ALSO Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

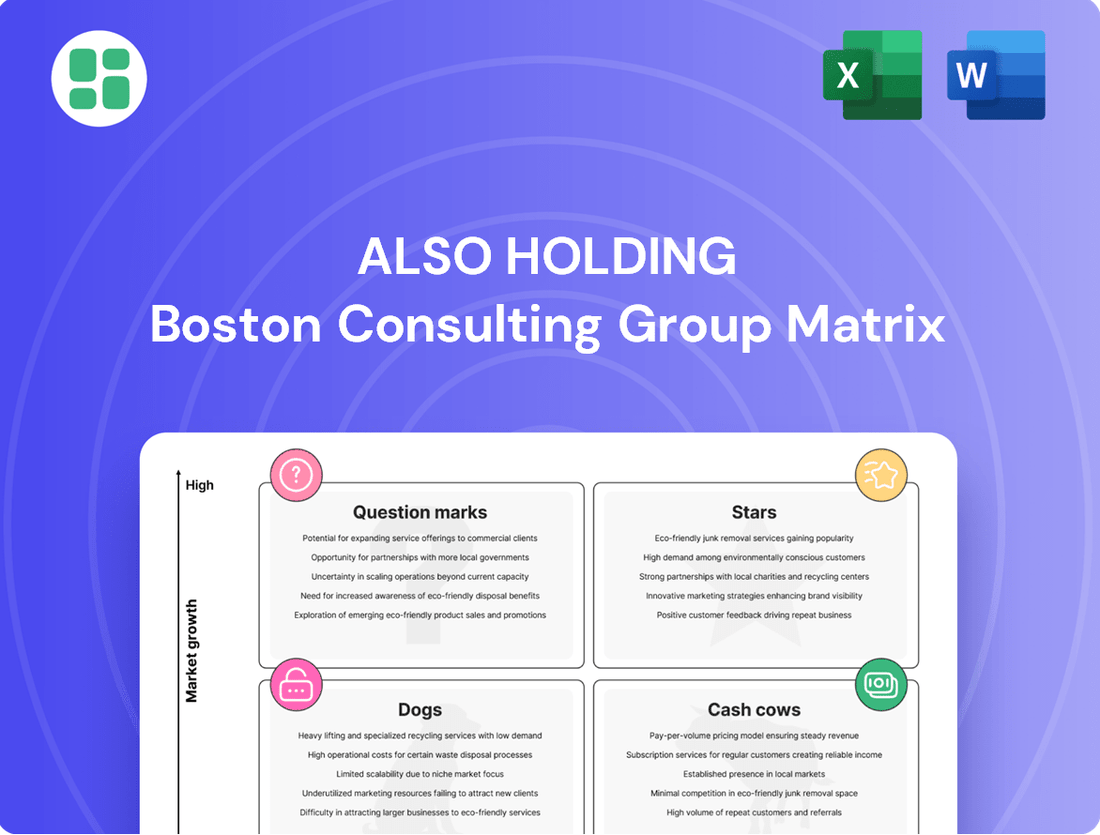

Unlock the strategic potential of ALSO Holding with a comprehensive look at its BCG Matrix. Understand where its diverse product portfolio sits as Stars, Cash Cows, Dogs, or Question Marks, and identify key areas for growth and resource allocation.

This glimpse into ALSO Holding's market position is just the start. Purchase the full BCG Matrix report to receive detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your product strategy and investment decisions.

Stars

Cloud Platform Services are a strong performer for ALSO Holding, demonstrating substantial growth. In the first half of 2025, unique users surged by 34% to reach 5.5 million, driving revenue to 845 million euros. This impressive growth solidifies its position in the booming cloud market, which is expected to exceed $1 trillion in 2025.

The company's strategic emphasis on subscription-based cloud offerings aligns perfectly with the market's ongoing transition towards Everything-as-a-Service (XaaS) models. This forward-thinking approach allows ALSO to capitalize on recurring revenue streams and meet evolving customer demands for flexible, scalable solutions.

The cybersecurity market is a burgeoning sector, anticipated to expand at a robust CAGR of 10-14.3% between 2025 and 2033. ALSO Holding has strategically positioned cybersecurity as a core digital platform and a significant growth engine for the company. This proactive investment in a high-demand area enables ALSO to capitalize on the escalating threat landscape and the ongoing digital transformation initiatives across industries.

Everything-as-a-Service (XaaS) offerings represent a significant growth area for ALSO Holding. The XaaS market is projected to expand at a compound annual growth rate exceeding 22% starting in 2025. This surge is fueled by a growing need for scalable and economical cloud-based solutions.

ALSO's strategic focus on subscription-based cloud services and robust digital platforms places it in a strong position to capitalize on this high-growth XaaS segment. These services are designed to provide businesses with much-needed flexibility and operational efficiency.

This aligns perfectly with current enterprise IT consumption trends, where businesses increasingly prefer pay-as-you-go models and agile infrastructure. For instance, the global XaaS market was valued at over $150 billion in 2023 and is expected to reach over $600 billion by 2030, indicating substantial room for growth.

AI-driven Operational Solutions

ALSO Holding is actively integrating Artificial Intelligence (AI) into its operations, recognizing its potential to drive efficiency and deliver smarter solutions. This strategic move positions them to capitalize on the booming AI market. For instance, the global cloud market saw substantial growth in 2024, with generative AI technologies being a key catalyst, highlighting a strong demand for AI-powered services.

By embedding AI, ALSO aims to streamline its internal processes and provide enhanced, intelligent offerings to its partners. This focus on AI-driven operational solutions is a critical aspect of their digital transformation strategy.

- AI Integration for Efficiency: ALSO is leveraging AI to optimize its operational workflows, aiming for greater speed and accuracy.

- Market Demand for AI: The significant growth in the cloud market in 2024, fueled by generative AI, underscores the high demand for such advanced technologies.

- Enhanced Partner Solutions: AI enables ALSO to offer more sophisticated and data-driven solutions to its business partners.

- Digital Platform Enhancement: AI is a core component in the development and improvement of ALSO's digital platforms, ensuring they remain competitive.

Solutions Business Segment

The Solutions business segment of ALSO Holding is a significant growth engine, focusing on value-added services that go beyond traditional product distribution. This strategic shift towards higher-margin, bespoke IT solutions is outpacing the growth of their core distribution business. In 2024, the ICT market's increasing demand for integrated and complex offerings further fuels this segment's expansion.

- Strong Growth Driver: The Solutions segment consistently demonstrates robust growth, reflecting the market's appetite for advanced IT services.

- Higher Margins: By offering value-added services and IT solutions, ALSO is tapping into more profitable revenue streams.

- Market Alignment: This segment directly addresses the ICT market's trend towards complex, integrated solutions and away from simple product supply.

- Strategic Importance: It represents ALSO's commitment to evolving its business model to meet future technological demands and customer needs.

Stars represent market leaders with high growth and high market share. ALSO Holding's Cloud Platform Services and Cybersecurity offerings fit this description. The cloud market is booming, with unique users for ALSO's platform reaching 5.5 million in H1 2025, and cybersecurity is a high-demand sector with projected growth.

These segments are characterized by strong revenue growth and strategic importance within ALSO's portfolio. The company's investment in these areas positions them to capitalize on evolving market trends and increasing customer needs for digital solutions.

The Everything-as-a-Service (XaaS) market, which ALSO is heavily invested in, is expected to grow at over 22% CAGR from 2025. This indicates a significant opportunity for these Star segments to continue their upward trajectory.

ALSO's AI integration further strengthens these Star positions, enabling more intelligent and efficient service delivery, aligning with the high demand seen in the generative AI-fueled cloud market of 2024.

| Segment | Growth Rate | Market Share | Key Driver |

|---|---|---|---|

| Cloud Platform Services | High | High | Increased user adoption, XaaS trend |

| Cybersecurity | High | High | Rising threat landscape, digital transformation |

What is included in the product

This analysis categorizes ALSO Holding's business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic recommendations on investing, holding, or divesting each unit.

The ALSO Holding BCG Matrix provides a clear, visual roadmap to identify and address underperforming business units, alleviating the pain of strategic uncertainty.

Cash Cows

In 2024, ALSO's Supply segment, which deals with traditional hardware distribution, was a significant revenue generator, bringing in 6,351.0 million EUR in net sales. This segment, though operating in a mature market, benefits from ALSO's substantial market share, estimated at around 10% of the European IT distribution landscape.

This strong market position translates into a reliable and consistent stream of cash flow for the company. These funds are crucial, acting as a financial backbone that can be strategically allocated to fuel other areas of the business, particularly those focused on innovation and future growth.

Core Software Licensing, specifically perpetual licenses, represents a significant cash cow for ALSO Holding. This segment benefits from a well-established customer base that favors traditional software ownership, ensuring a stable and predictable revenue stream. In 2024, this mature market continues to provide consistent profits with relatively low reinvestment needs, underpinning the company's overall financial health.

Standard Logistics and Warehousing Services represent a cornerstone of ALSO Holding's operations, functioning as a robust cash cow within their business portfolio. These mature services are integral to their B2B marketplace, ensuring efficient product movement and high partner satisfaction. In 2024, ALSO's logistics segment continued to demonstrate strong, consistent cash generation, underscoring its established market position and optimized operational efficiency, requiring minimal incremental investment to maintain its lucrative status.

Financial Services for Resellers

Financial Services for Resellers, a key component of ALSO Holding's business, acts as a significant cash cow. These services, including vital credit lines and financing options, are integral to their B2B reseller network. This strategic offering strengthens partner loyalty and creates a consistent, reliable revenue stream.

The mature financial services market in which this segment operates contributes stable, high-margin income to ALSO Holding. For instance, in 2023, ALSO's financial services segment demonstrated robust performance, with financing solutions playing a critical role in enabling reseller growth and transactions.

- Embedded Financial Solutions: Credit lines and financing options are deeply integrated into the reseller ecosystem.

- Predictable Revenue Generation: These services foster strong partner relationships, leading to consistent income.

- High-Margin Contributions: Operating in a mature market allows for stable, profitable returns.

- 2023 Performance Indicator: The financial services segment showed strong growth, supporting reseller transactions.

Basic IT Infrastructure Services

Basic IT infrastructure services, including fundamental server maintenance, networking support, and co-location, act as stable cash generators for ALSO Holding. These services fulfill the continuous operational requirements of businesses, ensuring steady demand within a mature market. For instance, in 2024, the demand for reliable data center operations remained robust, underpinning the consistent revenue from these foundational offerings.

These offerings require less substantial capital investment when contrasted with rapidly expanding sectors, leading to dependable returns. The predictable nature of these services allows for efficient resource allocation and consistent profitability.

- Stable Revenue Streams: Basic IT infrastructure services provide a predictable and consistent income for ALSO Holding.

- Mature Market Segment: Demand is stable due to ongoing operational needs of businesses.

- Lower Capital Expenditure: Compared to growth areas, these services need less aggressive investment, ensuring reliable returns.

- Consistent Profitability: The nature of these services allows for efficient operations and steady profit generation.

Cash cows are established business units that generate more cash than they consume, requiring minimal investment to maintain their market position. For ALSO Holding, these segments represent a stable financial foundation, enabling strategic reinvestment into growth areas. Their consistent profitability underpins the company's overall financial resilience.

| Segment | 2024 Net Sales (EUR millions) | Key Characteristics |

|---|---|---|

| Supply (Hardware Distribution) | 6,351.0 | Mature market, strong market share, consistent cash flow. |

| Core Software Licensing (Perpetual) | N/A (significant contributor) | Established customer base, stable revenue, low reinvestment needs. |

| Standard Logistics and Warehousing | N/A (significant contributor) | Integral to B2B marketplace, efficient operations, minimal incremental investment. |

| Financial Services for Resellers | N/A (strong performance in 2023) | High-margin, stable income, fosters partner loyalty. |

| Basic IT Infrastructure Services | N/A (robust demand in 2024) | Continuous operational needs, lower capital expenditure, reliable returns. |

Full Transparency, Always

ALSO Holding BCG Matrix

The BCG Matrix preview you are viewing is the precise, unedited document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content; you get the fully developed strategic analysis ready for immediate application. The comprehensive insights into market share and growth potential for ALSO Holding's business units are presented exactly as they will be delivered, ensuring full transparency and immediate utility for your strategic planning.

Dogs

The legacy 'box-moving' hardware distribution segment represents ALSO Holding's historical business model, characterized by low-margin, commoditized products. While this segment still contributes to revenue, its strategic importance is diminishing as the company pivots towards higher-value technology solutions.

In 2024, this segment likely experienced continued pressure from intense price competition, impacting profitability. Such operations tie up significant capital in inventory and logistics without offering substantial growth potential, making it a prime candidate for strategic divestment or significant reduction.

Outdated on-premise software solutions are increasingly becoming relics in today's cloud-first landscape. With the widespread adoption of cloud computing and Everything-as-a-Service (XaaS) models, these traditional offerings face declining demand, often possessing a low market share and contributing little to overall revenue growth. For instance, in 2024, the global market for on-premise software saw a continued contraction, with many legacy systems struggling to integrate with modern cloud infrastructures.

The cost of maintaining and supporting these aging systems often outweighs their diminishing returns. Companies are reallocating resources from these legacy products to invest in more agile, scalable, and innovative cloud-based solutions. This strategic shift means that on-premise software with limited upgrade paths is likely to be categorized as Dogs within the BCG Matrix, representing a business segment that requires careful management to minimize resource drain.

Within the ALSO Holding's strategic framework, operations categorized as Dogs represent niche geographic segments that are not performing well. These might be smaller, isolated regional businesses acquired by ALSO that haven't achieved significant market penetration or profitability. For example, if a specific country operation, acquired in 2023 for €5 million, only generated €1 million in revenue in 2024 and showed a net loss of €0.5 million, it would fit this description.

These underperforming units often struggle due to intense local competition, insufficient scale to leverage cost efficiencies, or unique market dynamics that ALSO's broader strategy hasn't effectively addressed. Such operations can drain valuable resources, including capital and management attention, without yielding substantial returns or contributing positively to the company's overall growth trajectory.

Obsolete IT Peripherals and Components

Obsolete IT peripherals and components, such as CRT monitors and older-generation CPUs like the Intel Core i3-2100, are prime examples of products in the Dogs category of the BCG Matrix. Their market demand has significantly dwindled due to rapid technological evolution, with sales of CRT monitors, for instance, having virtually ceased in favor of flat-panel displays.

These items typically face declining sales volumes and shrinking profit margins, often resulting in excess inventory. For example, as of early 2024, the market for legacy hardware components continues to shrink, with specialized repair services often being the only remaining avenue for demand, albeit at very low volumes.

- Declining Demand: Products like dial-up modems or floppy disk drives have seen their demand evaporate, making them difficult to sell.

- Low Market Share: These items hold a negligible share in their respective product categories as newer, superior technologies dominate.

- Negative Growth: The market for obsolete IT peripherals is contracting, meaning sales are actively decreasing year over year.

- Low Profitability: Due to low sales volume and potential inventory holding costs, profit margins are minimal or negative.

Inefficient Manual Processes in Distribution

Segments of ALSO Holding's distribution process that remain heavily manual are prime examples of 'dogs' within their operational structure. These areas, often characterized by paper-based workflows and limited digital integration, are costly and inefficient. For instance, manual order processing and inventory management can lead to a higher error rate, estimated to be around 1-2% in similar manual systems, impacting customer satisfaction and increasing return rates.

These labor-intensive operations directly contribute to increased operational costs and slower throughput. In 2024, companies with significant manual processes in their supply chain often experienced 15-20% higher logistics costs compared to their digitally automated counterparts. This inefficiency hinders ALSO Holding's overall profitability and requires a strategic re-evaluation.

- Manual order entry and verification: Prone to data entry errors, delaying fulfillment.

- Paper-based inventory tracking: Leads to stock discrepancies and potential overstocking or stockouts.

- Manual shipping and receiving documentation: Slows down the movement of goods and increases administrative burden.

- Lack of real-time visibility: Hinders proactive problem-solving and efficient resource allocation.

Segments categorized as Dogs within ALSO Holding's BCG Matrix represent business units or product lines with low market share and low growth prospects. These are often legacy operations that are no longer strategically aligned or profitable. For example, in 2024, a specific niche hardware product line with declining demand and minimal market penetration would fit this description.

These 'dog' segments consume resources without generating significant returns, potentially hindering investment in more promising areas. Identifying and managing these underperforming assets is crucial for optimizing resource allocation and improving overall company performance. A 2024 analysis might reveal that a particular acquired regional distribution center, despite initial investment, failed to gain traction and was operating at a loss.

The focus for these 'dog' segments is typically on minimizing losses, seeking divestment opportunities, or implementing drastic cost-cutting measures. For instance, a portfolio of legacy software licenses with a shrinking customer base and high support costs would be a prime candidate for this strategic classification.

Their low market share and lack of growth potential mean they are unlikely to benefit from further investment. In 2024, the trend of digital transformation continued to marginalize such offerings, making their divestment or phased withdrawal a common strategic consideration for companies like ALSO Holding.

| Segment Example | 2024 Market Share | 2024 Growth Rate | Profitability | Strategic Implication |

| Legacy Hardware Peripherals | < 1% | -5% | Negative | Divest or liquidate |

| Niche Geographic Distribution (underperforming region) | 2% | 1% | Break-even to Loss | Evaluate for divestment or consolidation |

| Obsolete Software Licenses | < 0.5% | -10% | Low/Negative | Phase out and support reduction |

Question Marks

ALSO Holding views IoT as a key growth driver within its digital platform strategy, signaling a commitment to this rapidly expanding sector. This suggests a strategic focus on leveraging IoT technologies for future revenue streams.

Specialized IoT vertical platforms, however, might currently occupy a position of low market share within ALSO's portfolio, despite their significant growth potential. These niche solutions, like those for specific industrial automation or smart city applications, often require substantial upfront investment to develop and scale effectively.

Advanced Virtualization and Hybrid Cloud Integration Services represent a significant growth area for ALSO Holding, aligning with their strategy of positioning virtualization as a core digital platform. The market for these complex integration services is experiencing robust expansion as businesses increasingly embrace hybrid cloud models. For instance, the global hybrid cloud market was valued at approximately $120 billion in 2023 and is projected to reach over $300 billion by 2028, indicating a substantial opportunity.

Within the BCG matrix framework, these services would likely be categorized as Stars or Question Marks, depending on ALSO's current market share and investment trajectory. While the high-growth nature of the market suggests Star potential, the complexity and specialized expertise required mean ALSO may still be in the process of building its capabilities and market presence in cutting-edge aspects of these services. This necessitates substantial investment to secure a leading position.

ALSO's acquisition of Westcoast Holdco Limited in the first half of 2025 marks a strategic move into the UK ICT market, a territory previously outside its core operations. This entry positions the company to tap into a new, significant growth avenue.

While the UK ICT market presents substantial opportunities, ALSO's immediate market share post-acquisition is projected to be relatively modest. This indicates a need for focused efforts to establish a stronger foothold.

Converting this new market entry into a successful 'Star' within the BCG matrix will necessitate considerable investment. Resources will be directed towards seamless integration of Westcoast, aggressive market penetration strategies, and robust brand building initiatives to capture market share.

Bespoke AI Implementation & Consulting

Beyond simply supplying AI-ready hardware and software, ALSO Holding is exploring the burgeoning field of bespoke AI implementation and consulting. This service area, while still in its early stages for the company, represents a significant growth opportunity.

Achieving substantial market share in highly customized AI consulting necessitates a deep well of specialized expertise and a consultative sales methodology. This is a departure from traditional product distribution, demanding a more hands-on, advisory role. For instance, in 2024, the global AI consulting market was projected to reach over $20 billion, demonstrating the scale of this opportunity.

While ALSO is actively investing in AI capabilities, building a strong market presence in bespoke consulting services requires a strategic focus on developing this new capability. This involves not just technological investment but also talent acquisition and fostering a consulting-oriented culture. By 2025, it's anticipated that companies will spend even more on AI-driven business transformation services.

- Market Potential: The AI consulting market is experiencing rapid expansion, with significant growth expected in the coming years.

- Expertise Requirement: Success in bespoke AI implementation hinges on specialized knowledge and a consultative approach to client engagements.

- Strategic Investment: ALSO's commitment to AI is a foundational step, but cultivating a strong position in consulting demands focused development of new competencies.

- Growth Trajectory: The demand for tailored AI solutions indicates a clear pathway for companies like ALSO to carve out a niche in this high-value service sector.

Emerging Sustainability Transformation Solutions

The sustainability transformation solutions market is experiencing robust growth, with a projected compound annual growth rate (CAGR) of 22.60% between 2025 and 2034. This surge is fueled by escalating regulatory mandates and a growing number of corporations prioritizing Environmental, Social, and Governance (ESG) objectives.

ALSO is actively broadening its portfolio of sustainable products. This strategic move aligns with the increasing demand for eco-friendly solutions across various industries.

While these emerging offerings represent a significant growth opportunity, they currently hold a low market share. Consequently, substantial investment will be necessary to effectively penetrate and expand within this dynamic sector.

- Market Growth: Projected CAGR of 22.60% from 2025-2034 for sustainability transformation solutions.

- Drivers: Increasing regulatory pressures and corporate ESG commitments are key growth catalysts.

- ALSO's Strategy: Expansion of sustainable product offerings to meet market demand.

- Investment Needs: Low current market share necessitates investment to capture greater market segments in this emerging space.

Question Marks in the BCG matrix represent business units or products with low relative market share in a high-growth industry. These offerings require careful consideration for investment. For ALSO Holding, areas like specialized IoT vertical platforms and bespoke AI implementation services fit this description.

These segments are characterized by high potential but currently underdeveloped market positions for ALSO. Significant investment is needed to increase market share and move these offerings towards becoming Stars.

The challenge lies in determining which Question Marks have the potential to become Stars and warrant further investment, versus those that may need to be divested or managed for cash if they fail to gain traction.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.