Alsea Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alsea Bundle

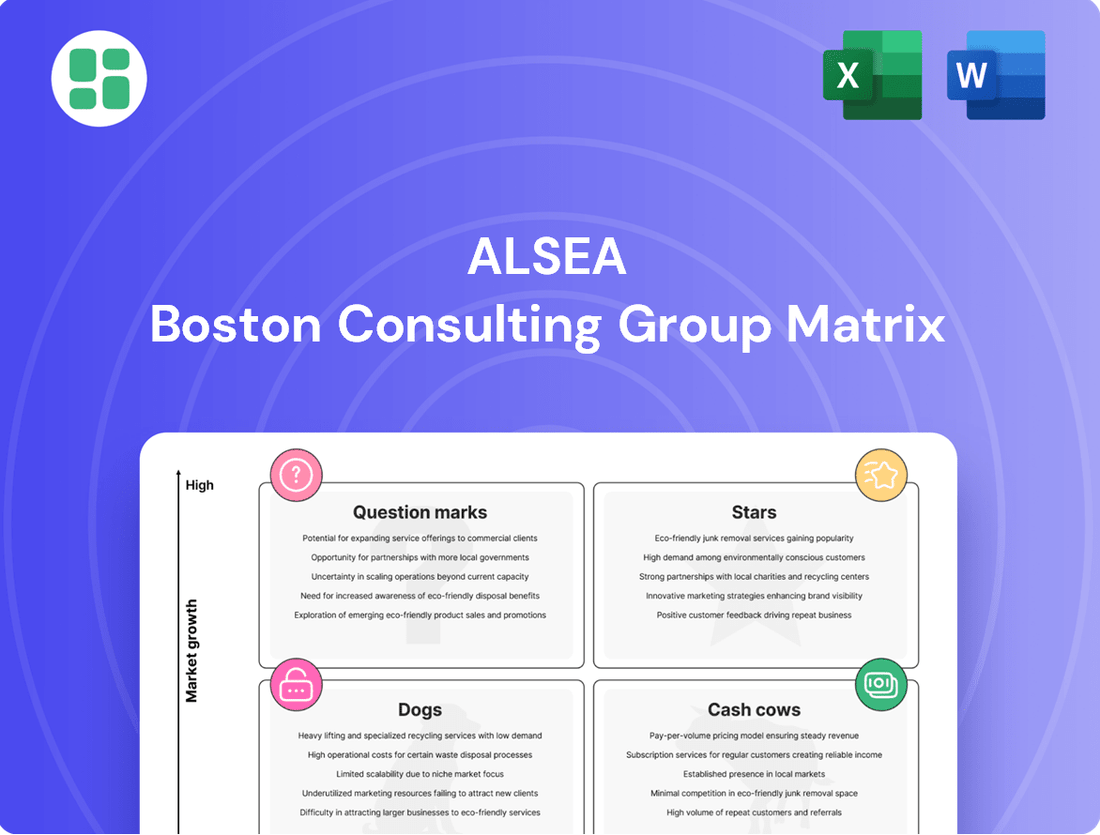

Curious about Alsea's strategic positioning? Our BCG Matrix preview highlights key product categories, revealing their potential for growth and profitability. See which brands are driving revenue and which need a closer look.

Unlock the full Alsea BCG Matrix to gain a comprehensive understanding of their portfolio, from established Cash Cows to emerging Stars. This detailed analysis provides actionable insights for optimizing your investment strategy and driving future success.

Don't miss out on the complete picture! Purchase the full BCG Matrix report for in-depth quadrant analysis, data-backed recommendations, and a clear roadmap to capitalize on Alsea's market opportunities.

Stars

Starbucks' presence in South America, particularly in Colombia and Chile, is a key growth driver for Alsea. In the second quarter of 2024, Alsea saw a robust 27% like-for-like sales growth in South America. This upward trend continued into the second quarter of 2025, with same-store sales increasing by 9.7%.

Alsea's strategic investment underscores the region's potential. The company is allocating $12 million to establish 30 new Starbucks stores in Colombia over the next three years. This expansion highlights a strong belief in the market's capacity for further development and customer engagement.

Starbucks in Mexico continues to be a strong performer for Alsea, solidifying its position as a Star in the BCG matrix. The brand has shown impressive resilience and growth, with like-for-like sales increasing by 8.7% in the second quarter of 2024. This upward trend continued into the first half of 2025, with same-store sales growing by 3.8% in Q2 2025, indicating sustained customer demand.

Mexico represents Alsea's largest market for Starbucks, boasting a significant network of 844 stores. The company's commitment to expansion is evident through ongoing new store openings, underscoring Starbucks' high market share and promising growth trajectory within the country. This strategic expansion is supported by strong consumer loyalty and a consistent stream of product innovations tailored to the Mexican market.

Domino's Pizza in Mexico is a significant growth engine for Alsea, demonstrating impressive financial health. In the second quarter of 2025, the brand achieved a strong 8.9% same-store sales growth, underscoring its popularity and market penetration.

Alsea's strategic focus on Domino's for new unit expansion, alongside Starbucks, highlights its position as a highly profitable brand within the portfolio. This emphasis suggests Domino's holds a substantial and growing share in Mexico's quick-service restaurant market.

Domino's Pizza in Colombia

Domino's Pizza in Colombia is performing exceptionally well, demonstrating a robust 10.8% same-store sales growth in the second quarter of 2025. This impressive growth in a developing market strongly suggests its classification as a Star within Alsea's portfolio. Alsea is actively leveraging this momentum to expand its footprint and solidify its market position in Colombia.

The quick-service restaurant sector in Latin America is experiencing substantial expansion, with projections indicating continued strong growth. This favorable market environment further supports Domino's Star status in Colombia, as it is well-positioned to capitalize on increasing consumer demand.

- High Growth Rate: Domino's Pizza in Colombia achieved 10.8% same-store sales growth in Q2 2025.

- Market Position: Its performance designates it as a Star in Alsea's BCG Matrix.

- Market Opportunity: The quick-service restaurant market in Latin America is experiencing significant growth.

- Strategic Focus: Alsea is likely prioritizing expansion and market share capture in Colombia.

Alsea's Digital Channels

Alsea's digital channels are a significant growth engine, demonstrating a strong market position. In Q2 2025, these channels accounted for a substantial 38.6% of tender, translating to an impressive 35.3 million orders. This marks a notable increase from the 30.3% share observed in Q1 2024, underscoring the rapid adoption and expanding influence of digital ordering across Alsea's brand portfolio.

The company's strategic focus for 2025 heavily emphasizes continued investment in its digital ecosystem and loyalty initiatives. This commitment is designed to further enhance customer engagement and drive increased foot traffic to physical store locations, solidifying Alsea's competitive edge in the evolving food service landscape.

- Digital Channel Growth: 38.6% of tender in Q2 2025.

- Order Volume: 35.3 million orders via digital channels in Q2 2025.

- Year-over-Year Increase: Digital tender share grew from 30.3% in Q1 2024.

- Strategic Priority: Continued investment in digital strategy and loyalty programs for 2025.

Starbucks in Mexico and Domino's Pizza in both Mexico and Colombia are prime examples of Stars within Alsea's portfolio. These brands exhibit strong same-store sales growth, with Starbucks Mexico showing 8.7% in Q2 2024 and Domino's Colombia achieving 10.8% in Q2 2025. Their significant market share and Alsea's strategic expansion plans, like investing $12 million in 30 new Starbucks in Colombia, solidify their status as high-growth, high-market-share entities. The overall growth in Latin America's quick-service restaurant sector further bolsters their potential.

| Brand | Market | Q2 2025 Same-Store Sales Growth | Q2 2024 Same-Store Sales Growth | Key Strategic Action |

| Starbucks | Mexico | 3.8% | 8.7% | Continued new store openings, 844 stores total. |

| Starbucks | Colombia | 9.7% | 27% | $12M investment for 30 new stores over 3 years. |

| Domino's Pizza | Mexico | 8.9% | N/A | Strategic focus for new unit expansion. |

| Domino's Pizza | Colombia | 10.8% | N/A | Expansion and market position solidification. |

What is included in the product

The Alsea BCG Matrix analyzes its business units based on market share and growth to guide investment decisions.

Alsea BCG Matrix: A clear visual of your portfolio's health, reducing the pain of strategic uncertainty.

Cash Cows

Alsea's full-service restaurants in Mexico, featuring brands like Vips and Chili's, are strong cash cows. These established brands demonstrated robust performance with 5.9% same-store sales growth in Q2 2025 and 3.9% in Q4 2024, reflecting their significant market share in a mature segment.

The consistent revenue generation from Vips and Chili's provides stable cash flow for Alsea. The company's strategic investments, including new openings in key locations such as the State of Mexico, aim to sustain their market leadership and productivity.

Mexico stands as Alsea's foundational Cash Cow, representing a substantial 54.6% of its consolidated sales in the second quarter of 2025. This mature market continues to demonstrate robust performance, with sales growth reaching 9.1% during the same period.

Despite not always leading in growth rates, Mexico's sheer scale and deep-rooted brand loyalty across various dining segments solidify Alsea's high market share and consistent, significant cash flow generation. The company's strategic investment focus remains on Mexico, ensuring its market leadership and operational efficiency are maintained.

Starbucks in Spain and Portugal represents a stable, mature market for Alsea. Despite broader European segment challenges, these operations contribute meaningfully to overall European revenue, highlighting their established position.

The coffee shop sector in Europe saw 2.5% same-store sales growth in Q2 2025. This suggests a steady, mature market where Starbucks in Spain and Portugal likely benefits from a high market share, requiring minimal aggressive investment for expansion, characteristic of a Cash Cow.

Domino's Pizza in Spain

Domino's Pizza in Spain represents a classic Cash Cow for Alsea. This market, while mature, consistently generates substantial cash flow due to its established presence and operational efficiencies. In Q2 2025, it posted a 1.9% same-store sales growth, a testament to its stability compared to Alsea's higher-growth brands.

Despite this more modest growth rate, Domino's Spain remains a vital contributor to Alsea's overall financial health. Its mature market position means it requires less aggressive marketing or expansion investment, allowing it to efficiently convert revenue into profit. Alsea's continued, albeit measured, expansion of the brand across Europe underscores its value as a reliable cash generator.

- Established Market Share: Domino's Spain benefits from a strong, recognized brand presence, ensuring consistent customer demand.

- Operational Efficiencies: Mature operations likely lead to optimized supply chains and cost management, boosting profitability.

- Consistent Cash Flow: The brand's stability translates into predictable and significant cash generation for Alsea.

- Lower Investment Needs: As a Cash Cow, it requires minimal capital expenditure compared to growth-stage brands.

Burger King in Argentina, Chile, and Colombia

Burger King's presence in Argentina, Chile, and Colombia under Alsea's management is a prime example of a Cash Cow in the BCG Matrix. Despite challenges faced by the brand in other regions like Mexico, Alsea remains committed to expanding its footprint in these South American markets.

These established markets are likely characterized by Burger King's strong brand recognition and Alsea's proven operational efficiency, enabling consistent revenue generation. While explosive growth might not be the primary driver, the steady cash flow supports other, more dynamic business ventures within Alsea's portfolio.

- Market Stability: Argentina, Chile, and Colombia offer a stable operating environment for Burger King, allowing for predictable cash flow generation.

- Brand Loyalty: The global appeal of Burger King, combined with Alsea's localized strategies, fosters strong customer loyalty in these countries.

- Operational Efficiency: Alsea's expertise in managing fast-food chains translates into optimized operations, maximizing profitability from existing Burger King outlets.

- Portfolio Support: The consistent cash flow from these Burger King operations helps fund Alsea's investments in higher-growth potential brands or markets.

Alsea's Cash Cows are its mature, high-market-share brands that generate significant, stable cash flow with minimal investment. These businesses, like Vips and Chili's in Mexico, and Starbucks in Spain and Portugal, represent the backbone of Alsea's financial stability.

These operations consistently contribute to Alsea's revenue, allowing the company to fund investments in other, more dynamic parts of its portfolio. For instance, Mexico, Alsea's foundational market, accounted for 54.6% of consolidated sales in Q2 2025, with sales growth reaching 9.1% in the same period.

Domino's Pizza in Spain is another key Cash Cow, showing 1.9% same-store sales growth in Q2 2025, demonstrating its reliable cash generation despite more modest growth rates.

Burger King in markets like Argentina, Chile, and Colombia also functions as a Cash Cow, benefiting from strong brand recognition and Alsea's operational efficiencies to provide consistent cash flow.

| Brand/Market | Category | Q2 2025 Same-Store Sales Growth | Key Contribution |

|---|---|---|---|

| Vips/Chili's (Mexico) | Full-Service Restaurants | 5.9% | High Market Share, Stable Cash Flow |

| Starbucks (Spain & Portugal) | Coffee Shops | 2.5% (European Segment) | Established Presence, Predictable Revenue |

| Domino's Pizza (Spain) | Pizza Delivery/Takeaway | 1.9% | Operational Efficiencies, Consistent Profitability |

| Burger King (Argentina, Chile, Colombia) | Fast Food | N/A (Focus on stability) | Brand Loyalty, Portfolio Support |

Delivered as Shown

Alsea BCG Matrix

The Alsea BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, is ready for immediate download and integration into your business planning. You can trust that the professional formatting and insightful data presented here are exactly what you will gain access to, ensuring no surprises and a seamless transition to actionable insights.

Dogs

Alsea's Burger King operations in Mexico are showing signs of weakness, with same-store sales dropping 6.8% in the second quarter of 2025. This performance suggests a challenging environment for these locations, potentially indicating a lower market share or facing intense competition within the Mexican fast-food sector.

Given these declining sales and Alsea's decision to halt master franchise development for Burger King in Mexico, these outlets may be considered question marks or even dogs in the BCG matrix. They likely require significant investment to improve performance or could be candidates for restructuring or divestment to free up resources for more promising ventures.

Starbucks' operations in France and Benelux faced headwinds in early 2024, with a notable 10% year-on-year sales decline in Europe during Q2 2024. This downturn was partly attributed to consumer boycotts targeting US brands, impacting Starbucks' market position in these key European markets.

The sales dip suggests a potential shift towards a question mark or even a dog in the BCG matrix for Starbucks in France and Benelux. These regions may represent low-growth or declining market share scenarios, necessitating careful evaluation of future investment and potential turnaround strategies.

Alsea's operations in Argentina are currently navigating a difficult economic landscape characterized by peso depreciation and a slowdown in consumer spending. These headwinds have created a challenging market environment.

The impact of these conditions is evident in Alsea's performance. Excluding Argentina, Coffee Shops experienced a 6.0% contraction in same-store sales, while Quick Service saw a modest 0.3% growth in Q2 2025. This contrast underscores the specific difficulties within the Argentinian market.

Given the low growth and significant challenges present, Alsea's Argentinian segment aligns with the characteristics of a Dog in the BCG matrix. The market conditions are not conducive to substantial expansion or high returns at this time.

Divested Burger King Spain Units

Alsea's divestment of 54 Burger King units in Spain in December 2024 aligns with a strategic portfolio optimization. This move suggests these particular operations were likely categorized as Dogs within the BCG matrix, indicating low market share and low growth potential, prompting their exit to enhance overall profitability and efficiency.

The sale of these Spanish Burger King locations points to a deliberate shift in Alsea's strategic focus. By divesting underperforming assets, Alsea aims to reallocate resources towards more promising ventures, thereby strengthening its market position and improving financial performance in its core operations.

- Divestment Rationale: The sale of 54 Burger King units in Spain in December 2024 was a strategic decision to exit underperforming assets.

- BCG Classification: These divested units likely represented 'Dogs' in Alsea's portfolio, characterized by low market share and low growth.

- Strategic Focus: The move allows Alsea to concentrate on profitability and operational efficiency in its remaining markets.

- Portfolio Optimization: This action is part of a broader strategy to streamline operations and enhance overall financial health.

Burger King Operations in Chile

Burger King's performance in Chile mirrors some of the challenges seen elsewhere, positioning it as a potential Dog in Alsea's portfolio. In the second quarter of 2025, same-store sales saw a decline of 5.1%.

This negative growth is a strong indicator of a market segment that is underperforming. Such a trend suggests that Burger King Chile may be losing ground to competitors or facing broader economic pressures impacting consumer spending on fast food.

The segment's struggling performance necessitates a thorough review. Decisions regarding future capital allocation or potential operational adjustments will be critical for this business unit.

- Burger King Chile Same-Store Sales (Q2 2025): -5.1%

- Implication: Indicates a struggling market segment.

- Strategic Consideration: Requires evaluation for investment or restructuring.

Alsea's Burger King operations in Mexico and Chile, along with its Argentinian segment, are exhibiting characteristics of Dogs in the BCG matrix. These units are experiencing declining or stagnant same-store sales, such as Burger King Chile's 5.1% drop in Q2 2025, indicating low market share and growth potential.

The divestment of 54 Burger King units in Spain in December 2024 further supports this classification, as these were likely underperforming assets. Starbucks' operations in France and Benelux also show potential Dog status due to a 10% sales decline in Europe during Q2 2024, exacerbated by consumer boycotts.

| Business Unit | Region | Metric | Value | BCG Classification |

| Burger King | Mexico | Same-Store Sales (Q2 2025) | -6.8% | Dog |

| Burger King | Chile | Same-Store Sales (Q2 2025) | -5.1% | Dog |

| Starbucks | France & Benelux | European Sales Decline (Q2 2024) | -10.0% | Potential Dog |

| Alsea Operations | Argentina | Market Conditions | Challenging (Peso Depreciation, Spending Slowdown) | Dog |

| Burger King | Spain | Divested Units (Dec 2024) | 54 | Dog |

Question Marks

Alsea's strategic move to introduce Chipotle Mexican Grill into Mexico, with initial openings slated for early 2026, positions the brand as a nascent player in a potentially lucrative market. This development agreement marks Alsea's entry into a segment where it currently holds no market share, signifying a bold step into a high-growth territory.

The venture into Mexico for Chipotle, under Alsea's operational umbrella, represents a significant investment. While the potential for Chipotle to evolve into a "Star" within Alsea's portfolio is substantial, it necessitates considerable capital expenditure and robust marketing efforts to build brand awareness and capture market share in a competitive landscape.

Alsea launched Starbucks' inaugural store in Paraguay in April 2023, signifying the brand's debut in a fresh Latin American territory. This move positions Starbucks as a Question Mark within Alsea's portfolio, indicating potential for significant growth but with an currently unestablished market presence.

Paraguay represents an emerging market with promising expansion opportunities for Starbucks. However, as of its entry, the brand's market share and consumer recognition are still in the early stages of development, characteristic of a Question Mark. Alsea's strategic objective is to cultivate this nascent market, aiming to transition Starbucks from a Question Mark to a Star performer through continued investment and brand building.

Alsea's strategy of opening new stores in underdeveloped regions, particularly in the State of Mexico with an investment exceeding MX$300 million by the end of 2025 for around 15 new locations, aligns with the concept of Stars or Question Marks within the BCG Matrix. These ventures are designed to capture nascent market share in areas with significant growth potential, even if some of Alsea's brands are mature overall.

Strategic Digital Transformation Initiatives

Alsea's strategic digital transformation initiatives are crucial for its future growth, aligning with its investment in new digital tools and enhanced loyalty programs for 2025. These efforts are designed to boost store traffic and elevate the customer experience.

Digital sales already represent a substantial portion of Alsea's revenue, and the company is further investing in this area. These new initiatives are considered Stars within the BCG matrix, signifying high-growth potential and a need for continued investment to secure market share and streamline operations.

- Digital Investment: Alsea is channeling significant resources into digital tools and loyalty programs, aiming for a robust digital strategy by 2025.

- Growth Drivers: These digital advancements are key to increasing foot traffic and improving overall customer satisfaction.

- Star Category: New digital initiatives are classified as Stars due to their high growth prospects and potential to capture greater market share.

- Operational Optimization: Continuous support for these digital ventures is essential for realizing their full potential in optimizing business operations.

Expansion of Other Brands into New European Countries

Alsea's strategic expansion into new European markets, targeting 400 new establishments by 2025, positions several of its brands for potential "question mark" status within the BCG matrix. This initiative focuses on countries like France, the Netherlands, Belgium, Luxembourg, Portugal, and Spain.

Brands being introduced to these new territories, or those with a nascent presence in specific high-growth regions within existing European markets, represent the question mark category. These ventures require significant investment to capture market share, mirroring the typical characteristics of question mark businesses.

For instance, while Starbucks is a well-established player for Alsea in Europe, introducing a brand like Domino's Pizza or expanding a less dominant brand into a new city within France where its current market share is low but growth prospects are high, fits the question mark profile. These moves are characterized by high market growth but low relative market share.

- High Market Growth: The targeted European countries exhibit strong potential for restaurant sector growth, driven by evolving consumer preferences and increasing disposable incomes.

- Low Market Share: Alsea aims to establish or significantly increase market share for specific brands in these new or underdeveloped regions.

- Investment Required: Substantial capital will be allocated to marketing, operations, and infrastructure to build brand awareness and customer loyalty.

- Uncertain Future: The success of these expansions hinges on market reception and competitive landscape, making their future cash flow generation uncertain, a hallmark of question marks.

Question Marks in Alsea's portfolio represent brands or ventures in high-growth markets where the company currently has a low market share. These require significant investment to foster growth and potentially become Stars. The expansion into Paraguay with Starbucks, for example, fits this profile, as does the planned introduction of Chipotle into Mexico.

Alsea's strategy for these Question Marks involves substantial capital allocation for marketing and operational development to build brand recognition and capture market share. The success of these ventures is not guaranteed, reflecting the inherent uncertainty of Question Marks in the BCG matrix.

By 2025, Alsea aims to establish a significant presence in new European markets, targeting 400 new establishments. Brands entering these territories, or those with minimal presence in high-potential regions within existing markets, are considered Question Marks, needing investment to gain traction against established competitors.

The digital transformation initiatives, while classified as Stars due to their high growth potential, also have elements of Question Marks in their early stages of implementation, requiring focused investment to ensure they achieve their projected market impact by 2025.

| Brand/Venture | Market Growth | Relative Market Share | Investment Need | Potential Outcome |

| Starbucks in Paraguay | High | Low | High | Star |

| Chipotle in Mexico | High | Low | High | Star |

| New European Market Entry (e.g., Domino's in France) | High | Low | High | Star |

| Digital Initiatives (early stage) | High | Low | High | Star |

BCG Matrix Data Sources

Our Alsea BCG Matrix is constructed using a blend of Alsea's official financial reports, industry-specific market research, and competitor performance data to provide a comprehensive view.