Alumasc Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumasc Group Bundle

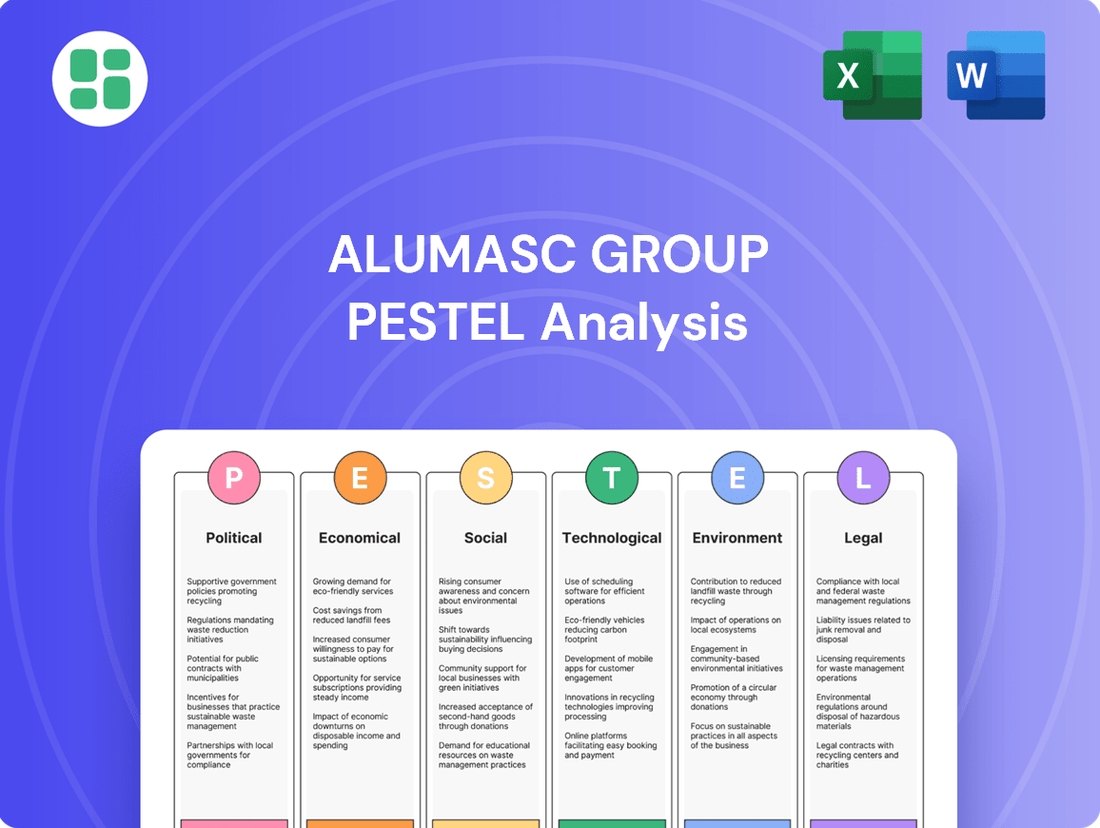

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Alumasc Group's trajectory. From evolving building regulations to the drive for sustainable construction, these external forces present both challenges and opportunities. Equip yourself with this essential intelligence.

Gain a strategic advantage by understanding the nuanced PESTLE landscape impacting Alumasc Group. Our comprehensive analysis delves into how shifting consumer preferences and economic volatility can influence market demand. Make informed decisions with expert insights.

Navigate the complexities of the modern market with our detailed PESTLE analysis of Alumasc Group. Discover how technological advancements in manufacturing and changing legal frameworks are redefining the industry. Download the full report for actionable intelligence.

Political factors

The UK government's commitment to substantial infrastructure spending, with a pledge of at least £725 billion over a decade, offers a robust and predictable market for construction materials. This significant investment, covering areas like housing, transport, and public services, directly translates into a sustained demand for Alumasc's building products and solutions.

Specifically, the emphasis on urban regeneration and the upgrade of essential public facilities, such as schools and hospitals, are key drivers for Alumasc. These projects require high-quality, durable building materials, aligning perfectly with Alumasc's product portfolio and creating a strong demand pipeline.

The UK's Building Safety Act 2022, alongside ongoing reforms, is reshaping the construction sector with more stringent rules, particularly for high-risk buildings. This means companies like Alumasc, which supply building products, must ensure their materials meet these updated safety standards, covering areas like fire resistance and cladding.

The heightened focus on building safety, including potential legal challenges, demands that Alumasc maintains rigorous product compliance and quality control. For instance, the government's commitment to addressing legacy issues means ongoing scrutiny of materials used in existing structures, impacting the entire supply chain.

The UK's ambitious target of reaching net zero emissions by 2050 is significantly reshaping the construction sector, pushing for sustainable materials and methods. This governmental push directly benefits companies like Alumasc, which specialize in environmentally conscious building solutions.

Mandates such as the Future Homes Standard, effective from 2025, will require new homes to incorporate energy-efficient designs and low-carbon heating, aligning perfectly with Alumasc's product offerings.

Furthermore, the ongoing development of a unified UK Net Zero Carbon Buildings Standard is expected to accelerate the decarbonisation of buildings, creating a stronger market for Alumasc's sustainable product portfolio.

Planning and Infrastructure Bill

The introduction of the Planning and Infrastructure Bill aims to simplify planning procedures and speed up approvals for significant construction projects, thereby reducing red tape. This reform could translate into quicker project starts for Alumasc and a more reliable stream of development work, opening up new business avenues.

The bill's emphasis on meeting housing targets directly benefits Alumasc by creating a robust market for its housebuilding components. For instance, the UK government has set ambitious housing delivery goals, with plans to build 300,000 new homes annually, a target that directly influences demand for Alumasc's product range.

- Streamlined Approvals: The bill's provisions are expected to cut down the time taken for planning permissions, potentially accelerating Alumasc's project timelines.

- Increased Housing Demand: Government housing targets, such as the 300,000 homes per year goal, directly boost the market for Alumasc's building materials.

- Predictable Development Pipeline: Reduced bureaucratic delays can lead to a more consistent and predictable flow of construction opportunities for Alumasc.

Trade Policies and Export Focus

Alumasc, though headquartered in the UK, is significantly affected by international trade policies due to its export activities, including sales to markets like Hong Kong. Changes in trade agreements or the imposition of tariffs can directly impact the cost and competitiveness of its products abroad, influencing profitability. For instance, if the UK were to implement new trade barriers with key export destinations, Alumasc's overseas revenue streams could face pressure.

The company's strategic emphasis on expanding its export markets serves as a crucial buffer against over-reliance on the UK's domestic economic conditions. This focus on international growth, a stated objective by Alumasc, is vital for diversifying revenue and mitigating risks associated with regional economic downturns or policy shifts. In 2023, Alumasc reported that its international sales contributed to its overall performance, underscoring the importance of these global trade relationships.

Specifically, Alumasc's exposure to markets such as Hong Kong means that trade policies enacted by both the UK and Hong Kong governments, or even broader geopolitical trade tensions, can have a tangible effect on its financial results. The company's ability to navigate these evolving trade landscapes will be key to sustaining and growing its international business operations.

Key considerations for Alumasc regarding trade policies include:

- Impact of tariffs and trade agreements on export pricing and market access.

- Diversification of export markets to reduce vulnerability to single-country trade disputes.

- Monitoring of global supply chain disruptions influenced by trade policy shifts.

- Adaptability of Alumasc's product offerings to meet varying international regulatory and trade requirements.

The UK government's substantial infrastructure spending, aiming for at least £725 billion over a decade, creates a strong, consistent demand for Alumasc's construction materials. This commitment supports projects in housing, transport, and public services, directly benefiting Alumasc's product lines.

The Building Safety Act 2022 and ongoing reforms impose stricter regulations, particularly for high-risk buildings, necessitating Alumasc's adherence to enhanced safety standards for fire resistance and cladding. This regulatory environment demands rigorous compliance and quality control from suppliers like Alumasc.

The UK's net-zero emissions target by 2050 is driving demand for sustainable building solutions, aligning with Alumasc's focus on environmentally conscious products. Initiatives like the Future Homes Standard, effective from 2025, mandate energy efficiency and low-carbon heating in new homes, further benefiting Alumasc's portfolio.

The Planning and Infrastructure Bill aims to streamline planning procedures, potentially accelerating project timelines and creating a more predictable development pipeline for Alumasc, especially with housing targets of 300,000 new homes annually.

What is included in the product

This PESTLE analysis of Alumasc Group examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides actionable insights into external macro-environmental forces, highlighting potential threats and opportunities for Alumasc Group's growth and competitive positioning.

A clear, actionable PESTLE analysis for Alumasc Group, designed to pinpoint external threats and opportunities, thereby alleviating the pain of strategic uncertainty.

This PESTLE analysis offers a concise overview of external factors impacting Alumasc Group, simplifying complex market dynamics to relieve the burden of detailed research for strategic planning.

Economic factors

The UK construction sector is navigating a period of anticipated subdued growth for 2025, with overall activity projected to increase by approximately 2%. This modest expansion rate suggests a cautious market environment.

Despite the broader market's tepid outlook, Alumasc has demonstrated impressive resilience, achieving organic revenue growth that substantially outpaces the general industry trend. This performance highlights the company's ability to capture market share and maintain momentum even in challenging economic conditions.

However, Alumasc's performance is inherently linked to wider macroeconomic factors. Fluctuations in business and consumer confidence directly impact demand across its key sectors, including commercial, industrial, and residential construction, posing a persistent risk to future growth.

High inflation and rising interest rates have significantly dampened customer demand and increased borrowing costs, directly impacting the UK's commercial real estate sector and new housing development. This economic climate makes it more expensive for both developers and consumers to finance new construction and renovation projects, a key market for Alumasc Group.

For Alumasc, these conditions translate to a tougher sales environment, as the affordability of their building products and systems is reduced. For instance, the Bank of England's base rate stood at 5.25% as of early 2024, a level that increases the cost of capital for construction firms and dampens consumer spending on home improvements.

However, there's a potential upside. Projections suggest a moderation in inflation and the possibility of interest rate reductions by 2025. Should these trends materialize, it would likely improve investment conditions, making borrowing cheaper and stimulating activity in the construction and renovation markets, which could benefit Alumasc's performance.

The UK housing market has seen a downturn, with private housing starts declining. This is largely due to persistent high mortgage costs, which are dampening consumer confidence despite underlying demand for homes. For Alumasc, this directly impacts its housebuilding products division.

However, the government's stated commitment to building new homes and improving existing ones presents a potential upside. For instance, in the first quarter of 2024, there were approximately 36,000 new build starts in Great Britain, a figure that, while potentially lower than previous periods, highlights ongoing activity and future potential for Alumasc's offerings.

Supply Chain Costs and Efficiency

The cost of raw materials and the overall efficiency of Alumasc's supply chain are critical drivers of its profitability. For instance, in the fiscal year ending June 30, 2023, Alumasc reported that its cost of sales was £170.2 million, highlighting the significant impact of material expenses.

The company's strategy to navigate these challenges involves disciplined capital allocation and a continuous focus on enhancing operational efficiencies. This approach aims to buffer against potential margin pressures arising from volatile input costs or global supply chain disruptions.

Global events can significantly impact Alumasc's performance. For example, the ongoing geopolitical tensions and their impact on shipping and logistics, coupled with fluctuating commodity prices, could lead to increased operational costs and potentially squeeze profit margins if not effectively managed.

- Material Costs: Alumasc's cost of sales was £170.2 million for FY23.

- Efficiency Focus: The company prioritizes capital allocation and operational improvements.

- Risk Mitigation: Strategies are in place to counter pressures from supply chain disruptions and rising material costs.

Investment in Sustainable Solutions

The UK's green building market is experiencing robust growth, with revenues in the billions, fueled by a rising consumer appetite for sustainable living. This trend is directly linked to increased household expenditure on eco-friendly homes and renovations.

Alumasc Group is strategically positioned to capitalize on this expanding market. Their focus on environmentally sustainable building products aligns perfectly with consumer demand, creating a more stable revenue source that can withstand wider economic downturns.

- Market Growth: The UK green building market is projected to see significant revenue increases, driven by consumer spending on sustainable housing.

- Consumer Demand: Households are increasingly prioritizing sustainable living spaces, boosting demand for eco-friendly building solutions.

- Alumasc's Position: The company's specialization in sustainable building products offers a competitive advantage in this growing sector.

- Resilience: This focus provides Alumasc with a more resilient demand stream, less susceptible to general market volatility.

The UK construction sector is expected to see modest growth of around 2% in 2025, a figure that reflects a generally cautious economic environment. Despite this, Alumasc has shown strong performance, outperforming the industry average through organic revenue growth.

Economic factors like inflation and interest rates significantly influence Alumasc's market. High borrowing costs, exemplified by the Bank of England's 5.25% base rate in early 2024, dampen demand for new builds and renovations, directly impacting Alumasc's product affordability and sales. However, anticipated inflation moderation and potential interest rate cuts by 2025 could stimulate market activity and benefit the company.

The UK housing market's downturn, marked by declining private housing starts due to high mortgage costs, affects Alumasc's housebuilding division. Nevertheless, government initiatives to boost housing supply, with approximately 36,000 new build starts in Great Britain in Q1 2024, offer a baseline for future demand.

Alumasc's profitability is heavily tied to material costs, as seen in its £170.2 million cost of sales in FY23. The company employs strategies like disciplined capital allocation and operational efficiency improvements to mitigate risks from volatile input costs and supply chain disruptions, including geopolitical impacts on logistics and commodity prices.

| Economic Factor | Impact on Alumasc | Data Point/Projection |

|---|---|---|

| UK Construction Growth | Subdued overall market | Projected 2% growth for 2025 |

| Interest Rates | Increased borrowing costs, reduced demand | Bank of England base rate at 5.25% (early 2024) |

| Inflation | Dampened consumer spending, higher input costs | Anticipated moderation by 2025 |

| Housing Market | Reduced private housing starts | 36,000 new build starts in Great Britain (Q1 2024) |

| Material Costs | Significant impact on profitability | £170.2 million cost of sales (FY23) |

What You See Is What You Get

Alumasc Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Alumasc Group PESTLE analysis offers a comprehensive examination of the political, economic, social, technological, legal, and environmental factors impacting the business. It provides valuable insights for strategic planning and risk assessment.

Sociological factors

Societal awareness regarding environmental concerns is notably escalating, fueling a greater demand for homes that are energy-efficient and building materials that are eco-friendly. This growing preference for sustainable living directly aligns with Alumasc's core business model.

A substantial portion of Alumasc's operations is dedicated to producing sustainable building products designed to optimize both energy and water consumption. For instance, the company's water management systems and energy-saving insulation products are key offerings in this expanding market.

Consumers and businesses alike are increasingly factoring in long-term financial benefits and environmental responsibility when making purchasing decisions. In 2024, reports indicated that over 60% of new home buyers considered energy efficiency a critical factor, a trend expected to continue growing through 2025.

The UK's urban population is expanding, with projections indicating continued growth. This trend is driving significant investment in urban regeneration and infrastructure improvements. For instance, the UK government's levelling-up agenda prioritizes urban development, aiming to revitalize towns and cities across the country. This creates a robust market for construction materials and solutions.

Retrofitting existing buildings to meet contemporary energy efficiency and safety standards is a major component of this urban renewal. Alumasc's expertise in high-performance building envelope solutions, including advanced roofing and walling systems, directly addresses this need. The demand for sustainable and durable building materials is increasing as older structures are upgraded.

The development of mixed-use spaces, combining residential, commercial, and leisure facilities, is also a key feature of modern urban planning. These projects often require integrated water management and building envelope systems. Alumasc's comprehensive product range positions it to benefit from the sustained demand generated by these multifaceted urban development initiatives.

Public concern over water quality and the increasing threat of flooding due to climate change are pushing for significant upgrades to old drainage systems. This heightened awareness directly fuels demand for advanced water management solutions.

Alumasc's water management division is strategically positioned to capitalize on this trend, offering specialized products for surface water management and the implementation of sustainable urban drainage systems (SUDS). For instance, the UK government's commitment to net-zero emissions by 2050, coupled with increasing investment in green infrastructure, underscores the market opportunity for companies like Alumasc.

Health and Safety Priorities in Construction

The construction sector is experiencing a heightened emphasis on health and safety, significantly influenced by evolving regulations and the aftermath of events like the Grenfell Tower fire. This heightened awareness directly impacts the selection of building materials and the methods employed on construction sites. For Alumasc Group, this translates into a demand for products that adhere to stringent safety benchmarks, positioning the company to capitalize on a market increasingly valuing dependable and compliant building solutions.

This societal shift also encompasses a greater concern for the well-being of construction workers and overall site safety. For instance, the UK's Health and Safety Executive (HSE) reported 73 fatalities in the construction industry in the year ending March 2024, a slight increase from 68 the previous year, underscoring the ongoing need for robust safety measures and products designed with worker protection in mind.

- Regulatory Scrutiny: Post-Grenfell, building regulations in the UK have been tightened, particularly concerning fire safety and materials used in high-rise buildings.

- Product Compliance: Alumasc's commitment to developing products that meet or exceed these rigorous safety standards, including fire performance ratings, is a key differentiator.

- Worker Safety: The industry-wide focus on reducing accidents and improving working conditions creates opportunities for Alumasc to supply materials that enhance site safety.

- Market Demand: A growing preference among developers and specifiers for suppliers with a proven track record in safety and compliance benefits Alumasc's market position.

Changing Workforce Demographics and Skills Shortages

The UK construction industry is grappling with persistent skilled labour shortages, notably impacting specialist trades and the growing demand for retrofit expertise. This societal challenge directly affects project timelines and escalates costs for companies like Alumasc Group.

The influx of Generation Z into the workforce is also a significant factor. This demographic prioritizes technology integration and robust safety measures, which could accelerate the adoption of innovative building techniques and materials within the sector.

- Skilled Labour Gap: Reports from the Office for National Statistics (ONS) indicated a significant shortage of skilled tradespeople in the UK construction sector throughout 2023 and into early 2024.

- Retrofit Demand: The government's net-zero targets are driving increased demand for retrofit specialists, a niche where shortages are particularly acute.

- Gen Z Influence: Surveys suggest that over 70% of Gen Z workers expect employers to offer advanced technology in their roles, influencing investment in digital construction tools.

Societal shifts towards sustainability and energy efficiency are a significant driver for Alumasc. Consumers and businesses are increasingly prioritizing eco-friendly building materials and homes that minimize energy and water consumption, aligning perfectly with Alumasc's product offerings. This trend is further amplified by urban regeneration initiatives and a growing need to retrofit older buildings, creating a robust market for Alumasc's specialized solutions.

Public concern over water quality and flood risks, exacerbated by climate change, is also fueling demand for advanced water management systems. Alumasc's expertise in SUDS and drainage solutions positions it to benefit from these environmental pressures and government commitments to green infrastructure. Furthermore, heightened awareness of health and safety in construction, especially post-Grenfell, necessitates materials with stringent safety and fire performance ratings, areas where Alumasc excels.

The construction sector faces challenges with skilled labour shortages, particularly in specialized retrofit work, while the influx of Gen Z workers emphasizes technology and safety. These factors present both challenges and opportunities for Alumasc, driving the need for innovative, safe, and efficient building solutions.

| Sociological Factor | Impact on Alumasc | Supporting Data (2024/2025 Trends) |

|---|---|---|

| Environmental Awareness & Sustainability | Increased demand for Alumasc's eco-friendly and energy-efficient products. | Over 60% of new home buyers in the UK considered energy efficiency critical in 2024. |

| Urbanization & Regeneration | Growth in demand for building materials for urban development and retrofitting. | UK government's levelling-up agenda prioritizes urban infrastructure improvements. |

| Water Management Concerns | Higher demand for Alumasc's advanced drainage and SUDS solutions. | Commitment to net-zero by 2050 drives investment in green infrastructure. |

| Health & Safety Focus | Preference for Alumasc's compliant and safe building materials. | UK HSE reported 73 construction fatalities in the year ending March 2024, highlighting safety importance. |

| Skilled Labour Shortage | Potential project delays and cost increases, but also opportunity for tech-driven solutions. | ONS data indicates significant skilled trades shortages in UK construction throughout 2023-2024. |

| Gen Z Workforce Influence | Accelerated adoption of technology and safety-focused building methods. | Over 70% of Gen Z workers expect employers to offer advanced technology. |

Technological factors

The construction sector is increasingly embracing low-carbon materials like recycled steel, cross-laminated timber (CLT), and advanced sustainable composites. This shift is driven by regulatory pressures and growing consumer demand for environmentally responsible building practices.

Alumasc's strategic emphasis on sustainable building products positions it favorably within this evolving landscape. The company's commitment to material science innovation is crucial for developing eco-friendly solutions that meet market expectations. For instance, by 2024, the global green building materials market was projected to reach over $400 billion, highlighting significant growth opportunities.

Digital innovation, including the widespread adoption of Building Information Modelling (BIM) software, 3D printing, and AI, is fundamentally reshaping project design, management, and construction processes. While the UK construction sector has historically seen some hurdles in adopting new technologies, there's a notable and growing investment in construction management software and digital tools aimed at boosting efficiency, enhancing safety, and cutting costs. For Alumasc, these advancements offer significant opportunities to refine product design, streamline supply chain operations, and improve client interaction.

The UK government's mandate for BIM Level 2 on all public projects by 2016 has accelerated its integration, with an estimated 70% of UK construction firms using BIM in some capacity by 2022, according to industry reports. This digital shift directly impacts material suppliers like Alumasc, as BIM facilitates more precise material specification and integration into digital project models, potentially leading to reduced waste and improved accuracy in project delivery.

The construction industry is seeing a significant shift towards off-site and modular construction, a trend that directly impacts Alumasc. This method, which involves pre-fabricating building components in a factory setting, is projected to capture a larger share of the global construction market. For instance, the modular construction market was valued at approximately $174.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching an estimated $285.5 billion.

This evolution offers Alumasc an opportunity to innovate its product lines, ensuring compatibility with modular systems. By adapting its building envelope solutions, such as roofing and cladding, for easier integration into pre-fabricated units, Alumasc can enhance its value proposition. This not only streamlines the installation process for builders but also potentially opens up new market segments and strengthens Alumasc's competitive position in a rapidly modernizing sector.

Smart Water Management Technologies

The global smart water management market is experiencing robust expansion, projected to reach approximately $36.5 billion by 2027, a significant increase from its 2022 valuation of around $19.8 billion, demonstrating a compound annual growth rate (CAGR) of about 12.8%. This growth is largely fueled by the increasing adoption of Internet of Things (IoT) solutions and advanced sensor technologies aimed at enhancing water efficiency and reducing waste.

Alumasc's water management division is well-positioned to capitalize on this technological shift. By integrating smart features, such as real-time monitoring and predictive analytics, into their existing product lines, Alumasc can offer clients more sophisticated solutions for managing water resources within buildings and infrastructure. This includes advanced leak detection capabilities and optimized water usage controls, aligning with growing environmental and cost-saving imperatives.

- Market Growth: The smart water management sector is anticipated to grow substantially, reflecting increased investment in water infrastructure modernization and efficiency.

- IoT Integration: The pervasive use of IoT devices allows for granular data collection, enabling better decision-making in water distribution and consumption.

- Efficiency Gains: Smart technologies offer substantial operational benefits, including reduced water loss, lower energy consumption for pumping, and improved system reliability.

- Alumasc Opportunity: Alumasc can leverage these trends by embedding smart capabilities, enhancing product value and market competitiveness.

Energy-Efficient Design and Renewable Energy Integration

Technological advancements are heavily influencing the construction sector, with a growing emphasis on energy-efficient design and renewable energy integration. Regulations such as the UK's Future Homes Standard, set to be implemented in 2025, mandate significantly lower carbon emissions for new homes, pushing developers towards passive design principles and the incorporation of renewable energy systems like solar panels and heat pumps. This shift presents a clear opportunity for companies like Alumasc, whose product portfolio, particularly in building envelopes and water management, directly supports enhanced building energy performance and the transition to low-carbon construction solutions.

Alumasc's strategic alignment with these technological trends is evident in its product development and market positioning. For instance, their Derbigum range of waterproofing membranes offers enhanced thermal performance, contributing to a building's overall energy efficiency. Furthermore, the increasing adoption of Building Integrated Photovoltaics (BIPV) systems, which seamlessly integrate solar energy generation into the building fabric, aligns with Alumasc's expertise in roofing and cladding solutions. In 2023, the UK government continued to support renewable energy adoption through schemes like the Boiler Upgrade Scheme, which incentivizes the installation of heat pumps, further bolstering the market for energy-efficient building technologies.

- Future Homes Standard (UK): Mandates a reduction in carbon emissions for new homes, driving demand for energy-efficient building materials and systems.

- Renewable Energy Integration: Increasing adoption of solar panels and heat pumps in new builds, supported by government incentives.

- Alumasc's Role: Products like high-performance waterproofing membranes and cladding systems contribute to improved building energy performance.

- Market Trend: The construction industry is increasingly prioritizing sustainability and low-carbon solutions in response to regulatory pressure and market demand.

Technological advancements are reshaping the construction sector, with a significant push towards digitalization and automation. Building Information Modelling (BIM) adoption is on the rise, with an estimated 70% of UK construction firms using it in some capacity by 2022, improving design precision and reducing waste. This digital integration directly benefits Alumasc by enabling more accurate product specification and streamlining supply chain operations.

The construction industry is also embracing off-site and modular construction methods, a trend expected to see the modular market grow from approximately $174.5 billion in 2023 to an estimated $285.5 billion by 2030. Alumasc can leverage this by adapting its building envelope solutions for easier integration into pre-fabricated units, thereby enhancing its value proposition and market reach.

Smart building technologies, particularly in water management, are also gaining traction, with the global market projected to reach $36.5 billion by 2027. Alumasc's water management division can capitalize on this by integrating IoT solutions for real-time monitoring and predictive analytics, offering clients more sophisticated water efficiency controls.

The drive for energy efficiency, spurred by regulations like the UK's Future Homes Standard (2025), is increasing demand for materials that enhance building performance. Alumasc's products, such as high-performance waterproofing membranes and cladding systems, directly contribute to improved energy efficiency, aligning with the market's focus on low-carbon solutions and renewable energy integration.

Legal factors

The Building Safety Act 2022, with key provisions effective from October 2023, imposes a more rigorous regulatory environment for designing and constructing higher-risk buildings in England and Wales. This legislation mandates new building control approval stages, including Gateway 2, and introduces continuous oversight for cladding remediation efforts. Alumasc Group must therefore guarantee its product offerings and integrated systems adhere to these elevated safety and compliance benchmarks, and remain vigilant against potential legal ramifications concerning building safety.

The Future Homes Standard, set to be fully implemented in 2025, will require new homes to produce 75-80% lower carbon emissions than current standards. This means a significant shift towards energy-efficient designs and the adoption of low-carbon heating solutions, impacting everything from insulation to ventilation systems.

As a key player in the premium building products sector, Alumasc Group must ensure its product portfolio aligns with these stringent new regulations. Failure to adapt could see its offerings overlooked in new build specifications, directly affecting market share and revenue streams within the UK construction market.

Regional variations in building regulations across the UK, such as differing energy efficiency targets or specific material requirements in Scotland versus England, add another layer of complexity. Alumasc needs to navigate these localized mandates to maintain consistent product relevance and compliance across all its target markets.

The UK's commitment to achieving net zero emissions by 2050, enshrined in law, significantly influences the construction sector. This overarching goal translates into increasingly stringent environmental regulations, particularly concerning embodied carbon within building materials and the energy efficiency of completed structures.

Alumasc's operations and product innovation are directly impacted by these evolving legal frameworks. The company must ensure its manufacturing processes and material offerings comply with these environmental laws, such as those related to waste reduction and emissions. For instance, the UK government's Construction Playbook, updated in 2023, emphasizes the importance of sustainable procurement and reducing whole-life carbon emissions for public projects.

Furthermore, Alumasc's products are designed to help its customers meet their own decarbonisation targets. This means Alumasc must provide solutions that enhance building performance, reduce energy consumption, and utilize materials with lower environmental impact. The increasing focus on Environmental, Social, and Governance (ESG) reporting by businesses, including those in the construction supply chain, further underscores the necessity of aligning with these environmental mandates.

Water Management Legislation (e.g., SUDS)

Alumasc's water management division is significantly influenced by evolving water management legislation, particularly concerning Sustainable Urban Drainage Systems (SUDS). These regulations, often driven by climate change adaptation goals and the need to manage increased rainfall intensity, mandate specific approaches to surface water management. For instance, in the UK, planning policies increasingly require SUDS to be incorporated into new developments, impacting the demand for Alumasc's drainage and water management solutions.

Ongoing changes in water quality standards and wastewater management directives also play a critical role. Alumasc’s product portfolio, designed to mitigate flooding risks and enhance the performance of aging drainage infrastructure, must align with these increasingly stringent environmental requirements. Compliance is not just a legal necessity but a key selling proposition for solutions addressing climate change impacts.

- Mandatory SUDS adoption: Planning policies in many regions, including the UK's National Planning Policy Framework, now strongly encourage or mandate SUDS for new developments, boosting demand for compliant products.

- Water quality regulations: Stricter discharge consents for surface water runoff necessitate advanced filtration and treatment solutions, areas where Alumasc offers products.

- Infrastructure upgrades: Government initiatives and funding aimed at improving and upgrading aging drainage infrastructure, often linked to flood resilience, create market opportunities for Alumasc.

- Climate change adaptation: Legislation and policy frameworks increasingly focus on climate resilience, directly supporting the market for Alumasc's water management systems designed to handle extreme weather events.

Product Standards and Certifications

The UK government is set to implement a new, risk-based safety requirement for all construction products, compelling manufacturers to evaluate safety risks before market entry. This initiative, expected to be phased in through 2024 and 2025, may include a digital product passport for enhanced traceability. Alumasc must adapt to these evolving standards to guarantee continued market access and uphold its commitment to product quality and safety.

Adherence to these new regulations is crucial for Alumasc. For instance, the proposed digital product passport could require detailed lifecycle information for products like Alumasc's building envelope systems, impacting supply chain management and data reporting. Failure to comply could result in penalties and damage to brand reputation, particularly in a sector where safety and reliability are paramount.

- New UK Construction Product Safety Regulations: Risk-based general safety requirement for all construction products.

- Manufacturer Responsibility: Mandate for manufacturers to assess safety risks prior to marketing.

- Digital Traceability: Potential introduction of a digital product passport system.

- Alumasc's Compliance Imperative: Need to adapt to evolving standards for market access and reputation.

The Building Safety Act 2022 and the upcoming Future Homes Standard (2025) significantly raise the bar for construction product safety and energy efficiency in the UK. Alumasc must ensure its offerings meet these stringent requirements, including potential digital product passports for enhanced traceability, to maintain market access and avoid penalties. Regional variations in regulations across the UK also necessitate careful navigation to ensure consistent compliance and product relevance.

Environmental factors

The UK's legally binding target to reach net zero carbon emissions by 2050 is a significant environmental factor impacting the construction sector. This goal requires substantial emission cuts from buildings, both new and existing, thereby boosting demand for Alumasc's sustainable products designed to lower energy and water usage.

The construction industry faces the critical challenge of halving its emissions by 2030 and achieving full decarbonization by 2050. This regulatory push directly supports Alumasc's strategic focus on providing environmentally conscious building solutions that align with these ambitious carbon reduction objectives.

The construction sector is increasingly focused on minimizing waste and maximizing the reuse and recycling of materials, a direct result of growing adoption of circular economy principles. This shift means companies like Alumasc, a key supplier, are expected to design products for longevity, integrate recycled content, and support the disassembly and repurposing of building components at the end of their life. For instance, the UK government's Construction Playbook, updated in 2023, emphasizes whole-life carbon assessments and the use of recycled materials, with targets for reducing construction waste by 50% by 2030.

Climate change is intensifying both water scarcity and flooding events, making robust water management crucial. Alumasc's expertise in surface water and drainage solutions positions them to capitalize on growing investments in resilient infrastructure.

For instance, the UK government's commitment to flood defense spending, projected to reach £5.2 billion by 2027, underscores the market opportunity for companies like Alumasc. Their products directly address the need for sustainable urban drainage systems, a sector expected to see significant growth as cities adapt to changing weather patterns.

Biodiversity and Green Infrastructure

Growing global awareness of biodiversity loss is increasingly shaping construction trends, with a notable emphasis on green infrastructure. This shift directly impacts building design and material selection, favoring solutions that support ecological well-being. For instance, the adoption of green roofs and walls is on the rise as a means to integrate nature into urban environments.

Alumasc Group's product range, particularly its expertise in roofing and water management systems, is well-positioned to capitalize on this trend. The company offers solutions designed to facilitate the creation of more sustainable buildings. These include advanced systems for rainwater harvesting and management, which are crucial for supporting the vegetation found in green infrastructure projects, thereby enhancing urban biodiversity and ecological resilience.

The market for green building materials is expanding. For example, the global green roof market was valued at approximately $16.5 billion in 2023 and is projected to grow significantly in the coming years, driven by environmental regulations and consumer demand for sustainable living spaces. Alumasc's offerings align with this growth trajectory.

- Growing Demand for Sustainable Building Materials: The increasing focus on biodiversity and green infrastructure is driving demand for innovative construction materials that support ecological functions.

- Alumasc's Product Alignment: Alumasc's roofing and water management solutions are directly relevant to the development of green buildings, offering rainwater management and substrate support for vegetation.

- Market Growth Potential: The global green building market, a key driver for biodiversity-focused infrastructure, is experiencing robust growth, indicating significant opportunities for companies like Alumasc.

- Contribution to Urban Resilience: By providing solutions for green roofs and water management, Alumasc contributes to enhancing urban ecological resilience and mitigating the impacts of climate change.

Embodied Carbon in Construction Materials

The construction industry is increasingly scrutinizing embodied carbon, the emissions generated from material production, transport, and construction. This growing awareness directly impacts companies like Alumasc Group. For instance, the UK's commitment to Net Zero is driving stricter regulations, with the upcoming UK Net Zero Carbon Buildings Standard set to impose tighter upfront carbon limits on new builds.

Alumasc's strategic focus on developing and supplying low-carbon building materials and enhancing supply chain sustainability positions it favorably. This proactive approach addresses the environmental imperative and offers a distinct competitive edge. As the market becomes more attuned to the total carbon footprint of buildings over their entire lifecycle, Alumasc's commitment to sustainability becomes a significant differentiator.

- Growing Pressure: The global construction sector faces escalating pressure to reduce embodied carbon emissions.

- Regulatory Shifts: The UK Net Zero Carbon Buildings Standard signifies a move towards more stringent upfront carbon limitations in construction projects.

- Alumasc's Advantage: Alumasc's investment in low-carbon product development and supply chain sustainability directly tackles this environmental challenge.

- Market Sensitivity: A heightened market sensitivity to whole-life carbon impacts creates a competitive advantage for companies offering sustainable solutions.

The UK's push for Net Zero by 2050, requiring significant building emission cuts, directly benefits Alumasc's sustainable products. The industry's drive to halve emissions by 2030 and achieve full decarbonization by 2050 aligns perfectly with Alumasc's focus on energy and water-efficient solutions.

Circular economy principles are reshaping construction, demanding products designed for longevity and recyclability, a trend Alumasc is addressing. The UK government's Construction Playbook, updated in 2023, mandates whole-life carbon assessments and waste reduction targets, reinforcing the need for Alumasc's sustainable material strategies.

Climate change impacts like water scarcity and flooding are increasing demand for resilient infrastructure, a key area for Alumasc's water management systems. The UK's commitment to flood defense spending, reaching £5.2 billion by 2027, highlights the market opportunity for Alumasc's sustainable urban drainage solutions.

Growing biodiversity concerns are driving the adoption of green infrastructure, such as green roofs and walls, creating a market for Alumasc's supporting technologies. The global green roof market, valued at approximately $16.5 billion in 2023, demonstrates the substantial growth potential for companies offering integrated ecological solutions.

| Environmental Factor | Impact on Construction | Alumasc's Relevance | Market Data/Targets |

| Net Zero Targets | Reduced building emissions required | Demand for energy/water-efficient products | UK Net Zero by 2050; 50% emission cut by 2030 |

| Circular Economy | Focus on waste reduction, reuse, recycling | Products designed for longevity and repurposing | UK Construction waste reduction target: 50% by 2030 |

| Climate Change Adaptation | Need for water management and flood resilience | Growth in surface water and drainage solutions | UK flood defense spending: £5.2 billion by 2027 |

| Biodiversity & Green Infrastructure | Increased use of green roofs/walls | Support for vegetation through water management | Global green roof market: $16.5 billion (2023) |

PESTLE Analysis Data Sources

Our Alumasc Group PESTLE analysis utilizes data from official government publications, reputable financial news outlets, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company's operations and strategic direction.