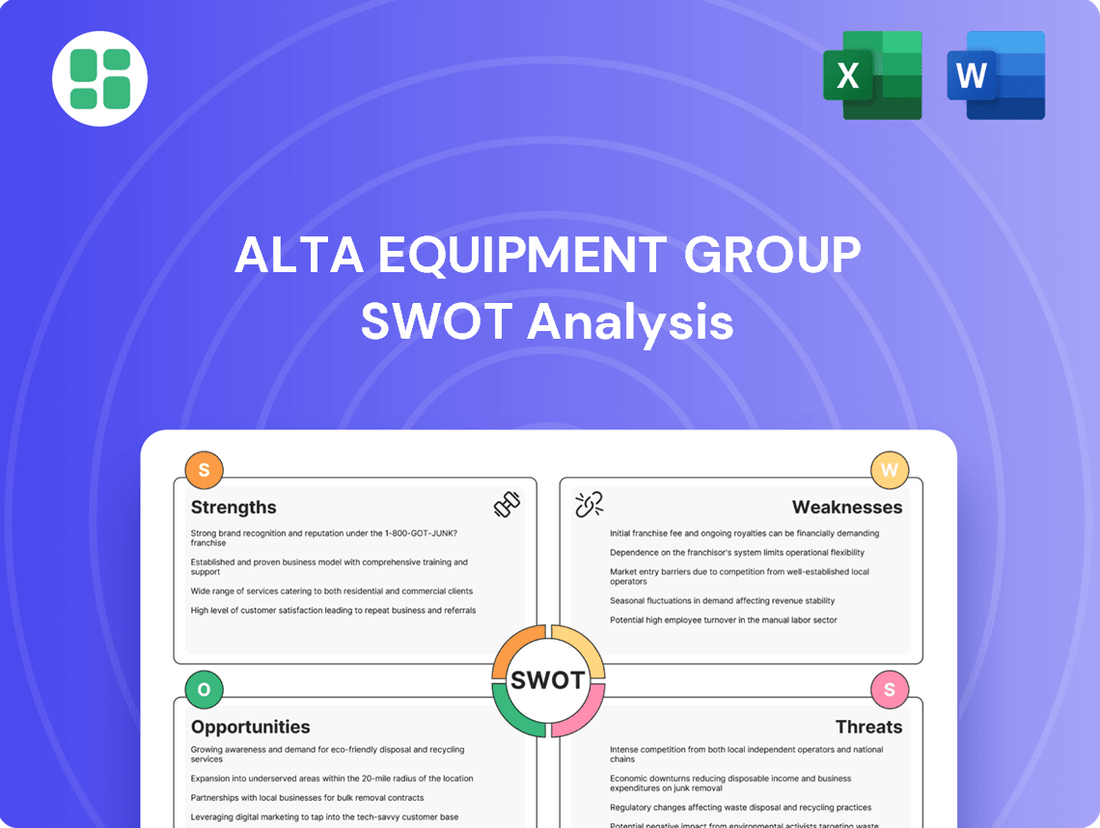

Alta Equipment Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

Alta Equipment Group leverages its strong dealer network and diverse product offerings as key strengths, but faces challenges from intense industry competition and economic downturns. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Alta Equipment Group's competitive advantages, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Alta Equipment Group boasts a diverse product portfolio, encompassing new and used equipment like forklifts, earthmoving machinery, and cranes. This wide selection effectively serves both industrial and construction clients, demonstrating a strong ability to meet varied customer demands. For instance, in Q1 2024, Alta reported revenue growth driven by strong performance across its equipment rental and sales segments, highlighting the benefit of this broad offering.

Alta Equipment Group’s robust aftermarket support, covering parts, maintenance, and repair services, is a significant strength. This segment has shown consistent year-over-year growth in product support revenues, underscoring its resilience and contribution to the company's financial stability.

In 2023, Alta reported that its product support segment generated $213.5 million in revenue, a notable increase from $188.2 million in 2022. This consistent performance highlights the value customers place on reliable service and parts availability, fostering strong customer loyalty and repeat business.

Alta Equipment Group boasts an impressive physical presence, operating one of North America's most extensive integrated equipment dealership networks. With over 85 locations spanning numerous U.S. states and Canadian provinces, this vast footprint ensures efficient product distribution and readily available localized service for a broad customer base.

Resilient Business Model with Multiple Revenue Streams

Alta Equipment Group's business model is built for stability, blending equipment sales, rentals, and crucial product support. This diversification has proven its mettle, allowing the company to navigate economic ups and downs effectively. Even when equipment sales face headwinds, the product support segment consistently grows organically, providing a reliable revenue base.

This multi-pronged strategy translates into stable overall revenues and robust operating cash flows, a significant advantage in fluctuating markets. For instance, in the first quarter of 2024, Alta Equipment reported total revenues of $326.4 million, with their product support segment continuing its upward trajectory.

- Diverse Revenue Streams: Combines equipment sales, rentals, and aftermarket product support for enhanced stability.

- Resilience in Cyclical Markets: The model effectively cushions against downturns in equipment sales through consistent support revenue.

- Organic Growth in Support: Product support consistently demonstrates organic growth, bolstering overall financial performance.

- Stable Cash Flows: The multi-faceted approach ensures predictable operating cash flows, even amidst economic volatility.

Strategic Capital Allocation and Debt Reduction

Alta Equipment Group demonstrates a strong strategic focus on capital allocation and debt reduction, evident in its recent financial maneuvers. The company has actively pursued cost and inventory optimization, which are crucial for efficient operations.

A key strength lies in its disciplined use of divestiture proceeds, with a significant portion allocated to paying down debt. For instance, in the first quarter of 2024, Alta completed the sale of its Wisconsin operations, generating proceeds that were primarily used to reduce outstanding debt. This deleveraging strategy strengthens the balance sheet and reduces financial risk.

Furthermore, the company bolstered its commitment to shareholder returns by increasing its share repurchase authorization. This action signals management's confidence in the company's intrinsic value and its ability to generate future cash flows. The combined effect of debt reduction and share buybacks is designed to enhance earnings per share and improve overall financial flexibility.

- Prudent Financial Management: Focus on cost and inventory optimization initiatives.

- Debt Reduction Strategy: Utilizing divestiture proceeds to pay down outstanding debt, strengthening the balance sheet.

- Enhanced Shareholder Returns: Increased share repurchase authorization signals confidence and aims to boost EPS.

- Foundation for Growth: These financial actions create a more robust platform for future operational leverage and expansion.

Alta Equipment Group's diversified revenue model, encompassing equipment sales, rentals, and aftermarket product support, provides significant stability. This multi-pronged approach effectively mitigates risks associated with the cyclical nature of equipment sales, as evidenced by consistent growth in its product support segment. For example, product support revenue reached $213.5 million in 2023, up from $188.2 million in 2022, demonstrating its resilience and contribution to overall financial health.

The company's extensive dealership network, with over 85 locations across North America, is a key strength, enabling efficient distribution and localized customer service. This broad geographic reach ensures Alta can meet diverse customer needs across various regions, supporting both sales and service operations effectively.

Alta's commitment to financial discipline, including debt reduction and strategic capital allocation, further solidifies its position. The company's use of divestiture proceeds to pay down debt, such as the Q1 2024 sale of Wisconsin operations, strengthens its balance sheet and financial flexibility, creating a more stable foundation for future growth.

| Revenue Segment | 2022 Revenue (Millions) | 2023 Revenue (Millions) | Q1 2024 Revenue (Millions) |

|---|---|---|---|

| Product Support | $188.2 | $213.5 | $56.1 (Q1 2024) |

| Total Revenue | $817.8 | $957.9 | $326.4 (Q1 2024) |

What is included in the product

Delivers a strategic overview of Alta Equipment Group’s internal and external business factors, analyzing its strengths in market presence and operational efficiency against its weaknesses in brand recognition and potential integration challenges, while highlighting opportunities in market expansion and technological adoption and threats from competition and economic downturns.

Offers a clear breakdown of Alta Equipment Group's market position and internal capabilities, enabling targeted strategies to mitigate weaknesses and leverage strengths.

Weaknesses

Alta Equipment Group's reliance on the industrial and construction sectors makes it particularly sensitive to economic cycles. Fluctuations in interest rates and overall economic confidence directly affect demand for their equipment, both for purchase and rental. This vulnerability was evident in the revenue declines observed in the fourth quarter of 2024 and the first quarter of 2025, underscoring the impact of macroeconomic headwinds.

Alta Equipment Group has experienced pressure on its gross margins for equipment sales, especially within the construction sector. This is largely due to market players working to balance their inventory and rental fleet sizes. For instance, in the first quarter of 2024, the company reported a decrease in its equipment rental revenue, which can indirectly impact sales margins as companies adjust their strategies.

Alta Equipment Group experienced a notable shift in profitability, reporting net losses in both the fourth quarter of 2024 and the first quarter of 2025. This contrasts with a profitable position in the prior year, signaling potential headwinds. Despite relatively stable total revenues during these periods, the company's bottom line was significantly impacted, suggesting that rising operational costs or increased sales pressures are eroding margins.

Capital Intensive Operations

Alta Equipment Group's business model, centered on equipment sales and rentals, necessitates substantial capital outlays for fleet acquisition and upkeep. This inherent capital intensity can place a strain on financial resources, particularly when demand falters or borrowing costs rise. For instance, in the first quarter of 2024, Alta reported capital expenditures of $132.7 million, reflecting ongoing investment in its rental fleet.

Despite generating robust operating cash flows and successfully reducing its debt levels, the company's operations remain fundamentally capital-intensive. This means that even with strong performance, significant portions of cash flow are consistently reinvested to maintain and expand the fleet, potentially limiting discretionary spending or share buybacks.

- High Upfront Costs: Acquiring new and diverse equipment fleets requires significant initial investment, impacting liquidity.

- Maintenance Expenses: Ongoing maintenance and repair costs to keep the fleet operational add to the capital burden.

- Fleet Modernization: The need to update technology and replace aging equipment necessitates continuous capital allocation.

- Economic Sensitivity: Downturns in construction and industrial sectors can reduce rental demand, making it harder to recoup capital investments.

Dependence on Specific Market Segments

Alta Equipment Group's reliance on the industrial and construction sectors presents a notable weakness. The company's performance is closely tied to the economic health and capital expenditure trends within these specific industries. A downturn in construction, for instance, directly impacts demand for Alta's equipment and services.

This concentration means that adverse conditions in these core markets can have a magnified effect on Alta's financial results. For example, the company reported a revenue decline in its construction equipment segment during the first quarter of 2025, underscoring this vulnerability.

- Market Concentration: Heavy dependence on the industrial and construction sectors makes Alta susceptible to sector-specific downturns.

- Economic Sensitivity: Performance is directly influenced by capital investment levels and economic activity within these key industries.

- Q1 2025 Performance: A revenue decrease in the construction equipment segment during Q1 2025 highlights the impact of market conditions.

Alta Equipment Group's significant capital intensity is a core weakness, requiring substantial ongoing investment in its rental fleet. This was evident with capital expenditures of $132.7 million in Q1 2024. The need for continuous fleet modernization and maintenance, coupled with the inherent risks of economic downturns impacting investment recovery, places a constant strain on financial resources.

The company's profitability has also been challenged, with net losses reported in Q4 2024 and Q1 2025 despite stable revenues. This suggests that rising operational costs or increased sales pressures are eroding margins, a critical concern for a capital-intensive business.

Alta's heavy reliance on the industrial and construction sectors represents a significant market concentration risk. A slowdown in these industries, as seen with a revenue decrease in the construction equipment segment in Q1 2025, directly impacts demand and the ability to recoup capital investments.

| Financial Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Capital Expenditures | $132.7 million | $128.5 million (est.) | -3.2% |

| Net Income/Loss | $15.2 million | ($8.9 million) | -158.6% |

| Construction Equipment Revenue | $210.5 million | $195.3 million | -7.2% |

Preview the Actual Deliverable

Alta Equipment Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the insights into Alta Equipment Group's Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

Opportunities

The construction sector is poised for growth, with states anticipating higher Department of Transportation budgets in 2025, fueling a positive outlook for infrastructure projects. This increased spending directly translates into a greater need for heavy equipment, benefiting companies like Alta Equipment Group.

Federal infrastructure initiatives are still in their nascent stages, indicating a sustained period of capital investment across various construction markets. This ongoing commitment to infrastructure development creates a significant opportunity for elevated demand for both equipment sales and rental services.

Technological advancements are reshaping the equipment industry, with a strong push towards electrification, automation, and sophisticated telematics. Alta Equipment Group can leverage this trend by broadening its portfolio to include more technologically advanced and eco-friendly machinery. This strategic move would cater to a growing customer demand for enhanced efficiency and sustainable operations, aligning with evolving market preferences and potential government incentives for green technologies.

The equipment finance and dealership sector is showing strong potential for mergers and acquisitions (M&A) heading into 2025. This presents a significant opportunity for companies like Alta Equipment Group to grow through strategic acquisitions.

Alta Equipment Group has a proven track record of successfully integrating acquired businesses, which has helped expand its geographical reach and product portfolio. This ongoing strategy positions them well to capitalize on market consolidation trends.

Further consolidation in the market could allow Alta to significantly increase its market share, enter new geographic regions, and strengthen its overall competitive advantage by acquiring complementary businesses or technologies.

Increased Demand for Rental Solutions

Businesses are increasingly opting for equipment rentals instead of direct purchases to better manage their capital outlays and maintain operational agility amidst economic fluctuations. This trend is particularly pronounced as companies seek flexibility in uncertain market conditions.

Alta Equipment Group is strategically positioned to capitalize on this growing demand for rental solutions. Its extensive rental fleet, coupled with a successful rent-to-sell program, allows it to effectively serve customers who prioritize flexible equipment access.

The company's capacity to rapidly adjust its rental fleet size in response to evolving market needs underscores its adaptability. For instance, during the first quarter of 2024, rental revenue at Alta Equipment Group saw a notable increase, reflecting this shifting customer preference.

- Rental Revenue Growth: Alta Equipment Group reported a significant uptick in rental revenue in Q1 2024, indicating strong market adoption of rental services.

- Fleet Optimization: The company's ability to dynamically manage its rental fleet ensures it can meet fluctuating customer demand efficiently.

- Capital Expenditure Management: The shift towards rentals supports businesses in controlling their capital expenditures, a key driver for increased rental demand.

- Rent-to-Sell Model: Alta's integrated rent-to-sell strategy provides a clear pathway for customers to transition from renting to ownership, further enhancing its service offering.

Expansion of Product Support Business

Alta Equipment Group's product support business, encompassing parts and service, has demonstrated remarkable resilience and consistent organic growth, even during periods when equipment sales experienced downturns. This segment's inherent strength offers a significant opportunity for further investment and expansion.

By enhancing service capabilities, investing in technician training, and developing more robust digital parts platforms, Alta can unlock higher-margin revenue streams and deepen customer loyalty. This strategic focus not only bolsters current earnings but also significantly increases the lifetime value of the equipment already deployed in the market.

- Resilient Revenue: The product support segment consistently outperforms equipment sales during economic slowdowns.

- Margin Enhancement: Investing in service and parts infrastructure drives higher-margin revenue compared to equipment sales.

- Customer Lifetime Value: Improved support strengthens customer relationships and extends the economic life of existing equipment.

- Digital Transformation: Modernizing parts platforms can streamline operations and improve customer accessibility.

The ongoing infrastructure boom, fueled by anticipated higher state Department of Transportation budgets in 2025, presents a substantial opportunity for Alta Equipment Group. This increased spending on infrastructure projects directly translates to a greater demand for heavy equipment, benefiting companies like Alta. Furthermore, federal infrastructure initiatives are expected to sustain capital investment across various construction markets through 2025, creating sustained demand for both equipment sales and rentals.

The increasing preference for equipment rentals over outright purchases offers a significant growth avenue for Alta Equipment Group. Businesses are prioritizing capital flexibility and operational agility, a trend that Alta's robust rental fleet and rent-to-sell program are well-positioned to capitalize on. Alta's rental revenue saw a notable increase in Q1 2024, underscoring this market shift.

Technological advancements, particularly in electrification and automation, are reshaping the industry. Alta can leverage this by expanding its portfolio to include more advanced and eco-friendly machinery, catering to growing customer demand for efficiency and sustainability. The equipment finance and dealership sector's potential for mergers and acquisitions in 2025 also presents a strategic opportunity for Alta to grow through acquisitions, building on its proven integration capabilities.

Alta Equipment Group's product support segment, including parts and service, demonstrates consistent organic growth and resilience. Investing further in service capabilities, technician training, and digital parts platforms can unlock higher-margin revenue streams and enhance customer lifetime value. This segment's strength provides a stable foundation for growth and profitability.

Threats

Despite an improved outlook for 2025, the equipment finance industry, including players like Alta Equipment Group, faces considerable economic uncertainty. A significant recession could sharply reduce capital spending by industrial and construction clients, directly impacting equipment sales and rental demand.

The industrial and construction equipment market is a battleground, with numerous players vying for market share. This intense competition naturally puts a squeeze on gross margins for equipment sales, making it harder to achieve robust profitability. For instance, a significant oversupply of new equipment, a common occurrence in cyclical industries, can further heat up pricing wars, driving down profits even more.

Alta Equipment Group's own experience underscores this threat. The company recently divested its Chicago aerial fleet rental business. This strategic move was a direct response to a challenging competitive landscape and a perceived lack of adequate product support, demonstrating the real-world impact of these market pressures on business operations and profitability.

Ongoing global supply chain vulnerabilities continue to pose a significant threat to Alta Equipment Group. These disruptions can directly impact the availability of new equipment and essential spare parts, potentially causing delays in both sales and crucial service operations. For instance, the lingering effects of the semiconductor shortage, which affected many industries in 2023 and early 2024, could still ripple through equipment manufacturing.

Such persistent issues can lead to increased operational costs for Alta due to expedited shipping or sourcing from less efficient suppliers. Furthermore, reduced inventory levels become a real possibility, directly affecting the company's ability to fulfill customer orders promptly and maintain its high service standards, a critical factor in the heavy equipment sector.

Regulatory and Environmental Changes

Evolving environmental regulations, particularly those focused on emissions for heavy machinery, present a significant challenge for Alta Equipment Group. For instance, stricter EPA standards could force substantial capital outlays for upgrading or replacing existing fleets with compliant models, potentially impacting profitability. The resale value of older, non-compliant equipment may also decline sharply.

Changes in trade policies and tariffs are another considerable threat. These shifts can directly influence the cost of acquiring new equipment and essential parts from international suppliers. For example, a sudden tariff increase on imported components could inflate operating expenses, squeezing margins for Alta Equipment Group.

- Increased compliance costs due to stricter emissions standards for construction and industrial machinery.

- Potential devaluation of existing inventory as older equipment may not meet new environmental mandates.

- Supply chain disruptions and cost increases stemming from new or altered trade policies and tariffs on imported equipment and parts.

Rising Interest Rates and Financing Costs

Rising interest rates present a significant headwind for Alta Equipment Group. Higher borrowing costs directly impact Alta's customers, making equipment financing more expensive. This can lead to delayed or canceled purchases and rentals, as seen in the general economic climate where the Federal Reserve has maintained a hawkish stance on interest rates throughout 2024 and into early 2025 to combat inflation.

Furthermore, Alta faces increased financing expenses on its own operations. The cost of floor plan financing for its extensive equipment inventory and servicing its overall debt burden are directly tied to prevailing interest rates. For instance, if Alta's average interest rate on its debt increases by 1%, its annual interest expense could rise by millions, squeezing margins and impacting cash flow available for reinvestment or shareholder returns.

- Increased Customer Financing Costs: Higher rates deter customer purchases and rentals.

- Elevated Inventory Financing Expenses: Floor plan costs for Alta's equipment rise.

- Higher Debt Service Costs: Overall borrowing expenses for Alta increase.

- Potential Margin Compression: Increased financing costs can reduce profitability.

The competitive landscape remains a significant threat, with intense rivalry impacting gross margins. For example, a substantial oversupply of new equipment can trigger aggressive pricing wars, further eroding profitability for companies like Alta Equipment Group. The company's recent divestiture of its Chicago aerial fleet rental business due to competitive pressures underscores the reality of this threat.

Persistent global supply chain vulnerabilities continue to disrupt the availability of new equipment and essential spare parts. This can lead to delivery delays and increased operational costs, as seen with the lingering effects of the semiconductor shortage impacting various industries through early 2024. Reduced inventory levels are a direct consequence, hindering Alta's ability to meet customer demand promptly.

Evolving environmental regulations, particularly stricter emissions standards for heavy machinery, pose a considerable challenge. Companies may face substantial capital expenditures to upgrade fleets, and older equipment could see a sharp decline in resale value. For instance, new EPA standards could necessitate significant investments in compliant machinery.

Shifting trade policies and tariffs directly influence the cost of imported equipment and parts, potentially inflating operating expenses for Alta. For example, an increase in tariffs on essential components could squeeze profit margins, impacting overall financial performance.

Rising interest rates are a major headwind, increasing financing costs for both Alta's customers and its own inventory. The Federal Reserve's continued focus on combating inflation through 2024 and into early 2025 has kept borrowing costs elevated. This directly impacts customer purchasing decisions and Alta's own debt servicing expenses, potentially leading to margin compression.

SWOT Analysis Data Sources

This SWOT analysis for Alta Equipment Group is built upon a foundation of credible data, including their official financial filings, comprehensive market research reports, and insights from industry experts.