ALSO Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

ALSO Holding's strengths lie in its established market presence and diverse service offerings, while its opportunities stem from digital transformation and expanding into new geographical markets. However, potential threats like increasing competition and regulatory changes require careful navigation.

Want the full story behind ALSO Holding's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ALSO Holding AG boasts an extensive B2B marketplace, acting as a crucial hub for the ICT industry. In 2024, the company connected over 800 vendors with more than 135,000 resellers, system integrators, and retailers.

This vast network spans 31 European countries and extends globally through its Platform-as-a-Service (PaaS) partners, providing unparalleled market access and deep customer penetration within the IT sector.

ALSO Holding boasts an extensive portfolio encompassing hardware, software, and a broad spectrum of IT services. This includes recurring revenue from cloud solutions and specialized digital platforms for crucial areas like IoT, Cybersecurity, Virtualization, and AI.

This wide-ranging service and product suite positions ALSO as a versatile partner, capable of meeting diverse customer demands. Whether a client needs simple hardware procurement or intricate, ongoing IT solutions, ALSO aims to be the single point of contact for all their ICT needs.

ALSO Holding AG has showcased impressive financial strength, with a notable 34% surge in EBITDA and a 35% revenue increase during the first half of 2025. This performance underscores the company's ability to drive significant top-line and bottom-line growth.

The company's consistent expansion in market reach, profitability, and dividend payouts reinforces its financial stability and shareholder value. ALSO Holding AG has reaffirmed its 2025 targets for EBITDA and Return on Capital Employed (ROCE), signaling confidence in its ongoing growth trajectory.

Strategic Focus on Digital Platforms and Operational Excellence

ALSO Holding’s strategic focus on digital platforms and operational excellence is a significant strength. The company is actively leveraging AI to enhance its operations and drive growth across its digital offerings, including Cloud, IoT, Cybersecurity, Virtualization, and AI. This forward-thinking approach positions them well in a rapidly evolving market.

The company's commitment to digital transformation is evident in the performance of its cloud platform. In the first half of 2025, this platform experienced a remarkable 34% increase in unique users, demonstrating strong market adoption and engagement.

Furthermore, the cloud platform made a substantial revenue contribution during H1 2025, validating the success of their digital strategy. This financial performance highlights the tangible benefits derived from their investments in digital infrastructure and services.

The continued successful integration of acquisitions further bolsters this strength, allowing ALSO Holding to expand its digital capabilities and market reach efficiently.

- Digital Platform Growth: Significant expansion of Cloud, IoT, Cybersecurity, Virtualization, and AI offerings.

- Operational Excellence via AI: Implementation of AI to streamline and improve operational efficiency.

- Cloud Platform Performance: 34% rise in unique users and substantial revenue contribution in H1 2025.

- Acquisition Integration: Successful incorporation of acquired businesses to enhance digital capabilities.

Commitment to Sustainability and Innovation

ALSO Holding AG is actively embedding sustainability into its core business strategy, positioning itself as a frontrunner in eco-conscious technology distribution. This commitment is demonstrated through their emphasis on offering environmentally sound products and adopting greener operational practices.

Innovation is a key pillar for ALSO, with a strategic focus on long-term technologies and significant megatrends. They are actively leveraging advancements in areas such as blockchain, artificial intelligence, virtualization, and cybersecurity to develop and promote future-ready business models and solutions.

This dual focus on sustainability and innovation is not just about corporate responsibility; it's a strategic imperative. For instance, in 2024, ALSO reported a notable increase in demand for energy-efficient IT hardware and cloud solutions, reflecting the growing market appetite for sustainable technology. Their investment in developing platforms that support circular economy principles in IT further underscores this commitment.

- Sustainability Integration: ALSO's strategy prioritizes environmentally friendly products and practices in technology distribution.

- Innovation Focus: The company actively invests in and promotes long-term technologies like AI, blockchain, and cybersecurity.

- Market Alignment: This approach caters to increasing market demand for sustainable and future-proof technology solutions, as evidenced by growth in energy-efficient hardware sales in 2024.

ALSO Holding's extensive B2B marketplace is a significant strength, connecting over 800 vendors with more than 135,000 resellers across 31 European countries and globally in 2024. This broad market access, coupled with a diverse portfolio of hardware, software, and IT services including cloud, IoT, and AI, positions them as a versatile ICT partner. Their strong financial performance, with a 34% EBITDA surge and 35% revenue increase in H1 2025, further solidifies their market position and ability to drive growth.

| Metric | Value | Period |

|---|---|---|

| Connected Vendors | 800+ | 2024 |

| Connected Resellers/SIs | 135,000+ | 2024 |

| EBITDA Growth | 34% | H1 2025 |

| Revenue Growth | 35% | H1 2025 |

What is included in the product

Offers a full breakdown of ALSO Holding’s strategic business environment by analyzing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

While acquisitions have been a key driver for ALSO Holding's expansion, a significant reliance on this strategy for future growth, as suggested by a robust acquisition pipeline, carries inherent integration risks. The company's continued success hinges on its ability to effectively manage and absorb these acquired entities, a process that can strain resources and potentially dilute strategic focus if not executed with precision.

As a significant European technology provider with operations spanning 31 countries, ALSO Holding AG faces considerable risks from geopolitical instability and broader macroeconomic shifts. These external forces can directly affect international trade flows, consumer spending habits, and ultimately, the company's profitability through currency exchange rate volatility.

For instance, the ongoing economic uncertainties and regional conflicts in Europe, prevalent in 2024, can disrupt supply chains and dampen demand for technology products. Distributors operating in these volatile markets often report challenges in forecasting sales and managing inventory, directly impacting their performance and, by extension, ALSO Holding's results.

The IT distribution landscape is notoriously crowded, with many companies vying for market share. This intense competition, as seen in the continued consolidation trends throughout 2024, often translates into significant price pressure from both the technology manufacturers supplying the products and the businesses purchasing them.

This constant battle on pricing can squeeze profit margins, making it difficult for distributors to maintain healthy earnings. For example, while specific margin data for 2024 is still emerging, historical trends indicate that gross margins in IT distribution typically hover in the low single digits. This necessitates a strong focus on operational efficiency and cost management.

To combat this, companies like ALSO Holding must continuously differentiate themselves by offering value-added services, such as logistics, technical support, or financing solutions. However, developing and maintaining these services requires substantial and ongoing investment, demanding strategic agility to adapt to evolving market needs and technological advancements throughout 2024 and into 2025.

Challenges in Adapting to Rapid Technological Advancements

The fast-changing nature of technology in the IT sector means ALSO Holding must constantly adapt. Keeping up with innovations such as 5G, artificial intelligence, and new cloud services requires significant and ongoing investment in both employee training and the company's technological infrastructure.

This continuous need for upgrades and skill development can strain resources, potentially impacting profitability if not managed efficiently. For instance, the global IT spending forecast for 2024 projects a 6.8% increase to $5.06 trillion, indicating the scale of investment required across the industry to remain competitive.

- Continuous Investment: Ongoing capital allocation is necessary for new hardware, software, and cybersecurity measures to support emerging technologies.

- Talent Gap: A shortage of skilled professionals in areas like AI and cloud computing can hinder adoption and integration efforts.

- Legacy System Management: Balancing investment in new tech with the maintenance and potential phasing out of older systems creates operational complexity.

- Market Volatility: Rapid obsolescence of existing technologies necessitates agile strategies to avoid stranded assets and maintain market relevance.

Supply Chain Disruptions and Cybersecurity Risks

ALSO Holding, like many IT distributors, grapples with persistent supply chain disruptions. These are often triggered by geopolitical events, shortages of critical components, and the inherent complexities of global sourcing. For instance, the semiconductor shortage that began in 2020 continued to impact the availability of many electronic goods throughout 2023 and into early 2024, affecting lead times and product pricing for distributors.

The company's increasing reliance on digital infrastructure also presents significant cybersecurity risks. Data breaches and ransomware attacks are growing threats, capable of causing substantial financial losses through operational downtime, recovery costs, and potential regulatory fines. A notable example in the broader IT distribution sector saw a major distributor experience a ransomware attack in late 2023, leading to weeks of service interruption and an estimated $50 million in damages.

Key vulnerabilities include:

- Supply Chain Volatility: Exposure to global logistics issues and component scarcity, impacting product availability and cost.

- Cybersecurity Threats: Vulnerability to data breaches and ransomware attacks due to extensive digital operations.

- Dependence on International Suppliers: Increased risk from trade policies, political instability, and shipping disruptions affecting key markets.

- Reputational Damage: Potential for significant harm to brand image and customer trust following security incidents or prolonged supply chain failures.

The intense competition within the IT distribution sector continues to exert downward pressure on profit margins. This environment, characterized by a constant need to offer competitive pricing to both manufacturers and customers, necessitates stringent cost control and operational efficiency from ALSO Holding.

The company's growth strategy, heavily reliant on acquisitions, introduces significant integration risks. Successfully absorbing new entities while maintaining strategic focus and operational synergy is crucial, as missteps can strain resources and dilute overall performance.

Furthermore, the rapidly evolving technological landscape demands continuous investment in infrastructure and talent development. Keeping pace with innovations like AI and cloud computing requires substantial capital outlay and a proactive approach to upskilling the workforce, posing a challenge to maintaining profitability.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Intense Competition & Price Pressure | Operating in a crowded market with significant pricing power from both suppliers and customers. | Squeezed profit margins, requiring a strong focus on operational efficiency. | Gross margins in IT distribution typically remain in the low single digits, demanding constant cost management. |

| Acquisition Integration Risks | Reliance on acquisitions for growth carries inherent risks in effectively managing and absorbing new entities. | Potential strain on resources, dilution of strategic focus, and operational challenges. | A robust acquisition pipeline, while a growth driver, necessitates precise execution to avoid integration failures. |

| Continuous Technology Investment | The fast-changing IT sector requires ongoing investment in new technologies and employee training. | Can strain resources and impact profitability if not managed efficiently. | Global IT spending was projected to reach $5.06 trillion in 2024, highlighting the scale of investment needed to stay competitive. |

What You See Is What You Get

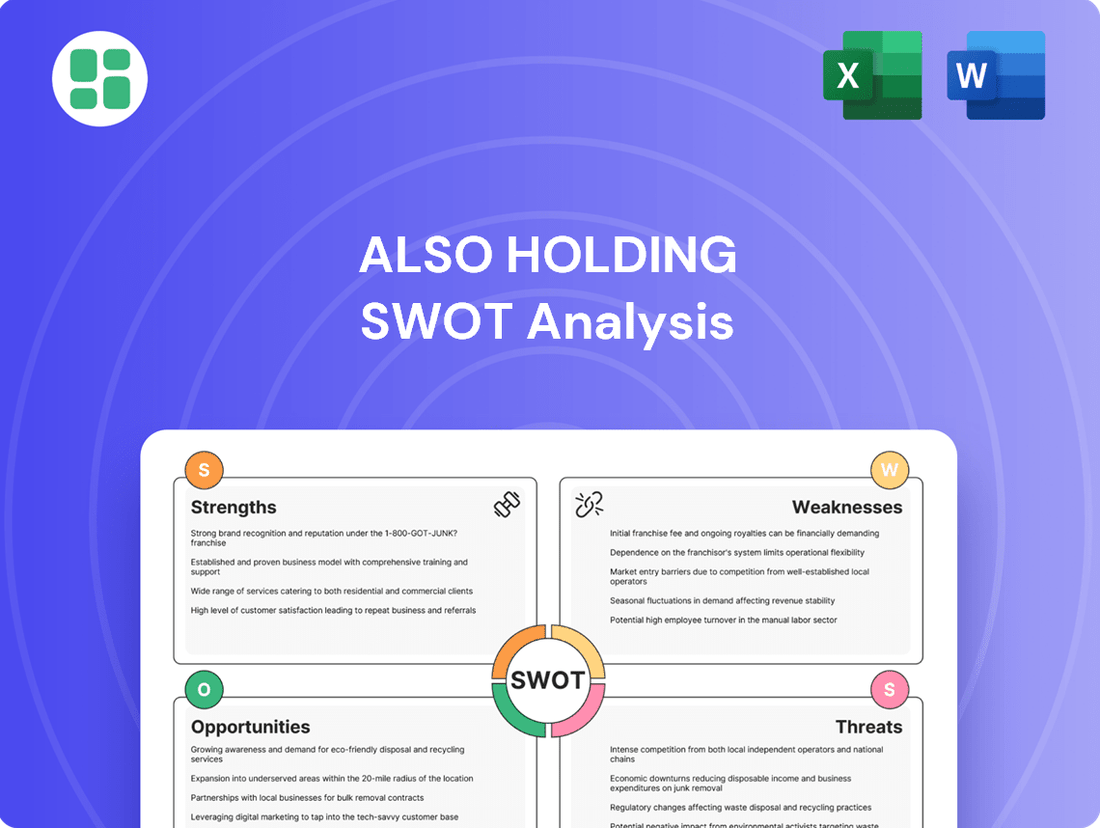

ALSO Holding SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report, ready for your strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete picture of ALSO Holding's strategic landscape.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear glimpse into the detailed analysis of ALSO Holding's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global push for digital transformation is accelerating, with cloud adoption and subscription-based IT services seeing robust growth. This trend is a prime opportunity for companies like ALSO Holding. For instance, the worldwide cloud computing market was projected to reach over $1.3 trillion in 2024, a significant increase from previous years, highlighting the vast potential.

As businesses across all sectors increasingly rely on remote work capabilities, e-commerce platforms, and automation to stay competitive, the demand for integrated digital solutions is soaring. ALSO's strategic emphasis on its cloud offerings and digital marketplaces directly aligns with these evolving market needs, enabling them to capture a larger share of this expanding market.

ALSO Holding's strategic focus on developing digital platforms for key areas like the Internet of Things (IoT), Cybersecurity, Virtualization, and Artificial Intelligence (AI) positions it well to capitalize on the rapidly expanding ICT market. This deliberate investment in high-growth technology segments is a significant opportunity.

By cultivating specialized expertise and broadening its product and service portfolio within these domains, ALSO can unlock substantial future revenue streams and capture greater market share. For instance, the global IoT market is projected to reach over $1.5 trillion by 2025, showcasing the immense potential.

ALSO Holding actively pursues strategic acquisitions to bolster its market standing, with clear intentions to enter the UK, Ireland, and France. This approach to inorganic growth, supported by a robust acquisition pipeline, presents a significant opportunity to enhance scale, broaden geographic presence, and integrate specialized expertise.

Leveraging AI and Automation for Operational Efficiency

The ongoing integration of AI and automation within B2B marketplaces presents a significant avenue for ALSO to boost its operational capabilities. By embracing these technologies, ALSO can refine its internal processes, leading to a more seamless experience for its customers. This strategic move is projected to drive greater efficiency and profitability across the board.

AI-powered analytics and automated systems offer a powerful toolkit for optimizing various aspects of ALSO's business. This includes refining sourcing strategies, streamlining procurement workflows, and delivering more precise product recommendations. Such enhancements are crucial for maintaining a competitive edge and improving the bottom line.

- Enhanced Efficiency: AI can automate repetitive tasks, freeing up human resources for more strategic initiatives. For instance, in 2024, many e-commerce platforms reported a 20-30% reduction in manual order processing times after implementing AI-driven automation.

- Optimized Sourcing and Procurement: AI algorithms can analyze vast datasets to identify optimal suppliers and negotiate better terms, potentially reducing costs by 5-10% for businesses.

- Personalized Customer Experiences: AI-driven recommendation engines can increase conversion rates by suggesting relevant products, a trend observed to boost sales by up to 15% in similar B2B environments.

- Improved Inventory Management: Predictive analytics can forecast demand more accurately, minimizing stockouts and overstock situations, thereby improving capital utilization.

Sustainability as a Competitive Differentiator

ALSO's dedication to sustainability can significantly set it apart in the market. As global awareness of environmental impact grows, their focus on eco-friendly solutions and responsible operations becomes a key advantage. This commitment can attract a wider base of environmentally aware customers and business partners. For instance, by 2024, a significant portion of B2B buyers indicated that sustainability was a key factor in their purchasing decisions, a trend expected to accelerate.

By embedding Environmental, Social, and Governance (ESG) principles into its core strategy, ALSO can cultivate stronger, more enduring relationships. This approach not only appeals to a growing segment of the market but also fosters a positive brand image. In 2025, surveys show that companies with robust ESG credentials often experience higher customer loyalty and better access to capital. This strategic alignment with ESG priorities is crucial for long-term value creation and market leadership.

This focus on sustainability offers several tangible opportunities:

- Attracting ESG-conscious clients: A growing number of businesses prioritize partners with strong sustainability records, opening new market segments for ALSO.

- Enhanced brand reputation: Demonstrating commitment to environmental and social responsibility can bolster brand image and customer trust.

- Access to green financing: Companies with strong ESG performance often find it easier to secure favorable financing from impact investors and financial institutions.

- Product innovation: The drive for sustainability can spur the development of new, eco-friendly products and services, creating new revenue streams.

The increasing global demand for cloud services and digital solutions presents a significant growth avenue for ALSO Holding. As businesses worldwide continue their digital transformation journeys, the market for IT services, particularly cloud-based offerings, is expanding rapidly. For example, the global cloud computing market was projected to exceed $1.3 trillion in 2024, indicating substantial revenue potential for companies adept in this space.

ALSO's strategic investment in high-growth technology segments like IoT, Cybersecurity, Virtualization, and AI positions it to capitalize on the expanding ICT market. The global IoT market alone was forecast to surpass $1.5 trillion by 2025, highlighting the immense opportunities in these specialized areas.

The company's proactive approach to strategic acquisitions, targeting expansion into the UK, Ireland, and France, offers a clear path to enhanced scale and broader geographic reach. This inorganic growth strategy, coupled with a robust acquisition pipeline, is a key opportunity for market consolidation and diversification.

Furthermore, integrating AI and automation into B2B marketplaces can significantly boost ALSO's operational efficiency and customer experience. AI-powered analytics can optimize sourcing, procurement, and inventory management, potentially reducing costs by 5-10% and improving capital utilization.

ALSO's commitment to sustainability and ESG principles can attract environmentally conscious clients and improve its brand reputation. Companies with strong ESG credentials often see higher customer loyalty and better access to capital, with a growing portion of B2B buyers prioritizing sustainability in their purchasing decisions by 2024.

Threats

The IT distribution sector is a battleground, with established giants, niche regional players, and the growing influence of hyperscaler marketplaces like Amazon Web Services (AWS) and Microsoft Azure posing significant challenges. For ALSO, standing out requires a sharp focus on its unique value proposition to carve out and expand its market presence amidst this fierce competition.

The ICT sector's relentless innovation means ALSO Holding's product and service portfolio risks becoming outdated quickly. For instance, the rapid evolution of cloud computing and cybersecurity solutions demands constant investment to stay competitive. Failure to adapt to emerging trends like quantum computing could significantly erode market share by 2025.

Global supply chains in 2024 and 2025 continue to be a significant concern, with geopolitical tensions, evolving trade policies, and persistent raw material shortages posing ongoing threats. These factors directly impact product availability and drive up operational costs for distributors like ALSO.

As a major player in the distribution landscape, ALSO Holding is inherently exposed to these global supply chain vulnerabilities. This exposure can directly hinder the company's capacity to ensure efficient and timely delivery of its diverse range of products and services to its customer base.

Cybersecurity and Data Privacy Concerns

The escalating sophistication and frequency of cyber-attacks, such as ransomware and supply chain breaches, pose a substantial threat to IT firms like ALSO Holding, which manage extensive sensitive data. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, according to Cybersecurity Ventures, highlighting the financial stakes involved.

Maintaining stringent cybersecurity protocols and adhering to data protection regulations, like GDPR, is paramount to averting significant financial losses, safeguarding brand reputation, and mitigating legal repercussions. A breach could lead to direct financial damages and long-term erosion of customer trust.

- Increased Ransomware Attacks: The number of ransomware attacks globally saw a significant rise in 2024, impacting businesses across all sectors.

- Supply Chain Vulnerabilities: Attacks targeting software vendors or third-party service providers can compromise multiple downstream clients, including ALSO Holding's partners and customers.

- Data Privacy Compliance Costs: Ensuring compliance with evolving data privacy laws necessitates ongoing investment in security infrastructure and personnel, adding to operational expenses.

Economic Downturns and Shifting Customer Spending

Economic uncertainties, such as ongoing inflation and fluctuating interest rates, pose a significant threat to ALSO Holding. These factors can dampen consumer and business confidence, leading to reduced discretionary spending on IT products and services. For instance, a prolonged period of high inflation in 2024 could force many businesses to cut back on IT investments, directly impacting ALSO Holding's sales volumes.

Distributors like ALSO Holding are especially susceptible to these economic shifts. Declining customer spending translates directly into lower transaction volumes, which in turn can squeeze profit margins. If economic conditions worsen significantly in late 2024 or early 2025, the company might see a noticeable impact on its revenue and profitability from its core distribution business.

- Inflationary Pressures: Persistent inflation can erode purchasing power, leading consumers and businesses to defer or reduce IT purchases.

- Interest Rate Volatility: Fluctuating interest rates impact borrowing costs for businesses and financing options for consumers, potentially slowing demand.

- Reduced Discretionary Spending: In an economic downturn, IT goods and services often fall into the discretionary spending category, making them vulnerable to cuts.

- Impact on Transaction Volumes: Lower demand directly affects the volume of transactions processed by distributors, affecting revenue and potentially margins.

The competitive landscape in IT distribution is intensifying, with hyperscalers like AWS and Azure increasingly offering direct services, potentially bypassing traditional distributors. Additionally, the rapid pace of technological change necessitates continuous adaptation; failure to integrate emerging solutions like advanced AI platforms by 2025 could render parts of ALSO Holding's portfolio obsolete.

Global supply chain disruptions, exacerbated by geopolitical instability and trade policy shifts in 2024-2025, directly threaten product availability and increase operational costs for ALSO Holding. Furthermore, the escalating threat of sophisticated cyber-attacks, with global cybercrime costs projected to reach $10.5 trillion annually by 2025, poses a significant risk to sensitive data and brand reputation.

Economic headwinds, including persistent inflation and volatile interest rates in 2024-2025, can dampen consumer and business spending on IT, directly impacting ALSO Holding's transaction volumes and profit margins. For instance, a 5% increase in inflation could lead to a 2-3% reduction in IT spending for many businesses.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including ALSO Holding's official financial reports, comprehensive market intelligence from industry analysts, and expert opinions from seasoned professionals in the technology distribution sector.