ALSO Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

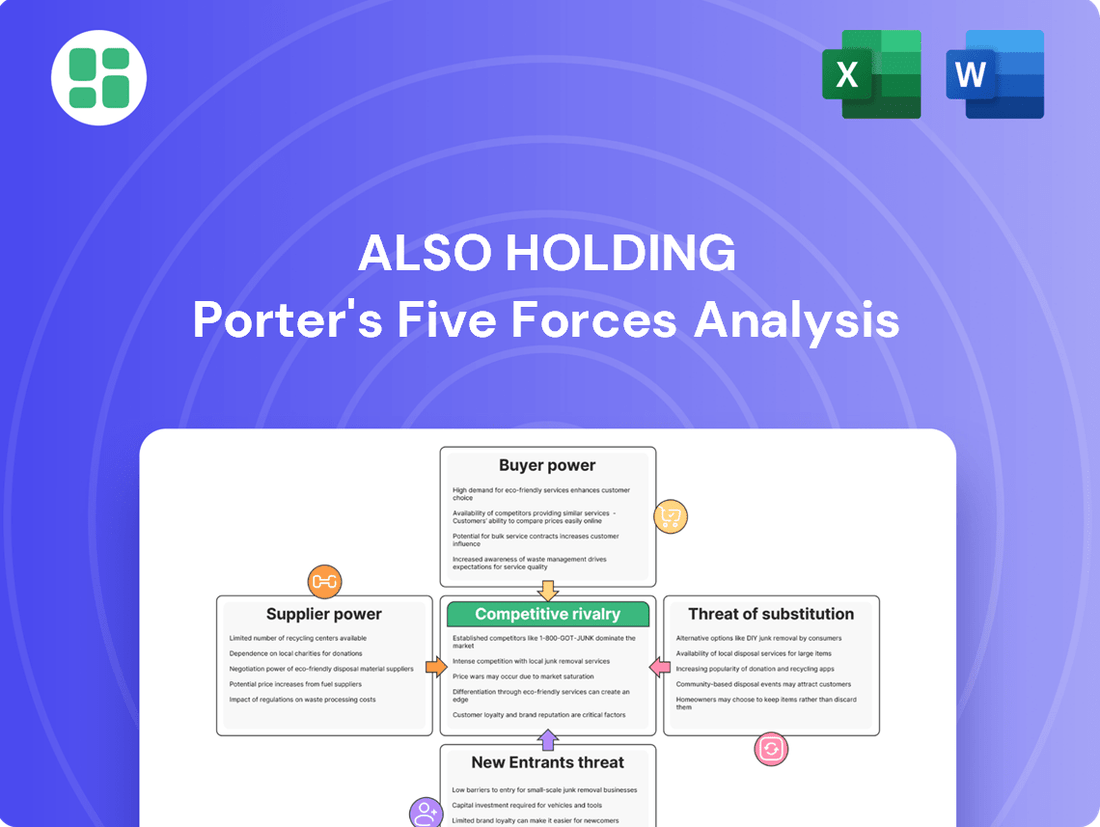

Understanding the competitive landscape for ALSO Holding is crucial for strategic success. Our Porter's Five Forces analysis delves into the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants, offering a comprehensive view of the market dynamics impacting the company.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ALSO Holding’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ALSO Holding operates within a broad ICT vendor landscape, sourcing from over 800 suppliers across more than 1,570 product categories. While major technology firms like Microsoft, HP, and Dell represent significant players, the sheer diversity of the supplier base, particularly for specialized IT services and software, generally limits the bargaining power of any single entity.

Switching from one major vendor to another can incur moderate to high costs for ALSO, encompassing integration efforts, training for their extensive reseller network, and the potential for supply chain disruptions. For instance, in 2023, IT infrastructure integration projects for large enterprises often ran into hundreds of thousands of euros, a significant consideration for a distributor like ALSO.

However, ALSO's strategic investments in its digital platforms and its established processes for rapidly onboarding new solutions are designed to mitigate these switching costs. This agility allows them to adapt more readily to market changes and vendor opportunities.

Furthermore, ALSO's commitment to fostering a broad and diverse ecosystem of technology partners inherently reduces its dependence on any single vendor. This diversification strategy makes it more feasible and less impactful to switch suppliers if market conditions or strategic priorities necessitate such a move.

While some suppliers provide unique hardware or software essential for specific solutions, such as specialized operating systems or advanced servers, the Information and Communication Technology (ICT) sector generally offers many alternatives. This means that the bargaining power stemming from sheer uniqueness is often limited.

ALSO's strategic approach of curating a broad portfolio that includes offerings from numerous vendors significantly diminishes its reliance on any single supplier's unique products. For instance, in 2024, ALSO's extensive partnerships across cloud infrastructure, cybersecurity, and hardware categories meant that if one vendor increased prices for a particular component, alternative solutions were readily available within their existing ecosystem.

Furthermore, the growing trend towards modular IT solutions and the widespread adoption of cloud services enhance flexibility. This allows companies like ALSO to more easily switch between suppliers or integrate different components, further reducing the bargaining power of suppliers who might otherwise leverage the uniqueness of their offerings.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward and bypassing distributors like ALSO is generally low for large hardware and software vendors. The immense cost and logistical complexity of replicating ALSO's established global distribution, sales, and support infrastructure present a significant barrier.

Suppliers often find it more efficient to leverage existing channels rather than invest in building a comparable global network. ALSO's comprehensive suite of value-added services, including specialized logistics, flexible financing options, and extensive IT support, solidifies its position as an indispensable partner, making direct-to-reseller or end-customer engagement by suppliers less attractive.

- Low Threat of Forward Integration: Suppliers face substantial costs and complexity in replicating ALSO's global distribution and support network.

- Value-Added Services: ALSO's logistics, financing, and IT services make it a critical partner, deterring suppliers from bypassing it.

- Cost Prohibitive: For most major hardware and software companies, building a comparable infrastructure is prohibitively expensive.

Importance of ALSO to Suppliers

The bargaining power of suppliers is significantly influenced by their reliance on ALSO Holding as a distribution channel. For many vendors, especially those specializing in niche or emerging technologies, ALSO’s extensive network of over 135,000 resellers across 31 European countries and its global PaaS partnerships are crucial for market access. This broad reach makes ALSO an indispensable partner for efficient sales and market penetration, thereby granting ALSO a degree of leverage in its dealings with these suppliers.

Suppliers who lack alternative significant distribution channels often find themselves with less power when negotiating terms with ALSO. The value-added services ALSO provides, such as logistics, financing, and marketing support, further solidify its position as a key partner. This reliance on ALSO's infrastructure and customer base can limit a supplier's ability to dictate terms, especially for smaller or less established companies.

In 2023, ALSO Holding reported a revenue of €13.1 billion, underscoring its substantial market presence and the volume of goods it moves for its suppliers. This scale means that suppliers are often keen to maintain a strong relationship with ALSO to ensure consistent sales volume and visibility. Consequently, the bargaining power of suppliers is often tempered by the significant benefits they derive from partnering with a major distributor like ALSO.

- Market Access: ALSO provides access to over 135,000 resellers in 31 European countries.

- Value-Added Services: Logistics, financing, and marketing support enhance ALSO's negotiating position.

- Supplier Dependence: Niche or smaller suppliers often rely heavily on ALSO for market penetration.

- Scale of Operations: ALSO's €13.1 billion revenue in 2023 highlights its significant influence in the supply chain.

The bargaining power of suppliers for ALSO Holding is generally moderate, primarily due to the company's vast supplier base and its ability to switch vendors. While some specialized components might grant a supplier temporary leverage, the overall ICT market offers numerous alternatives, limiting the impact of unique offerings. For example, in 2024, the availability of multiple cloud infrastructure providers meant ALSO could easily shift if one vendor's pricing became unfavorable.

However, the scale of ALSO's operations, evidenced by its €13.1 billion revenue in 2023, makes it a critical partner for many suppliers, particularly those in niche markets. This reliance on ALSO for market access and sales volume can temper a supplier's ability to dictate terms, especially when combined with ALSO's value-added services like logistics and financing.

The threat of suppliers integrating forward and bypassing distributors like ALSO is low, given the significant costs and complexity involved in replicating ALSO's established global network. ALSO’s comprehensive service offerings further solidify its indispensable role, making direct engagement by suppliers less efficient.

| Factor | Assessment | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | Low to Moderate | 800+ suppliers across 1,570+ categories; no single supplier dominates. |

| Switching Costs for ALSO | Moderate to High | Integration, training, and potential disruption costs; 2023 IT integration projects often cost hundreds of thousands of euros. |

| Availability of Alternatives | High | Numerous vendors in most ICT segments, especially with modular solutions and cloud services. |

| Supplier Dependence on ALSO | High for Niche/Emerging Vendors | Access to 135,000+ resellers across 31 European countries; crucial for market penetration. |

| Threat of Forward Integration | Low | High cost and complexity for suppliers to replicate ALSO's distribution, sales, and support infrastructure. |

| ALSO's Revenue (2023) | Significant | €13.1 billion revenue indicates substantial volume and influence for suppliers. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to ALSO Holding's position in the IT distribution and services market.

Instantly visualize the competitive landscape with a dynamic, interactive dashboard that highlights key pressures and opportunities.

Streamline strategic planning by quickly identifying and quantifying the impact of each Porter's Five Forces on your business.

Customers Bargaining Power

ALSO Holding serves a vast network of over 135,000 resellers, system integrators, and retailers throughout Europe. This extensive reach creates a fragmented customer base.

While certain large resellers may possess considerable purchasing influence, the sheer volume and variety of ALSO's customer relationships prevent any single entity from dominating revenue. This diffusion of customer power significantly limits the bargaining leverage of individual clients.

The bargaining power of customers, specifically resellers, is influenced by the availability of alternative distributors. Companies like ALSO Holding operate in a market where major global players such as TD Synnex and Ingram Micro offer comparable ICT products and services.

This competitive landscape empowers resellers, as they can readily compare pricing, product availability, and service levels across multiple distributors. For instance, the global ICT distribution market is substantial, with companies like TD Synnex reporting revenues in the tens of billions of dollars annually, indicating a broad ecosystem of choices for buyers.

Consequently, resellers can leverage these alternatives to negotiate more favorable terms, potentially driving down prices or demanding better service from distributors like ALSO. This dynamic directly impacts ALSO's ability to dictate terms and maintain profit margins.

While switching distributors for basic product procurement might seem low, ALSO's comprehensive ecosystem significantly increases these costs. Their integrated logistics, financial services, and proprietary digital platforms, such as the Cloud Marketplace, create a sticky environment for resellers.

Resellers deeply integrated into ALSO's full suite of services would face considerable disruption and effort to replicate these efficiencies with another provider. This integration makes a simple product switch a complex operational overhaul, thereby strengthening ALSO's bargaining power.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for ALSO Holding, as resellers operate in a highly competitive market. This means they are keenly aware of the prices for hardware, software, and the various services they purchase, pushing them to secure the most favorable terms.

However, ALSO can mitigate this by focusing on its value proposition beyond mere price. Offering integrated solutions, bundled packages, and flexible financing options allows ALSO to differentiate itself, making the overall value more compelling than simply the cost of individual components.

For instance, in 2024, the IT distribution market saw continued pressure on hardware margins, with many resellers reporting that price remained a primary driver in procurement decisions. Despite this, companies like ALSO that successfully bundled support, cloud services, and tailored financing often retained customers even when slightly higher on initial product cost.

- Price Sensitivity: Resellers in competitive markets prioritize cost-effective procurement of IT hardware, software, and services.

- Value Differentiation: ALSO can counter price sensitivity by offering value-added services, integrated solutions, and financing.

- Market Dynamics: In 2024, hardware price competition remained intense, yet bundled offerings and support services proved crucial for customer retention.

Threat of Backward Integration by Customers

The threat of backward integration by customers for a company like ALSO Holding is generally low. It’s typically impractical for most resellers to replicate the extensive vendor relationships, complex logistics networks, and specialized financial and IT service capabilities that ALSO provides.

The substantial capital investment and deep technical expertise needed to establish such operations on a comparable scale present significant barriers to entry for most customers looking to integrate backward. For instance, the IT infrastructure alone required to manage a broad portfolio of products and services, coupled with the financial acumen for complex transactions, is a considerable hurdle.

- Low Customer Backward Integration Threat: Resellers typically lack the resources and expertise to replicate ALSO's vendor management and logistics.

- High Barrier to Entry: Significant capital and specialized knowledge are required for customers to integrate backward effectively.

- Focus on Core Competencies: Most resellers concentrate on their primary sales and distribution functions rather than complex operational replication.

While ALSO Holding serves a vast customer base, the bargaining power of these customers, primarily resellers, is moderated by the availability of alternative distributors. The competitive landscape, featuring global players like TD Synnex and Ingram Micro, allows resellers to compare pricing and service levels, giving them leverage to negotiate better terms. However, ALSO's integrated ecosystem of logistics, financial services, and digital platforms increases switching costs for deeply integrated resellers, thereby strengthening ALSO's position.

Customer price sensitivity remains high due to the competitive nature of the reseller market. In 2024, hardware price competition was a key procurement factor for many resellers. Nevertheless, companies like ALSO that successfully bundle value-added services, cloud solutions, and financing can retain customers even with slightly higher initial product costs, demonstrating the effectiveness of value differentiation.

The threat of backward integration by customers is low for ALSO Holding. Most resellers lack the substantial capital, vendor relationships, and specialized expertise required to replicate ALSO's complex logistics and service capabilities. This high barrier to entry means customers typically focus on their core sales and distribution functions rather than attempting to build similar operational infrastructure.

| Factor | Customer Bargaining Power | Mitigation by ALSO |

|---|---|---|

| Customer Base Size & Fragmentation | Low (due to large, fragmented base) | N/A |

| Availability of Alternatives | Moderate to High (e.g., TD Synnex, Ingram Micro) | Value-added services, integrated ecosystem |

| Switching Costs for Customers | Low for basic procurement, High for integrated services | Proprietary digital platforms, bundled solutions |

| Customer Price Sensitivity | High (due to competitive reseller market) | Value differentiation, bundled offerings |

| Threat of Backward Integration | Low (high capital and expertise required) | N/A |

Full Version Awaits

ALSO Holding Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for ALSO Holding, offering a detailed examination of industry competitiveness. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency. You can confidently download and utilize this comprehensive analysis without any hidden surprises or placeholder content.

Rivalry Among Competitors

The ICT distribution landscape features a handful of dominant global entities like TD Synnex, Ingram Micro, and Arrow, who command significant market share. These giants operate alongside a vast network of smaller, regional, and niche distributors, creating a complex competitive environment.

ALSO Holding stands out as a major technology provider across Europe, with a presence in 31 countries. This extensive European footprint positions ALSO as a key player within a market segment that, while having global leaders, also exhibits considerable regional concentration.

The ICT sector is poised for significant expansion, with total revenue anticipated to climb from 802.6 billion euros in 2022 to 1,097.3 billion euros by 2027. This robust growth, fueled by ongoing digital transformation initiatives, can soften the intensity of competitive rivalry.

As the market expands, companies have greater opportunities to grow by capturing new demand rather than solely focusing on wresting market share from competitors. This dynamic can lead to a less aggressive competitive environment, at least in the short to medium term.

While basic IT hardware and software distribution can become a price-driven commodity, ALSO Holding actively combats this by building a robust ecosystem. Their digital platforms, encompassing Cloud, IoT, Cybersecurity, and AI, offer integrated solutions that go beyond simple product supply.

This strategic emphasis on comprehensive solutions, supported by value-added services like specialized logistics, financing options, and professional consulting, significantly diminishes direct competition based solely on price. For instance, in 2024, ALSO reported a substantial increase in its cloud services revenue, highlighting the market's demand for integrated, solution-oriented offerings.

Switching Costs for Resellers

While the initial setup for resellers to switch between IT distributors might seem straightforward, the ecosystem ALSO Holding has built creates significant switching costs. These aren't just about changing a supplier; they involve integrating new systems and retraining staff.

The true stickiness comes from ALSO's comprehensive digital platforms and value-added services. Resellers who leverage these integrated solutions, such as their cloud marketplace or financing options, face considerable disruption if they were to move to a competitor. This integration fosters loyalty and makes it less likely for resellers to seek out alternative providers for their core IT needs.

This inherent stickiness helps to moderate the intensity of competitive rivalry within the IT distribution sector. By making it more complex and costly for resellers to switch, ALSO Holding can cultivate more stable and long-term customer relationships, reducing the constant pressure of price wars or aggressive customer acquisition tactics from rivals.

- Integrated Services: ALSO's platform offers a suite of services from cloud solutions to cybersecurity, making it a one-stop shop that increases the effort for resellers to replicate elsewhere.

- Digital Platform Adoption: Resellers deeply embedded in ALSO's digital ordering, management, and analytics tools face significant operational hurdles if they switch.

- Customer Loyalty: The complexity of migrating data, workflows, and retraining personnel upon switching distributors directly contributes to higher switching costs for resellers.

Exit Barriers

For companies like ALSO Holding, the distribution sector presents significant exit barriers. High capital investment in logistics and warehousing, coupled with specialized IT infrastructure for inventory management and order fulfillment, makes it costly to leave the market. For instance, the average cost to set up a modern distribution center can run into tens of millions of dollars, a substantial commitment that discourages quick exits.

Furthermore, deep-rooted relationships with suppliers and a vast network of resellers are critical assets in the distribution business. Severing these established ties, often built over years, is not only difficult but also diminishes the residual value of a business. Competitors, therefore, tend to persist even when facing economic downturns, as the cost and complexity of exiting outweigh the benefits of leaving.

These high exit barriers directly fuel competitive rivalry. Because it's so hard to leave, companies are compelled to fight for market share. This can lead to price wars or aggressive marketing campaigns as businesses strive to maintain their position. In 2024, the IT distribution market, a key area for ALSO Holding, saw continued consolidation, but many smaller players remained, intensifying the competitive landscape due to these entrenched operational costs.

- High Capital Intensity: Significant investment required in logistics, warehousing, and specialized IT systems.

- Specialized Infrastructure: Distribution relies on dedicated facilities and technology that are difficult to repurpose.

- Established Relationships: Long-term partnerships with suppliers and customers create switching costs and loyalty.

- Persistence of Rivals: Due to the difficulty of exiting, competitors often remain in the market, sustaining rivalry even in challenging economic conditions.

The competitive rivalry within the ICT distribution sector, where ALSO Holding operates, is characterized by the presence of global giants and a multitude of smaller players. While market growth offers opportunities for expansion, the core distribution business can lean towards price competition. However, ALSO Holding mitigates this by fostering strong customer loyalty through its integrated digital platforms and value-added services, thereby increasing switching costs for resellers.

The high capital investment required for logistics and specialized IT infrastructure, coupled with established supplier and reseller relationships, creates significant exit barriers. These barriers compel companies to remain active competitors, contributing to sustained rivalry, even as market consolidation continues, as observed in the IT distribution market throughout 2024.

| Factor | Description | Impact on Rivalry |

| Market Structure | Dominated by a few global players (e.g., TD Synnex, Ingram Micro) alongside numerous regional and niche distributors. | Intense, especially among larger entities vying for market share. |

| Switching Costs for Resellers | High due to ALSO's integrated digital platforms (Cloud, IoT, Cybersecurity, AI) and value-added services. | Moderates rivalry by fostering customer loyalty and reducing the ease of switching. |

| Exit Barriers | Significant capital investment in logistics, warehousing, specialized IT, and established relationships. | Encourages persistence of competitors, sustaining rivalry even during economic downturns. |

| Market Growth | ICT sector projected to grow from €802.6 billion (2022) to €1,097.3 billion (2027). | Can soften rivalry by allowing companies to grow through capturing new demand rather than solely through market share battles. |

SSubstitutes Threaten

Resellers might explore sourcing directly from manufacturers, potentially bypassing distributors like ALSO. This could offer cost savings but often means forfeiting the extensive product portfolios, logistical efficiencies, and crucial credit facilities that established distributors provide. For instance, in 2024, the complexity of managing direct relationships with numerous hardware and software vendors, each with varying terms and minimum order quantities, presents a significant hurdle for many resellers.

While major vendors might bypass distributors for large enterprise clients, this direct route is not a viable substitute for the majority of the market. For instance, in 2024, the SMB market, which relies heavily on channel partners, continued to represent a significant portion of IT spending, estimated to be over $1.6 trillion globally, underscoring the necessity of reseller networks.

The threat of substitutes for ALSO Holding's vendor-to-end-customer sales model is moderate. Direct sales by vendors to end-customers can substitute the reseller channel, particularly for large enterprise deals where direct relationships and customized solutions are paramount. However, this substitution is limited for the vast segment of small and medium-sized businesses (SMBs) and niche solution providers that depend on the value-added services and reach offered by resellers. In 2024, the global SMB IT spending was projected to exceed $1.6 trillion, highlighting the substantial market that remains reliant on indirect sales channels.

The rise of cloud-native solutions and SaaS presents a threat of substitutes by allowing direct consumption of software, potentially bypassing traditional distribution channels. This shift means customers can opt for services directly from providers, reducing reliance on intermediaries. For example, the global SaaS market was projected to reach over $200 billion in 2024, highlighting the scale of this direct-to-consumer trend.

However, ALSO Holding has proactively addressed this threat by developing its own Cloud Marketplace. This strategic move transforms the company from a potential victim of substitution into a key enabler of cloud adoption. By offering a platform for subscription-based cloud services, ALSO facilitates access to these substitute solutions, thereby integrating itself into the evolving market landscape.

Emergence of Niche Marketplaces

The emergence of niche marketplaces presents a potential threat of substitutes for ALSO Holding. These specialized platforms could cater to very specific B2B technology needs, offering a more tailored experience than a broad distributor.

However, ALSO's strength lies in its extensive and diversified ecosystem. By offering a comprehensive range of hardware, software, and services across a multitude of categories, it acts as a convenient one-stop shop. This broad appeal makes it challenging for narrowly focused niche players to achieve the same widespread market penetration and value proposition that ALSO provides to its partners.

- Diversified Ecosystem: ALSO's broad product and service portfolio across hardware, software, and services acts as a significant barrier against niche competitors.

- One-Stop Shop Advantage: The convenience of a single, comprehensive source for diverse IT needs reduces the appeal of fragmented, specialized marketplaces for many businesses.

- Market Reach: While niche marketplaces might serve specific segments, ALSO's established network and reach across numerous verticals offer a broader competitive advantage.

In-house IT Capabilities of End-Customers

Larger enterprises may invest in building substantial in-house IT procurement and management expertise. This can diminish their dependence on external IT resellers, who are themselves reliant on distributors like ALSO Holding. For instance, a large corporation might establish a dedicated IT sourcing department to negotiate directly with hardware manufacturers, bypassing traditional reseller channels.

However, the sheer speed of IT evolution and the inherent complexity of managing diverse technology stacks present a significant barrier. Most businesses, particularly small and medium-sized enterprises (SMEs), find it more efficient and cost-effective to leverage the specialized knowledge and service offerings of external partners and established distribution channels. In 2024, the IT services market continued to grow, with many companies outsourcing aspects of their IT infrastructure and management to specialized providers.

- Reduced Reliance: Larger end-customers can develop in-house IT procurement and management capabilities, lessening their reliance on resellers.

- Complexity Barrier: The rapid pace of IT innovation and management complexity make in-house solutions challenging for most organizations.

- SME Dependence: Small and medium-sized enterprises (SMEs) predominantly continue to depend on external partners and distribution channels for their IT needs.

- Market Trend: The IT services market saw continued growth in 2024, underscoring the ongoing trend of outsourcing IT functions.

The threat of substitutes for ALSO Holding's business model is characterized by several key factors, primarily revolving around direct sales channels and evolving consumption patterns. Direct sales by vendors to end-customers, particularly for large enterprise deals, can bypass the reseller channel, impacting distributors. Similarly, the rise of cloud-native solutions and SaaS allows for direct consumption, reducing reliance on intermediaries.

However, the extensive reach and value-added services provided by distributors like ALSO remain crucial for the vast majority of the market, especially small and medium-sized businesses. While niche marketplaces offer specialized alternatives, ALSO's diversified ecosystem and one-stop-shop advantage present a strong counterpoint. Furthermore, the complexity and rapid evolution of IT make in-house solutions challenging for most organizations, reinforcing the value of established distribution networks.

| Substitute Threat Area | Description | Impact on ALSO Holding | Mitigation/Counterpoint |

|---|---|---|---|

| Direct Vendor Sales | Vendors selling directly to end-customers. | Moderate threat, especially for large enterprise deals. | Resellers are essential for the SMB market, which relies on value-added services. |

| Cloud/SaaS Consumption | Direct access to cloud services and software. | Moderate threat, bypassing traditional distribution. | ALSO's Cloud Marketplace integrates these solutions, transforming the threat into an opportunity. |

| Niche Marketplaces | Specialized platforms catering to specific B2B tech needs. | Low to moderate threat, potentially fragmenting demand. | ALSO's diversified ecosystem and one-stop-shop appeal offer a broader value proposition. |

| In-house IT Procurement | Large enterprises building internal IT management capabilities. | Low threat for most, as complexity and speed of IT evolution favor external partners. | SMEs continue to depend on external partners and distribution channels. |

Entrants Threaten

Establishing a robust ICT distribution business, akin to ALSO Holding's operations, demands substantial upfront capital. This includes investments in extensive logistics networks, modern warehousing facilities, significant inventory holdings, and sophisticated IT platforms for managing operations and sales. For instance, setting up a distribution center comparable to those needed for broad market coverage can easily run into tens of millions of Euros.

These considerable capital requirements act as a significant deterrent for many aspiring new entrants. The sheer financial outlay needed to build the necessary infrastructure and operational capacity creates a formidable barrier to entry, making it challenging for smaller or less-funded companies to compete effectively with established players like ALSO.

Existing players like ALSO benefit significantly from economies of scale in purchasing, logistics, and overall operational efficiency. Their large transaction volumes and extensive service portfolios allow them to negotiate better terms with suppliers and spread fixed costs over a wider base. For instance, in 2024, ALSO reported a revenue of €13.7 billion, underscoring the scale of their operations.

New entrants would face a considerable challenge in matching these cost efficiencies. Without a substantial initial investment to achieve comparable scale, it would be difficult for them to compete effectively on price or offer the same breadth of services. This barrier makes it tough for newcomers to gain a foothold against established, large-volume distributors.

ALSO Holding's established relationships with over 800 vendors and 135,000 resellers globally present a significant barrier to new entrants. These deep, trusted networks are not easily replicated, particularly in the B2B sector where reliability and established partnerships are crucial for success. Building such a robust ecosystem takes considerable time and investment, making it challenging for newcomers to gain immediate traction.

Regulatory and Legal Barriers

Navigating the complex web of regulations across the 31 European countries where ALSO Holding operates presents a significant hurdle for potential new entrants. Compliance with varying national laws and EU directives, especially concerning IT product and service standards, requires substantial investment and expertise. For instance, in 2023, the European Union continued to strengthen its digital single market regulations, impacting areas like data privacy (GDPR) and cybersecurity, which new players must meticulously adhere to from inception.

The cost and effort associated with understanding and implementing these diverse regulatory frameworks can deter new companies. This includes obtaining necessary certifications, licenses, and ensuring adherence to consumer protection laws that differ from one member state to another. ALSO Holding's established infrastructure and experience in managing these complexities provide a competitive advantage, making it more difficult for newcomers to match their operational readiness.

The threat of new entrants is further mitigated by the need for specialized knowledge in IT product distribution and services, coupled with the ongoing evolution of compliance requirements. Key areas include:

- Data Protection: Strict adherence to GDPR across all operating regions.

- Cybersecurity Standards: Meeting evolving security protocols for hardware and software.

- Product Certifications: Obtaining and maintaining certifications for various IT components and solutions.

- Cross-Border Compliance: Managing differing legal and tax frameworks in 31 countries.

Technological Complexity and Digital Platforms

The technological complexity and the rapid evolution of digital platforms present a significant barrier to new entrants in ALSO Holding's operating space. Developing and maintaining sophisticated B2B marketplaces, cloud services, and advanced IT solutions like AI, cybersecurity, and IoT platforms demands immense technological expertise and continuous, substantial investment. For instance, in 2024, the global IT services market reached an estimated $1.3 trillion, highlighting the scale of investment required to compete effectively.

ALSO's commitment to its digital ecosystem, including ongoing upgrades and integration of new technologies, effectively creates a moving target for potential competitors. This continuous innovation means that any new entrant would need to not only match existing capabilities but also anticipate and invest in future technological advancements, a costly and challenging endeavor. In 2023, technology research and development spending by major tech companies averaged over 15% of their revenue, demonstrating the high ongoing costs.

- High R&D Investment: Competitors must commit significant capital to research and development to keep pace with technological advancements.

- Talent Acquisition: Access to specialized talent in areas like AI, cloud computing, and cybersecurity is crucial and often scarce, driving up labor costs.

- Platform Development Costs: Building and maintaining robust, scalable digital platforms requires substantial upfront and ongoing expenditure.

- Cybersecurity Demands: The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures, adding to operational costs.

The threat of new entrants for a company like ALSO Holding is significantly low due to immense capital requirements for establishing logistics, warehousing, and IT infrastructure, potentially costing tens of millions of Euros. Furthermore, achieving economies of scale, as evidenced by ALSO's €13.7 billion revenue in 2024, allows for better pricing and service breadth that newcomers struggle to match without substantial initial investment.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ALSO Holding is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and relevant industry research from leading market intelligence firms. We also incorporate data from financial news outlets and economic databases to ensure a robust understanding of the competitive landscape.