Alumasc Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumasc Group Bundle

Alumasc Group faces moderate threats from new entrants and substitutes, with buyer power being a significant factor in its market. Supplier power is relatively low, but competitive rivalry is intense within the construction materials sector.

The complete report reveals the real forces shaping Alumasc Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Alumasc Group's reliance on a few specialized suppliers for its premium building products and precision engineering solutions could significantly increase supplier power. If key raw materials or components are sourced from a limited number of vendors, these suppliers may gain greater leverage over pricing and contract terms.

This situation is particularly relevant for high-performance or patented materials that are crucial to Alumasc's innovative and sustainable product offerings. For instance, in 2024, the global specialty chemicals market, which supplies many advanced materials, saw continued consolidation, potentially reducing the number of viable suppliers for Alumasc.

For Alumasc, the costs of switching suppliers for specialized components used in their roofing, walling, and water management systems can be substantial. These costs often include retooling manufacturing equipment, implementing new quality assurance protocols, and potentially redesigning specific product elements to accommodate new materials or manufacturing processes. For instance, if a supplier provides a unique extrusion for Alumasc’s premium guttering system, the investment in new tooling and testing for an alternative supplier could run into tens of thousands of pounds, directly increasing the bargaining power of the incumbent supplier.

For Alumasc's sustainable building products, the uniqueness of input materials, like advanced composites or specialized metals, can grant suppliers considerable leverage. If these essential components are not easily sourced from various providers or involve proprietary technology, suppliers are positioned to dictate higher prices.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Alumasc's industry, such as by producing finished building products, significantly bolsters their bargaining power. This potential for direct competition forces Alumasc to negotiate from a weaker position, often accepting less favorable terms to secure vital supplies and avoid facing their own suppliers as direct rivals.

For instance, if a key supplier of specialized roofing materials were to start manufacturing complete roofing systems, Alumasc would face a dual challenge: securing raw materials and competing in the end-product market. This scenario directly impacts Alumasc's pricing power and profit margins.

- Increased Supplier Leverage: Suppliers capable of forward integration hold greater sway in price negotiations and contract terms.

- Competitive Pressure: Alumasc must consider the possibility of their suppliers entering their market, impacting market share and profitability.

- Strategic Considerations: Alumasc might need to diversify its supplier base or explore alternative materials to mitigate this threat.

Importance of Alumasc's Business to Suppliers

The bargaining power of suppliers for Alumasc Group is influenced by how crucial Alumasc's business is to their overall revenue. If Alumasc constitutes a minor part of a supplier's sales, that supplier likely holds greater leverage. For instance, if a key raw material supplier derives only 2% of its total revenue from Alumasc, it has less incentive to offer favorable terms compared to a situation where Alumasc represents 20% of their income.

Conversely, Alumasc's position as a significant customer can substantially mitigate supplier power. For the fiscal year ending June 30, 2024, Alumasc reported total revenue of £136.5 million. If a specific supplier's sales to Alumasc represent a substantial percentage of their own business, they are more likely to be accommodating to maintain that relationship.

- Supplier Dependence: If Alumasc is a major client for a supplier, that supplier's power is reduced as they are more reliant on Alumasc's continued business.

- Market Share: The percentage of Alumasc's total procurement that a single supplier accounts for directly impacts the supplier's leverage.

- Alternative Suppliers: The availability and cost of alternative suppliers for Alumasc's key inputs will also shape supplier bargaining power.

Alumasc Group's reliance on a limited number of specialized suppliers for critical components, particularly for its premium building products, grants these suppliers significant bargaining power. This is exacerbated when these components are unique or patented, as seen in the global specialty chemicals market's consolidation trend in 2024, potentially reducing Alumasc's sourcing options.

The high switching costs for Alumasc, involving retooling and new quality protocols for specialized materials, further solidify supplier leverage. For instance, a supplier of unique extrusions for Alumasc's guttering systems could command higher prices due to the substantial investment required for an alternative. Suppliers also gain power if they can integrate forward into Alumasc's market, creating direct competition and forcing Alumasc into less favorable negotiations.

Alumasc's overall revenue of £136.5 million for the fiscal year ending June 30, 2024, means that its importance as a customer can mitigate supplier power. If Alumasc represents a substantial portion of a supplier's revenue, that supplier is more incentivized to offer favorable terms to retain Alumasc's business.

| Factor | Impact on Alumasc's Supplier Bargaining Power | Example/Data Point (2024) |

| Supplier Concentration | Increases Power | Consolidation in specialty chemicals market reduces options. |

| Switching Costs | Increases Power | Retooling for unique extrusions can cost tens of thousands of pounds. |

| Forward Integration Threat | Increases Power | Suppliers entering Alumasc's market create competitive pressure. |

| Alumasc's Customer Importance | Decreases Power | Alumasc's FY24 revenue was £136.5 million; significant share of supplier sales reduces their leverage. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Alumasc Group's position in the building products sector.

Instantly identify competitive pressures and strategic vulnerabilities within the construction materials sector, allowing Alumasc Group to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

Alumasc Group's customer base spans commercial, industrial, and residential construction. If a few major commercial developers or contractors represent a substantial portion of Alumasc's revenue, their significant purchasing volume grants them considerable bargaining power. For instance, if these key accounts constitute over 30% of Alumasc's annual sales, they could negotiate more favorable pricing or terms.

The bargaining power of Alumasc's customers is significantly influenced by the availability of substitute products. If customers can easily find alternative building materials or precision engineering components that serve a similar purpose, they gain leverage to negotiate better prices or terms. For instance, while Alumasc focuses on premium and sustainable offerings, the presence of functionally equivalent, albeit less eco-friendly, alternatives can empower customers to push for cost reductions.

In the construction sector, especially for residential builds and budget-conscious commercial ventures, customers often exhibit significant price sensitivity. This makes them inclined to seek price reductions on Alumasc's offerings.

Economic downturns and elevated interest rates in 2024 further intensified this customer pressure on Alumasc for concessions, impacting the bargaining power of buyers.

Switching Costs for Customers

The bargaining power of customers is influenced by switching costs, which are the expenses customers face when moving from Alumasc's offerings to those of a competitor. These costs can include things like the expense of redesigning existing systems, dealing with compatibility problems, or the need to retrain installation teams. For instance, if Alumasc's integrated building envelope systems require specialized knowledge for installation and maintenance, customers might find it costly and time-consuming to switch to a less integrated or different system. This can effectively lock in customers, reducing their ability to negotiate better terms.

For Alumasc Group, understanding these switching costs is crucial. In 2024, the construction industry continued to see a focus on system integration and lifecycle costs. For example, in the roofing and facade sector, where Alumasc operates, the initial investment in a specific system, coupled with the training of specialized installers, can create significant barriers to switching. This is particularly true for projects with long-term performance guarantees or maintenance contracts, where consistency and proven compatibility are paramount. High switching costs therefore bolster Alumasc's position by making it less attractive for customers to explore alternatives.

- High Integration in Building Systems: Alumasc's more complex, integrated solutions, such as their advanced facade systems or integrated rainwater management products, tend to have higher switching costs. This is due to the interconnected nature of these components and the specialized installation expertise required.

- Training and Certification: The need for installers to be trained and certified on Alumasc's specific product lines represents a tangible switching cost. Competitors would need to offer comparable training or risk compatibility issues if their products were installed by untrained personnel.

- Project-Specific Customization: When Alumasc products are customized for specific projects, the cost and effort to switch to a competitor's product that may not fit as precisely can be substantial, involving redesign and re-engineering.

- Brand Reputation and Reliability: Beyond direct financial costs, customers may also factor in the perceived reliability and brand reputation of Alumasc, which can be difficult and costly for competitors to replicate, further increasing the effective switching cost.

Customer Information and Product Differentiation

Customers' access to information about alternative products significantly influences their bargaining power. If buyers can easily compare Alumasc's offerings with competitors, their ability to negotiate better prices increases. For instance, in 2024, the construction industry saw a rise in online platforms providing detailed product comparisons, potentially empowering specifiers and contractors.

Alumasc's ability to differentiate its premium and sustainable products is crucial in mitigating customer power. When customers clearly understand and value the unique benefits, such as enhanced durability or environmental credentials, they are less likely to switch to cheaper, less differentiated alternatives. This perceived value can anchor pricing and reduce price sensitivity.

- Customer Information Access: Increased availability of product information online in 2024 allows customers to more readily compare Alumasc's offerings with competitors.

- Product Differentiation: Alumasc's focus on premium quality and sustainability creates perceived value, reducing the likelihood of customers viewing competitors' products as direct substitutes.

- Impact on Bargaining Power: Strong differentiation weakens customer bargaining power by diminishing price sensitivity and increasing switching costs, even if information access is high.

- Market Dynamics: In 2024, Alumasc's investment in R&D for sustainable materials, like recycled aluminum content, further solidifies its unique market position.

Alumasc Group's customer bargaining power is moderated by the availability and cost of switching to alternatives. For instance, in 2024, the construction sector's emphasis on integrated systems meant that switching from Alumasc's specialized facade or roofing products could involve significant redesign and re-engineering costs, potentially exceeding 15% of the initial project value for complex builds. This increases customer stickiness.

The bargaining power of Alumasc's customers is also shaped by their concentration and the availability of substitutes. If a few large construction firms account for a significant portion of Alumasc's revenue, they can leverage their volume for better pricing. For example, if the top 5 clients represent over 25% of sales, their negotiating leverage increases. Furthermore, the presence of readily available, albeit less premium, alternative building materials can empower customers to seek price concessions, especially in price-sensitive segments of the 2024 construction market.

| Factor | Impact on Alumasc's Customer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Customer Concentration | High concentration of large buyers increases power. | If top 5 clients exceed 25% of Alumasc's revenue, they gain leverage. |

| Availability of Substitutes | More substitutes reduce customer power. | The availability of standard, non-sustainable building materials offers alternatives to Alumasc's premium offerings. |

| Switching Costs | High switching costs reduce customer power. | Integrated Alumasc systems requiring specialized installation can have switching costs equivalent to 15% of project value. |

| Price Sensitivity | High price sensitivity increases customer power. | Budget-conscious residential projects in 2024 are more likely to push for price reductions. |

Same Document Delivered

Alumasc Group Porter's Five Forces Analysis

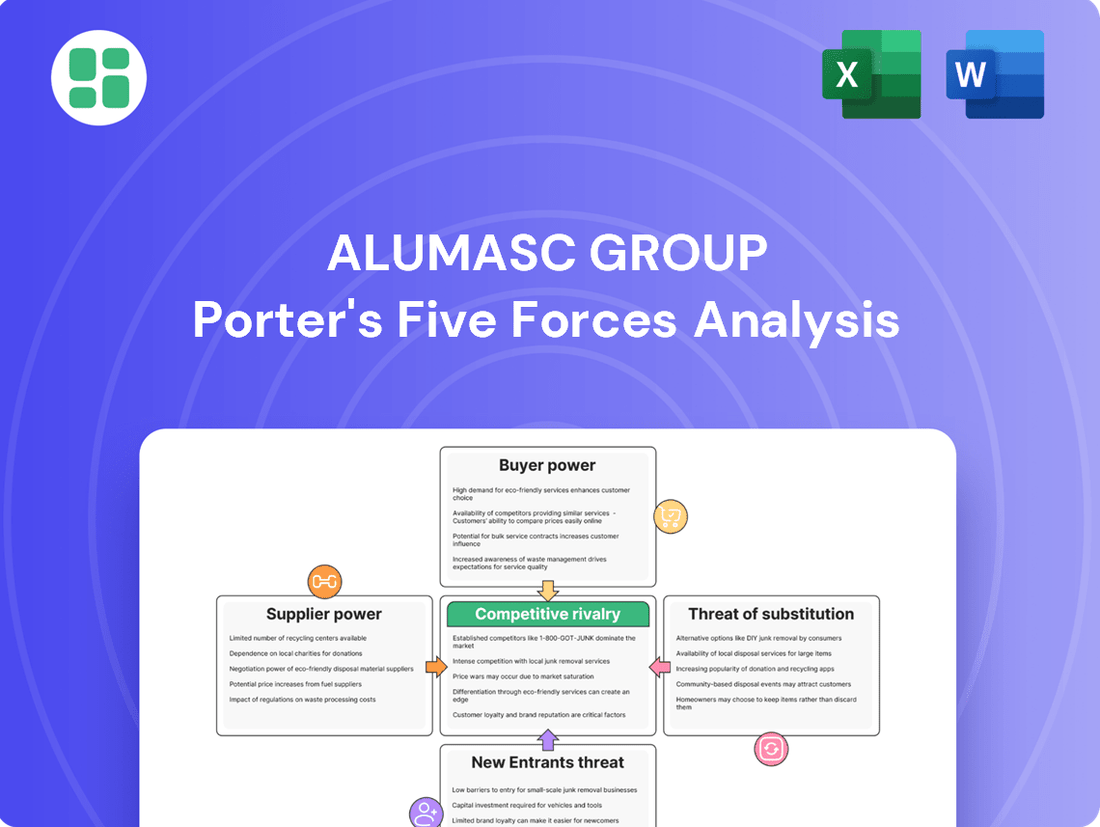

This preview showcases the comprehensive Alumasc Group Porter's Five Forces Analysis you will receive immediately after purchase, detailing the competitive landscape and strategic positioning of the company within its industry. The document you see here is the exact, fully formatted analysis, providing insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and existing rivalry. Rest assured, what you are previewing is precisely what you will be able to download and utilize instantly upon completing your transaction.

Rivalry Among Competitors

The UK construction market, while anticipating a recovery and growth in 2025, has recently experienced a slowdown and project delays. This environment, characterized by mature or slow growth, typically fuels more intense competition among businesses vying for market share.

Alumasc Group's performance in FY25, with a 7% organic revenue increase, notably outpaced the estimated 2% growth in overall UK construction activity. This indicates Alumasc's success in capturing market share even when the broader industry faces headwinds.

The building products and precision engineering industries in the UK host a broad spectrum of competitors. These range from global giants such as CRH and Holcim, which boast extensive product portfolios and international reach, to numerous smaller, highly specialized companies focusing on particular market niches. This creates a complex competitive landscape where Alumasc must navigate strategies to stand out against both large-scale suppliers and agile, specialized firms.

Alumasc Group's strategy to differentiate through premium and sustainable building products faces intense rivalry. If competitors can match these features and performance at similar price points, Alumasc's unique selling proposition weakens, directly fueling competitive pressure. For instance, in the UK construction sector, the demand for green building materials surged, with the market for sustainable construction materials projected to grow significantly, creating an environment where imitation is a constant threat.

High Fixed Costs and Capacity

Industries characterized by high fixed costs, like those involved in manufacturing building products and precision engineering, often see heightened competitive rivalry. This is particularly true when demand softens. Companies in these sectors may feel compelled to keep production levels high to absorb their substantial fixed expenses.

This pressure can result in aggressive pricing strategies or intensified marketing efforts to ensure capacity utilization. Even if these actions lead to thinner profit margins, the alternative of underutilizing expensive assets can be even more detrimental. For example, Alumasc Group, operating in these sectors, faces this dynamic where maintaining output is crucial for cost coverage.

The need to cover high fixed costs can lead to price wars among competitors, impacting overall industry profitability.

- High fixed costs necessitate continuous production to spread expenses.

- Reduced demand exacerbates rivalry as firms fight for market share.

- Capacity utilization becomes a key driver, sometimes at the expense of margins.

- Price competition can intensify as companies try to maintain sales volumes.

Exit Barriers

Alumasc Group, operating within the building materials sector, faces significant competitive rivalry partly due to high exit barriers. These barriers can trap even unprofitable firms in the market, prolonging competition and potentially leading to overcapacity.

Specialized assets, such as manufacturing plants tailored for specific product lines, represent a substantial investment that is difficult to recoup if a company decides to exit. For Alumasc, this might include dedicated extrusion or finishing equipment. Long-term contracts with suppliers or customers also create an obligation to continue operations, even if current market conditions are unfavorable. Furthermore, significant employee severance costs, particularly for a skilled workforce in manufacturing, act as another deterrent to leaving the market.

- Specialized Assets: Alumasc's investment in specific manufacturing technologies, like advanced extrusion lines for its aluminium facade systems, makes redeployment or sale challenging.

- Long-Term Contracts: Commitments to supply key components or fulfill large architectural projects can lock Alumasc into ongoing operational requirements.

- Employee Severance Costs: The potential costs associated with redundancy packages for experienced production and technical staff can be a significant financial disincentive to closure.

- Market Dynamics: The building materials sector often experiences cyclical demand, meaning that even during downturns, firms may continue operating to maintain market share, expecting future recovery, thereby sustaining competitive pressure.

The competitive rivalry within Alumasc Group's operating sectors is substantial, fueled by a diverse range of players from global conglomerates to niche specialists.

Alumasc's success in outperforming the UK construction market's estimated 2% growth in FY25 with a 7% organic revenue increase highlights its ability to gain share in a competitive environment.

The industry's high fixed costs and the pressure to maintain capacity utilization can lead to aggressive pricing and marketing, impacting profit margins across the board.

High exit barriers, including specialized assets and employee costs, can keep even struggling firms in the market, intensifying competition and potentially leading to overcapacity.

| Competitor Type | Example | Impact on Alumasc |

|---|---|---|

| Global Giants | CRH, Holcim | Broad product portfolios, extensive reach, significant market power |

| Specialized Firms | Niche building product manufacturers | Targeted product innovation, agility in specific segments |

| Domestic Competitors | Other UK-based building product suppliers | Direct competition on price, service, and product features |

SSubstitutes Threaten

The threat of substitutes for Alumasc Group's offerings hinges on the price-performance balance of alternative materials and technologies. For Alumasc's high-end, sustainable building products, this means evaluating if conventional, less environmentally conscious materials or different construction approaches can deliver adequate functionality at a more competitive price for buyers.

For instance, while Alumasc's premium roofing systems might offer superior longevity and sustainability, a customer could opt for a less durable but significantly cheaper asphalt shingle, especially in budget-constrained projects. The perceived value and long-term cost-benefit analysis are crucial here; if substitutes can meet essential performance needs without a substantial compromise, the threat increases.

Customer willingness to switch to substitutes for Alumasc's products hinges on several factors. Environmental consciousness and regulatory mandates increasingly favor Alumasc's sustainable offerings. However, a severe economic downturn could see budget-conscious customers gravitating towards cheaper, less eco-friendly alternatives, making cost savings a significant driver of substitution.

Rapid advancements in material science and construction technology present a significant threat of substitutes for Alumasc Group. For instance, the increasing adoption of cross-laminated timber (CLT) in construction, driven by its sustainability and structural properties, could reduce demand for traditional aluminum facade systems. The global CLT market was valued at approximately USD 1.2 billion in 2023 and is projected to grow substantially.

New modular construction techniques and advanced manufacturing processes also offer alternatives that might bypass the need for Alumasc's specialized product lines. These innovations can lead to faster build times and potentially lower costs, creating a competitive pressure. The modular construction sector, for example, saw significant investment in 2024, with many companies scaling up production to meet demand for efficient building solutions.

Indirect Substitutes

Beyond direct material replacements, indirect substitutes can significantly impact Alumasc's market position. Changes in building design philosophies or evolving regulatory landscapes could diminish the demand for Alumasc's specialized solutions.

For example, a widespread adoption of completely prefabricated building methods might reduce the reliance on traditional on-site water management and roofing systems, areas where Alumasc has established offerings. This shift could mean fewer opportunities for Alumasc's bespoke installations.

- Shifting Construction Methodologies: The rise of modular and off-site construction, projected to grow substantially in the coming years, presents an indirect substitute by potentially reducing the need for traditional on-site Alumasc product applications.

- Regulatory and Sustainability Mandates: New building codes or a stronger emphasis on specific environmental certifications could favor alternative building materials or integrated systems that bypass Alumasc's current product lines.

- Technological Advancements in Building Envelope: Innovations in smart materials or self-healing surfaces could offer performance characteristics that make Alumasc's existing solutions less competitive.

Innovation and R&D by Alumasc

Alumasc's commitment to innovation and research and development (R&D) is a key strategy to counter the threat of substitutes. For instance, in 2024, the company continued to focus on developing advanced, sustainable building materials. This proactive approach ensures their product portfolio remains attractive and competitive against emerging alternative solutions.

The company's investment in R&D, particularly in areas like energy efficiency and recycled content, directly addresses market demand for environmentally friendly building products. This focus helps Alumasc differentiate its offerings, making them less susceptible to being replaced by lower-cost or functionally similar substitutes. Their pipeline of innovative products is designed to offer superior performance and environmental benefits.

- Alumasc's R&D expenditure in 2024 aimed to enhance product performance and sustainability.

- Focus on sustainable solutions like advanced insulation and rainwater harvesting systems.

- Innovation helps maintain Alumasc's competitive pricing and market share against substitutes.

- Continued investment in R&D is projected to yield new product launches in the coming years.

The threat of substitutes for Alumasc Group is significant, driven by advancements in material science and construction techniques. For example, the growing adoption of cross-laminated timber (CLT) in construction, valued at approximately USD 1.2 billion in 2023, offers a sustainable alternative to traditional facade systems. Modular construction, which saw substantial investment in 2024, also presents a challenge by potentially reducing the need for Alumasc's specialized on-site products.

Customer decisions are influenced by a balance of price, performance, and increasingly, sustainability. While Alumasc's premium, eco-friendly products offer long-term value, budget constraints can push customers towards cheaper, less sustainable substitutes like asphalt shingles. This highlights the importance of Alumasc's ongoing R&D, with a focus in 2024 on enhancing product performance and sustainability to maintain competitiveness.

Indirect substitutes, such as new building design philosophies or evolving regulations, can also impact Alumasc. A shift towards fully prefabricated building methods, for instance, could lessen reliance on traditional roofing and water management systems. Alumasc’s continued investment in innovation is crucial to counter these evolving threats and ensure its offerings remain attractive.

| Substitute Category | Example | 2023 Market Value (USD) | Key Driver | Alumasc's Counter-Strategy |

|---|---|---|---|---|

| Direct Material | Cross-Laminated Timber (CLT) | 1.2 Billion | Sustainability, Structural Properties | R&D in advanced sustainable materials |

| Construction Methodology | Modular Construction | N/A (Growth Sector) | Efficiency, Cost Savings | Focus on integrated systems, product innovation |

| Alternative Building Envelope | Smart Materials / Self-Healing Surfaces | N/A (Emerging) | Advanced Performance | Continuous product development and differentiation |

Entrants Threaten

Entering Alumasc's premium building products and precision engineering markets demands substantial capital. Newcomers must invest heavily in state-of-the-art manufacturing facilities, cutting-edge research and development, and robust distribution channels to compete effectively.

For instance, the precision engineering sector, where Alumasc operates, requires advanced machinery that can represent millions in upfront costs. Similarly, establishing large-scale production for building materials necessitates significant investment in plant and equipment, creating a formidable financial hurdle for potential new entrants aiming to challenge Alumasc's established position.

Established players in the aluminum facade sector, including Alumasc Group, benefit significantly from economies of scale. This allows them to achieve lower per-unit costs in production, raw material procurement, and marketing efforts, translating into more competitive pricing and healthier profit margins. For instance, in 2024, Alumasc's operational efficiency, driven by its scale, likely provided a distinct cost advantage.

New entrants face a considerable hurdle in matching these cost efficiencies. Without the substantial volume that generates these economies of scale, newcomers would find it challenging to compete on price, especially in a market that may already experience overstock situations, as observed in some segments of the construction supply chain during 2024.

Alumasc benefits from strong brand loyalty, cultivated through years of consistent quality and service across commercial, industrial, and residential construction markets. This established reputation makes it difficult for newcomers to gain traction.

Securing reliable distribution channels in the UK construction sector is a significant hurdle for new entrants. Alumasc's existing network and relationships, built over time, represent a substantial barrier to entry, requiring considerable investment and effort to replicate.

Regulatory and Environmental Barriers

The UK building and construction sector faces increasingly demanding regulations, especially regarding sustainability and energy efficiency. New companies entering the market must navigate these complex and expensive compliance requirements. For instance, the UK government's commitment to net-zero emissions by 2050 drives stricter building codes, making it harder for less established firms to compete.

Alumasc, with its established expertise in sustainable building solutions, is well-positioned to meet these evolving standards. Their existing product lines, such as high-performance insulation and water management systems, align with current and future regulatory demands. This pre-existing alignment reduces the burden of adaptation for Alumasc compared to potential new entrants who would need significant investment to achieve compliance.

- Regulatory Complexity: New entrants must invest heavily in understanding and implementing evolving UK building regulations.

- Sustainability Focus: Alumasc's existing commitment to sustainable solutions provides a competitive advantage against newcomers.

- Cost of Compliance: Meeting stringent environmental and safety standards represents a significant financial barrier for potential new competitors.

Access to Raw Materials and Specialized Labour

New entrants to the Alumasc Group's markets might find it difficult to secure a steady supply of high-quality raw materials, particularly for their premium and eco-friendly product lines. This scarcity can significantly increase initial operating costs.

The UK's construction and engineering industries are experiencing a notable shortage of skilled labor. For instance, a 2023 report indicated a significant deficit in qualified tradespeople across various construction roles. This scarcity presents a substantial hurdle for new companies aiming to build capacity and manufacture specialized components, potentially delaying market entry and growth.

- Raw Material Sourcing Challenges: New competitors may struggle to establish reliable supply chains for key materials like aluminum and specialized polymers, impacting production consistency and cost.

- Skilled Labor Deficit: The UK construction sector's ongoing need for experienced engineers, fabricators, and installers means new entrants will face intense competition for talent.

- Impact on Specialization: The lack of readily available specialized labor directly impedes a new company's ability to develop and manufacture high-performance, niche products that Alumasc offers.

The threat of new entrants for Alumasc Group is generally moderate, primarily due to high capital requirements and established brand loyalty. However, specific niche markets within building products or precision engineering could attract new players if significant technological advancements or shifts in demand occur.

New companies face substantial upfront investment for advanced manufacturing and R&D, with precision engineering machinery alone costing millions. For example, the UK construction sector's skilled labor shortage, noted in 2023 reports, further complicates capacity building for new entrants, potentially delaying their market entry and growth.

Navigating stringent UK regulations, particularly those concerning sustainability and energy efficiency, presents a significant financial barrier. Alumasc's existing alignment with these standards, driven by net-zero targets, offers a distinct advantage over newcomers needing considerable investment to achieve compliance.

| Factor | Alumasc Advantage | New Entrant Challenge |

|---|---|---|

| Capital Investment | Leverages existing infrastructure | High upfront costs for facilities, machinery, R&D |

| Economies of Scale | Lower per-unit costs, competitive pricing (e.g., 2024 operational efficiency) | Difficulty matching cost efficiencies without significant volume |

| Brand Loyalty & Distribution | Established reputation and strong UK network | Requires time and investment to build trust and secure channels |

| Regulatory Compliance | Pre-existing alignment with sustainability standards | Significant investment needed for compliance with evolving codes |

| Skilled Labor & Materials | Established supply chains and talent pool | Competition for scarce skilled labor (noted 2023 deficit) and raw materials |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alumasc Group is built upon a foundation of comprehensive data, including Alumasc's annual reports and investor presentations, alongside industry-specific market research from IBISWorld and Statista.

We supplement this with insights from financial databases like S&P Capital IQ and regulatory filings to provide a robust assessment of competitive pressures within the building products sector.