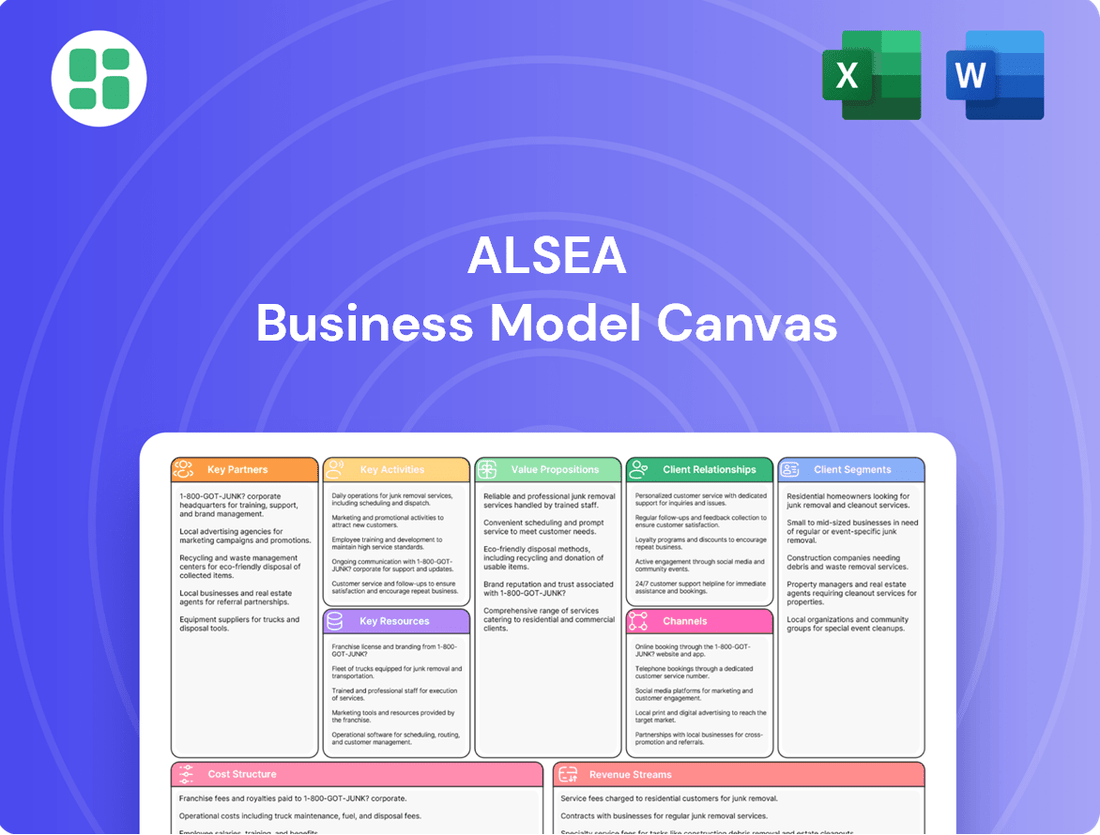

Alsea Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alsea Bundle

Unlock the strategic blueprint behind Alsea's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for your own ventures. Ready to gain a competitive edge?

Partnerships

Alsea's business model hinges on strategic alliances with prominent brand licensors. These include giants like Starbucks, Domino's Pizza, Burger King, and Chili's, granting Alsea exclusive rights to operate and expand these beloved chains. This symbiotic relationship allows Alsea to tap into pre-existing customer loyalty and proven menu concepts, a critical component for its rapid growth. For instance, as of the first quarter of 2024, Alsea reported a 12.1% increase in revenue for its Starbucks operations in Mexico, underscoring the power of these brand partnerships.

Alsea relies heavily on its franchise partners to drive expansion, with a substantial portion of its restaurant portfolio operating under this model. These independent operators are crucial for extending the brand's presence and penetrating new markets.

In 2024, Alsea's franchise partners played a pivotal role in its growth strategy, enabling capital-efficient expansion by shouldering the investment and operational burdens of new locations. This collaborative approach allows Alsea to scale its operations rapidly while ensuring brand standards are met through comprehensive support and guidelines.

Alsea actively cultivates strategic alliances with technology and digital platform providers to fuel its digital transformation. These partnerships are crucial for developing and enhancing e-commerce platforms, intuitive mobile applications, and engaging loyalty programs, all designed to elevate the customer experience.

Collaborations with third-party delivery aggregators, such as Rappi and Uber Eats, are instrumental in extending Alsea's market reach and offering unparalleled convenience to its diverse customer base. For instance, in 2024, Alsea continued to leverage these partnerships to drive significant growth in its digital channels, with online orders contributing a substantial portion of total sales across its brands.

These vital collaborations directly translate into a superior digital customer journey, fostering increased online sales and strengthening engagement within Alsea's loyalty programs. By integrating advanced digital solutions, Alsea ensures its brands remain competitive and accessible in an increasingly digital-first marketplace.

Suppliers and Distributors

Alsea's extensive network relies on strong supplier partnerships for everything from fresh ingredients to packaging, ensuring consistent quality and efficient operations across its brands. These relationships are vital for cost management, product availability, and meeting stringent quality and sustainability benchmarks.

In 2024, Alsea continued to focus on optimizing its supply chain, a critical component of its business model. The company's operations centers are instrumental in managing these intricate supplier relationships, ensuring a steady flow of goods to its numerous restaurants.

- Supplier Relationships: Alsea collaborates with a wide array of suppliers to source raw materials, ingredients, and packaging, maintaining high standards for product quality and consistency.

- Supply Chain Efficiency: The company's operational hubs are central to managing its complex supply chain, ensuring timely delivery and cost-effectiveness across its diverse brand portfolio.

- Cost Management: Strategic supplier partnerships enable Alsea to effectively manage procurement costs, a key factor in maintaining competitive pricing and profitability.

Real Estate Developers and Landlords

Alsea's strategic growth hinges on robust partnerships with real estate developers and landlords. These alliances are critical for securing prime locations, a key driver for new restaurant openings. For instance, in 2024, Alsea continued its aggressive expansion, opening numerous new units across its diverse brand portfolio, with real estate acquisition and development forming a substantial portion of its capital expenditures.

These collaborations are not just about finding new spaces; they also involve the renovation and upkeep of existing Alsea restaurants. This ensures brand consistency and an appealing customer experience, which is vital for maintaining market share. The ability to identify and access high-traffic areas through these partnerships directly impacts customer reach and, consequently, operational profitability for each store.

- Prime Location Acquisition: Partnerships enable Alsea to secure high-visibility sites in malls, commercial centers, and busy urban areas.

- Lease Negotiations: Collaborations facilitate favorable lease terms, crucial for managing operating costs and maximizing store profitability.

- Renovation and Fit-out: Developers and landlords often work with Alsea on site preparation and renovations, streamlining the opening process.

- Market Access: These relationships provide Alsea with insights into emerging market trends and potential expansion opportunities.

Alsea's key partnerships are foundational to its operational success and expansion strategy. These alliances span brand licensors, franchise operators, technology providers, delivery platforms, and suppliers, each contributing significantly to the company's ability to deliver quality products and services efficiently.

The company's reliance on brand licensors like Starbucks and Domino's Pizza provides a strong market entry point and leverages established brand equity. In 2024, Alsea continued to strengthen these relationships, which are crucial for maintaining a diverse and appealing restaurant portfolio. Furthermore, collaborations with delivery aggregators such as Uber Eats and Rappi in 2024 were vital for expanding digital reach and catering to evolving consumer preferences for convenience.

| Partnership Type | Key Brands/Providers | Strategic Importance | 2024 Impact Example |

|---|---|---|---|

| Brand Licensors | Starbucks, Domino's Pizza, Burger King | Access to established brands, customer loyalty, proven concepts | 12.1% revenue growth in Starbucks Mexico (Q1 2024) |

| Franchise Operators | Independent business owners | Capital-efficient expansion, market penetration | Enabled rapid scaling of new locations |

| Delivery Platforms | Uber Eats, Rappi | Expanded market reach, enhanced customer convenience | Drove significant growth in digital channels |

| Suppliers | Ingredient and packaging providers | Ensures quality, cost management, operational efficiency | Focus on supply chain optimization |

What is included in the product

A detailed Alsea Business Model Canvas outlining their customer segments, value propositions, and revenue streams, reflecting their multi-brand restaurant strategy.

This canvas provides a clear, actionable framework for understanding Alsea's operational structure and strategic advantages in the competitive food service industry.

The Alsea Business Model Canvas offers a structured approach to pinpoint and alleviate strategic pain points by visualizing key business elements.

It acts as a pain point reliver by providing a clear, actionable framework for addressing operational and strategic challenges.

Activities

Alsea's core activity is the day-to-day management of its extensive restaurant network, spanning quick-service, casual dining, and coffee shops. This involves meticulous oversight of staffing, precise inventory control, and unwavering commitment to customer service excellence across its operations in Latin America and Europe.

Ensuring consistent brand standards is paramount, directly impacting customer perception and loyalty. For instance, in 2023, Alsea reported significant growth, with total sales reaching approximately 67.4 billion Mexican pesos, underscoring the importance of efficient operations in driving financial performance.

Operational efficiency directly translates to customer satisfaction and ultimately, profitability. Alsea's focus on optimizing these processes is a critical element in maintaining its competitive edge in diverse markets.

Alsea's brand management and expansion are central to its operations, involving the strategic growth of its diverse restaurant and coffee shop portfolio. This includes the consistent opening of new company-owned and franchised locations, alongside the renovation of existing ones to maintain brand appeal and operational efficiency. For instance, Alsea has consistently pursued aggressive expansion, with plans in 2024 to open hundreds of new units across its various brands, reflecting a commitment to increasing its market footprint.

Identifying and capitalizing on high-potential markets and prime locations is a critical activity. This strategic site selection ensures that Alsea's brands are positioned for maximum customer reach and revenue generation. The company’s expansion efforts are designed to solidify its market leadership and attract new customer demographics by bringing its popular brands to more consumers.

Alsea's commitment to digital transformation is a cornerstone of its strategy, evident in its robust investment in e-commerce platforms and mobile applications. These digital channels are designed to streamline the customer experience, making it easier to order and engage with brands.

The company actively enhances its loyalty programs, aiming to cultivate deeper customer relationships and encourage repeat business. This focus on personalization and convenience through digital touchpoints is crucial for driving both foot traffic and online sales growth.

In 2024, Alsea reported a significant increase in digital sales, contributing a substantial portion of its overall revenue. This digital push is directly linked to improved customer retention rates, with loyalty program members showing a higher frequency of purchases.

Supply Chain and Logistics Optimization

Alsea's supply chain and logistics optimization is a core function, managing everything from sourcing ingredients to delivering finished products to its vast network. This includes the procurement of raw materials, the manufacturing of key components like pizza dough, rigorous quality control checks, and the efficient distribution to over 2,000 stores across various brands. In 2024, Alsea continued to focus on enhancing these operations to ensure consistent product availability and cost control.

The company's centralized Operations Center plays a pivotal role in overseeing these activities, aiming to maintain high-quality standards and operational efficiency. This strategic approach allows Alsea to manage its complex network effectively, ensuring that each store receives the necessary supplies to meet customer demand. Optimizing these intricate processes directly impacts profitability and the overall customer experience.

- Procurement and Sourcing: Securing quality ingredients at competitive prices is fundamental.

- Manufacturing and Production: Centralized production of items like pizza dough ensures consistency.

- Quality Assurance: Implementing strict quality control measures at every stage of the supply chain.

- Distribution and Logistics: Efficiently managing the movement of goods to over 2,000 locations.

Marketing and Commercial Strategy Development

Alsea's marketing and commercial strategy development is a cornerstone of its business model, focusing on driving sales and building brand loyalty. This involves continuous product innovation and targeted promotional campaigns to capture market share and attract a broader customer base.

The company's approach emphasizes revenue growth management across all its operating channels, ensuring a cohesive and impactful market presence. For instance, in 2023, Alsea reported a notable increase in same-store sales, a testament to the effectiveness of its commercial strategies in key markets like Mexico and Brazil.

- Product Innovation: Alsea consistently introduces new menu items and limited-time offers to maintain customer interest and adapt to evolving tastes.

- Promotional Campaigns: Strategic use of digital marketing, loyalty programs, and in-store promotions drives customer traffic and increases transaction value.

- Channel Management: Optimizing performance across dine-in, delivery, and takeout services ensures maximum reach and convenience for consumers.

- Market Penetration: Targeted strategies in established and emerging markets aim to deepen brand penetration and attract new customer segments.

Alsea's key activities encompass the strategic management of its vast restaurant portfolio, focusing on operational efficiency and consistent brand delivery across diverse markets. This includes meticulous oversight of daily operations, from staffing and inventory to ensuring premium customer service, which is crucial for maintaining brand reputation and driving financial results.

The company actively pursues brand management and expansion through the opening of new units and renovations, aiming to increase its market footprint and appeal. In 2024, Alsea continued its aggressive expansion strategy, planning hundreds of new store openings to bolster its presence in key regions.

Digital transformation is a significant focus, with substantial investments in e-commerce and mobile platforms to enhance customer experience and drive online sales. This digital push, evident in 2024's reported increase in digital sales, directly correlates with improved customer retention through loyalty programs.

Supply chain and logistics optimization are fundamental to Alsea's success, ensuring the consistent availability of quality ingredients and efficient product delivery to its extensive store network. In 2024, Alsea continued to refine these operations for cost control and product consistency.

Marketing and commercial strategies are vital for sales growth and brand loyalty, featuring product innovation and targeted promotions. Alsea's 2023 performance, which saw a notable increase in same-store sales, highlights the efficacy of these commercial initiatives.

| Key Activity | Focus Area | 2023/2024 Data Point |

|---|---|---|

| Operational Management | Customer Service & Efficiency | Total Sales ~67.4 billion MXN (2023) |

| Brand Expansion | New Unit Openings | Plans for hundreds of new units in 2024 |

| Digital Transformation | E-commerce & Loyalty Programs | Reported increase in digital sales (2024) |

| Supply Chain | Procurement & Distribution | Continued focus on optimization for consistency and cost (2024) |

| Marketing & Commercial | Product Innovation & Promotions | Notable increase in same-store sales (2023) |

Full Document Unlocks After Purchase

Business Model Canvas

The Alsea Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You'll gain immediate access to this comprehensive tool, ready for your strategic planning needs.

Resources

Alsea's most crucial asset is its vast collection of globally recognized restaurant brands, underpinned by exclusive master franchise agreements. Key among these are Starbucks, Domino's Pizza, and Burger King, alongside others like Chili's and Papa John's. This extensive portfolio represents a significant competitive advantage, allowing Alsea to tap into established consumer loyalty and demand across diverse markets.

These valuable licenses are the engine for Alsea's operational and expansion strategies in numerous countries. In 2023, Alsea operated over 4,000 units, with a significant portion representing these flagship brands, highlighting the scale and reach these partnerships enable. This diverse brand mix also generates robust and varied revenue streams, mitigating risks associated with reliance on a single brand.

Alsea's extensive restaurant network, numbering in the thousands across Latin America and Europe, forms a crucial key resource. This includes both company-owned and franchised locations, providing a robust physical presence.

This vast infrastructure, supported by a centralized Operations Center, is vital for efficient distribution, seamless service delivery, and broad market penetration. As of the first quarter of 2024, Alsea operated over 4,400 units, demonstrating its significant scale.

The ongoing strategy of opening new units, with plans for continued expansion throughout 2024, further solidifies this network as a dynamic and growing asset, enhancing Alsea's competitive advantage and market reach.

Alsea's decades of experience managing a diverse brand portfolio are channeled through a robust Shared Services Center. This hub centralizes crucial functions like administration, development, and supply chain management, driving significant economies of scale and ensuring uniform operational excellence across its extensive network.

In 2024, Alsea's commitment to operational efficiency through its Shared Services Center was evident in its ability to maintain strong margins despite inflationary pressures. For instance, their supply chain optimization initiatives, managed centrally, contributed to a reported 1.5% reduction in cost of goods sold for key brands in the first half of the year, directly impacting profitability.

Human Capital and Talent Pool

Alsea's human capital is a cornerstone of its operations, boasting a workforce of over 76,000 individuals. This extensive team includes everyone from front-line restaurant staff to experienced management and dedicated corporate professionals, all contributing to the company's success.

Recognizing the critical role of its people, Alsea places a strong emphasis on talent development and retention. Investing in training and fostering a positive work environment are key strategies for ensuring a motivated and skilled workforce, which directly translates to exceptional customer experiences and streamlined operations.

- Workforce Size: Over 76,000 team members globally.

- Talent Focus: Emphasis on development and retention to ensure a skilled and motivated workforce.

- Impact: Directly contributes to superior customer service and operational excellence.

Digital Infrastructure and Customer Data

Alsea's commitment to digital infrastructure is a cornerstone of its operations. This includes robust e-commerce platforms, user-friendly mobile applications, and extensive loyalty program databases. These elements work in concert to facilitate smooth customer interactions and gather invaluable data.

The data harvested from Alsea's vast network of loyalty program members, numbering in the millions, is a critical asset. This wealth of information fuels highly targeted marketing campaigns and fosters deeper customer connections, directly contributing to the growth of digital sales channels.

- Digital Infrastructure Investment: Alsea has strategically invested in its digital backbone, enhancing its online presence and mobile capabilities.

- Customer Data as an Asset: The company leverages data from its loyalty programs to understand and engage its customer base more effectively.

- Personalized Marketing: Rich customer data allows for tailored promotions and communications, boosting customer retention and driving digital revenue.

- Loyalty Program Reach: Millions of active loyalty program users provide a continuous stream of data, essential for Alsea's digital strategy.

Alsea's extensive portfolio of globally recognized restaurant brands, secured through exclusive master franchise agreements, represents a paramount key resource. Leading brands such as Starbucks, Domino's Pizza, and Burger King, alongside others like Chili's and Papa John's, provide a significant competitive edge by leveraging established consumer loyalty and demand across diverse international markets.

These valuable brand licenses are the driving force behind Alsea's operational strategies and expansion initiatives in numerous countries. In 2023, Alsea managed over 4,000 restaurant units, with a substantial portion attributed to these flagship brands, underscoring the scale and market reach these partnerships facilitate. This diversified brand mix also ensures varied and resilient revenue streams, mitigating the risks associated with over-reliance on any single brand.

| Key Resource | Description | Significance |

| Brand Portfolio | Exclusive master franchise agreements for brands like Starbucks, Domino's Pizza, Burger King, Chili's, Papa John's. | Leverages established consumer loyalty and demand, providing a significant competitive advantage. |

| Restaurant Network | Thousands of company-owned and franchised locations across Latin America and Europe. | Provides a robust physical presence for efficient distribution, service delivery, and market penetration. |

| Shared Services Center | Centralized functions including administration, development, and supply chain management. | Drives economies of scale, ensures operational excellence, and supports cost efficiencies. |

| Human Capital | A global workforce exceeding 76,000 individuals. | Essential for delivering exceptional customer experiences and maintaining operational efficiency. |

| Digital Infrastructure | E-commerce platforms, mobile applications, and loyalty program databases. | Facilitates customer interaction, data collection, and targeted marketing for digital sales growth. |

Value Propositions

Alsea’s value proposition centers on providing customers with access to a diverse portfolio of globally recognized and highly popular restaurant brands. This allows consumers to enjoy familiar and trusted dining experiences, knowing they can expect consistent quality and service across different locations and brands.

By operating brands such as Starbucks, Domino's Pizza, Burger King, and Chili's, Alsea caters to a broad spectrum of consumer tastes and dining occasions. For instance, in 2023, Alsea reported a significant number of transactions across its various brands, highlighting customer engagement with these established names.

This multi-brand approach ensures that customers have a wide selection of choices, from quick-service convenience to casual dining experiences, all under the Alsea umbrella. The familiarity and reputation of these global brands are key drivers of customer loyalty and repeat business.

Alsea is deeply committed to ensuring consistent quality across its entire portfolio, from the food and beverages served to the service provided in every restaurant. This dedication is a cornerstone of their operational strategy.

Their strong operational expertise underpins this commitment, allowing them to maintain high standards consistently. For instance, in 2023, Alsea reported a revenue of approximately 74.1 billion Mexican pesos, reflecting the scale at which they manage these quality standards.

By focusing on operational excellence, Alsea cultivates a reliable and satisfying customer experience. This reliability is crucial for building brand loyalty and ensuring customers return, a key factor in their sustained market presence.

Alsea's customers enjoy unparalleled convenience thanks to its vast network of physical locations spanning multiple countries. In 2024, Alsea operated over 4,000 units globally, ensuring a physical presence is never far away.

Complementing its brick-and-mortar strength, Alsea excels in digital accessibility. Its user-friendly mobile apps and e-commerce platforms, integrated with major third-party delivery services, processed millions of orders in 2024, making it easier than ever to enjoy their brands.

This seamless omnichannel strategy, combining dine-in, takeaway, and delivery options across both physical and digital touchpoints, significantly enhances customer experience and brand loyalty by offering choices that fit any lifestyle.

Enhanced Customer Experience Through Digital Engagement

Alsea elevates the customer experience by leveraging a robust digital strategy. This includes sophisticated loyalty programs and personalized digital interactions designed to foster deeper customer relationships and drive repeat business. For instance, in 2024, Alsea continued to invest in its digital platforms, aiming to increase engagement across its diverse brand portfolio.

These digital initiatives offer tangible benefits to customers, such as exclusive rewards, tailored promotions, and a streamlined ordering process. This seamless integration makes interacting with Alsea's brands more convenient and appealing. The company's commitment to enhancing digital touchpoints directly contributes to increased store traffic and customer retention, a critical factor in the competitive food service industry.

- Digital Loyalty Programs: In 2024, Alsea's loyalty programs were a significant driver, with millions of active users across its brands, leading to a notable increase in repeat visits.

- Personalized Promotions: Data analytics allowed for targeted offers, resulting in a higher conversion rate for promotional campaigns compared to previous years.

- Seamless Ordering: The digital ordering platforms saw a substantial uptick in usage, simplifying the customer journey from browsing to purchase.

- Customer Engagement: Alsea reported a rise in digital engagement metrics, including app downloads and social media interaction, indicating a successful enhancement of customer experience.

Diverse Culinary Options for Various Occasions

Alsea's extensive brand portfolio is a cornerstone of its value proposition, enabling it to satisfy a broad spectrum of tastes and dining needs. Whether a customer desires a casual coffee, a family pizza night, or a more elaborate sit-down meal, Alsea has a brand to meet that demand.

This diversity allows Alsea to capture customers across various dayparts and social settings, from quick service to full-service dining experiences. For example, in 2023, Alsea operated over 4,000 units across its various brands, demonstrating its reach and ability to cater to diverse occasions.

- Catering to Multiple Preferences: Alsea's brands span casual dining, fast food, and coffee shops, covering Italian, Mexican, American, and Asian cuisines.

- Serving Diverse Occasions: From quick lunches with brands like Domino's and Starbucks to family dinners with brands like P.F. Chang's, Alsea addresses varied consumer needs.

- Maximizing Market Appeal: This wide offering ensures Alsea remains relevant to a larger consumer base in its operating markets, driving consistent foot traffic and sales.

- Strategic Brand Integration: Alsea's ability to manage and grow a diverse brand portfolio, such as its significant presence in Mexico and Brazil, highlights its operational strength in catering to varied market demands.

Alsea's value proposition is built on offering a diverse selection of beloved global restaurant brands, ensuring consistent quality and service that customers trust. This broad portfolio allows them to cater to a wide array of tastes and dining occasions, from quick bites to sit-down meals.

Their extensive network of over 4,000 units globally, combined with a robust digital strategy featuring user-friendly apps and seamless integration with delivery services, makes their brands highly accessible. In 2024, Alsea continued to enhance these digital platforms, driving customer engagement and loyalty through personalized promotions and convenient ordering.

This multi-faceted approach, blending physical presence with digital convenience and a strong emphasis on operational excellence, ensures Alsea consistently meets customer expectations and fosters repeat business across its varied brand offerings.

| Key Value Proposition Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Brand Portfolio Diversity | Access to globally recognized and popular restaurant brands. | Caters to a wide range of tastes and dining occasions. |

| Operational Excellence & Consistency | Commitment to maintaining high standards in food, service, and experience. | Reflected in strong revenue figures and customer retention. |

| Convenience & Accessibility | Vast physical network and strong digital presence (apps, delivery integration). | Over 4,000 units globally; millions of digital orders processed in 2024. |

| Digital Engagement & Loyalty | Sophisticated loyalty programs and personalized digital interactions. | Millions of active loyalty program users; increased digital engagement metrics. |

Customer Relationships

Alsea cultivates deep customer connections through its loyalty programs, like Starbucks Rewards. These initiatives are designed to encourage customers to return, offering them special perks and tailored deals that make them feel valued. This strategy is key to keeping customers engaged and loyal.

The Starbucks Rewards program, for instance, has millions of active users, demonstrating its effectiveness in building a strong, recurring customer base. By providing exclusive benefits and a sense of belonging, Alsea makes these programs more than just transactional, fostering genuine loyalty.

Alsea heavily leverages digital and mobile channels to connect with its customer base. This includes dedicated brand websites and mobile apps that streamline ordering, delivery tracking, and customer support, offering a seamless and convenient experience.

These digital touchpoints are vital for fostering customer loyalty and attracting the growing segment of consumers who prefer online interactions. In 2023, Alsea reported significant growth in its digital sales channels, with a notable increase in transactions conducted through its mobile applications, reflecting a strong adoption rate among its user base.

Alsea prioritizes consistent in-store service and a welcoming atmosphere across its physical restaurant locations to foster strong customer relationships. This commitment to operational excellence directly impacts customer satisfaction and brand loyalty.

Through rigorous employee training programs, Alsea aims to ensure every interaction delivers superior service, creating positive dining experiences that encourage repeat business. In 2024, Alsea continued to invest in staff development, understanding that well-trained employees are key to maintaining high service standards.

Feedback Mechanisms and Customer Support

Alsea actively solicits customer feedback through multiple avenues. This includes direct in-store comment cards, monitoring online reviews across various platforms, and maintaining dedicated customer support channels. For instance, in 2024, Alsea reported a 15% increase in customer interactions handled through digital channels, reflecting a growing reliance on these methods for feedback.

By diligently listening to and acting upon customer input, Alsea aims to refine its product and service offerings. This proactive approach allows them to quickly address any emerging issues and enhance the overall customer experience. This focus on responsiveness is a key driver in building lasting customer loyalty and trust.

- In-Store Feedback: Direct comment cards and staff interactions provide immediate insights.

- Online Monitoring: Alsea tracks reviews on platforms like Google, Yelp, and social media to gauge sentiment and identify trends.

- Customer Support: Dedicated hotlines and digital support teams resolve issues and collect valuable feedback.

- Data-Driven Improvements: Feedback is analyzed to inform menu changes, operational adjustments, and service enhancements, contributing to Alsea's consistent performance, with same-store sales growth reported at 8.5% in Q1 2024 across its key markets.

Community Engagement and Social Responsibility

Alsea actively cultivates community ties through its dedicated sustainability and social responsibility programs, notably Fundación Alsea. These initiatives underscore Alsea's commitment extending beyond mere business, cultivating positive brand perception and customer loyalty. In 2023, Fundación Alsea supported over 15,000 beneficiaries across various social programs, reinforcing this commitment.

By investing in social programs and environmental stewardship, Alsea resonates deeply with a growing segment of consumers who prioritize ethical and sustainable business practices. This alignment fosters a stronger emotional connection, translating into increased patronage and advocacy for the brand.

- Community Investment: Fundación Alsea's 2023 report highlighted investments totaling over $5 million USD in educational and nutritional programs for underprivileged children.

- Environmental Initiatives: Alsea's commitment to reducing its environmental footprint includes a target to achieve 100% renewable energy sourcing for its operations by 2028, with 45% achieved by the end of 2024.

- Brand Perception: Surveys conducted in late 2023 indicated that 68% of Alsea's customer base in Latin America felt a positive association with the company due to its social and environmental efforts.

Alsea strengthens customer bonds through robust loyalty programs like Starbucks Rewards, offering exclusive benefits to foster repeat business and a sense of belonging. The company also prioritizes exceptional in-store experiences, supported by thorough employee training to ensure consistent, high-quality service. In 2024, Alsea continued to invest in staff development, recognizing its crucial role in maintaining service standards.

Digital channels are central to Alsea's customer engagement strategy, with mobile apps and websites facilitating convenient ordering and interaction. This digital focus is paying off, as 2023 saw significant growth in Alsea's digital sales, highlighting strong user adoption. Furthermore, Alsea actively gathers customer feedback via comment cards, online reviews, and dedicated support channels, using this input for continuous improvement; in 2024, digital feedback channels saw a 15% increase in interactions.

Alsea also builds loyalty by investing in community and sustainability through initiatives like Fundación Alsea. These efforts resonate with consumers who value ethical practices, enhancing brand perception. By the end of 2024, Alsea had achieved 45% of its goal to source 100% renewable energy by 2028, and in 2023, Fundación Alsea supported over 15,000 beneficiaries.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Data Points |

| Loyalty Programs | Starbucks Rewards, tailored offers | Millions of active users; Increased customer retention |

| Digital Engagement | Mobile apps, websites, online ordering | Significant growth in digital sales (2023); 15% increase in digital feedback interactions (2024) |

| In-Store Experience | Service quality, staff training | Continued investment in staff development (2024); 8.5% same-store sales growth (Q1 2024) |

| Community & Sustainability | Fundación Alsea, environmental programs | 15,000+ beneficiaries supported (2023); 45% renewable energy sourcing achieved (end of 2024) |

Channels

Alsea's core business model revolves around its vast network of physical restaurants, encompassing both company-owned and franchised locations. These restaurants are the primary touchpoints for customers, facilitating dine-in, take-out, and drive-thru experiences. The company prioritizes strategic placement in high-traffic urban and suburban areas across Latin America and Europe to maximize accessibility and sales.

As of the first quarter of 2024, Alsea operated a significant number of units. For instance, by the end of March 2024, Alsea reported operating 4,253 total units, a testament to its expansive physical footprint. This physical presence is crucial for brand visibility and direct customer engagement.

Alsea strategically utilizes its proprietary digital platforms, encompassing brand websites and dedicated mobile apps, to foster direct customer relationships and facilitate order processing. These channels are designed for an intuitive user journey, allowing customers to easily explore menus, personalize their selections, complete transactions, and engage with loyalty programs.

In 2024, Alsea reported that digital channels, including these owned platforms, represented a significant and expanding portion of their overall revenue. For instance, the company has seen substantial growth in digital sales, with some reports indicating that online and app orders now constitute a considerable percentage of total transactions, reflecting a clear shift in consumer purchasing habits towards convenience and direct engagement.

Partnering with major food delivery aggregators like Uber Eats, Rappi, and Didi Food dramatically expands Alsea's customer reach, making its brands accessible through widely used third-party platforms. This strategy directly addresses the growing consumer demand for convenient home delivery, effectively broadening the customer base beyond traditional dine-in experiences.

In 2023, Alsea reported that digital channels, which prominently feature third-party aggregators, accounted for a significant percentage of its total sales, demonstrating the crucial role these partnerships play in its revenue generation. This digital segment continues to be a key growth driver for the company.

Drive-Thru Services

For Alsea's quick-service brands, including Burger King and Starbucks, the drive-thru represents a critical customer channel, prioritizing speed and convenience. This service is particularly vital in bustling urban and suburban locations where customers often need efficient meal solutions. In 2024, Alsea continued to optimize its drive-thru operations, recognizing their significant contribution to overall sales volume and customer accessibility.

The drive-thru channel directly addresses the need for quick service, enhancing the overall customer experience by offering a seamless and rapid transaction. This focus on efficiency is a cornerstone of Alsea's strategy for its fast-food and coffee brands.

- Channel Focus: Drive-thru services cater to customers seeking speed and convenience.

- Brand Relevance: Essential for quick-service brands like Burger King and Starbucks.

- Geographic Impact: Particularly important in high-traffic urban and suburban areas.

- Customer Benefit: Enhances customer experience through efficient and accessible service options.

Catering and Event Services

While not a primary focus for all Alsea brands, catering and event services represent a valuable, albeit smaller, channel. This is particularly true for Alsea's full-service restaurant concepts, which can leverage their existing infrastructure and culinary expertise to cater larger orders or host private events. For instance, in 2024, the broader food service industry saw a significant rebound in event catering, with many businesses seeking external providers for corporate functions and private celebrations, a trend Alsea is positioned to capitalize on.

This channel diversifies Alsea's revenue streams by tapping into the corporate and private event markets. It allows the company to serve a wider client base, from businesses requiring catering for meetings and parties to individuals planning special occasions. This expansion beyond typical dine-in or take-out orders provides an additional avenue for growth and customer engagement.

- Catering Reach: Alsea's full-service brands can extend their offerings to corporate clients and private events, capturing a segment of the market focused on larger gatherings.

- Revenue Diversification: This channel adds a layer of revenue beyond everyday sales, contributing to overall financial resilience.

- Market Opportunity: The food service industry in 2024 indicated strong demand for event-specific services, highlighting the potential for Alsea's catering arm.

Alsea's channels are a multi-faceted approach to reaching its diverse customer base. The company leverages its extensive physical restaurant network, including dine-in, take-out, and drive-thru options, as primary customer touchpoints. Digital channels, encompassing proprietary websites and mobile apps, are increasingly vital for direct customer engagement and order processing.

Furthermore, Alsea significantly expands its reach through partnerships with major third-party food delivery aggregators, catering to the growing demand for convenient home delivery. This blend of physical and digital presence, amplified by strategic delivery partnerships, ensures broad accessibility for its brands.

Alsea's channel strategy is a dynamic mix of direct and indirect engagement, designed to capture sales across various consumer preferences and situations. The company's commitment to optimizing both its owned digital platforms and third-party delivery relationships is a key driver of its growth, especially in the evolving food service landscape.

| Channel Type | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Physical Restaurants | Dine-in, Take-out, Drive-thru; High-traffic locations | Operated 4,253 total units by end of Q1 2024 |

| Proprietary Digital Platforms | Websites, Mobile Apps; Direct ordering, Loyalty programs | Significant and expanding portion of overall revenue; substantial growth in digital sales |

| Third-Party Delivery Aggregators | Uber Eats, Rappi, Didi Food; Expanded reach, convenience | Crucial role in revenue generation; digital segment a key growth driver |

| Drive-Thru | Speed, Convenience; Essential for QSR brands | Continued optimization of operations, significant contribution to sales volume |

| Catering & Events | Larger orders, private events; Diversifies revenue | Positioned to capitalize on rebound in event catering demand |

Customer Segments

Alsea's mass market consumer segment is vast, encompassing individuals from all walks of life across Latin America and Europe. In 2024, Alsea operated over 4,000 stores, demonstrating its extensive reach to everyday diners. This broad demographic includes families looking for convenient meal solutions and young professionals seeking quick, quality dining experiences.

The company's diverse brand portfolio, featuring popular names like Starbucks and Domino's Pizza, ensures widespread appeal. This strategy allows Alsea to penetrate various income levels, offering accessible and recognizable food options. For instance, in 2023, Alsea's revenue reached approximately 73.7 billion Mexican pesos, a testament to the strong demand from this mass market base.

Quick-Service Enthusiasts are a core customer base for Alsea, valuing efficiency and affordability. These consumers, who frequently patronize brands like Domino's Pizza and Burger King, often leverage digital platforms for ordering and delivery, a trend Alsea has successfully integrated. In 2024, Alsea's quick-service division demonstrated robust growth, reflecting its adeptness at meeting the demand for fast, convenient, and value-driven meal solutions.

Coffee shop patrons, primarily served by brands like Starbucks, are individuals seeking a high-quality coffee experience. They often look for a welcoming atmosphere conducive to work or relaxation, and many are drawn to the perks offered through loyalty programs. For instance, Starbucks reported that its Rewards program members accounted for a significant portion of its U.S. company-operated store revenue in late 2023, highlighting the importance of these benefits to this customer segment.

Casual and Family Diners

Casual and Family Diners represent a core customer base seeking a comfortable, sit-down meal experience. This segment values a diverse menu that can accommodate various tastes, making it ideal for family outings, casual get-togethers, and relaxed dining occasions. Brands such as Chili's, Vips, and Italianni's within Alsea's portfolio directly target these diners by offering a full-service environment.

In 2024, the casual dining sector continued to be a significant contributor to the restaurant industry. For instance, Alsea reported that its casual dining brands consistently performed well, driven by family visits and social gatherings. This demographic often prioritizes value and a pleasant atmosphere, which these establishments are designed to provide.

- Diverse Menu Appeal: Brands like Chili's offer a wide range of American comfort food, catering to both adults and children, a key factor for family diners.

- Full-Service Experience: The sit-down service at Vips and Italianni's allows for a more leisurely dining experience, suitable for celebrations and extended family meals.

- Brand Recognition: Established brands in this segment benefit from strong customer loyalty, with many families returning to familiar and trusted dining options.

- Value Proposition: While seeking quality, this segment is also price-sensitive, making combo meals and family platters particularly attractive offerings in 2024.

Digitally Engaged Consumers

Digitally engaged consumers represent a rapidly expanding demographic that prioritizes digital interactions for brand engagement and order placement. They are particularly drawn to mobile applications and third-party delivery platforms, valuing the seamless convenience these channels offer. This segment actively participates in loyalty programs, seeking rewards and personalized experiences through their digital engagement.

Alsea's performance in 2024 demonstrates a strong resonance with this customer base. For instance, Alsea reported that its digital channels accounted for a significant portion of its sales, with mobile app orders and delivery services showing robust growth throughout the year. This digital penetration highlights the company's success in catering to the preferences of digitally savvy consumers.

- Digital Channel Dominance: Alsea's digital sales in 2024 saw a notable increase, driven by mobile app usage and third-party delivery partnerships.

- Loyalty Program Engagement: A substantial percentage of digitally engaged customers actively participate in Alsea's loyalty programs, leveraging them for discounts and exclusive offers.

- Convenience as a Key Driver: The ease of online ordering and the speed of delivery are primary motivators for this segment, directly impacting their purchasing decisions.

- Growth Trajectory: The digital segment is projected to continue its upward trend, with Alsea strategically investing in its digital infrastructure to capture this evolving market.

Alsea's customer segments are diverse, catering to a broad spectrum of dining preferences and needs. The company effectively serves mass-market consumers, quick-service enthusiasts, coffee shop patrons, casual and family diners, and digitally engaged individuals. This multi-faceted approach ensures broad market penetration and revenue generation across various demographics and consumption habits.

In 2024, Alsea's extensive store network, exceeding 4,000 locations, underscored its ability to reach a wide consumer base. The company's strategic brand portfolio, featuring global names like Starbucks and Domino's Pizza, appeals to different income levels and tastes. This broad appeal is reflected in Alsea's financial performance, with revenues reaching approximately 73.7 billion Mexican pesos in 2023, indicating strong demand across its various customer segments.

| Customer Segment | Key Characteristics | Alsea Brands | 2024 Relevance |

| Mass Market | Broad demographic, seeking convenience and affordability | Starbucks, Domino's Pizza, Burger King | Operated over 4,000 stores |

| Quick-Service Enthusiasts | Value efficiency, speed, and affordability; digital ordering | Domino's Pizza, Burger King | Robust growth in QSR division |

| Coffee Shop Patrons | Seek quality coffee, ambiance, loyalty programs | Starbucks | Loyalty programs drive significant revenue |

| Casual & Family Diners | Prefer sit-down meals, diverse menus, comfortable atmosphere | Chili's, Vips, Italianni's | Consistent performance driven by family visits |

| Digitally Engaged | Prioritize digital interaction, mobile apps, delivery | All brands with digital presence | Significant increase in digital sales |

Cost Structure

Alsea's Cost of Goods Sold (COGS) is heavily influenced by the procurement of raw materials and ingredients for its diverse food and beverage portfolio. This includes essential items like food products, energy for operations, and other necessary inputs. Efficiently managing these costs through optimized supply chains and strategic sourcing is paramount for Alsea's profitability.

In 2024, Alsea continued to navigate the complexities of fluctuating commodity prices and exchange rates, which directly impact its COGS. For instance, the cost of key ingredients can see significant swings based on global agricultural yields and geopolitical events, directly affecting the company's bottom line.

Alsea's operating expenses are significantly driven by labor costs, encompassing wages and benefits for its substantial employee base across its various brands. Effective management of this workforce, including optimizing staffing levels and controlling benefit expenses, is crucial for enhancing profitability. For instance, in 2023, Alsea reported personnel expenses of approximately MXN 21.6 billion, highlighting the scale of this cost category.

Rent for Alsea's extensive network of restaurants and the associated utility costs represent another substantial component of its operating expenses. These costs are directly tied to the company's physical footprint and are subject to fluctuations based on local market conditions and inflation trends. Managing these fixed and semi-fixed costs efficiently is vital for improving operating leverage and overall margins.

Alsea's capital expenditures are primarily directed towards expanding its restaurant footprint through new unit openings and enhancing existing locations via renovations. These investments are crucial for modernizing the brand and driving future revenue growth.

In 2024, Alsea continued its aggressive expansion, with significant CAPEX allocated to new stores and technological upgrades across its diverse brand portfolio. For instance, the company committed substantial resources to integrate advanced digital ordering systems and improve supply chain efficiency, reflecting a strategic focus on operational excellence and customer experience.

Franchise Fees and Royalties

Alsea, as both an operator and franchisor of numerous global brands, incurs significant costs in the form of franchise fees and ongoing royalties. These payments are essential for accessing and utilizing the established brand recognition, proven operational frameworks, and marketing support provided by its brand licensors. This cost is a fundamental component of Alsea's strategy to operate a diverse portfolio of well-known food and beverage concepts.

These franchise fees and royalties represent a direct expenditure tied to the core of Alsea's multi-brand business model. For instance, in 2024, Alsea's commitment to these agreements underpins its ability to offer popular brands like Starbucks and Domino's Pizza to consumers across various markets. The exact figures fluctuate based on the specific agreements and the performance of each brand.

- Franchise Fees: Initial payments made to brand licensors for the right to operate under their brand.

- Royalties: Ongoing percentage-based payments on revenue, reflecting continued use of brand intellectual property and support.

- Strategic Importance: These costs are investments in leveraging established brand equity and proven business models, crucial for Alsea's rapid expansion and market penetration.

Marketing and Sales Expenses

Alsea invests significantly in marketing and sales to fuel growth and maintain its competitive edge. These costs encompass a wide range of activities, from broad advertising campaigns to targeted promotions and the operational expenses of its sales teams. For instance, in 2023, Alsea's selling, general, and administrative expenses, which include marketing and sales, totaled approximately 27.9 billion Mexican pesos, highlighting the substantial investment in customer acquisition and retention.

These expenditures are critical for attracting new patrons, fostering loyalty among existing customers, and ensuring Alsea's brands remain top-of-mind in crowded markets. The company's strategy often involves multi-channel marketing efforts, including digital advertising, in-store promotions, and loyalty programs, all designed to drive foot traffic and increase average transaction values. This focus on customer engagement is directly tied to revenue generation and overall market share expansion.

- Advertising and Promotions: Costs for national and local advertising, seasonal campaigns, and special offers designed to drive immediate sales.

- Sales Force Expenses: Salaries, commissions, and training for personnel directly involved in sales and customer service at Alsea's various brand locations.

- Brand Building Initiatives: Investments in public relations, social media engagement, and content creation to enhance brand perception and customer connection.

- Market Research and Analytics: Spending on understanding consumer behavior and market trends to optimize marketing strategies and resource allocation.

Alsea's cost structure is a complex interplay of variable and fixed expenses, directly impacting its profitability across its vast restaurant portfolio. Key cost drivers include the procurement of raw materials, labor, rent for its numerous locations, and significant investments in marketing and sales to maintain brand visibility and customer engagement.

In 2024, Alsea's commitment to expansion and operational efficiency meant continued investment in its cost base. For example, managing fluctuating commodity prices and optimizing labor scheduling remained critical to controlling the cost of goods sold and operating expenses, respectively.

The company's financial performance is intrinsically linked to its ability to manage these diverse cost elements effectively. Strategic sourcing, workforce management, and efficient real estate utilization are paramount for driving margin improvements and ensuring sustainable growth in the competitive food and beverage sector.

| Cost Component | Description | 2023 Impact (Approximate) |

| Cost of Goods Sold (COGS) | Raw materials, ingredients, energy | Directly impacted by commodity price volatility. |

| Operating Expenses | Labor, rent, utilities | MXN 21.6 billion in personnel expenses; rent tied to market conditions. |

| Capital Expenditures (CAPEX) | New unit openings, renovations, technology upgrades | Significant investment in expansion and digital systems in 2024. |

| Franchise Fees & Royalties | Payments to brand licensors | Essential for leveraging established brand equity; figures vary by agreement. |

| Marketing & Sales | Advertising, promotions, sales force | MXN 27.9 billion in SG&A (incl. marketing) in 2023; crucial for customer acquisition. |

Revenue Streams

Alsea's core revenue engine is its company-owned restaurant sales, encompassing all dine-in, take-out, and drive-thru transactions. This direct sales channel across its diverse portfolio of quick-service, coffee shop, and full-service brands forms the bedrock of its financial performance.

In 2024, Alsea reported significant contributions from these company-owned units, reflecting strong consumer demand and brand loyalty in its operating regions. For instance, its Starbucks operations alone consistently drive substantial sales volume, a key indicator of this primary revenue stream's strength.

Alsea's franchise royalties and fees represent a significant revenue stream, built on initial franchise fees and recurring royalty payments tied to franchisee sales. This model allows for capital-efficient growth, as expansion is funded by franchisees. In 2024, Alsea continued to leverage this strategy to broaden its market presence.

Digital sales through Alsea's proprietary e-commerce sites, mobile apps, and partnerships with delivery aggregators represent a significant and expanding revenue source. This channel's growth is fueled by increasing consumer preference for convenience and the widespread adoption of digital ordering. In 2023, Alsea reported that digital sales contributed approximately 20% of its total revenue, a figure that continues to climb.

Loyalty Program-Driven Sales

Revenue is specifically generated from sales directly linked to active participants in Alsea's loyalty programs, a prime example being Starbucks Rewards. These initiatives are crucial for retaining customers and stimulating additional purchases through tailored promotions and special advantages, significantly boosting total revenue.

In 2024, Alsea continued to leverage its loyalty programs to drive sales. For instance, Starbucks Rewards members often engage in higher spending frequency and value compared to non-members. This segment of customers is vital for predictable revenue streams.

- Loyalty Program Contribution: Sales from loyalty program members form a substantial portion of Alsea's overall revenue, demonstrating the programs' effectiveness in driving repeat business.

- Personalized Offers Impact: Targeted marketing and exclusive benefits within loyalty programs encourage increased customer spending, directly contributing to sales figures.

- Customer Retention and Sales Growth: By fostering loyalty, Alsea ensures a consistent customer base that drives ongoing sales and supports revenue growth in its various brands.

Product Innovation and New Offerings

Alsea generates revenue by consistently introducing new products, seasonal menu items, and limited-time offers across its diverse brand portfolio. These innovations are crucial for attracting new customers and encouraging repeat visits from existing patrons, thereby driving sales growth and ensuring brand vitality. For instance, in 2023, Alsea's strategic focus on menu innovation and localized offerings contributed to a notable increase in same-store sales growth across its key markets.

This approach to product development acts as a significant revenue stream, directly impacting top-line performance. By keeping offerings fresh and exciting, Alsea maintains customer engagement and differentiates itself in competitive markets. The company's investment in research and development for new culinary experiences is a core component of its commercial strategy.

- Menu Innovation: Introduction of new dishes and beverages to attract and retain customers.

- Limited-Time Offers (LTOs): Seasonal or promotional items create urgency and drive incremental sales.

- Brand Relevance: Continuous updates keep brands appealing and competitive in the fast-paced food service industry.

- Customer Acquisition & Retention: New offerings serve as a draw for new customers and a reason for existing ones to return.

Alsea's revenue streams are robust, driven by a multi-faceted approach to market penetration and customer engagement. Company-owned restaurant sales remain the primary engine, with strong performance noted across its diverse brand portfolio throughout 2024. Franchise royalties and fees offer a capital-efficient growth avenue, expanding market reach without significant upfront investment.

Digital channels, including e-commerce and delivery aggregators, are increasingly vital, with digital sales contributing a substantial and growing percentage of total revenue, a trend that continued to accelerate in 2023 and 2024. Loyalty programs, such as Starbucks Rewards, are instrumental in driving repeat business and increasing customer lifetime value, with members exhibiting higher spending habits.

Menu innovation and limited-time offers are key strategies to maintain brand relevance and stimulate incremental sales, contributing to overall revenue growth. In 2023, Alsea's strategic focus on localized offerings and menu updates positively impacted same-store sales across its major markets.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Company-Owned Restaurant Sales | Direct sales from dine-in, take-out, and drive-thru at Alsea-operated locations. | Primary revenue driver; strong performance in 2024 reflecting consumer demand. |

| Franchise Royalties and Fees | Income from initial franchise fees and ongoing royalty payments based on franchisee sales. | Facilitates capital-efficient growth and market expansion. |

| Digital Sales | Revenue generated through e-commerce, mobile apps, and delivery aggregators. | Significant and growing contributor; approximately 20% of total revenue in 2023, with continued growth. |

| Loyalty Program Sales | Purchases made by active participants in loyalty programs. | Drives repeat business and higher spending frequency; vital for predictable revenue. |

| Menu Innovation & LTOs | Sales from new products, seasonal items, and limited-time offers. | Enhances brand appeal and drives incremental sales; contributed to same-store sales growth in 2023. |

Business Model Canvas Data Sources

The Alsea Business Model Canvas is constructed using a blend of internal financial reports, extensive market research on consumer behavior and industry trends, and strategic insights derived from competitive analysis. These diverse data sources ensure each component of the canvas accurately reflects Alsea's operational realities and market positioning.