Amgen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

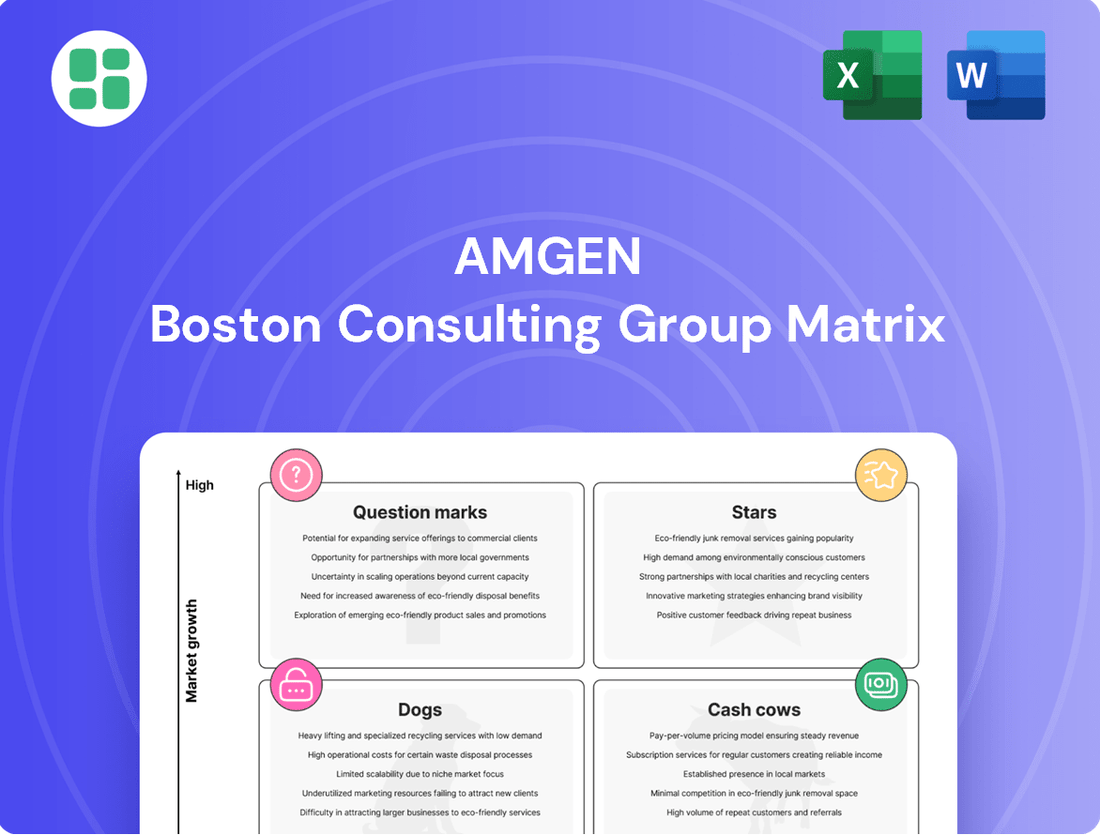

Amgen's strategic positioning within its product portfolio is crucial for sustained growth. Understanding which of its innovations are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or nascent opportunities requiring investment (Question Marks) is key to informed decision-making.

This preview offers a glimpse into Amgen's BCG Matrix, highlighting the potential strategic implications. To unlock a comprehensive understanding of each product's market share and growth rate, and to receive actionable insights for optimizing resource allocation, purchase the full BCG Matrix report today.

Stars

Repatha is a significant growth engine for Amgen, driven by consistent, strong volume increases. Its sales saw a notable 27% year-over-year jump in the first quarter of 2025, and this momentum continued with a 31% increase in the second quarter of 2025.

This cardiovascular treatment occupies a substantial portion of a rapidly expanding market. Its leading position and ongoing strong performance solidify Repatha as a star product for Amgen, indicating continued positive trajectory.

EVENITY (romosozumab-aqqg), a bone-building agent, is demonstrating impressive momentum. Its sales surged by 29% in the first quarter of 2025 and an even stronger 32% in the second quarter of 2025, largely fueled by increased product volume.

This significant growth solidifies EVENITY's position as a leader within Amgen's bone health portfolio. The drug is capturing a substantial market share in a segment that remains a strategic priority for the company.

The robust sales trajectory for EVENITY suggests strong market acceptance and indicates a high potential for continued expansion and market leadership in the bone health therapeutic area.

TEZSPIRE (tezepelumab-ekko) is a standout performer for Amgen, positioned as a strong contender in the high-growth severe asthma market. Its sales trajectory is impressive, with a 65% increase in the first quarter of 2025 and a further 46% jump in the second quarter of 2025, signaling robust demand and market penetration.

This rapid expansion, driven by significant volume growth, highlights TEZSPIRE's emerging leadership within its therapeutic category. Analysts project it to become a multi-billion-dollar asset for Amgen, underscoring its strategic importance and potential to capture substantial market share.

BLINCYTO (blinatumomab)

BLINCYTO, an oncology treatment, is demonstrating significant growth for Amgen. Sales saw a robust 52% increase year-over-year in the first quarter of 2025, followed by a strong 45% rise in the second quarter of 2025. This impressive performance is fueled by increased patient uptake and the successful expansion into new indications, particularly for acute lymphoblastic leukemia.

As Amgen's second FDA-approved bispecific T-cell engager, BLINCYTO represents a vital component of the company's portfolio. Its substantial market share in the dynamic oncology sector underscores its strategic importance and potential for continued expansion.

- Product: BLINCYTO (blinatumomab)

- Therapeutic Area: Oncology

- Q1 2025 Sales Growth: 52% year-over-year

- Q2 2025 Sales Growth: 45% year-over-year

- Growth Drivers: Expanding volume, new indications (acute lymphoblastic leukemia)

- Strategic Importance: Amgen's second FDA-approved bispecific T-cell engager, high market share

UPLIZNA (inebilizumab-cdon)

UPLIZNA, targeting rare neurological diseases, has demonstrated exceptional growth, with a 91% increase in sales year-over-year in Q2 2025. This remarkable performance highlights its strong market penetration and increasing demand. The drug's effectiveness in treating conditions like neuromyelitis optica spectrum disorder (NMOSD) is a key driver of this expansion.

Its recent FDA approval for IgG4-related disease further expands its market potential, opening up new avenues for revenue generation. This broadened indication significantly increases the addressable patient population for UPLIZNA, solidifying its position in the rare disease market.

While still building its overall market share, its high growth rate in a niche, high-need market positions UPLIZNA as a promising star for Amgen. The company's strategic focus on rare diseases, coupled with UPLIZNA's clinical success, suggests a bright future for this therapeutic.

- UPLIZNA Sales Growth: 91% year-over-year increase in Q2 2025.

- Expanded Market: Recent FDA approval for IgG4-related disease.

- Market Position: High growth in a niche, high-need market.

- Amgen's Star: Promising future potential within Amgen's portfolio.

Amgen's portfolio features several products exhibiting star-like qualities, characterized by high growth and significant market potential. Repatha, EVENITY, TEZSPIRE, BLINCYTO, and UPLIZNA are prime examples, each demonstrating impressive sales increases and strategic importance within their respective therapeutic areas.

These products are not only driving substantial revenue growth for Amgen but are also solidifying the company's leadership in key markets like cardiovascular health, bone health, severe asthma, oncology, and rare neurological diseases.

Their strong performance, fueled by increasing patient uptake and market expansion, positions them as key contributors to Amgen's future success, aligning with the characteristics of star products in a BCG matrix.

| Product | Therapeutic Area | Q1 2025 Sales Growth | Q2 2025 Sales Growth | Key Growth Drivers |

|---|---|---|---|---|

| Repatha | Cardiovascular | 27% | 31% | Strong volume increases, expanding market |

| EVENITY | Bone Health | 29% | 32% | Increased product volume, market leadership |

| TEZSPIRE | Severe Asthma | 65% | 46% | Significant volume growth, emerging market leadership |

| BLINCYTO | Oncology | 52% | 45% | Expanding volume, new indications |

| UPLIZNA | Rare Neurological Diseases | N/A (91% in Q2) | 91% | Expanding indications, high demand in niche market |

What is included in the product

This overview provides strategic insights into Amgen's product portfolio by categorizing each unit within the BCG Matrix.

It highlights which Amgen business units represent Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

The Amgen BCG Matrix provides a clear, visual overview of its product portfolio, highlighting growth opportunities and areas needing strategic attention.

Cash Cows

Prolia continues to be a significant cash cow for Amgen, bringing in $1.1 billion in sales during the first quarter of 2025. This demonstrates its established dominance and strong revenue-generating capabilities in the osteoporosis market.

However, the landscape is shifting with the anticipated launch of biosimilar competitors in the latter half of 2025. This development is expected to lead to a projected sales decline of 4% in the second quarter of 2025, signaling a move towards market maturity and potential erosion of its market share.

While Prolia still generates substantial cash flow, its position in a mature market with slowing growth means it's entering a phase where its ability to expand significantly is limited, characteristic of a mature product within the BCG matrix.

XGEVA, a key product for Amgen, is positioned as a cash cow within the BCG matrix. Its recent performance shows strong sales, with $566 million in Q1 2025 and $532 million in Q2 2025, underscoring its significant contribution to Amgen's revenue.

Despite its current success and high market share, similar to its sibling drug Prolia, XGEVA faces an anticipated sales decline in the latter half of 2025. This is primarily due to the impending entry of biosimilar competitors into the United States market.

This situation indicates that while XGEVA is currently a substantial cash generator, it operates in a mature market with limited future growth potential, a hallmark of a cash cow.

Otezla, a treatment for inflammatory conditions, generated $437 million in sales during the first quarter of 2025, following $624 million in the fourth quarter of 2024.

While Otezla saw some volume expansion, it was impacted by reduced net selling prices, and had previously experienced sales declines in 2024.

Despite its substantial revenue contribution, Otezla operates within a crowded and established market. This maturity positions it as a reliable source of cash for Amgen, rather than a product with significant future growth potential.

Enbrel (etanercept)

Enbrel, a key treatment for various rheumatic diseases, remains a significant revenue generator for Amgen. In the fourth quarter of 2024, it achieved sales of $1.0 billion, underscoring its continued importance.

However, the drug faced challenges throughout 2024, with full-year sales experiencing a 10% decline. This downward trend accelerated in the second quarter of 2025, showing a substantial 34% drop in sales.

The primary drivers behind this decline are increasing biosimilar competition and mounting pricing pressures within the market. These factors are impacting Enbrel's performance despite its historically strong market position.

- Enbrel's Q4 2024 Sales: $1.0 billion.

- Full Year 2024 Sales Decline: 10%.

- Q2 2025 Sales Decline: 34%.

- Market Dynamics: Mature, eroding market due to biosimilar competition and pricing pressures.

Established Biosimilars (e.g., MVASI)

Amgen's established biosimilars, exemplified by MVASI, represent a significant cash cow. This segment collectively delivered robust growth, with a 35% revenue increase in Q1 2025 and a remarkable 40% in Q2 2025.

While the overall biosimilar portfolio demonstrates strong expansion, individual established products operate within mature markets. These products are instrumental in generating consistent cash flow for Amgen.

- Consistent Cash Generation: Established biosimilars provide a reliable stream of income.

- Portfolio Growth: The biosimilar segment saw impressive year-over-year growth in early 2025.

- Offsetting Declines: These products help mitigate revenue shortfalls from originator drugs.

- Market Maturity: Individual products face the realities of established biosimilar competition and pricing pressures.

Amgen's portfolio includes several products that function as cash cows, generating substantial revenue with limited growth potential. These products are vital for funding new research and development. Prolia and XGEVA, both significant revenue drivers, are experiencing market maturity and the onset of biosimilar competition, indicating their transition into this phase. Otezla also contributes reliably to cash flow despite operating in a competitive market.

| Product | Q1 2025 Sales (Billions) | Q2 2025 Sales (Billions) | Key Trend |

|---|---|---|---|

| Prolia | $1.1 | Projected 4% decline | Mature market, biosimilar entry expected |

| XGEVA | $0.566 | $0.532 | Mature market, biosimilar entry expected |

| Otezla | $0.437 | N/A | Crowded market, pricing pressures |

| Enbrel | N/A | Significant decline (34% in Q2 2025) | Eroding market due to biosimilars and pricing |

Preview = Final Product

Amgen BCG Matrix

The Amgen BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no sample data, and no hidden surprises—just the complete, analysis-ready strategic tool designed for immediate application. You can confidently use this preview as a direct representation of the professional report you will download, enabling you to make informed decisions about Amgen's product portfolio.

Dogs

Neulasta, a key product for Amgen, has experienced substantial revenue challenges. This is primarily due to the increasing presence of biosimilar alternatives in the market, which has led to a gradual decline in its market share and profitability over time.

Despite a modest 9% year-over-year revenue increase to $129 million in the first quarter of 2025, Neulasta's overall market position is characterized by declining trends. This suggests limited potential for significant future growth for Amgen in this particular segment.

EPOGEN, a treatment for anemia, is an established biologic that has faced significant challenges following patent expiration and the emergence of biosimilar competitors. While precise recent sales data isn't readily available, its positioning within Amgen's portfolio, where it's discussed in terms of offsetting losses, strongly indicates a very low market share and minimal growth prospects. This profile aligns it squarely with the characteristics of a 'dog' in the BCG matrix.

Aranesp, a long-standing biologic treatment for anemia, experienced a 3% year-over-year sales decrease in the first quarter of 2025, bringing its sales to $530 million. This downturn suggests Aranesp is positioned in a mature or declining market segment for Amgen, likely facing pressure from newer therapies and generics. Its contribution to Amgen's overall portfolio is minimal, reflecting its status as a low-growth asset.

Parsabiv (etelcalcetide)

Parsabiv, a treatment for secondary hyperparathyroidism, faced a significant sales downturn. In the first quarter of 2025, its sales dropped by 16% compared to the previous year. This contraction suggests a low market share and a negative growth trajectory within its specific medical field.

Products like Parsabiv, characterized by declining sales and market share, are often classified as Dogs in the Boston Consulting Group (BCG) matrix. This classification highlights their potential to drain company resources without yielding commensurate profits, making them candidates for strategic divestment or restructuring.

- Product: Parsabiv (etelcalcetide)

- Indication: Secondary hyperparathyroidism

- Q1 2025 Sales Performance: 16% year-over-year decrease

- BCG Matrix Classification Implication: Dog (low market share, negative growth)

Aimovig (erenumab-aooe)

Aimovig, a treatment for migraine prevention, is currently positioned in Amgen's 'Other products' category. This segment experienced a significant 14% revenue decline in the first quarter of 2025, indicating a challenging environment for Aimovig.

Despite its initial market entry and potential, Aimovig faces intense competition from both established migraine therapies and newer entrants. This competitive landscape has likely impacted its market share and growth trajectory.

The declining contribution of Aimovig suggests it may be a Question Mark or potentially a Dog in the BCG Matrix, with limited growth prospects and a small market share within Amgen's portfolio.

- Aimovig's Category: Positioned within 'Other products'.

- Q1 2025 Performance: This category saw a 14% decline.

- Market Dynamics: Faces increasing competition in migraine prevention.

- Growth Prospects: Limited growth indicated by declining contribution.

Products like Parsabiv, which saw a 16% year-over-year sales drop in Q1 2025, exemplify Amgen's Dogs. These are typically established products with declining revenues and market share, facing intense competition from generics or newer therapies, such as the biosimil alternatives impacting Neulasta. Their low growth and market share mean they require significant investment for minimal return, often draining resources rather than contributing to profits.

Aranesp's 3% sales decrease in Q1 2025 further illustrates this category, indicating a mature or declining market segment for Amgen. Similarly, EPOGEN, despite its history, is likely a Dog due to patent expirations and biosimilar competition, contributing minimally to overall portfolio growth. These products often represent legacy assets that may be candidates for divestment or strategic repositioning to free up resources for more promising areas.

| Product | Q1 2025 Sales (Millions USD) | YoY Change | BCG Classification | Rationale |

|---|---|---|---|---|

| Parsabiv | N/A (declining) | -16% | Dog | Low market share, negative growth trajectory. |

| Aranesp | 530 | -3% | Dog | Mature/declining market, pressure from newer therapies. |

| Neulasta | 129 | +9% | Potential Dog/Question Mark | Facing biosimilar competition, declining market share despite recent modest growth. |

| EPOGEN | N/A (low contribution) | N/A | Dog | Patent expiration, biosimilar competition, minimal growth prospects. |

Question Marks

MariTide, Amgen's promising obesity drug, is currently positioned as a question mark in the BCG matrix. It's in late-stage Phase 3 trials, aiming for a convenient once-monthly dosing. This drug is targeting the burgeoning GLP-1 market, a sector experiencing substantial growth.

The GLP-1 market is projected to reach tens of billions of dollars in the coming years, with estimates suggesting it could surpass $50 billion by 2030. MariTide, not yet approved, currently has zero market share. This makes it a high-risk, high-reward investment for Amgen, requiring significant capital for development and marketing.

IMDELLTRA (tarlatamab-dlle) is positioned as a potential Question Mark within Amgen's BCG Matrix. Its accelerated FDA approval in May 2024 for extensive-stage small cell lung cancer addresses a significant unmet medical need, a market characterized by high growth and innovation.

The drug demonstrated robust commercial performance, with sales reaching $81 million in Q1 2025 and escalating to $134 million in Q2 2025, reflecting substantial quarter-over-quarter growth. This rapid adoption in a competitive oncology landscape suggests a strong trajectory.

Although IMDELLTRA currently holds a modest market share, its rapid uptake and the high-growth nature of the small cell lung cancer market indicate a strong potential to evolve into a Star product. Continued strategic investment and market penetration will be crucial for this transition.

Olpasiren, an siRNA therapy targeting lipoprotein(a) or Lp(a), is positioned as a potential star in Amgen's pipeline. Its Phase 3 development signifies a move towards commercialization, addressing a significant unmet need in cardiovascular disease prevention. This therapy targets a broad patient base, indicating substantial future market potential.

In the context of the BCG matrix, Olpasiren would be considered a question mark due to its current lack of market share but high growth potential. Amgen's investment in its Phase 3 trials, which can cost hundreds of millions of dollars, reflects the significant capital required to bring such innovative therapies to market and capture this emerging opportunity.

Bemarituzumab (FGFR2b inhibitor)

Bemarituzumab, an FGFR2b inhibitor, is a promising candidate for Amgen's oncology pipeline. Its recent positive Phase 3 results in August 2025 for first-line gastric cancer, a segment with significant unmet need, highlight its potential. While not yet commercialized, its strong clinical profile suggests it could capture substantial market share in this high-growth area. Amgen's investment in its launch and market penetration will be crucial for its success.

- High Growth Potential: Bemarituzumab targets a specific genetic mutation in gastric cancer, a market poised for significant expansion.

- Unmet Medical Need: The drug addresses a critical gap in treatment options for first-line gastric cancer patients.

- Investment Required: Amgen faces substantial costs for regulatory approval, manufacturing scale-up, and market entry.

- Future Market Share: Clinical success suggests a strong potential to achieve a significant market share upon commercialization.

New Biosimilar Launches (e.g., PAVBLU, WEZLANA)

Amgen's strategic focus on biosimilars is evident with the recent launches of PAVBLU and WEZLANA. PAVBLU, a biosimilar to EYLEA, entered the market in November 2024, targeting a significant ophthalmology segment. WEZLANA also represents an entry into a substantial and competitive therapeutic area.

These new biosimilar products, while starting with a modest market share, are crucial for Amgen's long-term growth strategy. They are positioned as high-growth potential assets that require dedicated investment to build market presence and capture a larger share within their respective, highly competitive markets.

- PAVBLU (biosimilar to EYLEA) launched November 2024.

- WEZLANA targets a large, competitive market.

- These biosimilars represent high-growth opportunities requiring strategic investment.

- Amgen's biosimilar portfolio experienced 40% growth in Q2 2025, underscoring their importance.

Question marks represent Amgen's products with low market share but high growth potential. These are typically new drugs or therapies in development or recently launched, requiring significant investment to gain traction. Their success hinges on clinical efficacy, market acceptance, and competitive positioning.

MariTide, Amgen's obesity drug, and IMDELLTRA, a lung cancer treatment, are prime examples of question marks. Both are in high-growth markets but have yet to establish significant market share. Olpasiren, an siRNA therapy for cardiovascular disease, also fits this category, with substantial investment in Phase 3 trials.

Bemarituzumab, an FGFR2b inhibitor for gastric cancer, and Amgen's biosimilars like PAVBLU and WEZLANA, also fall under the question mark umbrella. These products demand considerable capital for regulatory approval, manufacturing, and market penetration to realize their high growth potential.

| Product | Status | Market | Growth Potential | Investment Needs |

| MariTide | Phase 3 Trials | Obesity (GLP-1) | High | High |

| IMDELLTRA | Recently Approved | Small Cell Lung Cancer | High | Moderate to High |

| Olpasiren | Phase 3 Development | Cardiovascular (Lp(a)) | High | Very High |

| Bemarituzumab | Positive Phase 3 Results | Gastric Cancer | High | High |

| PAVBLU | Launched Nov 2024 | Ophthalmology (EYLEA biosimilar) | High | Moderate |

| WEZLANA | Launched | Competitive Therapeutic Area | High | Moderate |

BCG Matrix Data Sources

Our Amgen BCG Matrix is built on a robust foundation of data, incorporating internal sales figures, R&D investment, and clinical trial outcomes alongside external market share data and therapeutic area growth projections.