Alta Equipment Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alta Equipment Group Bundle

Alta Equipment Group operates within an industry characterized by moderate buyer power and significant threat of substitutes, as customers can often opt for rental or used equipment. The bargaining power of suppliers is also a key consideration, influencing the cost of goods sold and overall profitability. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alta Equipment Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The industrial and construction equipment sector, which includes products like forklifts and cranes, is dominated by a small number of large global manufacturers. This limited supplier base means these Original Equipment Manufacturers (OEMs) hold considerable sway over distributors such as Alta Equipment Group.

This concentration of suppliers directly impacts Alta's operational costs and product sourcing. For instance, in 2023, the average price of new heavy construction equipment saw an increase, partly influenced by supply chain pressures and OEM pricing strategies. Alta's success hinges on its ability to cultivate robust relationships with a variety of OEMs to lessen the impact of any single supplier's leverage.

Suppliers of specialized components or proprietary technologies for heavy equipment, like those used by Alta Equipment Group, can wield significant bargaining power. This is particularly true when their products are unique or essential, making it difficult for Alta to find alternative sources. For instance, if a specific hydraulic system or engine control unit is only produced by one manufacturer, that supplier has a strong hand in dictating terms.

The reliance on a limited number of suppliers for critical parts can constrain Alta's ability to maintain its service and repair operations efficiently. This dependency can lead to higher input costs or potential delays if supply chains are disrupted. As of the first quarter of 2024, Alta reported a 10.5% increase in cost of sales, partly reflecting these supply chain dynamics.

However, Alta's substantial aftermarket support business, which involves providing parts and services for a wide range of heavy equipment, indicates a well-developed network of suppliers for many essential components. This suggests that while some suppliers may hold leverage, Alta has likely secured reliable sourcing for the majority of its needs, mitigating some of the supplier bargaining power.

Switching major equipment manufacturers or key component suppliers can be costly and disruptive for Alta Equipment Group. These costs can include re-training technicians, investing in new diagnostic tools, adjusting inventory systems, and potentially losing established customer relationships tied to specific brands. This makes Alta somewhat dependent on its existing supplier relationships, granting suppliers more leverage.

Threat of Forward Integration by Suppliers

While a less frequent occurrence, major equipment manufacturers (OEMs) could potentially integrate forward into direct distribution or service, thereby bypassing dealers like Alta Equipment Group. This would allow them to capture more of the value chain. However, the intricate requirements of local sales, aftermarket support, and specialized service infrastructure often render this move impractical for OEMs, significantly mitigating this particular threat.

The current industry landscape heavily favors the established dealer network model. OEMs typically lack the localized infrastructure and customer relationships necessary for efficient direct sales and service operations. For instance, in 2024, the heavy equipment distribution market continues to be dominated by independent dealerships that offer tailored solutions and immediate support, which are difficult for OEMs to replicate on a broad scale.

- Forward Integration Risk: Theoretically, OEMs could bypass dealers, but the operational complexities of local distribution and service make this a low probability threat.

- Dealer Network Strength: The existing dealer model is robust and well-entrenched, providing essential local market expertise and customer support that OEMs struggle to match.

- Industry Norms: The prevalence of dealerships in the heavy equipment sector underscores the ongoing reliance on this distribution channel.

Importance of Alta to Suppliers

Alta Equipment Group's position as one of the largest integrated equipment dealership platforms in the U.S., with an extensive branch network, makes it a crucial sales channel for numerous Original Equipment Manufacturer (OEM) partners. This broad reach means suppliers often depend on Alta for significant sales volumes, giving Alta some bargaining power. Suppliers are likely motivated to maintain a strong relationship with Alta to ensure continued access to its substantial customer base and market penetration.

Alta's market performance directly impacts its suppliers' revenue streams and overall business health. For instance, in 2023, Alta reported total revenues of $1.9 billion, showcasing the scale of transactions facilitated through its dealerships. A disruption in this channel could significantly affect an OEM's sales targets and profitability, making them more amenable to Alta's terms.

- Significant Sales Channel: Alta's extensive network of dealerships across the U.S. serves as a vital sales outlet for many equipment manufacturers.

- Market Reach: Alta's ability to reach a diverse and widespread customer base provides a valuable service to its OEM partners.

- Revenue Dependence: Suppliers may have a notable portion of their revenue tied to sales through Alta, influencing their negotiating stance.

- Brand Visibility: Association with a large, reputable dealer like Alta can enhance brand visibility and market presence for suppliers.

The bargaining power of suppliers for Alta Equipment Group is influenced by several factors, including the concentration of manufacturers and the uniqueness of components. While a limited number of large global manufacturers dominate the industrial and construction equipment sector, giving them significant leverage, Alta's extensive dealer network and aftermarket support also provide it with some counter-bargaining power.

Alta's substantial sales volumes make it a crucial partner for many Original Equipment Manufacturers (OEMs), meaning suppliers often depend on Alta for significant revenue. This dependence can give Alta leverage in negotiations, as suppliers are motivated to maintain access to its broad customer base. For instance, Alta's 2023 revenues of $1.9 billion highlight the scale of its market influence.

However, reliance on specialized or proprietary components from single suppliers can create situations where Alta has limited alternatives, thereby increasing supplier leverage. The cost and disruption associated with switching suppliers also reinforce existing relationships and grant suppliers more power. Alta's first quarter of 2024 saw a 10.5% increase in its cost of sales, partly reflecting these supply chain dynamics and supplier pricing power.

| Factor | Impact on Alta Equipment Group | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | High leverage for dominant OEMs | Limited number of large global manufacturers in the sector |

| Component Uniqueness | Increased supplier power for proprietary parts | Difficulty finding alternatives for specialized systems |

| Switching Costs | Reinforces supplier relationships | Costs include retraining, new tools, inventory adjustments |

| Alta's Market Reach | Provides counter-leverage to Alta | $1.9 billion in 2023 revenues, significant sales channel for OEMs |

| Cost of Sales | Reflects supplier cost pressures | 10.5% increase in Q1 2024 |

What is included in the product

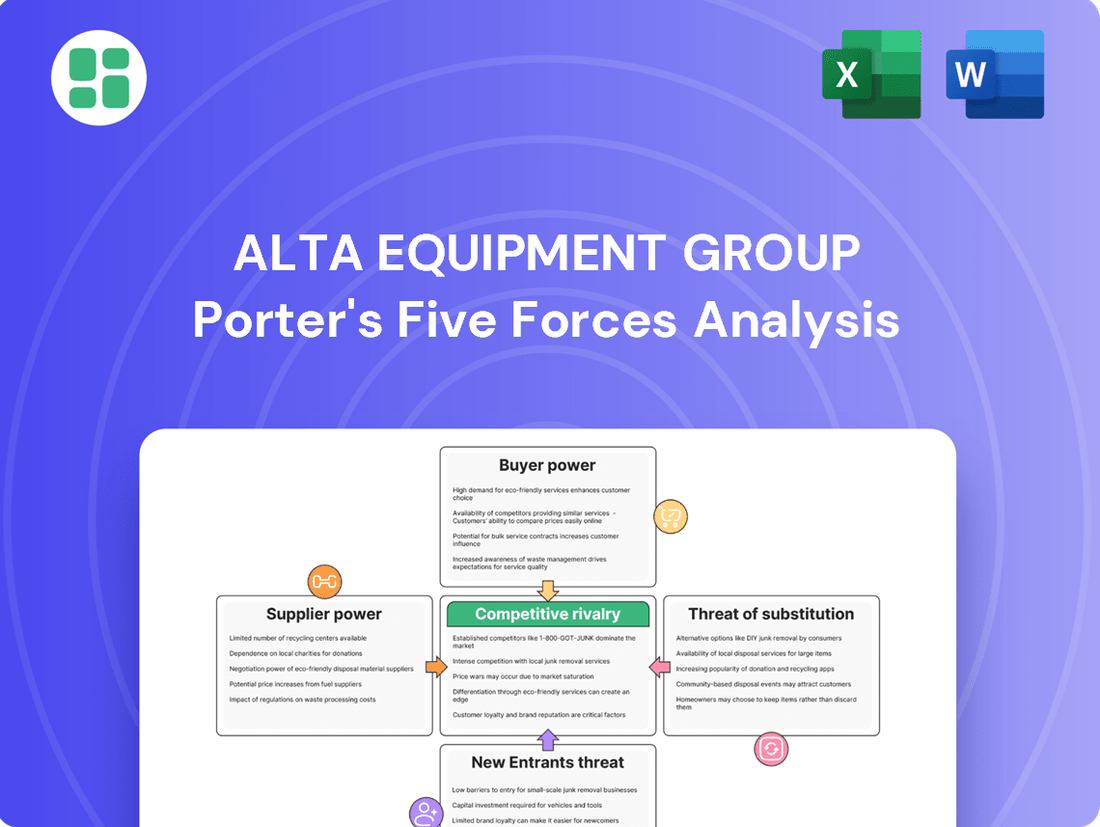

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for Alta Equipment Group, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Quickly identify and address competitive threats with a visual representation of each Porter's Five Force, allowing for immediate strategic adjustments.

Customers Bargaining Power

Alta Equipment Group serves a wide array of customers across the industrial and construction sectors. This diversity, from small contractors to major industrial firms, generally limits the bargaining power of any single customer. For instance, in 2023, Alta's top ten customers accounted for approximately 15% of its total revenue, indicating a relatively diffused customer base.

Switching equipment providers can be a significant undertaking for customers, often involving moderate to high switching costs. These costs can arise from investments in specialized equipment that is tied to a particular manufacturer's ecosystem, or from reliance on a provider like Alta Equipment Group for comprehensive aftermarket support, including parts and specialized maintenance. For instance, a construction company heavily invested in a specific brand of excavators might face substantial costs in retraining staff and retooling if they were to switch to a different brand.

Alta's strategy of offering a 'one-stop-shop' model, which integrates sales, rental, parts, and service, is designed to further embed itself within customer operations. This comprehensive approach aims to make it more inconvenient and costly for customers to seek these services elsewhere. By centralizing these critical functions, Alta can increase the stickiness of its customer relationships, as customers become more dependent on their integrated service offerings.

Customers in the industrial and construction sectors are often quite sensitive to price, especially when making significant investments in equipment or managing rental expenses. For example, the average price of a new medium-duty construction excavator can range from $100,000 to $200,000, making cost a major consideration.

Economic conditions play a huge role in how much customers are willing to spend. Factors like rising interest rates, which increased by 1.25% in the Federal Reserve's March 2023 meeting, can make financing equipment more expensive, thereby reducing demand and pushing customers to seek lower prices.

This price sensitivity means Alta Equipment Group often needs to offer competitive pricing and adaptable payment or rental terms to attract and retain business, especially when market demand is unpredictable.

Availability of Substitute Products/Services for Customers

Customers seeking equipment have numerous alternatives to purchasing new machinery from Alta Equipment Group. These options include acquiring used equipment, renting from various providers, or even adopting entirely different technological solutions that might meet their needs without traditional equipment purchases.

The presence of a strong secondary market for used equipment and a rapidly expanding rental sector significantly amplifies customer choices. For instance, a report from Allied Market Research projected the global used construction equipment market to reach $200.2 billion by 2027, indicating substantial customer alternatives. This broadens the competitive landscape and directly enhances the bargaining power of customers by providing viable alternatives.

Alta Equipment Group itself acknowledges and caters to these customer alternatives by offering a diverse portfolio that includes both new and used equipment for sale, alongside comprehensive rental services. This strategic approach allows Alta to capture a wider customer base and mitigate the threat posed by readily available substitute options.

- Customer Alternatives: Used equipment sales, rental services from competitors, alternative technologies.

- Market Trends: Growth in the used equipment market and rental sector increases customer options.

- Alta's Strategy: Offering both new and used equipment, plus rentals, to meet diverse customer needs.

- Impact on Bargaining Power: Increased availability of substitutes empowers customers to negotiate better terms.

Customer's Ability to Self-Provide

While some very large construction or industrial companies possess the financial clout and internal capabilities to acquire and manage their own equipment fleets, thereby lessening their dependence on third-party rental companies like Alta Equipment Group, this self-provisioning option isn't universally practical.

The substantial upfront capital outlay for purchasing heavy machinery, coupled with ongoing expenses for maintenance, repairs, and the necessity of employing skilled technicians, often makes renting or leasing from specialized dealers a more economically sensible choice for many businesses. This is particularly true for specialized equipment or machinery that is only needed intermittently.

For instance, the total market for construction equipment in North America saw significant activity in 2024, with rental revenue projected to grow. However, the capital expenditure required for a large fleet can easily run into tens or hundreds of millions of dollars, a barrier many firms cannot or will not overcome.

- High Capital Investment: Acquiring a comprehensive fleet requires substantial upfront capital, often millions of dollars, making it prohibitive for many.

- Maintenance & Operational Costs: Beyond purchase price, ongoing costs for maintenance, parts, fuel, and storage are considerable.

- Specialized Expertise: Operating and maintaining diverse heavy equipment necessitates specialized training and a dedicated technical workforce.

- Utilization Rates: For equipment used infrequently, the cost of ownership versus rental becomes a clear economic disadvantage.

The bargaining power of Alta Equipment Group's customers is moderate, influenced by several factors. While a fragmented customer base generally limits individual leverage, price sensitivity is a key driver, especially given the high cost of equipment, with new excavators often costing $100,000 to $200,000. Economic conditions, such as rising interest rates, further empower customers to seek better pricing and terms.

The availability of substitutes, including used equipment and rentals from competitors, significantly boosts customer bargaining power. The global used construction equipment market was projected to reach $200.2 billion by 2027, highlighting the breadth of alternatives. Alta's strategy of offering new, used, and rental options helps mitigate this, but the competitive landscape remains robust.

While some large firms can self-provision, the substantial capital investment, ongoing maintenance, and specialized expertise required for owning fleets make third-party providers like Alta more attractive for many. For example, the capital expenditure for a large equipment fleet can easily reach tens of millions of dollars, a significant barrier.

| Factor | Description | Impact on Bargaining Power |

|---|---|---|

| Customer Concentration | Alta's top ten customers represented about 15% of revenue in 2023, indicating a diffused base. | Lowers individual customer leverage. |

| Price Sensitivity | Customers are sensitive to equipment costs, with new excavators ranging from $100,000-$200,000. | Increases pressure for competitive pricing. |

| Availability of Substitutes | Strong markets for used equipment and rentals provide numerous alternatives. | Significantly enhances customer leverage. |

| Switching Costs | Costs related to specialized equipment and aftermarket support can be moderate to high. | Can reduce customer willingness to switch, slightly dampening leverage. |

What You See Is What You Get

Alta Equipment Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Porter's Five Forces analysis for Alta Equipment Group details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This in-depth examination provides actionable insights into the strategic positioning and potential challenges for Alta Equipment Group.

Rivalry Among Competitors

Alta Equipment Group competes in a market with a significant number of players, ranging from large national companies to smaller, localized dealerships. This creates a fragmented competitive environment. For instance, in 2024, the industrial and construction equipment sector sees robust activity from both integrated firms and independent operators, contributing to a high degree of rivalry.

As one of North America's largest integrated equipment rental and sales platforms, Alta Equipment Group contends with other major entities in the industry. These competitors also possess substantial market presence and resources, intensifying the competitive pressures Alta faces in securing market share and customer loyalty.

The heavy equipment and material handling sectors are seeing growth, fueled by infrastructure projects, the boom in e-commerce, and the increasing adoption of automation. This expansion generally helps to ease competition, as there's more market for everyone to tap into.

However, when growth rates are more moderate, as some forecasts suggest for certain segments in 2025, competition for market share can heat up. Alta Equipment Group's material handling division demonstrated resilience in 2024, posting slight revenue gains, which indicates a stable, albeit not explosive, demand environment.

While equipment itself can be highly standardized, making it tough to stand out on product features alone, Alta Equipment Group focuses on a comprehensive 'one-stop-shop' approach. This means they bundle sales, rentals, parts, and crucial service support, offering a more complete solution to customers.

Alta's strategy aims to reduce head-to-head price competition by emphasizing reliable aftermarket support and a wide selection of products from various manufacturers. This broad portfolio and strong service reputation are key differentiators in a market where equipment can otherwise appear similar.

Switching Costs for Customers Among Competitors

Alta Equipment Group aims to build switching costs by offering integrated services, but these barriers aren't insurmountable. If rivals present substantially more attractive pricing, superior service, or better equipment availability, customers might still opt to switch.

The inherent ease with which customers can move between rental providers or equipment dealers, particularly for standard machinery, fuels the competitive rivalry. This is evident in the equipment rental sector where, for many common items, the decision to switch can be relatively straightforward if a competitor offers a compelling advantage.

- Low Switching Costs: For many standard equipment rentals, the cost and effort for a customer to switch from one provider to another are minimal, intensifying competition.

- Price Sensitivity: In 2024, the construction equipment rental market, a key segment for Alta, continued to show significant price sensitivity among customers, making it easier to attract business away from competitors.

- Service & Availability as Differentiators: While price is a factor, superior customer service and immediate equipment availability can create stickiness, even with lower switching costs.

Exit Barriers

The equipment dealership sector, including companies like Alta Equipment Group, faces substantial exit barriers due to the high fixed costs tied to maintaining a large equipment inventory, extensive service infrastructure, and specialized technical staff. These significant investments make it economically challenging for dealerships to simply cease operations, especially during economic downturns.

Consequently, companies are often compelled to remain active competitors, even when demand is low, intensifying the rivalry as they vie for a shrinking pool of customers. This situation can lead to prolonged periods of competitive pressure.

Alta Equipment Group's 2024 strategic focus on reducing its rent-to-sell fleet size and optimizing inventory levels directly addresses these high fixed costs. By streamlining these operations, Alta aims to mitigate the financial burden associated with idle assets and improve its ability to navigate market fluctuations, thereby managing the impact of exit barriers on its competitive landscape.

- High Fixed Costs: Significant capital is tied up in equipment inventory and service facilities.

- Specialized Personnel: The need for skilled technicians adds to operational overhead.

- Forced Competition: High exit barriers encourage companies to stay in the market, even during weak demand periods.

- Alta's 2024 Strategy: Initiatives like reducing rent-to-sell fleet and inventory optimization aim to lower these costs.

Competitive rivalry within Alta Equipment Group's operating sectors is intense, driven by a large number of competitors, including national firms and localized dealerships. This fragmentation means Alta constantly contends with other major players possessing significant market presence and resources, leading to a constant battle for market share and customer loyalty.

While market growth, fueled by infrastructure spending, can ease competitive pressures, periods of moderate growth, as anticipated by some in 2025, intensify the fight for customers. Alta's strategy of offering a comprehensive 'one-stop-shop' experience, bundling sales, rentals, parts, and service, aims to differentiate itself beyond mere price competition.

The ease with which customers can switch providers, especially for standard equipment, coupled with a notable price sensitivity observed in the 2024 construction equipment rental market, keeps rivalry high. Despite this, superior service and immediate equipment availability remain key factors in retaining customers.

High exit barriers, such as substantial fixed costs in inventory and service infrastructure, compel companies to remain active competitors, even in weaker demand periods. Alta's 2024 focus on optimizing its fleet and inventory directly addresses these costs to better manage competitive pressures.

| Competitive Factor | Description | Impact on Alta Equipment Group |

|---|---|---|

| Number of Competitors | Fragmented market with national and local players. | High rivalry, constant need to differentiate. |

| Competitor Resources | Major entities with substantial market presence. | Intensified competition for market share and customer loyalty. |

| Switching Costs | Low for standard equipment rentals. | Easier for customers to move to competitors offering better value. |

| Price Sensitivity | Significant in key markets like construction equipment rental. | Pressure on pricing strategies, need for cost efficiency. |

| Exit Barriers | High due to fixed costs in inventory and infrastructure. | Forces companies to remain active competitors, prolonging competitive pressure. |

SSubstitutes Threaten

While heavy construction and material handling equipment have few direct substitutes for large projects, emerging technologies pose a potential threat. Advancements in automation and robotics are increasingly being integrated into material handling operations, which could lessen the demand for certain traditional machinery and human-operated equipment. This trend might impact specific segments of Alta Equipment Group's material handling division.

In certain simpler tasks, manual labor or basic tools could replace some of Alta Equipment Group's machinery. However, for the demanding jobs in construction and industry, the speed and precision of specialized equipment are hard to match with human effort alone. For instance, the average hourly wage for construction laborers in the US was around $23.00 in 2024, making large-scale manual projects increasingly costly compared to equipment rental or purchase.

Customers opting for Do-It-Yourself (DIY) maintenance and repairs present a potential threat to Alta Equipment Group's aftermarket services. For simpler tasks, some clients might indeed choose to handle them internally to save costs.

However, the specialized nature and complexity of heavy equipment, like the machinery Alta provides, significantly curb the effectiveness of DIY solutions. The need for specific tools, technical expertise, and diagnostic equipment often makes professional servicing by Alta a more practical and reliable choice for most customers.

While DIY might address very minor issues, it's unlikely to fully substitute Alta's comprehensive service offerings, which include advanced diagnostics, specialized repairs, and preventative maintenance programs. For instance, in 2023, Alta's aftermarket segment generated approximately $1.3 billion in revenue, underscoring the significant reliance on professional services.

Secondhand Equipment Market

The secondhand equipment market presents a substantial threat of substitutes for Alta Equipment Group. This market provides a more budget-friendly option for customers who might otherwise purchase new machinery, especially when new equipment prices are elevated or delivery times are extended. For instance, in 2024, many industries faced supply chain disruptions and increased manufacturing costs, driving demand for used equipment as a cost-saving measure.

Alta actively addresses this threat by participating in the used equipment market itself. By offering a selection of pre-owned machinery, Alta captures a segment of customers seeking value and can potentially convert them to new equipment purchases later. This strategy helps mitigate the direct competition from independent used equipment dealers.

- Affordability: Used equipment offers a lower entry price point compared to new machinery.

- Market Dynamics: High new equipment prices or long lead times in 2024 amplified the appeal of secondhand options.

- Alta's Strategy: The company mitigates this threat by also selling used equipment, capturing value across different customer segments.

Equipment Rental Services (from non-Alta providers)

The threat of substitutes from non-Alta equipment rental providers is significant. Many businesses, particularly those with variable project demands or capital constraints, find renting equipment from specialized rental companies a viable alternative to purchasing from Alta. This rental market's expansion is fueled by its cost-efficiency and adaptability.

Alta itself actively participates in this competitive landscape by maintaining its own substantial rental fleet, directly addressing the demand for flexible equipment access. For instance, the equipment rental market in the U.S. was valued at approximately $60 billion in 2023 and is projected to grow steadily.

- Cost-Effectiveness: Renting often eliminates large upfront capital expenditures, making it attractive for businesses managing cash flow.

- Flexibility: Rental options allow companies to scale their equipment needs up or down based on project requirements, avoiding the burden of ownership for underutilized assets.

- Access to Latest Technology: Rental companies frequently update their fleets, providing access to newer, more efficient machinery without the need for continuous investment in new purchases.

The threat of substitutes for Alta Equipment Group is moderate, primarily stemming from the used equipment market and rental services. While direct technological substitutes for heavy-duty construction machinery are limited, the availability of pre-owned equipment and rental options provides cost-conscious customers with viable alternatives. Alta's strategy of participating in both the used equipment and rental markets helps to mitigate these threats by capturing value across different customer segments.

| Substitute Type | Description | Impact on Alta | Mitigation Strategy | 2024 Market Context |

|---|---|---|---|---|

| Used Equipment Market | Lower-cost alternative to new machinery. | Moderate threat, especially during periods of high new equipment prices or extended lead times. | Alta sells used equipment, capturing value and potential future new equipment sales. | Increased demand due to supply chain disruptions and rising manufacturing costs. |

| Equipment Rental Services | Flexible, cost-effective solution for variable project needs. | Significant threat for customers prioritizing flexibility and avoiding capital expenditure. | Alta operates its own rental fleet, directly competing and meeting customer demand for flexible access. | U.S. rental market valued around $60 billion in 2023, with steady projected growth. |

Entrants Threaten

Entering the industrial and construction equipment dealership market demands significant capital. New entrants need substantial funds for inventory, including new and used machinery, and to build rental fleets. For instance, a dealership might need millions of dollars just to stock a basic inventory of heavy equipment.

Beyond equipment, establishing robust service facilities and extensive parts warehousing requires considerable investment. These upfront costs create a formidable barrier, making it challenging for newcomers to match the scale and operational capacity of established players like Alta Equipment Group, which has already made these investments.

Established brand loyalty and deep relationships present a significant barrier for new entrants. Alta Equipment Group, for instance, benefits from years of cultivating strong ties with major equipment manufacturers (OEMs), securing crucial dealership agreements. This existing network makes it difficult for newcomers to access the same high-quality product lines. In 2024, the equipment rental market continued to see consolidation, reinforcing the advantage of established players with broad OEM partnerships.

Alta Equipment Group's extensive network of over 85 locations across multiple states and Canadian provinces is a formidable barrier to new entrants. This broad market reach for sales, rentals, parts, and service is not easily replicated.

Establishing a comparable distribution and service infrastructure requires substantial capital investment and time, making it incredibly challenging for newcomers to gain immediate traction and compete effectively against Alta's established presence.

Economies of Scale and Experience Curve

Established players like Alta Equipment Group leverage significant economies of scale, particularly in purchasing power and operational efficiency. This allows them to secure better terms with suppliers and spread fixed costs over a larger production volume, leading to lower per-unit costs. For instance, in 2024, the heavy equipment rental market continued to see consolidation, with larger firms benefiting from their extensive networks and purchasing volume, making it harder for newcomers to match pricing.

Alta's established operational experience curve also provides a distinct advantage. Years of refining processes in inventory management, equipment maintenance, and service delivery translate into greater efficiency and reliability. New entrants would face higher initial unit costs and a steep learning curve to achieve comparable operational effectiveness, hindering their ability to compete on price or service quality.

- Economies of Scale: Established firms benefit from lower per-unit costs due to bulk purchasing and efficient operations.

- Experience Curve: Years of operational refinement lead to greater efficiency and service quality for incumbents.

- Barriers to Entry: New entrants struggle to match the cost advantages and operational expertise of established players like Alta.

- Competitive Pricing: Alta's scale allows for more competitive pricing, a significant hurdle for new companies entering the market.

Regulatory Requirements and Certifications

The heavy equipment industry, including sectors where Alta Equipment Group operates, faces significant hurdles for new players due to stringent regulatory requirements. For instance, in 2024, companies involved in the sale, rental, and servicing of construction and industrial machinery must adhere to a complex web of safety standards, environmental protection laws, and operational certifications.

Navigating these compliance demands, including obtaining necessary licenses and ensuring staff are properly trained and certified, represents a substantial barrier. For example, in the United States, the Occupational Safety and Health Administration (OSHA) mandates specific training and certification for operators of certain heavy machinery, adding to the initial investment and ongoing operational costs for any new entrant.

- Regulatory Complexity: New entrants must understand and comply with diverse safety, environmental, and operational regulations.

- Certification Hurdles: Obtaining required certifications for equipment and personnel is time-consuming and costly.

- Increased Costs: Compliance and training requirements directly inflate the capital needed to enter the market.

- Operational Challenges: Ensuring all operations meet established standards requires significant ongoing management and investment.

The threat of new entrants for Alta Equipment Group remains relatively low due to substantial capital requirements for inventory, facilities, and rental fleets, often running into millions of dollars for basic operations. Furthermore, established brand loyalty and exclusive OEM dealership agreements, which Alta secured years ago, make it difficult for newcomers to access desirable product lines. In 2024, the ongoing consolidation within the equipment rental market further solidified the advantages held by established players with strong manufacturer relationships.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alta Equipment Group leverages data from company annual reports, SEC filings, and industry-specific market research reports. We also incorporate insights from trade publications and financial news outlets to capture current market dynamics and competitive pressures.