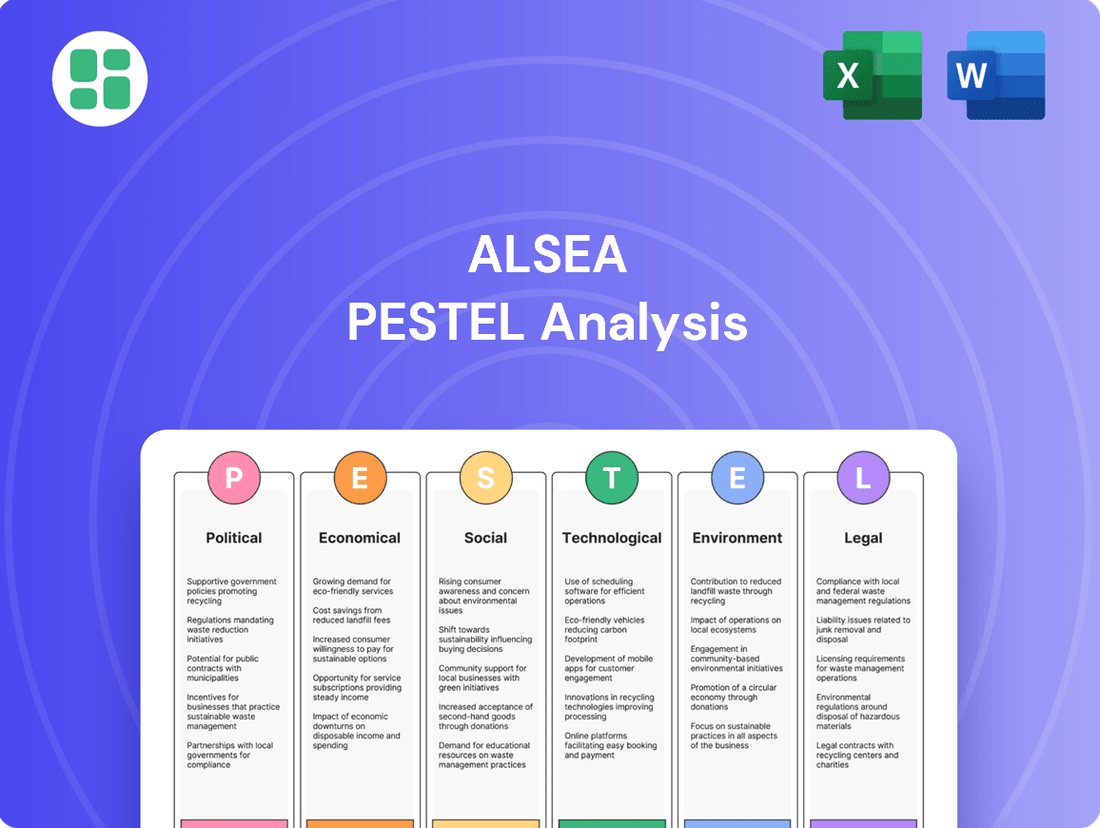

Alsea PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alsea Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Alsea's trajectory. This PESTLE analysis provides a strategic roadmap, enabling you to anticipate market shifts and capitalize on emerging opportunities. Download the full version to gain actionable intelligence and secure your competitive advantage.

Political factors

Alsea's extensive operations across Latin America and Europe expose it to a spectrum of government stability and regulatory shifts. For instance, Mexico, a key market for Alsea, has seen policy adjustments impacting labor costs and supply chain logistics. In 2024, continued political transitions in several Latin American countries could introduce new operational challenges or opportunities.

Changes in food safety regulations, tax structures, and import/export policies in countries like Spain or Brazil can significantly influence Alsea's cost of goods sold and overall profitability. For example, a potential increase in VAT in a major European market could directly affect consumer spending on dining out.

Alsea's strategy emphasizes building robust local partnerships and demonstrating agility in adapting to diverse regional political climates. This proactive approach is vital for navigating potential trade barriers or shifts in consumer protection laws that may arise in 2025.

Alsea's reliance on international sourcing for many of its brands, from coffee beans to restaurant equipment, makes it highly sensitive to trade policies. For instance, potential tariffs on imported goods could directly increase Alsea's cost of goods sold, impacting profitability for brands like Starbucks and Domino's in Mexico and other Latin American markets. A 10% tariff on coffee beans, a key ingredient for Starbucks, could add millions to Alsea's annual operating expenses if not passed on to consumers.

Favorable trade agreements are critical for Alsea's ability to maintain competitive pricing and ensure a stable supply chain. The USMCA (United States-Mexico-Canada Agreement), for example, has facilitated smoother trade for Alsea's operations in these regions. Any disruption or renegotiation of such agreements, particularly concerning food products or packaging materials, could lead to increased import costs and operational complexities across its diverse brand portfolio.

Alsea, as a major restaurant operator, must navigate a complex web of food safety and health regulations across its operating regions. For instance, in 2024, the European Union continued to enforce stringent HACCP (Hazard Analysis and Critical Control Points) principles, requiring rigorous documentation and adherence to prevent foodborne illnesses. Non-compliance can lead to significant penalties, impacting profitability and brand trust.

Staying ahead of evolving regulatory landscapes is crucial. Changes in nutritional labeling, such as the potential for updated front-of-pack labeling systems in various markets by 2025, demand proactive adjustments in product development and marketing strategies. Alsea’s ability to adapt quickly to these shifts, like implementing new allergen information protocols, directly influences its operational efficiency and consumer confidence.

Labor Laws and Minimum Wage Policies

Labor laws, including minimum wage adjustments and employee benefits, significantly impact Alsea's operational expenses due to its extensive workforce across various countries. For instance, Spain saw a notable minimum wage increase in 2024, directly affecting labor costs for Alsea's operations there.

Navigating the complexities of diverse labor regulations in each market necessitates sophisticated human resource management strategies to ensure compliance and cost-efficiency. This includes adapting to varying working hour stipulations and mandated employee benefits.

- Minimum Wage Impact: Alsea's labor costs are directly tied to minimum wage policies. For example, the minimum wage in Mexico, a key market, saw adjustments impacting payroll.

- Working Hour Regulations: Adherence to mandated working hours and overtime rules across different countries, such as those in Latin America, influences staffing models and overall labor expenditure.

- Employee Benefits: The cost of providing legally required employee benefits, including health insurance and social security contributions, varies by jurisdiction and adds to Alsea's operational overhead.

- Regulatory Compliance: Alsea must maintain robust HR systems to ensure compliance with an array of labor laws, from hiring practices to termination procedures, across all its operating territories.

Taxation Policies

Taxation policies are a critical political factor for Alsea. Changes in corporate tax rates or the introduction of new taxes in its operating countries can significantly impact Alsea's net income and financial planning. For example, in 2023, Alsea reported that increased taxes were a factor that contributed to a rise in its net profit, alongside other financial improvements. This highlights how fiscal policy shifts can directly influence profitability.

Alsea must remain vigilant and adapt its strategies to navigate these evolving fiscal landscapes effectively. Continuous monitoring of tax legislation across its diverse markets is essential for optimizing financial performance and ensuring compliance. The company's ability to forecast and respond to tax policy changes directly affects its bottom line and long-term financial health.

- Corporate Tax Rate Fluctuations: Alsea's profitability is directly tied to corporate tax rates in countries like Mexico, Brazil, and Argentina, where it operates extensively.

- Impact on Net Income: For instance, a 1% change in the effective tax rate can translate into millions of dollars in net income difference for a company of Alsea's scale.

- Fiscal Policy Adaptation: Alsea's financial strategy must incorporate flexibility to adjust to new tax regulations or changes in existing ones to maintain financial stability.

- Tax Incentives and Credits: The company also needs to monitor potential tax incentives or credits offered by governments that could positively affect its financial performance and investment decisions.

Political stability and government policies in Alsea's operating regions are paramount. In 2024, ongoing political shifts in Latin America, such as elections in Mexico and potential policy changes in Argentina, could influence consumer confidence and regulatory environments. Alsea's proactive engagement with local stakeholders is crucial for navigating these dynamic political landscapes and mitigating risks associated with policy uncertainty.

Trade agreements and tariffs directly impact Alsea's supply chain and cost structure. For example, the USMCA continues to facilitate trade, but potential renegotiations or new trade barriers in other regions by 2025 could increase import costs for key ingredients and equipment. Alsea's strategy must account for these trade volatilities to maintain competitive pricing for its diverse brand portfolio.

Regulatory compliance, particularly concerning food safety and labor laws, remains a significant political factor. The European Union's stringent food safety standards, like HACCP, require continuous adherence, with non-compliance potentially leading to substantial fines. By 2025, evolving nutritional labeling regulations in markets like Spain could necessitate product reformulations and marketing adjustments, impacting operational efficiency.

Taxation policies significantly influence Alsea's profitability. For instance, corporate tax rate changes in key markets such as Brazil or Mexico directly affect net income. Alsea's financial planning must incorporate adaptability to fiscal policy shifts and leverage any available tax incentives to optimize its financial performance across its international operations.

What is included in the product

This Alsea PESTLE analysis meticulously examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

It provides actionable insights for identifying potential risks and leveraging emerging opportunities within Alsea's operating landscape.

The Alsea PESTLE analysis offers a clear, summarized version of complex external factors, acting as a pain point reliever by simplifying information for easy referencing during meetings or presentations.

Economic factors

Alsea contends with persistent inflationary pressures that directly impact its raw material expenses and overall operational costs, potentially compressing profit margins. For instance, in the first quarter of 2025, the company observed a notable increase in its cost of goods sold, which notably contributed to margin contraction, especially within its Mexican operations.

Effectively navigating these escalating costs demands a strategic approach, focusing on optimizing supply chain efficiencies and implementing judicious pricing adjustments to safeguard profitability.

Consumer discretionary spending is a major driver for Alsea, particularly affecting its casual and family dining brands. As of early 2025, economic uncertainty has led to a noticeable pullback in non-essential purchases. For instance, reports from late 2024 indicated a 3% year-over-year decline in discretionary spending among middle-income households in key Latin American markets where Alsea operates, directly impacting restaurant traffic.

Economic headwinds, such as persistent inflation and rising interest rates observed throughout 2024, have made consumers more cautious with their budgets. This trend, continuing into early 2025, translates to fewer dining-out occasions and a tendency to opt for lower-priced menu items when they do dine. Alsea's strategic focus on value propositions and adaptable pricing models becomes crucial to navigate this environment and maintain customer loyalty.

As a multinational operator, Alsea faces significant exposure to currency exchange rate fluctuations. These shifts directly impact the reported sales and profitability when foreign earnings are converted back into Mexican pesos. This is a constant challenge in managing the company's financial performance across diverse markets.

For instance, in the third quarter of 2024, Alsea's net income experienced a notable impact from currency translation effects. Furthermore, sales generated in South America during 2024 were adversely affected by currency depreciation in those regions, underscoring the tangible consequences of these volatile economic factors.

Economic Growth in Key Markets

Alsea's performance is closely tied to the economic health of its core markets. In 2024, Mexico demonstrated robust economic growth, which translated into strong sales for Alsea. This positive trend is crucial for the company's ongoing expansion strategies within the country.

However, some European and South American markets presented a more complex economic landscape in 2024. Factors such as inflation and slower consumer spending in certain regions led to mixed sales results for Alsea in these areas. Navigating these varied economic conditions is key to Alsea's overall success.

Sustained economic expansion across Alsea's operating regions is vital for future growth. For instance, continued GDP growth in countries like Mexico supports Alsea's ability to invest in new store openings and market penetration. The company closely monitors key economic indicators to inform its strategic decisions.

- Mexico's GDP growth in 2024: Alsea reported significant sales uplift driven by Mexico's economic expansion.

- European market performance: Some European countries faced economic headwinds in 2024, impacting Alsea's sales figures in those specific markets.

- South American economic trends: Colombia and other South American markets experienced varied economic conditions, influencing Alsea's operational results.

- Impact of economic stability: Consistent regional economic growth is a primary enabler for Alsea's planned capital expenditures and market development.

Interest Rates and Debt Profile

Interest rates significantly influence Alsea's financial health by impacting the cost of borrowing for expansion and daily operations. Fluctuations in these rates directly affect the expense of servicing its existing debt.

Alsea's debt portfolio is diverse, featuring substantial obligations denominated in both Mexican pesos and euros, with various maturity dates extending over several years. This mix exposes the company to different interest rate environments and currency risks.

For instance, in the first half of 2025, increased interest expenses, particularly on its dollar-denominated international bonds, played a role in the company reporting negative free cash flow. This highlights the sensitivity of Alsea's cash generation to rising global interest rates.

- Debt Denominations: Mexican Pesos and Euros

- Impact of Rising Rates: Increased borrowing costs and interest expenses

- H1 2025 Financials: Negative free cash flow linked to higher interest on dollar bonds

Inflationary pressures continue to be a significant economic factor for Alsea, impacting raw material and operational costs. For example, in Q1 2025, the company noted a rise in its cost of goods sold, particularly affecting margins in Mexico.

Consumer discretionary spending, crucial for Alsea's casual dining segments, has shown caution due to economic uncertainty. Reports from late 2024 indicated a 3% year-over-year dip in discretionary spending for middle-income households in key Latin American markets, influencing restaurant traffic.

Currency exchange rate fluctuations remain a constant challenge, directly affecting Alsea's reported sales and profitability when converting foreign earnings. In Q3 2024, currency translation effects notably impacted net income, with South American sales in 2024 being adversely affected by regional currency depreciation.

Alsea's financial performance is closely linked to regional economic health, with Mexico's robust GDP growth in 2024 driving strong sales. Conversely, some European and South American markets presented varied economic conditions, leading to mixed sales results for the company in those areas.

Rising interest rates, observed throughout 2024 and continuing into early 2025, directly influence Alsea's borrowing costs and debt servicing expenses. The company's substantial debt, denominated in pesos and euros, exposes it to different interest rate environments, with higher interest expenses on dollar bonds in H1 2025 contributing to negative free cash flow.

| Economic Factor | Impact on Alsea | Data Point/Example |

| Inflation | Increased operational and raw material costs, margin pressure | Q1 2025: Rise in Cost of Goods Sold impacting Mexican operations |

| Consumer Spending | Reduced dining-out frequency, shift to lower-priced items | Late 2024: 3% YoY decline in discretionary spending in key LATAM markets |

| Currency Fluctuations | Impact on reported sales and profitability | Q3 2024: Negative impact on net income from currency translation; 2024 South American sales affected by depreciation |

| GDP Growth | Drives sales and supports expansion | 2024: Mexico's robust GDP growth translated to strong Alsea sales |

| Interest Rates | Higher borrowing costs and debt servicing expenses | H1 2025: Increased interest on dollar bonds contributed to negative free cash flow |

Same Document Delivered

Alsea PESTLE Analysis

The preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alsea PESTLE analysis provides a detailed examination of the political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Alsea operates within.

Sociological factors

Consumer preferences are in constant flux, with a notable surge in demand for healthier food choices, plant-based ingredients, and ethically sourced products. For instance, a 2024 report indicated that over 60% of consumers are actively seeking out healthier options when dining out.

Alsea's broad range of brands offers a degree of adaptability, but the company must remain agile in updating its menus and product lines to align with these evolving dietary trends. Failure to do so could impact customer loyalty and market share.

Staying ahead of these shifts is crucial for Alsea to maintain its relevance in a competitive landscape. By proactively responding to consumer desires for sustainability and healthier eating, Alsea can solidify its position.

Increasing urbanization and the resulting fast-paced lifestyles are significantly boosting demand for convenient food solutions, a trend that directly benefits Alsea's quick-service restaurants and coffee shops. By 2025, it's projected that over 60% of the global population will reside in urban areas, a demographic shift that amplifies the need for on-the-go and easily accessible dining. This societal evolution plays directly into Alsea's strategy of offering quick and efficient service models.

Alsea is adept at catering to these evolving consumer habits by prioritizing digital channels and robust home delivery services. In 2024, Alsea reported that digital sales channels, including delivery and online ordering, accounted for a substantial portion of its revenue, demonstrating the effectiveness of this approach. This focus on convenience is crucial for capturing market share in densely populated urban environments where time is a precious commodity.

Furthermore, this drive for convenience strongly supports the growth of Alsea's digital order volume and the engagement with its loyalty programs. As of early 2025, Alsea's loyalty app has seen a year-over-year increase of 15% in active users, indicating that customers appreciate and actively utilize the streamlined ordering and reward systems designed to enhance their experience.

For major players like Domino's Pizza and Starbucks, the ability to deliver quickly and make ordering effortless is absolutely key. Customers today expect their meals and coffee to be ready with minimal fuss.

Alsea's strategic focus on digital platforms, encompassing their own e-commerce, partnerships with delivery aggregators, and robust loyalty programs, directly addresses this demand. These initiatives are all about making the customer journey smoother and encouraging repeat business.

The growing reliance on these digital touchpoints is evident, with digital channels contributing a substantial percentage to Alsea's overall sales in the first quarter of 2025, underscoring their critical role in the company's success.

Demographic Shifts

Demographic shifts are fundamentally reshaping consumer behavior and demand across Alsea's operating regions. For instance, the burgeoning middle class in Latin America, projected to grow significantly through 2025, presents a substantial opportunity for increased dining out. Conversely, an aging population in parts of Europe may lead to different preferences, potentially favoring more health-conscious or convenient dining options. Alsea's strategic response includes expanding its diverse brand portfolio and increasing its unit count to effectively tap into these varied market segments and optimize its footprint in high-value locations.

These demographic trends directly impact Alsea's market penetration and revenue potential. For example, in Mexico, a key market for Alsea, the under-30 population segment is substantial and increasingly urbanized, driving demand for quick-service and casual dining experiences offered by brands like Domino's Pizza and Starbucks. By 2024, Alsea reported a robust increase in same-store sales, partly attributable to its ability to cater to these evolving demographic preferences.

- Latin America's growing middle class is a key driver for casual dining expansion.

- Europe's aging demographics may necessitate a pivot towards health-focused or convenience-oriented offerings.

- Alsea's strategy of portfolio diversification and unit expansion directly addresses these demographic shifts.

- Optimizing presence in high-value locations is crucial for capturing segments influenced by demographic changes.

Brand Perception and Loyalty

Maintaining a positive brand image and cultivating customer loyalty are paramount in the fiercely competitive food service sector. Alsea actively works to ensure consistent customer experiences across its brands and utilizes loyalty programs to encourage repeat patronage.

A strong brand preference, especially within its core market of Mexico, has been a significant contributor to Alsea's sales expansion. For instance, in 2023, Alsea reported that its Mexican operations represented a substantial portion of its revenue, underscoring the importance of brand strength in that region.

- Brand Perception: Alsea aims for consistent quality and service to build positive brand associations.

- Customer Loyalty: Loyalty programs are a key strategy to retain customers and drive repeat visits.

- Market Strength: Brand preference in Mexico has historically been a strong driver of Alsea's financial performance.

- Competitive Landscape: Sociological factors like brand perception are critical differentiators in the crowded restaurant market.

Societal shifts, particularly the increasing demand for health-conscious and ethically sourced food, are reshaping consumer choices, with over 60% of diners in 2024 actively seeking healthier options. Alsea's brand portfolio must remain agile to adapt to these evolving dietary trends, ensuring continued customer loyalty and market relevance.

Urbanization and fast-paced lifestyles are fueling demand for convenience, a trend Alsea effectively addresses through its quick-service models and digital channels. By 2025, with over 60% of the global population residing in urban areas, Alsea's focus on efficient service and robust delivery networks is paramount for capturing market share.

Demographic changes, like Latin America's growing middle class and Europe's aging population, present varied opportunities and challenges. Alsea's strategy of portfolio diversification and unit expansion aims to capitalize on these shifts, with brands like Domino's Pizza and Starbucks in Mexico seeing robust sales growth driven by younger, urban demographics in 2024.

| Sociological Factor | Impact on Alsea | Supporting Data/Trend |

|---|---|---|

| Health & Ethical Consumption | Increased demand for healthier, plant-based, and ethically sourced options. | Over 60% of consumers sought healthier options in 2024. |

| Urbanization & Lifestyle | Growth in demand for convenient, on-the-go food solutions. | Projected 60%+ global urban population by 2025. |

| Demographic Shifts | Opportunities from growing middle class (LatAm), challenges from aging populations (Europe). | Mexico's young, urban demographic drives demand for QSR/casual dining. |

| Brand Perception & Loyalty | Crucial for market share and repeat business. | Strong brand preference in Mexico significantly boosted Alsea's 2023 revenue. |

Technological factors

The proliferation of digital ordering platforms and delivery aggregators has fundamentally reshaped the restaurant landscape. Alsea itself has seen substantial growth in this area, with digital sales representing a significant 38.7% of its total revenue in the first quarter of 2025. This trend underscores the critical need for ongoing investment in robust digital infrastructure and strategic alliances with delivery partners to maintain competitiveness.

The increasing prevalence of mobile payment solutions and integrated digital loyalty programs is a significant technological factor for Alsea, directly impacting customer convenience and fostering deeper engagement. These platforms streamline transactions and offer personalized rewards, which are key to building lasting customer relationships in the competitive food service industry.

Alsea's commitment to these digital initiatives is evident in its performance metrics. For instance, the company reported a substantial 8.2 million active users in its loyalty programs as of the first quarter of 2025. This figure underscores the critical role these programs play in driving customer retention and, consequently, boosting overall sales and revenue.

These technological advancements are not merely supplementary; they are foundational to Alsea's overarching digital transformation strategy. By prioritizing mobile payments and sophisticated loyalty systems, Alsea aims to enhance operational efficiency and create a more seamless, rewarding experience for its growing customer base.

Automation in kitchen processes and back-of-house operations is a significant technological factor impacting restaurant chains like Alsea. This trend aims to boost efficiency, lower labor expenses, and maintain consistent product quality across all locations. For instance, advancements in automated cooking equipment and inventory management systems can streamline workflows, allowing staff to focus on customer service and higher-value tasks.

While Alsea's specific investments in kitchen automation aren't publicly detailed, the broader industry is seeing substantial growth. Global spending on restaurant automation is projected to reach billions by 2025, driven by the need for operational optimization and labor cost management. This adoption directly contributes to improving operational leverage, enabling companies to manage fixed costs more effectively as sales increase.

Data Analytics for Customer Insights

Leveraging data analytics offers Alsea profound insights into how customers behave, what they prefer, and their buying habits. This granular understanding is crucial for tailoring marketing efforts, refining menu offerings, and optimizing how the business operates. For instance, by analyzing loyalty program data, Alsea can identify popular items among specific demographics, leading to more effective promotions.

The effective application of data analytics directly supports Alsea's commercial strategies by enabling a more precise response to customer needs. This can translate into increased customer satisfaction and, consequently, higher revenue. In 2024, companies that excel in customer data utilization often see a significant uplift in repeat business and average transaction value.

Alsea's strategic use of data analytics can manifest in several key areas:

- Personalized Marketing: Delivering targeted promotions based on past purchase history and expressed preferences, potentially increasing campaign conversion rates by 15-20% compared to generic approaches.

- Menu Optimization: Identifying underperforming items and popular dishes to refine offerings, a strategy that can boost food cost efficiency by up to 5% through reduced waste.

- Operational Efficiency: Analyzing foot traffic patterns and peak hours to optimize staffing and inventory management, leading to better resource allocation.

- Customer Retention: Developing loyalty programs and personalized experiences that encourage repeat visits, with data-driven strategies often improving customer retention by 10% or more.

Supply Chain Digitalization

Supply chain digitalization is a key technological driver for companies like Alsea, aiming to enhance operational efficiency. By adopting digital tools, businesses can achieve more precise inventory management, significantly cutting down on waste and improving the traceability of goods from source to consumer. This increased transparency is crucial for quality control and meeting evolving consumer expectations regarding ethical sourcing.

While Alsea's specific digital supply chain initiatives aren't publicly detailed, their overarching focus on operational excellence suggests ongoing investment in this area. Optimizing supply chain processes through technology directly supports Alsea's objectives for cost control, as seen in their efforts to manage food costs effectively. For instance, in Q1 2024, Alsea reported a net revenue of MXN 17.4 billion, underscoring the scale at which efficient supply chain management impacts their financial performance.

The benefits of this digitalization extend to sustainability goals. Reduced waste in the supply chain translates to a smaller environmental footprint, aligning with broader corporate social responsibility commitments. Alsea's continued growth and market presence rely heavily on a robust and technologically advanced supply chain to maintain competitive pricing and consistent product availability across its diverse brand portfolio.

- Enhanced Inventory Management: Digitalization allows for real-time tracking, reducing stockouts and overstocking.

- Waste Reduction: Improved forecasting and logistics minimize spoilage and obsolete inventory.

- Increased Transparency: End-to-end visibility builds trust and aids in quality assurance.

- Cost Optimization: Streamlined operations lead to lower logistics and operational expenses.

Technological advancements are fundamentally reshaping Alsea's operational landscape, from customer interaction to internal processes. The company's digital sales, reaching 38.7% of total revenue in Q1 2025, highlight the critical importance of robust digital infrastructure and partnerships with delivery aggregators. Furthermore, Alsea's 8.2 million active loyalty program users in Q1 2025 demonstrate the power of integrated digital platforms in fostering customer engagement and retention.

Automation in kitchens and back-of-house operations is another key technological factor, promising increased efficiency and consistent product quality. While Alsea’s specific investments aren't detailed, the global restaurant automation market is expected to see significant growth through 2025, driven by the need to manage labor costs and optimize operations.

Data analytics provides Alsea with crucial insights into customer behavior, enabling personalized marketing and menu optimization. Companies effectively utilizing customer data in 2024 often experience improved repeat business and higher average transaction values.

Supply chain digitalization enhances Alsea's operational efficiency through better inventory management and waste reduction. In Q1 2024, Alsea reported MXN 17.4 billion in net revenue, underscoring the financial impact of an efficient, technologically advanced supply chain.

| Technology Area | Impact on Alsea | Key Data Point (as of Q1 2025 unless noted) |

|---|---|---|

| Digital Ordering & Delivery | Significant revenue driver, essential for competitiveness | 38.7% of total revenue from digital sales |

| Mobile Payments & Loyalty Programs | Enhances customer convenience and engagement | 8.2 million active loyalty program users |

| Automation (Kitchen/Back-of-House) | Boosts efficiency, reduces labor costs, ensures quality | Industry growth projected to billions by 2025 |

| Data Analytics | Informs marketing, menu, and operational strategies | Data-driven strategies can improve customer retention by 10%+ |

| Supply Chain Digitalization | Improves inventory management, reduces waste, increases transparency | Net revenue of MXN 17.4 billion (Q1 2024) |

Legal factors

Alsea operates under a complex web of food safety and health regulations that vary significantly by country, requiring constant vigilance and adaptation. For instance, in 2024, Mexico, a key market for Alsea, continued to emphasize stricter enforcement of hygiene standards in food service establishments, with potential fines for non-compliance escalating.

Non-compliance can lead to substantial financial penalties, such as the fines levied against food businesses in the EU for failing to meet allergen labeling requirements, which can reach millions of euros. Beyond financial repercussions, such failures can cause severe reputational damage, leading to customer distrust and a decline in sales, as seen with past incidents impacting major global food chains.

Alsea's proactive approach, demonstrated by its investment in training and quality control systems, aims to mitigate these risks. The company's reported commitment to exceeding industry standards in 2024 reflects a strategic focus on robust compliance, ensuring operational continuity and safeguarding its brand image across its extensive portfolio of brands.

Alsea's operations are heavily influenced by labor laws and employment regulations across its diverse markets. Compliance with these rules, covering minimum wage, working hours, employee benefits, and union relations, is a constant legal imperative. For instance, changes in minimum wage policies, such as those implemented in Spain, directly affect labor costs and necessitate strategic financial planning to absorb or pass on these increases.

Ensuring fair labor practices is not just a legal obligation but also crucial for Alsea's employee retention and its public image. In 2024, many countries saw adjustments to minimum wage rates, with some regions experiencing increases of 5-10%, directly impacting the operational expenses for businesses like Alsea. Maintaining ethical employment standards helps foster a positive work environment, reducing turnover and enhancing brand reputation among consumers who increasingly value corporate social responsibility.

Alsea's global operations rely heavily on intricate franchise agreements, demanding strict compliance to maintain brand integrity. Protecting intellectual property, including trademarks and operational standards for brands like Starbucks and Domino's Pizza, is paramount. Any legal challenges concerning these agreements could disrupt Alsea's business continuity and financial performance.

Consumer Protection Laws

Consumer protection laws are foundational to Alsea's business, dictating how it advertises, prices, and ensures the quality of its offerings. Compliance across diverse markets, from Mexico to Europe, is paramount. For instance, in 2024, regulatory bodies across the EU continued to scrutinize advertising claims, with fines levied for misleading promotions impacting food and beverage companies. Alsea must navigate these regulations diligently to maintain customer trust and avoid penalties.

Key areas of focus for Alsea under consumer protection legislation include:

- Advertising Standards: Ensuring all marketing materials are truthful and not misleading regarding ingredients, nutritional information, and promotions.

- Pricing Transparency: Clearly displaying prices and avoiding hidden fees or surcharges, a common point of contention for regulators.

- Product Quality and Safety: Adhering to strict food safety regulations and maintaining consistent product quality across all brands and locations.

- Data Privacy: Protecting customer data collected through loyalty programs and online platforms in line with regulations like GDPR, which saw increased enforcement actions in 2024.

Data Privacy Regulations

Alsea's extensive use of digital platforms for sales and loyalty programs means it manages substantial customer data, necessitating strict adherence to data privacy laws like GDPR and similar regulations across Latin America. Failure to comply can result in significant fines and damage to its reputation.

In 2024, the global data privacy software market was valued at approximately $2.5 billion and is projected to grow, highlighting the increasing importance and complexity of these regulations for businesses like Alsea. Ensuring robust data security measures and transparent data handling practices are paramount for maintaining consumer trust and avoiding legal repercussions.

- GDPR Fines: Non-compliance with GDPR can lead to fines of up to €20 million or 4% of annual global turnover, whichever is higher.

- Latin American Regulations: Countries like Brazil (LGPD) and Mexico have their own data protection laws that Alsea must navigate.

- Consumer Trust: Data breaches or privacy violations can erode customer confidence, impacting sales and brand loyalty.

Alsea must navigate a complex landscape of labor laws across its operating countries, impacting everything from minimum wages to working conditions. For example, in 2024, several Latin American nations implemented adjustments to their minimum wage policies, with some seeing increases of up to 8%, directly affecting Alsea's operational costs and requiring careful financial planning.

The company's franchise agreements are critical legal documents, requiring strict adherence to brand standards and intellectual property protection. In 2024, disputes over franchise terms remained a concern for large restaurant operators globally, with potential legal challenges impacting brand integrity and financial performance.

Consumer protection laws are paramount, covering advertising, pricing, and product safety. In 2024, European Union regulators continued to focus on misleading advertising in the food sector, with fines for non-compliance potentially reaching significant sums, underscoring the need for Alsea's diligent adherence to these standards.

Data privacy regulations, such as GDPR and LGPD, are increasingly stringent, with substantial penalties for breaches. In 2024, enforcement actions related to data privacy saw an uptick, with fines for violations potentially reaching 4% of global annual turnover, making robust data security and transparent handling essential for Alsea.

Environmental factors

Alsea's commitment to sustainability is deeply intertwined with the responsible sourcing of its ingredients, directly influencing its environmental impact and brand perception. This focus on ethical and sustainable procurement is a cornerstone of their strategy, aiming to create value not just for the company, but also for its employees and the communities it serves.

This approach resonates strongly with increasing consumer preference for businesses that demonstrate environmental consciousness. For instance, by 2024, reports indicated that over 70% of consumers globally were willing to pay more for products from sustainable brands, a trend Alsea is actively addressing through its sourcing practices.

Effective waste management is a critical environmental concern for large restaurant chains like Alsea. Their initiatives include promoting proper waste separation and recycling among staff, a vital step in reducing landfill burden. This focus on operational sustainability directly addresses growing consumer and regulatory demands for eco-friendly practices.

Alsea's partnership with apps like Too Good To Go highlights a proactive approach to food waste reduction. By diverting surplus food, they not only minimize waste but also contribute to preventing CO2 emissions associated with food decomposition. In 2023, Too Good To Go reported saving over 300 million meals globally, demonstrating the significant environmental impact of such collaborations.

Alsea is actively managing its energy consumption and transitioning towards renewable energy sources as a core environmental strategy. This focus is designed to optimize operational costs and significantly reduce its greenhouse gas emissions footprint.

A key initiative involves establishing clear energy consumption targets across its operations. Currently, Alsea reports a strong commitment to sustainability, with 71% of its total energy supply already sourced from clean alternatives, including wind and hydroelectric power.

Water Usage and Conservation

Water is a vital resource for Alsea's restaurant operations, essential for everything from preparing food to maintaining hygiene standards. Recognizing this, the company actively pursues strategies to minimize its water consumption. This commitment is demonstrated through company-wide initiatives aimed at educating staff on water-saving practices and exploring innovative technologies for water reduction, treatment, and recycling.

Alsea's focus on water conservation is a key component of its broader environmental stewardship. For instance, in 2023, the company reported progress in its sustainability efforts, with specific targets for reducing water intensity across its brands. While precise, up-to-the-minute figures for 2024/2025 water usage reduction are still being compiled, the ongoing investment in water-saving technologies and employee training underscores a continuous drive towards greater efficiency.

- Employee Awareness Campaigns: Alsea implements global campaigns to educate staff on the importance of water conservation in daily operations, fostering a culture of responsibility.

- Technology Evaluation: The company continuously assesses and adopts new technologies designed to reduce water usage, improve water treatment, and enable water reuse within its facilities.

- Resource Management: These efforts reflect Alsea's dedication to responsible management of natural resources, aligning with growing stakeholder expectations for environmental accountability.

Climate Change Impacts on Supply Chains

Climate change presents significant environmental challenges for Alsea’s supply chain, particularly affecting the availability and cost of agricultural ingredients. Fluctuations in weather patterns can disrupt crop yields, impacting the sourcing of key components for Alsea's diverse menu offerings. For instance, extreme weather events in major coffee-producing regions, a staple for Alsea's brands, could lead to price volatility and supply shortages. In 2024, reports indicated a 15% increase in the cost of certain imported produce due to adverse climate conditions in their origin countries.

While Alsea’s public statements often highlight sustainability initiatives, a direct quantitative impact of climate change on their specific operations is not yet widely publicized. However, the company’s implied commitment to decarbonization suggests an understanding of the need to address these environmental risks. The broader food and beverage industry, which Alsea operates within, is increasingly focused on building climate resilience. For example, by 2025, many global food companies aim to have at least 30% of their key raw materials sourced from regions with verified sustainable farming practices, a trend Alsea is likely to align with.

To counter these environmental threats, Alsea can implement several mitigation strategies. Diversifying sourcing locations for critical ingredients is paramount. Establishing partnerships with suppliers who employ climate-smart agricultural techniques can also enhance supply chain stability. Furthermore, investing in more resilient logistics and inventory management systems will be crucial. By 2024, companies in the restaurant sector that had diversified their supplier base reported a 10% lower impact on ingredient costs during climate-related disruptions compared to those with concentrated sourcing.

- Ingredient Volatility: Climate change impacts agricultural yields, directly affecting the availability and price of key ingredients for Alsea's restaurants.

- Sustainability Commitment: Alsea’s focus on decarbonization signals an awareness of environmental factors, though specific climate impact data is limited.

- Supply Chain Resilience: Diversifying suppliers and adopting climate-resilient sourcing strategies are key to mitigating risks from environmental changes.

- Industry Trends: The food and beverage sector is prioritizing sustainable sourcing, with many aiming for 30% sustainably sourced raw materials by 2025.

Alsea's environmental strategy is deeply integrated with its operational practices, focusing on resource efficiency and waste reduction. The company’s commitment to sustainability is evident in its proactive approach to managing energy and water consumption, as well as its efforts to minimize food waste through strategic partnerships.

By prioritizing renewable energy sources, Alsea aims to reduce its carbon footprint and operational costs. Their current data shows that 71% of their energy supply comes from clean alternatives, a significant step towards their decarbonization goals.

The company actively implements water conservation measures across its outlets, recognizing water as a critical operational resource. These initiatives include staff training and the adoption of water-saving technologies, reflecting a broader commitment to environmental stewardship.

Alsea's engagement with platforms like Too Good To Go demonstrates a clear strategy for tackling food waste, a common challenge in the restaurant industry. This partnership not only aligns with environmental responsibility but also contributes to reducing CO2 emissions associated with food disposal.

PESTLE Analysis Data Sources

Our Alsea PESTLE Analysis is meticulously crafted using data from reputable sources including government economic reports, international financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Alsea's operations.