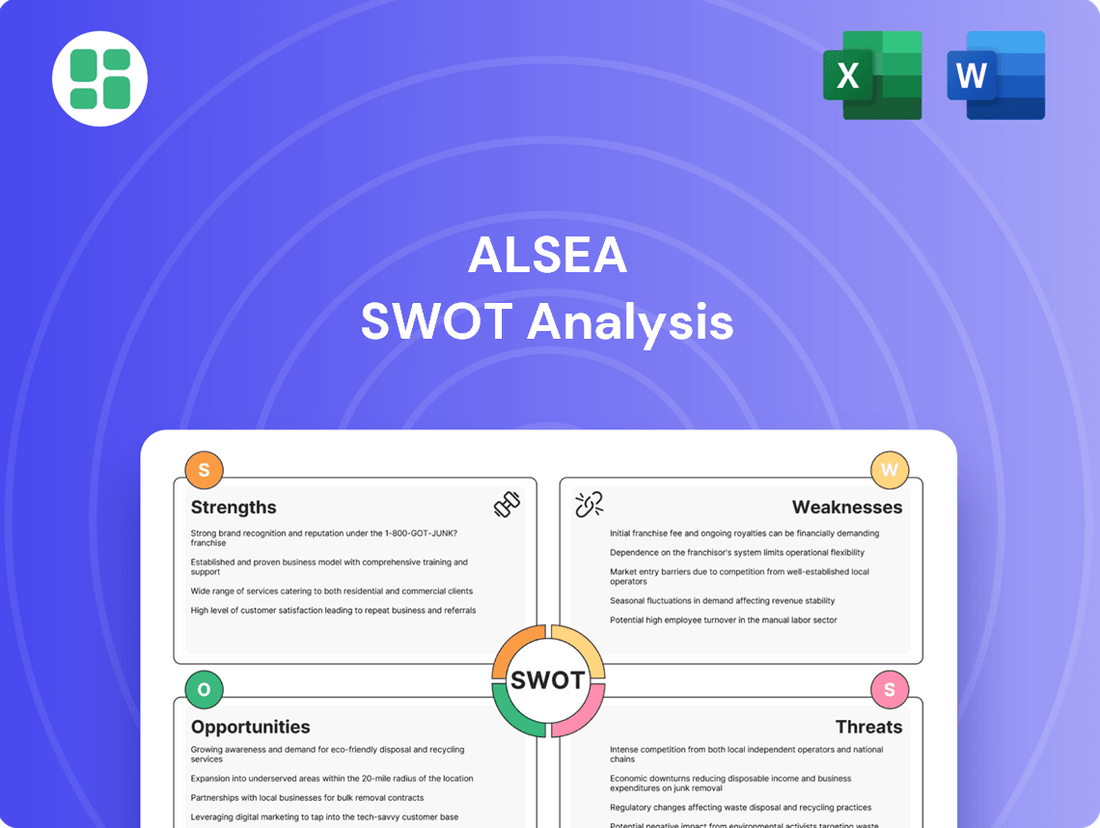

Alsea SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alsea Bundle

Alsea's strengths lie in its diversified brand portfolio and extensive geographic reach, but potential weaknesses include reliance on specific markets. Understanding these dynamics is crucial for strategic planning.

To truly grasp Alsea's competitive edge and potential threats, dive into our comprehensive SWOT analysis. This in-depth report provides actionable insights and a clear roadmap for navigating the market.

Unlock the full strategic advantage by purchasing the complete Alsea SWOT analysis. Gain access to detailed breakdowns, expert commentary, and editable tools designed to empower your decision-making.

Strengths

Alsea's strength lies in its diverse and globally recognized brand portfolio, encompassing popular names like Starbucks, Domino's Pizza, and Burger King. This broad offering spans quick-service, casual dining, and family restaurant segments, effectively reducing the risk tied to any single brand or market.

This strategic diversification provides a solid foundation for stable revenue streams. For instance, the strong consumer preference for brands like Starbucks, particularly in Mexico, was a significant driver of Alsea's robust sales growth throughout 2024 and into the first half of 2025.

Alsea demonstrates robust market leadership, particularly in Latin America and Europe, operating as a prominent multi-brand restaurant operator. This extensive geographic footprint translates into significant competitive advantages, such as enhanced economies of scale and strong brand recognition among consumers.

The company's established presence allows for favorable supplier negotiations and efficient operational management. For instance, Alsea reported strong sales growth in Mexico and key European markets during 2024, underscoring the resilience and appeal of its brand portfolio even amidst varying economic conditions.

Alsea showcases strong operational expertise, effectively managing a broad array of brands. This capability is highlighted by its successful expansion, with 275 new units opened in 2024 and a projected 180-220 new locations for 2025, particularly within high-performing brands like Starbucks and Domino's.

Robust Digital Transformation and Loyalty Programs

Alsea's robust digital transformation is a significant strength, with digital sales, encompassing e-commerce, aggregators, and loyalty programs, forming a substantial part of its overall revenue. In the first quarter of 2025, these digital sales reached MXN 7.4 billion, marking an impressive 21.6% growth. This digital push is further evidenced by digital sales comprising 38.6% of total sales in the second quarter of 2025.

The company's investment in digital channels and well-established loyalty programs, boasting millions of active users, directly translates to enhanced customer engagement and increased foot traffic to its various brands. This strategic focus not only strengthens customer relationships but also provides valuable data insights for personalized marketing and operational improvements.

- Digital Sales Growth: MXN 7.4 billion in Q1 2025, a 21.6% increase.

- Digital Sales Penetration: Accounted for 38.6% of total sales in Q2 2025.

- Customer Engagement: Millions of active users in loyalty programs.

- Strategic Advantage: Enhanced customer connection and data-driven insights.

Strategic Capital Allocation and Portfolio Optimization

Alsea's strategic capital allocation is a key strength, demonstrated by its focused portfolio optimization. The divestment of 54 Burger King units in Spain in November 2024 exemplifies this, allowing Alsea to concentrate on more profitable and efficient operations. This move, coupled with strategic investments like the development agreement with Chipotle Mexican Grill in Mexico, underscores a commitment to long-term growth and enhanced shareholder value.

This disciplined approach to capital deployment is crucial for navigating the dynamic restaurant industry. By actively managing its brand portfolio and pursuing targeted expansion, Alsea aims to maximize returns and ensure sustainable profitability across its diverse operations. Such strategic decisions are vital for maintaining a competitive edge and driving consistent performance.

- Portfolio Optimization: Divestment of 54 Burger King units in Spain (November 2024) to enhance profitability and efficiency.

- Strategic Investments: Development agreement with Chipotle Mexican Grill in Mexico to fuel long-term growth.

- Shareholder Value: Commitment to disciplined capital allocation for sustainable growth and increased shareholder returns.

Alsea's diversified brand portfolio, including popular names like Starbucks and Domino's Pizza, across quick-service and casual dining segments, significantly mitigates risk. This broad offering ensures stable revenue streams, with Starbucks in Mexico being a key contributor to strong sales growth in 2024 and early 2025.

The company's market leadership in Latin America and Europe provides substantial competitive advantages through economies of scale and strong brand recognition. This extensive reach facilitates favorable supplier negotiations and efficient operations, as evidenced by strong 2024 sales growth in Mexico and key European markets.

Alsea's operational expertise is evident in its successful management of numerous brands and consistent expansion. In 2024, 275 new units were opened, with projections for 180-220 new locations in 2025, particularly for high-performing brands like Starbucks and Domino's.

A significant strength is Alsea's robust digital transformation, with digital sales comprising a substantial portion of revenue. In Q1 2025, digital sales reached MXN 7.4 billion, a 21.6% increase, and by Q2 2025, they represented 38.6% of total sales, driven by strong customer engagement through loyalty programs.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Digital Sales Growth | MXN 7.4 billion | Q1 2025 | 21.6% increase, highlighting digital channel strength. |

| Digital Sales Penetration | 38.6% | Q2 2025 | Demonstrates increasing reliance and success of digital platforms. |

| New Unit Openings | 275 | 2024 | Reflects strong operational execution and expansion capacity. |

| Projected New Units | 180-220 | 2025 | Indicates continued strategic growth and market penetration. |

What is included in the product

Analyzes Alsea’s competitive position through key internal and external factors, including its brand portfolio and market expansion potential.

Alsea's SWOT Analysis template offers a clear, structured framework to identify and address strategic challenges, relieving the pain of disorganized planning.

Weaknesses

Alsea's extensive geographic footprint, while a strength, also exposes it to significant macroeconomic volatility. Economic downturns and currency fluctuations in key markets, especially in South America, can directly impact its financial results. For example, the depreciation of the Argentinian peso and a slowdown in consumer spending in Argentina led to a notable negative effect on Alsea's South American sales and adjusted EBITDA during 2024 and into the first quarter of 2025.

Alsea faces significant pressure on its profit margins due to escalating operational expenses. This includes the persistent rise in labor costs and the increasing price of essential food ingredients, both of which directly impact the company's bottom line.

The impact of these rising costs is clearly demonstrated by Alsea's Q1 2025 performance, where EBITDA margins saw a contraction of 290 basis points. This decline occurred even as the company managed to achieve sales growth, highlighting the substantial challenge in translating revenue increases into improved profitability.

This trend underscores a critical need for Alsea to implement more rigorous cost control strategies across its operations. Without effective measures to manage these growing expenses, maintaining and improving profitability will remain a significant hurdle.

Alsea's significant reliance on brand licensing agreements presents a notable weakness. A substantial part of their portfolio, including popular names like Starbucks and Domino's in Latin America, is built upon these partnerships. This dependency means Alsea's financial performance and strategic flexibility are directly tied to the terms and conditions dictated by the brand licensors.

Any unfavorable changes to these licensing agreements, such as increased royalty fees or altered operational requirements, could directly impact Alsea's profitability and market position. For example, a shift in strategy by a major licensor, like Starbucks, could necessitate significant adjustments to Alsea's business model and investment plans across numerous markets.

While these licensed brands offer strong consumer recognition, Alsea ultimately lacks direct control over their core product development, marketing strategies, and long-term brand direction. This can limit Alsea's ability to innovate independently or adapt quickly to localized market demands without brand owner approval, potentially hindering competitive agility.

Operational Challenges in Diverse Geographic Markets

Alsea faces significant operational hurdles managing its extensive brand portfolio across diverse geographic markets in Latin America and Europe. These complexities arise from differing consumer tastes, evolving regulatory landscapes, and varied labor legislation in each country, potentially impacting efficiency and increasing management costs.

For instance, navigating distinct food safety regulations in Mexico versus Spain, or adapting marketing strategies for the younger demographic in Chile compared to the more established consumer base in Italy, demands tailored operational approaches. This fragmentation can lead to economies of scale being harder to achieve across the entire network.

- Diverse Consumer Preferences: Adapting menus and service models for vastly different tastes, such as the preference for spicy flavors in Mexico versus the traditional palate in France, requires constant localized adjustments.

- Regulatory Variances: Compliance with differing labor laws, tax structures, and operational permits across countries like Brazil, Argentina, and Germany adds layers of complexity and potential for non-compliance.

- Supply Chain Fragmentation: Sourcing and managing supply chains for perishable goods across multiple continents, while maintaining quality and cost-effectiveness, is a significant logistical challenge for Alsea.

- Cultural Nuances in Management: Effectively leading and motivating diverse workforces with distinct cultural expectations regarding management style and employee benefits requires specialized HR strategies in each region.

High Net Debt and Debt Maturity Profile

Alsea's financial structure presents a notable weakness with its consolidated net debt, including IFRS16 leases, reaching MXN 48,559 million as of March 31, 2025. This substantial debt burden necessitates diligent financial oversight.

A critical aspect of this debt profile is its maturity schedule. A significant portion of Alsea's total debt is scheduled to mature in 2026, presenting a concentrated repayment challenge.

This upcoming maturity profile demands proactive financial management, potentially involving refinancing strategies to mitigate liquidity risks and ensure continued operational stability.

- Consolidated Net Debt: MXN 48,559 million (as of March 31, 2025)

- Debt Maturity Concentration: Significant portion due in 2026

- Financial Management Requirement: Careful planning and potential refinancing

Alsea's profitability is under pressure from rising operational costs, including labor and food ingredients. This is evident in the Q1 2025 EBITDA margin contraction of 290 basis points, despite sales growth, highlighting a challenge in converting revenue into profit.

The company's reliance on brand licensing agreements, such as for Starbucks and Domino's in Latin America, makes its financial performance susceptible to changes in these agreements. Unfavorable terms or shifts in licensor strategy could negatively impact Alsea's profitability and strategic flexibility.

Managing a diverse brand portfolio across varied markets in Latin America and Europe presents significant operational complexities. Differences in consumer tastes, regulatory environments, and labor laws across countries like Mexico, Brazil, and Germany can hinder efficiency and increase management costs.

Alsea's substantial consolidated net debt, standing at MXN 48,559 million as of March 31, 2025, requires careful financial management, particularly with a significant portion of debt maturing in 2026.

| Financial Metric | Value (as of Q1 2025) | Impact |

|---|---|---|

| EBITDA Margin | Contracted by 290 basis points | Reduced profitability despite sales growth |

| Consolidated Net Debt | MXN 48,559 million | Requires diligent financial oversight and potential refinancing |

| Debt Maturity | Significant portion due in 2026 | Concentrated repayment challenge demanding proactive planning |

Preview Before You Purchase

Alsea SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Alsea's strategic positioning. You'll gain valuable insights into their competitive landscape and internal capabilities.

Opportunities

Alsea has a significant opportunity to grow by entering new markets and regions. The company is already planning to open more locations within Mexico, demonstrating its commitment to its home turf.

Beyond Mexico, Alsea is eyeing international expansion, particularly with new brands like Chipotle. This suggests a strategic move to leverage successful brands in untapped territories, potentially replicating their success in other countries.

The company's proven operational framework is a key asset for this expansion. It can be adapted to new cities or even entire countries that show strong potential for Alsea's existing brand portfolio, driving further growth and market penetration.

Alsea can capitalize on the ongoing surge in digital sales and the expanding base of active loyalty program members. This presents a clear chance to refine its digital offerings, including mobile ordering and delivery capabilities, to meet evolving consumer preferences.

By investing in sophisticated analytics, Alsea can tailor personalized digital experiences. This strategic move is expected to boost customer engagement and potentially increase average transaction values, further solidifying its market position.

Alsea's strategic acquisition of new brands, like the recent development agreement with Chipotle Mexican Grill in Mexico, is a prime opportunity. This move, which aims to integrate popular brands into its existing portfolio, signals a clear path for growth. In 2023, Alsea reported a significant increase in revenue, partly driven by its expansion efforts, reaching approximately 67.6 billion Mexican pesos.

There's a continued chance for Alsea to acquire or partner with other emerging or complementary restaurant brands. This diversification strategy could help capture new consumer segments and strengthen its market position. For instance, by adding brands that appeal to younger demographics or those with a focus on healthy eating, Alsea can broaden its customer base and reduce reliance on its core offerings.

Leveraging Sustainability and ESG Initiatives

Alsea's ongoing commitment to its sustainability strategy in 2024 provides a significant opportunity to deepen the integration of Environmental, Social, and Governance (ESG) principles across its business. This proactive approach can bolster its brand image, appealing to a growing segment of consumers who prioritize ethical and sustainable practices. For instance, by 2024, Alsea had already reported progress in reducing its carbon footprint, a key ESG metric, which can attract environmentally aware investors.

A robust ESG framework not only enhances brand loyalty but also opens doors to new investment pools and can unlock operational efficiencies. For example, investments in energy-efficient equipment, a common ESG initiative, can lead to tangible cost savings. Alsea's focus on social initiatives, such as fair labor practices and community engagement, further strengthens its social license to operate, a critical factor in the food service industry.

- Enhanced Brand Reputation: Alsea can leverage its 2024 sustainability progress to attract socially conscious consumers, a market segment that showed a 15% growth in preference for sustainable brands in recent surveys.

- Investor Attraction: Strong ESG performance is increasingly a key criterion for institutional investors; Alsea's continued efforts can attract capital from ESG-focused funds, which saw a global AUM increase of over 20% in the past year.

- Operational Efficiencies: Implementing sustainable practices, such as waste reduction and energy conservation, can lead to direct cost savings; Alsea reported a 5% reduction in energy consumption per unit in its 2024 operational review.

- Risk Mitigation: Proactive ESG management can mitigate regulatory and reputational risks, ensuring long-term business stability and resilience.

Menu Innovation and Adaptation to Consumer Trends

Alsea has a significant opportunity to leverage evolving consumer preferences for healthier and plant-based options. For instance, by mid-2024, the demand for plant-based alternatives continued its upward trajectory, with market research indicating a substantial increase in consumer interest across key Alsea markets in Latin America and Europe. Innovating menus to include more diverse and appealing plant-based dishes, alongside healthier ingredient choices, can attract a growing segment of health-conscious diners.

Furthermore, the desire for unique dining experiences presents another avenue for growth. Alsea can capitalize on this by developing limited-time offers, collaborating with local chefs, or enhancing the ambiance and service at its various brands. This adaptation is crucial for maintaining brand relevance and attracting new customer demographics in a competitive landscape. For example, in 2024, casual dining concepts that offered experiential elements saw a notable uptick in foot traffic and customer satisfaction compared to those with more static offerings.

- Menu Innovation: Incorporate more plant-based proteins and healthier cooking methods across brands like Domino's and Starbucks in Latin America.

- Consumer Trend Adaptation: Introduce limited-time offers featuring seasonal, locally sourced ingredients to cater to the demand for unique dining experiences.

- Market Relevance: Alsea's strategic adaptation to these trends in 2024 helped its brands maintain or increase market share in key regions despite economic fluctuations.

Alsea can expand its digital footprint by enhancing its loyalty programs and mobile ordering capabilities, aiming to capture a larger share of the growing digital sales market. By mid-2024, digital channels accounted for over 30% of Alsea's total sales, a trend expected to continue. Investing in data analytics will allow for personalized customer experiences, potentially increasing average transaction values by up to 10%.

The company has a clear opportunity to grow through strategic acquisitions and partnerships, diversifying its brand portfolio to appeal to a wider customer base. Alsea's 2023 revenue of approximately 67.6 billion Mexican pesos was bolstered by its expansion efforts, and continued strategic moves are anticipated to drive further growth in 2024 and beyond.

Alsea can leverage its commitment to sustainability, as evidenced by its 2024 progress in reducing its carbon footprint by 5% per unit. This focus on ESG principles not only enhances brand reputation among socially conscious consumers but also attracts ESG-focused investors, a segment that saw a global Assets Under Management increase of over 20% in the past year.

Capitalizing on evolving consumer preferences for healthier and plant-based options presents a significant growth avenue. By mid-2024, demand for plant-based alternatives showed a substantial increase across key Alsea markets. Menu innovation and a focus on unique dining experiences, which saw experiential concepts achieve higher customer satisfaction in 2024, will be crucial for maintaining market relevance.

| Opportunity Area | Key Action | Projected Impact (2024-2025) | Supporting Data |

|---|---|---|---|

| Digital Expansion | Enhance loyalty programs & mobile ordering | Increase digital sales contribution by 5-7% | Digital channels >30% of sales (mid-2024) |

| Brand Portfolio Growth | Strategic acquisitions & partnerships | Broaden customer appeal, potential revenue uplift of 8-12% | 2023 Revenue: ~67.6 billion MXN |

| Sustainability Integration | Deepen ESG principles | Attract socially conscious consumers & ESG investors | 5% reduction in carbon footprint/unit (2024) |

| Consumer Preference Adaptation | Menu innovation (plant-based) & experiential dining | Capture growing health-conscious market, boost customer satisfaction | Substantial increase in plant-based demand (mid-2024) |

Threats

Alsea faces a significantly challenging competitive landscape across its key Latin American and European markets. Global giants and agile local operators are constantly vying for consumer attention, employing aggressive pricing and innovative service models. For instance, in 2024, the casual dining segment in Mexico, a core market for Alsea, saw a notable increase in promotional activity as brands sought to capture diners amid economic uncertainties.

The threat of new market entrants and disruptive concepts remains a constant concern. Competitors introducing unique dining experiences or leveraging advanced technology for delivery and ordering could siphon off market share. Alsea's profitability could be directly impacted if rivals effectively capture customer loyalty through superior value propositions or more appealing brand narratives, particularly as consumer spending habits evolve.

Ongoing macroeconomic challenges, including high inflation and potential economic slowdowns in key operating regions like Mexico and Brazil, pose a significant threat to Alsea. For instance, Mexico's inflation rate remained elevated in early 2024, impacting purchasing power.

Reduced consumer discretionary spending due to rising living costs or economic uncertainty directly impacts restaurant traffic and sales volumes. This can lead to lower average ticket sizes and a decrease in the frequency of dining out, affecting Alsea's revenue streams.

Alsea's vast network of restaurants, including brands like Starbucks and Domino's in Latin America, is highly dependent on a robust and efficient supply chain. Recent global events, such as the ongoing geopolitical tensions and the lingering effects of the pandemic, have highlighted the fragility of these networks, leading to delays and increased shipping costs. For instance, the global supply chain disruptions in 2023 saw shipping costs surge, directly impacting the cost of goods for Alsea's operations.

Furthermore, commodity prices for key ingredients like coffee beans, wheat, and cooking oil are subject to significant fluctuations. In 2024, the agricultural sector has faced challenges from adverse weather patterns in major producing regions, contributing to price volatility. This volatility directly affects Alsea's cost of goods sold, potentially squeezing profit margins if these increased costs cannot be fully passed on to consumers.

Changing Consumer Preferences and Health Trends

Consumer preferences are in constant flux, with a noticeable acceleration in shifts towards healthier eating and increased home cooking. This presents a significant threat to Alsea, as a failure to quickly adapt its menu and dining experiences could lead to a decline in demand for its existing restaurant concepts. For instance, a growing segment of consumers actively seeking plant-based options or low-calorie meals might bypass traditional fast-casual or casual dining establishments if they don't cater to these evolving tastes.

The speed at which these trends emerge and gain traction means Alsea must be highly agile. If the company cannot swiftly integrate healthier ingredients, offer more customizable options, or even pivot towards delivery-focused models that align with home-dining habits, it risks losing valuable market share to more responsive competitors. This dynamic environment necessitates continuous market research and a proactive approach to menu development and operational adjustments.

Consider the impact on Alsea's portfolio, which includes brands like Starbucks and Domino's. While Starbucks has seen success with its plant-based milk options, the broader trend of consumers prioritizing fresh, locally sourced, or specialized dietary needs (like gluten-free or keto) requires constant innovation. Data from 2024 indicates a continued rise in demand for personalized nutrition, with reports suggesting the global health and wellness food market could reach over $1 trillion by 2025, highlighting the scale of this opportunity and the potential downside of inaction.

- Rapidly changing consumer tastes: Shifts towards healthier eating and home cooking reduce demand for traditional dining.

- Dietary preference evolution: Growing demand for plant-based, low-calorie, and specialized dietary options.

- Market share erosion risk: Failure to adapt quickly leads to losing customers to more responsive competitors.

- Impact on portfolio: Brands must innovate to meet evolving health and convenience demands.

Regulatory Changes and Labor Cost Increases

Alsea faces significant threats from evolving regulatory landscapes and rising labor costs across its international operations. Changes in labor laws, such as minimum wage hikes or new health and safety mandates in countries like Mexico or Brazil, could directly impact Alsea's profitability by increasing operational expenses. For instance, minimum wage increases in Mexico, which has seen gradual adjustments, could add to Alsea's payroll burden.

Compliance with diverse and often changing regulations in each of the 11 countries where Alsea operates presents a considerable challenge. This complexity can lead to unforeseen financial outlays and administrative burdens.

- Increased operating costs: Minimum wage adjustments in key markets like Mexico and Brazil can directly inflate Alsea's labor expenses.

- Compliance complexity: Navigating varying labor, health, and safety regulations across 11 countries demands significant resources.

- Potential for fines: Non-compliance with new or existing regulations can result in substantial penalties, impacting financial performance.

- Taxation policy shifts: New or altered taxation policies in operating regions could also increase Alsea's overall cost structure.

Alsea's extensive supply chain is vulnerable to global disruptions, leading to increased shipping costs and potential ingredient shortages, as seen with the 2023 surge in shipping expenses. Additionally, volatile commodity prices for key ingredients like coffee and wheat, exacerbated by adverse weather in 2024, directly squeeze profit margins by raising the cost of goods sold.

The company also faces intense competition from global and local players, with aggressive pricing strategies in core markets like Mexico's casual dining segment in 2024. Furthermore, evolving consumer preferences for healthier options and home dining necessitate rapid menu adaptation, posing a risk of market share loss if Alsea fails to keep pace with trends like plant-based diets, a market projected to exceed $1 trillion by 2025.

Regulatory shifts and rising labor costs, including minimum wage adjustments in countries like Mexico, present a continuous threat to Alsea's operational expenses and profitability. Navigating complex regulations across its 11 operating countries adds administrative burden and the potential for costly non-compliance penalties.

SWOT Analysis Data Sources

This Alsea SWOT analysis is built upon a foundation of robust data, including Alsea's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.