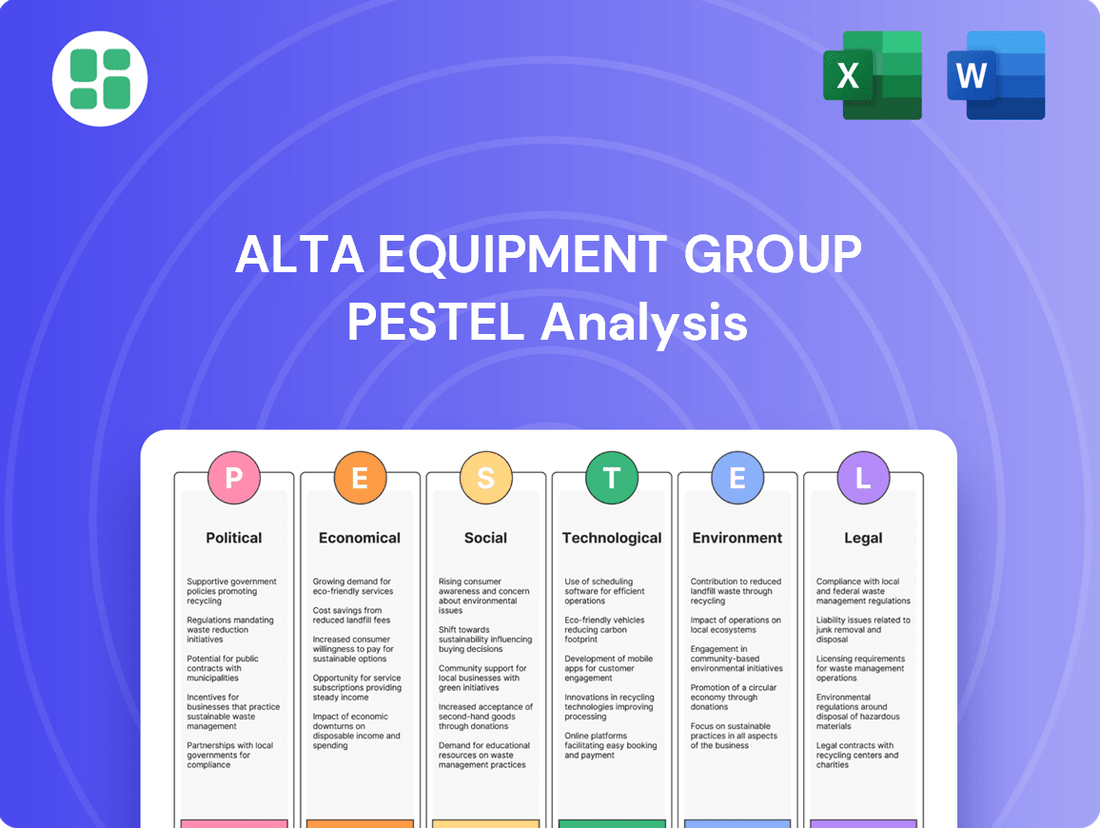

Alta Equipment Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

Political shifts, economic volatility, and technological advancements are profoundly influencing Alta Equipment Group's operational landscape. Understanding these external forces is crucial for strategic planning and risk mitigation. Download our comprehensive PESTLE analysis to gain actionable intelligence and stay ahead of the curve.

Political factors

Government-led infrastructure development projects are a significant driver for the heavy construction equipment market, directly benefiting Alta Equipment Group.

Initiatives like the $1 trillion Infrastructure Investment and Jobs Act (IIJA) in the US, enacted in 2021, are set to provide a sustained pipeline of projects through 2025 and beyond. This legislation is projected to boost demand for construction and material handling equipment, as well as rental services, by an estimated $250 billion annually.

These projects encompass a wide range of areas including roads, bridges, electric power grids, rail, transit, airports, broadband, and environmental initiatives, all of which require the types of equipment Alta Equipment Group specializes in providing.

Changes in international trade policies and tariffs can significantly influence Alta Equipment Group's operational costs and supply chain reliability. For instance, tariffs imposed on construction equipment or essential components could directly increase the cost of goods sold, impacting profitability.

While specific tariff impacts on Alta haven't been detailed recently, the broader construction equipment sector has faced challenges. Supply chain disruptions, particularly from key manufacturing hubs like China and South Korea, have been a notable headwind throughout 2024 and into 2025, affecting the availability and pricing of both new machinery and replacement parts.

The regulatory environment for construction and industrial equipment is a significant political factor for Alta Equipment Group. Evolving standards for emissions and safety directly impact the types of products Alta can offer and the costs associated with compliance. For instance, the push towards lower carbon emissions is a major trend, requiring significant investment in new technologies and inventory adaptation.

As of 2024, many regions are implementing or strengthening regulations on equipment emissions. For example, the EPA in the United States continues to enforce Tier 4 emission standards for diesel engines, which significantly impact the design and cost of new equipment. Similarly, Europe's Stage V emission standards for non-road mobile machinery are driving demand for cleaner technologies, forcing companies like Alta to pivot their offerings and invest in training for servicing these advanced machines.

Government Incentives and Subsidies

Government incentives designed to promote technological advancements, particularly in areas like electric or hybrid machinery and support for manufacturing sectors, present significant growth avenues for Alta Equipment Group. These programs can directly stimulate demand for the types of innovative solutions Alta offers.

Subsidies and tax credits, notably in the European Union and North America, have demonstrably impacted equipment acquisition trends. For instance, these policies contributed to a notable 25% surge in zero-emission equipment purchases during 2024, a clear indicator of how such financial support bolsters the market for environmentally conscious machinery that Alta supplies.

- Increased Demand: Incentives make advanced, greener equipment more affordable, driving customer adoption.

- Market Expansion: Government support can open new markets or accelerate growth in existing ones for new technologies.

- Competitive Advantage: Companies like Alta that align with incentive programs gain a competitive edge.

Political Stability and Elections

Political stability and the outcomes of elections significantly shape customer sentiment and investment decisions within the industrial and construction sectors. For example, a positive shift in customer sentiment following the late 2024 elections helped boost equipment demand, even with persistent challenges to gross margins. This indicates that political certainty can directly translate into tangible business opportunities.

Anticipation of policy changes from incoming administrations can create a ripple effect on future business outlooks. For instance, potential shifts in infrastructure spending or regulatory frameworks following a new administration's election in 2024 could influence capital expenditure plans for construction and industrial companies into 2025. This makes monitoring electoral results and proposed policies crucial for strategic planning.

- Electoral Impact: Post-election sentiment in late 2024 positively affected equipment demand.

- Policy Uncertainty: New administrations' proposed policies can create uncertainty for future investment.

- Market Responsiveness: The industrial and construction sectors are sensitive to political stability and policy direction.

Government spending on infrastructure, like the US Infrastructure Investment and Jobs Act, fuels demand for Alta Equipment Group's machinery. Regulatory shifts, such as stricter emission standards in the US and Europe, necessitate technological adaptation and can increase compliance costs. Government incentives, including subsidies for green equipment, have demonstrably boosted sales, with a notable 25% surge in zero-emission machinery purchases in 2024.

Political stability and election outcomes directly influence customer confidence and investment. Positive post-election sentiment in late 2024, for example, saw an uptick in equipment demand, highlighting the sector's sensitivity to political certainty.

| Political Factor | Impact on Alta Equipment Group | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Infrastructure Spending | Increased demand for construction and material handling equipment. | US Infrastructure Investment and Jobs Act driving projects through 2025. Estimated $250 billion annual boost to equipment demand. |

| Emissions Regulations | Need for investment in compliant technologies and inventory adaptation. | Continued enforcement of US EPA Tier 4 and EU Stage V emission standards impacting equipment design and cost. |

| Government Incentives | Accelerated adoption of advanced and green equipment. | Contributed to a 25% surge in zero-emission equipment purchases in 2024. |

| Political Stability/Elections | Influences customer sentiment and investment decisions. | Positive post-election sentiment in late 2024 led to increased equipment demand. |

What is included in the product

This PESTLE analysis for Alta Equipment Group meticulously examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive understanding of the external landscape, enabling informed decision-making and proactive strategy development for the company.

This PESTLE analysis provides a clear, summarized version of the external factors impacting Alta Equipment Group, offering a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning and decision-making.

Economic factors

Fluctuations in interest rates directly influence how much it costs Alta Equipment Group's customers to finance their equipment purchases and rentals. For instance, the Federal Reserve's benchmark interest rate, which influences many lending rates, saw increases through much of 2023 and early 2024, making borrowing more expensive.

The equipment finance industry faced headwinds in 2024 due to these higher interest rates, which dampened demand. While a slight easing of rates in late 2024 provided some relief, the prospect of further rate reductions in 2025 is a key factor to watch.

When borrowing costs rise, it can put pressure on customers' profit margins, often leading them to postpone or scale back equipment acquisition plans, which directly impacts Alta's sales and rental revenue streams.

The overall health of the economy is a critical driver for Alta Equipment Group, especially the construction and industrial sectors. Strong economic conditions translate directly into increased demand for the heavy machinery and services Alta provides.

The heavy construction equipment market is expected to see robust growth, expanding from an estimated $204.24 billion in 2024 to $219.33 billion in 2025. This surge is largely fueled by the ongoing expansion within the construction industry and significant investments in infrastructure projects.

While some economic uncertainties might lead to a stabilization in non-residential construction during 2025, it's important to note that overall construction spending year-to-date is actually exceeding the figures from 2024, indicating continued activity and demand.

Inflationary pressures significantly impact Alta Equipment Group's operational costs. Rising prices for essential raw materials like steel, coupled with increased labor expenses due to wage adjustments, directly affect the company's cost of goods sold and can necessitate higher equipment pricing for customers.

The construction equipment sector faced considerable headwinds in 2024 and early 2025 due to escalating raw material costs and ongoing supply chain disruptions. These factors have squeezed original equipment manufacturer (OEM) margins, making it challenging to maintain profitability amidst these cost increases.

These rising input costs, including the necessity to offer competitive wages to attract and retain skilled labor, create a double-edged sword for Alta Equipment Group. Not only do these pressures impact Alta's own profitability, but they also translate to increased operational expenses for their customer base, potentially affecting demand for new equipment.

Supply Chain Dynamics

Supply chain dynamics significantly impact Alta Equipment Group's operations, influencing the availability of new machinery and essential parts. While 2024 saw considerable supply chain disruptions, the heavy construction equipment sector anticipates a shift towards normalization and greater predictability throughout 2025. This evolving landscape is expected to lead to improved equipment availability and reduced delivery times for Alta and its clientele.

The normalization trend in supply chains is a critical factor for Alta. As lead times for components and finished goods decrease, the company can better manage its inventory and fulfill customer orders more efficiently. For instance, improvements in semiconductor availability, a key component in modern heavy equipment, are crucial for manufacturers like those Alta partners with.

- Supply Chain Normalization: Expected throughout 2025, leading to more predictable availability of new equipment and parts.

- Impact on Alta: Improved equipment availability and delivery times for Alta and its customers.

- Industry Trend: Heavy construction equipment sector moving from disruption to stabilization.

Rental Market Trends

The demand for equipment rental versus outright purchase is a significant economic factor for Alta Equipment Group, directly impacting its fleet management strategies and revenue streams. As of early 2024, the US equipment rental market is projected to experience consistent growth, with forecasts extending through 2028. This expansion is largely fueled by increased infrastructure investment and a growing inclination towards renting equipment, especially as the cost of acquiring new machinery continues to climb.

Alta's strategic decision in 2024 to decrease the size of its rent-to-sell fleet and simultaneously boost overall fleet utilization demonstrates a proactive response to these prevailing market conditions. This initiative aims to capitalize on the rental demand while optimizing the efficiency of its existing assets.

- The US equipment rental market is anticipated to grow steadily through 2028.

- Infrastructure spending is a primary driver of this rental market expansion.

- Rising new equipment acquisition costs encourage a preference for rental solutions.

- Alta Equipment Group is adjusting its fleet strategy in 2024 to align with these trends.

Economic factors significantly influence Alta Equipment Group's performance, with interest rates and overall economic health being paramount. Higher interest rates in 2023 and early 2024 increased financing costs for customers, potentially dampening demand for equipment purchases and rentals. However, the heavy construction equipment market is projected for robust growth, with an estimated expansion from $204.24 billion in 2024 to $219.33 billion in 2025, driven by infrastructure investments.

| Economic Factor | Impact on Alta Equipment Group | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Affects customer financing costs and demand for equipment. | Increased through early 2024; slight easing expected later in 2024/2025. |

| Economic Growth (Construction/Industrial) | Directly correlates with demand for heavy machinery. | Heavy construction equipment market to grow from $204.24B (2024) to $219.33B (2025). |

| Inflation | Increases operational costs (raw materials, labor). | Escalating raw material costs and wage adjustments impacting margins. |

| Equipment Rental Demand | Influences fleet utilization and revenue. | US equipment rental market projected for consistent growth through 2028, driven by infrastructure spending. |

Preview Before You Purchase

Alta Equipment Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Alta Equipment Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to offer actionable insights for strategic planning.

Sociological factors

Persistent labor shortages in construction and industrial sectors directly affect Alta Equipment Group's customers. These shortages can slow down projects, leading to reduced demand for new equipment as contractors face difficulties filling critical roles, especially for skilled craft workers.

The construction industry alone is projected to need an additional 439,000 workers in 2025 to keep pace with demand. This scarcity of labor means many companies struggle to operate at full capacity, impacting their purchasing power for essential machinery.

Project delays caused by labor gaps increase financing and holding costs for contractors. These added expenses can strain a contractor's budget, potentially making them hesitant to invest in new equipment, thereby dampening sales opportunities for Alta.

The aging workforce presents a significant challenge for Alta Equipment Group's customers. With an estimated 41% of the construction workforce set to retire by 2031, there's a growing scarcity of experienced professionals. This demographic trend directly impacts the demand for equipment that can bridge this experience gap.

This demographic shift means a substantial portion of the remaining workforce may lack the deep, hands-on experience of retiring workers. Consequently, there's a rising need for machinery that is more intuitive to operate, incorporates advanced automation, or requires less specialized, time-intensive training.

Alta Equipment Group must consider this evolving labor landscape when curating its equipment offerings and developing training programs. The demand for user-friendly, technologically advanced equipment that can be operated efficiently by a less experienced workforce will likely increase.

Customer preferences are shifting significantly, with a growing demand for equipment that is not only technologically advanced and user-friendly but also environmentally sustainable. This evolution directly impacts Alta Equipment Group's sales and rental portfolios.

A key trend is the increasing preference for electric and hybrid machinery. This surge is fueled by stricter environmental regulations and corporate sustainability objectives. For instance, by the end of 2024, it's projected that over 15% of new heavy equipment sales in North America will incorporate some form of electrification, a figure expected to climb to 25% by 2026, with major manufacturers actively expanding their eco-friendly model lines.

Furthermore, customers are increasingly valuing digital tools and personalized service interactions. This is prompting Alta to invest in enhancing its customer relationship management systems and digital platforms to provide a more tailored and efficient experience, aiming to boost customer satisfaction scores by an estimated 10% in the coming year.

Safety Culture and Standards

The construction and industrial sectors are placing an ever-greater importance on safety. This heightened focus directly fuels demand for equipment equipped with sophisticated safety technologies. For instance, manufacturers are increasingly embedding features such as proximity sensors, rearview cameras, and blind-spot monitoring systems into heavy machinery to improve operator visibility and minimize accidents.

Alta Equipment Group, as a key player in this market, must ensure its rental fleet not only meets but surpasses these escalating safety benchmarks. Furthermore, educating customers on the correct and effective utilization of these advanced safety features is crucial for accident prevention and operational efficiency.

- Growing Demand for Safety: The construction industry, for example, saw a 5.6% increase in safety training hours per employee in 2024, reflecting the sector's commitment to reducing incidents.

- Technological Integration: By mid-2025, it's projected that over 70% of new heavy equipment will come standard with at least two advanced safety features, up from 45% in 2023.

- Alta's Role: Alta's fleet modernization efforts in 2024 included a 15% investment in equipment upgrades featuring enhanced safety systems, aiming to meet stringent client requirements.

- Customer Education: Providing comprehensive training on telematics and safety features can reduce equipment misuse incidents by an estimated 20-25%.

Urbanization and Demographic Shifts

Rapid urbanization continues to fuel the demand for construction and material handling equipment. As populations grow and migrate to cities, particularly in developing economies, the need for new infrastructure and housing projects escalates. This trend directly translates into increased sales opportunities for companies like Alta Equipment Group, even within their established North American markets, as global economic development often influences regional investment and construction activity.

Demographic shifts, including an aging population in some developed nations and a younger, growing workforce in others, also play a crucial role. An aging workforce might necessitate more efficient, automated equipment, while a growing young population can drive demand for entry-level housing and infrastructure. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from the current 57%. This sustained urbanization underscores the long-term importance of construction and material handling machinery.

- Urban Population Growth: Global urban population is projected to reach 6.7 billion by 2050, up from 4.4 billion in 2021, according to UN data.

- Infrastructure Investment: Many governments are increasing infrastructure spending to accommodate urban growth, directly benefiting construction equipment manufacturers.

- Emerging Market Demand: Emerging markets, with their rapidly expanding urban centers, represent a significant growth driver for the construction equipment sector.

Sociological factors significantly influence Alta Equipment Group's market dynamics, primarily through evolving customer preferences and workforce demographics. The increasing demand for technologically advanced, user-friendly, and environmentally sustainable equipment, particularly electric and hybrid models, is a key trend. By mid-2025, over 15% of new heavy equipment sales in North America are expected to incorporate electrification, a figure projected to reach 25% by 2026.

Furthermore, a heightened emphasis on safety within the construction sector is driving demand for machinery with advanced safety features. By mid-2025, it's projected that over 70% of new heavy equipment will come standard with at least two advanced safety features. Alta's investment in fleet modernization in 2024 included a 15% allocation to equipment upgrades with enhanced safety systems to meet these stringent client requirements.

Technological factors

The heavy equipment sector is seeing significant integration of automation, robotics, and artificial intelligence. This trend is directly impacting operational efficiency, safety protocols, and the precision of tasks performed on job sites.

Automated heavy machinery, such as robotic excavators and self-driving bulldozers, are now capable of executing intricate operations with dramatically reduced human input. This not only minimizes the potential for human error but also substantially enhances workplace safety by keeping operators out of hazardous situations.

For companies like Alta Equipment Group, this technological shift necessitates a strategic adaptation of their inventory offerings and service infrastructure. They must be prepared to support and maintain these advanced, sophisticated machines to remain competitive in the evolving market.

The industry is rapidly shifting towards electric, hybrid, and alternative fuel vehicles, a change driven by stricter environmental regulations and a growing emphasis on sustainability. This transition is particularly noticeable in the construction sector, where advancements in battery technology are making electric equipment more viable, offering benefits such as reduced emissions and lower operating expenses.

For instance, by the end of 2024, it's projected that the global electric construction equipment market will reach approximately $10.6 billion, with significant growth anticipated in the coming years. Alta Equipment Group needs to actively invest in and promote these cleaner alternatives to align with evolving customer preferences and comply with increasingly stringent environmental mandates.

The increasing integration of telematics and Internet of Things (IoT) in heavy equipment is a significant technological driver. These systems provide real-time data on machine performance, location, and usage, which is invaluable for operational efficiency and maintenance planning. For instance, by tracking engine hours and fuel consumption, customers can better manage their resources and reduce operating expenses.

Alta Equipment Group can capitalize on this trend by enhancing its aftermarket support services. Offering predictive maintenance solutions powered by telematics data can help customers avoid costly downtime and extend the lifespan of their machinery. As of late 2024, the adoption of IoT in the construction equipment sector is rapidly growing, with many manufacturers embedding these capabilities as standard, signaling a shift towards more connected and data-driven operations.

Digital Platforms for Sales and Service

The shift towards digital platforms for sales and service is fundamentally altering how customers interact with equipment providers. Alta Equipment Group, like its peers, must embrace this trend to remain competitive. For instance, the global equipment rental market is projected to reach $126.7 billion by 2027, with digital channels playing an increasingly significant role in customer acquisition and service delivery.

Investing in a robust digital infrastructure allows companies to offer a more streamlined and efficient customer journey. This includes everything from browsing inventory and securing rentals online to accessing real-time service updates and predictive maintenance alerts. Companies that excel in this area, such as those offering intuitive mobile apps and comprehensive online portals, are better positioned to capture market share.

Alta Equipment Group's strategic focus on digital transformation is crucial for several reasons:

- Enhanced Customer Experience: Digital platforms enable personalized interactions, faster response times, and convenient access to information, improving overall customer satisfaction.

- Operational Efficiency: Automating sales, rental, and service processes through digital tools can significantly reduce administrative overhead and improve resource allocation.

- New Revenue Streams: Digital capabilities can unlock opportunities for data-driven services like remote monitoring, predictive maintenance subscriptions, and optimized fleet management, creating new avenues for revenue growth.

Predictive Maintenance and AI Analytics

AI-powered predictive maintenance is revolutionizing equipment management. By analyzing vast datasets, these systems can anticipate failures before they occur, ensuring machines operate at peak efficiency. This translates directly to reduced fuel waste and minimized costly downtime, critical for industries relying on heavy machinery.

For Alta Equipment Group, integrating AI analytics offers substantial advantages. Beyond predicting maintenance needs, AI can also monitor worker productivity and identify potential safety hazards in real-time. This proactive approach allows for timely interventions, improving overall operational safety and efficiency.

Alta's aftermarket services stand to gain significantly from these advancements. Offering predictive maintenance as part of their service packages enhances customer value by extending equipment lifespan and reducing unexpected repair costs. For instance, by 2025, the global predictive maintenance market is projected to reach $28.25 billion, indicating a strong demand for such solutions.

- Improved Machine Uptime: AI predicts component failures, allowing for scheduled maintenance, thus minimizing unexpected breakdowns.

- Enhanced Fuel Efficiency: Optimal machine performance, a result of predictive maintenance, directly reduces fuel consumption.

- Proactive Service Offerings: Alta can leverage AI to provide customers with proactive maintenance schedules and support, increasing customer satisfaction and loyalty.

The heavy equipment sector is increasingly adopting automation, robotics, and AI, boosting efficiency and safety. For example, automated excavators can perform complex tasks with minimal human input, reducing errors and operator risk. Alta Equipment Group must adapt its offerings and services to support these advanced machines to stay competitive in this evolving landscape.

The industry is shifting towards electric and hybrid vehicles due to environmental regulations. The global electric construction equipment market is projected to reach $10.6 billion by the end of 2024, highlighting a strong move towards sustainability. Alta Equipment Group needs to invest in and promote these cleaner alternatives to meet customer demand and comply with environmental standards.

Telematics and IoT integration provide real-time data on machine performance, aiding efficiency and maintenance. By tracking usage, customers can better manage resources. Alta can enhance its aftermarket support by offering predictive maintenance based on this data, reducing downtime. The adoption of IoT in construction equipment is rapidly growing, signaling a trend towards data-driven operations.

Digital platforms are transforming customer interactions for sales and service. The global equipment rental market is expected to reach $126.7 billion by 2027, with digital channels playing a key role. Alta Equipment Group's digital investment is crucial for an enhanced customer experience, operational efficiency, and new revenue streams from data-driven services.

Legal factors

Stricter environmental regulations, especially regarding carbon emissions from heavy machinery, directly influence Alta Equipment Group's product compliance and sales strategies. The U.S. Environmental Protection Agency (EPA) has been progressively implementing more stringent emissions guidelines for new equipment, with a notable push towards low-emission and zero-emission vehicles impacting the 2024 and 2025 model years.

Non-compliance with these evolving standards can result in substantial fines and diminished marketability for Alta's fleet. Consequently, the company must proactively ensure its inventory aligns with both current and anticipated environmental benchmarks, potentially necessitating investments in cleaner technologies and updated product lines to maintain competitiveness.

Occupational Health and Safety (OHS) laws are a significant consideration for Alta Equipment Group. These regulations mandate that the equipment Alta provides, particularly for construction sites, must meet stringent safety standards for operation. This legal framework directly influences Alta's product development, pushing for features like proximity sensors and advanced camera systems, which are designed to prevent accidents and injuries. For instance, in 2023, the Occupational Safety and Health Administration (OSHA) reported over 170,000 citations for OHS violations in the construction industry alone, highlighting the critical need for compliance.

Product liability and warranty laws directly shape Alta Equipment Group's obligations concerning the equipment it sells and rents. These regulations impact how Alta manages risk and structures its service agreements, especially given the heavy machinery it deals with. For instance, in 2023, the construction equipment sector saw a notable increase in product recalls, underscoring the importance of these legal frameworks for companies like Alta.

Alta's commitment to extensive aftermarket support, encompassing parts, maintenance, and repair services, is a crucial strategy for managing equipment performance and longevity. This proactive approach helps mitigate potential product liability issues by ensuring equipment is maintained to high standards. In 2024, industry reports highlighted that companies with strong aftermarket support often experienced lower warranty claim rates, a trend Alta likely aims to leverage.

Establishing and maintaining robust warranty agreements with manufacturers, coupled with clear and transparent terms for customers, is paramount. This dual approach protects Alta from unforeseen defects and ensures customer satisfaction, thereby minimizing disputes and potential legal entanglements. The average warranty period for heavy construction equipment can range from 12 to 24 months, making these agreements a significant factor in operational costs and risk assessment for Alta.

Labor Laws and Employment Regulations

Changes in labor laws, such as minimum wage adjustments and updated working condition standards, directly influence Alta Equipment Group's operational expenses and how it manages its workforce. For instance, the Bureau of Labor Statistics reported that wages in construction and extraction occupations increased by an average of 4.5% in the year ending May 2024, reflecting ongoing pressures from labor shortages. These evolving regulations require careful navigation to ensure compliance while remaining competitive in attracting and retaining essential skilled employees for both operational and service roles.

The construction sector, where Alta operates, has seen consistent upward pressure on wages. This trend is exacerbated by a persistent shortage of skilled labor, which directly impacts overall project costs and the expense of maintaining service teams. Alta must proactively adapt its compensation and benefits strategies to align with these market realities and legal mandates, ensuring it can secure the talent needed for its growth.

- Minimum Wage Impact: Federal minimum wage has remained at $7.25 per hour since 2009, but many states and cities have enacted significantly higher rates, increasing labor costs for businesses like Alta.

- Worker Shortages: The U.S. construction industry faced a shortage of approximately 546,000 workers in 2023, according to Associated Builders and Contractors, driving up wages and recruitment costs.

- Unionization Trends: While unionization rates have fluctuated, increased union activity in certain sectors can lead to higher wage demands and more stringent working condition requirements for companies.

- Skills Gap: The demand for specialized skills in equipment operation and maintenance outstrips supply, forcing companies to invest more in training and competitive compensation packages.

Import/Export Regulations and Trade Compliance

Import and export regulations directly influence Alta Equipment Group's ability to source machinery and parts, impacting its supply chain efficiency and the accessibility of its products to international markets. Navigating these complex rules is paramount for maintaining a competitive edge and facilitating global operations.

The heavy equipment sector, including companies like Alta, can be affected by evolving trade policies. For instance, in 2024, ongoing discussions around potential safeguard duties on imported steel, a key component in manufacturing, could lead to increased material costs and affect equipment production timelines. Compliance with international trade laws, such as those governing tariffs and customs, is essential for both sourcing components and expanding sales territories.

- Supply Chain Vulnerability: Trade restrictions can disrupt the flow of essential equipment and spare parts, leading to production delays and increased operational costs for Alta.

- Market Access: Export regulations dictate where Alta can sell its products, influencing its global revenue potential and market diversification strategies.

- Cost Fluctuations: Tariffs and duties on imported materials or finished goods can significantly impact Alta's cost of goods sold and pricing strategies in 2024 and beyond.

Legal frameworks surrounding product safety and emissions are critical for Alta Equipment Group, particularly with evolving environmental regulations impacting machinery. For instance, the EPA's push for cleaner emissions in 2024 and 2025 necessitates Alta's adherence to new standards to avoid penalties and maintain market relevance.

Occupational safety laws also directly influence Alta, as equipment must meet strict operational safety standards to prevent workplace accidents, a constant concern in the construction industry. Furthermore, product liability and warranty laws shape Alta's responsibilities for equipment performance and customer satisfaction, impacting service agreements and risk management.

Labor laws, including minimum wage and working conditions, directly affect Alta's operational costs and talent acquisition strategies, especially given the ongoing skilled worker shortages in the construction sector. Import/export regulations also play a significant role, influencing Alta's supply chain and its ability to access global markets for both sourcing and sales.

| Legal Factor | Impact on Alta Equipment Group | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Environmental Regulations | Product compliance, sales strategy, investment in cleaner tech | EPA emissions standards tightening for 2024/2025 models |

| Occupational Health & Safety | Equipment safety features, accident prevention | OSHA citations in construction industry over 170,000 in 2023 |

| Product Liability & Warranty | Risk management, service agreements, customer satisfaction | Increased product recalls in construction equipment sector (2023) |

| Labor Laws | Operational costs, wage adjustments, workforce management | Construction wages up 4.5% (May 2024); 546,000 worker shortage (2023) |

| Import/Export Regulations | Supply chain efficiency, market access, cost fluctuations | Potential steel tariffs impacting manufacturing costs (2024) |

Environmental factors

Global and national emission reduction targets are accelerating the heavy equipment sector's move toward cleaner technologies. For instance, the European Union's ambitious Fit for 55 package aims for a 55% net greenhouse gas emission reduction by 2030 compared to 1990 levels, directly influencing equipment demand.

Stricter carbon emission standards, such as those being implemented across various regions in 2024, are compelling companies like Alta Equipment Group to focus on low-emission and zero-emission vehicles, including electric and hybrid models. This regulatory push is a key driver for innovation and adoption in the industry.

This evolving landscape significantly impacts Alta's operational strategies, particularly in procurement, as the company must invest in sourcing and offering these advanced, cleaner equipment options. Furthermore, it necessitates developing the necessary infrastructure for charging and servicing these new types of equipment to support customer adoption and operational efficiency.

Customers and corporations increasingly favor sustainability, driving demand for environmentally friendly construction and material handling equipment. This trend is highlighted by a projected 15% year-over-year increase in demand for electric-powered heavy machinery in North America through 2025.

Environmental regulations and corporate carbon neutrality targets are accelerating the adoption of electric and hydrogen fuel cell machinery. For instance, by the end of 2024, over 30 major construction firms in the US have publicly committed to electrifying at least 20% of their fleet by 2030.

Alta Equipment Group must adapt its inventory and rental fleet to these sustainability trends to stay competitive. Meeting customer expectations for greener solutions is crucial, especially as the market for sustainable equipment is anticipated to grow by an average of 12% annually between 2024 and 2028.

Regulations concerning the disposal and recycling of old equipment, parts, and hazardous materials directly influence Alta Equipment Group's operational procedures and associated expenses. For instance, in 2024, the Environmental Protection Agency (EPA) continued to emphasize stricter guidelines for managing electronic waste, which includes components found in modern heavy machinery, potentially increasing compliance costs for businesses like Alta.

As equipment evolves with more sophisticated technology and intricate components, the importance of responsible end-of-life management escalates significantly. This trend is reflected in the growing complexity of materials used in new equipment, requiring specialized handling and disposal methods that were not as prevalent even a decade ago.

Alta's robust aftermarket support, encompassing parts and repair services, is strategically positioned to mitigate some of these environmental challenges. By extending the operational lifespan of existing equipment and facilitating the responsible recycling or refurbishment of parts, Alta can contribute to a more circular economy within the heavy equipment sector.

Climate Change Impacts on Operations

Climate change poses direct physical risks to construction operations. Extreme weather events, like prolonged droughts or intensified storms, can significantly disrupt project timelines and reduce the operational efficiency of heavy machinery. For instance, extended monsoon seasons have already been identified as a challenge for the construction equipment market in regions like India during 2024-2025, leading to a slowdown in domestic sales.

While Alta Equipment Group primarily operates in North America, anticipating and planning for regional climate shifts is crucial. Understanding how changing weather patterns might impact construction activity is vital for accurate demand forecasting and effective operational planning. This includes considering the potential for increased downtime or altered equipment needs due to unseasonable weather.

- Physical Disruptions: Extreme weather events can cause project delays and damage equipment, impacting utilization rates.

- Market Headwinds: Extended monsoon seasons in 2024-2025 have negatively affected construction equipment sales in India, illustrating the real-world impact of climate variability.

- Demand Forecasting: Analyzing regional climate patterns is essential for Alta to predict construction activity levels and adjust equipment inventory accordingly.

- Operational Planning: Understanding potential climate-related disruptions allows for more resilient operational strategies and resource allocation.

Corporate Social Responsibility (CSR) and ESG Reporting

Growing expectations for Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting significantly impact Alta Equipment Group's public perception and how investors view the company. While specific Alta data isn't public, the equipment industry is seeing a trend towards more mandatory ESG disclosures.

Adopting sustainable practices, such as providing greener equipment options and managing operational waste effectively, boosts Alta's brand image and attractiveness to stakeholders who prioritize environmental consciousness. For instance, many construction equipment manufacturers are investing in electric and hybrid machinery, a trend Alta is likely to follow to meet market demand and regulatory pressures.

- Increasing Regulatory Landscape: Many jurisdictions are moving towards making ESG reporting mandatory, not just voluntary. For example, the EU's Corporate Sustainability Reporting Directive (CSRD) significantly expands reporting requirements for companies operating within the EU, potentially impacting companies like Alta that have international operations.

- Investor Demand for ESG: A significant portion of institutional investors now integrate ESG factors into their investment decisions. BlackRock, a major asset manager, has consistently emphasized the importance of ESG performance, influencing companies to improve their sustainability practices to attract capital.

- Reputational Benefits: Companies with strong ESG performance often experience enhanced brand loyalty and a better ability to attract and retain talent. This can translate into a competitive advantage in the marketplace.

Global emission reduction targets are driving a significant shift towards cleaner heavy equipment technologies, influencing demand for electric and hybrid models. Stricter carbon standards, like those evolving in 2024, compel companies to invest in and offer low-emission machinery, necessitating new infrastructure for charging and servicing.

Customer preference for sustainability is boosting demand for environmentally friendly equipment, with North America expecting a 15% year-over-year increase in electric-powered heavy machinery demand through 2025. Moreover, over 30 major US construction firms have committed to electrifying at least 20% of their fleets by 2030, underscoring this industry-wide trend.

Environmental regulations and corporate carbon neutrality goals are accelerating the adoption of electric and hydrogen fuel cell machinery, with the sustainable equipment market projected to grow by 12% annually between 2024 and 2028. Alta Equipment Group must adapt its inventory and rental fleet to meet these evolving customer expectations and stay competitive.

Regulations concerning equipment disposal and recycling, including stricter EPA guidelines for electronic waste in 2024, are increasing compliance costs. The growing complexity of materials in new machinery requires specialized handling and disposal, making responsible end-of-life management critical for companies like Alta.

| Trend | Impact on Alta Equipment Group | Supporting Data/Examples |

| Emission Reduction Targets | Increased demand for electric/hybrid equipment; need for new infrastructure | EU's Fit for 55 package; 15% YoY growth in electric heavy machinery demand (North America, by 2025) |

| Stricter Emission Standards | Focus on low-emission vehicle development and procurement | 30+ US construction firms committing to 20% fleet electrification by 2030 |

| Customer Sustainability Preferences | Competitive advantage through greener solutions; market growth | Sustainable equipment market growth of 12% annually (2024-2028) |

| Waste Management Regulations | Increased operational costs; need for specialized handling | EPA's continued emphasis on electronic waste management (2024) |

PESTLE Analysis Data Sources

Our Alta Equipment Group PESTLE Analysis is built on a foundation of comprehensive data from official government publications, leading economic research firms, and reputable industry-specific reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.