Alumasc Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumasc Group Bundle

Alumasc Group's SWOT analysis reveals a company with strong brand recognition and a diversified product portfolio, but also highlights potential vulnerabilities in supply chain disruptions and evolving regulatory landscapes. Understanding these internal capabilities and external pressures is crucial for navigating the competitive construction materials market.

Want the full story behind Alumasc's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Alumasc Group's emphasis on sustainable building products is a significant strength, directly addressing the growing global demand for eco-friendly construction solutions. This strategic alignment positions them favorably in a market increasingly driven by environmental consciousness and regulatory pressures.

Their portfolio, featuring products that enhance energy efficiency and water management, offers a clear competitive edge. For instance, their Derbigum roofing systems, known for their durability and recyclability, contribute to reduced environmental impact over a building's lifecycle, appealing to clients seeking long-term sustainability credentials.

This focus extends to innovative solutions like their extensive green roof systems, which not only improve a building's thermal performance but also bolster climate resilience by managing stormwater runoff. Alumasc's commitment to these green building materials supports biodiversity and aligns with the UK's net-zero targets, a key driver for construction projects in 2024 and beyond.

Alumasc has shown impressive financial strength, with revenue climbing 20% to £57.4 million in the first half of FY25. Underlying profit before tax also saw a significant 19% increase, reaching a record £7.5 million. This performance underscores the company's ability to generate substantial returns.

Looking ahead, Alumasc anticipates full-year revenue for FY25 to reach £113 million, marking a 12% increase. Notably, its organic growth is significantly outpacing the wider UK construction sector, demonstrating a competitive edge and effective strategy.

The company's consistent growth trajectory, even amidst a challenging economic climate, is a testament to the robustness of its business model. This financial resilience positions Alumasc favorably for continued expansion and market leadership.

Alumasc Group's diversified product portfolio, spanning Water Management, Building Envelope, and Housebuilding Products, offers a wide array of premium solutions like roofing, walling, and water management systems. This broad offering across commercial, industrial, and residential construction sectors mitigates risk by reducing dependence on any single market.

The strategic acquisition of ARP Group in 2024 significantly bolstered Alumasc's Water Management division, enhancing its market position. This integration is expected to unlock valuable cross-selling opportunities and generate purchasing synergies, further solidifying its diverse market reach.

Outperformance in Challenging Markets

Alumasc has demonstrated a notable ability to outperform even when the UK construction sector faces headwinds. For instance, in the fiscal year 2025, the company achieved organic revenue growth of around 7%. This stands in contrast to the broader UK construction market, which was estimated to grow by only about 2% during the same period.

This resilience and superior growth can be attributed to several key strategic drivers. Alumasc has been actively working to gain market share, a testament to its competitive positioning and effective sales strategies. Furthermore, the company has successfully expanded into new, related markets, broadening its revenue streams and reducing reliance on any single segment.

Product innovation plays a crucial role in this outperformance, ensuring Alumasc's offerings remain attractive and relevant to customer needs. Coupled with a strong focus on delivering excellent customer service, these factors combine to create a compelling value proposition that allows Alumasc to thrive where others might struggle.

- Market Share Gains: Alumasc actively pursues strategies to increase its share of the existing market.

- Adjacent Market Entry: Expansion into new, related market segments diversifies revenue.

- Product Innovation: Continuous development of new and improved products keeps Alumasc competitive.

- Customer Service Excellence: A strong emphasis on customer satisfaction fosters loyalty and repeat business.

Strong Balance Sheet and Cash Generation

Alumasc Group boasts a robust financial foundation, evidenced by its significantly reduced net bank debt. As of December 2024, this figure stood at £4.6 million, translating to a low gearing ratio of just 0.3x. This position is comfortably within the Group's banking covenants, highlighting its financial stability.

The company's ability to generate strong operating cash flow is a key strength. In the period ending December 2024, Alumasc achieved an impressive cash conversion rate of 127% on its underlying profit. This healthy cash generation provides ample capacity to support both strategic initiatives and ongoing operational needs, including investments in further organic growth.

- Reduced Net Bank Debt: £4.6 million as of December 2024.

- Low Gearing: 0.3x, well within covenants.

- Strong Cash Conversion: 127% of underlying profit for the period ending December 2024.

- Funding Capacity: Substantial capacity to fund organic growth and strategic plans.

Alumasc's financial performance in the first half of FY25 was exceptionally strong, with revenue up 20% to £57.4 million and underlying profit before tax rising 19% to £7.5 million. This robust growth, projected to continue with a full-year revenue target of £113 million for FY25 (a 12% increase), highlights the company's ability to generate significant returns and outperform the broader UK construction sector, which saw only about 2% growth in the same period.

| Metric | H1 FY25 | FY25 Projection | FY24 (Actual) |

|---|---|---|---|

| Revenue | £57.4 million | £113 million | £101 million (approx.) |

| Underlying PBT | £7.5 million | N/A | N/A |

| Organic Revenue Growth | N/A | ~12% | ~7% |

| Net Bank Debt | £4.6 million (Dec 2024) | N/A | N/A |

| Gearing | 0.3x (Dec 2024) | N/A | N/A |

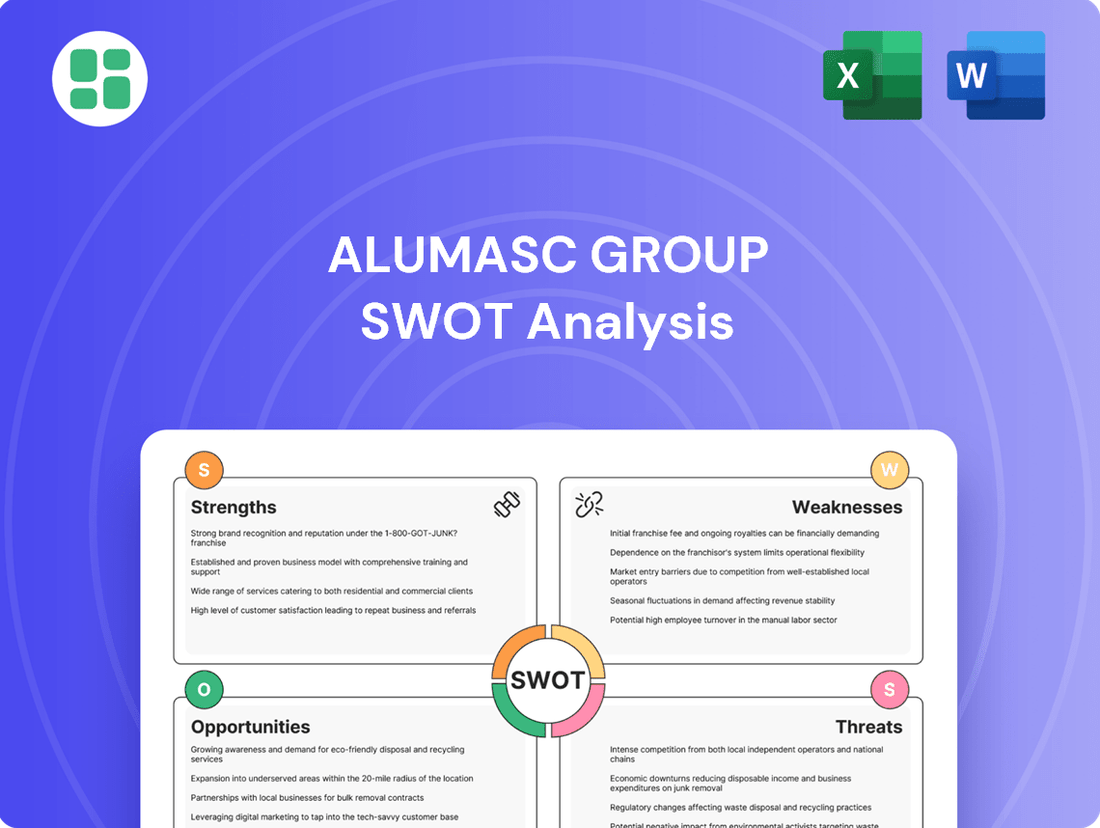

What is included in the product

Delivers a strategic overview of Alumasc Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Alumasc Group's strategic challenges and opportunities.

Weaknesses

Alumasc Group's significant reliance on the UK construction market presents a key weakness. Despite diversification efforts, a substantial portion of its revenue is still generated domestically, leaving it vulnerable to the sector's inherent cyclicality and recent downturns.

The UK construction sector has experienced considerable headwinds, with reports indicating a contraction in output during 2023 and a cautious outlook for 2024. For instance, the Office for National Statistics (ONS) data showed a 3.2% decrease in construction output in the three months to November 2023 compared to the previous three months. This domestic exposure means Alumasc is directly impacted by fluctuations in UK economic conditions, interest rates, and government spending on infrastructure.

This concentration exposes Alumasc to risks associated with a slowdown in housebuilding and commercial projects, which have been affected by rising costs and reduced consumer and business confidence. The company's performance is therefore closely tied to the health of the UK economy, making it susceptible to domestic recessions or prolonged periods of low construction activity.

Alumasc Group's profitability is closely tied to the health of the construction sector, making it vulnerable to economic downturns. Broad economic uncertainty, as seen in 2023, can dampen business and consumer confidence, leading to delays in construction projects. For example, Alumasc's Water Management division experienced a revenue dip in the UK due to domestic project delays, though this was partially mitigated by strong export performance.

While Alumasc has shown resilience in managing cost pressures, the anticipated rise in Employers' National Insurance and the National Living Wage from April 2025 presents a potential headwind to operational expenses. These mandated increases, alongside ongoing inflationary trends in raw materials and labor, could exert pressure on profit margins if they cannot be fully offset by efficiency improvements or strategic pricing actions.

Niche Market Focus and Limited Scale

Alumasc's dedication to premium and sustainable building products, while a strength, inherently places it within specialized niche markets. This contrasts with the broader, more commoditized construction materials sector, potentially capping its overall market share. For instance, in the UK, the market for high-performance facade systems, a key Alumasc area, is significant but smaller than that for general building aggregates or cement.

This specialized focus, coupled with Alumasc's size relative to larger, multinational construction material suppliers, can also limit its negotiating leverage with suppliers and large-scale distributors. While Alumasc reported revenue of £116.5 million for the year ended 30 June 2023, this is considerably smaller than diversified global players, impacting its ability to command volume discounts or dictate terms across the entire construction supply chain.

- Niche Market Specialization: Focus on premium, sustainable products limits exposure to the larger, commoditized construction materials market.

- Limited Scale vs. Competitors: Alumasc's size, with FY23 revenue of £116.5 million, is smaller than many global competitors, impacting its market share potential.

- Reduced Negotiating Power: Smaller scale can translate to less leverage with suppliers and large distributors compared to larger industry players.

- Potential for Market Saturation: Niche markets, while offering higher margins, can become saturated more quickly, impacting long-term growth.

Integration Risks of Acquisitions

While Alumasc Group's acquisition of ARP Group has been a success, exceeding expectations, future acquisitions present inherent integration risks. The ability to achieve purchasing and cross-selling synergies hinges on meticulous management, and any missteps in this process could lead to significant challenges.

For instance, a poorly executed integration could disrupt Alumasc's existing operations, potentially impacting day-to-day activities and customer service. This disruption can, in turn, dilute the anticipated financial benefits of the acquisition, making it harder to recoup the initial investment and achieve the desired return.

- Integration Complexity: Future acquisitions may involve integrating businesses with different operational models, IT systems, and corporate cultures, increasing the potential for friction and delays.

- Synergy Realization: Achieving projected cost savings and revenue enhancements from cross-selling requires seamless coordination across departments, which can be difficult to orchestrate effectively.

- Operational Disruption: A rushed or poorly managed integration process can lead to a temporary decline in productivity, employee morale, and customer satisfaction, impacting the company's overall performance.

- Financial Dilution: If integration costs exceed projections or synergies fail to materialize as planned, the acquisition could dilute earnings per share and negatively impact shareholder value.

Alumasc's reliance on the UK construction market makes it susceptible to domestic economic downturns and sector-specific challenges. The ongoing inflationary pressures and potential increases in labor costs, such as the National Living Wage from April 2025, could squeeze profit margins if not effectively managed through pricing strategies or cost efficiencies.

The company's focus on niche, premium markets, while beneficial for margins, limits its overall market share compared to larger, more diversified competitors. This smaller scale can also translate into reduced negotiating power with suppliers and major distributors, potentially impacting procurement costs and supply chain terms.

Future acquisitions, despite past successes like ARP Group, carry inherent integration risks. Challenges in merging operations, IT systems, and corporate cultures could lead to operational disruptions, hinder synergy realization, and potentially dilute financial performance if not managed meticulously.

| Weakness | Description | Relevant Data/Context |

|---|---|---|

| UK Market Concentration | High dependence on the UK construction sector's performance. | UK construction output saw a 3.2% decrease in the three months to November 2023 (ONS). |

| Cost Pressures | Vulnerability to rising labor and material costs. | Anticipated increase in Employers' National Insurance and National Living Wage from April 2025. |

| Niche Market Size | Limited overall market share due to specialization. | FY23 revenue of £116.5 million, smaller than diversified global players. |

| Acquisition Integration Risks | Potential for operational disruption and failure to realize synergies from future acquisitions. | Integration complexity requires meticulous management to avoid financial dilution. |

What You See Is What You Get

Alumasc Group SWOT Analysis

The preview you see is the same Alumasc Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic decision-making.

Opportunities

The global and UK push for sustainability and decarbonization is a major tailwind for Alumasc. This trend fuels demand for green building solutions, a sector where Alumasc is already well-positioned.

Government policies and incentives, alongside growing consumer preference for eco-friendly buildings, are creating a booming market for sustainable materials. For instance, the UK government's target to reach net-zero emissions by 2050 is a key driver for this sector.

Alumasc's export revenues saw a substantial 43% surge in the first half of fiscal year 2025. This impressive growth was fueled by high-profile projects, such as the Chek Lap Kok airport in Hong Kong, and strategic investments in bolstering its international sales infrastructure.

The company's increasing success in these higher-growth international markets presents a significant opportunity for sustained revenue and profit expansion. This strategic focus not only opens new avenues for business but also serves to diversify Alumasc's revenue streams, lessening its dependence on the domestic UK market.

Alumasc's commitment to innovation is evident in its continued investment in new product development and technology. For instance, the adoption of Building Information Modeling (BIM) can significantly streamline design and construction processes, offering clients greater efficiency and accuracy. This focus on technological advancement is crucial for maintaining a competitive edge in the construction materials sector.

Developing solutions that prioritize energy efficiency and water conservation directly addresses growing market demands for sustainable building practices. Alumasc's ability to offer products that enhance environmental performance, such as improved insulation or water management systems, allows it to capture market share from environmentally conscious consumers and developers. This strategic alignment with sustainability trends is key to reinforcing its premium market position.

Strategic Acquisitions and Partnerships

Alumasc's successful integration of ARP Group in 2023, a move that contributed to a 17% increase in revenue for the Water Management division in the first half of FY24, demonstrates the significant potential for value-enhancing acquisitions. This success underscores the group's capability to identify and integrate businesses that accelerate growth and unlock synergies within current or new markets.

Further strategic acquisitions, particularly bolt-on acquisitions, present a clear opportunity for Alumasc. These could expand its product offerings, enhance its market penetration, and bolster its technical expertise. For instance, acquiring companies with complementary technologies in areas like sustainable building materials or advanced water management solutions could solidify its competitive position.

Strategic partnerships also offer a pathway to growth and innovation. Collaborating with technology providers or distributors could open up new revenue streams and geographical markets. Such alliances can provide access to cutting-edge solutions and broader customer bases without the full capital commitment of an acquisition, thereby contributing to long-term shareholder value.

- Acquisition of ARP Group: Contributed to a 17% revenue increase in Alumasc's Water Management division in H1 FY24.

- Bolt-on Acquisitions: Opportunity to expand product portfolio and market reach in adjacent sectors.

- Strategic Partnerships: Potential to access new technologies and customer segments, fostering innovation.

- Synergy Creation: Focus on integrating acquired businesses to drive operational efficiencies and growth.

Capitalizing on UK Housing Undersupply and Infrastructure Investment

Despite a slowdown in new UK housing starts, a significant underlying demand persists, coupled with an aging building stock necessitating continuous upgrades and maintenance. This scenario presents a substantial, albeit often overlooked, market for Alumasc's solutions.

Broader infrastructure investment, particularly in areas like building safety and climate resilience, creates long-term growth avenues for Alumasc's building and water management systems. Government initiatives are actively pushing for higher standards, directly benefiting companies offering compliant and sustainable products.

- Latent Demand: The UK faces a housing deficit, with estimates suggesting millions of new homes are needed by 2030 to meet demand.

- Aging Stock: Over 60% of UK homes were built before 1970, indicating a vast market for refurbishment and retrofitting.

- Infrastructure Focus: Government plans for £27 billion in transport infrastructure investment for 2020-2025 and ongoing focus on building safety regulations, like the Fire Safety Act 2021, drive demand for specialized building materials.

- Climate Resilience: Increasing focus on flood defenses and sustainable building practices, spurred by climate change concerns, creates opportunities for Alumasc's water management products.

Alumasc's export performance is a significant growth driver, with revenues up 43% in H1 FY25, boosted by projects like Hong Kong's Chek Lap Kok airport. This international expansion diversifies revenue and reduces reliance on the UK market.

The company's focus on innovation, including BIM adoption, enhances efficiency and provides a competitive edge. Developing energy-efficient and water-conserving solutions directly meets market demand for sustainability.

Strategic acquisitions, such as the ARP Group integration which boosted Water Management revenue by 17% in H1 FY24, highlight Alumasc's capability to drive growth through bolt-on acquisitions and partnerships.

Addressing the UK's housing deficit and the need to upgrade its aging building stock, estimated at over 60% built before 1970, presents a substantial market for Alumasc's refurbishment solutions.

| Opportunity Area | Description | Supporting Data/Fact |

|---|---|---|

| International Market Expansion | Leveraging strong export growth and diversifying revenue streams. | Export revenues surged 43% in H1 FY25. |

| Innovation and Sustainability | Developing and marketing energy-efficient and water-conserving products. | BIM adoption streamlines design; focus on environmental performance. |

| Strategic Acquisitions & Partnerships | Acquiring complementary businesses and forming strategic alliances. | ARP Group acquisition increased Water Management revenue by 17% (H1 FY24). |

| Refurbishment and Infrastructure | Capitalizing on the need to upgrade aging UK buildings and infrastructure projects. | Over 60% of UK homes built before 1970; UK infrastructure investment planned. |

Threats

Persistent macroeconomic uncertainty and a prolonged slowdown in the UK construction industry, especially in housing, present a significant threat to Alumasc. This downturn can directly reduce demand for their building products.

Despite Alumasc's ability to outperform the market, a general decline in new housing starts and overall construction activity directly impacts sales volumes. Business confidence in the sector has remained notably low, hitting its lowest point since December 2022, underscoring the challenging environment.

The market for sustainable building products, a key area for Alumasc, is seeing a surge in new entrants, intensifying competition. This influx of companies into the green construction sector means Alumasc faces a more crowded marketplace. For instance, the global green building materials market was valued at approximately USD 275 billion in 2023 and is projected to grow significantly, indicating increased competition for market share.

This heightened competition could lead to downward pressure on pricing and profit margins, challenging Alumasc's ability to maintain its premium positioning. To counter this, the company must prioritize continuous innovation in its product offerings and maintain exceptional customer service to retain its competitive edge and market share.

Alumasc Group faces significant threats from volatile raw material prices. For instance, the price of aluminum, a key component in many of their products, experienced considerable fluctuations throughout 2024, driven by global energy costs and production levels. These price swings directly impact Alumasc's cost of goods sold, potentially squeezing profit margins if not effectively managed through hedging or pricing adjustments.

Supply chain disruptions, amplified by geopolitical tensions and logistical bottlenecks like the extended Red Sea crisis in late 2023 and into 2024, pose another substantial risk. These disruptions can lead to delivery delays, increased freight costs, and shortages of essential materials, further escalating production expenses and potentially hindering Alumasc's ability to meet customer demand promptly. While the company actively seeks to build resilience, unforeseen global events can still create significant operational challenges.

Changes in Building Regulations and Standards

Changes in building regulations and standards pose a significant threat to Alumasc Group. For instance, the UK government's commitment to net-zero carbon emissions by 2050, with interim targets for 2030, means building regulations will continue to evolve towards greater energy efficiency and sustainability. This could require substantial investment in adapting Alumasc's product lines, such as their water management and building envelope systems, to meet new performance criteria. A failure to keep pace with these evolving standards could render existing products obsolete or lead to costly redesigns, impacting market share and profitability.

The potential for rapid or unexpected shifts in these regulations presents a challenge. For example, new fire safety regulations following incidents like the Grenfell Tower fire have already led to significant product re-engineering across the construction sector. If similar unforeseen changes occur in areas like insulation performance, material sourcing, or waste management within the 2024-2025 period, Alumasc might face increased R&D costs and production delays. This could affect their ability to supply compliant products efficiently, potentially leading to a loss of competitive advantage.

Key considerations include:

- Increased R&D Investment: Future regulatory changes may necessitate higher spending on research and development to ensure product compliance and market relevance.

- Product Adaptation Costs: Adapting existing product ranges to meet new environmental or safety standards could incur significant manufacturing and material costs.

- Market Relevance Risk: Non-compliance or slow adaptation to new regulations could lead to a decline in market share and a loss of brand reputation.

Economic Headwinds and Inflationary Pressures

Broader economic headwinds, such as persistent inflation and elevated interest rates, pose a significant threat by potentially curbing overall construction investment. For Alumasc, this translates to a more cautious approach from clients regarding capital expenditure, which could dampen demand for its premium building products.

These economic pressures directly impact operational costs for Alumasc, while simultaneously reducing the spending power of consumers and businesses. This combination creates a challenging environment where project viability may be questioned, impacting Alumasc's sales pipeline.

- Inflationary Impact: Persistent inflation, as seen in the UK's CPI figures which remained at 2.3% in April 2024, increases Alumasc's raw material and energy costs.

- Interest Rate Hikes: Continued higher interest rates, with the Bank of England base rate at 5.25% as of May 2024, make financing for construction projects more expensive, potentially delaying or reducing new builds.

- Consumer Spending: Reduced consumer spending power directly affects the residential construction and renovation sectors, a key market for Alumasc's products.

Intensifying competition in the sustainable building products market presents a significant threat, as new entrants vie for market share in a sector projected for substantial growth. This increased competition could exert downward pressure on Alumasc's pricing and profit margins.

Volatile raw material prices, particularly for aluminum, directly impact Alumasc's cost of goods sold, potentially squeezing profit margins if not effectively managed. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, further increase production expenses and risk delivery delays.

Evolving building regulations and standards, driven by net-zero targets, necessitate continuous product adaptation and could incur substantial R&D and manufacturing costs. Failure to keep pace with these changes risks market relevance and brand reputation.

Broader economic headwinds, including persistent inflation and elevated interest rates, threaten to curb construction investment by making financing more expensive and reducing consumer spending power. For example, the UK CPI was 2.3% in April 2024 and the Bank of England base rate stood at 5.25% in May 2024.

SWOT Analysis Data Sources

This Alumasc Group SWOT analysis is built upon a foundation of robust data, including their latest financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.