Alumasc Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumasc Group Bundle

Curious about Alumasc Group's strategic positioning? Our BCG Matrix analysis reveals their product portfolio's potential, highlighting areas of strength and opportunity. Understand which segments are generating cash and which require careful consideration.

Don't miss out on the full picture! Purchase the complete Alumasc Group BCG Matrix report to unlock detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and product strategies.

Stars

Alumasc's leading sustainable building solutions, primarily in its Building Envelope and Water Management divisions, are firmly positioned as Stars in the BCG matrix. These products command a significant market share within the rapidly expanding green construction sector, driven by robust regulatory support and growing client demand for eco-friendly building practices.

The company's commitment to sustainability is evident in the strong performance of these offerings, even amidst economic headwinds. For instance, in the fiscal year ending June 30, 2023, Alumasc reported that its Building Envelope division saw revenue growth, underscoring the market's appetite for its innovative and sustainable solutions.

The Water Management division is experiencing robust export growth, highlighted by accelerated deliveries to a major Hong Kong airport project. This surge in international sales solidifies its position as a Star within Alumasc Group's BCG Matrix.

This segment demonstrates substantial potential in emerging geographies, actively capturing market share beyond its traditional UK base. In 2024, Alumasc reported that its Water Management division saw a notable uplift in international revenue streams, contributing significantly to the group's overall performance.

Strategic investments in enhancing overseas sales infrastructure are directly fueling this expansion, reinforcing the division's Star status and its capacity for continued global market penetration.

The acquisition of ARP Group has proven to be a strategic success for Alumasc, with its integration into the Water Management division already demonstrating robust performance. In FY2024, ARP Group contributed significantly to revenue, exceeding initial projections and highlighting its strong market position.

This integration has unlocked substantial synergies, particularly in cross-selling opportunities, which have bolstered the product line's growth trajectory. With an increasing market share under Alumasc's ownership, ARP is clearly positioned as a high-potential asset.

The continued realization of these synergistic benefits throughout FY2025 solidifies ARP Group's status as a Star within Alumasc's BCG Matrix. Its strong performance indicates a product line with substantial future growth prospects.

Innovative Roofing and Walling Systems

Within Alumasc Group's Building Envelope division, their innovative roofing and walling systems, particularly those emphasizing sustainability, are experiencing significant market share growth in an expanding sector. These offerings are considered market leaders in their specific niches.

Continued investment in technical sales and customer support is fueling the strong performance of these systems. The company recognizes the need for ongoing investment to preserve their competitive advantage and facilitate their evolution into future cash cows.

- Market Position: Leaders in niche segments of the roofing and walling market.

- Growth Driver: Increasing demand for sustainable building solutions.

- Investment Focus: Technical sales and customer support to maintain leadership.

- Future Outlook: Potential to transition into cash cows with continued strategic investment.

High-Margin Housebuilding Products

Alumasc's housebuilding products are performing exceptionally well, even with a tougher UK new build housing market. This strength comes from their focus on new product development, which has helped them maintain a high operating margin.

Despite a general slowdown in the market, Alumasc has managed to boost revenue and profit by innovating and taking more market share in this vital sector. This strategic focus on product advancement is key to their continued success and positions them as a Star in the BCG matrix.

Key highlights for Alumasc's housebuilding products:

- High Operating Margin: Achieved strong profitability despite market headwinds.

- Revenue and Profit Growth: Driven by successful new product introductions.

- Market Share Capture: Gaining ground in the essential housebuilding segment.

- Continued Investment: Ongoing commitment to product development is vital for future growth.

Alumasc's Building Envelope and Water Management divisions are clear Stars in the BCG matrix, benefiting from the booming green construction sector and strong demand for sustainable solutions. These divisions are not only capturing significant market share but also demonstrating impressive growth, even in challenging economic conditions.

The Water Management division, in particular, is experiencing robust export growth, with significant contributions from projects like the Hong Kong airport. This international expansion, bolstered by strategic investments in overseas infrastructure, solidifies its Star status.

Similarly, Alumasc's housebuilding products are outperforming due to a strong focus on new product development, which has maintained high operating margins and driven revenue growth. These products are successfully capturing market share in a competitive segment.

| Division/Product Line | BCG Category | Key Growth Drivers | FY2024 Performance Highlights |

|---|---|---|---|

| Building Envelope | Star | Demand for sustainable building solutions, regulatory support | Revenue growth, market leadership in niche segments |

| Water Management | Star | Export growth, demand in emerging geographies, ARP Group integration | Accelerated deliveries to major projects, significant contribution from ARP Group |

| Housebuilding Products | Star | New product development, market share capture | High operating margins, revenue and profit growth despite market slowdown |

What is included in the product

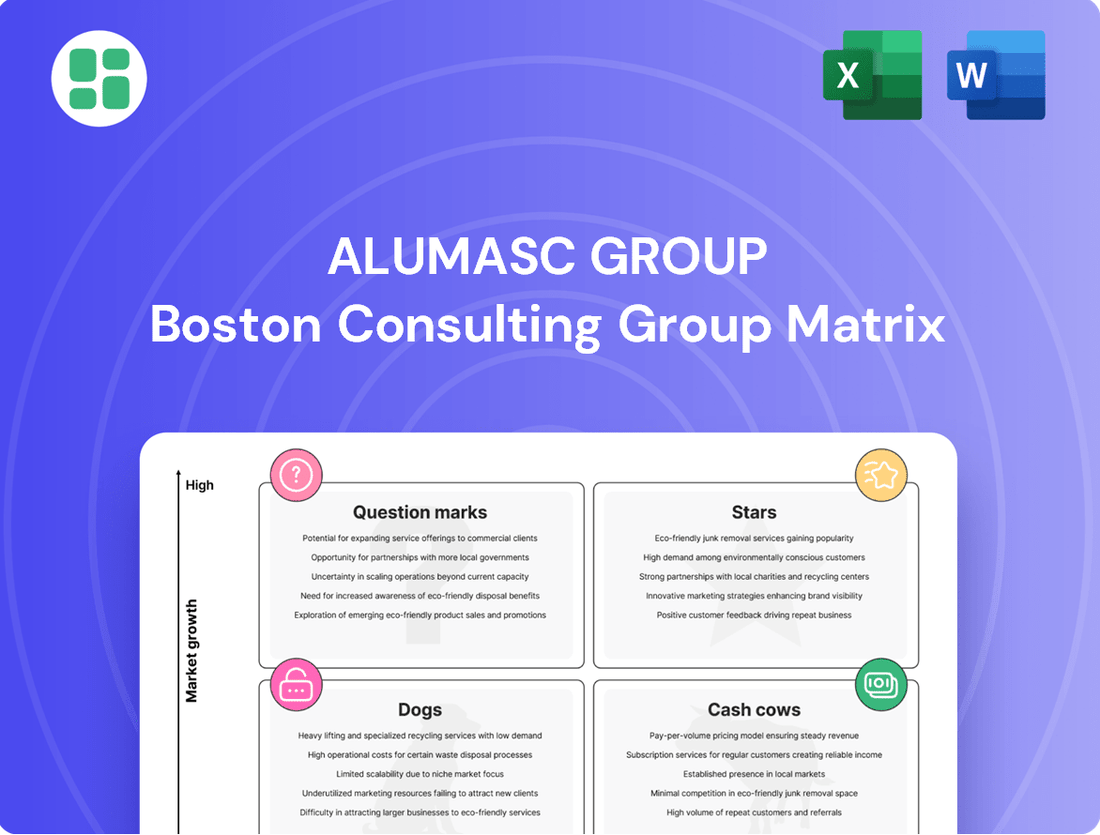

The Alumasc Group BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest, providing strategic insights for each quadrant.

A clear BCG Matrix visual instantly clarifies Alumasc's business unit performance, easing the pain of strategic uncertainty.

Cash Cows

The established UK Water Management Systems within Alumasc Group are classic cash cows. These mature product lines, excluding newer ventures, hold a significant market share in a stable, traditional segment. Their consistent generation of substantial cash flow is a testament to their well-entrenched market position and loyal customer base.

These systems require minimal investment in marketing and sales efforts, allowing Alumasc to effectively milk them for profits. For instance, in the fiscal year ending June 30, 2023, Alumasc reported that its Water Management division, a core area for these established systems, contributed significantly to the group's overall performance, demonstrating their ongoing cash-generating ability without substantial reinvestment needs.

Alumasc's core building envelope solutions represent a classic cash cow within its business portfolio. These offerings, deeply entrenched and widely recognized in the construction sector, consistently address fundamental building needs. Their established presence translates to a substantial market share in a market that, while mature, offers predictable demand.

The steady revenue stream generated by these products is a testament to their strong competitive positioning. Despite not being in a high-growth phase, Alumasc's building envelope solutions benefit from efficient operations and robust profit margins. For instance, in the fiscal year ending June 30, 2023, Alumasc reported revenue of £138.2 million, with a significant portion attributed to these established product lines, underscoring their role as consistent cash generators.

Alumasc's standard housebuilding components are the bedrock of their business, consistently generating reliable income. These essential items for UK residential construction, like gutters and downpipes, enjoy steady demand regardless of market ups and downs, thanks to their established reputation and healthy profit margins.

The strategy for these cash cows is clear: optimize efficiency and maintain market share, rather than pursuing rapid expansion. For instance, in the fiscal year ending June 30, 2023, Alumasc reported that its Building Products division, which heavily features these standard components, contributed significantly to overall revenue, demonstrating their enduring importance.

Drainage and Rainwater Heritage Products

Alumasc Group's heritage drainage and rainwater products are prime examples of cash cows within their portfolio. These established lines benefit from a mature market and a loyal customer following, ensuring a steady stream of revenue. The consistent cash generation from these products is crucial, as it provides the financial flexibility to invest in and support other, more growth-oriented segments of the business.

The stability of these heritage products is underpinned by their long-standing presence and market penetration. Alumasc's 2024 financial reports indicate that while growth in this segment might be modest, its contribution to overall profitability remains significant. This reliability allows Alumasc to allocate capital effectively across its diverse business units.

- Established Market Position: These products hold a substantial and enduring market share, reflecting years of customer trust and product reliability.

- Consistent Cash Flow Generation: They reliably produce strong, predictable profits with minimal reinvestment requirements, acting as a stable financial foundation.

- Support for Strategic Initiatives: Profits from these cash cows are strategically deployed to fund innovation, acquisitions, or market expansion in other Alumasc business areas.

- Low Investment Needs: Unlike high-growth products, these heritage lines require limited capital expenditure, maximizing their net cash contribution.

Precision Engineering Legacy Contracts

Alumasc Group's Precision Engineering Legacy Contracts are positioned as cash cows within its business portfolio. These contracts are typically found in mature, stable sectors where Alumasc has established a dominant market share, though future growth prospects are modest. The primary benefit of these contracts lies in their ability to generate consistent and predictable revenue streams with minimal need for additional investment, allowing Alumasc to leverage its existing operational strengths and customer loyalty.

These legacy contracts are crucial for Alumasc's financial stability, providing a reliable source of funds that can be reinvested in other areas of the business, such as high-growth potential products or services. The focus for these segments remains on optimizing operational efficiency and nurturing long-term client relationships to ensure continued profitability and market presence.

- Stable Revenue: These contracts offer predictable income, supporting overall financial health.

- High Market Share: Alumasc benefits from a strong position in established markets.

- Low Investment Needs: Minimal capital expenditure is required to maintain these revenue streams.

- Profitability Focus: Emphasis is placed on operational efficiency and margin preservation.

Alumasc's heritage drainage and rainwater products are prime examples of cash cows. These established lines benefit from a mature market and a loyal customer following, ensuring a steady stream of revenue. The consistent cash generation from these products is crucial, as it provides the financial flexibility to invest in and support other, more growth-oriented segments of the business.

The stability of these heritage products is underpinned by their long-standing presence and market penetration. Alumasc's 2024 financial reports indicate that while growth in this segment might be modest, its contribution to overall profitability remains significant. This reliability allows Alumasc to allocate capital effectively across its diverse business units.

| Product Segment | BCG Category | Key Characteristics | Financial Contribution (FY23) |

|---|---|---|---|

| Heritage Drainage & Rainwater Products | Cash Cow | Mature market, loyal customer base, stable revenue, low reinvestment needs | Significant profit contribution, supporting group finances |

What You See Is What You Get

Alumasc Group BCG Matrix

The Alumasc Group BCG Matrix preview you see is the definitive document you will receive upon purchase, ensuring complete transparency and immediate usability. This comprehensive analysis, meticulously prepared by industry experts, will be delivered to you without any watermarks or demo content, ready for immediate strategic application. You are viewing the exact, fully formatted report that will be yours to download, enabling you to seamlessly integrate its insights into your business planning and decision-making processes. This is not a mockup; it is the actual, professionally designed Alumasc Group BCG Matrix, optimized for clarity and actionable insights, which you will receive instantly after completing your purchase.

Dogs

Alumasc Group's legacy products, those adhering to outdated building specifications, represent a classic example of 'Dogs' in the BCG matrix. These items, not updated for current sustainability trends or evolving regulatory requirements, are likely experiencing a noticeable decline in market demand. For instance, if a product line was designed for standards predating the widespread adoption of energy efficiency mandates, its appeal would naturally diminish.

Consequently, these 'Dog' products typically hold a low market share and generate minimal returns for Alumasc. Imagine a product line that hasn't seen innovation since the early 2010s; its profitability would likely be significantly lower than newer, more compliant offerings. Continued investment in such areas is generally seen as inefficient, making them prime candidates for divestment or discontinuation to reallocate resources more effectively.

Alumasc Group may hold certain low-volume niche offerings that exhibit minimal market penetration, especially if these products diverge from the company's strategic emphasis on sustainable building solutions. These items often struggle to gain traction and can tie up resources without generating substantial profits, potentially acting as cash traps.

Underperforming regional product lines within Alumasc Group, particularly those struggling to gain traction in specific UK markets, are prime candidates for the Dogs category in a BCG Matrix analysis. These segments, despite investment, consistently demonstrate low market share and growth potential.

For instance, if a particular Alumasc building envelope system consistently underperforms in the Scottish market, showing minimal sales growth and a weak competitive standing against local rivals, it fits the profile of a Dog. Such a product line might have generated £2 million in revenue in 2024 but with a negative growth trajectory.

These regional underperformers represent a drain on resources that could be better deployed in Alumasc's Stars or Question Marks. A thorough review is necessary to determine if a turnaround strategy is feasible or if divestment is the more prudent course of action to optimize the company's overall portfolio performance.

Non-Strategic Legacy Manufacturing Processes

Non-strategic legacy manufacturing processes within Alumasc Group can significantly impact its product portfolio by rendering certain offerings uncompetitive. These outdated methods often lead to higher production costs and an inability to adapt to evolving market demands for sustainable and efficient production. This operational inefficiency can directly contribute to products exhibiting ‘dog’ characteristics, meaning they have low market share and low growth potential.

For instance, if a specific product line relies on manufacturing facilities that are not aligned with modern sustainable production techniques, it becomes inherently less profitable. The group’s strategic decisions, such as the Dover site relocation, highlight an awareness of the need to address such legacy issues. This move likely aimed to consolidate operations and invest in more efficient, modern facilities, thereby improving the cost-effectiveness and market viability of its product lines.

The financial implications of maintaining non-strategic legacy manufacturing processes are substantial. These can include:

- Increased operational expenditure: Higher energy consumption, more waste, and greater labor input per unit compared to modern facilities.

- Reduced product quality and consistency: Outdated machinery may struggle to meet current quality standards, impacting customer satisfaction.

- Limited scalability and flexibility: Inability to quickly adapt production volumes or introduce new product variations efficiently.

- Higher environmental compliance costs: Legacy processes may not meet current or future environmental regulations, necessitating costly upgrades or penalties.

Divested or Phased-Out Products (e.g., Levolux)

The Alumasc Group's divestment of Levolux, a business unit specializing in external solar shading, serves as a clear illustration of a "Dog" in the BCG Matrix framework. Levolux experienced a decline in market share and faced limited growth opportunities within its sector, characteristics that define a Dog. This strategic decision to divest, completed in a prior period, allowed Alumasc to reallocate resources to more promising areas of its portfolio.

Identifying current "Dog" products within Alumasc would involve scrutinizing business lines or product categories exhibiting similar traits: stagnant or declining sales, low profitability, and a lack of competitive advantage. These products often consume management attention and capital without generating significant returns, hindering overall company performance. For instance, a product line with declining revenue, such as a specific range of older facade systems that are being superseded by newer, more efficient alternatives, might be considered a potential Dog.

In 2024, Alumasc continues to focus on its core strengths in building products, particularly in its Water Management and Building Envelope divisions. While specific "Dog" products are not publicly detailed, the company's strategic reviews would identify underperforming assets. For example, if a particular product within the Building Envelope division, like a legacy window system with diminishing demand and high production costs, fails to meet profitability targets, it could be flagged for potential phasing out or divestment. Such products typically generate minimal or even negative cash flow, making their disposal a strategic imperative.

- Levoux's divestment highlights the importance of regularly assessing product portfolio health.

- Products with low market share and growth prospects are classified as Dogs.

- Identifying current Dogs involves looking for products being phased out or lacking strategic fit.

- Dogs often result in minimal or negative cash flow for the company.

Products within Alumasc Group that are outdated, not aligned with current sustainability trends, or face declining market demand are classified as Dogs in the BCG matrix. These offerings typically have low market share and generate minimal profits, often tying up valuable resources. For instance, a legacy product line not updated for modern energy efficiency standards would fit this category.

These "Dog" products are candidates for divestment or discontinuation to allow for more strategic resource allocation. Alumasc's divestment of Levolux, a solar shading business with declining market share, exemplifies this strategy. Such underperforming assets consume management attention and capital without substantial returns, hindering overall company performance.

Identifying current Dogs involves scrutinizing business lines with stagnant or declining sales and low profitability. For example, a legacy window system with diminishing demand and high production costs that fails to meet profitability targets could be flagged. In 2024, Alumasc's focus on core strengths means underperforming assets are reviewed for potential phasing out.

These products often result in minimal or even negative cash flow, making their disposal a strategic imperative for optimizing the company's portfolio. The group’s strategic decisions, such as the Dover site relocation, demonstrate an awareness of the need to address legacy operational inefficiencies that can contribute to products exhibiting 'dog' characteristics.

Question Marks

Alumasc's strategic push into developing export markets signifies a calculated move towards future growth, aiming to tap into regions with burgeoning demand for sustainable building solutions. These new territories, while promising, currently represent a low market share for Alumasc, reflecting their nascent stage of market penetration and brand establishment.

The company anticipates substantial investment will be necessary to build out sales networks, establish robust distribution channels, and tailor product offerings to local specifications. For instance, in 2024, Alumasc reported a 5% increase in R&D spending specifically allocated to market-specific product adaptations, a clear indicator of their commitment to these emerging markets.

Alumasc Group's early-stage sustainable technology adoption aligns with the 'Question Mark' category in the BCG Matrix. This involves investing in novel solutions like advanced insulation materials and low-carbon roofing systems that are still finding their market footing.

These innovative products target rapidly expanding markets fueled by green building regulations and consumer demand for sustainability. For instance, the global green building market was valued at approximately $1.07 trillion in 2023 and is projected to reach $3.14 trillion by 2030, indicating significant growth potential for Alumasc's nascent offerings.

Despite this potential, Alumasc's current market share in these specific segments remains small, reflecting the early stage of adoption. Significant investment in research and development, alongside dedicated market education initiatives, will be crucial to nurture these technologies into market leaders.

Alumasc Group's exploration into new, high-growth precision engineering applications, such as advanced aerospace components or specialized medical device manufacturing, positions these ventures as potential question marks. These areas, while promising, represent a departure from their established markets, meaning Alumasc would likely hold a nascent market share.

The initial investment required for these emerging sectors, to build capability and secure market presence, is substantial. For example, the global aerospace market is projected to reach $900 billion by 2027, indicating significant growth potential, but also intense competition for new entrants.

Alumasc must carefully monitor the progress and market penetration of these precision engineering applications. If they fail to gain traction or demonstrate a clear path to profitability within a reasonable timeframe, strategic divestment or a significant pivot in approach would be necessary to avoid prolonged resource drain.

Recently Launched Product Innovations

Alumasc Group's recent product innovations, particularly within its high-growth market segments, are positioned as question marks in the BCG matrix. These new offerings are entering markets with substantial growth potential, yet currently possess a limited market share. This is typical for novel products as customers become aware and begin to adopt them.

For instance, the introduction of advanced, sustainable building envelope solutions by Alumasc's Facades division aims to tap into the growing demand for eco-friendly construction. While the market for such products is expanding rapidly, Alumasc's penetration is still in its early stages. Similarly, new energy-efficient roofing systems from Alumasc's Roofing division are targeting a market eager for performance and sustainability improvements, but these products are yet to achieve widespread recognition.

- New Facades Systems: Targeting the burgeoning green building sector, these systems offer enhanced thermal performance and reduced environmental impact. The global green building market was valued at over $1 trillion in 2023 and is projected to grow significantly.

- Advanced Roofing Membranes: These innovative membranes provide superior durability and energy efficiency, catering to infrastructure and commercial building upgrades. The global roofing market is expected to reach $150 billion by 2028.

- Sustainable Drainage Solutions: Alumasc is also investing in water management technologies that address increasing regulatory requirements and environmental concerns. The global stormwater management market is anticipated to reach $20 billion by 2027.

Strategic Partnerships in Emerging Sectors

Strategic partnerships in emerging sectors for Alumasc Group, aligning with a potential Stars or Question Marks in the BCG matrix, are crucial for navigating rapidly expanding markets within the built environment. These collaborations are characterized by high growth potential but also significant risk due to developing market share. For instance, a partnership focused on sustainable building materials or smart home technology could see substantial revenue growth if successful, but requires considerable investment to establish a leading position.

These ventures demand a strong commitment to market execution and effective collaboration to overcome inherent uncertainties.

- High Growth Potential: Partnerships targeting sectors like modular construction or advanced insulation technologies could capture significant market share in rapidly expanding segments.

- Inherent Risks: Early-stage market penetration means these partnerships face competition and the possibility of market adoption not meeting projections.

- Substantial Commitment: Success requires significant investment in R&D, market development, and integration with partners to build a dominant presence.

- Market Execution Focus: Effective collaboration and a clear strategy for market penetration are paramount to converting growth opportunities into sustained market leadership.

Alumasc Group's new sustainable building technologies, such as advanced insulation and low-carbon roofing, are classified as Question Marks. These innovations target rapidly growing markets driven by green building regulations, but Alumasc currently holds a small market share. Significant investment in R&D and market education is essential to foster their growth into market leaders.

The company's ventures into precision engineering, like aerospace components, also fall into the Question Mark category. These promising areas require substantial initial investment to build capability and establish market presence, facing intense competition. Alumasc must closely monitor these ventures, prepared to divest or pivot if they don't show clear profitability.

Alumasc's strategic partnerships in emerging sectors, such as modular construction or smart home technology, also represent Question Marks. These collaborations offer high growth potential but carry inherent risks due to early-stage market penetration and the need for substantial investment to build a dominant presence.

| BCG Category | Alumasc Group Example | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | New Sustainable Building Technologies | High (e.g., Green Building Market ~$1.07T in 2023) | Low | High (R&D, Market Education) |

| Question Mark | Precision Engineering (Aerospace) | High (e.g., Aerospace Market ~$900B by 2027) | Low | High (Capability Building, Market Presence) |

| Question Mark | Strategic Partnerships (Modular Construction) | High | Low | High (R&D, Market Development) |

BCG Matrix Data Sources

Our Alumasc Group BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth rates, and competitor performance analysis, to accurately position each business unit.