Alsea Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alsea Bundle

Alsea's competitive landscape is shaped by powerful forces, from the bargaining power of its suppliers to the intense rivalry among existing players. Understanding these dynamics is crucial for any stakeholder looking to navigate the food and beverage industry.

The complete report reveals the real forces shaping Alsea’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Franchisors wield considerable power due to their globally recognized brands, such as Starbucks and Domino's, which Alsea operates under. This brand power allows franchisors to set stringent standards for everything from ingredients to operational procedures, directly impacting Alsea's sourcing flexibility and cost structures.

The deep reliance Alsea has on these established, high-demand brands significantly strengthens the franchisors' bargaining position. Renegotiating franchise terms or seeking alternative brands presents substantial challenges, effectively locking Alsea into the franchisors' terms and limiting Alsea's ability to negotiate more favorable arrangements.

The bargaining power of Alsea's primary food and beverage suppliers is typically moderate to low. This is largely because the agricultural and food processing sectors are quite fragmented, meaning there are many suppliers available. Alsea's significant purchasing power, stemming from its operations across numerous brands, enables it to secure favorable pricing and discounts.

However, this dynamic can shift when Alsea requires specialized or proprietary ingredients, often dictated by specific franchise agreements. In such cases, the bargaining power of those particular suppliers can rise, as finding suitable alternatives might be difficult or involve lengthy approval procedures, potentially increasing costs.

Real estate lessors, especially in sought-after urban centers, wield considerable influence over companies like Alsea. In 2024, prime commercial rents in major global cities continued their upward trend, with some areas seeing year-over-year increases exceeding 5%, making it challenging for businesses to secure advantageous lease terms.

Long-term leases with pre-set rent escalations are common, directly impacting Alsea's cost structure and limiting its agility in adapting to market shifts or pursuing new opportunities. While Alsea's well-known brands might offer some leverage, the fundamental scarcity of prime locations means landlords often dictate terms, demanding premium pricing.

Technology and Equipment Providers

Suppliers of specialized restaurant technology, like advanced POS systems and integrated digital ordering platforms, hold a moderate bargaining power over Alsea. This is particularly true when their solutions are proprietary or deeply embedded within Alsea's operational framework. For instance, a company providing a highly customized inventory management system that links directly to kitchen operations might command more leverage.

While Alsea's considerable size enables significant purchasing power and the ability to negotiate custom solutions, the cost and complexity of switching integrated technology systems can create substantial switching costs. This means Alsea might be hesitant to change providers even if better alternatives emerge, giving the incumbent supplier a degree of influence. For example, migrating an entire chain's POS data and retraining staff can be a multi-million dollar undertaking.

However, this supplier power is tempered by the competitive nature of the technology sector. Numerous vendors are actively seeking large enterprise contracts within the food service industry, creating a more balanced negotiation dynamic. Alsea can often leverage this competition to secure favorable terms, especially as they represent a significant potential revenue stream for technology providers.

- Moderate Supplier Power: Technology and equipment providers can exert influence, especially with proprietary or integrated systems.

- Switching Costs: High costs associated with integrating and migrating new technology systems can limit Alsea's flexibility.

- Competitive Landscape: A competitive market among technology vendors helps to counterbalance supplier influence.

- Alsea's Scale: Alsea's size allows for bulk purchasing and negotiation leverage, mitigating some supplier power.

Labor Market Dynamics

The labor force, while not a direct material supplier, wields significant bargaining power over Alsea, impacting operational costs and service quality. In competitive labor markets, especially for essential roles like kitchen staff and servers, Alsea faces increased wage demands and recruitment hurdles. This dynamic is shaped by minimum wage regulations, the presence of labor unions, and broader economic conditions across its operating regions.

For instance, in 2024, many Latin American countries where Alsea operates saw adjustments to minimum wages. In Mexico, the federal minimum wage saw an increase, and some states implemented higher regional minimums, directly affecting Alsea's labor expenses.

- Increased Labor Costs: Rising minimum wages and competitive pressures in 2024 directly translate to higher payroll expenses for Alsea.

- Talent Acquisition Challenges: A tight labor market, particularly for experienced restaurant personnel, can make it difficult and costly for Alsea to attract and retain qualified employees.

- Impact on Service Quality: Staffing shortages or under-trained employees due to recruitment difficulties can negatively affect customer experience and brand reputation.

- Unionization Influence: The potential for unionization in certain markets can further amplify labor's bargaining power, leading to collective wage negotiations and stricter working condition demands.

Alsea's primary food and beverage suppliers generally have moderate to low bargaining power due to the fragmented nature of the agricultural and food processing industries. Alsea's substantial purchasing volume across its diverse brand portfolio allows it to negotiate favorable pricing and secure discounts, effectively leveraging its scale.

However, this power can shift when Alsea requires specialized or proprietary ingredients mandated by franchise agreements. In such scenarios, the bargaining power of these specific suppliers increases, as finding alternatives can be difficult and time-consuming, potentially leading to higher costs for Alsea.

| Supplier Type | Bargaining Power | Key Factors Influencing Power |

|---|---|---|

| General Food & Beverage | Moderate to Low | Fragmented industry, Alsea's purchasing scale |

| Specialized/Proprietary Ingredients | Moderate to High | Franchise mandates, difficulty of finding alternatives |

| Real Estate Lessors (Prime Locations) | High | Scarcity of prime locations, rising rents (e.g., >5% YoY in some 2024 urban centers) |

| Specialized Technology Providers | Moderate | Proprietary systems, high switching costs, but tempered by competition |

| Labor Force | High | Minimum wage increases (e.g., in Mexico in 2024), competitive labor markets, potential unionization |

What is included in the product

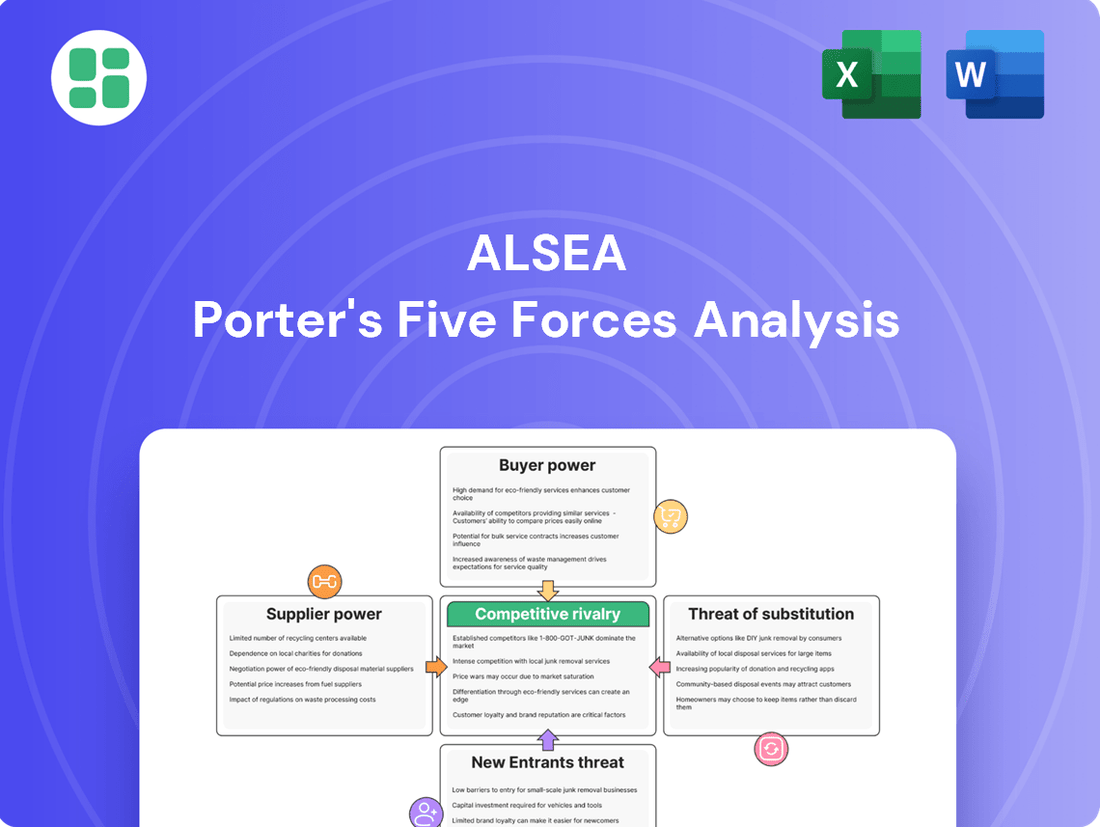

Analyzes the five competitive forces impacting Alsea, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and industry rivalry, to understand its competitive intensity and profitability.

Quickly identify and mitigate competitive threats with a visual breakdown of market power dynamics.

Customers Bargaining Power

Alsea's customers face a vast landscape of dining choices, from global quick-service giants to local eateries. This sheer volume of alternatives means customers can readily switch brands if Alsea's offerings don't meet their expectations on price, quality, or experience.

For instance, in 2024, the quick-service restaurant (QSR) market in Mexico, a key market for Alsea, saw continued growth with numerous international and domestic players vying for market share. This intense competition directly translates to higher bargaining power for consumers, who can easily compare and choose based on promotions or perceived value.

Customer price sensitivity is a significant factor for Alsea, particularly within its quick-service restaurant (QSR) brands where value for money is paramount. For instance, in 2024, the QSR market continued to see consumers actively comparing prices and seeking out deals, making Alsea’s pricing strategies highly responsive to this pressure.

This sensitivity means that Alsea must carefully balance its pricing to remain competitive while also maintaining profitability. The widespread availability of competitor pricing, often just a click away, amplifies this dynamic. Many consumers in 2024 demonstrated a willingness to switch brands based on minor price differences or promotional offers.

Consequently, Alsea heavily relies on promotions, discounts, and loyalty programs to attract and retain customers. These tactics are not just marketing tools; they are essential strategies to manage customer price sensitivity and maintain market share. For example, during promotional periods in 2024, Alsea observed noticeable upticks in sales volume across various brands.

The bargaining power of customers is amplified by low switching costs. For Alsea, this means customers can easily move to a competitor without incurring financial penalties or significant effort. For instance, in 2024, the casual dining sector, where Alsea operates many brands, saw intense competition with numerous new entrants, further reducing the perceived cost of switching for consumers.

This ease of transition empowers customers to explore different dining options readily. Alsea's strategy must therefore prioritize delivering exceptional value through consistent quality, outstanding service, and memorable brand experiences to cultivate customer loyalty and minimize the risk of customers defecting to rivals.

Access to Information and Reviews

Customers today wield significant power due to the vast amount of information readily available. Online reviews, social media, and food delivery platforms empower diners to thoroughly research and compare Alsea's brands before making a choice. This transparency means Alsea must actively manage its online reputation and respond to customer feedback to maintain brand appeal.

The ease with which consumers can access and share information directly impacts Alsea's market position. For instance, in 2024, platforms like TripAdvisor and Yelp continue to be critical for restaurant discovery, with millions of reviews influencing dining decisions daily. Alsea's ability to monitor and engage with these platforms is crucial for managing customer perception and driving foot traffic.

- Informed Choices: Customers can easily compare prices, quality, and service across multiple restaurant brands.

- Reputation Management: Negative reviews can spread rapidly, directly impacting Alsea's sales and brand image.

- Demand for Transparency: Consumers expect businesses to be open about their offerings and responsive to their concerns.

Fragmented Customer Base

Alsea's customer base is incredibly diverse, comprising millions of individual consumers across its various brands. This fragmentation means that no single customer or small group of customers possesses substantial individual bargaining power to dictate terms or prices. For instance, in 2023, Alsea operated over 4,000 units, serving a vast number of patrons daily, underscoring the dispersed nature of its customer base.

While individual customers have limited power, their collective purchasing decisions significantly influence Alsea's strategic direction. The aggregated preferences and demand from this massive consumer pool are critical for the company's performance. This collective influence shapes everything from menu innovation to marketing campaigns, making broad market appeal a key driver of Alsea's ongoing expansion and success.

- Millions of Individual Consumers: Alsea's widespread presence ensures a highly fragmented customer base.

- Limited Individual Influence: No single customer can significantly impact Alsea's pricing or operations.

- Collective Power: Aggregated customer demand and preferences drive Alsea's strategic decisions.

- Market Appeal is Crucial: Maintaining broad appeal is essential for sustained growth and profitability.

Alsea's customers possess significant bargaining power due to the abundance of dining alternatives and low switching costs. In 2024, the competitive landscape for quick-service restaurants (QSR) and casual dining in key markets like Mexico remained intense, with numerous players offering comparable products and services. This environment allows consumers to easily shift between brands based on price, promotions, or perceived value, forcing Alsea to maintain competitive pricing and focus on delivering superior customer experiences to foster loyalty.

| Factor | Impact on Alsea | 2024 Context |

|---|---|---|

| Availability of Alternatives | High customer bargaining power | Continued strong competition in QSR and casual dining sectors across Alsea's operating regions. |

| Switching Costs | Low customer bargaining power | Minimal financial or effort barriers for customers to try competing restaurants. |

| Price Sensitivity | High customer bargaining power | Consumers actively seek deals and promotions, influencing Alsea's pricing strategies. |

| Information Access | High customer bargaining power | Online reviews and social media empower customers to research and compare Alsea's brands, impacting reputation. |

Preview the Actual Deliverable

Alsea Porter's Five Forces Analysis

This preview shows the exact Alsea Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive understanding of the competitive landscape. You're looking at the actual document, complete with detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

Alsea navigates intensely competitive restaurant landscapes in Latin America and Europe, where markets are frequently fragmented. This means Alsea contends with a broad spectrum of rivals, from well-established global brands to numerous local and independent eateries. For instance, in Mexico, a key market, Alsea faces strong competition in the fast-food sector from brands like McDonald's and Burger King, alongside a vibrant casual dining scene populated by many distinct local concepts.

The restaurant sector thrives on a continuous stream of new ideas and brand growth, creating a crowded landscape of diverse offerings. Alsea's approach of managing multiple brands helps it cater to varied tastes, yet it contends with formidable rivals, including other large multi-brand groups and niche, single-concept eateries. For instance, in 2024, the quick-service restaurant segment alone saw numerous new entrants and significant expansion from established players, intensifying the battle for consumer attention.

Competitive rivalry in the restaurant industry, including Alsea's operating markets, frequently manifests through aggressive pricing strategies and promotional activities. This includes discount offers, happy hour specials, and loyalty programs designed to capture market share and customer loyalty. For instance, in 2024, many casual dining chains continued to offer BOGO deals and percentage-off coupons to drive traffic.

Alsea must diligently track competitor pricing and promotional calendars to maintain its competitive edge without compromising profitability. The intense pressure on pricing can affect the margins of its diverse brand portfolio across different geographical regions. For example, a price war initiated by a major competitor in a key market could force Alsea to respond, potentially impacting its earnings per share.

High Fixed Costs and Perishable Inventory

The restaurant sector, including Alsea's operations, faces intense rivalry driven by substantial fixed costs. These include expenses for prime real estate leases, essential kitchen equipment, and a consistent labor force. For instance, in 2024, many restaurant chains reported that occupancy costs alone represented a significant portion of their operating expenses, often exceeding 10% of revenue.

Compounding this pressure is the inherent perishability of inventory. Restaurants must sell food and beverages before they spoil, creating an urgent need to maintain high sales volumes. This urgency fuels aggressive competition as operators strive to capture market share and ensure product turnover.

- High Fixed Costs: Leases, equipment, and labor are significant ongoing expenses for restaurant operators like Alsea.

- Perishable Inventory: The need to sell products before they expire necessitates high sales volumes.

- Intensified Competition: Pressure to cover costs and minimize waste drives aggressive strategies to attract and retain customers.

- Sales Volume Imperative: Operators must consistently fill seats and move inventory to remain profitable in this environment.

Digitalization and Delivery Platform Competition

The digital landscape has fundamentally reshaped competition in the food service industry. Alsea, like its peers, faces intensified rivalry not just from brick-and-mortar locations but also from online visibility and the efficiency of delivery services. This shift means success hinges on strong digital infrastructure and strategic partnerships with delivery aggregators.

Managing the associated commission costs from these platforms is a critical challenge. For instance, in 2023, the global online food delivery market was valued at over $150 billion, with significant portions going to platform commissions. Alsea's ability to navigate these costs while maintaining profitability is key.

- Digital Investment: Alsea needs to continue investing in its own digital ordering capabilities and user experience to reduce reliance on third-party platforms.

- Platform Partnerships: Strategic alliances with major delivery aggregators are essential for market reach, but require careful negotiation of commission rates.

- Delivery Efficiency: Optimizing internal delivery logistics or collaborating on efficient delivery models can provide a competitive edge.

- Data Analytics: Leveraging customer data from digital platforms allows for more targeted marketing and personalized offers, enhancing customer loyalty.

Alsea operates in highly competitive markets, facing numerous rivals from global chains to local eateries, particularly in Latin America and Europe. This intense rivalry is further fueled by the industry's constant innovation and the need to maintain high sales volumes due to perishable inventory and significant fixed costs. For example, in 2024, the quick-service restaurant segment saw aggressive expansion and new entrants, intensifying the battle for market share and customer loyalty through promotions and pricing strategies.

| Rivalry Factor | Impact on Alsea | Example (2024 Data) |

|---|---|---|

| Market Fragmentation | Contention with diverse competitors | Strong presence of local brands alongside global players in Mexico |

| Promotional Activities | Pressure on margins and need for strategic offers | Widespread BOGO deals and percentage-off coupons in casual dining |

| High Fixed Costs | Necessity for high sales volume to cover expenses | Occupancy costs often exceeding 10% of revenue for restaurant chains |

| Digital Competition | Need for strong online presence and efficient delivery | Growth in online food delivery market valued over $150 billion in 2023 |

SSubstitutes Threaten

Home cooking and the increasing popularity of meal preparation represent a significant threat of substitutes for Alsea's restaurant portfolio. Consumers often turn to preparing meals at home due to lower costs and the ability to tailor ingredients and flavors precisely to their preferences. For instance, in 2024, the average household grocery bill continued to be substantially lower than dining out regularly, particularly for families.

The landscape of home meal solutions has also evolved dramatically, with meal kit services and supermarkets enhancing their offerings of high-quality, ready-to-eat meals. These options provide a level of convenience that directly competes with quick-service and casual dining establishments. In 2023, the global meal kit delivery service market was valued at approximately $15 billion and is projected to grow, indicating a strong consumer preference for convenient home-based dining solutions.

To effectively counter this substitute threat, Alsea must consistently highlight the unique value propositions of its brands. This includes emphasizing the convenience of not having to shop or prepare food, the dining experience itself, and the distinct flavors or culinary expertise that are challenging for the average consumer to replicate at home. For example, Alsea's Starbucks brand, with its specialized coffee beverages and cafe atmosphere, offers an experience beyond just a drink, which is difficult to substitute with home brewing.

Supermarkets and convenience stores are stepping up their game with a vast selection of ready-made meals, deli counters, and quick-grab items. These options are becoming formidable substitutes for traditional restaurant dining, offering convenience and often a lower price point. For example, in 2024, the global market for ready-to-eat meals was projected to reach over $200 billion, highlighting the significant consumer shift towards these convenient food solutions.

These readily available food choices directly compete with Alsea's offerings by fulfilling the immediate need for a meal without the associated dining-out experience. Consumers are increasingly prioritizing speed and ease, making these supermarket options a compelling alternative. In the US, grocery store prepared food sales saw a significant uptick in 2023, with many chains reporting double-digit growth in this segment.

To counter this threat, Alsea must clearly articulate and deliver a value proposition that extends far beyond just the food itself. The emphasis needs to be on the entire dining experience – the ambiance, the service quality, and the unique culinary offerings that cannot be replicated by a grocery store. For instance, Alsea's Starbucks brand, known for its distinct café atmosphere and customer service, offers a different kind of value than a quick stop at a supermarket deli.

The rise of food trucks and street food vendors poses a significant threat of substitutes for established restaurant chains like Alsea. These mobile eateries offer a more casual and often cheaper dining experience, with flexibility in location and menu. For instance, in 2024, the global food truck market was valued at approximately $1.2 billion, demonstrating substantial growth and consumer adoption.

These vendors can quickly adapt to changing consumer tastes and often provide unique, artisanal offerings that appeal to a broad demographic, especially younger consumers. Their lower overhead allows for competitive pricing, making them an attractive alternative to sit-down restaurants. Alsea needs to emphasize its consistent quality, superior hygiene, and comfortable ambiance as key differentiators against these agile, pop-up competitors.

Alternative Entertainment and Social Activities

Consumers often choose dining out as a way to socialize or be entertained, but they have numerous other options for their leisure time and money. These substitutes range from attending live events like sports games or concerts to enjoying movies or even staying in for home entertainment.

Alsea's various restaurant brands are not just competing for food spending; they're also vying for a share of consumers' overall leisure budgets. This means highlighting the unique experience of dining out is crucial to draw customers away from these other entertainment choices.

For instance, in 2024, the global entertainment and media industry was projected to reach over $2.9 trillion, showcasing the vast array of choices consumers have. This highlights the significant pressure Alsea faces from these alternative leisure activities.

- Direct Competition: Other restaurants and food service providers.

- Indirect Competition: Home cooking, meal kits, and grocery store prepared foods.

- Leisure Substitutes: Movies, concerts, sporting events, travel, and other recreational activities.

- Digital Entertainment: Streaming services, video games, and social media platforms compete for consumer attention and disposable income.

Health and Wellness Trends

The growing consumer focus on health and wellness presents a significant threat of substitution for traditional restaurant offerings. As people become more aware of nutrition and specific dietary needs, they may opt for healthier home-cooked meals or niche food providers that cater to these preferences. For instance, the plant-based food market has seen substantial growth, with global sales projected to reach over $160 billion by 2030, indicating a clear shift away from conventional meat-centric diets.

Alsea needs to proactively address this trend by adapting its menus. This includes incorporating more health-conscious options and providing clear, accessible nutritional information for all its dishes. Failing to do so could lead to a decline in customer loyalty as consumers seek out alternatives that better align with their evolving wellness goals.

Key areas for Alsea to consider in mitigating this threat include:

- Menu Innovation: Introducing a wider range of plant-based, low-calorie, and allergen-friendly options.

- Nutritional Transparency: Clearly displaying calorie counts, macronutrient breakdowns, and ingredient lists on menus and online platforms.

- Partnerships: Collaborating with health and wellness influencers or organizations to promote healthier choices.

- Supply Chain Focus: Sourcing fresh, high-quality ingredients that support healthy eating.

The threat of substitutes for Alsea is multifaceted, encompassing everything from home-cooked meals to alternative leisure activities. Consumers increasingly turn to home preparation due to cost savings and customization, with grocery store prepared foods and meal kits offering convenient alternatives. For instance, the global meal kit market was valued around $15 billion in 2023, indicating a strong preference for convenient home dining.

Furthermore, food trucks and street vendors provide agile, often cheaper dining options that compete directly with Alsea's established brands. These vendors can quickly adapt to trends, making them appealing alternatives, especially to younger demographics. Alsea must emphasize its consistent quality and dining experience to stand out.

Beyond food, Alsea competes for consumer leisure time and budgets against a vast entertainment industry, projected to reach over $2.9 trillion globally in 2024. This includes movies, concerts, and digital entertainment, all vying for consumer attention and disposable income, making the dining experience a critical differentiator.

The growing health and wellness trend also presents a substitution threat, as consumers seek healthier options. The plant-based food market, for example, is expected to exceed $160 billion by 2030, highlighting a shift away from traditional diets that Alsea must address through menu innovation and transparency.

| Substitute Category | Examples | 2023/2024 Data Point | Alsea's Counter-Strategy Focus |

|---|---|---|---|

| Home Consumption | Home cooking, Meal kits, Grocery store prepared meals | Meal kit market valued at ~$15 billion (2023) | Highlighting dining experience, convenience of not cooking |

| Alternative Food Vendors | Food trucks, Street food | Global food truck market valued at ~$1.2 billion (2024) | Emphasizing consistent quality, hygiene, ambiance |

| Leisure Activities | Movies, Concerts, Sports, Digital Entertainment | Global entertainment industry projected >$2.9 trillion (2024) | Offering unique social and entertainment value |

| Health & Wellness | Plant-based diets, Specialized healthy eating | Plant-based market projected >$160 billion by 2030 | Menu innovation, nutritional transparency, healthier options |

Entrants Threaten

Establishing a multi-brand restaurant operation like Alsea, with numerous locations and complex supply chains, demands significant capital. This includes substantial upfront costs for real estate, construction, kitchen equipment, technology, and initial inventory, creating a formidable barrier for potential new competitors.

For instance, the average cost to open a full-service restaurant in the US can range from $275,000 to $2 million or more, depending on size and concept. Alsea's extensive portfolio, encompassing brands like Domino's and Starbucks across multiple countries, implies billions in cumulative investment, making it incredibly difficult for newcomers to match their scale and reach.

Alsea benefits from operating globally recognized brands like Starbucks and Domino's, which possess substantial brand equity and customer loyalty. In 2023, Starbucks alone reported over $35 billion in global revenue, underscoring its market dominance. This established brand power presents a significant hurdle for any potential new entrants aiming to build comparable recognition and trust from the ground up.

Alsea's substantial operational scale grants it significant economies of scale in purchasing, marketing, and distribution. This translates to lower per-unit costs, a hurdle for any new entrant aiming to compete on price. For instance, in 2024, Alsea's consolidated revenue reached approximately MXN 73.7 billion, reflecting its vast purchasing power.

New businesses would find it incredibly challenging to replicate Alsea's cost efficiencies. The established and highly optimized supply chain networks Alsea possesses further solidify this advantage, offering superior sourcing and logistics capabilities that new entrants would struggle to match in their initial stages.

Franchise Agreement Barriers

The difficulty in securing master franchise agreements for prominent global brands presents a substantial hurdle for potential competitors aiming to replicate Alsea's success. Franchisors often prefer established, well-capitalized operators for these exclusive rights, limiting the ability of newcomers to gain access to Alsea's established brand portfolio within key territories.

This exclusivity means that new entrants cannot easily enter the market by simply adopting Alsea's successful brand mix. For instance, obtaining a master franchise for a brand like Starbucks or Domino's in a major market is a complex process, often requiring significant prior experience in the food service industry and substantial capital investment, making direct replication of Alsea's brand-centric strategy exceptionally challenging.

Consider the landscape in 2024: while specific franchise agreement terms are proprietary, the general trend for major food and beverage franchises remains stringent. Many require multi-million dollar net worth and liquidity, alongside a proven track record of operational success. This financial and experiential barrier effectively fences off many aspiring competitors from directly challenging Alsea's established market presence.

- High Capital Requirements: New entrants often face demands for significant upfront investment, including franchise fees, build-out costs, and initial inventory, which can run into millions of dollars for master agreements.

- Proven Track Record Mandate: Franchisors prioritize operators with demonstrated success in managing multiple units or similar business models, a credential typically unavailable to nascent competitors.

- Territorial Exclusivity: Master franchise agreements grant exclusive rights within defined geographic areas, preventing new entrants from establishing a comparable brand presence in the same markets.

- Brand Reputation Risk: Franchisors are highly selective to protect their brand's image, making it difficult for unproven entities to secure agreements for globally recognized and valuable brands.

Regulatory and Licensing Hurdles

The restaurant industry faces significant regulatory and licensing hurdles that act as a barrier to new entrants. These include stringent health and safety standards, food handling protocols, labor laws, and various permits, all of which differ across jurisdictions. For instance, in 2024, obtaining a new food service license in major cities often involves multiple agency approvals and can take several months, incurring substantial upfront costs.

Alsea, as an established operator, benefits from a well-developed compliance infrastructure and experience in navigating these complex requirements. This existing framework allows Alsea to adapt more readily to regulatory changes and manage operational licenses efficiently, giving it a distinct advantage over newcomers who must invest heavily in understanding and meeting these often intricate demands.

- Regulatory Complexity: Health, safety, labor, and licensing laws create a demanding environment for new food service businesses.

- Cost and Time Investment: Securing necessary permits and ensuring compliance is both time-consuming and financially burdensome for startups.

- Alsea's Advantage: Established compliance systems and operational experience provide Alsea with a significant competitive edge against new market entrants.

The threat of new entrants for Alsea is relatively low due to substantial capital requirements and established brand loyalty. Newcomers face immense financial burdens to match Alsea's scale and market presence, a hurdle amplified by the difficulty in securing master franchise agreements for globally recognized brands.

Regulatory complexities and the need for proven operational track records further deter new players. For example, in 2024, the cost of securing prime real estate and fitting out new restaurant locations can easily exceed several million dollars, a significant barrier compared to Alsea's existing infrastructure.

Alsea's economies of scale, evident in its 2024 consolidated revenue of approximately MXN 73.7 billion, allow for cost efficiencies that are difficult for new entrants to replicate. This, combined with the strong brand equity of its portfolio, including Starbucks' over $35 billion global revenue in 2023, creates a formidable competitive moat.

Porter's Five Forces Analysis Data Sources

Our Alsea Porter's Five Forces analysis leverages data from Alsea's annual reports, investor presentations, and financial statements, supplemented by industry-specific market research reports and competitor financial filings.