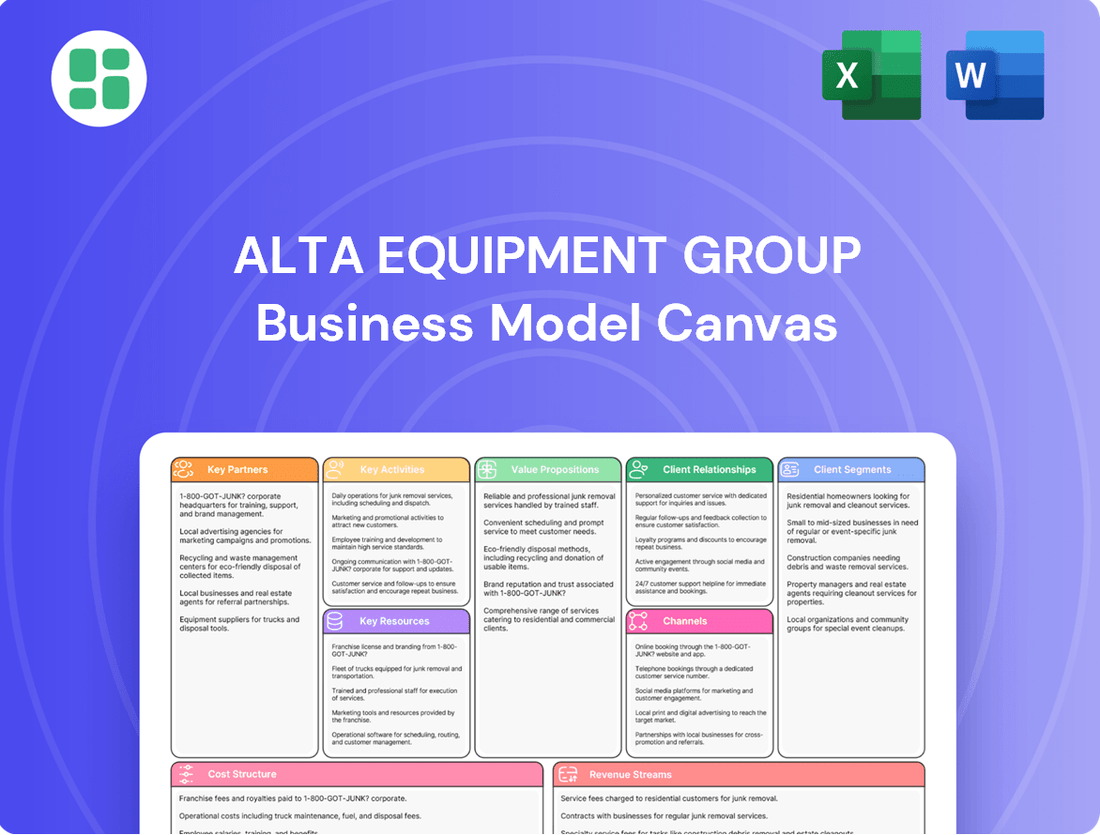

Alta Equipment Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

Unlock the core strategic blueprint of Alta Equipment Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively serve diverse customer segments and leverage key partnerships to deliver exceptional value.

Dive deeper into Alta Equipment Group’s operational engine with the full Business Model Canvas. This professionally crafted document breaks down their revenue streams, cost structure, and key resources, offering a clear roadmap to their market dominance.

Ready to gain actionable insights from Alta Equipment Group's proven strategy? Download the complete Business Model Canvas to explore their unique value propositions and customer relationships, empowering your own business planning.

Partnerships

Alta Equipment Group cultivates key partnerships with prominent Original Equipment Manufacturers (OEMs) like Hyster, Yale, Volvo, and JCB. These alliances are fundamental to providing a broad selection of new forklifts, earthmoving equipment, and specialized machinery, ensuring Alta has access to top-tier products for both sales and rental operations. This strategy underpins their ability to offer a diverse and high-quality equipment portfolio.

Alta Equipment Group’s success hinges on robust relationships with its parts and component suppliers, a critical element for its extensive aftermarket support. These partnerships ensure a steady flow of genuine, high-quality spare parts essential for maintaining and repairing the equipment they sell and service. This reliability directly translates to better equipment uptime for their customers, a key factor in customer satisfaction and loyalty.

For instance, in 2023, Alta Equipment Group reported that its product support segment, which heavily relies on parts availability, generated approximately $443.1 million in revenue. This underscores how crucial a well-managed supply chain for parts is to Alta's overall financial performance and its ability to generate recurring revenue streams.

Alta Equipment Group's collaboration with financial institutions and leasing companies is crucial for offering flexible customer financing and leasing solutions. These partnerships directly support equipment sales and rentals by making significant capital outlays more manageable for clients.

For instance, in 2023, approximately 30% of Alta Equipment Group's new equipment sales were facilitated through financing or leasing arrangements, highlighting the importance of these relationships in driving revenue. By providing diverse financing options, Alta strengthens its ability to attract new customers and retain existing ones, fostering long-term business growth and customer loyalty.

Technology and Software Providers

Alta Equipment Group’s partnerships with technology and software providers are crucial for modernizing its fleet management capabilities. These collaborations are essential for developing and integrating advanced systems that optimize equipment utilization and enable predictive maintenance, thereby boosting operational efficiency for their customers.

These strategic alliances are also vital for exploring and capitalizing on emerging market trends, such as the growing demand for eMobility solutions. By teaming up with specialized providers, Alta can expand its service portfolio and offer innovative, sustainable equipment options.

- Fleet Management Software: Partnerships with providers of sophisticated fleet management software allow Alta to offer customers enhanced tracking, diagnostics, and maintenance scheduling.

- Telematics and IoT Solutions: Collaborations on telematics and Internet of Things (IoT) platforms enable real-time data collection from equipment, facilitating predictive maintenance and operational insights.

- eMobility Technology Providers: Strategic alliances with companies developing electric vehicle (EV) charging infrastructure and electric-powered equipment are key to Alta's expansion into the eMobility sector.

- Data Analytics and AI: Working with data analytics and artificial intelligence firms helps Alta leverage collected data to provide deeper insights into equipment performance and customer needs.

Acquisition Targets and Integration Partners

Alta Equipment Group views potential acquisition targets as vital partners, actively seeking companies that can broaden its geographic reach and enhance its product portfolio. This inorganic growth strategy is a cornerstone of its expansion plans.

The successful integration of these acquired businesses is paramount for Alta Equipment Group to unlock synergies and effectively increase its market share. For example, in 2023, Alta completed several acquisitions, contributing significantly to its revenue growth.

- Acquisition Strategy Focus: Geographic expansion and product line enhancement.

- Integration Importance: Realizing synergies and boosting market share.

- 2023 Performance: Acquisitions contributed meaningfully to revenue, with reported growth figures underscoring the strategy's impact.

Alta Equipment Group's key partnerships are multi-faceted, encompassing OEM relationships for product access, supplier collaborations for aftermarket support, and financial institutions for customer financing. These alliances are critical for delivering a comprehensive equipment offering and facilitating sales.

Strategic partnerships with technology providers enhance fleet management and eMobility offerings, while acquisition targets serve as crucial partners for geographic and product portfolio expansion. In 2023, Alta's product support segment, heavily reliant on parts partnerships, generated $443.1 million, and approximately 30% of new equipment sales involved financing partnerships.

| Partnership Type | Key Partners Example | Impact on Alta | 2023 Data/Significance |

|---|---|---|---|

| OEMs | Hyster, Yale, Volvo, JCB | Access to new equipment for sales/rental | Underpins diverse, high-quality portfolio |

| Suppliers | Parts & Component Providers | Ensures genuine parts for aftermarket support | Product support revenue: $443.1 million |

| Financial Institutions | Leasing Companies | Facilitates customer financing and leasing | ~30% of new equipment sales financed/leased |

| Technology Providers | Fleet Management Software, IoT | Enhances fleet management, eMobility solutions | Drives operational efficiency and innovation |

| Acquisition Targets | Various Companies | Broadens geographic reach, enhances product portfolio | Contributed significantly to 2023 revenue growth |

What is included in the product

This Business Model Canvas provides a detailed overview of Alta Equipment Group's strategy, focusing on its equipment rental and sales operations. It outlines key customer segments, value propositions, and channels, reflecting the company's real-world operations.

Alta Equipment Group's Business Model Canvas provides a clear, actionable framework that alleviates the pain of fragmented operational data and inefficient resource allocation.

It offers a consolidated view of their multi-faceted equipment rental and lifecycle management, simplifying complex processes for improved decision-making.

Activities

Alta Equipment Group's core activity is the direct sale of new and used industrial and construction equipment. This includes a wide range of machinery like forklifts, earthmoving equipment, and cranes, catering to various industries.

The company manages its inventory, sales processes, and distribution network efficiently to serve its customer base. In 2023, Alta Equipment Group reported total revenue of $1.9 billion, with equipment sales being a significant driver of this performance.

Their strategy centers on offering a comprehensive, industry-leading product selection. This broad portfolio ensures they can meet the diverse needs of customers across different market segments, from small contractors to large industrial operations.

Alta Equipment Group's key activity revolves around managing its substantial equipment rental fleet. This involves ensuring the fleet is well-maintained, efficiently delivered to and picked up from customer sites, and consistently utilized to maximize revenue.

The company's rent-to-sell strategy is a core component of its operational success, enabling nimble fleet management and generating robust operating cash flows.

In 2024, Alta Equipment Group's rental segment contributed significantly to its overall performance, with rental revenues playing a crucial role in its financial stability and growth trajectory.

Alta Equipment Group's aftermarket parts and service support is a crucial engine for recurring revenue and customer retention. This segment focuses on providing comprehensive support, encompassing parts sales, routine maintenance, and repair services to ensure optimal equipment uptime for their clients.

The company leverages a substantial network of over 500 factory-trained technicians to deliver these specialized services. This skilled workforce is essential for maintaining the high standards of service expected by their customer base, ensuring that equipment is repaired and maintained efficiently and effectively.

A key differentiator for Alta is their commitment to rapid response and continuous availability. By guaranteeing response times and offering 24/7 service, they aim to minimize downtime for their customers' critical operations, thereby fostering strong loyalty and trust in their brand.

Warehouse Solutions and Distribution Center Design

Alta Equipment Group's key activity involves providing specialized warehouse solutions and distribution center design for its material handling customers. This goes beyond simply selling equipment, offering a comprehensive service to optimize client operations.

These services are designed to boost productivity, streamline workflows, and significantly improve safety within customer warehouses. By focusing on these critical areas, Alta adds substantial value, differentiating itself in the market.

- Distribution Center Design: Alta's expertise aids clients in creating efficient and effective warehouse layouts.

- Racking Systems: Provision and integration of various racking solutions to maximize storage density and accessibility.

- Process Improvement: Implementing strategies to enhance the flow of goods and information within the distribution center.

- Safety Enhancement: Ensuring designs and systems meet high safety standards for warehouse personnel.

Strategic Portfolio Management

Alta Equipment Group actively manages its business portfolio through strategic acquisitions and divestitures to optimize performance and market presence. This includes identifying and selling non-core assets while integrating new businesses to strengthen its competitive edge.

For instance, in 2024, Alta completed the divestiture of its Chicago aerial equipment rental business. This move was aimed at streamlining operations and focusing resources on core growth areas.

- Strategic Portfolio Management: Ongoing evaluation of business units for optimal performance and market alignment.

- Acquisitions: Integration of new businesses to expand market reach and service offerings.

- Divestitures: Sale of non-core or underperforming assets to enhance financial health and focus.

- Optimization Initiatives: Streamlining operations and resource allocation to improve efficiency and profitability.

Alta Equipment Group's key activities encompass the direct sale of new and used industrial and construction equipment, managing a significant rental fleet, and providing essential aftermarket parts and service support. They also offer specialized warehouse solutions and engage in strategic portfolio management through acquisitions and divestitures.

In 2023, Alta Equipment Group reported total revenues of $1.9 billion, with equipment sales forming a substantial portion. The rental segment played a vital role in their 2024 financial performance, contributing to stability and growth.

Their aftermarket services are driven by over 500 factory-trained technicians, ensuring rapid response and 24/7 availability to minimize customer downtime. This focus on service fosters strong customer loyalty.

In 2024, Alta strategically divested its Chicago aerial equipment rental business to concentrate on core growth areas, demonstrating active portfolio optimization.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Equipment Sales | Direct sale of new and used industrial/construction machinery. | Significant driver of $1.9 billion total revenue in 2023. |

| Equipment Rental | Managing and renting out a diverse equipment fleet. | Crucial contributor to financial stability and growth in 2024. |

| Aftermarket Services | Parts sales, maintenance, and repair by 500+ technicians. | Focus on rapid response and 24/7 availability to minimize customer downtime. |

| Warehouse Solutions | Design and optimization of warehouse operations for material handling. | Enhances productivity, workflow, and safety for clients. |

| Portfolio Management | Strategic acquisitions and divestitures. | Divested Chicago aerial rental business in 2024 to focus on core growth. |

Delivered as Displayed

Business Model Canvas

The Alta Equipment Group Business Model Canvas preview you see is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, ready-to-use analysis, not a sample or mockup. Once your order is processed, you'll gain full access to this exact file, ensuring no surprises and immediate utility for your strategic planning needs.

Resources

Alta Equipment Group boasts an extensive inventory of both new and used equipment, alongside a significant rental fleet. This vast physical asset base is the bedrock of their operations, supporting both direct sales and rental income streams. In 2023, Alta's rental fleet contributed substantially to their revenue, with rental revenues reaching $378.8 million, highlighting its importance.

The company's capacity to efficiently manage and right-size its fleet levels is a testament to its effective working capital management. This agility allows them to adapt to market demands, ensuring they have the right equipment available for customers while optimizing their investment in physical assets.

Alta Equipment Group's skilled workforce, boasting over 500 factory-trained service technicians, is a cornerstone of its aftermarket support. This expertise is vital for delivering top-tier maintenance, tackling intricate repairs, and offering specialized services that differentiate Alta in the market.

The company's commitment to ongoing training ensures these technicians remain at the forefront of technological advancements, maintaining a high standard of service excellence. This continuous development directly translates into customer satisfaction and operational efficiency.

Alta Equipment Group boasts an impressive geographic branch network with over 85 locations spanning multiple U.S. states and Canadian provinces. This extensive footprint positions Alta as one of North America's largest integrated equipment dealership platforms.

This broad network facilitates significant market reach, offering comprehensive sales, rental, parts, and service capabilities to a diverse customer base. It's designed to provide customers with a convenient 'one-stop-shop' experience, regardless of their location.

Established Customer Relationships and Sales Force

Alta Equipment Group's established customer relationships, built over four decades, are a cornerstone of its business model. This long-standing trust with a diverse clientele is a critical intangible asset, driving consistent revenue and market stability.

The company's dedicated sales and customer service teams are instrumental in nurturing these relationships. Their focus on fostering 'customers for life' translates directly into repeat business and valuable word-of-mouth referrals, significantly reducing customer acquisition costs.

- Customer Loyalty: Over 40 years of operation have solidified deep ties with a broad customer spectrum.

- Sales Force Impact: A proactive sales force actively cultivates and maintains these vital connections.

- Service Excellence: Customer service teams ensure satisfaction, promoting long-term retention and referrals.

- Repeat Business: The emphasis on enduring relationships directly fuels consistent sales and predictable revenue streams.

Proprietary Systems and Operational Know-How

Alta Equipment Group leverages proprietary systems for sophisticated fleet management and inventory control. This technological backbone is crucial for optimizing the utilization of its extensive equipment fleet, a key asset in the rental and sales markets. For instance, in 2023, the company reported significant investments in technology to enhance operational efficiency, aiming to improve asset tracking and maintenance scheduling.

The operational know-how embedded within these systems allows for data-driven decision-making. This translates into better cost management, from fuel efficiency to predictive maintenance, ultimately boosting profitability. Alta’s expertise in managing complex equipment lifecycles and service delivery provides a distinct competitive edge.

These key resources directly contribute to Alta's ability to streamline service delivery and maintain high customer satisfaction. By continuously refining these proprietary systems and operational processes, Alta Equipment Group solidifies its position in a competitive industry.

- Proprietary Systems: Advanced fleet management and inventory control software.

- Operational Know-How: Expertise in equipment lifecycle management and service optimization.

- Efficiency Gains: Data-driven insights improve asset utilization and cost control.

- Competitive Advantage: Streamlined operations and enhanced service delivery.

Alta Equipment Group's key resources are its extensive equipment fleet, a robust network of over 85 branches, a highly skilled service technician team, and strong, long-standing customer relationships. These assets are fundamental to its integrated dealership model, supporting sales, rentals, and aftermarket services.

The company's proprietary systems for fleet management and operational know-how are also critical, enabling efficient asset utilization and data-driven decision-making. These technological and intellectual resources provide a significant competitive advantage in optimizing operations and customer service.

| Key Resource | Description | Impact | Supporting Data (2023) |

|---|---|---|---|

| Equipment Fleet & Rental Operations | Vast inventory of new and used equipment, plus a significant rental fleet. | Drives sales and rental revenue streams, supports market demand. | Rental revenues of $378.8 million. |

| Branch Network | Over 85 locations across multiple U.S. states and Canadian provinces. | Provides broad market reach and a convenient customer experience. | One of North America's largest integrated dealership platforms. |

| Skilled Workforce | Over 500 factory-trained service technicians. | Ensures high-quality maintenance, repairs, and specialized services. | Essential for customer satisfaction and operational efficiency. |

| Customer Relationships | Established ties built over four decades with a diverse clientele. | Drives consistent revenue, market stability, and repeat business. | Focus on fostering 'customers for life' reduces acquisition costs. |

| Proprietary Systems & Know-How | Advanced fleet management, inventory control, and operational expertise. | Optimizes asset utilization, cost management, and service delivery. | Investments in technology to enhance operational efficiency. |

Value Propositions

Alta Equipment Group provides a broad spectrum of new and used equipment for both purchase and rent, catering to material handling, construction, and environmental processing sectors. This extensive inventory acts as a one-stop shop for customers needing diverse machinery.

By offering a single point of access for various equipment needs, Alta simplifies the procurement process for businesses. This consolidation streamlines operations and reduces the complexity of managing multiple vendors or rental agreements.

For instance, in 2024, Alta reported significant revenue growth, partly driven by the demand for their comprehensive equipment solutions across these key industries. Their ability to meet varied customer demands with a single, robust offering is a core strength.

Alta Equipment Group's customers gain a significant advantage through its robust aftermarket support, encompassing a comprehensive range of parts, maintenance, and repair services. This ensures their heavy machinery operates at peak performance and enjoys a longer lifespan.

The value lies in minimizing costly operational downtime and maximizing the equipment's overall utility. For instance, in 2023, Alta reported a substantial increase in service revenue, reflecting the strong demand for their reliable support network.

This commitment is underscored by a dedicated network of certified technicians and a promise of guaranteed response times, offering peace of mind and consistent operational readiness to their diverse clientele.

Alta Equipment Group enhances operational efficiency and cost management for its clients by offering comprehensive fleet management services, optimizing distribution center design, and providing expert advice. This strategic approach goes beyond simply supplying equipment, focusing instead on delivering tailored solutions that improve how businesses handle material handling and construction needs.

For instance, in 2023, Alta’s focus on efficiency contributed to their reported revenue of $1.6 billion, demonstrating their ability to scale while supporting customer operational improvements. By leveraging their expertise, Alta helps businesses streamline operations and reduce overall operating costs, a critical factor in today's competitive landscape.

Convenient One-Stop-Shop Experience

Alta Equipment Group offers a convenient 'one-stop-shop' experience, consolidating equipment sales, rentals, parts, and service within a single location. This integrated approach significantly reduces the time and effort customers typically spend managing their equipment needs, making the entire process more efficient.

This streamlined model simplifies the complexities of equipment acquisition and ongoing maintenance. For instance, in 2023, Alta reported revenue of $1.7 billion, reflecting the scale and demand for such comprehensive solutions. The convenience factor directly contributes to customer satisfaction and loyalty.

- Consolidated Offerings: Sales, rentals, parts, and service are all managed under one roof.

- Time and Effort Savings: Customers avoid the hassle of dealing with multiple vendors.

- Simplified Management: Streamlines the process of acquiring and maintaining essential equipment.

- Customer Efficiency: Directly supports operational efficiency for businesses relying on equipment.

Access to Premium, Industry-Leading Brands

Customers at Alta Equipment Group benefit from access to a curated selection of top-tier equipment from industry leaders. This means they can secure machinery from highly respected brands known for their innovation and quality. For instance, in 2024, Alta Equipment Group continued its strong partnerships with manufacturers like Volvo, a brand consistently recognized for its heavy equipment durability and advanced technology, and Hyster and Yale, leaders in the forklift and material handling sector.

This access ensures businesses acquire machinery that is not only high-quality but also reliable and at the forefront of technological advancement. The strategic choice to partner with such reputable manufacturers directly translates into tangible value for clients, emphasizing performance and long-term durability in their operations.

- Access to Premium Brands: Customers can acquire equipment from industry-leading manufacturers such as Volvo, Hyster, and Yale.

- High-Quality and Reliable Machinery: The focus on reputable brands ensures the acquisition of advanced and dependable equipment.

- Performance and Durability: Partnerships with established manufacturers underscore a commitment to machinery that excels in performance and offers long-term durability.

Alta Equipment Group's value proposition centers on providing customers with a comprehensive, single-source solution for their equipment needs. This includes a wide array of new and used equipment for sale and rent, covering material handling, construction, and environmental processing sectors. The company also offers robust aftermarket support, including parts, maintenance, and repair services, ensuring equipment longevity and peak performance. Furthermore, Alta provides value-added services like fleet management and operational consulting, aiming to enhance client efficiency and cost-effectiveness.

| Value Proposition Element | Description | Supporting Data/Fact |

|---|---|---|

| Consolidated Equipment Solutions | One-stop shop for sales, rentals, parts, and service across multiple industries. | Alta reported revenue of $1.7 billion in 2023, indicating significant demand for integrated offerings. |

| Aftermarket Support & Reliability | Comprehensive parts, maintenance, and repair services to minimize downtime. | Service revenue saw a substantial increase in 2023, highlighting customer reliance on Alta's support network. |

| Operational Efficiency Enhancement | Fleet management and expert advice to optimize client operations. | The company's focus on efficiency contributed to its 2023 revenue of $1.6 billion. |

| Access to Premium Brands | Provision of high-quality, reliable machinery from industry leaders. | Partnerships with brands like Volvo, Hyster, and Yale ensure access to advanced and durable equipment. |

Customer Relationships

Alta Equipment Group cultivates deep customer loyalty by assigning dedicated account managers. These professionals act as a primary point of contact, ensuring a thorough understanding of each client's unique operational requirements and challenges. This personalized service is key to fostering long-term partnerships.

The company's sales support is designed to be highly responsive, offering tailored solutions that address specific customer needs. This proactive engagement aims to build trust and deliver value beyond the initial transaction, ultimately striving for a 'customers for life' philosophy.

Alta Equipment Group fosters strong customer relationships through proactive aftermarket service and maintenance programs. These initiatives, including scheduled inspections and preventive care, are designed to maximize equipment uptime and minimize costly, unexpected breakdowns. This commitment directly supports the operational continuity of their clients.

In 2024, Alta's service and maintenance offerings are crucial for customer retention. For instance, their guaranteed response times for service calls are a significant differentiator, ensuring that clients can rely on swift support to keep their businesses running smoothly. This focus on reliability builds trust and loyalty.

Alta Equipment Group embraces a consultative sales model, acting as a trusted advisor to its clients. They offer expert guidance on selecting the right equipment, optimizing existing fleets, and designing efficient warehouse solutions. This approach ensures customers make choices that directly support their operational objectives and financial constraints.

This consultative strategy positions Alta beyond a mere equipment vendor, fostering long-term partnerships built on trust and expertise. For instance, in 2024, Alta's focus on solution-oriented sales contributed to their reported revenue growth, demonstrating the value customers place on this personalized advisory service.

Customer Training and Education Initiatives

Alta Equipment Group provides operator and technician training, enabling customers to enhance equipment efficiency and conduct essential in-house maintenance. These programs not only build customer capabilities but also deepen their reliance on Alta for ongoing, comprehensive support.

These educational initiatives are crucial for fostering safer and more productive operations for their clientele. For instance, in 2024, Alta continued to invest in its training infrastructure, aiming to equip a growing number of technicians with the specialized skills needed for the latest heavy equipment models.

- Operator Training: Focuses on safe and efficient operation to maximize equipment lifespan and productivity.

- Technician Education: Equips customers with skills for basic maintenance and troubleshooting, reducing downtime.

- Enhanced Customer Reliance: Builds stronger relationships by providing valuable skills and ongoing support.

- Safety and Productivity Gains: Directly contributes to improved operational outcomes for customers.

Responsive Customer Service and Support Channels

Alta Equipment Group prioritizes responsive customer service, offering support through multiple channels to ensure prompt issue resolution. This includes 24/7 availability for critical needs, fostering trust and reliability. In 2024, their focus on accessibility aims to maintain high customer satisfaction levels.

- 24/7 Availability: Critical support is accessible around the clock.

- Multi-Channel Support: Customers can reach out through various convenient methods.

- Prompt Resolution: Commitment to quickly addressing customer concerns.

- Customer Satisfaction: The core aim is to ensure clients are happy and well-supported.

Alta Equipment Group solidifies customer relationships through dedicated account management and a consultative sales approach. Their commitment extends to comprehensive aftermarket services, including training and 24/7 support, all designed to maximize client uptime and foster long-term partnerships. This focus on value-added services is a cornerstone of their business strategy.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Dedicated Account Management | Personalized point of contact, understanding client needs | Fostering loyalty and long-term partnerships |

| Consultative Sales | Expert guidance on equipment selection and optimization | Solution-oriented sales contributing to revenue growth |

| Aftermarket Services | Proactive maintenance, scheduled inspections, preventive care | Maximizing equipment uptime and minimizing downtime for clients |

| Training Programs | Operator and technician education for efficiency and basic maintenance | Enhancing customer capabilities and reliance on Alta |

| Responsive Customer Service | Multi-channel support, 24/7 availability for critical needs | Maintaining high customer satisfaction through accessibility and prompt resolution |

Channels

Alta Equipment Group's primary channel is its extensive network of over 85 physical branch locations spread across North America. These dealerships are crucial hubs for equipment sales, rentals, parts, and service.

These physical locations offer customers localized access and direct, hands-on interaction with both the equipment and Alta's expert staff. This direct engagement is vital for building customer relationships and understanding specific needs.

As of the first quarter of 2024, Alta reported continued growth, with its branch network playing a pivotal role in facilitating equipment transactions and providing essential support services to a broad customer base.

Alta Equipment Group's direct sales force and field representatives are the backbone of their customer engagement strategy, directly connecting with industrial and construction businesses. These teams provide personalized consultations, conduct on-site assessments, and develop tailored solutions, fostering deep relationships and securing significant contracts.

In 2024, this direct approach was instrumental in driving Alta's revenue. The company reported that a substantial portion of its new equipment sales and rental agreements were initiated and closed by its field representatives, highlighting the channel's effectiveness in reaching key decision-makers and understanding specific client needs.

Alta Equipment Group leverages its corporate website and various digital platforms as a crucial touchpoint for potential customers. These online spaces are designed to showcase their extensive equipment inventory, offer detailed product specifications, and streamline the process for customer inquiries and lead generation.

While not a direct e-commerce platform for substantial equipment purchases, the digital presence functions as a vital information hub. It empowers customers to conduct thorough research and initiate engagement, laying the groundwork for future sales interactions.

In 2024, the company continued to invest in enhancing its online user experience. Data from early 2024 indicated a significant portion of customer interactions begin with online research, underscoring the importance of these digital channels for Alta Equipment Group's outreach and lead qualification efforts.

Timed Auctions for Used Equipment

Timed auctions serve as a crucial channel for Alta Equipment Group to efficiently liquidate used equipment, particularly from their rental fleet. This method offers a predictable sales cycle and reaches a wide base of buyers looking for value. For instance, in the first quarter of 2024, Alta reported a significant portion of its used equipment sales were driven by these structured auction events, contributing to effective inventory turnover.

- Channel Function: Facilitates the sale of used equipment, optimizing fleet management and inventory turnover.

- Buyer Reach: Attracts a broad spectrum of potential buyers seeking cost-effective machinery solutions.

- Efficiency: Provides a structured and time-bound process for selling assets, ensuring timely liquidation.

- Financial Impact: Contributes to revenue generation and capital recovery from retired rental assets.

Customer Service and Product Support Centers

Alta Equipment Group leverages dedicated customer service and product support centers as a primary channel to engage with clients. These hubs are essential for managing customer inquiries, facilitating service appointments, and offering vital technical support. They are instrumental in ensuring a seamless post-sale and post-rental experience, directly contributing to customer satisfaction and loyalty.

These support centers are critical for maintaining Alta's commitment to high service standards. In 2024, companies like Alta that prioritize responsive customer support often see improved customer retention rates, with some studies indicating that excellent service can boost retention by as much as 5% or more. This focus on ongoing communication reinforces the value proposition beyond the initial transaction.

- Direct Customer Interaction: Facilitates immediate resolution of issues and builds strong client relationships.

- Service Scheduling: Streamlines the process for maintenance and repairs, minimizing equipment downtime for customers.

- Technical Expertise: Provides access to knowledgeable staff for troubleshooting and product guidance.

- Post-Sale Engagement: Ensures continued support, enhancing the overall customer lifecycle and fostering repeat business.

Alta Equipment Group's channels are a blend of physical and digital touchpoints designed to serve their diverse customer base. The extensive branch network acts as the core for sales, rentals, and services, offering direct customer engagement. Complementing this, a direct sales force and field representatives build deep relationships by providing personalized solutions. The company's website and digital platforms serve as vital information hubs, initiating customer research and lead generation, with significant investment in 2024 to enhance online user experience.

Timed auctions are a key channel for efficient liquidation of used equipment, particularly from the rental fleet, contributing to effective inventory turnover. Furthermore, dedicated customer service and product support centers are crucial for post-sale engagement, ensuring customer satisfaction and loyalty through responsive technical assistance and service scheduling.

| Channel | Primary Function | Key Activities/Benefits | 2024 Data/Insight |

|---|---|---|---|

| Branch Network | Equipment Sales, Rentals, Parts, Service | Localized access, direct interaction, relationship building | Over 85 locations; pivotal in facilitating transactions and support |

| Direct Sales Force | Customer Engagement, Solution Provision | Personalized consultations, on-site assessments, tailored solutions | Instrumental in driving revenue; substantial new equipment sales initiated and closed |

| Digital Platforms (Website) | Information Hub, Lead Generation | Inventory showcase, product specifications, inquiry streamlining | Continued investment in user experience; significant customer interactions begin online |

| Timed Auctions | Used Equipment Liquidation | Efficient sales cycle, broad buyer reach, inventory turnover | Significant portion of used equipment sales driven by these events in Q1 2024 |

| Customer Service/Support Centers | Post-Sale Engagement, Technical Assistance | Issue resolution, service scheduling, product guidance | Focus on responsive support can boost customer retention; critical for lifecycle enhancement |

Customer Segments

Industrial and Material Handling Businesses are a core customer group for Alta Equipment Group. This segment encompasses companies heavily reliant on efficient operations within warehouses, logistics centers, and manufacturing plants. Their primary need is for reliable forklifts, aerial work platforms, and other equipment essential for moving and managing goods.

These businesses are actively seeking solutions that enhance their storage, movement, and overall inventory management processes. For instance, in 2024, the global material handling equipment market was projected to reach over $130 billion, indicating a strong demand for the types of products Alta offers.

Furthermore, this customer base often requires more than just equipment sales; they look for integrated warehouse solutions and robust fleet management services to optimize their operations and minimize downtime. This includes maintenance, repair, and potentially rental options to ensure continuous productivity.

Construction and infrastructure contractors represent a core customer segment for Alta Equipment Group. This group includes a wide range, from smaller local builders to major developers undertaking large-scale infrastructure projects. They rely heavily on earthmoving machinery, cranes, and other specialized construction equipment to prepare sites, erect structures, and build roads.

These businesses have diverse needs, often requiring both outright purchases of new or used equipment and short-to-medium term rentals to manage project lifecycles. For instance, in 2024, the construction equipment rental market in North America was projected to reach over $60 billion, highlighting the significant demand for flexible equipment solutions that Alta can provide.

Businesses in the mining, quarrying, and aggregate sectors are a core customer base for Alta Equipment Group. These companies, involved in extracting and processing raw materials, depend on robust earthmoving, crushing, and screening equipment to maintain their operations. For instance, in 2024, the global mining equipment market was projected to reach over $200 billion, highlighting the significant demand for specialized machinery that Alta serves.

These clients operate in some of the most challenging environments, where equipment durability and reliability are paramount. Alta's product portfolio is specifically designed to withstand the rigors of these demanding applications, ensuring consistent performance and minimizing downtime. This focus on resilience is crucial, as unscheduled equipment failures can lead to substantial production losses in these high-intensity industries.

Governmental and Municipal Entities

Governmental and municipal entities, especially those focused on public works and infrastructure, are a key customer segment for Alta Equipment Group. These organizations, such as Departments of Transportation (DOTs), rely on heavy equipment for crucial tasks like road construction, bridge repair, and general infrastructure maintenance. Their procurement decisions are often tied to the availability of public funds and the passage of infrastructure bills.

For instance, the U.S. Department of Transportation's Federal Highway Administration (FHWA) oversees significant funding for state DOTs. In 2024, the Infrastructure Investment and Jobs Act (IIJA) continued to drive substantial investment in infrastructure projects across the nation, creating demand for the types of equipment Alta provides. These entities often require reliable, heavy-duty machinery for long-term public projects.

- Public Works Departments: Municipalities and counties utilize equipment for road maintenance, snow removal, and park upkeep.

- Transportation Agencies: State DOTs are major purchasers for highway construction and repair projects.

- Infrastructure Projects: Federal and state funding initiatives, like those stemming from the IIJA, directly influence equipment demand.

- Procurement Cycles: Purchasing is often dictated by fiscal year budgets and the allocation of public funds for infrastructure development.

Specialized Equipment Operators and Rental Houses

Specialized equipment operators and rental houses form a key customer segment for Alta Equipment Group. These businesses often require specific machinery to fulfill their contracts or meet customer demands. For instance, a company specializing in high-rise construction might need aerial work platforms, while an environmental remediation firm would seek out specialized processing equipment. Alta provides them with access to these vital tools, allowing them to expand their capabilities without the full capital investment of purchasing every piece of equipment outright.

This segment values Alta's extensive inventory, which offers a broad spectrum of specialized machinery. By renting or purchasing from Alta, these operators and rental houses can efficiently supplement their existing fleets, take on larger or more diverse projects, and respond flexibly to market needs. This strategic access to equipment is crucial for maintaining competitiveness and profitability in their respective fields.

In 2024, Alta Equipment Group reported significant revenue streams from its rental operations, underscoring the importance of this customer base. The demand for specialized equipment rentals remained robust, driven by infrastructure projects and industrial expansion. For example, Alta's Rental segment revenue saw a notable increase, reflecting the strong utilization of its diverse fleet by these specialized operators and rental houses.

- Diverse Fleet Access: Rental houses and specialized operators rely on Alta for a wide selection of niche equipment, from scissor lifts to complex environmental machinery.

- Fleet Augmentation: This segment uses Alta's offerings to temporarily expand their own rental fleets, enabling them to serve more clients or handle larger projects.

- Operational Flexibility: By renting, these businesses gain the agility to adapt to changing project requirements and market demands without long-term capital commitments.

- Revenue Contribution: Alta's rental segment, which serves these customers, is a significant contributor to the company's overall financial performance, with revenues showing positive year-over-year growth in 2024.

Alta Equipment Group serves a diverse clientele, including industrial and material handling businesses that depend on efficient operations. This segment requires reliable equipment like forklifts and aerial work platforms, with the global material handling equipment market projected to exceed $130 billion in 2024.

Construction and infrastructure contractors are another vital customer group, needing earthmoving machinery and cranes for projects. The North American construction equipment rental market was expected to surpass $60 billion in 2024, showcasing the demand for flexible equipment solutions.

Mining, quarrying, and aggregate sectors rely on robust earthmoving and processing equipment, with the global mining equipment market anticipated to reach over $200 billion in 2024. These clients prioritize durability in harsh environments.

Governmental and municipal entities, particularly public works departments and transportation agencies, are key customers for infrastructure maintenance and construction. The Infrastructure Investment and Jobs Act continues to fuel demand for heavy equipment in 2024.

Specialized equipment operators and rental houses also form a significant segment, utilizing Alta's broad inventory to supplement their fleets and take on diverse projects. Alta's rental segment revenue showed strong growth in 2024, reflecting this demand.

| Customer Segment | Key Needs | 2024 Market Insight | Alta's Role |

| Industrial & Material Handling | Forklifts, aerial platforms, warehouse solutions | Global market > $130 billion | Provides reliable equipment and fleet management |

| Construction & Infrastructure | Earthmoving, cranes, rental flexibility | North American rental market > $60 billion | Offers new, used, and rental equipment |

| Mining, Quarrying, Aggregates | Heavy earthmoving, crushing, screening | Global market > $200 billion | Supplies durable, high-performance machinery |

| Government & Municipal | Road maintenance, infrastructure projects | Driven by IIJA funding | Provides heavy-duty equipment for public works |

| Specialized Operators & Rental Houses | Niche equipment, fleet augmentation | Strong rental demand | Access to diverse, specialized equipment |

Cost Structure

Alta Equipment Group's cost structure heavily relies on acquiring both new and used machinery for its sales inventory and rental fleet. This is a substantial expense, encompassing the direct purchase price of equipment, the ongoing costs of holding this inventory, and the depreciation that naturally occurs over time.

For instance, in the first quarter of 2024, Alta Equipment Group reported that its cost of sales, which includes equipment procurement, was $271.5 million. This highlights the significant capital outlay required to maintain a competitive equipment offering.

Effectively managing the size of the rental fleet and the overall inventory levels is paramount to controlling these costs. Overstocking ties up capital and increases holding expenses, while insufficient inventory can lead to lost sales and rental opportunities.

Personnel and labor costs represent a significant portion of Alta Equipment Group's expenses. This includes salaries, wages, and benefits for a diverse workforce, from sales and administrative teams to a substantial number of highly skilled technicians essential for service and repair operations.

The company makes a considerable investment in training and retaining qualified personnel, recognizing that their expertise directly impacts customer satisfaction and operational efficiency. For instance, in 2023, Alta Equipment Group reported significant investments in employee development programs to ensure their technical staff remained at the forefront of equipment maintenance and repair.

Efficient management of this workforce is therefore critical for profitability. By optimizing staffing levels and ensuring high productivity among its skilled labor, Alta Equipment Group aims to control costs while delivering high-quality service, a key differentiator in the competitive equipment rental and sales market.

Alta Equipment Group's extensive network of over 85 branches represents a substantial cost center. These operating expenses encompass rent for prime locations, essential utilities like electricity and water, ongoing facility maintenance, and localized administrative salaries and supplies. In 2024, managing these overheads efficiently is paramount to profitability.

Aftermarket Service and Parts Inventory Costs

Alta Equipment Group incurs significant costs in its aftermarket service and parts inventory. These include the expenses of maintaining a broad range of spare parts, operating service vans, and managing repair facilities. Furthermore, the company invests in training its technicians and optimizing service logistics, which are crucial for customer satisfaction and operational efficiency.

This segment, while generating high margins, demands considerable upfront capital for inventory and infrastructure. For instance, in 2024, the company continued to focus on optimizing its parts inventory to balance availability with carrying costs, a key challenge in this high-service business model.

- Parts Inventory: Costs associated with stocking a comprehensive inventory of spare parts to meet customer demand promptly.

- Service Operations: Expenses related to the maintenance and operation of service vehicles, repair shops, and diagnostic equipment.

- Technician Training: Investment in continuous training and development for service technicians to ensure expertise in handling diverse equipment and repairs.

- Logistics Management: Costs incurred in managing the efficient flow of parts and service personnel to customer locations.

Financing and Debt Service Costs

Given the capital-intensive nature of equipment sales and rentals, financing and debt service costs represent a significant portion of Alta Equipment Group's cost structure. These expenses primarily stem from interest payments on various forms of debt, including floor plan financing essential for maintaining inventory and other loans used to acquire the substantial assets required for their operations.

For instance, in 2023, Alta Equipment Group reported interest expense of $48.1 million. This figure highlights the considerable financial commitment associated with leveraging debt to fund their business model, directly impacting profitability. The company's ability to manage its interest rate exposure is therefore a critical financial consideration, as fluctuations in rates can directly influence their cost of capital and overall financial performance.

- Interest Expense: In 2023, Alta Equipment Group incurred $48.1 million in interest expense.

- Financing Needs: The capital-intensive nature of equipment sales and rentals necessitates significant financing for inventory and asset acquisition.

- Debt Management: Managing interest rate fluctuations is a key strategy to control borrowing costs and maintain financial stability.

Alta Equipment Group's cost structure is heavily influenced by the acquisition and maintenance of its extensive equipment inventory, both for sale and rental. This includes the direct purchase costs, holding expenses, and depreciation of machinery. In the first quarter of 2024, the cost of sales, encompassing equipment procurement, reached $271.5 million, underscoring the significant capital investment required.

Personnel and labor are also major cost drivers, covering salaries, benefits, and essential training for technicians and support staff. The company's operational footprint, with over 85 branches, incurs substantial overheads like rent, utilities, and facility upkeep. Furthermore, the aftermarket service and parts segment demands investment in parts inventory, service vehicles, and technician expertise.

Financing costs, particularly interest on debt used for inventory and asset acquisition, represent another significant expense. In 2023, Alta Equipment Group reported $48.1 million in interest expense, highlighting the impact of debt on its cost of capital.

| Cost Category | Q1 2024 Data | 2023 Data |

| Cost of Sales (Equipment Procurement) | $271.5 million | N/A |

| Interest Expense | N/A | $48.1 million |

| Branch Operating Expenses | Ongoing | Ongoing |

| Aftermarket Service & Parts Investment | Ongoing | Ongoing |

Revenue Streams

Alta Equipment Group’s business model heavily relies on the sale of both new and used industrial and construction equipment. This segment is a primary driver of their revenue, encompassing a wide array of machinery like forklifts and earthmoving equipment, catering to diverse industry needs.

In 2024, the company continued to see strong demand for its equipment offerings. For instance, their new equipment sales saw a notable increase, contributing significantly to the overall financial performance, with revenue being booked upon successful delivery to the client.

Alta Equipment Group generates significant revenue through the rental of its extensive equipment fleet. This includes everything from heavy machinery for construction to specialized equipment for various industrial applications. The company caters to a wide range of clients, offering rental terms that suit both short-term project demands and extended operational needs, ensuring a consistent revenue flow.

Rental income represents a crucial recurring revenue stream for Alta Equipment Group. In 2023, rental revenue was a substantial component of their overall financial performance, contributing significantly to their top line. This model provides a predictable cash flow, which is vital for ongoing operations and fleet management.

The company also leverages a rent-to-sell strategy, which further bolsters cash flow. This approach allows them to manage their fleet effectively, ensuring it remains modern and in high demand. By facilitating fleet turnover through rentals that can convert to sales, Alta Equipment Group optimizes its asset utilization and capital efficiency.

Alta Equipment Group generates substantial revenue from selling both genuine and aftermarket parts, crucial for maintaining and repairing its equipment fleet. These parts sales are a significant contributor, often boasting healthier profit margins compared to the initial equipment sale.

The extensive installed base of equipment that Alta has sold and rented provides a robust foundation for its aftermarket parts business. This creates a recurring revenue stream as customers require ongoing maintenance and replacement parts.

Product support, with parts sales being a key component, has demonstrated consistent organic growth for Alta. For instance, in Q1 2024, Alta reported a 12.4% increase in rental revenue, which indirectly fuels parts sales through increased equipment utilization and subsequent maintenance needs.

Service and Maintenance Contract Fees

Alta Equipment Group generates revenue by offering comprehensive service, maintenance, and repair solutions for customer-owned and rental equipment. This includes diagnostic services and often operates through long-term service contracts.

These service contracts are crucial for creating a predictable and high-margin recurring revenue stream for the company. The company's skilled technicians are a key asset in delivering these valuable services.

- Service Contracts: Alta offers service contracts that cover routine maintenance, repairs, and diagnostics for equipment.

- Recurring Revenue: These contracts provide a stable and predictable revenue source, contributing significantly to profitability.

- Technician Expertise: The company leverages its highly trained technicians to deliver high-quality service, driving customer satisfaction and contract renewals.

- High Margins: Service and maintenance typically represent a higher-margin business compared to equipment sales alone.

Master Distribution Sales

Alta Equipment Group's Master Distribution segment is a key revenue driver, focusing on supplying specialized equipment and components to a network of dealers and large end-users. This strategy diversifies their income and capitalizes on established supply chain connections.

In 2024, this segment demonstrated notable resilience, with specific periods showing strong rebound activity, contributing to Alta's overall financial performance. This segment's ability to adapt to market fluctuations is a significant advantage.

- Diversified Revenue: Master Distribution sales provide an income stream separate from direct equipment sales, reducing reliance on a single market.

- Supply Chain Leverage: This segment allows Alta to leverage its relationships with manufacturers and large customers, enhancing its market position.

- Resilience and Rebound: In 2024, this segment proved its ability to recover and grow, even amidst challenging economic conditions.

Alta Equipment Group’s revenue streams are diverse, encompassing equipment sales, rentals, parts, and service. In 2023, the company reported total revenues of $1.9 billion, with equipment sales and rentals forming the largest segments.

The company’s rental fleet is a significant contributor, generating recurring income. In the first quarter of 2024, Alta reported a 12.4% increase in rental revenue, underscoring the segment's growing importance.

Parts and service revenue also play a vital role, often carrying higher profit margins. This segment benefits from Alta’s substantial installed base of equipment, ensuring ongoing demand for maintenance and repairs.

The Master Distribution segment further diversifies Alta's revenue by supplying equipment and components to dealers and end-users, demonstrating resilience and adaptability in 2024 market conditions.

| Revenue Stream | Description | 2023 Contribution (Approx.) | 2024 Trend (Q1) |

|---|---|---|---|

| Equipment Sales | New and used industrial and construction equipment. | Largest segment | Strong demand |

| Equipment Rentals | Rental of heavy machinery and specialized equipment. | Significant recurring revenue | +12.4% revenue growth |

| Parts Sales | Genuine and aftermarket parts for maintenance and repair. | High-margin, recurring | Steady growth |

| Service & Maintenance | Repair, diagnostics, and service contracts. | High-margin, recurring | Consistent organic growth |

| Master Distribution | Supply of equipment and components to dealers and end-users. | Diversified income | Resilient and rebounding |

Business Model Canvas Data Sources

The Alta Equipment Group Business Model Canvas is built upon a foundation of financial reports, market analysis, and operational data. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.