ALSO Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALSO Holding Bundle

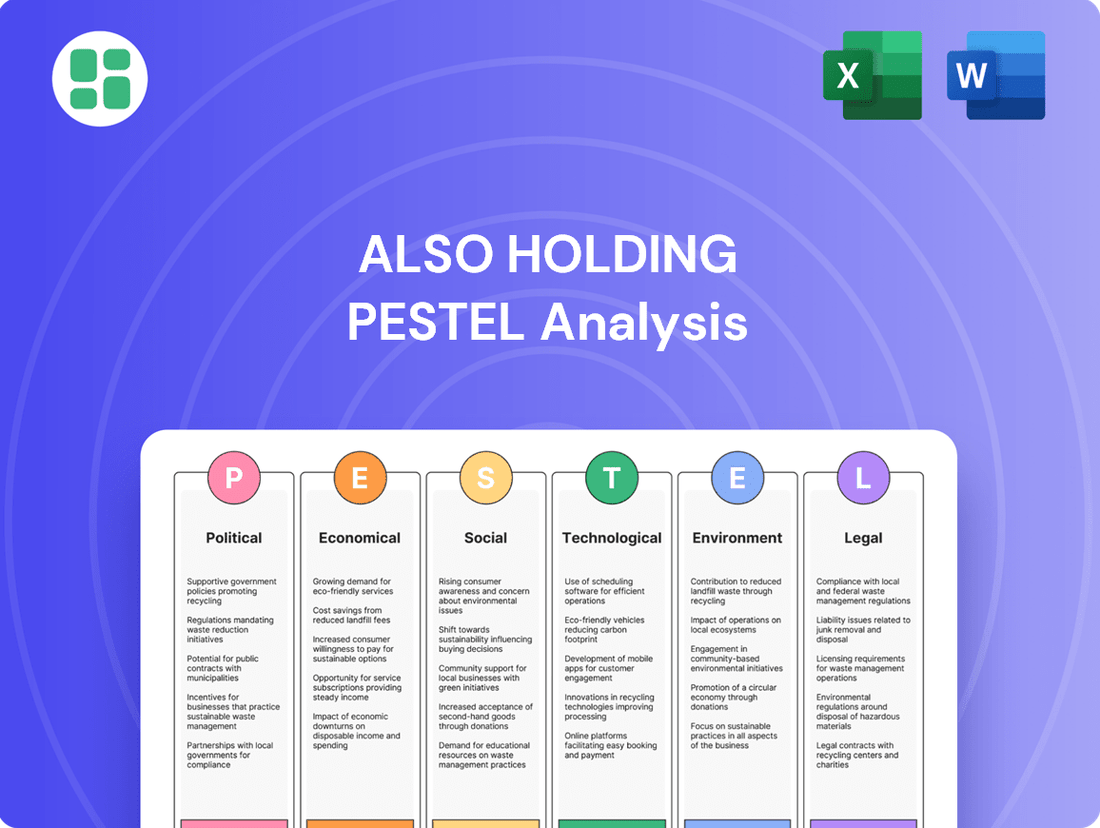

Navigate the complex external forces shaping ALSO Holding's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and legal frameworks are impacting the company's operations and future growth. Gain a critical competitive edge by leveraging these actionable insights for strategic planning. Download the full PESTLE analysis now to unlock a deeper understanding and make more informed business decisions.

Political factors

Government IT spending policies are a critical factor for ALSO Holding AG. For instance, the European Union's Digital Decade targets, aiming for widespread digital transformation by 2030, are likely to spur increased public sector IT investment across member states, benefiting distributors like ALSO. Conversely, budget constraints or a shift in government priorities away from technology could dampen demand.

International trade policies, including tariffs and import/export regulations, directly influence the cost and accessibility of the Information and Communication Technology (ICT) products that ALSO Holding AG distributes. Changes in these policies can significantly alter supply chain expenses and delivery times, impacting the company's ability to offer competitive pricing across its diverse markets.

For instance, a shift towards protectionist trade measures by major economies in 2024 could lead to increased duties on electronic components, potentially raising ALSO Holding's procurement costs. Conversely, the continuation or expansion of favorable trade agreements, such as those within the European Union, would likely support smoother cross-border logistics and more predictable pricing for their extensive product portfolio.

Geopolitical tensions, particularly in Eastern Europe and the Middle East, continue to pose significant risks for global supply chains. For ALSO Holding AG, operating across numerous international markets, instability in key sourcing or sales regions could lead to supply disruptions and fluctuating demand. For instance, ongoing conflicts in regions adjacent to major manufacturing hubs could impact component availability, potentially increasing lead times and costs throughout 2024 and into 2025.

To counter these risks, ALSO Holding AG's strategy of maintaining diversified sourcing and distribution networks remains paramount. As of their latest reports, the company emphasizes its global presence, which allows for flexibility in shifting operations or suppliers if one region experiences heightened political instability. This approach is vital for ensuring business continuity and mitigating the impact of localized conflicts on their overall performance.

Data Privacy Regulations

Data privacy regulations are becoming increasingly stringent globally, impacting how companies like ALSO Holding AG manage customer and partner information. These laws, exemplified by the General Data Protection Regulation (GDPR) in Europe, mandate robust data protection measures and significant penalties for non-compliance. For an IT service provider and distributor, adhering to these evolving frameworks is crucial for maintaining trust and operational legality.

ALSO Holding AG must navigate a complex web of data privacy laws that affect its core business operations. The company's ability to offer secure and compliant solutions to its partners is directly tied to its own data handling practices. Failure to comply can result in substantial fines, reputational damage, and loss of business opportunities.

- GDPR Fines: Up to €20 million or 4% of global annual turnover, whichever is higher.

- CCPA/CPRA Impact: California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers more control over their personal data.

- Global Harmonization Challenges: Businesses face the task of aligning diverse international privacy standards.

- Increased Compliance Costs: Investing in data security infrastructure and legal expertise is a growing necessity.

Competition Policy and Antitrust

Regulatory scrutiny over market concentration and fair competition presents a significant political factor for ALSO Holding AG. Antitrust investigations or new regulations designed to curb monopolistic practices could directly affect their acquisition strategies and overall market share within the ICT distribution landscape.

For instance, the European Commission actively monitors mergers and acquisitions to ensure they do not harm competition. In 2023, the Commission reviewed numerous transactions within the tech sector, highlighting a heightened focus on market power. This ongoing vigilance means ALSO Holding must carefully consider potential antitrust implications when planning expansion through M&A activities.

- Regulatory Oversight: Increased focus by competition authorities on market concentration in the ICT sector.

- Antitrust Investigations: Potential impact of investigations on growth opportunities and operational freedom.

- Merger Control: Scrutiny of acquisitions by bodies like the European Commission can influence M&A strategies.

- Fair Competition Laws: Adherence to evolving antitrust regulations is crucial for maintaining market access and operational flexibility.

Government IT spending policies significantly influence ALSO Holding AG's revenue streams, with EU digital decade targets by 2030 expected to boost public sector IT investment. Conversely, austerity measures or shifts in government tech priorities could temper this growth, impacting the demand for distributed ICT products throughout 2024 and 2025.

What is included in the product

This PESTLE analysis critically examines the external macro-environmental forces impacting ALSO Holding across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a comprehensive understanding of how these factors shape the company's strategic landscape, identifying potential threats and opportunities for informed decision-making.

A PESTLE analysis for ALSO Holding provides a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain of navigating complex market dynamics and unforeseen challenges.

Economic factors

Rising inflation presents a direct challenge for ALSO Holding AG, potentially escalating operational expenses. For instance, the European Union's inflation rate averaged 5.3% in 2023, a figure that could translate to higher costs for logistics, raw materials, and energy throughout 2024. This squeeze on costs can impact profit margins if not effectively passed on to customers.

Increased interest rates, a common response to inflation, also pose a financial consideration for ALSO Holding. Central banks in major economies, such as the European Central Bank, have maintained higher policy rates through late 2023 and into 2024. This environment makes borrowing more expensive for both ALSO Holding and its extensive network of partners, potentially slowing down investment in new IT infrastructure and upgrades, which are crucial for the company's growth.

Economic growth is a significant driver for ALSO Holding. For instance, in 2024, global GDP growth is projected to be around 2.7%, a slight slowdown from previous years but still indicating expansion. This generally translates to increased business investment in IT infrastructure and services, directly benefiting companies like ALSO Holding.

However, recession risks remain a concern. The International Monetary Fund (IMF) has highlighted potential headwinds, including geopolitical tensions and persistent inflation, which could dampen consumer and business spending. A downturn would likely lead to tighter IT budgets and a pause in new technology adoption, impacting ALSO Holding's revenue streams.

The interplay between growth and recessionary pressures shapes the demand for IT solutions. In 2025, analysts anticipate a mixed economic outlook, with some regions showing resilience while others face potential slowdowns. This necessitates a flexible strategy for ALSO Holding to navigate varying market conditions and capitalize on opportunities arising from economic stability or recovery.

As an international company, ALSO Holding AG's financial performance is significantly influenced by currency exchange rate fluctuations. These shifts directly impact the reported value of revenues and costs when translated into their reporting currency, the Euro.

For instance, a strengthening Euro against currencies where ALSO Holding generates substantial revenue could reduce the Euro-denominated value of those earnings. Conversely, a weaker Euro can boost the translated value of foreign income, though it also increases the cost of imported goods or services.

In 2024, the Euro experienced moderate volatility against major currencies like the US Dollar and Swiss Franc. For example, the EUR/USD rate saw fluctuations, impacting the cost of goods sourced from the US and the profitability of sales in that market.

Consumer and Business Spending Power

Consumer and business spending power is a critical driver for demand in the ICT sector. When individuals have more disposable income and businesses are profitable, they are more likely to invest in new technology. For instance, in the US, real disposable personal income saw an increase in early 2024, which can translate to greater consumer spending on electronics and digital services.

Changes in employment and wages directly impact this spending capacity. Higher employment rates and rising wages boost consumer confidence and their ability to purchase ICT goods. Conversely, economic downturns or job losses can significantly curtail spending. In 2024, many economies are experiencing a tight labor market with wage growth, supporting consumer spending power.

Corporate profitability is equally important for business investment in ICT. When companies report strong earnings, they have greater capacity to fund digital transformations, software upgrades, and new hardware. For example, many technology companies reported robust revenue growth in late 2023 and early 2024, indicating healthy investment capacity.

- Consumer Disposable Income: In Q1 2024, US real disposable income showed a positive trend, supporting consumer spending on discretionary items like technology.

- Employment and Wages: Global unemployment rates remained relatively low in early 2024, with several regions experiencing wage increases, bolstering household spending.

- Corporate Profitability: Major tech firms, such as Microsoft and Apple, reported strong financial results in their fiscal year ending 2024, demonstrating significant capacity for business investment.

- ICT Sector Demand: Increased spending power directly correlates with demand for cloud services, software, and hardware upgrades across both consumer and enterprise markets.

Supply Chain Costs and Logistics

The efficiency and cost of global supply chains remain a paramount economic consideration for companies like ALSO Holding AG. Fluctuations in shipping rates, warehousing expenses, and overall transportation costs directly influence operational expenditures. For instance, the Drewry World Container Index, a benchmark for global shipping costs, saw significant volatility in late 2023 and early 2024, impacting the landed cost of goods.

Disruptions, whether stemming from geopolitical events, adverse weather, or labor issues, can exacerbate these costs. Increased fuel prices, a persistent economic factor, further inflate logistics expenses. These rising costs can pressure ALSO Holding's profit margins and necessitate adjustments in product pricing strategies to maintain competitiveness.

- Global shipping costs experienced a notable increase in early 2024, with some routes seeing double-digit percentage rises compared to the previous year.

- Fuel surcharges, a direct component of logistics costs, have been sensitive to global energy market volatility.

- Labor shortages in key transportation sectors, particularly trucking, have contributed to higher operational expenses and potential delivery delays.

- The cost of warehousing has also climbed due to increased demand and higher operating expenses, affecting inventory management strategies.

Economic growth projections for 2024 and 2025 indicate a moderate pace, with global GDP expected to expand by around 2.7% in 2024. This growth, while solid, is tempered by recessionary risks stemming from geopolitical tensions and persistent inflation, which could impact consumer and business spending on IT solutions. Currency fluctuations, particularly the Euro's volatility against currencies like the US Dollar, also present a financial consideration for ALSO Holding, affecting the translation of foreign revenues and costs.

| Economic Factor | 2024/2025 Outlook | Impact on ALSO Holding |

|---|---|---|

| Global GDP Growth | Projected ~2.7% in 2024; moderate growth expected in 2025 | Supports demand for IT infrastructure and services, but slower growth may temper investment. |

| Inflation | Averaged 5.3% in EU for 2023; persistent concerns | Increases operational costs (logistics, energy); potential pressure on profit margins. |

| Interest Rates | Maintained at higher levels by ECB and other central banks | Makes borrowing more expensive, potentially slowing IT investment by ALSO and its partners. |

| Currency Exchange Rates | Moderate volatility for EUR/USD and EUR/CHF in 2024 | Affects reported revenue and cost values; a stronger Euro can reduce foreign earnings' translated value. |

Preview the Actual Deliverable

ALSO Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ALSO Holding covers all key external factors impacting their business. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

The ongoing surge in digitalization is fundamentally reshaping how businesses operate, directly fueling demand for services that support these transformations. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the immense growth in this sector. This trend is intrinsically linked to the widespread adoption of remote and hybrid work arrangements, which were solidified in 2024 and continue to evolve. Companies are actively seeking solutions that enable seamless collaboration and efficient IT infrastructure to support their distributed workforces, creating a significant opportunity for companies like ALSO Holding AG.

The IT sector, including areas like cloud computing and cybersecurity, faces a significant and ongoing skills gap. For instance, a 2024 report indicated that over 60% of IT leaders worldwide struggle to find qualified cybersecurity talent, a critical area for ALSO Holding's partners. This shortage directly impacts the capacity of businesses to deploy advanced technological solutions and effectively support their own customer bases.

This persistent lack of skilled IT professionals, particularly in specialized fields, can create bottlenecks for innovation and service delivery among ALSO Holding's partners. It also creates a clear opportunity, potentially driving increased demand for managed IT services and comprehensive training programs, areas where ALSO Holding can play a pivotal role in bridging these critical workforce deficiencies.

Customers now demand IT services that are not just functional but also exceptionally user-friendly and readily available, much like consumer apps. This expectation for intuitive interfaces and instant access is reshaping how businesses procure and utilize technology. For instance, the global cloud computing market, a key enabler of these flexible IT services, was projected to reach over $1.3 trillion by 2025, highlighting this significant shift.

This societal trend pushes companies like ALSO Holding AG to move beyond traditional product sales towards subscription-based models and managed services. The demand for as-a-service solutions, encompassing everything from software to infrastructure, requires a fundamental rethink of IT delivery. Gartner predicted in 2024 that the majority of IT spending would be on cloud services, underscoring the urgency for adaptation.

Demographic Shifts

Demographic shifts are significantly reshaping the IT solutions market for companies like ALSO Holding. An aging workforce, for instance, often requires more intuitive and accessible technology, while the increasing presence of digitally native generations, like Gen Z, drives demand for mobile-first, collaborative, and cloud-based platforms. This generational dynamic means IT providers must offer solutions that cater to a wide range of digital literacy and work preferences.

For example, in 2024, the global workforce continues to see a blend of experienced professionals and younger talent entering the job market. This requires IT solutions that are not only cutting-edge but also easily adaptable for all users. The emphasis is shifting towards user experience (UX) and seamless integration across devices, reflecting a need for IT infrastructure that supports flexible and remote working arrangements.

- Aging Workforce Needs: Demand for simplified interfaces and robust training support for IT systems is growing as older workers remain in the workforce longer.

- Gen Z Impact: The younger generation entering the workforce expects advanced digital tools, strong mobile capabilities, and integrated collaboration platforms as standard.

- Digital Inclusion: IT solutions must be designed with accessibility and ease of use in mind to accommodate a broader spectrum of digital skills within organizations.

- Remote Work Enablement: Demographic trends supporting remote and hybrid work models necessitate IT solutions that facilitate secure, efficient, and connected collaboration from any location.

Social Responsibility and Ethical Consumption

Societal expectations are increasingly shaping business practices, with a growing emphasis on corporate social responsibility and ethical consumption. Consumers and business partners alike are actively seeking out companies that align with their values, particularly concerning environmental, social, and governance (ESG) performance. This trend directly impacts companies like ALSO Holding AG, necessitating a clear demonstration of their commitment to sustainability and ethical sourcing to maintain and grow market share.

The demand for socially responsible businesses is not just a consumer preference but a significant market driver. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products from sustainable brands. This translates to a tangible business imperative for ALSO Holding AG to integrate and communicate its ESG initiatives effectively. The company's efforts in areas such as responsible supply chain management and reducing its carbon footprint are crucial for appealing to this conscious market segment.

- Consumer Preference: A significant majority of consumers now factor sustainability into their purchasing decisions.

- Partner Expectations: Business partners are increasingly scrutinizing the ESG credentials of their suppliers and collaborators.

- Competitive Advantage: Strong ESG performance can differentiate ALSO Holding AG in a crowded marketplace.

- Risk Mitigation: Proactive engagement with social responsibility can help avoid reputational damage and regulatory scrutiny.

Societal expectations are increasingly shaping business practices, with a growing emphasis on corporate social responsibility and ethical consumption. Consumers and business partners alike are actively seeking out companies that align with their values, particularly concerning environmental, social, and governance (ESG) performance. This trend directly impacts companies like ALSO Holding AG, necessitating a clear demonstration of their commitment to sustainability and ethical sourcing to maintain and grow market share.

The demand for socially responsible businesses is not just a consumer preference but a significant market driver. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products from sustainable brands. This translates to a tangible business imperative for ALSO Holding AG to integrate and communicate its ESG initiatives effectively. The company's efforts in areas such as responsible supply chain management and reducing its carbon footprint are crucial for appealing to this conscious market segment.

Demographic shifts, such as an aging workforce and the rise of digitally native generations, are significantly reshaping IT needs. Younger workers expect advanced digital tools and collaboration platforms, while older workers often require more intuitive systems and training. This necessitates IT solutions that cater to a broad spectrum of digital literacy and work preferences, driving demand for user-friendly and accessible technology.

| Societal Factor | Impact on IT Market | Example/Data (2024/2025) |

|---|---|---|

| Corporate Social Responsibility (CSR) & ESG | Increased demand for sustainable and ethical IT solutions and supply chains. | Over 60% of consumers willing to pay more for sustainable brands (2024). |

| Digital Literacy & Generational Shifts | Need for user-friendly interfaces, robust training, and mobile-first platforms. | Growing demand for integrated collaboration tools to support diverse workforces. |

| Consumer Expectations for Usability | Shift towards subscription-based models and managed services with intuitive user experiences. | Cloud services projected to be the majority of IT spending (Gartner, 2024). |

Technological factors

The global cloud computing market is experiencing robust growth, with projections indicating it will reach over $1.3 trillion by 2025, up from approximately $600 billion in 2023. This surge in adoption across Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) presents a significant technological tailwind.

For ALSO Holding AG, a key player in the B2B IT sector, this trend necessitates a continuous expansion of its cloud service portfolio and the development of deeper expertise. Enabling partners to effectively leverage and resell comprehensive cloud solutions is paramount to meeting end-customer demand in this evolving landscape.

The swift integration of Artificial Intelligence and automation is reshaping business operations, offering ALSO Holding AG opportunities to boost efficiency and develop AI-driven solutions for its partners.

For instance, in 2024, the global AI market was projected to reach $200 billion, highlighting the significant potential for companies like ALSO to capitalize on this growth by offering advanced AI services.

However, ALSO must also proactively manage the potential impact of automation on its workforce, ensuring reskilling and upskilling initiatives are in place to adapt to evolving job requirements.

Cybersecurity threats are evolving rapidly, with attacks becoming more sophisticated and widespread. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, a significant increase from previous years. This escalating risk landscape directly impacts companies like ALSO Holding AG, which operates within the critical ICT sector.

Given its position as a major distributor and service provider, ALSO Holding AG has a dual responsibility: safeguarding its own extensive digital infrastructure and equipping its partners with advanced cybersecurity tools. The company is therefore focused on offering a comprehensive portfolio of cybersecurity software and managed security services, ensuring both its internal operations and its partners’ businesses are resilient against these growing threats.

Emerging Technologies

The rapid evolution of technologies such as the Internet of Things (IoT), 5G connectivity, blockchain, and quantum computing significantly shapes the future demands on IT infrastructure and application development. These advancements create both challenges and opportunities for companies like ALSO Holding AG.

To maintain its competitive edge and foster innovation among its extensive partner network, ALSO Holding AG must proactively monitor these technological shifts. Integrating relevant emerging technologies into its service offerings and solutions is crucial for staying ahead in the dynamic IT landscape.

For instance, the global IoT market was projected to reach over $1.1 trillion by 2024, indicating a massive expansion in connected devices and the data they generate. Similarly, the ongoing rollout of 5G is expected to unlock new use cases and increase data transmission speeds exponentially, impacting everything from cloud services to edge computing. Blockchain technology continues to mature, offering enhanced security and transparency in supply chain management and financial transactions, areas where ALSO Holding AG operates.

- IoT Growth: The global IoT market is expected to surpass $1.1 trillion by 2024, driving demand for robust IT infrastructure.

- 5G Impact: The widespread adoption of 5G promises to accelerate data processing and enable new digital services.

- Blockchain Adoption: Blockchain's potential for secure and transparent transactions is influencing various business sectors.

- Quantum Computing Potential: While still nascent, quantum computing could revolutionize complex problem-solving in the future.

Pace of Technological Obsolescence

The relentless march of technological advancement significantly shortens product lifecycles, creating a constant demand for innovation. This rapid obsolescence pressures companies like ALSO Holding AG to manage inventory with precision and adapt their offerings to emerging hardware and software generations. For instance, the average lifespan of a smartphone has been shrinking, with many consumers upgrading every 2-3 years, necessitating a nimble approach to stock management for devices that were cutting-edge just months prior.

To navigate this, ALSO Holding must proactively support its partners in transitioning to newer, more efficient solutions, ensuring they remain competitive. This involves not only supplying the latest products but also providing the necessary training and logistical support for channel partners to effectively market and service these evolving technologies. The IT distribution sector, where ALSO operates, saw significant growth in cloud services and cybersecurity solutions in 2024, reflecting this shift towards newer, more dynamic technologies.

- Rapid Product Lifecycles: The fast pace of tech innovation means devices and software can become outdated quickly, requiring constant updates and replacements.

- Inventory Management Challenges: Companies must balance having enough stock of current products with avoiding excess inventory of soon-to-be-obsolete items.

- Partner Enablement: Crucial for ALSO Holding is assisting its network of resellers and integrators in adopting and selling new technologies effectively.

- Market Adaptation: The company needs to continuously adjust its portfolio to align with the latest technological trends and customer demands, such as the increasing adoption of AI-powered solutions.

Technological advancements, particularly in cloud computing and AI, are reshaping the IT landscape. The global cloud market is projected to exceed $1.3 trillion by 2025, emphasizing the need for companies like ALSO Holding AG to expand their cloud offerings and expertise. AI adoption is also surging, with the market expected to reach $200 billion in 2024, presenting opportunities for AI-driven solutions and efficiency gains.

Emerging technologies like IoT and 5G are driving significant growth, with the IoT market alone projected to surpass $1.1 trillion by 2024, necessitating robust IT infrastructure. Cybersecurity remains a critical concern, with global cybercrime costs anticipated to reach $10.5 trillion annually by 2025, requiring ALSO Holding AG to bolster its own defenses and provide advanced security solutions to partners.

The rapid pace of technological innovation leads to shorter product lifecycles, impacting inventory management and demanding continuous adaptation. ALSO Holding AG must support its partners in adopting new technologies, as seen in the IT distribution sector's growth in cloud and cybersecurity services in 2024.

| Technology Trend | Market Projection/Impact | Implication for ALSO Holding AG |

|---|---|---|

| Cloud Computing | Global market > $1.3 trillion by 2025 | Expand cloud service portfolio and expertise |

| Artificial Intelligence (AI) | Global market ~$200 billion in 2024 | Develop AI-driven solutions, enhance operational efficiency |

| Internet of Things (IoT) | Global market > $1.1 trillion by 2024 | Strengthen IT infrastructure support for connected devices |

| Cybersecurity Threats | Global cost of cybercrime ~$10.5 trillion annually by 2025 | Enhance internal security, offer advanced cybersecurity tools and services |

Legal factors

Compliance with data protection laws like GDPR is critical for ALSO Holding AG. Failure to adhere to these regulations, which carry substantial fines, can lead to significant financial penalties and damage to the company's reputation. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is greater.

Evolving cybersecurity laws, such as the EU's NIS2 Directive, are placing greater emphasis on mandatory breach reporting and the protection of critical infrastructure, directly impacting ICT providers like ALSO Holding AG. These regulations require robust data protection measures and timely notification in the event of a security incident, creating significant compliance obligations.

For ALSO Holding AG, adherence to these stringent legal frameworks is paramount, especially when handling sensitive customer data. The company must not only ensure its own compliance but also support its partners in navigating these complex requirements, particularly concerning data privacy and system security.

The increasing focus on cybersecurity compliance is reflected in the growing number of data breaches reported globally. For instance, in 2023, the number of reported data breaches continued to rise, underscoring the critical need for companies like ALSO Holding to invest in and demonstrate strong cybersecurity postures to meet legal mandates.

Intellectual property rights are paramount for ALSO Holding AG, especially given its focus on software and technology distribution. Navigating complex global IP laws concerning software licensing, patents, and trademarks is essential for ensuring authorized product distribution and safeguarding its own proprietary platforms and services. For instance, ongoing legal challenges in the tech sector regarding software patent infringement highlight the critical need for robust IP management strategies.

Labor Laws and Employment Regulations

ALSO Holding AG, operating internationally, navigates a complex web of labor laws. These regulations govern everything from minimum wages and working hours to employee rights and union negotiations. For instance, in Germany, the Works Constitution Act (Betriebsverfassungsgesetz) grants significant co-determination rights to employee works councils, impacting management decisions.

Changes in employment regulations can directly affect ALSO Holding's operational expenses and its approach to managing its workforce. For example, an increase in the statutory minimum wage in a key market like Switzerland could raise payroll costs. Similarly, new legislation mandating specific employee benefits or training programs would require adjustments to HR strategies and budget allocations.

- Compliance Burden: ALSO Holding must adhere to varying labor laws across its operating countries, potentially leading to increased administrative and legal costs.

- Wage Pressures: Minimum wage hikes in major European markets, such as the recent increases in Germany and France throughout 2024 and projected for 2025, can directly impact payroll expenses.

- Employee Rights Evolution: Stricter regulations on working conditions, such as those concerning remote work or data privacy for employees, require ongoing adaptation of HR policies.

- Collective Bargaining Impact: The strength and scope of collective bargaining agreements in different regions can influence salary structures, benefits, and employment terms for a significant portion of ALSO Holding's workforce.

Antitrust and Fair Competition Laws

Antitrust and fair competition laws are crucial for ALSO Holding AG, a major force in ICT distribution. These regulations, enforced by bodies like the European Commission, aim to prevent any single company from dominating the market. For instance, the EU’s merger control regulations require companies like ALSO to notify authorities of significant acquisitions, ensuring that market concentration doesn't stifle competition. In 2023, the European Commission reviewed several large mergers across various sectors, highlighting the ongoing scrutiny of market power.

These laws directly impact ALSO Holding's operations by dictating how it can engage in pricing, form partnerships, and pursue mergers and acquisitions. Adherence to these rules is vital to avoid substantial fines and maintain market access. For example, pricing practices are closely monitored to prevent predatory pricing or price-fixing, which could harm smaller competitors and consumers. The goal is to ensure that the ICT distribution landscape remains dynamic and offers a fair chance for all players.

Key aspects of these legal frameworks include:

- Market Dominance: Regulations prevent companies from abusing a dominant market position, which could involve unfair pricing or restricting access for rivals.

- Merger Control: Significant mergers and acquisitions must be approved by competition authorities to assess their impact on market competition.

- Anti-Competitive Agreements: Practices like price-fixing, market sharing, and bid-rigging are strictly prohibited.

- State Aid: While not directly related to ALSO's internal operations, government subsidies to competitors could be challenged under state aid rules if they distort competition.

Data protection and privacy laws, such as GDPR, impose strict requirements on how ALSO Holding AG handles personal data. Non-compliance can result in significant fines, with GDPR penalties potentially reaching 4% of global annual turnover or €20 million. Cybersecurity regulations like the EU's NIS2 Directive further mandate breach reporting and critical infrastructure protection.

Intellectual property laws are crucial for protecting ALSO Holding's software and technology distribution interests. Navigating global IP regulations for licensing, patents, and trademarks is essential for authorized distribution and safeguarding proprietary platforms. The tech sector's ongoing software patent infringement cases underscore the need for robust IP management.

Labor laws across different operating regions impact ALSO Holding's workforce management and operational costs. For instance, minimum wage adjustments in countries like Germany and Switzerland can directly affect payroll. Employee rights and collective bargaining agreements also necessitate ongoing adaptation of HR policies.

Antitrust and fair competition laws govern ALSO Holding's market activities, preventing abuse of dominant positions and ensuring fair play. Merger control regulations require notification of significant acquisitions to competition authorities, as seen in the European Commission's reviews throughout 2023.

Environmental factors

Sustainability regulations are increasingly shaping the ICT landscape, with directives like the EU's Waste Electrical and Electronic Equipment (WEEE) and stringent energy efficiency standards becoming paramount. These evolving environmental laws directly affect companies like ALSO Holding AG, necessitating strict adherence in their operations and product distribution chains. For instance, the EU's Green Deal aims for climate neutrality by 2050, implying a continuous tightening of carbon emission targets across all sectors, including technology supply chains.

Stakeholders and regulators are increasingly pushing companies to lower their carbon emissions, directly impacting how businesses operate. For ALSO Holding AG, this means a strong incentive to refine its logistics, warehousing, and IT systems to shrink its environmental impact.

This focus on reducing its carbon footprint also positions ALSO Holding AG to assist its partners in achieving their own sustainability goals. For instance, in 2024, the company continued to invest in energy-efficient data centers and optimized delivery routes, contributing to a projected 5% reduction in Scope 1 and 2 emissions by year-end.

The environmental footprint of the entire ICT supply chain, from raw material extraction and manufacturing to global transportation and end-of-life disposal, is a growing concern for companies like ALSO Holding AG. Consumers and regulators are increasingly demanding transparency and action on issues like carbon emissions, e-waste, and resource depletion.

To address this, ALSO Holding AG must actively collaborate with its network of vendors and logistics providers. This includes pushing for sustainable sourcing of components, implementing strategies to minimize packaging waste, and championing circular economy principles such as product refurbishment and responsible recycling. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and continuing its momentum through 2024, sets ambitious targets for waste reduction and promotes the repair and reuse of electronic products, directly impacting how companies like ALSO operate.

Resource Scarcity

Resource scarcity, particularly concerning rare earth minerals vital for hardware, presents significant long-term environmental and economic challenges for companies like ALSO Holding AG. This reliance on finite materials necessitates a strategic shift towards sustainability.

This environmental pressure drives ALSO Holding AG to champion solutions that enhance product longevity, streamline recycling processes, and foster the adoption of resource-efficient technologies across its operations and partner ecosystem. For instance, the global demand for critical raw materials, essential for electronics, is projected to surge. The International Energy Agency reported in 2024 that demand for critical minerals like lithium and cobalt could increase by over 40 times by 2040 under net-zero emissions scenarios.

- Extended Product Lifecycles: Promoting repairability and offering refurbished products reduces the need for new manufacturing.

- Circular Economy Initiatives: Implementing robust recycling programs for electronic waste recovers valuable materials.

- Resource-Efficient Technologies: Investing in and distributing hardware designed for lower energy consumption and reduced material input.

- Supply Chain Transparency: Ensuring responsible sourcing of materials to mitigate environmental and social risks.

Customer and Investor Pressure for Green IT

Customers and investors are increasingly prioritizing environmental sustainability, driving demand for what's known as 'Green IT.' This trend means companies like ALSO Holding AG must actively showcase their commitment to eco-friendly practices to remain competitive and appealing to investors.

Demonstrating this commitment involves transparent reporting on environmental impact, offering products and services designed with sustainability in mind, and implementing strong environmental management systems. For instance, by 2024, a significant portion of IT decision-makers surveyed indicated that sustainability was a key factor in their purchasing decisions, with some reporting a willingness to pay a premium for greener solutions.

- Growing Demand: A substantial percentage of businesses now factor environmental impact into their IT procurement.

- Investor Scrutiny: Investment funds increasingly screen companies based on their ESG (Environmental, Social, and Governance) performance, impacting access to capital.

- Competitive Edge: Companies with strong Green IT initiatives gain a competitive advantage in attracting both customers and investment.

- Regulatory Tailwinds: Evolving environmental regulations are further pushing the IT sector towards more sustainable operations.

Environmental factors are increasingly influencing the ICT sector, pushing companies like ALSO Holding AG to prioritize sustainability in their operations and offerings. Stricter regulations, such as the EU's Green Deal, are driving a focus on reducing carbon emissions and waste. For example, in 2024, ALSO Holding AG continued its investment in energy-efficient data centers and route optimization, aiming for a 5% reduction in Scope 1 and 2 emissions.

The demand for 'Green IT' is also growing, with a significant portion of IT decision-makers in 2024 indicating sustainability as a key purchasing factor. This trend, coupled with investor scrutiny on ESG performance, necessitates transparency and eco-friendly practices for competitive advantage and capital access.

Resource scarcity, particularly for rare earth minerals, presents long-term challenges, driving a need for circular economy principles like product refurbishment and enhanced recycling programs. The projected surge in demand for critical minerals, as highlighted by the International Energy Agency in 2024, underscores the urgency for resource-efficient technologies and supply chain transparency.

| Environmental Factor | Impact on ALSO Holding AG | Key Initiatives/Data (2024/2025) |

|---|---|---|

| Sustainability Regulations (e.g., EU Green Deal) | Requires adherence to emission targets and waste management directives. | Continued investment in energy-efficient data centers; optimized delivery routes. |

| Carbon Footprint Reduction | Incentivizes efficiency in logistics, warehousing, and IT systems. | Targeting a 5% reduction in Scope 1 and 2 emissions by year-end 2024. |

| Circular Economy Principles | Promotes product longevity, refurbishment, and robust recycling. | Collaboration with vendors for sustainable sourcing and minimized packaging; championing repair and reuse of electronics. |

| Resource Scarcity (Critical Minerals) | Highlights the need for resource-efficient technologies and sustainable sourcing. | Addressing the projected surge in demand for critical minerals essential for electronics. |

| Demand for Green IT | Drives customer preference and investor interest in eco-friendly practices. | Significant portion of IT decision-makers prioritize sustainability; potential willingness to pay a premium for greener solutions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ALSO Holding is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, and environmental regulations to provide a comprehensive overview.