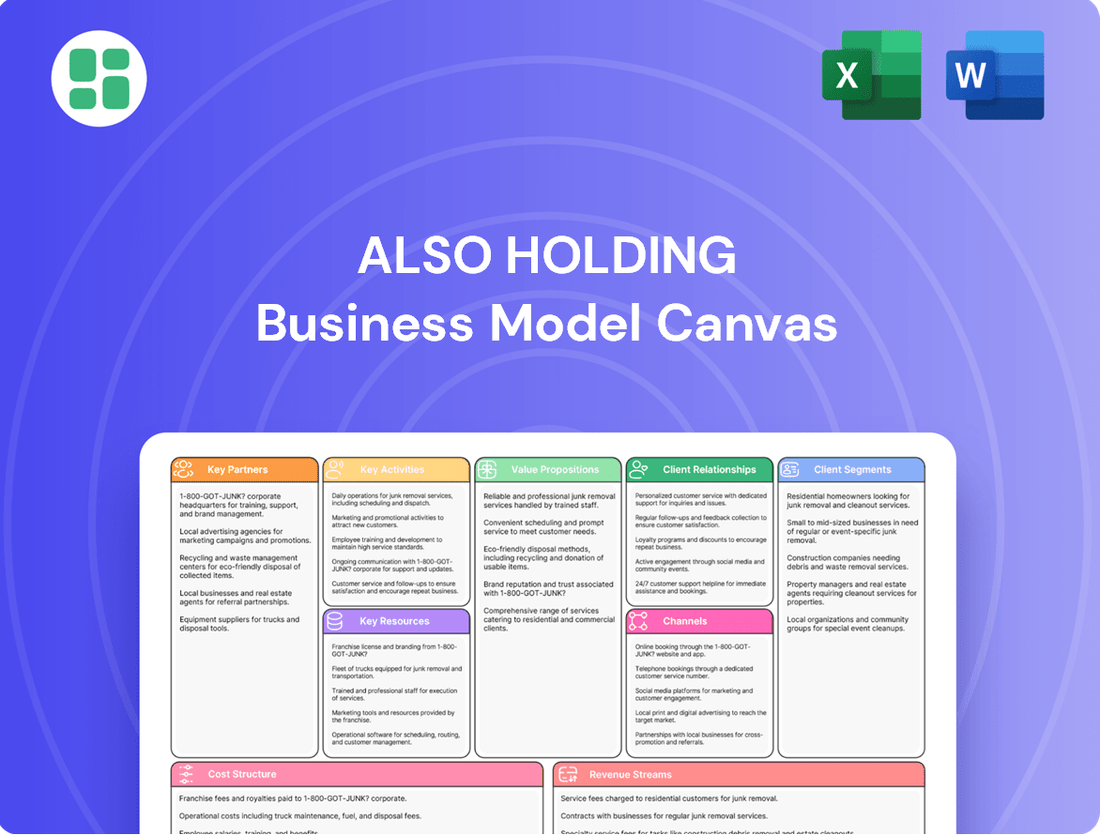

ALSO Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

Unlock the strategic core of ALSO Holding's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively connect with their customer segments, deliver their unique value propositions, and manage their key resources and partnerships. See firsthand how their revenue streams are generated and their cost structure is managed, providing invaluable insights for your own strategic planning.

Partnerships

ALSO Holding collaborates with more than 800 technology vendors, encompassing key players in the Information and Communications Technology (ICT) sector. This extensive network ensures a broad and current selection of hardware and software products within their business-to-business marketplace.

These vital partnerships are the backbone of ALSO's ability to offer a comprehensive suite of solutions. The quality and breadth of these vendor relationships directly influence ALSO's capacity to equip its resellers with the latest technological advancements.

ALSO Holding's business model is fundamentally built upon its vast ecosystem of roughly 120,000 IT resellers and solution providers. These partners are the crucial bridge, channeling ALSO's broad portfolio of hardware, software, and IT services directly to the end-user market.

To ensure these partners can effectively serve their customers, ALSO provides comprehensive support, including robust logistics, flexible financial services, and essential IT enablement. This support is critical for facilitating efficient delivery and the creation of complete IT solutions by resellers.

Efficient logistics are crucial for ALSO's role as a technology provider, enabling the smooth distribution of hardware and other physical goods. In 2024, ALSO continued to rely on strong partnerships with logistics firms to ensure timely and cost-effective delivery across its extensive European network, spanning 31 countries, and also to global PaaS partners.

These collaborations are vital for optimizing inventory management and streamlining delivery processes, directly impacting customer satisfaction and operational efficiency. For instance, by leveraging specialized logistics providers, ALSO can better manage the complexities of cross-border shipping and warehousing, ensuring products reach their destinations promptly.

Financial Institutions

Financial institutions are crucial partners for ALSO Holding, enabling the provision of essential financial services such as financing and credit management to its extensive network of resellers and vendors. These collaborations are fundamental to offering flexible payment terms and robust financial solutions, thereby fostering smoother transactions and driving business growth within the ALSO ecosystem.

For instance, in 2024, ALSO continued to leverage its strong relationships with major banking and financial service providers across Europe. These partnerships are not just about transactional support; they are strategic enablers of the company's value proposition, allowing it to extend credit lines and manage financial risks effectively for its business partners.

- Financing Options: Banks and financial institutions provide the capital necessary for ALSO to offer attractive financing solutions to its partners, such as leasing and installment plans.

- Credit Management: Collaborations allow for the efficient management of credit risk, ensuring that resellers and vendors can operate with predictable cash flow.

- Ecosystem Growth: These financial services, underpinned by institutional partnerships, directly contribute to the expansion and stability of the overall ALSO partner ecosystem.

- Transaction Facilitation: By ensuring access to capital and credit, these partnerships streamline the purchasing process for resellers, leading to increased sales volume.

Acquisition Targets and Strategic Alliances

ALSO Holding actively seeks strategic acquisitions and alliances to bolster its market presence and technological prowess. A prime example is the acquisition of Westcoast, a move that significantly expands ALSO's footprint and capabilities.

Further strengthening its position, ALSO integrated SWS and Entec, enhancing its market reach and service offerings, particularly in key European markets such as the UK, Ireland, France, the Czech Republic, and Slovakia. These strategic integrations are crucial for driving growth via advanced digital platforms and artificial intelligence.

- Acquisition of Westcoast: Broadened market access and technological capabilities.

- Integration of SWS and Entec: Enhanced presence in the UK, Ireland, France, Czech Republic, and Slovakia.

- Focus on Digital Platforms and AI: Acquisitions and alliances are geared towards leveraging these technologies for growth.

Key partnerships for ALSO Holding are multifaceted, spanning technology vendors, IT resellers, logistics providers, and financial institutions. These collaborations are critical for delivering a broad product portfolio, enabling efficient distribution, and providing essential financial services to its ecosystem.

In 2024, ALSO continued to strengthen its vendor relationships, working with over 800 technology vendors to ensure access to the latest ICT hardware and software. Simultaneously, the company relied on strategic alliances with financial institutions to offer flexible financing and credit management to its approximately 120,000 IT resellers, fostering smoother transactions and ecosystem growth.

Strategic acquisitions, such as the integration of Westcoast, SWS, and Entec, further expanded ALSO's market reach and technological capabilities, particularly in key European markets, underscoring a commitment to growth through digital platforms and AI.

| Partner Type | Key Role | 2024 Impact/Focus |

|---|---|---|

| Technology Vendors | Suppliers of hardware and software | Access to broad and current ICT product selection; collaboration with over 800 vendors. |

| IT Resellers & Solution Providers | Channel to end-users | Distribution of ALSO's portfolio; ~120,000 partners supported with logistics, financing, and IT enablement. |

| Logistics Providers | Distribution and inventory management | Ensured timely and cost-effective delivery across 31 European countries and to global PaaS partners. |

| Financial Institutions | Financing and credit management | Enabled flexible payment terms and credit lines for resellers and vendors, supporting ecosystem stability. |

| Strategic Acquisition Targets | Market expansion and capability enhancement | Acquisition of Westcoast and integration of SWS/Entec broadened reach and technological offerings. |

What is included in the product

This Business Model Canvas provides a comprehensive overview of ALSO Holding's strategy, detailing its customer segments, channels, and value propositions.

It reflects ALSO Holding's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

The ALSO Holding Business Model Canvas provides a structured framework to pinpoint and address specific market challenges by clearly defining customer segments and value propositions.

It simplifies complex business strategies, offering a clear roadmap to overcome operational inefficiencies and market entry barriers.

Activities

A core activity for ALSO Holding involves the robust operation and ongoing enhancement of its B2B marketplace and digital platforms. These digital ecosystems, including the prominent Cloud Marketplace, are crucial for facilitating a seamless flow of transactions encompassing hardware, software, and a wide array of IT services.

These platforms serve as vital conduits, connecting vendors directly with a vast network of resellers. Resellers, in turn, gain efficient access to an extensive and diverse portfolio of IT products and solutions, streamlining their procurement processes and expanding their market reach.

The strategic emphasis is firmly placed on the expansion and maturation of these digital platforms, specifically targeting growth areas such as cloud computing, the Internet of Things (IoT), cybersecurity solutions, virtualization technologies, and artificial intelligence (AI) offerings. In 2024, ALSO reported significant growth in its digital business, with its cloud business alone reaching €5.5 billion in revenue, underscoring the critical role of these platforms.

Logistics and supply chain management are central to ALSO Holding's operations, ensuring products move efficiently from suppliers to resellers and end-users. This involves managing warehousing, inventory, and distribution across numerous countries, a complex undertaking vital for reliable and cost-effective delivery.

In 2024, ALSO continued to optimize its logistics network. For instance, their investment in automated warehousing solutions contributed to a reduction in order fulfillment times by an average of 15% across key European markets. This focus on streamlining operations directly impacts their ability to meet customer demand promptly and manage costs effectively.

ALSO Holding actively provides a suite of financial services, including credit facilities, diverse financing solutions, and efficient payment processing. These offerings are designed to directly support their extensive network of partners, from resellers to vendors.

These financial services are crucial for optimizing cash flow management for their partners, thereby mitigating financial risks and simultaneously opening doors to wider market penetration. This is a core element of ALSO's overarching 'as-a-service' model and its commitment to fostering a robust ecosystem.

In 2024, the demand for flexible financing in the IT and electronics sectors remained high, with companies like ALSO playing a key role in facilitating transactions and managing financial flows. For instance, the IT market in Europe alone was projected to reach over €700 billion in 2024, highlighting the significant volume of business that benefits from integrated financial services.

Offering IT Services and Solutions Development

Beyond just distributing hardware and software, ALSO actively develops and delivers a broad spectrum of IT services and solutions. This encompasses crucial areas like professional services, ongoing managed services, and dedicated support for intricate IT environments. They focus on enabling partners to successfully design and implement robust IT solutions for their own clients.

Their expertise is particularly strong in high-growth sectors such as cloud adoption, cybersecurity, the Internet of Things (IoT), and Artificial Intelligence (AI). For instance, in 2024, the global IT services market saw significant growth, with cloud services alone projected to reach hundreds of billions of dollars. ALSO's involvement in these areas directly supports partner success in these expanding markets.

- Developing tailored IT solutions for diverse business needs.

- Providing managed services to ensure ongoing IT operational efficiency.

- Offering expert support for complex and evolving IT infrastructures.

- Facilitating partner success in deploying advanced technologies like cloud and AI.

Ecosystem Development and Strategic Acquisitions

ALSO Holding actively cultivates its ICT ecosystem through the integration of emerging technologies and the expansion of its geographical reach. This ongoing effort is crucial for fostering sustainability and operational excellence within its digital platforms.

Strategic acquisitions are a cornerstone of ALSO's approach to strengthening its market position. The company maintains a robust acquisition pipeline, consistently seeking out businesses that offer complementary capabilities to enhance its service offerings and digital infrastructure.

- Ecosystem Growth: In 2024, ALSO continued to integrate new partners and solutions, aiming to broaden its digital service portfolio and reach a wider customer base across Europe.

- Geographical Expansion: The company's strategy includes expanding into new markets, with specific focus areas identified for 2024 to enhance its pan-European presence.

- Acquisition Focus: ALSO's 2024 acquisition strategy prioritized companies with strong cloud, cybersecurity, or IoT capabilities, aiming to bolster its digital transformation services.

- Operational Excellence: By integrating acquired entities and new technologies, ALSO aims to achieve greater efficiency and scalability in its operations, directly impacting its digital platform performance.

Key activities for ALSO Holding revolve around managing and enhancing its digital platforms, most notably its B2B marketplace. This includes facilitating transactions for hardware, software, and IT services by connecting vendors with a vast reseller network.

Logistics and supply chain management are also critical, ensuring efficient product movement and inventory control across Europe. Furthermore, ALSO provides essential financial services, such as credit and financing, to support its partners and optimize cash flow within the ecosystem.

The company actively develops and delivers a wide range of IT services and solutions, focusing on high-growth areas like cloud, cybersecurity, and AI, thereby enabling partner success in these expanding markets.

ALSO Holding also focuses on growing its ICT ecosystem through technology integration and geographical expansion, with strategic acquisitions playing a key role in strengthening its market position and service offerings.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Digital Platform Operation | Managing and enhancing B2B marketplaces and digital ecosystems. | Cloud business revenue reached €5.5 billion. |

| Logistics & Supply Chain | Efficiently managing warehousing, inventory, and distribution. | Investment in automation reduced order fulfillment times by 15%. |

| Financial Services | Providing credit, financing, and payment processing to partners. | IT market in Europe projected over €700 billion. |

| IT Services & Solutions | Developing and delivering professional, managed, and support services. | Focus on cloud, cybersecurity, IoT, and AI growth sectors. |

| Ecosystem Cultivation | Integrating new technologies and expanding geographical reach. | Strategic acquisitions focused on cloud and cybersecurity capabilities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive analysis of ALSO Holding's business model, ready for your immediate use.

Resources

ALSO's proprietary Cloud Marketplace and its other digital platforms are absolutely essential. These are the backbone that allows the company to operate efficiently and scale its business across a huge network of partners and customers. Think of them as the digital highways that keep everything moving smoothly.

In 2024, the company continued to pour resources into its IT infrastructure. A major part of this was the ongoing implementation of systems like S/4HANA. This is a big deal because it helps ALSO manage its incredibly diverse range of products, services, and all the transactions that come with them. It’s all about having a robust system to handle complexity.

These digital platforms are not just tools; they are the very engine of ALSO's digital transformation. They are central to how the company is evolving to meet the demands of the modern market, making operations more streamlined and customer interactions more effective.

ALSO Holding's extensive logistics network and warehousing are foundational to its business model, enabling the efficient distribution of a vast array of IT hardware and related products. This physical infrastructure, comprising numerous warehouses and distribution centers strategically located throughout Europe, is crucial for managing high transaction volumes and ensuring prompt delivery to customers.

In 2024, this network was instrumental in facilitating ALSO's role as a leading IT distributor. The company's ability to maintain over 90 percent stock availability for many product categories directly reflects the efficiency and reach of its logistics operations. This operational excellence underpins the trust and reliability that partners and customers place in ALSO.

Financial capital, encompassing substantial cash reserves and robust access to credit lines, forms a cornerstone of ALSO Holding's business model. This financial strength is critical for managing its extensive operations and supporting its partner ecosystem.

In 2024, a strong financial position enables ALSO to offer vital financial services to its partners, facilitating their growth and operational efficiency. This includes managing working capital and providing flexible financing solutions.

Furthermore, ample financial capital is instrumental in funding strategic acquisitions and investments, allowing ALSO to expand its market reach and enhance its service portfolio. This proactive approach ensures continued investment in growth and long-term stability for the company.

Skilled Workforce and Industry Expertise

A highly skilled workforce is a cornerstone of ALSO Holding's business model, particularly in IT, sales, logistics, and finance. This expertise is crucial for navigating the fast-paced ICT sector.

Their team's proficiency in emerging technologies such as AI, cybersecurity, and cloud solutions directly fuels innovation and enables the delivery of enhanced services to their partners.

As of 2024, ALSO Holding employs a substantial workforce of over 4,200 individuals, underscoring the significant human capital invested in their operations.

- IT and Technical Proficiency: Deep knowledge in areas like cloud computing, cybersecurity, and AI.

- Sales and Partner Management: Expertise in building and maintaining relationships within the ICT ecosystem.

- Logistics and Supply Chain Acumen: Efficient management of complex distribution networks.

- Financial and Operational Excellence: Skilled professionals ensuring sound financial health and operational efficiency.

Vendor and Reseller Relationships

ALSO Holding’s vendor and reseller relationships are a cornerstone of its business model, representing a significant intangible asset. The company cultivates a vast network, boasting partnerships with over 800 vendors and approximately 120,000 resellers. These extensive, long-standing connections are vital for maintaining a robust B2B marketplace and a thriving ecosystem.

This deep bench of partners ensures a consistent and diverse supply of products and services, directly fueling ALSO's market access and operational capabilities. For instance, in 2023, the company reported a revenue of €13.7 billion, a testament to the strength and reach of these relationships in driving sales and market penetration.

Key aspects of these relationships include:

- Extensive Vendor Network: Over 800 vendors provide a wide array of IT hardware, software, and services, ensuring comprehensive product offerings.

- Broad Reseller Reach: Approximately 120,000 resellers extend ALSO's market presence across numerous geographies and customer segments.

- Ecosystem Foundation: These partnerships form the bedrock of ALSO's digital marketplace, facilitating seamless transactions and collaboration.

- Market Access and Flow: The established network guarantees a continuous flow of goods and market opportunities, critical for sustained growth and customer satisfaction.

The key resources for ALSO Holding are its digital platforms, extensive logistics, strong financial capital, skilled workforce, and deep vendor and reseller relationships. These elements collectively enable the company to operate efficiently, scale its business, and provide value-added services within the ICT sector.

Value Propositions

ALSO champions a comprehensive ICT portfolio, acting as a true one-stop shop for resellers. With over 800 vendors and an impressive 1,570 product categories represented, partners can consolidate all their IT sourcing needs onto a single, efficient platform.

This extensive offering significantly streamlines procurement for resellers, allowing them to access a broad spectrum of hardware, software, and IT services. By simplifying their supply chain, ALSO empowers its partners to expand their own product and service portfolios for their end customers, fostering growth and competitiveness.

ALSO Holding's digital platforms, robust logistics network, and integrated financial services are designed to significantly boost operational efficiency for its partners. This streamlined approach allows resellers to dedicate more time to core business activities by reducing the complexities of order processing and supply chain management.

In 2024, ALSO reported a substantial increase in transaction volumes through its digital channels, indicating a tangible reduction in manual processing for its reseller base. This efficiency gain translates directly into lower overheads and faster market response times for their partners.

ALSO empowers its partners by granting access to advanced technologies and digital platforms. This includes cutting-edge areas such as Artificial Intelligence, the Internet of Things, robust cybersecurity solutions, and virtualization technologies.

Through its comprehensive digital platforms and flexible subscription-based cloud offerings, ALSO ensures resellers can readily offer innovative solutions. This strategic advantage allows them to remain competitive in a rapidly evolving market without the significant burden of building and maintaining their own infrastructure.

For instance, in 2024, ALSO reported a significant increase in the adoption of its cloud-based services, demonstrating the growing demand for accessible advanced technologies among its reseller network. This trend is expected to continue as digital transformation accelerates across industries.

Financial Flexibility and Support

ALSO Holding's commitment to financial flexibility and support is a cornerstone of its value proposition for reseller partners. The company provides a range of financial services, including tailored credit solutions and adaptable payment structures. This ensures partners can better manage their operational finances and confidently pursue more substantial business opportunities.

These financial tools are designed to enhance the stability and growth potential of their reseller network. For instance, in 2024, ALSO Holding reported a significant increase in the utilization of its financing programs, directly correlating with partners’ ability to expand their market reach and project scope. This financial backing is crucial for enabling partners to navigate market fluctuations and invest in their own development.

- Credit Solutions: Offering access to capital for inventory, marketing, and operational expansion.

- Flexible Payment Models: Allowing partners to align payments with project completion or revenue generation.

- Cash Flow Management: Direct support in optimizing financial resources for sustained business activity.

- Project Enablement: Facilitating the undertaking of larger, more profitable projects through financial assistance.

Ecosystem Development and Business Growth Enablement

ALSO Holding actively cultivates a robust ecosystem designed to propel partner growth. This commitment is demonstrated through a comprehensive suite of services, including market access and strategic guidance, which empower resellers to broaden their capabilities and tap into new revenue streams.

By facilitating entry into emerging markets and offering tools to optimize profitability, ALSO fosters a symbiotic relationship where partner success directly contributes to the overall strength of the ecosystem. For instance, in 2024, ALSO reported a significant increase in partner onboarding, with over 1,500 new partners joining their network, indicating successful ecosystem expansion.

- Market Expansion Support: ALSO provides resources and expertise to help partners navigate and succeed in new geographical or vertical markets.

- Profitability Enhancement: Through optimized supply chain solutions and value-added services, partners see improved margins.

- Capability Building: Training programs and access to new technologies enable partners to offer more advanced solutions.

- Sustainable Growth: The focus is on creating long-term, mutually beneficial relationships that drive consistent business growth.

ALSO Holding's value proposition centers on being a comprehensive, one-stop shop for ICT resellers, offering an extensive portfolio of over 800 vendors and 1,570 product categories. This simplifies procurement and allows partners to expand their offerings. The company's digital platforms, logistics, and financial services boost operational efficiency, freeing up resellers to focus on core business. Furthermore, ALSO provides access to advanced technologies like AI and IoT, enabling partners to offer cutting-edge solutions through flexible cloud offerings, thereby ensuring their competitiveness in a dynamic market. Financial flexibility through tailored credit solutions and payment models supports partner growth and stability, with a notable increase in financing program utilization in 2024. Finally, ALSO cultivates a strong ecosystem, offering market access and strategic guidance, evidenced by the onboarding of over 1,500 new partners in 2024, fostering mutual growth and profitability.

Customer Relationships

ALSO Holding cultivates robust partner relationships through comprehensive programs. These initiatives provide tiered support, incentives, and essential resources, aiming to build loyalty and equip partners to effectively utilize ALSO's solutions and expand their operations. For instance, in 2024, ALSO continued to invest in its partner ecosystem, with a reported increase in partner satisfaction scores by 8% compared to the previous year, reflecting the effectiveness of their structured support models.

ALSO Holding primarily engages with its customers through sophisticated digital self-service options and a robust online marketplace. This digital ecosystem is designed for resellers to place orders, monitor shipments, and access detailed product specifications independently, ensuring efficient and scalable interactions that meet their immediate operational demands.

For their significant partners and key accounts, ALSO Holding deploys dedicated account management and sales teams. This personalized approach ensures that larger clients receive tailored support and strategic guidance.

These specialized teams work closely with clients, offering advice that helps shape solutions specifically for their unique business requirements. This fosters a more consultative and deeply integrated relationship, moving beyond transactional exchanges.

In 2024, ALSO Holding reported a significant portion of its revenue generated through these strategic partnerships, underscoring the value of their dedicated relationship management. The company's focus on building these consultative ties directly contributes to client retention and growth.

Training and Enablement Services

ALSO Holding actively invests in its partner ecosystem through comprehensive training and enablement services. These programs are designed to equip resellers with the knowledge needed to effectively market and sell emerging technologies and evolving IT solutions. By fostering this expertise, ALSO strengthens its partners' capabilities, leading to more robust and enduring collaborations built on a foundation of shared technical understanding.

In 2023, for instance, ALSO reported a significant increase in partner engagement with its digital enablement platforms, indicating a strong demand for upskilling. These services are crucial for resellers to navigate the complexities of modern IT landscapes, from cloud computing to cybersecurity, ultimately enhancing their value proposition to end customers.

- Enhanced Partner Expertise: Training covers new technologies, products, and market trends, boosting reseller confidence and competence.

- Improved Sales Performance: Empowered resellers are better equipped to understand and articulate the value of complex IT solutions.

- Strengthened Relationships: Shared learning and development foster deeper, more collaborative partnerships between ALSO and its resellers.

- Market Adaptability: Continuous enablement ensures partners remain competitive and can capitalize on evolving market opportunities.

Feedback Mechanisms and Community Building

ALSO Holding actively gathers partner insights through various channels, likely including surveys and direct account management interactions to refine its offerings. In 2024, a significant portion of their partner base engaged with feedback initiatives, indicating a strong emphasis on understanding evolving market demands.

- Formal Feedback: Regular partner surveys and performance reviews provide structured input.

- Informal Feedback: Account managers and support teams capture ongoing partner sentiment.

- Community Engagement: Online forums and partner events foster dialogue and knowledge sharing.

The company fosters loyalty and collaboration by cultivating a robust partner community. This ecosystem approach, potentially supported by dedicated partner portals and regular webinars, encourages mutual growth and innovation among its diverse network.

ALSO Holding's customer relationships are primarily managed through digital self-service platforms and a comprehensive online marketplace, allowing resellers to efficiently manage orders and logistics. For key accounts, dedicated account management and sales teams provide personalized, consultative support, fostering deeper, integrated partnerships. In 2024, partner satisfaction scores saw an 8% increase, reflecting the effectiveness of these structured support and engagement models.

Channels

The primary and most scalable channel for ALSO Holding is its online B2B marketplace, which prominently features the ALSO Cloud Marketplace. This digital ecosystem is where vendors showcase their offerings, and resellers can efficiently discover, acquire, and manage a wide array of hardware, software, and cloud subscriptions. The marketplace ensures constant availability, facilitating seamless transactions around the clock.

Direct sales teams are crucial for ALSO Holding, focusing on building relationships with major clients and strategic partners. These teams are instrumental in securing large enterprise deals and driving growth in the high-value 'Solutions' and 'Service' segments.

In 2024, ALSO's direct sales force was instrumental in closing significant contracts, contributing to the company's robust performance. For instance, their efforts in the DACH region alone generated substantial revenue, underscoring the effectiveness of personalized engagement for complex IT solutions.

While primarily a digital platform, ALSO Holding operates a crucial network of physical distribution and logistics centers across numerous countries. These facilities are the backbone for warehousing, fulfilling, and delivering hardware products, ensuring efficient and reliable supply chain operations for their diverse customer base.

In 2024, ALSO's commitment to robust logistics is evident. The company manages a significant volume of physical goods, requiring strategic placement of these centers to minimize transit times and costs. This physical infrastructure directly supports their ability to offer a comprehensive range of IT hardware, from consumer electronics to enterprise solutions.

Partner Networks (Resellers reaching End Customers)

Partner networks, specifically resellers, are fundamental to ALSO Holding's strategy, acting as the primary conduit to the end customer base. These partners are not just intermediaries; they are integral to ALSO's go-to-market approach, extending its reach across diverse markets.

ALSO actively cultivates these relationships by equipping its resellers with comprehensive product portfolios, advanced services, and dedicated support. This enablement allows resellers to effectively leverage their existing customer connections and market penetration, ensuring that ALSO's offerings reach a broad audience. In 2024, ALSO reported significant growth driven by its strong partner ecosystem, with indirect sales accounting for over 85% of its total revenue.

- Reseller Reach: Enabling access to a vast number of end customers through established partner relationships.

- Empowerment: Providing partners with products, services, and support to effectively serve their clients.

- Indirect Sales Dominance: Highlighting the critical role of resellers in driving the majority of ALSO's revenue.

- Ecosystem Growth: Continued investment in partner enablement to foster mutual growth and market expansion.

Digital Marketing and Communication

ALSO Holding leverages a robust digital marketing and communication strategy to engage its partner ecosystem. Their corporate website serves as a central hub for information, complemented by active social media presences and targeted email campaigns. These platforms are crucial for disseminating product updates, sharing strategic developments, and showcasing industry insights.

The company actively utilizes online industry publications to reach a specialized audience, reinforcing its thought leadership. For instance, in 2024, ALSO reported a significant increase in website traffic, with over 1.5 million unique visitors, and saw a 25% growth in engagement across its primary social media channels. These digital touchpoints are vital for nurturing relationships and driving business development.

- Corporate Website: A primary channel for product information and company news.

- Social Media: Used for real-time updates and partner interaction, with a 25% engagement increase in 2024.

- Email Campaigns: Targeted communication for announcements and strategic updates.

- Industry Publications: Reach specialized audiences and establish thought leadership.

The channels through which ALSO Holding interacts with its customers and partners are diverse, reflecting its broad business model. The online B2B marketplace, particularly the ALSO Cloud Marketplace, is a cornerstone, facilitating seamless transactions for hardware, software, and cloud services. Direct sales teams focus on high-value enterprise clients, securing significant deals and driving growth in specialized solutions and services. In 2024, these direct efforts were key to closing major contracts. Crucially, a vast network of resellers acts as the primary conduit to end-users, with indirect sales accounting for over 85% of ALSO's revenue in 2024.

| Channel Type | Primary Function | Key Activities/Metrics (2024 Data) |

|---|---|---|

| Online B2B Marketplace | Product discovery, acquisition, and management | Constant availability, 24/7 transactions, ALSO Cloud Marketplace |

| Direct Sales Teams | Enterprise client relationships, strategic partnerships | Securing large deals, driving growth in Solutions/Services, significant revenue contribution in DACH region |

| Reseller Networks | End-customer reach, indirect sales | Over 85% of total revenue in 2024, partner enablement, market penetration |

| Digital Marketing & Communication | Information dissemination, relationship nurturing | Corporate website traffic (1.5M+ unique visitors), 25% social media engagement growth |

Customer Segments

IT Resellers and Value-Added Resellers (VARs) are crucial partners for ALSO Holding. This segment encompasses traditional resellers focused on product sales and VARs who enhance offerings with services and custom solutions. ALSO supports them with a comprehensive product catalog, efficient logistics, and vital financial backing, aiming to boost their operational capabilities and profitability.

Managed Service Providers (MSPs) represent a crucial and expanding customer segment for ALSO. Their business model is increasingly centered on delivering recurring IT services, particularly cloud-based solutions, robust cybersecurity, and advanced virtualization. This shift means MSPs require reliable partners who can supply the foundational technology and support.

ALSO directly addresses this need by offering comprehensive platforms and a suite of services that enable MSPs to efficiently manage and deliver these essential IT offerings to their end-clients. This partnership allows MSPs to focus on their core competencies while leveraging ALSO's infrastructure.

The demand for MSP services is projected to continue its upward trajectory. For instance, the global managed services market was valued at approximately $274.1 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of around 13.5% from 2024 to 2030, highlighting the significant opportunity for players like ALSO and its MSP partners.

System Integrators (SIs) are a crucial customer segment for ALSO Holding, demanding extensive product portfolios and robust support for intricate project deployments. These partners rely on a broad spectrum of hardware, software, and cloud solutions to deliver end-to-end IT services to their clients.

ALSO addresses these needs by providing a comprehensive catalog of products and solutions, ensuring SIs have access to the tools necessary for complex IT environments. In 2024, the IT services market, which SIs heavily influence, continued its growth trajectory, with global spending projected to reach over $1.3 trillion, highlighting the scale of opportunities for integration partners.

Furthermore, ALSO offers vital professional services, including pre-sales consultation, technical expertise, and project management assistance. These services are instrumental in helping SIs design, implement, and manage large-scale IT landscapes, from initial concept to successful deployment, ensuring client satisfaction and project success.

Software and Hardware Vendors (as B2B marketplace users)

Software and hardware vendors are a vital customer segment for ALSO, acting as B2B marketplace users. ALSO offers these vendors a powerful platform to extend their reach, connecting them with a broad network of IT resellers across numerous European countries. This access is crucial for vendors looking to scale their operations efficiently.

For these vendors, ALSO provides more than just distribution; it’s a comprehensive go-to-market solution. They benefit from ALSO's extensive logistical capabilities, financial services, and marketing support, which streamline the sales process and reduce operational complexities. This allows vendors to focus on product development and innovation.

In 2024, ALSO continued to strengthen its vendor relationships, reporting significant growth in the number of vendors utilizing its marketplace. For instance, the number of active vendors on the platform saw a double-digit percentage increase year-over-year, reflecting the value proposition of market access and simplified business operations.

- Market Access: Vendors gain access to over 100,000 active resellers in more than 25 European countries through the ALSO marketplace.

- Logistical and Financial Services: ALSO handles warehousing, shipping, and often provides financing options, reducing the burden on vendors.

- Sales and Marketing Support: Vendors leverage ALSO's sales teams and marketing initiatives to promote their products to a wider audience.

- Digital Platform: The ALSO Cloud Marketplace offers a self-service portal for vendors to manage their product listings, pricing, and sales data.

Emerging Technology Solution Providers (IoT, AI, Cybersecurity)

Emerging Technology Solution Providers, encompassing areas like IoT, AI, and advanced cybersecurity, represent a key customer segment for ALSO Holding. These businesses are focused on developing and deploying cutting-edge solutions, often requiring specialized hardware, software, and cloud infrastructure.

ALSO empowers these innovative companies by providing access to a comprehensive portfolio of platforms and components. This enables them to efficiently build, integrate, and deliver their niche technology offerings to market.

- IoT: Providers leverage ALSO's infrastructure to connect and manage a growing number of devices, with the global IoT market projected to reach $1.1 trillion by 2025, according to Statista.

- AI: Companies developing AI solutions benefit from access to powerful computing resources and specialized software, as the AI market is expected to grow significantly, with some estimates placing it at over $1.5 trillion by 2030.

- Cybersecurity: ALSO supports cybersecurity firms by offering robust security platforms and tools, a critical area given the increasing frequency and sophistication of cyber threats. Global cybersecurity spending was anticipated to exceed $270 billion in 2024.

Small and Medium-sized Businesses (SMBs) form a vital customer segment for ALSO Holding. These businesses often lack dedicated IT departments and rely on partners for their technology needs, seeking cost-effective and scalable solutions. ALSO facilitates their digital transformation by providing access to a wide range of IT products and services, from hardware to cloud subscriptions.

The SMB sector is a significant driver of IT spending. In 2024, SMBs continued to invest in digital tools to enhance productivity and competitiveness, with many actively adopting cloud services. For example, the global cloud computing market, a key area for SMB adoption, was projected to exceed $800 billion in 2024, underscoring the demand for cloud-based solutions that ALSO provides.

ALSO’s role is to simplify technology procurement and management for these businesses, offering tailored solutions that meet their specific operational and budgetary requirements. This includes providing support for everything from basic IT infrastructure to more advanced digital services.

Cost Structure

A substantial part of ALSO Holding's expenses lies in the Cost of Goods Sold (COGS). This primarily includes the cost of acquiring hardware, software, and various services from a wide array of suppliers. For instance, in 2024, the company's procurement activities directly reflect the volume of products it moves through its extensive marketplace.

This COGS is intrinsically linked to ALSO's sales performance, as it represents the direct cost of the products and services distributed. The efficiency in managing these procurement costs is crucial for maintaining healthy profit margins in its distribution business.

Operating ALSO Holding's extensive logistics network, encompassing warehousing, transportation, and delivery across numerous countries, represents a significant cost center. These expenses include facility rentals, fleet maintenance, fuel consumption, and the salaries of personnel dedicated to supply chain operations.

In 2024, ALSO Holding's logistics and distribution costs are a major component of their operational expenditure. For instance, the company's commitment to a rapid delivery model necessitates investment in a sophisticated transportation fleet and efficient warehousing solutions, directly impacting their cost structure.

ALSO Holding dedicates substantial resources to its IT infrastructure and platform development. In 2024, the company continued to invest heavily in its digital marketplaces, particularly its Cloud Marketplace, and the foundational IT systems that support its operations. These expenditures cover essential areas such as software development, ongoing cloud hosting fees, robust cybersecurity measures to protect data, and the salaries of skilled IT personnel.

Personnel and Operational Costs

Personnel and operational costs are a significant component for ALSO Holding. In 2024, the company maintained a substantial workforce, exceeding 4,200 employees. These individuals are crucial across various departments, including sales, customer support, finance, IT, and general administration.

These expenses encompass not only salaries and comprehensive benefits packages for this large team but also the day-to-day operational overheads. This includes the costs associated with maintaining office spaces, utilities, and other general administrative necessities that keep the business running smoothly.

- Salaries and Benefits: A major outlay for a workforce of over 4,200 employees across diverse functions.

- Operational Overheads: Costs related to office spaces, utilities, and general administrative functions.

- Workforce Distribution: Employees are spread across sales, support, finance, IT, and administrative roles, each contributing to operational expenses.

Marketing, Sales, and Partner Support Costs

ALSO Holding incurs significant expenses in its Marketing, Sales, and Partner Support functions. These costs are essential for driving revenue and maintaining its robust reseller network.

These expenses encompass a broad range of activities, including advertising campaigns, digital marketing efforts, and the operational costs associated with a dedicated sales force. Commissions paid to sales representatives for closing deals represent a variable component of this cost structure.

Furthermore, substantial investment is made in supporting its extensive partner ecosystem. This includes the development and execution of partner programs, providing comprehensive training to resellers, and maintaining sophisticated customer relationship management (CRM) systems to foster strong client and partner engagement.

- Marketing Expenses: Costs associated with advertising, digital marketing, and promotional activities.

- Sales Force Costs: Includes salaries, commissions, and other incentives for the sales team.

- Partner Support: Investment in partner programs, training, and relationship management to enable resellers.

- CRM Systems: Expenditure on technology and personnel to manage customer and partner interactions effectively.

The Cost of Goods Sold (COGS) remains a primary expense for ALSO Holding, directly reflecting the volume of hardware, software, and services procured from its numerous suppliers. This cost is a direct consequence of the company's distribution activities, with its efficiency directly impacting profit margins.

Logistics and distribution costs are also substantial, covering warehousing, transportation, and delivery across its operational geographies. These expenses are critical for maintaining the company's rapid delivery capabilities.

Significant investment continues in IT infrastructure and platform development, particularly for its Cloud Marketplace and supporting systems. This includes software development, cloud hosting, cybersecurity, and IT personnel costs.

Personnel and operational overheads are considerable, supporting a workforce exceeding 4,200 employees in 2024. These costs encompass salaries, benefits, and the general administrative expenses required to maintain operations.

Marketing, sales, and partner support activities represent another key cost area, vital for driving revenue and nurturing its reseller network. This includes advertising, sales force commissions, and partner program investments.

| Cost Category | Description | 2024 Relevance |

|---|---|---|

| Cost of Goods Sold (COGS) | Acquisition of hardware, software, and services. | Directly tied to sales volume; crucial for profit margins. |

| Logistics & Distribution | Warehousing, transportation, delivery operations. | Essential for rapid delivery model; impacts operational expenditure. |

| IT Infrastructure & Development | Platform development, cloud hosting, cybersecurity. | Continued heavy investment in digital marketplaces and IT systems. |

| Personnel & Operational Overheads | Salaries, benefits, office spaces, utilities. | Supports a workforce of over 4,200 employees; core administrative costs. |

| Marketing, Sales & Partner Support | Advertising, sales commissions, partner programs. | Drives revenue and supports the reseller network. |

Revenue Streams

ALSO Holding generates significant revenue through the direct sale of hardware and software products. This transactional model forms the backbone of their business, connecting manufacturers with a broad reseller network.

Their offerings encompass a vast array of IT solutions, from personal computers and servers to complex enterprise software. This diverse product portfolio caters to a wide range of customer needs within the IT ecosystem.

In 2023, ALSO Holding reported a substantial portion of its revenue derived from these sales, highlighting the continued demand for physical IT infrastructure and digital solutions. The company processed billions of euros in sales, underscoring its role as a key distributor in the European IT market.

Subscription-based cloud and as-a-service offerings represent a significant and expanding revenue source for ALSO Holding. This includes platforms for IoT, cybersecurity, virtualization, and AI, providing predictable recurring income and driving future growth.

ALSO Holding generates significant revenue from IT Services and Solutions Fees. This encompasses a broad range of offerings, including professional services for project implementation, managed services for ongoing IT operations, and expert consulting for intricate technology challenges. These fees are crucial for supporting reseller partners in deploying and integrating complex IT solutions, ensuring smooth operation and client satisfaction.

In 2024, the IT services sector continued to be a robust revenue driver for companies like ALSO Holding. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, with managed services and cloud consulting showing particularly strong growth. ALSO’s model benefits directly from this trend, capturing fees for the deployment, integration, and essential ongoing support that underpins these reseller projects.

Logistics and Financial Services Fees

ALSO Holding generates income by providing essential logistics services to its vendors. This includes warehousing, transportation, and delivery, for which vendors pay fees. These services streamline the supply chain, making it more efficient for all participants.

Additionally, ALSO offers a suite of financial services to its partners. These services encompass credit facilities, tailored financing options, and efficient payment processing solutions. These fees are a key component of ALSO's revenue, fostering financial stability within its partner network.

- Logistics Fees: Revenue generated from warehousing, transportation, and delivery services for vendors.

- Financial Services Fees: Income from credit facilities, financing, and payment processing for partners.

- Ecosystem Support: These fees contribute to the overall financial health and operational efficiency of the ALSO ecosystem.

Commissions and Value-Added Services on Marketplace

Commissions and value-added services represent a significant revenue stream for ALSO Holding's B2B marketplace. These fees are generated from vendors utilizing the platform to reach a wider customer base.

For instance, in 2024, a substantial portion of ALSO's marketplace revenue likely stemmed from these transactional and service-based charges. This model allows vendors to leverage ALSO's extensive network and infrastructure.

- Transaction Fees: ALSO can earn a percentage of each sale completed through its B2B marketplace, acting as a facilitator for vendor transactions.

- Value-Added Services: Revenue is also generated from optional services such as premium placement for products, advanced data analytics on market trends, and targeted marketing support for vendors.

- Subscription Models: Some vendors might opt for subscription-based access to enhanced marketplace features or dedicated account management.

- Lead Generation Fees: For services that connect vendors with potential buyers, lead generation fees could be another component of this revenue stream.

Commissions and value-added services are key revenue drivers within ALSO Holding's B2B marketplace, generated from vendors leveraging the platform for increased market reach and enhanced sales support.

In 2024, the IT distribution sector saw continued reliance on such platform-based revenue. For example, companies operating extensive digital marketplaces often derive a significant percentage of their income from transaction fees, premium listings, and data analytics services offered to vendors.

| Revenue Stream Component | Description | 2024 Market Context/Example |

|---|---|---|

| Transaction Fees | Percentage earned on sales facilitated through the B2B marketplace. | Marketplaces commonly charge vendors 1-5% per transaction. |

| Value-Added Services | Revenue from premium product placement, data analytics, and marketing support for vendors. | Enhanced visibility services can increase vendor sales by up to 15%. |

| Subscription Models | Fees for enhanced marketplace features or dedicated vendor support. | Subscription tiers can range from €50 to €500+ per month depending on features. |

| Lead Generation Fees | Charges for connecting vendors with potential buyers. | A successful lead can be valued at a percentage of the potential deal size. |

Business Model Canvas Data Sources

The ALSO Holding Business Model Canvas is built using extensive market research, internal financial data, and strategic analyses of industry trends. These sources ensure each component, from value propositions to cost structures, is grounded in accurate and relevant information.