Alta Equipment Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

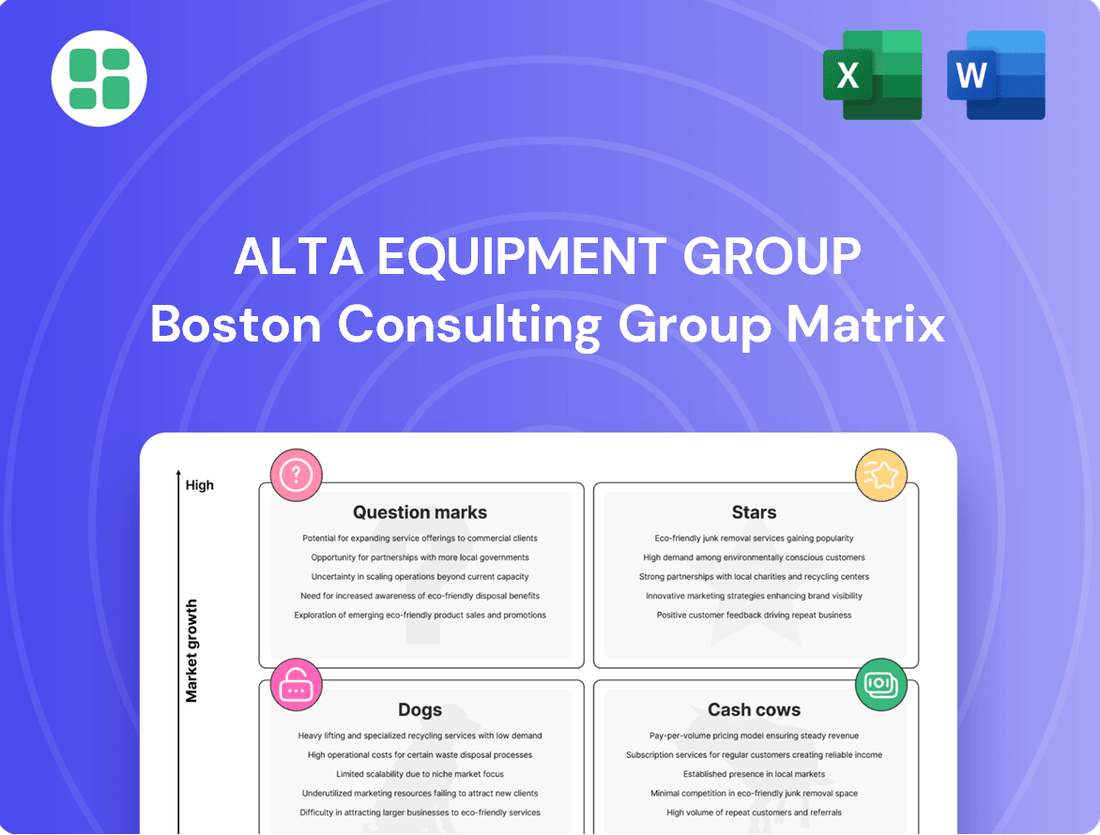

Curious about Alta Equipment Group's product portfolio performance? This BCG Matrix preview highlights key areas, but to truly understand their market standing—identifying Stars, Cash Cows, Dogs, and Question Marks—you need the full picture. Purchase the complete report for a comprehensive breakdown and actionable strategic insights.

Stars

Alta Equipment Group is strategically investing in emerging technologies like e-mobility and advanced data-driven solutions within the equipment sector. These areas are poised for substantial growth as industries transition towards more sustainable and intelligent machinery. For instance, the global electric construction equipment market is projected to reach $26.8 billion by 2030, indicating a significant opportunity for companies like Alta that are early adopters.

Alta Equipment Group's infrastructure-related construction equipment likely falls into the Stars category of the BCG Matrix. The significant push from state Departments of Transportation (DOT) budgets and federal infrastructure initiatives, such as the Infrastructure Investment and Jobs Act, creates a robust and expanding market for heavy machinery. This sustained capital expenditure is a powerful tailwind.

This focus on infrastructure means a consistent, long-term demand for Alta's equipment, offering stability beyond the cyclical nature of general non-residential construction. For instance, as of early 2024, many states reported record DOT budgets, directly translating to increased opportunities for equipment providers.

Alta Equipment Group’s history is marked by strategic acquisitions, notably expanding into new territories and integrating specialized equipment lines like Ecoverse. These moves have helped establish strong market positions in growing niches. For instance, in 2023, Alta completed acquisitions that significantly expanded its geographic footprint, contributing to a reported 17% increase in revenue for the Equipment Operations segment.

While recent acquisitions have concentrated on deepening market penetration, future strategic acquisitions in high-growth regions are crucial for solidifying Alta's Star status within the BCG matrix. The company is actively pursuing opportunities to expand its master dealer rights in key geographic territories, aiming to capture a larger share of burgeoning markets.

Advanced Aftermarket Support and Services

Alta Equipment Group's Advanced Aftermarket Support and Services, including parts and service, are a strong performer. This segment saw a 5.5% organic growth in 2024, and early 2025 data shows continued strength with an increase in service gross profit percentage.

This area is crucial for Alta. It typically boasts higher profit margins. As equipment fleets expand and age, the need for advanced maintenance and repair services naturally rises.

This positions the aftermarket segment as a high-growth, high-market share area for Alta Equipment Group.

- Consistent Organic Growth: 5.5% year-over-year increase in 2024 for parts and service.

- Strong Q1 2025 Performance: Service gross profit percentage has increased.

- High Margin Potential: Aftermarket services often contribute significantly to profitability.

- Growing Demand: Increasing equipment fleets and their aging lifecycle drive demand for sophisticated support.

Rental Fleet Expansion in Key Segments

Alta Equipment Group's strategic rental fleet expansion in key segments positions it well for growth, particularly in areas experiencing high demand. This focus on optimizing specific equipment categories, especially those linked to strong construction and industrial markets, is a hallmark of a Star in the BCG matrix.

The company's performance in Q1 2024 underscores this strategy, with rental revenue climbing by an impressive 11.5%. This surge points to robust demand for Alta's rental offerings and its effectiveness in maximizing equipment utilization.

- Strategic Expansion: Focusing on high-demand rental equipment categories that align with robust construction and industrial sectors.

- Revenue Growth: Achieved an 11.5% increase in rental revenue in Q1 2024, demonstrating strong market demand.

- Utilization Efficiency: Alta's ability to capitalize on equipment utilization is a key driver of this success.

- Rent-to-Sell Model: This model not only generates immediate rental income but also cultivates future equipment sales and aftermarket opportunities.

Alta Equipment Group's infrastructure-related construction equipment and its Advanced Aftermarket Support and Services are positioned as Stars in the BCG Matrix. These segments benefit from high market growth, driven by infrastructure spending and increasing demand for equipment maintenance. The company's strategic rental fleet expansion also shows Star characteristics, with strong revenue growth indicating high demand and effective utilization.

| BCG Category | Alta Equipment Group Segment | Market Growth | Market Share | Key Data Points (2024/Early 2025) |

|---|---|---|---|---|

| Stars | Infrastructure Construction Equipment | High (Infrastructure Investment and Jobs Act, state DOT budgets) | Strong (Acquisitions expanding footprint, new dealer rights) | Record state DOT budgets in early 2024; 17% revenue increase in Equipment Operations (2023) |

| Stars | Advanced Aftermarket Support & Services | High (Aging fleets, increased complexity) | High (Strong profit margins, growing demand) | 5.5% organic growth in 2024; increased service gross profit percentage in Q1 2025 |

| Stars | Strategic Rental Fleet Expansion | High (Robust construction and industrial markets) | High (Effective utilization, rent-to-sell model) | 11.5% increase in rental revenue in Q1 2024 |

What is included in the product

This BCG Matrix analysis categorizes Alta Equipment Group's business units, guiding strategic decisions on investment, divestment, or holding.

Provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Alta Equipment Group's traditional material handling equipment, encompassing forklifts and lift trucks, represents a significant Cash Cow. This segment thrives in a mature, stable market where Alta commands a strong, established presence.

While new equipment sales saw some dips in 2024 due to market oversupply, the segment proved resilient. Notably, North American lift truck deliveries experienced growth in 2024, underscoring its underlying strength.

The consistent generation of substantial cash flow is a hallmark of this segment. This is driven by a loyal customer base and the recurring, essential nature of material handling needs.

Alta Equipment Group's core aftermarket parts sales represent a classic cash cow. In 2024, this segment generated a robust $294.4 million in revenue, underscoring its significant contribution. This predictable and profitable business thrives on the extensive installed base of equipment that necessitates continuous maintenance and part replacements.

The aftermarket parts segment offers stable, high-margin revenue streams. While growth in this area is typically lower compared to other business units, the consistent demand ensures it acts as a reliable cash generator for Alta Equipment Group. This stability is a key characteristic of a cash cow, providing a dependable financial foundation.

Routine equipment maintenance and repair services represent a significant Cash Cow for Alta Equipment Group. These services are vital for keeping customer equipment operational and extend its lifespan, creating a dependable and profitable income source. In 2024, service revenues saw a healthy increase, reaching $253.8 million, highlighting the consistent demand and strong performance of this segment.

This consistent revenue stream is a cornerstone of Alta Equipment Group's financial stability. By providing essential upkeep, the company fosters strong customer loyalty and ensures recurring cash flow, effectively insulating it from the cyclical nature of new equipment sales. This reliable income supports ongoing operations and strategic investments.

Established Geographic Footprint and Branch Network

Alta Equipment Group's established geographic footprint and branch network, boasting over 85 locations across North America, positions its dealerships as strong cash cows within the BCG matrix. This extensive, mature network requires less capital infusion to sustain its market position, allowing it to consistently generate substantial cash flow. For instance, as of early 2024, the company's broad reach across numerous states and Canadian provinces underscores its stability and ability to capture consistent revenue from sales, rentals, and services.

These mature operations are characterized by their ability to generate reliable cash flow with limited need for aggressive expansion or innovation investment. This stability is a hallmark of cash cow businesses.

- Extensive Network: Over 85 locations across North America.

- Stable Foundation: Supports consistent sales, rentals, and services.

- Reduced Investment Needs: Allows for consistent cash generation.

- Market Dominance: Significant competitive advantage in established markets.

Long-Term Rental Contracts for Core Equipment

Long-term rental contracts for core equipment represent a significant cash cow for Alta Equipment Group. These agreements, often with established clients in stable industries, generate a predictable and consistent stream of revenue. In 2024, Alta Equipment Group continued to leverage its robust fleet, focusing on maximizing utilization rates for its most reliable machinery.

The company's strategy prioritizes securing multi-year rental agreements for frequently used equipment, ensuring a steady return on investment. This approach is particularly effective for machinery deployed in sectors with consistent demand, such as construction and infrastructure development. Alta’s commitment to maintaining a high-quality, well-utilized rental fleet underpins the cash cow status of these contracts.

- Predictable Revenue: Long-term contracts provide a stable income base, reducing financial volatility.

- High Utilization: Core equipment is kept in constant operation, maximizing asset efficiency.

- Established Client Base: Repeat business from reliable customers ensures ongoing demand.

- Proven Equipment: Utilizing machinery with a track record of performance minimizes maintenance surprises and downtime.

Alta Equipment Group's aftermarket parts and service segments are definitive Cash Cows, consistently generating substantial revenue with high margins. In 2024, aftermarket parts alone brought in $294.4 million, while service revenues reached $253.8 million, demonstrating their critical role in the company's financial stability.

These segments benefit from a large, established installed base of equipment, ensuring ongoing demand for maintenance, repairs, and replacement parts. This predictable revenue stream requires minimal new investment, allowing Alta to leverage these mature operations for reliable cash generation.

The company's extensive network of over 85 branches across North America further solidifies these segments as cash cows. This mature infrastructure supports consistent sales, rentals, and services, providing a stable foundation with reduced capital expenditure needs.

Long-term rental contracts for core equipment also function as cash cows, offering predictable income streams from a loyal customer base. Alta's focus on maximizing utilization rates for its reliable machinery ensures these contracts deliver steady returns.

| Segment | 2024 Revenue (Millions USD) | Key Characteristics |

|---|---|---|

| Aftermarket Parts | $294.4 | High margins, recurring demand, low investment needs |

| Service & Maintenance | $253.8 | Essential for equipment longevity, customer loyalty driver |

| Long-Term Rentals (Core Equipment) | N/A (Focus on utilization) | Predictable revenue, high asset efficiency |

| Established Branch Network | N/A (Supports other segments) | Mature, stable, low capital expenditure |

What You’re Viewing Is Included

Alta Equipment Group BCG Matrix

The Alta Equipment Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or demo content, just a professionally crafted strategic analysis ready for your immediate use. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the complete report, ensuring no surprises and immediate utility for your business planning.

Dogs

Underperforming regional rental fleets, such as Alta Equipment Group's recently divested aerial fleet in Chicago for $18.0 million, often represent the Dogs in a BCG Matrix. This divestiture, attributed to a competitive market and insufficient product support, highlights businesses with low market share and limited growth prospects.

Outdated or niche equipment, such as older internal combustion engine models being replaced by electric alternatives, often finds itself in the Dogs quadrant of the BCG matrix. These products typically exhibit low market share and minimal growth potential, tying up valuable capital without generating significant returns.

For instance, in 2024, the demand for certain legacy construction equipment models that have been superseded by more technologically advanced and fuel-efficient counterparts has seen a notable decline. Companies holding substantial inventory of these older units may face challenges in liquidation, impacting their overall profitability and capital efficiency.

Within Alta Equipment Group's used equipment segment, certain categories can be classified as Dogs in a BCG Matrix analysis. These are typically older models with low market demand, requiring significant investment in reconditioning before sale.

For instance, if Alta holds a substantial inventory of older, less technologically advanced telehandlers that are slow to sell and incur high carrying costs, these would likely fall into the Dog quadrant. Such assets may offer minimal profit margins or even represent a net loss due to storage and maintenance expenses.

Segments Impacted by Significant Market Oversupply

The construction equipment sector experienced significant headwinds in 2024, primarily driven by an oversupply within dealer channels. This situation put considerable pressure on gross margins and market share for companies like Alta Equipment Group. Alta's objective is to achieve market normalization by 2025, but certain segments facing prolonged oversupply where the company lacks a distinct competitive edge are at risk.

These vulnerable segments, if they continue to exhibit low market share and stagnant growth, could be categorized as Dogs within the BCG Matrix framework. For instance, if the heavy equipment rental segment, which saw a 5% decline in utilization rates in early 2024 according to industry reports, doesn't recover with Alta unable to differentiate its offerings, it could fall into this category.

- Construction Equipment Oversupply: Industry dealer channels were significantly overstocked in 2024, impacting gross margins.

- Market Share Pressure: Companies struggled to maintain market share due to the oversupply conditions.

- Alta's Normalization Goal: Alta Equipment Group aims for market normalization by 2025.

- Risk of "Dogs": Segments with persistent oversupply and no competitive advantage risk becoming Dogs if market share and growth remain low.

Geographic Markets with Limited Growth Potential

Geographic markets with limited growth potential for Alta Equipment Group are those regions where the demand for equipment is stagnant and Alta's market presence is minimal. These areas, often mature or saturated, present challenges for expansion.

For instance, if a particular state or region shows consistently low year-over-year growth in construction or industrial equipment sales, and Alta's market share there is below 5%, it would likely fall into this category. An example could be a Midwestern state with an aging industrial base and limited new infrastructure projects. In 2023, for example, some less industrialized states in the Midwest saw equipment rental revenue growth rates in the low single digits, significantly below the national average.

- Mature Markets: Regions with established infrastructure and little new development.

- Low Market Share: Areas where Alta's presence is insignificant.

- Stagnant Demand: Geographic areas experiencing minimal economic activity related to equipment sales or rentals.

- Limited Investment Justification: These markets may not warrant substantial capital allocation for growth initiatives.

Dogs in Alta Equipment Group's portfolio represent segments with low market share and little to no growth prospects, often burdened by oversupply or outdated offerings. For example, legacy construction equipment models, facing declining demand in 2024 due to advancements in technology, can become Dogs. These underperforming assets tie up capital without generating substantial returns, impacting overall profitability and efficiency.

Geographic markets with stagnant demand and minimal market presence for Alta also fall into the Dog category. These mature or saturated regions, like some Midwestern states that saw low single-digit rental revenue growth in 2023, do not warrant significant investment for expansion.

The oversupply in construction equipment dealer channels during 2024 pressured margins and market share, increasing the risk for segments where Alta lacks a competitive edge. If these segments continue to show low utilization rates, such as a potential 5% decline in heavy equipment rental utilization observed in early 2024, they risk becoming Dogs.

Divesting underperforming assets, like Alta's $18.0 million sale of its Chicago aerial fleet, is a strategy to manage these Dogs. This move addresses competitive market challenges and insufficient product support, aiming to reallocate resources more effectively.

| Segment Example | BCG Category | Reasoning | 2024/2023 Data Point |

|---|---|---|---|

| Legacy Construction Equipment | Dog | Low market share, declining demand due to technological obsolescence | Demand for superseded models declined |

| Mature Geographic Markets | Dog | Stagnant demand, minimal market presence | Low single-digit rental revenue growth in some Midwestern states (2023) |

| Underperforming Rental Fleets | Dog | Low utilization, competitive market, insufficient support | Chicago aerial fleet divestiture ($18.0 million) |

| Segments with Persistent Oversupply | Dog | Low market share, no competitive advantage, stagnant growth | Potential 5% decline in heavy equipment rental utilization (early 2024) |

Question Marks

Alta Equipment Group is strategically positioning itself within the burgeoning e-mobility sector, recognizing its significant growth potential for industrial and construction equipment. This area, while promising, represents a nascent market for Alta, meaning their current penetration and market share are likely modest.

Capitalizing on this high-growth e-mobility segment necessitates substantial investment. This includes building out a robust inventory of electric-powered machinery, establishing necessary charging infrastructure, and developing specialized service capabilities to support these advanced technologies.

The market for advanced data analytics and predictive maintenance services in the equipment sector is booming, with projections indicating significant growth. For instance, the global telematics market, which underpins fleet management solutions, was valued at approximately $30 billion in 2023 and is expected to reach over $70 billion by 2028, showcasing a compound annual growth rate of around 18%.

Alta Equipment Group can capitalize on this trend by offering sophisticated fleet management solutions that harness telematics data. These solutions can provide real-time insights into equipment performance, maintenance needs, and operational efficiency, allowing customers to optimize their fleets and reduce downtime.

However, Alta's current market presence in these specialized software and service segments may be nascent. Establishing a strong foothold in this competitive landscape will likely demand considerable investment in technology development, talent acquisition, and marketing to effectively differentiate its offerings and achieve scalable growth.

Alta Equipment Group's strategic consideration of expansion into new, untapped geographic markets positions these ventures as potential Question Marks within the BCG framework. While Alta has demonstrably grown its branch network, venturing into regions where its presence is currently minimal represents a significant undertaking with inherent risks and potential rewards.

These new market entries demand substantial upfront capital for establishing infrastructure, marketing, and sales operations. The uncertainty surrounding customer adoption rates, the intensity of local competition, and the ability to achieve significant market share are key factors contributing to their Question Mark status. For instance, entering a market like Southeast Asia, known for its rapid economic development and growing infrastructure needs, would require careful analysis of local regulatory environments and competitive landscapes.

Specialized Environmental Processing Equipment (Ecoverse)

Alta Equipment Group's acquisition of Ecoverse Industries LTD in 2022 strategically positioned it within the burgeoning wholesale master distribution of environmental processing equipment. This move into a specialized niche, while promising, means Alta's current market share in this segment is likely still developing. For instance, the global environmental equipment market was valued at approximately $280 billion in 2023 and is projected to grow significantly, indicating substantial opportunity for expansion.

Given the growth trajectory of the environmental sector, Ecoverse, as a specialized unit within Alta, could be categorized as a question mark in the BCG matrix. This suggests it has high growth potential but currently holds a low market share. Continued strategic investment in sales, marketing, and potentially product development will be crucial for Ecoverse to increase its penetration and solidify its position.

- Market Growth: The environmental processing equipment market is expanding, driven by increasing regulatory compliance and sustainability initiatives.

- Low Market Share: Despite its niche focus, Ecoverse's market share within this specialized segment is likely still nascent following its 2022 acquisition.

- Investment Need: To transition from a question mark to a star, Ecoverse requires strategic investment to build brand awareness and distribution networks.

- Future Potential: Successful market capture could see Ecoverse become a significant revenue driver for Alta Equipment Group as environmental concerns continue to rise.

Leveraging AI in Equipment Finance and Operations

The equipment finance sector is rapidly adopting AI to streamline the entire leasing process, from application to servicing, and to unlock new avenues for funding. Alta Equipment Group could see significant growth by investing in AI for internal efficiencies and customer financing, particularly in areas where their current market presence is limited.

AI can optimize underwriting, automate documentation, and personalize customer interactions, potentially boosting Alta's market share in these nascent AI-driven segments. For instance, AI-powered predictive maintenance can reduce downtime and operational costs for leased equipment, a key differentiator.

- AI-driven credit scoring can improve loan approval rates and reduce risk.

- Predictive analytics can forecast equipment maintenance needs, minimizing unexpected breakdowns.

- AI can personalize financing offers, enhancing customer acquisition and retention.

- Automation of administrative tasks frees up resources for strategic growth initiatives.

New geographic market entries for Alta Equipment Group represent potential Question Marks. These ventures possess high growth potential but currently low market share, demanding significant investment for infrastructure and market penetration. Success hinges on overcoming competitive landscapes and ensuring customer adoption.

The Ecoverse Industries LTD acquisition positions environmental processing equipment as a Question Mark. While the market is growing, Alta's share is still developing, requiring strategic investment to build brand awareness and distribution. This segment could become a key revenue driver.

Investing in AI for equipment finance and internal efficiencies also falls into the Question Mark category. While AI offers significant growth potential and competitive advantages, Alta's current market penetration in these AI-driven segments is likely nascent. Continued investment is key to unlocking these benefits.

BCG Matrix Data Sources

Our Alta Equipment Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.