoring trends in conditions such as diabetes and heart disease, Amgen can better align its research and development pipeline, ensuring it addresses the most pressing future healthcare needs and capitalizes on emerging market opportunities.

Access to Healthcare and Health Equity

Societal expectations increasingly demand greater health equity and improved access to healthcare. This pressure directly impacts how companies like Amgen approach drug distribution and pricing, pushing for more inclusive models. Amgen's stated commitment to expanding access, especially in lower-income regions, aligns with these global aspirations, though it brings significant operational hurdles.

Amgen actively participates in humanitarian access programs and has set goals to address health equity. For instance, in 2023, Amgen reported providing $3.7 billion in product donations and discounts through its patient assistance programs, demonstrating a tangible effort to bridge access gaps. This focus is crucial as global health organizations and governments emphasize reducing disparities in medical treatment availability.

- Societal Pressure: Growing public demand for equitable healthcare access influences Amgen's pricing and distribution strategies.

- Global Alignment: Amgen's efforts to increase access in low-and-middle-income countries mirror broader international health objectives.

- Operational Challenges: Expanding access in diverse global markets presents complex logistical and regulatory hurdles.

- Company Initiatives: Amgen supports humanitarian access programs and aims to tackle health equity issues, evidenced by significant product donation figures.

Public Perception of Biotechnology and Pharmaceuticals

Public trust in the biotechnology and pharmaceutical sectors is a significant factor influencing Amgen's operations. Concerns around drug pricing, the ethics of genetic research, and the speed of new drug development can shape public opinion and, consequently, regulatory and market access. For instance, a 2024 survey indicated that while a majority of people recognize the importance of pharmaceutical innovation, a substantial portion still expresses skepticism regarding pricing practices.

Amgen's commitment to transparency in its research and development processes, coupled with a focus on responsible business practices, is vital for cultivating a positive public image. Demonstrating ethical conduct in R&D, particularly with advanced therapies, directly impacts its social license to operate. The company's emphasis on ethical research and development, as highlighted in its 2024 sustainability report, aims to address these public concerns head-on.

Maintaining a strong reputation requires proactive engagement with societal expectations.

- Public trust is essential for market acceptance and regulatory approval.

- Concerns over drug pricing remain a persistent issue influencing public perception.

- Ethical considerations in R&D, especially with novel technologies, are under constant scrutiny.

- Companies like Amgen must demonstrate transparency to build and maintain credibility.

The aging global population is a significant driver for Amgen, as older demographics often require treatments for chronic conditions like cardiovascular disease and cancer, areas where Amgen has a strong presence. By 2050, projections indicate that nearly 1 in 6 people worldwide will be over 65, a substantial increase from 2015. This demographic shift directly fuels demand for Amgen's innovative therapies.

Increased public awareness of chronic diseases, such as obesity and diabetes, further bolsters the market for Amgen's products. For example, the World Health Organization reported in 2022 that around 1 in 8 people globally lived with obesity, a trend that often correlates with increased demand for treatments addressing related health issues.

Patient advocacy groups are increasingly influential, pushing for better drug access and affordability, which can steer R&D towards unmet medical needs. Amgen's focus on rare diseases and oncology aligns with the priorities often championed by these groups. Societal expectations for greater health equity also pressure companies like Amgen to improve access and pricing, a challenge Amgen addresses through humanitarian programs and product donations, totaling $3.7 billion in 2023.

Public trust in the pharmaceutical sector, particularly concerning drug pricing and research ethics, significantly impacts Amgen's operations and market perception. A 2024 survey highlighted ongoing public skepticism regarding pricing practices, underscoring the need for Amgen's commitment to transparency in its R&D and business practices to maintain credibility.

| Sociological Factor | Impact on Amgen | Relevant Data/Trend |

|---|---|---|

| Aging Population | Increased demand for treatments in oncology, cardiovascular, and bone health. | By 2050, nearly 1 in 6 people globally projected to be over 65 (up from 1 in 11 in 2015). |

| Health Awareness & Lifestyle Trends | Growing market for treatments addressing chronic diseases like obesity and diabetes. | In 2022, approximately 1 in 8 people globally lived with obesity (WHO). |

| Patient Advocacy & Health Equity | Influence on R&D priorities and pressure for improved access and pricing. | Amgen provided $3.7 billion in product donations and discounts in 2023 through patient assistance programs. |

| Public Trust & Ethical Concerns | Impacts reputation, market acceptance, and regulatory scrutiny. | A 2024 survey indicated public skepticism regarding pharmaceutical pricing practices. |

Technological factors

Amgen's foundation is built on its pioneering work in genetic and protein engineering, allowing it to create groundbreaking human therapies. Recent advancements like CRISPR-Cas9 gene editing and sophisticated protein design are directly bolstering its capacity to discover and develop novel treatments.

The gene editing market is poised for substantial expansion, with an increasing number of CRISPR-based medicines receiving regulatory approval. This trend is projected to reach $7.6 billion by 2028, indicating a significant opportunity for companies like Amgen that are at the forefront of this technology.

Artificial intelligence and machine learning are revolutionizing drug discovery, speeding up processes, lowering expenses, and uncovering new treatment avenues. Amgen is actively using AI throughout its operations, from creating new molecules to managing clinical trials and submitting regulatory documents.

AI-powered systems are projected to significantly shorten the duration of drug development. For instance, in 2023, companies utilizing AI reported an average reduction of 15-20% in early-stage discovery timelines compared to traditional methods.

Amgen's commitment to biomanufacturing innovation is evident in its strategic investments. The company opened its first fully electric biomanufacturing facility in Ohio in 2024, a significant step towards more sustainable and cost-efficient production. This facility is designed to scale operations, reflecting the critical role of advanced manufacturing in meeting growing demand for biopharmaceuticals.

Automation is a key driver in this evolution. By integrating automated processes, Amgen aims to enhance the speed, precision, and reliability of its manufacturing operations. This trend extends to laboratory automation, a vital component for accelerating research and development, ultimately enabling faster delivery of new therapies to patients.

Precision Medicine and Personalized Therapeutics

The technological landscape is increasingly shaped by precision medicine, which uses genomics and biomarkers to customize treatments for individual patients. This trend directly supports Amgen's strategy of tackling severe diseases with cutting-edge science and personalized healthcare approaches.

The growth in this sector is substantial, with the precision medicine market anticipated to reach USD 207.80 billion by 2032. This expansion highlights the increasing demand and investment in tailored therapeutic solutions.

- Genomic Sequencing: Advancements in DNA sequencing technology enable deeper understanding of individual patient profiles.

- Biomarker Discovery: Identifying specific biomarkers allows for more targeted drug development and patient selection.

- Data Analytics: Sophisticated data analysis tools are crucial for processing the vast amounts of genomic and clinical data generated.

- Personalized Therapies: The development of drugs designed to act on specific genetic mutations or biological pathways is a key outcome.

Digital Health and Real-World Evidence

The rise of digital health tools and remote patient monitoring is transforming pharmaceutical development and oversight. Amgen is actively integrating these technologies, including advanced data science, to enhance its operations.

Real-world evidence (RWE) is increasingly crucial for clinical trials and post-market surveillance, offering deeper insights into drug efficacy and patient outcomes. This trend allows for more efficient data collection and a richer understanding of treatment impact.

- Digital Health Adoption: By 2024, the global digital health market was projected to reach over $660 billion, underscoring the significant shift towards technology-driven healthcare solutions.

- RWE Integration: A 2023 survey indicated that over 70% of pharmaceutical companies were increasing their investment in RWE capabilities to inform decision-making.

- Amgen's Focus: Amgen's strategic investments in data science and digital platforms are aimed at optimizing clinical trial design and accelerating the delivery of innovative therapies.

Amgen's technological edge is amplified by its embrace of AI and machine learning, which are accelerating drug discovery and streamlining clinical trials, with AI-driven development showing a 15-20% reduction in early-stage timelines in 2023.

The company's investment in advanced biomanufacturing, including its first fully electric facility opened in 2024, alongside automation in research and production, enhances efficiency and scalability.

Furthermore, Amgen is leveraging precision medicine, a market projected to reach $207.80 billion by 2032, by utilizing genomic sequencing and biomarker discovery to tailor treatments.

The integration of digital health tools and real-world evidence is also a key focus, with the digital health market surpassing $660 billion in 2024 and over 70% of pharma companies increasing RWE investment in 2023.

| Technology Area | Impact on Amgen | Market Projection/Data Point |

|---|---|---|

| AI & Machine Learning | Accelerated drug discovery, optimized clinical trials | 15-20% reduction in early-stage discovery timelines (2023) |

| Biomanufacturing & Automation | Enhanced efficiency, scalability, sustainability | First fully electric facility opened (2024) |

| Precision Medicine | Personalized therapies, targeted treatments | Market to reach $207.80 billion by 2032 |

| Digital Health & RWE | Improved clinical trial design, real-world insights | Digital health market >$660 billion (2024); 70%+ pharma RWE investment increase (2023) |

Legal factors

Amgen's business heavily relies on robust legal frameworks for intellectual property, particularly patent protection and enforcement. These legal safeguards are crucial for recouping substantial research and development expenditures and maintaining market exclusivity for its innovative therapies.

The company actively monitors and engages with patent litigation and evolving patent laws, such as those concerning double patenting or government license rights, which directly impact its ability to protect its innovations. In 2023, Amgen was involved in numerous patent disputes, reflecting the high stakes in the biopharmaceutical industry where patent expirations can lead to significant revenue loss.

Patent activity serves as a vital barometer for the biotech sector's health and Amgen's competitive standing. For instance, the number of patents granted to Amgen and its ongoing patent filings in 2024 and early 2025 will be key indicators of its future product pipeline and market potential.

Amgen navigates a complex web of global regulatory requirements, with the U.S. Food and Drug Administration (FDA) being a primary authority. For 2025, new directives are expected, including intensified scrutiny of artificial intelligence applications in drug discovery and more rigorous Good Manufacturing Practices (GMP) for biologic drugs. These evolving standards, alongside mandates for greater diversity in clinical trials, demand ongoing strategic adjustments and substantial compliance investments.

Failure to adhere to these stringent regulations can result in significant financial penalties, product recalls, and restricted market access, directly impacting Amgen's revenue streams and operational continuity. The company's proactive approach to understanding and implementing these global compliance shifts is crucial for maintaining its competitive edge and ensuring patient safety.

Antitrust and competition laws are significant factors for Amgen, particularly concerning its strategic growth through mergers and acquisitions. The company's acquisition of Horizon Therapeutics plc, completed in late 2023 for approximately $27.8 billion, faced considerable antitrust review, underscoring the intense scrutiny on large-scale pharma deals. This regulatory landscape directly influences Amgen's ability to expand its portfolio and market presence.

Furthermore, competition laws shape Amgen's operational environment by dictating fair practices in areas such as biosimilar development and market access negotiations. These regulations impact how Amgen competes with other pharmaceutical companies, influencing pricing strategies and the introduction of new therapies. Amgen's successful integration of Horizon Therapeutics demonstrates its capacity to navigate these complex legal frameworks to achieve its growth objectives.

Data Privacy and Cybersecurity Regulations

Amgen, like all major biopharmaceutical companies, navigates a complex web of data privacy and cybersecurity regulations. Strict global rules, including the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), dictate how Amgen must handle sensitive patient data and critical clinical trial information. Failure to comply can result in significant legal penalties and damage to patient trust, necessitating substantial investment in robust cybersecurity infrastructure.

The responsible integration of artificial intelligence (AI) into Amgen's operations also falls under these evolving governance frameworks. Ensuring data integrity and patient confidentiality is paramount as Amgen leverages AI for drug discovery and development. In 2024, the global cybersecurity market is projected to reach over $270 billion, highlighting the significant resources companies like Amgen must allocate to data protection.

- GDPR and CCPA Compliance: Amgen must adhere to stringent rules regarding the collection, storage, and processing of personal data, impacting clinical trial recruitment and patient engagement strategies.

- Cybersecurity Investments: Significant financial resources are dedicated to protecting sensitive R&D data and patient information from breaches, with cybersecurity spending expected to rise globally.

- AI Governance: The ethical and secure use of AI in pharmaceutical research and development requires clear policies to manage data access and algorithmic transparency.

- Regulatory Scrutiny: Increased focus on data privacy by regulators worldwide means Amgen must continuously update its practices to meet evolving legal standards.

Product Liability and Litigation

Amgen, like all major pharmaceutical firms, navigates a landscape fraught with potential product liability claims. These lawsuits often stem from concerns about drug safety, effectiveness, or alleged manufacturing flaws. For instance, in 2024, the pharmaceutical industry continued to see litigation surrounding side effects and marketing practices, with significant settlements impacting company finances and public perception.

Legal battles concerning adverse patient reactions, off-label marketing of prescription drugs, or deviations in manufacturing processes can lead to substantial financial penalties and considerable damage to a company's reputation. Amgen's commitment to rigorous quality control measures and comprehensive pharmacovigilance programs is therefore crucial for minimizing exposure to these litigation risks.

- Product Liability Exposure: Pharmaceutical companies, including Amgen, are consistently exposed to lawsuits alleging harm caused by their products.

- Litigation Triggers: Adverse events, off-label promotion, and manufacturing defects are primary drivers of product liability litigation.

- Financial and Reputational Impact: Successful lawsuits can result in significant financial penalties and lasting reputational damage.

- Risk Mitigation: Robust quality control and pharmacovigilance are essential strategies for managing product liability risks.

Amgen's legal strategy is deeply intertwined with intellectual property rights, particularly patents, which are vital for protecting its significant R&D investments. The company actively engages in patent litigation and monitors changes in patent law, as demonstrated by its involvement in numerous patent disputes in 2023. Future patent filings and grants in 2024 and 2025 will be key indicators of Amgen's innovation pipeline.

Navigating global regulatory landscapes, including the FDA's evolving standards for 2025, requires substantial compliance investments. Failure to meet these stringent requirements can lead to severe financial penalties and market access limitations.

Antitrust laws significantly influence Amgen's growth strategies, as seen in the extensive review of its $27.8 billion acquisition of Horizon Therapeutics in late 2023. These laws also shape fair competition practices within the biopharmaceutical market.

Amgen must comply with stringent data privacy and cybersecurity regulations like GDPR and CCPA, necessitating significant investments in data protection infrastructure. The global cybersecurity market exceeding $270 billion in 2024 highlights the scale of these efforts.

Environmental factors

Amgen is committed to mitigating its environmental footprint, setting a target for carbon neutrality across its owned and operated facilities by 2027. The company has already achieved a notable reduction in Scope 1 and 2 greenhouse gas emissions, demonstrating tangible progress towards its sustainability objectives.

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, pose a significant risk to Amgen's global supply chain operations. These disruptions could impact manufacturing, logistics, and the availability of critical raw materials, necessitating robust contingency planning.

The biotechnology sector, including companies like Amgen, faces significant challenges in managing specialized waste generated from research and manufacturing. Strict environmental regulations necessitate robust pollution control measures to ensure compliance and minimize ecological impact. Effective waste management is not just a regulatory hurdle but a core component of corporate sustainability efforts.

Amgen has publicly committed to substantial waste reduction, aiming for a 75% decrease in disposed waste by 2027, measured against a 2019 baseline. This ambitious target underscores the company's dedication to shrinking its environmental footprint across its operational activities, from laboratory research to large-scale production.

Water is absolutely essential for Amgen's operations, from research and development to the actual manufacturing of medicines. The company recognizes this, setting ambitious goals for reducing its water consumption. As of 2024, Amgen had already achieved a significant 57% of its water reduction target, demonstrating a strong commitment to efficiency.

However, the reality of water scarcity in various geographical locations where Amgen operates presents a tangible risk. This scarcity could disrupt production and research activities, making robust and efficient water management strategies not just a best practice, but a critical necessity for continued operational success.

Sustainable Sourcing and Supply Chain

Amgen is actively working to embed environmental sustainability throughout its supply chain. A key objective is to have 73% of its suppliers, based on spending, adopt science-based targets by 2027. This initiative underscores Amgen's dedication to ensuring its partners align with global climate goals.

The company recognizes that robust supplier engagement is crucial for its environmental stewardship. By encouraging and verifying that suppliers adhere to sustainable practices and comply with environmental regulations, Amgen aims to mitigate risks and enhance its overall environmental footprint and corporate image.

- Supplier Engagement Goal: Amgen aims for 73% of suppliers by spend to have science-based targets by 2027.

- Risk Mitigation: Ensuring supplier compliance with environmental regulations is vital for Amgen's reputation.

- Sustainable Practices: The focus is on integrating eco-friendly operations across the entire supply network.

Renewable Energy Adoption

Amgen is actively pursuing a significant shift towards renewable energy, with a key environmental goal to source 100% renewable electricity for all its operations by 2027. This commitment is demonstrated through concrete actions, such as the development of its first entirely electric biomanufacturing facility.

This strategic move is designed to substantially lower Amgen's carbon footprint, aligning it with broader global sustainability objectives and the increasing demand for environmentally responsible business practices. By 2024, Amgen had already achieved an impressive 69% of its carbon reduction targets.

- Renewable Electricity Target: 100% by 2027.

- First Fully Electric Facility: A key milestone in operational sustainability.

- Carbon Reduction Progress: 69% achieved by 2024.

Amgen is actively pursuing ambitious environmental goals, aiming for carbon neutrality in its facilities by 2027 and a 75% reduction in disposed waste by 2027 from a 2019 baseline. The company is also focused on water conservation, having achieved 57% of its water reduction target by 2024, and plans to source 100% renewable electricity by 2027, with 69% of carbon reduction targets met as of 2024.

| Environmental Goal | Target Year | Progress (as of 2024) | Baseline |

|---|---|---|---|

| Carbon Neutrality (Owned/Operated Facilities) | 2027 | N/A | N/A |

| Waste Reduction (Disposed) | 2027 | N/A | 2019 |

| Water Consumption Reduction | N/A | 57% achieved | N/A |

| Renewable Electricity Sourcing | 2027 | N/A | N/A |

| Carbon Reduction Targets | N/A | 69% achieved | N/A |

PESTLE Analysis Data Sources

Our Amgen PESTLE Analysis is built on a robust foundation of data from leading global health organizations, government regulatory bodies, and reputable market research firms. We synthesize insights from scientific journals, economic indicators, and industry-specific reports to ensure comprehensive and accurate assessments.