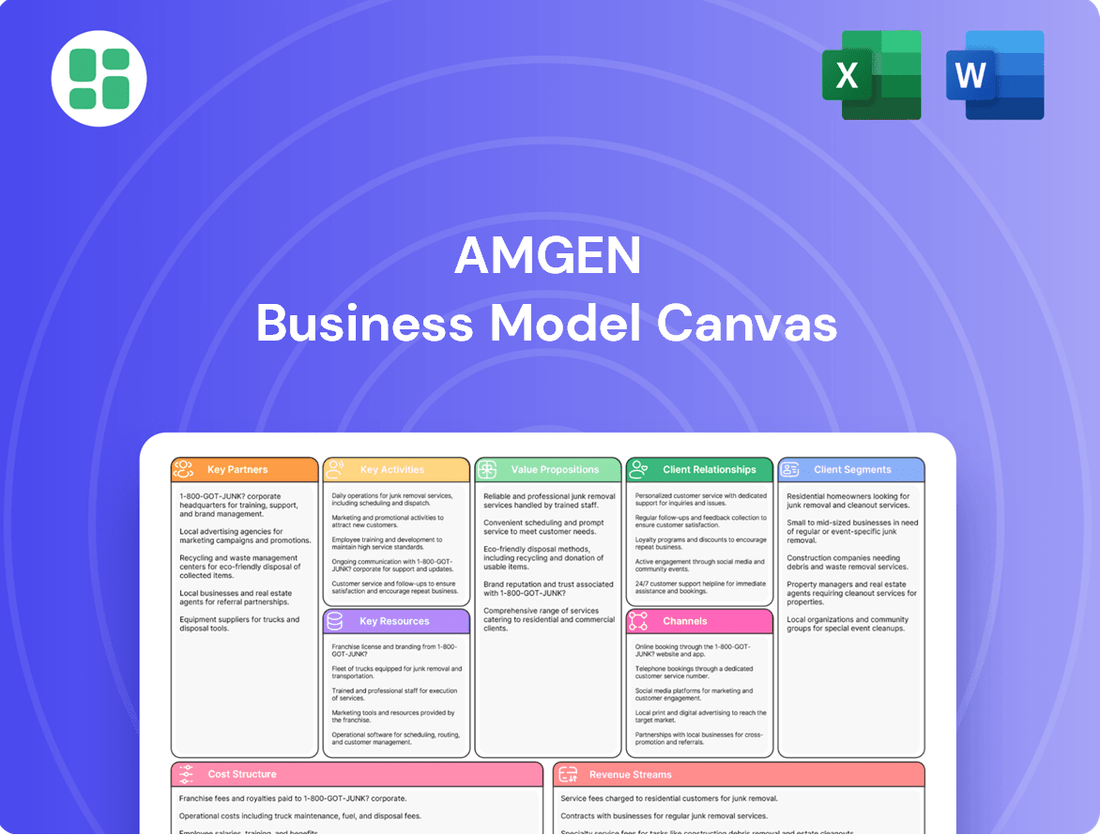

Amgen Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amgen Bundle

Discover the intricate workings of Amgen's groundbreaking business model. Our comprehensive Business Model Canvas breaks down their value proposition, customer relationships, and revenue streams, offering a clear roadmap to their success.

Want to understand how Amgen innovates and delivers life-changing therapies? This detailed canvas illuminates their key resources, activities, and cost structure, providing invaluable insights for strategic planning.

Unlock the full strategic blueprint behind Amgen's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights. Get your copy today!

Partnerships

Amgen strategically expands its product portfolio and market leadership through significant acquisitions. A prime example is the late 2023 acquisition of Horizon Therapeutics, valued at approximately $27.8 billion, which has established Amgen as a prominent leader in the rare disease therapeutic area. This integration expanded Amgen's offerings and reinforced its focus on addressing unmet medical needs, with Horizon's key drug Tepezza contributing significantly to Amgen's revenue growth projections.

Amgen actively pursues research and development collaborations to propel its drug pipeline forward. These strategic alliances often include co-development agreements with other major pharmaceutical firms, exemplified by its partnership with AstraZeneca for TEZSPIRE. Such collaborations are vital for pooling specialized knowledge, sharing resources, and expediting the complex journey of drug discovery and development.

Amgen leverages strategic alliances with third-party manufacturers to bolster its extensive global biomanufacturing network, ensuring consistent and efficient delivery of its high-quality medicines. These collaborations are crucial for meeting patient demand across the globe.

These partnerships are supported by Amgen's significant investments in expanding its own manufacturing capabilities. For instance, Amgen's substantial investments in facilities in Ohio and North Carolina, totaling hundreds of millions of dollars, enhance its capacity and provide a strong foundation for these external manufacturing collaborations.

Academic and Research Institution Partnerships

Amgen actively partners with universities and research institutes to fuel its innovation pipeline. These collaborations are crucial for tapping into early-stage scientific discoveries and identifying promising new therapeutic targets. For instance, in 2024, Amgen continued its long-standing support for numerous university research programs, contributing millions to advance understanding in areas like oncology and cardiovascular disease.

These academic alliances are instrumental in Amgen's mission to translate cutting-edge science into life-changing medicines. By working with world-renowned institutions, Amgen gains access to novel research methodologies and deep scientific expertise. This synergy accelerates the identification and validation of potential drug candidates, a critical step in the drug development process.

Amgen's commitment to these partnerships underscores its dedication to advancing scientific frontiers. Such collaborations enable the exploration of novel biological pathways and the development of innovative treatment approaches. In 2024, Amgen announced several new research grants to academic centers focused on areas such as rare diseases and immunology, further solidifying its role in fostering scientific progress.

- Academic Collaboration Focus: Amgen partners with leading universities and research organizations to foster scientific innovation and leverage cutting-edge research.

- Therapeutic Target Identification: These partnerships are vital for exploring new scientific breakthroughs and identifying potential therapeutic targets.

- Early-Stage Development: Collaborations contribute to the early-stage development of novel medicines, accelerating the translation of science into treatments.

- Commitment to Science: Such alliances are integral to Amgen's ongoing commitment to advanced science and technology in its drug discovery efforts.

Equity Investments for Pipeline Expansion

Amgen strategically leverages equity investments in other biotechnology and pharmaceutical firms to fuel pipeline expansion. This approach grants access to novel technologies, burgeoning markets, and promising drug candidates, thereby diversifying Amgen's future growth avenues.

A prime example of this strategy is Amgen's significant equity investment in BeiGene, Ltd., a global oncology company. This partnership, as of recent disclosures, underscores Amgen's commitment to broadening its therapeutic reach and accessing innovative treatments in high-demand areas.

- Strategic Access: Equity investments provide Amgen with early-stage access to cutting-edge research and development, potentially de-risking future acquisitions or licensing deals.

- Diversification of Growth: By investing in a range of companies, Amgen spreads its risk and taps into multiple potential revenue streams from diverse therapeutic areas and geographic markets.

- Enhanced Innovation: These partnerships foster collaboration and knowledge exchange, accelerating the pace of innovation and the development of new medicines.

Amgen's key partnerships are crucial for its business model, enabling pipeline expansion and market leadership. These alliances span acquisitions, research collaborations, manufacturing agreements, and strategic equity investments, all designed to accelerate innovation and broaden therapeutic reach.

The acquisition of Horizon Therapeutics for approximately $27.8 billion in late 2023 significantly bolstered Amgen's rare disease portfolio. Amgen also actively collaborates with other pharmaceutical firms, such as AstraZeneca for TEZSPIRE, to co-develop new therapies. Furthermore, strategic equity investments, like the one in BeiGene, Ltd., provide access to novel oncology treatments and markets.

| Partnership Type | Example | Strategic Benefit | 2024 Focus/Impact |

|---|---|---|---|

| Acquisitions | Horizon Therapeutics | Market leadership in rare diseases | Integration and revenue growth from Tepezza |

| R&D Collaborations | AstraZeneca (TEZSPIRE) | Accelerated drug development | Continued co-development and pipeline advancement |

| Equity Investments | BeiGene, Ltd. | Access to novel oncology treatments | Expanding therapeutic reach and market access |

| Academic Partnerships | University research programs | Early-stage scientific discovery | Millions invested in oncology and cardiovascular research |

What is included in the product

Amgen's Business Model Canvas focuses on developing and marketing innovative biotechnology medicines for serious illnesses, targeting specific patient populations and healthcare providers through direct sales and strategic partnerships.

It highlights Amgen's core competencies in scientific research and development, robust manufacturing capabilities, and a strong global distribution network to deliver value to patients and stakeholders.

Amgen's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their complex operations, simplifying strategic discussions and identifying areas for improvement.

It offers a structured framework to diagnose and address challenges in drug development, manufacturing, and market access, ultimately streamlining Amgen's path to delivering innovative therapies.

Activities

Amgen's primary focus is groundbreaking research and development aimed at creating novel treatments for serious illnesses. This commitment translates into substantial R&D investments, which saw an increase to bolster both advanced clinical programs and early-stage pipeline exploration.

A significant portion of Amgen's R&D efforts involves conducting a wide array of clinical trials. For instance, the company is actively progressing through Phase 3 trials for promising candidates like MariTide, alongside other critical product developments, underscoring their dedication to bringing new therapies to patients.

Amgen's core activity involves the large-scale manufacturing and global distribution of its innovative biotechnology medicines. This is crucial for getting life-changing treatments to patients worldwide.

The company leverages advanced biomanufacturing facilities, such as its recently expanded sites in Ohio and North Carolina, to ensure consistent production. These facilities are vital for meeting the significant global demand for Amgen's complex biologic and biosimilar drugs, supporting their commitment to patient access.

Amgen's clinical development and regulatory affairs teams are central to bringing new therapies to patients. This involves meticulously managing every stage of clinical trials, from initial human testing to large-scale Phase 3 studies designed to prove efficacy and safety. These efforts are critical for demonstrating the value of Amgen's innovations.

Navigating the intricate web of global regulatory requirements is another core activity. This means working closely with agencies like the FDA and EMA to secure approvals for novel medicines and to gain authorization for expanded uses of existing treatments. Amgen reported robust Phase 3 trial results for several key pipeline assets in the first quarter of 2025, underscoring the success of these regulatory and development strategies.

Commercialization and Marketing

Amgen focuses on bringing its innovative therapies to patients worldwide, a crucial part of its business model. This involves not just developing groundbreaking medicines but also ensuring they reach the people who need them through robust commercialization and marketing efforts.

The company actively launches new products in key global markets, aiming to establish them as leading treatments. For instance, Amgen's efforts around its oncology portfolio, including Lumakras (sotorasib) for KRAS G12C-mutated non-small cell lung cancer, demonstrate this commitment to market penetration and patient access. In 2023, Amgen reported total revenues of $24.3 billion, with a significant portion driven by its commercial success in areas like cardiovascular and oncology.

- Global Product Launches: Amgen strategically introduces its diverse product pipeline across various therapeutic areas, aiming for broad patient reach.

- Driving Volume Growth: The company works to increase the utilization of its established medicines by highlighting their clinical benefits and value proposition.

- Market Share Expansion: Through targeted sales and marketing initiatives, Amgen seeks to capture a larger share of the markets it operates in, enhancing patient access and physician adoption.

- Competitive Landscape Management: Amgen navigates competitive environments by emphasizing the unique advantages and patient outcomes associated with its therapies.

Strategic Portfolio Management

Amgen's strategic portfolio management is a cornerstone of its business model. The company actively shapes its product pipeline and market presence through calculated acquisitions, divestitures, and internal development prioritization. This dynamic approach ensures Amgen remains at the forefront of innovation and market demand.

A prime example of this strategy in action is the integration of Horizon Therapeutics, acquired for approximately $27.8 billion in October 2023. This move significantly bolsters Amgen's capabilities in rare diseases, a key growth area. The company continuously assesses its existing product lifecycles, making decisions to maximize value and resource allocation.

- Acquisitions: Strategic purchases like Horizon Therapeutics enhance Amgen's therapeutic focus and market reach.

- Divestitures: The company may divest non-core assets to streamline operations and reinvest in high-potential areas.

- Pipeline Prioritization: Amgen rigorously evaluates its internal research and development projects to focus on those with the greatest scientific and commercial promise.

- Lifecycle Management: Proactive management of product lifecycles ensures sustained revenue streams and market competitiveness.

Amgen's key activities revolve around the entire lifecycle of developing and delivering innovative medicines. This includes the initial, often lengthy, process of groundbreaking research and development, followed by rigorous clinical trials and navigating complex global regulatory pathways to secure approvals.

Crucially, Amgen then engages in large-scale manufacturing and global distribution of these therapies, ensuring they reach patients. The company also focuses on strategic portfolio management, which involves acquisitions, divestitures, and prioritizing internal development to maintain a competitive edge and address unmet medical needs.

Commercialization efforts are also vital, encompassing strategic product launches, driving volume growth for existing medicines, and expanding market share. Amgen actively manages its competitive landscape by highlighting the unique benefits of its treatments.

| Key Activity | Description | 2024/2025 Data/Focus |

|---|---|---|

| Research & Development | Discovering and developing novel treatments for serious illnesses. | Continued investment in advanced clinical programs and early-stage pipeline exploration. Focus on areas like oncology and inflammation. |

| Clinical Trials & Regulatory Affairs | Conducting extensive clinical trials and securing global regulatory approvals. | Advancing Phase 3 trials for key assets; robust engagement with regulatory bodies like FDA and EMA. Positive Q1 2025 trial results reported for pipeline assets. |

| Manufacturing & Distribution | Large-scale production and global delivery of biotechnology medicines. | Utilizing advanced biomanufacturing facilities to meet global demand for biologics and biosimilars. |

| Commercialization & Marketing | Launching new products and driving market penetration for existing therapies. | Strategic launches in key markets, emphasis on oncology and cardiovascular portfolios. 2023 revenues reached $24.3 billion. |

| Portfolio Management | Strategic acquisitions, divestitures, and pipeline prioritization. | Integration of Horizon Therapeutics (approx. $27.8 billion acquisition in Oct 2023) to strengthen rare disease capabilities. Lifecycle management of existing products. |

Full Document Unlocks After Purchase

Business Model Canvas

The Amgen Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct snapshot of the complete, professionally formatted file. Upon completing your order, you will gain full access to this same comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Amgen’s intellectual property is a cornerstone of its business, encompassing a vast collection of patents that safeguard its groundbreaking biologics, biosimilars, and sophisticated manufacturing techniques. These patents are not just legal documents; they are critical assets that grant Amgen exclusive rights, shielding its innovations from direct competition.

The company’s robust patent portfolio is instrumental in securing its market position and ensuring long-term revenue generation. For instance, in 2023, Amgen reported significant R&D investment, a clear indicator of its commitment to developing and protecting new intellectual property that fuels future growth and maintains its competitive edge in the biopharmaceutical landscape.

Amgen's advanced manufacturing facilities are a cornerstone of its operations, representing a critical physical resource. These state-of-the-art sites are strategically located across the globe to ensure efficient production of its complex biologic medicines.

Recent significant investments underscore the company's commitment to expanding and upgrading these capabilities. In 2024, Amgen announced a substantial $900 million investment in its Ohio facility and a $1 billion investment in its North Carolina site, signaling a major expansion of its manufacturing footprint.

These facilities are engineered with cutting-edge automation and advanced technologies, which are vital for maintaining the high quality and efficiency required for producing sophisticated biologic therapies. This investment in advanced manufacturing directly supports Amgen's ability to meet growing patient demand.

Amgen's highly skilled human capital, including its scientists, researchers, manufacturing experts, and commercial teams, is a cornerstone of its business model. Their deep knowledge in areas like genetic and protein engineering is crucial for Amgen's groundbreaking work in biotechnology.

This expertise fuels innovation and ensures operational efficiency across the company. Amgen's commitment to ongoing employee development underscores the strategic importance of maintaining a highly skilled workforce to drive future growth and scientific advancement.

Diverse Product Portfolio and Pipeline

Amgen's diverse product portfolio and robust pipeline are foundational key resources. The company boasts a broad and deep pipeline of potential first- or best-in-class medicines, complementing a strong base of already successful blockbuster products. This dual approach ensures both current revenue streams and future growth potential.

As of late 2024, Amgen had an impressive 14 products generating over $1 billion in annualized sales. This demonstrates the commercial success and market penetration of its existing offerings. The breadth of these blockbuster products across various therapeutic areas underscores Amgen's ability to compete and win in multiple segments of the pharmaceutical market.

The company's strategic focus on oncology, rare disease, inflammation, and general medicine further solidifies its position. This diversification across critical and often underserved medical areas provides a resilient foundation. It allows Amgen to mitigate risks associated with any single therapeutic area and capitalize on diverse market opportunities.

- Blockbuster Products: 14 products with over $1 billion in annualized sales as of late 2024.

- Pipeline Strength: A deep pipeline of potential first- or best-in-class medicines.

- Therapeutic Diversification: Presence in oncology, rare disease, inflammation, and general medicine.

- Growth Foundation: A strong base for both current and future revenue generation.

Financial Capital

Amgen's financial capital is a cornerstone of its business model, enabling substantial investments in innovation and growth. This strong financial foundation is crucial for funding its extensive research and development pipeline, which is vital for discovering and bringing new therapies to market.

The company's ability to generate significant revenue and free cash flow directly fuels its strategic initiatives. For instance, in the first quarter of 2025, Amgen reported total revenues of $8.1 billion and generated $1.0 billion in free cash flow. This financial strength allows for ongoing investments in manufacturing capabilities and the pursuit of strategic acquisitions that can enhance its product portfolio and market reach.

- Robust Revenue Generation: Amgen consistently demonstrates strong revenue performance, providing the financial fuel for its operations and investments.

- Healthy Free Cash Flow: The company's ability to generate substantial free cash flow, as seen with $1.0 billion in Q1 2025, offers significant flexibility for strategic deployment.

- Investment Capacity: This financial capital underpins Amgen's capacity to fund critical areas such as research and development, manufacturing expansions, and potential acquisitions.

- Strategic Flexibility: Strong financial health grants Amgen the agility to pursue growth opportunities and navigate the dynamic biotechnology landscape.

Amgen's intellectual property, particularly its extensive patent portfolio, is a critical resource. These patents protect its innovative biologics and biosimilars, granting market exclusivity and safeguarding revenue streams. The company's commitment to R&D, evidenced by significant investments in 2023, directly contributes to expanding this valuable IP asset.

The company's advanced manufacturing facilities are a key physical resource, with substantial investments made in 2024, including $900 million for its Ohio site and $1 billion for its North Carolina facility. These state-of-the-art sites utilize cutting-edge automation to ensure the efficient production of complex biologic medicines, meeting growing patient demand.

Amgen's human capital, comprising highly skilled scientists, researchers, and commercial teams, is a vital resource. Their expertise in areas like genetic and protein engineering drives innovation and operational efficiency, ensuring the company remains at the forefront of biotechnology advancements.

Amgen's diverse product portfolio and robust pipeline represent a foundational key resource. As of late 2024, 14 products generated over $1 billion in annualized sales, demonstrating strong market penetration. The company's strategic focus on oncology, rare disease, inflammation, and general medicine further diversifies its offerings and mitigates risk.

Amgen's financial capital is a crucial enabler of its business model, funding extensive R&D and strategic initiatives. The company reported $8.1 billion in total revenues and $1.0 billion in free cash flow in Q1 2025, highlighting its capacity for continued investment in innovation and growth.

Value Propositions

Amgen's core value is bringing groundbreaking medicines to people battling serious diseases. They concentrate on areas where current treatments fall short, like cancer, kidney disease, inflammatory conditions, and heart issues.

These therapies are designed to offer substantial improvements in patient health and quality of life. In 2024, Amgen continued to invest heavily in its R&D pipeline, with a significant portion of its revenue dedicated to discovering and developing these innovative treatments.

Amgen's value proposition heavily relies on its application of advanced science and technology. The company excels in genetic and protein engineering, using these sophisticated tools to develop medicines that stand out from the competition. This scientific foundation is crucial for translating intricate biological discoveries into tangible, innovative treatments.

This dedication to cutting-edge science is what enables Amgen to pioneer groundbreaking therapies. For instance, in 2024, Amgen continued to invest significantly in research and development, with R&D expenses often exceeding billions of dollars annually, underscoring their commitment to scientific advancement as a core driver of their business model.

Amgen is deeply committed to enhancing patient lives across the globe by transforming scientific discoveries into tangible, accessible treatments. This unwavering focus on the patient shapes every aspect of their research and development, as well as their market strategies.

The company's core mission is to significantly improve health outcomes for countless individuals battling serious diseases. For instance, in 2023, Amgen reported revenues of $24.3 billion, a portion of which is reinvested into R&D to bring innovative therapies to those in need.

Leadership in Specific Therapeutic Areas

Amgen’s leadership in specific therapeutic areas like rare diseases, oncology, and cardiometabolic conditions is a core value proposition. This specialization allows for deep expertise and a robust product pipeline tailored to unmet medical needs.

The strategic acquisition of Horizon Therapeutics in 2023 significantly bolstered Amgen’s position in the rare disease market, adding key treatments and expanding its patient reach. This move underscores a commitment to addressing complex genetic disorders.

Products such as Repatha, a PCSK9 inhibitor for cardiovascular disease, and BLINCYTO, a bispecific antibody for acute lymphoblastic leukemia, exemplify Amgen’s success in delivering impactful therapies. These drugs represent significant advancements in their respective fields, demonstrating Amgen's ability to innovate and lead.

This focused approach translates into highly effective and targeted solutions for patients, driving both clinical success and market leadership.

- Rare Disease Leadership: Strengthened by the acquisition of Horizon Therapeutics, Amgen is a key player in treating rare genetic conditions.

- Oncology Impact: Products like BLINCYTO highlight Amgen’s contributions to cancer treatment, particularly in hematologic malignancies.

- Cardiometabolic Solutions: Repatha showcases Amgen's commitment to addressing significant cardiovascular risk factors with innovative therapies.

- Targeted Expertise: Amgen's deep focus on these therapeutic areas allows for the development of specialized and effective patient solutions.

Commitment to Patient Access and Support

Amgen goes beyond just creating innovative medicines; they are deeply invested in ensuring patients can actually access and benefit from them. This means developing robust patient support programs designed to make treatment more manageable.

For instance, Amgen SupportPlus and the Amgen Safety Net Foundation are key initiatives. These programs are specifically crafted to offer financial aid and educational materials to patients who qualify, tackling affordability barriers head-on. In 2023 alone, Amgen reported providing over $2.4 billion in financial assistance to patients in the U.S. through various programs, highlighting the scale of their commitment.

Their dedication aims to remove obstacles so that patients can not only afford their prescribed medications but also use them effectively. This holistic approach underscores Amgen’s commitment to patient well-being throughout their treatment journey.

- Amgen SupportPlus: Offers financial assistance and educational resources to eligible patients.

- Amgen Safety Net Foundation: Provides a safety net for patients facing financial challenges in accessing medication.

- Financial Assistance Scale: In 2023, Amgen provided over $2.4 billion in financial assistance to U.S. patients.

- Adherence Focus: Programs are designed to help patients afford and effectively use their treatments.

Amgen's value proposition centers on delivering life-changing therapies for serious illnesses, leveraging advanced science like genetic and protein engineering. Their focus on specific therapeutic areas, such as oncology and rare diseases, allows for deep expertise and a strong pipeline, as demonstrated by their 2023 acquisition of Horizon Therapeutics. This commitment is backed by significant R&D investment, with billions allocated annually to drive innovation and improve patient outcomes.

Customer Relationships

Amgen cultivates robust customer relationships by offering comprehensive patient support programs like Amgen By Your Side and Amgen SupportPlus. These initiatives are designed to guide patients through their treatment, providing crucial non-medical education, access to financial aid information, and assistance with appointment management.

In 2024, Amgen reported significant investment in these patient-centric programs, underscoring their importance in ensuring treatment adherence and improving patient outcomes. This dedication to support directly translates into stronger, more loyal patient relationships.

Amgen actively cultivates relationships with healthcare professionals (HCPs), encompassing physicians, specialists, and nurses. This engagement is crucial for disseminating medical education, sharing vital clinical data, and providing comprehensive product information. In 2024, Amgen's dedicated sales force and medical liaisons played a pivotal role in nurturing these essential professional connections, ensuring that HCPs are well-informed about Amgen's innovative therapies.

Amgen provides crucial financial assistance through programs like the Amgen SupportPlus Co-Pay Program and the Amgen Safety Net Foundation. These initiatives are designed to alleviate the burden of out-of-pocket prescription expenses for eligible patients with commercial insurance, ensuring greater access to vital Amgen therapies.

Direct Communication and Education

Amgen fosters direct relationships with patients and healthcare providers through dedicated communication channels offering extensive educational resources. This approach ensures stakeholders receive vital information about Amgen's treatments, disease management, and available support services.

These channels include specialized websites and accessible contact centers, acting as crucial touchpoints for information dissemination and ongoing support. For instance, Amgen's patient support programs often provide personalized assistance, highlighting their commitment to direct engagement.

- Direct Engagement: Maintaining relationships via direct communication, including websites and contact centers.

- Educational Resources: Providing comprehensive information on products, diseases, and support services.

- Stakeholder Empowerment: Ensuring patients and healthcare providers are well-informed and supported.

- 2024 Focus: Continued investment in digital platforms and patient advocacy outreach to enhance direct communication.

Long-Term Patient and Provider Partnerships

Amgen focuses on cultivating enduring partnerships with both patients and healthcare providers, extending its commitment beyond simply supplying medicines. This strategy involves a deep understanding of how patient needs and healthcare landscapes shift over time, prompting continuous adaptation of Amgen's support services.

The company's approach aims to establish Amgen as a reliable ally in the long-term management of serious diseases. For instance, Amgen's patient support programs, which often include educational resources and adherence assistance, are designed to foster this sustained engagement.

- Value Beyond Medication: Amgen invests in programs that offer ongoing support, such as patient education and financial assistance navigation, to enhance treatment adherence and outcomes.

- Adapting to Evolving Needs: The company actively monitors and responds to changes in patient health profiles and healthcare system requirements, ensuring its services remain relevant and impactful.

- Trusted Partner in Chronic Care: By consistently delivering value and demonstrating a commitment to patient well-being over extended periods, Amgen seeks to become an indispensable partner in managing chronic and serious conditions.

Amgen prioritizes building strong, lasting relationships with patients and healthcare professionals through comprehensive support and education. The company's commitment extends beyond product delivery, focusing on patient adherence and improved health outcomes via programs like Amgen By Your Side. In 2024, Amgen continued to invest heavily in these patient-centric initiatives, recognizing their critical role in fostering loyalty and ensuring treatment success.

| Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Patient Support Programs | Financial assistance, adherence support, non-medical education | Significant investment in programs like Amgen SupportPlus |

| Healthcare Professional Engagement | Medical education, clinical data dissemination, product information | Dedicated sales force and medical liaisons actively engaged |

| Direct Communication | Websites, contact centers, educational resources | Enhanced digital platforms and patient advocacy outreach |

Channels

Amgen leverages a dedicated direct sales force to engage healthcare providers, a critical channel for communicating the value of its innovative therapies. This team, comprised of skilled professionals, educates physicians, specialists, and hospital administrators on product efficacy and clinical trial results. In 2024, Amgen’s sales force played a pivotal role in driving adoption of its biologics, contributing significantly to its revenue streams.

Amgen utilizes established specialty pharmacy networks to deliver its complex biologic medicines, ensuring these high-value, often temperature-sensitive drugs reach patients safely and efficiently. This channel is crucial for managing the intricate logistics inherent in biotechnology products, with specialty pharmacies playing a key role in patient support and adherence.

Broader distribution networks complement specialty pharmacies, providing the infrastructure for widespread access to Amgen's therapeutic innovations. These networks are vital for navigating regulatory requirements and maintaining product integrity throughout the supply chain, a critical factor for biologics.

Amgen's global manufacturing and supply chain is a critical channel, encompassing a vast network of biomanufacturing facilities. These sites are strategically positioned to ensure efficient production and worldwide distribution of its innovative therapies.

Significant investments in its U.S. facilities, alongside other key international locations, bolster Amgen's production capacity and global reach. For instance, Amgen's capital expenditures on property, plant, and equipment were approximately $2.7 billion in 2023, underscoring its commitment to expanding and maintaining these vital operations.

This robust, integrated supply chain is designed to guarantee consistent product availability for patients across a multitude of diverse geographic markets, a testament to its operational excellence and forward-thinking strategy.

Digital Platforms and Online Resources

Amgen leverages digital platforms like Amgen SupportPlus to offer vital information and assistance to both patients and healthcare providers. These online resources are crucial for program enrollment, such as co-pay assistance, and provide extensive educational content and detailed product information.

These digital channels significantly improve accessibility and efficiency in delivering support services. For instance, in 2024, Amgen reported a substantial increase in website traffic for its patient support portals, indicating a growing reliance on these digital touchpoints for information and engagement.

- Amgen SupportPlus Website: A primary digital channel for patient and healthcare professional engagement.

- Resource Availability: Offers co-pay program enrollment, educational materials, and product details.

- Enhanced Accessibility: Streamlines access to support and information, improving user experience.

- Digital Engagement Growth: Saw increased usage in 2024, highlighting the importance of online support.

Clinical Trial Sites and Research Collaborations

Clinical trial sites are a crucial channel, not just for developing new drugs but also for giving patients early access to potentially life-changing treatments. In 2024, Amgen continued to leverage a vast network of these sites globally to advance its diverse pipeline, from oncology to cardiovascular diseases.

Collaborations with leading research institutions and academic medical centers act as vital channels for scientific exchange. These partnerships facilitate the sharing of groundbreaking data and foster the dissemination of new findings, reinforcing Amgen's position as a leader in scientific innovation.

- Global Reach: Amgen's clinical trial network spans numerous countries, enabling access to diverse patient populations and ensuring broad applicability of its therapies.

- Research Partnerships: The company actively partners with top-tier academic and research organizations to drive cutting-edge scientific discovery and validation.

- Data Dissemination: Findings from these trials and collaborations are regularly published in peer-reviewed journals, contributing to the scientific community's knowledge base.

Amgen's channel strategy encompasses a multifaceted approach, blending direct engagement, specialized distribution, and robust digital platforms. The company's direct sales force is instrumental in educating healthcare providers about its innovative therapies, a strategy that saw significant success in driving biologic adoption throughout 2024. Specialty pharmacies are critical for delivering Amgen's complex biologic medicines, ensuring safe and efficient patient access, while broader distribution networks provide the infrastructure for widespread availability.

Digital channels, such as Amgen SupportPlus, enhance accessibility by offering vital information and assistance to patients and healthcare providers, with a notable increase in user engagement reported in 2024. Furthermore, clinical trial sites and collaborations with research institutions serve as crucial channels for drug development and early patient access, reinforcing Amgen's commitment to scientific advancement.

| Channel Type | Key Function | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales Force | Educate healthcare providers, drive therapy adoption | Pivotal in driving biologic adoption; significant revenue contribution |

| Specialty Pharmacies | Deliver complex biologic medicines, patient support | Crucial for managing intricate logistics and ensuring patient adherence |

| Broader Distribution Networks | Ensure widespread access, navigate regulatory requirements | Vital for product integrity and market reach |

| Digital Platforms (e.g., Amgen SupportPlus) | Provide patient/HCP information and assistance | Substantial increase in traffic to patient support portals in 2024 |

| Clinical Trial Sites | Drug development, early patient access | Network advanced diverse pipeline across oncology, cardiovascular, etc. |

Customer Segments

Amgen's core customer segment comprises patients grappling with chronic and serious illnesses. This includes individuals battling conditions in critical therapeutic areas like oncology, cardiovascular diseases, inflammation, bone health, nephrology, and various rare diseases. These patients are actively seeking innovative treatments that can significantly improve their quality of life and manage their long-term health challenges.

The company's strategic focus is on addressing the high unmet medical needs within these patient populations. Amgen's extensive research and development pipeline is meticulously crafted to deliver novel therapies that offer substantial benefits to those suffering from these debilitating conditions, aiming to provide life-changing solutions.

Healthcare providers, including oncologists, cardiologists, nephrologists, and rheumatologists, represent a critical customer segment for Amgen. These specialists are the primary prescribers of Amgen's innovative therapies, making their informed adoption essential for market success.

Amgen actively engages these medical professionals by providing comprehensive clinical data, robust scientific support, and consistent, value-driven engagement. For instance, in 2024, Amgen continued its robust investment in medical affairs, aiming to deepen understanding of its portfolio among these key opinion leaders.

Hospitals, clinics, and larger integrated delivery networks (IDNs) are key institutional customers for Amgen, managing the administration of many of its injectable and infused therapies. In 2024, the U.S. hospital sector generated over $1.3 trillion in revenue, highlighting the scale of these healthcare systems. Amgen actively collaborates with these entities to secure product availability on their formularies and promote appropriate patient care and product utilization.

Payers and Health Systems

Payers, including insurance companies and government programs like Medicare and Medicaid, are vital customers for Amgen. These entities significantly impact patient access and the reimbursement Amgen receives for its innovative therapies. In 2023, Amgen reported net sales of $24.7 billion, with a substantial portion influenced by payer negotiations and coverage decisions.

Amgen actively engages with payers to demonstrate the clinical and economic value of its medicines. This involves presenting robust data on efficacy, safety, and cost-effectiveness to secure favorable coverage terms and formulary placement. For instance, securing positive coverage decisions for new biologics often requires extensive health economics and outcomes research.

The company also plays a role in helping patients navigate the often-complex insurance landscape. Amgen offers various patient assistance programs designed to reduce out-of-pocket costs and facilitate access to treatment, a critical component in maintaining market share and patient adherence.

- Insurance Companies: Private insurers are key decision-makers for patient coverage.

- Government Health Programs: Medicare and Medicaid represent significant patient populations and reimbursement channels.

- Value Demonstration: Amgen must prove the economic and clinical worth of its drugs to payers.

- Patient Assistance: Programs help patients overcome financial and insurance hurdles.

Global Markets and Regions

Amgen's customer base spans the globe, with a strong foothold in established markets such as the United States, Europe, and Canada. This broad reach is crucial for its revenue generation. In 2024, Amgen continued to focus on expanding its presence in key emerging markets, notably Japan, recognizing the significant growth potential there.

The company's approach to these diverse regions is highly customized. Strategies are carefully crafted to navigate varying regulatory landscapes, market access challenges, and distinct patient needs. This geographical segmentation allows Amgen to optimize its product offerings and commercial efforts for maximum impact in each area.

- United States: Remains Amgen's largest market, contributing a substantial portion of its global revenue.

- Europe: A key region with significant sales, requiring tailored market access strategies for individual countries.

- Japan: An increasingly important growth market where Amgen is investing to expand its footprint and product portfolio.

- Emerging Markets: Continued focus on expanding access and sales in other developing economies to drive future growth.

Amgen's customer segments are diverse, encompassing patients with serious illnesses, healthcare providers who prescribe their therapies, and institutional entities like hospitals and clinics. Payers, including insurance companies and government programs, are also critical as they influence market access and reimbursement. Geographically, Amgen targets major markets like the US and Europe, while also focusing on growth in regions such as Japan.

| Customer Segment | Key Characteristics | 2024/2023 Data Point |

|---|---|---|

| Patients | Individuals with chronic/serious illnesses (oncology, cardiovascular, etc.) seeking improved quality of life. | Amgen's R&D pipeline is focused on high unmet medical needs. |

| Healthcare Providers | Specialists (oncologists, cardiologists, etc.) who prescribe Amgen's therapies. | Continued investment in medical affairs in 2024 to engage key opinion leaders. |

| Hospitals & Clinics | Institutional customers administering therapies, managing formularies. | U.S. hospital sector revenue exceeded $1.3 trillion in 2024. |

| Payers | Insurance companies, Medicare, Medicaid influencing access and reimbursement. | Amgen reported $24.7 billion in net sales in 2023, heavily influenced by payer decisions. |

| Geographic Markets | Established markets (US, Europe) and growth markets (Japan). | Focus on expanding presence in Japan in 2024. |

Cost Structure

Research and Development (R&D) represents a significant component of Amgen's cost structure, underscoring its dedication to pioneering new therapies. In the second quarter of 2025, non-GAAP R&D expenditures rose by 18% compared to the previous year, reaching $1.7 billion. This substantial investment is crucial for funding extensive clinical trials, early-stage scientific exploration, and the progression of its drug pipeline.

Amgen's commitment to innovation is further evidenced by its record R&D investment of $6.0 billion for the full year 2024. These costs are directly tied to the complex and lengthy process of developing new medicines, from initial discovery through to regulatory approval and market launch.

Manufacturing and producing complex biologic medicines is a major expense for Amgen. This involves the cost of essential raw materials, running the manufacturing facilities, ensuring strict quality control, and continually investing in upgrading and expanding production sites. For instance, Amgen's capital expenditures in 2023 were approximately $3.4 billion, with a significant portion allocated to manufacturing and capacity expansion.

Amgen's Selling, General & Administrative (SG&A) expenses are a significant component of its cost structure, encompassing sales and marketing efforts, administrative functions, and corporate overhead. These costs are essential for reaching customers and managing the business effectively.

In the fourth quarter of 2024, Amgen observed a reduction in SG&A, partly attributed to a decline in expenses related to the Horizon acquisition. However, for the full year 2024, SG&A expenses saw an increase, largely driven by the integration of the Horizon business and ongoing commercial operations.

Acquisition and Integration Costs

Amgen's strategic acquisitions, like the significant $27.8 billion purchase of Horizon Therapeutics in 2023, represent a major component of their cost structure. These deals incur substantial upfront costs, encompassing legal and financial advisory fees, alongside the expenses tied to integrating acquired operations and product lines.

The integration process itself is resource-intensive, involving the harmonization of IT systems, sales forces, and research and development pipelines. While these expenditures can temporarily affect short-term profitability, they are fundamentally investments designed to fuel long-term growth and market expansion.

- Strategic Acquisitions: Amgen's acquisition of Horizon Therapeutics for approximately $27.8 billion in 2023 is a prime example of the significant capital outlay involved.

- Integration Expenses: Costs include fees for legal counsel, financial advisors, and the operational challenges of merging distinct business units and product portfolios.

- Impact on Profitability: These acquisition and integration costs can lead to a temporary reduction in short-term earnings per share, but are strategically undertaken for future revenue generation.

- Long-Term Growth Driver: The primary objective of these investments is to enhance Amgen's therapeutic offerings, expand its market reach, and drive sustainable long-term financial performance.

Clinical Trial and Regulatory Compliance Costs

Amgen's cost structure is significantly impacted by the substantial expenses associated with conducting extensive clinical trials. These trials, spanning multiple phases and therapeutic areas, involve considerable outlays for patient recruitment, rigorous data collection, and in-depth analysis. For instance, in 2023, Amgen reported R&D expenses of approximately $4.9 billion, a significant portion of which is allocated to clinical development.

Furthermore, maintaining compliance with stringent global regulatory requirements for drug approval and ongoing post-market surveillance represents another major cost driver. These regulatory hurdles are essential for ensuring the safety and efficacy of new therapies before they can reach patients. The process of gaining approval for a new drug can take many years and cost hundreds of millions, if not billions, of dollars.

- Clinical Trial Expenses: Costs include patient recruitment, site management, data collection, and statistical analysis across Phase I, II, and III trials.

- Regulatory Compliance: Expenses cover submissions to agencies like the FDA and EMA, ongoing safety monitoring, and adherence to Good Manufacturing Practices (GMP).

- Post-Market Surveillance: Costs are incurred for pharmacovigilance, real-world evidence studies, and regulatory updates after a drug is approved.

- Research and Development Investment: In 2023, Amgen's R&D spending reached roughly $4.9 billion, underscoring the significant investment in bringing new treatments to market.

Amgen's cost structure is heavily influenced by its substantial investments in Research and Development (R&D) and manufacturing. In the second quarter of 2025, R&D spending reached $1.7 billion, reflecting a 18% year-over-year increase. This commitment to innovation extends to manufacturing, with capital expenditures in 2023 around $3.4 billion, supporting production of complex biologic medicines.

Selling, General & Administrative (SG&A) expenses are also a key cost driver, essential for market reach and business operations. While Q4 2024 saw a reduction in SG&A due to acquisition-related expense declines, full-year 2024 SG&A increased, largely due to the Horizon acquisition integration. This acquisition, a $27.8 billion deal in 2023, represents a significant capital outlay and integration cost.

| Cost Component | Q2 2025 (Est.) | Full Year 2024 | 2023 |

| R&D Expenses | $1.7 billion | $6.0 billion | $4.9 billion |

| Capital Expenditures | ~$3.4 billion | ||

| Horizon Acquisition | $27.8 billion |

Revenue Streams

Amgen's core revenue generation comes from selling its groundbreaking human therapeutics. In the second quarter of 2025, the company reported a substantial 9% increase in total revenues, reaching $9.2 billion. This growth was primarily fueled by a 9% rise in product sales, which saw a significant 13% boost in volume year-over-year.

Key medications such as Repatha, BLINCYTO, TEZSPIRE, EVENITY, and UPLIZNA are consistently strong performers, each contributing meaningfully to Amgen's overall sales figures and demonstrating the company's success in bringing innovative treatments to market.

Amgen's revenue streams are significantly bolstered by its blockbuster products, defined as those achieving over $1 billion in annual sales. By the close of 2024, the company proudly maintained a portfolio of 14 such high-performing therapies.

These blockbuster products span critical therapeutic areas, including cardiovascular disease, bone health, and oncology, demonstrating Amgen's broad impact. The strong performance in these segments, particularly with high-growth therapies, underscores their importance to the company's financial stability and growth trajectory.

Amgen's rare disease portfolio is a substantial revenue engine, particularly following the Horizon Therapeutics acquisition. In 2024, this segment brought in $4.5 billion in sales, highlighting its critical role.

Key products such as TEPEZZA, KRYSTEXXA, and UPLIZNA are at the forefront of this success, addressing significant unmet medical needs for specific patient groups and driving substantial revenue.

The momentum continues into 2025, with sales of Amgen's rare disease drugs experiencing a robust 19% year-over-year increase in the second quarter, underscoring the portfolio's growing market impact.

Biosimilar Product Sales

Amgen generates revenue through its biosimilar product sales, providing more affordable versions of existing biologic medicines. This segment is crucial for capturing market share in crowded therapeutic areas. For instance, in the first quarter of 2024, Amgen reported that its biosimilar portfolio contributed to its overall financial performance, with specific products like Wezlana and Bekemv showing promising uptake.

The biosimilar market is dynamic, with sales performance often influenced by competitive pressures and market access. Amgen's strategy involves offering high-quality, cost-effective biosimilars that can gain traction against originator biologics. The company's commitment to this segment reflects an effort to broaden patient access to essential treatments while securing a revenue stream.

- Biosimilar Revenue Contribution: Amgen's biosimilar portfolio is a growing revenue stream, offering cost-effective alternatives to established biologic drugs.

- Key Biosimilar Products: Products like Wezlana and Bekemv are significant contributors to this segment's financial performance.

- Market Strategy: The company aims to capture market share in competitive therapeutic landscapes by providing these lower-cost options.

International Product Sales

Amgen's international product sales represent a crucial revenue stream, reflecting its strategy for global market penetration. The company's innovative therapies are distributed to patients across numerous countries, underscoring a broad geographic reach.

In the first quarter of 2025, Amgen observed a robust 14% growth in its U.S. sales. Simultaneously, international markets are demonstrating significant contributions, particularly with recent product introductions such as IMDELLTRA and Tepezza in Japan, bolstering overall revenue figures.

- Global Market Reach: Amgen's products are available to patients worldwide, driving substantial international revenue.

- Q1 2025 Performance: U.S. sales saw a 14% increase, complemented by strong international growth.

- Key International Markets: Japan, with new launches like IMDELLTRA and Tepezza, is a notable contributor to international sales.

- Risk Mitigation: Geographic diversification of sales helps Amgen manage and mitigate pressures specific to individual regional markets.

Amgen's revenue streams are diverse, primarily driven by its innovative human therapeutics. The company also benefits from its growing biosimilar portfolio and international sales, creating a robust financial foundation.

The company's blockbuster products, those exceeding $1 billion in annual sales, form a significant pillar of its revenue. In 2024, Amgen proudly maintained 14 such high-performing therapies across critical areas like cardiovascular disease and oncology.

The rare disease segment, significantly enhanced by the Horizon Therapeutics acquisition, is a substantial revenue engine. In 2024, this segment alone generated $4.5 billion in sales, with key products like TEPEZZA and KRYSTEXXA leading the charge.

| Revenue Stream | Key Products/Segments | 2024/Q2 2025 Data Point |

|---|---|---|

| Human Therapeutics | Repatha, BLINCYTO, TEZSPIRE, EVENITY, UPLIZNA | Product sales up 9% in Q2 2025; 14 blockbuster products in 2024 |

| Rare Disease Portfolio | TEPEZZA, KRYSTEXXA, UPLIZNA | $4.5 billion in sales in 2024; 19% YoY increase in Q2 2025 |

| Biosimilars | Wezlana, Bekemv | Growing revenue stream, capturing market share |

| International Sales | IMDELLTRA, Tepezza (Japan launch) | Strong international growth complementing 14% U.S. sales increase in Q1 2025 |

Business Model Canvas Data Sources

The Amgen Business Model Canvas is built using a combination of internal financial data, comprehensive market research reports, and strategic insights from industry experts. These diverse data sources ensure each block of the canvas is informed by accurate, relevant, and actionable information.