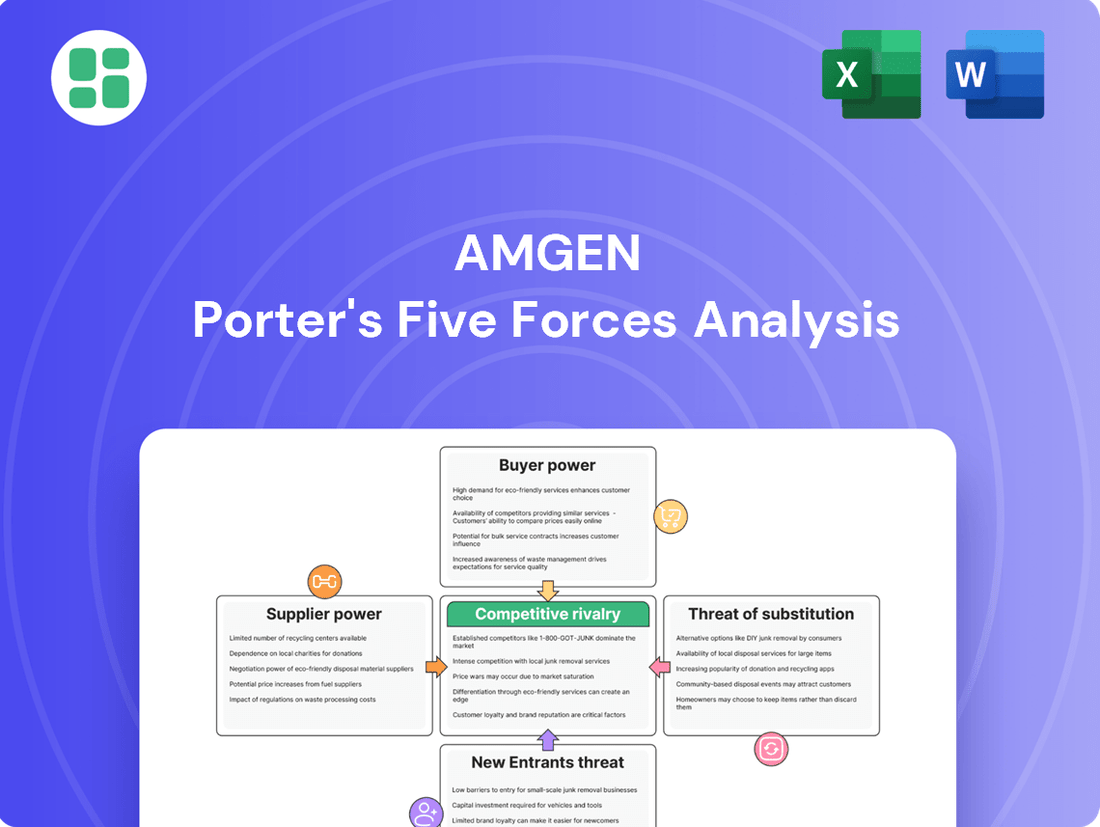

Amgen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

Amgen navigates a complex landscape shaped by intense rivalry, powerful buyers, and the constant threat of new entrants and substitutes. Understanding these forces is crucial for any stakeholder in the biopharmaceutical sector.

The complete report reveals the real forces shaping Amgen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Amgen's reliance on a select group of specialized suppliers for crucial components like Active Pharmaceutical Ingredients (APIs) and advanced manufacturing materials significantly amplifies supplier bargaining power. The scarcity of viable alternatives for these highly specialized inputs means suppliers can exert considerable influence over pricing and terms. In 2024, the cost of APIs alone constituted a notable percentage of Amgen's Cost of Goods Sold, underscoring the financial impact of these concentrated supplier relationships.

High switching costs significantly bolster suppliers' bargaining power. For Amgen, transitioning to a new specialized supplier isn't a simple task; it involves considerable expense and time. This is largely due to the rigorous validation processes required for new suppliers, which can easily extend for 18 to 24 months.

Furthermore, obtaining necessary compliance certifications for these new suppliers adds another layer of cost, potentially ranging from $3.5 million to $5.2 million. These substantial financial and temporal barriers limit Amgen's ability to easily change suppliers, thereby strengthening the hand of existing suppliers during price and contract negotiations.

Suppliers with proprietary technologies or unique expertise in bioprocessing and manufacturing can hold significant sway. Amgen's deep reliance on advanced science, especially in genetic and protein engineering, means that certain critical inputs are sourced from a limited number of highly specialized providers.

This dependence on specialized knowledge and technology can translate into higher costs for essential components. For instance, the development and manufacturing of complex biologics often require unique cell lines or specialized reagents that are not readily available from multiple sources, potentially leading to premium pricing that impacts Amgen's overall cost structure.

Quality and Regulatory Compliance Dependence

The pharmaceutical and biotech sectors operate under a strict regulatory framework, demanding that suppliers meet exceptionally high quality and compliance benchmarks. Amgen's reliance on its suppliers to consistently meet these exacting standards significantly limits its ability to easily transition to new or unproven vendors. A failure in quality or compliance from a supplier could lead to serious consequences for Amgen's product reliability and its reputation in the market.

Amgen's dependence on specialized suppliers for critical components, such as active pharmaceutical ingredients (APIs) and advanced manufacturing equipment, underscores the bargaining power of these suppliers. For instance, in 2024, the global API market was valued at approximately $230 billion, with a significant portion concentrated among a few key manufacturers that adhere to stringent Good Manufacturing Practices (GMP) required by regulatory bodies like the FDA and EMA.

- High Switching Costs: Amgen faces substantial costs and time delays in qualifying new suppliers, particularly for specialized raw materials or complex manufacturing processes, due to rigorous validation and testing protocols.

- Supplier Concentration: The market for certain critical inputs, like specific biologics manufacturing components or advanced cell culture media, may be dominated by a limited number of suppliers, increasing their leverage.

- Regulatory Hurdles: Suppliers must maintain compliance with evolving global regulations (e.g., FDA's 21 CFR Part 210/211, EMA's EudraLex Volume 4), and any disruption in this compliance can directly impact Amgen's production continuity.

- Intellectual Property and Expertise: Some suppliers possess unique intellectual property or specialized technical expertise essential for Amgen's innovative drug development and manufacturing, granting them significant bargaining power.

Increasing Input Costs and Supply Chain Volatility

The biopharmaceutical industry, including companies like Amgen, faces increasing input costs and supply chain volatility. Raw materials such as specialized plastics and chemicals crucial for bioprocessing have seen price instability. For instance, reports in early 2024 indicated potential price hikes for certain single-use bioprocessing components due to manufacturing complexities and demand surges.

Global economic factors, including persistent inflation and ongoing supply chain disruptions stemming from geopolitical events, exacerbate this issue. These external pressures can directly translate into higher costs for essential inputs, impacting Amgen's cost of goods sold. For example, the cost of shipping and logistics, vital for sourcing materials, remained elevated throughout much of 2023 and into 2024.

This upward pressure on supplier costs poses a direct threat to Amgen's profitability. If Amgen cannot effectively absorb these increased expenses or pass them on to customers through price adjustments, its profit margins could be squeezed. The company's ability to negotiate favorable terms with suppliers or secure long-term contracts becomes critical in mitigating this risk.

- Bioprocessing Component Costs: Reports in early 2024 highlighted potential price increases for specialized plastics and other single-use bioprocessing supplies.

- Inflationary Impact: Persistent global inflation continued to drive up the cost of various raw materials and manufacturing inputs throughout 2023 and into 2024.

- Supply Chain Vulnerabilities: Ongoing geopolitical tensions and logistical challenges have contributed to increased shipping and transportation expenses for critical supplies.

- Margin Erosion Risk: Amgen's profitability could be negatively affected if it cannot offset rising supplier costs through efficiency gains or price adjustments.

Amgen's reliance on a few specialized suppliers for critical components like APIs and advanced manufacturing materials significantly enhances supplier bargaining power. The limited availability of alternatives for these highly specific inputs allows suppliers to dictate pricing and terms, impacting Amgen's cost structure. In 2024, the cost of APIs represented a substantial portion of Amgen's Cost of Goods Sold, highlighting the financial leverage held by these concentrated suppliers.

The high costs and extended timelines associated with qualifying new suppliers, often 18 to 24 months, coupled with certification expenses potentially ranging from $3.5 million to $5.2 million, create formidable switching barriers. This significantly strengthens the negotiating position of existing suppliers, making it difficult for Amgen to easily change vendors.

Suppliers possessing proprietary technologies or unique expertise in bioprocessing and manufacturing, particularly in areas like genetic and protein engineering, wield considerable influence. This dependence on specialized knowledge for essential components, such as unique cell lines or specific reagents for complex biologics, can lead to premium pricing that affects Amgen's overall profitability.

| Factor | Impact on Amgen | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Key APIs and specialized bioprocessing components sourced from a few manufacturers. |

| Switching Costs | High costs and time for supplier qualification. | Validation processes can take 18-24 months; certification costs $3.5M-$5.2M. |

| Proprietary Technology/Expertise | Suppliers with unique capabilities command higher prices. | Essential for advanced biologics, genetic engineering, and protein manufacturing. |

| Regulatory Compliance | Suppliers must meet stringent quality standards. | FDA and EMA compliance (e.g., GMP) limits supplier options and necessitates rigorous vetting. |

What is included in the product

This analysis dissects the competitive forces impacting Amgen, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the prevalence of substitutes within the biopharmaceutical industry.

Effortlessly identify and mitigate competitive threats by visualizing Amgen's industry landscape with a dynamic Porter's Five Forces analysis.

Customers Bargaining Power

Amgen's customers are primarily large organizations like Pharmacy Benefit Managers (PBMs), hospitals, and government healthcare programs, not individual patients. These powerful buyers use their significant purchasing volume to secure substantial discounts and influence which of Amgen's high-value biologic drugs are included on their approved lists. In 2024, PBMs continue to wield considerable influence, with major players managing prescription benefits for tens of millions of Americans, directly impacting Amgen's market access and pricing power.

Government regulations are significantly impacting drug pricing, thereby influencing the bargaining power of customers. Policies like the Inflation Reduction Act (IRA) in the United States and the upcoming Joint Clinical Assessments (JCA) under the EU HTA legislation in Europe are designed to exert downward pressure on drug costs. This regulatory environment directly challenges pharmaceutical companies like Amgen by potentially reducing their pricing power and, consequently, their revenue per unit.

While the pharmaceutical sector historically saw upward pricing trends, the current regulatory landscape demands careful consideration of pricing strategies. For instance, the IRA allows Medicare to negotiate prices for certain high-cost drugs, a measure that began impacting a select group of drugs in 2024. This increased scrutiny means that while companies may anticipate continued demand, their ability to set prices freely is diminishing, amplifying customer influence through regulatory channels.

The increasing availability and adoption of biosimilars directly challenge Amgen's pricing power. Biosimilars often launch with a discount of 30-35%, compelling Amgen to reduce prices for its biologics to stay competitive, as observed with key products.

Demand for Value-Based Care

Customers, particularly healthcare providers and payers, are increasingly focused on value-based care. This means they want to see tangible evidence that Amgen's products deliver superior clinical outcomes and cost-effectiveness. For instance, in 2024, the trend towards outcomes-based contracts in the pharmaceutical sector continued to gain momentum, with payers scrutinizing real-world data more rigorously than ever before.

This shift directly impacts Amgen's bargaining power. As reimbursement models increasingly tie payments to patient results, Amgen faces pressure to prove its therapies are not just effective, but also economically advantageous compared to alternatives. This demand for demonstrable value means customers have more leverage in negotiating pricing and market access for Amgen's innovative treatments.

- Increased Scrutiny on Real-World Evidence: Payers and providers are demanding robust data demonstrating long-term patient benefits and cost savings, moving beyond traditional clinical trial endpoints.

- Shift to Outcomes-Based Contracts: The adoption of payment models linked to patient success metrics gives customers greater power to influence pricing and market penetration based on performance.

- Emphasis on Economic Value Proposition: Amgen must clearly articulate the total economic benefit of its therapies, including reduced hospitalizations, fewer side effects, and improved quality of life, to justify its pricing.

Patient Advocacy and Public Scrutiny

While individual patients typically have minimal direct bargaining power when it comes to specialized biologics like those produced by Amgen, collective patient advocacy groups and broader public sentiment can significantly influence drug pricing. High drug costs have consistently been a focal point in public discourse and political debates throughout 2024 and into 2025. This heightened scrutiny often translates into increased demands for price controls and greater transparency in pharmaceutical pricing, indirectly bolstering the negotiating leverage of major payers when dealing with companies such as Amgen.

The impact of patient advocacy is amplified by public sentiment, which has shown a growing intolerance for what is perceived as exorbitant drug pricing. For instance, in 2024, several high-profile legislative efforts and public campaigns focused on lowering prescription drug costs, directly pressuring pharmaceutical companies. This environment creates a scenario where even if individual patients cannot negotiate, the collective voice, amplified through media and political channels, forces companies to consider public perception and potential regulatory repercussions when setting prices.

- Patient Advocacy Groups: Organizations representing patients with specific conditions often lobby for lower drug prices, influencing public opinion and policy.

- Public Scrutiny: Media coverage and public outcry over high drug costs can lead to reputational damage for pharmaceutical companies.

- Political Pressure: Elected officials often respond to constituent concerns by proposing or enacting legislation aimed at controlling drug prices.

- Payer Leverage: Increased public and political pressure on drug manufacturers can empower large insurance companies and government healthcare programs to negotiate more aggressively on pricing.

Amgen's customers, primarily large entities like Pharmacy Benefit Managers (PBMs) and government programs, wield significant bargaining power due to their substantial purchasing volume. This allows them to negotiate lower prices and influence Amgen's market access, a trend amplified by regulatory pressures in 2024. The increasing prevalence of biosimilars further erodes Amgen's pricing leverage, as these competing products often enter the market at a substantial discount.

The shift towards value-based care models in 2024 means customers demand robust evidence of Amgen's product efficacy and cost-effectiveness. This necessitates a clear articulation of economic benefits, empowering payers to negotiate more aggressively based on real-world outcomes. Public sentiment and patient advocacy also exert indirect pressure, pushing for price transparency and controls, which can translate into stronger negotiating positions for Amgen's buyers.

| Customer Type | Bargaining Power Factors | Impact on Amgen |

| PBMs & Payers | High purchasing volume, formulary control, value-based contracting | Price concessions, restricted market access, demand for outcome data |

| Government Programs (e.g., Medicare) | Price negotiation mandates (IRA), bulk purchasing power | Direct price reductions on negotiated drugs, increased regulatory scrutiny |

| Hospitals & Health Systems | Volume discounts, formulary management, preference for cost-effective alternatives | Pressure on list prices, demand for bundled pricing or rebates |

| Biosimilar Manufacturers | Lower production costs, market entry with significant discounts | Erosion of Amgen's market share and pricing power for biologics |

Preview Before You Purchase

Amgen Porter's Five Forces Analysis

This preview showcases the complete Amgen Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the biopharmaceutical industry. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

Amgen faces intense competition in crucial therapeutic areas like oncology, nephrology, inflammation, and cardiovascular diseases. Established pharmaceutical giants and agile biotech firms are all aggressively pursuing market share in these lucrative and impactful fields. This creates a dynamic environment where innovation is paramount, with companies constantly striving to bring novel treatments to market.

The competitive pressure is evident in the ongoing 'innovation arms race' within these therapeutic segments. Companies are heavily invested in research and development, aiming to be first-to-market with groundbreaking therapies. Despite Amgen's strong portfolio, including 14 blockbuster products exiting 2024, the sheer number of competitors means that market dominance requires continuous adaptation and superior product offerings.

The competitive rivalry in the biopharmaceutical sector is intense, fueled by relentless investment in research and development (R&D) to discover and launch novel human therapeutics. Companies must continuously innovate to maintain their market position and drive future growth.

Amgen's commitment to innovation is evident in its substantial R&D spending. In 2024, the company invested a record $6.0 billion in R&D, underscoring the critical need to develop a robust pipeline of innovative medicines to stay ahead of competitors.

Amgen's diverse pipeline, featuring potential first- or best-in-class therapies across various therapeutic areas, is a key differentiator. This pipeline is essential for securing future revenue streams and effectively competing against established and emerging rivals in the dynamic biopharmaceutical landscape.

Amgen is navigating intense competition as patents expire on its blockbuster drugs, paving the way for biosimilar and generic rivals. This trend significantly impacts its revenue streams, as seen with the anticipated market entry of biosimilars for key products. For instance, the biosimilar competition for Enbrel, a significant revenue generator, poses a direct threat to Amgen's market share and pricing power.

The introduction of biosimilars for Amgen's biologics, including Prolia, Xgeva, and Eylea, is already contributing to sales erosion and heightened price competition. This dynamic forces Amgen to adapt its commercial strategies to retain market presence and profitability in the face of lower-cost alternatives. The market for these biologics is substantial, making the impact of biosimilar entry particularly pronounced.

Effectively managing these patent cliffs and proactively developing its own biosimilar pipeline are crucial for Amgen's sustained growth. By introducing its own biosimilars, Amgen aims to capture market share in the evolving therapeutic landscape and offset the revenue losses from its originator products. This dual strategy is essential for maintaining a competitive edge and ensuring long-term financial health.

Strategic Mergers and Acquisitions

The biotechnology and pharmaceutical industries are experiencing a significant uptick in strategic mergers and acquisitions (M&A). Companies are actively pursuing these deals to bolster their drug pipelines, acquire novel technologies, and solidify their presence in lucrative therapeutic markets. This consolidation trend directly fuels competitive rivalry.

By combining forces, larger entities emerge with expanded research and development capacities and broader market penetration. This increased scale and scope can create formidable competitors, intensifying the pressure on other players to innovate and maintain market share. For instance, in 2023, the total value of M&A deals in the biopharmaceutical sector reached hundreds of billions of dollars, with major transactions aimed at acquiring innovative assets.

- Increased Consolidation: M&A activity leads to fewer, larger competitors, concentrating market power and intensifying direct competition.

- Pipeline Replenishment: Acquisitions are crucial for companies like Amgen to access new drug candidates, especially as existing patents expire.

- Technological Advancement: Deals often focus on acquiring cutting-edge platforms, such as gene editing or AI-driven drug discovery, enhancing the competitive edge of the acquiring entity.

- Market Share Expansion: Mergers can combine complementary product portfolios, allowing the merged entity to capture a larger share of specific therapeutic markets.

Global Market Expansion and Regional Competition

Amgen faces intense competition not just within its home market but globally, as pharmaceutical giants increasingly expand their reach into international territories. The company's presence in roughly 100 countries means it must contend with a patchwork of regulatory landscapes and formidable local players. For instance, in 2023, Amgen reported international sales contributing a significant portion of its total revenue, underscoring the importance of this global competitive arena.

Navigating these diverse markets requires a sophisticated understanding of local pricing strategies and reimbursement systems, which can vary dramatically. Successfully adapting to these regional economic realities is paramount for Amgen to maintain and grow its competitive edge. Failure to do so can lead to market share erosion, as seen in some European markets where local biosimilar manufacturers have gained traction due to favorable pricing policies.

- Global Reach: Amgen operates in approximately 100 countries, highlighting the worldwide nature of its competitive landscape.

- Regulatory Diversity: Each country presents unique regulatory hurdles and approval processes that Amgen must successfully navigate.

- Local Competitors: Beyond multinational rivals, Amgen must also contend with established local pharmaceutical companies in various regions.

- Pricing and Reimbursement: Adapting to varied pricing structures and reimbursement policies is a critical factor for success in international markets.

Amgen faces fierce competition from both large pharmaceutical companies and smaller biotech firms across its key therapeutic areas. This rivalry is driven by a constant need for innovation, with companies investing heavily in research and development to bring novel treatments to market. The pressure to be first-to-market with groundbreaking therapies is intense, and Amgen's success hinges on its ability to continuously adapt and offer superior products. In 2024, Amgen's $6.0 billion investment in R&D reflects this commitment to staying ahead in a highly competitive environment.

SSubstitutes Threaten

The most significant threat of substitution for Amgen stems from the growing availability of biosimilars. These are essentially highly similar versions of Amgen's biologic medicines, and they directly challenge the company's blockbuster products.

Biosimilars typically enter the market with a price reduction of around 30-35%. For instance, biosimilars targeting Amgen's established drugs like Eylea and Stelara are already making inroads, directly impacting Amgen's revenue streams through competitive pricing.

This trend of increasing biosimilar competition is projected to persist, posing a continuous challenge to Amgen's market share and sales figures in the coming years.

The threat of generic drug competition is a significant concern for Amgen, particularly for its small molecule drugs. When patents expire, chemically identical generic versions enter the market at much lower prices, directly eroding market share and profitability for the originator. For example, in 2023, the U.S. market saw a substantial increase in generic drug approvals, with over 100 new generics launched, highlighting the ongoing pressure on branded pharmaceuticals.

While Amgen's strategic focus is increasingly on biologics, which are more complex and harder to replicate, any remaining or pipeline small molecule products are vulnerable. This threat necessitates a robust lifecycle management strategy, including the development of next-generation therapies or strategic partnerships to mitigate the impact of generic entry. The pharmaceutical industry's revenue from generics reached an estimated $170 billion in the U.S. in 2024, underscoring the scale of this competitive force.

Emerging advanced therapies like gene and cell therapies, along with RNA-based medicines, pose a significant threat of substitution. These innovative approaches offer fundamentally different mechanisms of action, potentially providing more curative solutions for severe diseases, directly challenging Amgen's established drug portfolios.

While currently expensive and in nascent stages of development, these cutting-edge treatments are poised to disrupt existing treatment paradigms. For instance, the global gene therapy market was valued at approximately USD 12.2 billion in 2023 and is projected to grow substantially, indicating a growing acceptance and potential for these therapies to become viable alternatives to Amgen's current offerings in the coming years.

Lifestyle Modifications and Non-Pharmacological Interventions

For certain health conditions, particularly those related to cardiovascular health, obesity, and inflammation, lifestyle modifications and non-pharmacological interventions present a significant threat of substitutes to Amgen's pharmaceutical products. These can include dietary changes, exercise regimens, and even surgical procedures. For instance, in the obesity market, bariatric surgery is a viable alternative to weight-loss medications, potentially impacting the demand for Amgen's obesity treatments.

These non-drug approaches can directly reduce the need for prescription medications, thereby shrinking the potential market size and patient base for Amgen's therapies. For example, a growing emphasis on preventative health and wellness, coupled with increased public awareness of the benefits of healthy living, could lead more patients to opt for these alternatives over long-term drug use. This trend is supported by data showing a rise in participation in wellness programs and adoption of healthier diets globally.

- Lifestyle Modifications: Increased patient adoption of diet and exercise programs can directly reduce the need for certain Amgen medications.

- Surgical Interventions: Procedures like bariatric surgery offer alternatives for conditions such as obesity, impacting the market for related pharmaceuticals.

- Preventative Health Trends: A global shift towards preventative care and wellness may divert patients from pharmacological treatments towards lifestyle-based solutions.

Off-Label Use and Repurposed Drugs

The threat of substitutes for Amgen's products is amplified by the potential for off-label use and drug repurposing. Existing medications approved for one condition may be prescribed by physicians for another, creating an informal substitute. For instance, in 2024, the market for off-label prescriptions continued to grow, with an estimated 20% of all prescriptions being for unapproved uses, impacting various therapeutic areas where Amgen operates.

Furthermore, older drugs are frequently being repurposed for new indications, often at a lower cost than Amgen's newer, targeted therapies. This repurposing trend, driven by cost-effectiveness and existing safety profiles, can divert patient populations. For example, studies in 2024 highlighted several instances where repurposed older antivirals were considered as alternatives for conditions where newer, more expensive treatments were available, potentially impacting Amgen's market share in those segments.

This pathway of informal substitution, while not always representing the most clinically optimal treatment, poses a tangible threat. It can erode market penetration for Amgen's innovative therapies by offering more budget-friendly alternatives. The ability of physicians to prescribe existing drugs for new uses, coupled with the pharmaceutical industry's increasing focus on repurposing, creates a dynamic competitive landscape that Amgen must continuously monitor and address.

The threat of substitutes for Amgen is multifaceted, encompassing biosimilars, generics, advanced therapies, lifestyle changes, and off-label drug use. Biosimilars, often priced 30-35% lower, directly challenge Amgen's biologics, with examples like Eylea and Stelara facing such competition. Generic drugs, particularly for Amgen's small molecule portfolio, continue to exert pressure, with over 100 new generics launched in the U.S. in 2023, contributing to an estimated $170 billion in generic revenue in 2024.

Emerging gene and cell therapies, valued at approximately USD 12.2 billion globally in 2023, represent a more fundamental substitution threat by offering potentially curative solutions. Non-pharmacological interventions, such as bariatric surgery for obesity, also divert patients from Amgen's treatments. Furthermore, off-label prescriptions, estimated at 20% of all prescriptions in 2024, and the repurposing of older drugs for new indications, create cost-effective alternatives that can impact Amgen's market share.

| Substitute Type | Impact on Amgen | Key Data Point (2023-2024) |

|---|---|---|

| Biosimilars | Price erosion, market share loss for biologics | 30-35% typical price reduction; competition for Eylea, Stelara |

| Generic Drugs | Revenue decline for small molecule drugs | Over 100 new generics launched in U.S. (2023); $170B U.S. generic revenue (2024) |

| Advanced Therapies (Gene/Cell) | Disruption of established treatment paradigms | Global gene therapy market valued at USD 12.2 billion (2023) |

| Lifestyle/Surgical Interventions | Reduced demand for certain pharmaceuticals | Bariatric surgery as an alternative for obesity treatments |

| Off-Label Use/Repurposing | Erosion of market penetration for innovative therapies | Estimated 20% of prescriptions are off-label (2024) |

Entrants Threaten

The biotechnology sector presents a formidable barrier to entry due to the astronomical costs associated with research and development. Creating a novel therapeutic demands billions of dollars, with substantial initial outlays for preclinical studies and extensive clinical trials. Amgen's significant investment in R&D, approximating $4.7 billion in 2024, underscores the massive capital commitment required, effectively discouraging most prospective competitors.

New entrants into the biopharmaceutical sector, like Amgen, face a formidable barrier due to complex and lengthy regulatory approval processes. These can span 10-15 years, encompassing multiple phases of clinical trials and rigorous safety and efficacy evaluations mandated by bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

The sheer capital investment required for these trials, often in the hundreds of millions of dollars, alongside the evolving nature of regulatory requirements, presents a significant deterrent for potential new competitors. For instance, the cost of bringing a new drug to market has been estimated to be over $2 billion, a figure that discourages smaller, less-resourced entrants.

Amgen's robust intellectual property and extensive patent protection significantly deter new entrants. For instance, in 2023, Amgen held thousands of active patents covering its diverse product pipeline, many of which are for blockbuster drugs with market exclusivity extending well into the future.

These patents act as a powerful barrier, requiring potential competitors to invest heavily in developing entirely new therapeutic approaches or secure costly licensing deals to enter the market. Without such innovation or agreements, new companies face lengthy development timelines and significant R&D hurdles before they can even consider launching a competing product.

Need for Extensive Manufacturing and Distribution Infrastructure

The development, manufacturing, and distribution of complex biologic medicines necessitate specialized, large-scale, and highly regulated infrastructure. This creates a significant barrier to entry, as new companies must invest heavily in advanced facilities and comply with stringent regulatory standards. For instance, Amgen's commitment to expanding its manufacturing network, including investments in new biologics drug substance and drug product facilities, underscores the capital intensity required to compete.

Building these capabilities demands substantial capital investment and specialized expertise, making it a formidable challenge for potential new entrants. The sheer scale and complexity of operations, from cell culture to sterile filling, require a deep understanding of bioprocessing and quality control. Amgen's strategic investments in its global manufacturing footprint are designed to maintain and enhance its competitive advantage by ensuring reliable supply chains for its innovative therapies.

- High Capital Requirements: Establishing state-of-the-art biologics manufacturing facilities can cost hundreds of millions to billions of dollars.

- Regulatory Hurdles: Navigating the complex regulatory landscape for drug manufacturing (e.g., FDA, EMA) requires significant expertise and time.

- Technological Sophistication: Biologics manufacturing involves advanced techniques like cell line development, fermentation, purification, and aseptic filling, demanding specialized knowledge.

- Supply Chain Complexity: Building and managing a robust global supply chain for raw materials and finished biologics products is a significant undertaking.

Established Brand Reputation and Customer Relationships

Amgen benefits from a robust brand reputation and deep-seated relationships with healthcare providers, cultivated over decades of delivering innovative therapies. Its integrated distribution networks further solidify its market presence, making it challenging for new entrants to replicate this established trust and market penetration, especially within critical areas of unmet medical need.

Newcomers face significant hurdles in overcoming Amgen's entrenched market position, which is underpinned by its proven track record and extensive patient engagement. For instance, Amgen's oncology portfolio, a key area of unmet medical need, has seen consistent growth, with its net sales in this segment reaching approximately $11.7 billion in 2023, demonstrating the strength of its established presence.

- Established Brand Loyalty: Amgen's long history of success fosters significant brand loyalty among physicians and patients, creating a barrier to entry for new competitors.

- Provider Relationships: Decades of collaboration with healthcare professionals have built strong relationships and trust, influencing prescribing patterns.

- Distribution Network Strength: Amgen's sophisticated and reliable distribution channels ensure product availability and timely delivery, a complex system for new entrants to build.

The threat of new entrants in the biopharmaceutical industry, particularly for companies like Amgen, is significantly mitigated by the immense capital required for research, development, and manufacturing. Amgen's 2024 R&D expenditure alone was approximately $4.7 billion, illustrating the substantial financial commitment needed to innovate and bring new therapies to market, thereby creating a high barrier for potential competitors.

Navigating the stringent and lengthy regulatory pathways, which can take over a decade and cost upwards of $2 billion per drug, presents another formidable challenge. Coupled with Amgen's extensive patent portfolio, which protected thousands of its products in 2023, these regulatory and intellectual property hurdles make it exceptionally difficult for new players to gain a foothold.

| Barrier Type | Description | Example Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D costs (e.g., Amgen's $4.7B in 2024) and manufacturing infrastructure investment. | Discourages smaller companies; requires significant funding to even begin. |

| Regulatory Approval | Lengthy (10-15 years) and costly (>$2B per drug) processes. | Creates significant time delays and financial risk for new products. |

| Intellectual Property | Extensive patent protection (Amgen held thousands in 2023). | Requires development of novel approaches or expensive licensing. |

| Manufacturing & Infrastructure | Specialized, large-scale, regulated facilities. | Demands massive upfront investment and specialized expertise. |

| Brand Reputation & Relationships | Established trust and provider networks. | Difficult for new entrants to replicate Amgen's market penetration and physician loyalty. |

Porter's Five Forces Analysis Data Sources

Our Amgen Porter's Five Forces analysis leverages data from Amgen's SEC filings, investor relations reports, and industry-specific market research from firms like EvaluatePharma and GlobalData. This ensures a comprehensive understanding of competitive dynamics within the biopharmaceutical sector.