Alumasc Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumasc Group Bundle

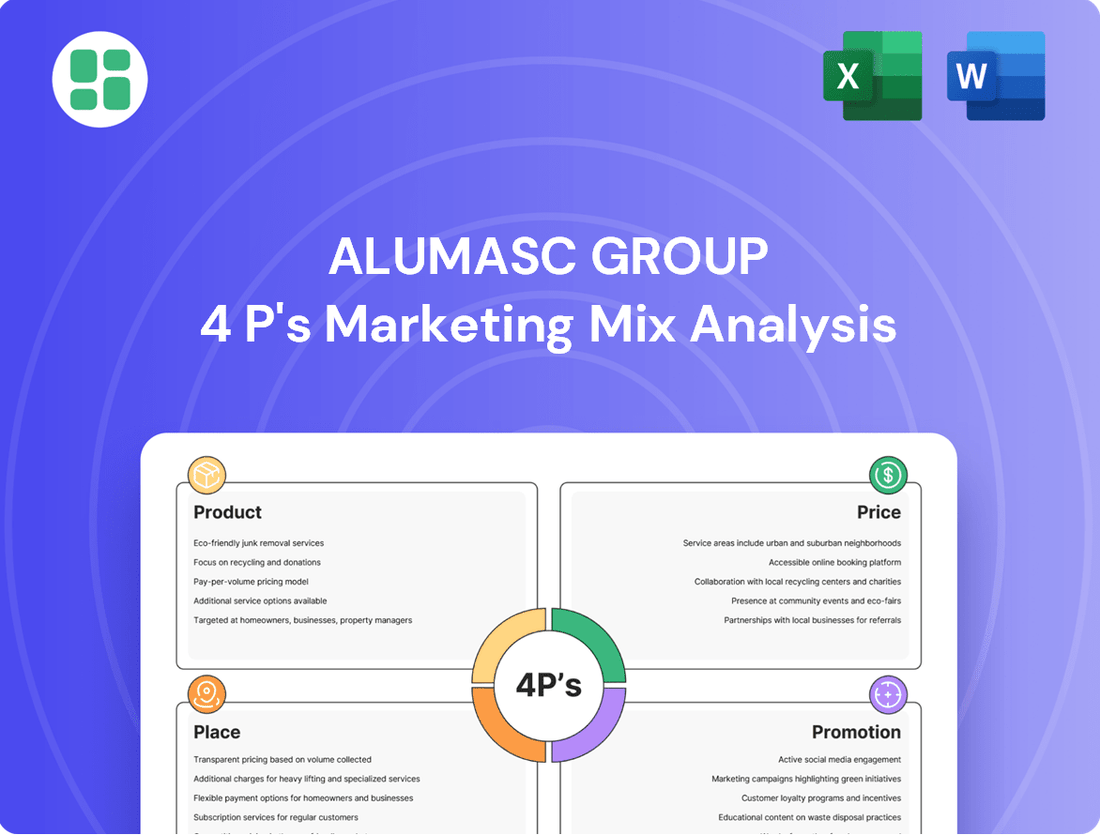

Delve into Alumasc Group's strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis. Uncover how their innovative product development, competitive pricing, strategic distribution, and impactful promotional campaigns create a powerful market presence.

Ready to gain a competitive edge? This full, editable analysis provides actionable insights into Alumasc Group's marketing success, perfect for professionals, students, and consultants seeking strategic advantage.

Save valuable time and gain expert-level understanding. Our pre-written report offers a detailed breakdown of Alumasc Group's 4Ps, complete with real-world examples and structured thinking for your next project.

Product

Under the Product element of the 4Ps, Alumasc Group's sustainable building solutions are specifically engineered to enhance energy and water efficiency in construction. These offerings, including their high-performance insulation and rainwater harvesting systems, directly address the increasing demand for environmentally responsible building practices. For instance, Alumasc's Derbigum range has been recognized for its durability and contribution to building longevity, a key aspect of sustainability.

Alumasc Group structures its offerings across three key divisions: Water Management, Building Envelope, and Housebuilding. This divisional approach allows for specialized product development and market focus within each area.

The Water Management division offers a comprehensive 'rain to drain' solution, encompassing rainwater goods, drainage products, and inspection covers. This segment addresses critical infrastructure needs for managing water flow and ensuring system integrity.

In the Building Envelope segment, Alumasc provides advanced roofing systems, including membranes and insulation. Notably, this division is at the forefront of sustainable building with its innovative green and blue roof technologies, contributing to environmental resilience.

The Housebuilding division concentrates on manufacturing items for the residential sector, with a strong emphasis on sustainability. Products are primarily crafted from recycled and recyclable materials, aligning with growing demand for eco-conscious construction solutions.

Alumasc Group's product strategy centers on a dual commitment to quality and innovation. They focus on creating durable, environmentally sound products, exemplified by their investment in non-combustible materials that enhance building safety. This dedication ensures their offerings meet stringent industry standards and customer expectations for longevity and performance.

The company actively invests in research and development, driving new product introductions to stay ahead of market trends. For instance, their Biosolar systems represent a significant innovation, integrating energy generation with biodiversity enhancement. This forward-looking approach ensures Alumasc's product portfolio remains competitive, offering advanced solutions that address contemporary environmental and performance challenges.

Recycled and Recyclable Materials

Alumasc Group's product strategy heavily emphasizes recycled and recyclable materials, a key differentiator in the market. This focus not only minimizes environmental footprint but also resonates with increasingly eco-conscious customers.

The company's commitment is evident in its manufacturing: around 80% of the polymers Alumasc utilizes are recycled. Furthermore, a substantial portion of their product range is designed for full recyclability at the end of its service life, embodying a strong circular economy principle.

This approach to product composition offers several advantages:

- Reduced Environmental Impact: By incorporating recycled content and ensuring recyclability, Alumasc lowers reliance on virgin resources and diverts waste from landfills.

- Enhanced Brand Reputation: The sustainability focus strengthens Alumasc's image as an environmentally responsible manufacturer, appealing to a broader customer base.

- Potential Cost Savings: Utilizing recycled materials can sometimes lead to lower raw material costs compared to virgin alternatives.

- Regulatory Compliance and Future-Proofing: Proactive adoption of sustainable practices positions Alumasc favorably for evolving environmental regulations and market demands.

Problem-Solving Design

Alumasc's product design is fundamentally about tackling construction's toughest challenges. For instance, their advanced insulation and ventilation systems directly combat the growing need for improved energy efficiency in buildings, a critical factor as energy costs continue to fluctuate. This focus on performance enhancement addresses a core desire for lower running costs and a more comfortable internal environment for occupants.

Furthermore, Alumasc offers sophisticated solutions for urban water management, specifically addressing the increasing strain on infrastructure due to climate change and intensified rainfall. Their efficient rainwater and stormwater attenuation systems are engineered to prevent flooding and manage water resources more effectively, a vital concern for urban planners and developers alike.

By engineering products that deliver tangible benefits like enhanced building performance and improved occupant well-being, Alumasc ensures they are not just selling materials, but providing effective solutions. This problem-solving approach resonates with a broad customer base, from architects seeking sustainable designs to building owners prioritizing long-term value and resilience.

- Energy Efficiency: Alumasc's solutions contribute to reducing a building's carbon footprint and operational costs. For example, their high-performance insulation can significantly lower heating and cooling demands.

- Water Management: Products designed for rainwater harvesting and stormwater attenuation help mitigate flood risks and support sustainable water use in urban environments.

- Occupant Comfort: Improved ventilation and thermal regulation lead to healthier and more comfortable living and working spaces.

- Durability & Longevity: Alumasc's commitment to quality engineering ensures their products contribute to the long-term performance and reduced maintenance needs of buildings.

Alumasc Group's product strategy emphasizes sustainable building solutions across its three core divisions: Water Management, Building Envelope, and Housebuilding. Their offerings, such as high-performance insulation and rainwater harvesting systems, directly address the growing demand for environmentally conscious construction, with a significant focus on recycled materials. For example, approximately 80% of the polymers Alumasc utilizes are recycled, and many products are designed for end-of-life recyclability, aligning with circular economy principles.

| Product Focus | Key Features | Sustainability Impact | Market Relevance (2024/2025) |

|---|---|---|---|

| Water Management | Rainwater goods, drainage, inspection covers | Mitigates flood risk, supports efficient water use | Increased infrastructure investment for climate resilience |

| Building Envelope | Advanced roofing, membranes, insulation, green/blue roofs | Enhances energy efficiency, promotes biodiversity | Growing demand for net-zero building solutions |

| Housebuilding | Residential construction materials | Utilizes recycled/recyclable materials, reduces environmental footprint | Consumer preference for eco-friendly homes |

What is included in the product

This analysis provides a comprehensive breakdown of Alumasc Group's marketing mix, examining their Product, Price, Place, and Promotion strategies with real-world examples and competitive context.

It's designed for professionals seeking to understand Alumasc Group's marketing positioning, offering insights for stakeholder reports, strategy audits, or benchmarking against industry leaders.

This Alumasc Group 4Ps analysis acts as a pain point reliever by clearly defining how product innovation, strategic pricing, accessible distribution, and impactful promotion address market challenges and customer needs.

Place

The United Kingdom remains Alumasc Group's bedrock, contributing the lion's share of its revenue. This dominance is particularly noteworthy given the often-turbulent macroeconomic landscape impacting the UK construction sector.

For the fiscal year ending June 30, 2023, Alumasc reported that 87% of its revenue was generated from the UK market, underscoring its deep integration within the domestic construction industry. This strong performance, often exceeding the broader market's growth, highlights Alumasc's effective market penetration and resilient brand positioning.

Alumasc Group is strategically broadening its horizons beyond the United Kingdom, targeting significant growth in export markets. Key regions for expansion include Europe, North America, the Middle East, and the Far East, reflecting a global approach to capturing new business opportunities.

This international focus is already yielding tangible results, with export revenues demonstrating robust growth. A notable example is the accelerated delivery of Alumasc products for a major project at Chek Lap Kok airport in Hong Kong, underscoring the company's capability in fulfilling large-scale international demand.

By diversifying its revenue streams through these expanding export markets, Alumasc is effectively capitalizing on burgeoning international construction trends and mitigating risks associated with over-reliance on a single geographical market.

Alumasc Group's diverse sector reach is a significant strength within its marketing mix. The company actively serves commercial, industrial, and residential construction segments, demonstrating a broad market penetration. This wide engagement, as evidenced by their participation in projects ranging from large-scale industrial facilities to individual housing developments, provides a buffer against sector-specific downturns.

Strategic Distribution Channels

Alumasc Group employs a multi-channel distribution strategy to reach its diverse customer base. This approach is designed to offer flexibility and convenience, ensuring products are accessible where and how customers prefer to purchase.

Direct selling is a key component, especially for businesses integrated through acquisitions, such as ARP. This allows for a more personalized customer experience and direct feedback.

Furthermore, Alumasc leverages online sales platforms to broaden its reach and cater to the growing trend of e-commerce in the building materials sector. This digital presence complements its traditional channels.

The strategic selection of these channels aims to optimize logistics, enhance product availability, and ultimately maximize sales potential by meeting customer needs efficiently.

- Direct Sales: Crucial for acquired entities like ARP, fostering direct customer relationships.

- Online Platforms: Expanding market access and catering to digital purchasing habits.

- Customer Convenience: Channels are chosen to ensure ease of access and purchasing.

- Logistical Efficiency: Optimizing the movement of goods to enhance sales potential.

Optimized Manufacturing and Logistics

Alumasc Group is actively optimizing its manufacturing and logistics to enhance efficiency and reduce costs. A key strategic move involves consolidating its operational footprint, exemplified by the planned closure of its Dover manufacturing site. This consolidation is expected to yield significant structural cost reductions.

The transfer of access cover manufacturing from Dover to the Halstead facility is a core component of this optimization strategy. This move is projected to deliver substantial efficiency gains across the production process, streamlining operations. These changes are designed to improve Alumasc's overall competitiveness.

This focus on streamlined logistics is crucial for ensuring product availability where and when customers require them. By optimizing its supply chain, Alumasc aims to bolster customer satisfaction. The group anticipates these operational enhancements will contribute positively to its financial performance in the coming periods.

- Consolidation of Manufacturing: Planned closure of Dover site to reduce operational costs.

- Efficiency Gains: Moving access cover production to Halstead for improved output.

- Logistics Optimization: Ensuring timely product availability to meet customer demand.

- Cost Reduction: Structural cost savings anticipated from operational streamlining.

Alumasc Group's place in the market is defined by its strong UK presence, which accounted for 87% of its revenue in the fiscal year ending June 30, 2023. However, the company is actively expanding its geographical footprint, targeting growth in Europe, North America, the Middle East, and the Far East, as demonstrated by its involvement in projects like Chek Lap Kok airport in Hong Kong. This dual focus on its established home market and emerging international opportunities shapes its distribution and sales strategies.

Same Document Delivered

Alumasc Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Alumasc Group's 4P's Marketing Mix is fully complete and ready for immediate use. You can trust that the detailed insights into Product, Price, Place, and Promotion are exactly what you'll download.

Promotion

Alumasc Group prioritizes open communication with its investors. This commitment is evident through timely interim and full-year financial reports, as well as engaging investor presentations. For instance, in their 2024 interim results, Alumasc highlighted a robust performance, with revenue up 7% to £79.2 million, demonstrating their dedication to keeping stakeholders informed.

The company actively participates in platforms like Investor Meet Company, offering direct engagement opportunities. This allows for detailed discussions on financial performance and strategic direction, fostering a strong connection with the investment community. Their consistent presence and detailed updates build confidence and encourage sustained investor interest.

Alumasc Group prominently features sustainability as a core promotional theme, positioning itself as a provider of environmentally responsible building products. This focus directly addresses the growing demand for green construction solutions within the industry.

The company's communication strategy emphasizes how its offerings contribute to resource management, specifically highlighting water and energy efficiency, carbon reduction, and enhanced building safety. This clear articulation of benefits aligns with market trends and consumer preferences for sustainable building practices.

For instance, Alumasc's 2024 interim report noted a significant increase in demand for products with strong environmental credentials, reflecting the market's embrace of sustainability. This trend is expected to continue, with industry forecasts from late 2024 predicting a 15% annual growth in the green building materials sector through 2027.

Alumasc Group consistently emphasizes its capacity to deliver superior performance compared to the wider UK construction sector, a key element of its 'Outperformance Narrative'. This messaging highlights the robustness of their business model and the success of their strategic decisions, even when the market faces headwinds.

For instance, in the fiscal year ending June 30, 2024, Alumasc reported a revenue of £218.2 million, demonstrating resilience. This financial performance, coupled with a focus on innovation and operational efficiency, underpins their claim of outperformance.

This consistent communication of strong results builds investor and customer trust, showcasing Alumasc's ability to navigate economic volatility and maintain a positive growth trajectory, a crucial aspect of their marketing strategy.

Digital and Event Engagement

Alumasc Group actively uses its official website as a primary source for investor relations, news, and financial reports, ensuring stakeholders have readily available information. This digital presence is complemented by online investor presentations, reflecting a contemporary approach to transparent communication.

The company also engages directly with the financial community through participation in events like Capital Markets Days. These occasions facilitate deeper discussions with analysts and investors, providing a platform to articulate strategic objectives and future growth prospects.

For instance, Alumasc Group's commitment to digital engagement was evident in its proactive dissemination of information leading up to its interim results announcement in early 2025, with updates shared via their investor portal and relevant financial news channels.

- Website as Investor Hub: Centralized access to reports, news, and financial statements.

- Digital Presentations: Utilizing online platforms for investor briefings and updates.

- Event Participation: Engaging directly with analysts and investors at industry events like Capital Markets Days.

- Information Dissemination: Timely sharing of crucial data, such as interim and annual financial results, through digital channels.

Customer Service and Innovation Showcase

Alumasc Group's promotional strategy heavily features its dedication to superior customer service and ongoing product innovation. This dual focus is presented as a key driver for gaining market share and boosting client contentment.

The company actively communicates how these strengths translate into tangible benefits for its customers, reinforcing its position as a leader in building product solutions. For instance, Alumasc's investment in R&D, which fuels innovation, saw a notable increase in its 2024 financial reports, supporting its market expansion goals.

- Customer-Centric Approach: Alumasc promotes its responsive customer support and tailored solutions, aiming to build lasting relationships.

- Innovation Pipeline: The company showcases new product developments, demonstrating its commitment to addressing evolving market needs and technological advancements.

- Market Share Growth: Promotional materials often link customer satisfaction and innovation directly to Alumasc's success in capturing a larger portion of the building materials market.

- Industry Recognition: Alumasc's efforts in service and innovation have been acknowledged through various industry awards, further bolstering its promotional message.

Alumasc Group leverages a multi-faceted promotional approach centered on investor relations, sustainability, and product innovation. Their communication strategy emphasizes financial transparency, evidenced by timely reports and investor presentations, such as the 2024 interim results showing 7% revenue growth to £79.2 million. Sustainability is a core theme, highlighting resource efficiency and carbon reduction, with market forecasts in late 2024 predicting 15% annual growth in green building materials through 2027. The company also promotes its superior customer service and innovation pipeline, linking these to market share gains and client satisfaction, supported by increased R&D investment noted in their 2024 reports.

| Promotional Focus | Key Messaging | Supporting Data/Examples |

|---|---|---|

| Investor Relations & Financial Performance | Transparency, Outperformance Narrative | 2024 Interim Revenue: £79.2M (+7%); FY24 Revenue: £218.2M |

| Sustainability | Environmental Responsibility, Green Building | Market growth forecast: 15% annually (late 2024) for green building materials (through 2027) |

| Customer Service & Innovation | Client Satisfaction, Market Leadership | Increased R&D investment (2024 reports); Industry awards |

Price

Alumasc's value-based pricing strategy centers on the superior quality, performance, and sustainability of its building products. This approach allows them to command premium prices, as customers recognize the long-term benefits and environmental advantages. For instance, their focus on durable, energy-efficient solutions resonates with a market increasingly prioritizing lifecycle costs and eco-credentials.

This strategy demonstrably fuels Alumasc's financial success. Even amidst economic headwinds, the company has achieved strong revenue growth and improved profitability. In the fiscal year ending June 30, 2024, Alumasc reported revenue of £235.5 million, a notable increase from £207.2 million in the prior year, underscoring the market's willingness to pay for their value proposition.

Alumasc Group is actively pursuing margin improvement as a core strategic goal, aiming for an operating margin between 15% and 20% in the medium term. This objective underscores a commitment to disciplined pricing strategies, alongside rigorous cost control and operational efficiency enhancements, to ensure robust profitability.

To achieve these margin targets, Alumasc is implementing strategic pricing adjustments. These adjustments are designed to effectively offset rising input costs, thereby safeguarding and enhancing the company's profit margins.

Alumasc Group demonstrates strong competitive market positioning, evidenced by its organic revenue growth outperforming the broader UK construction market despite economic headwinds. In 2024, Alumasc reported a 7% increase in organic revenue, compared to a projected 2% contraction in overall UK construction output for the same period. This suggests their pricing strategies are effective in attracting and retaining customers, allowing them to capture market share.

Strategic Investment and Efficiency

Alumasc Group's pricing strategy is intrinsically linked to its commitment to strategic investment and operational efficiency. The company prioritizes disciplined capital allocation, channeling funds into areas that promise enhanced value and cost reduction. This focus directly impacts its ability to maintain competitive pricing while ensuring profitability.

Investments in new product development and sales capabilities are key components of this strategy. For instance, Alumasc has been actively investing in its Halstead manufacturing facility to consolidate operations and drive efficiency. These efforts are designed to create a more streamlined and cost-effective production process, which ultimately supports more flexible and attractive pricing for its customers.

- Capital Allocation: Alumasc's approach to investing in growth areas and operational improvements underpins its pricing decisions.

- Efficiency Gains: Investments in facilities like Halstead aim to reduce costs, providing pricing flexibility.

- Value Enhancement: Focus on new products and sales capabilities allows for premium pricing where value is demonstrably higher.

- Profitability Targets: The efficiency and investment strategy is geared towards achieving consistent profitability, influencing price setting.

Financial Performance and Outlook

Alumasc Group has demonstrated robust financial performance, with projected revenue for Fiscal Year 2025 anticipated to reach £113 million. This growth, coupled with an increase in underlying pre-tax profit, underscores the effectiveness of their pricing strategies in driving both revenue and profitability.

The company's financial health is a key component of its marketing mix, reflecting a successful approach to the price element. This strong showing suggests that Alumasc is effectively balancing cost management with market demand to achieve favorable outcomes.

- Projected FY25 Revenue: £113 million

- Profitability: Increased underlying pre-tax profit

- Strategy: Growth initiatives and focus on sustainable solutions

- Outlook: Confidence in delivering shareholder value

Alumasc's pricing strategy is deeply rooted in the value its products deliver, focusing on quality, performance, and sustainability. This approach justifies premium pricing, as customers recognize the long-term benefits and eco-credentials. The company's ability to achieve strong revenue growth, with reported revenue of £235.5 million for FY24, demonstrates the market's acceptance of this value proposition.

| Metric | FY24 (Actual) | FY25 (Projected) | Target Margin |

|---|---|---|---|

| Revenue | £235.5 million | £113 million | 15%-20% (Operating Margin) |

| Organic Revenue Growth | 7% | N/A | N/A |

| UK Construction Market Output | -2% (Projected) | N/A | N/A |

4P's Marketing Mix Analysis Data Sources

Our Alumasc Group 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor communications, and detailed product information. We also incorporate market research and competitor analysis to ensure a holistic view.