Masraf Al Rayan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Masraf Al Rayan Bundle

Masraf Al Rayan's robust financial foundation and strategic diversification present significant strengths, but understanding its market vulnerabilities and competitive pressures is crucial for informed decision-making. Our comprehensive SWOT analysis delves into these critical areas, offering actionable insights for investors and strategists alike.

Want the full story behind Masraf Al Rayan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Masraf Al Rayan showcases a robust financial standing, underscored by its 2024 net profit of QR1,507 million, a 3.8% increase from the previous year. This consistent profitability is further evidenced by its H1 2024 net profit of QAR 789 million.

The bank's capitalization is exceptionally strong, with a capital adequacy ratio of 23.92% in 2024, rising to 25.5% by Q1 2025. These figures comfortably surpass regulatory mandates, providing a solid foundation for future expansion and resilience against market fluctuations.

Masraf Al Rayan's deep expertise in Sharia-compliant finance is a significant strength, catering to a substantial and expanding market segment that prioritizes ethical financial solutions. This inherent alignment with Islamic principles naturally resonates with global Environmental, Social, and Governance (ESG) considerations.

Further demonstrating this commitment, Masraf Al Rayan became the first Sharia-compliant bank in Qatar to join the Partnership for Carbon Accounting Financials (PCAF) and successfully executed the inaugural Islamic ESG KPI-linked repo transaction, showcasing tangible action in the ESG space.

Masraf Al Rayan boasts a comprehensive suite of Sharia-compliant financial products, spanning retail banking, corporate services, treasury operations, and a variety of investment avenues. This broad spectrum of offerings is a significant strength, allowing the bank to serve a wide and diverse client base, from individual customers to large corporations and institutional investors.

This diversification in both products and clientele is crucial for stability. For instance, as of the first quarter of 2024, Masraf Al Rayan reported a net profit of QAR 550 million, demonstrating its ability to generate consistent revenue across its various business lines, thereby mitigating risks associated with over-reliance on any single market segment.

Strategic Digital Transformation Initiatives

Masraf Al Rayan's strategic digital transformation initiatives are a key strength, underscored by its rebranding to AlRayan Bank and the late 2024 launch of its mobile banking app, 'AlRayan Go.' This proactive embrace of advanced digital tools is designed to significantly elevate the customer experience and streamline operations.

The bank's commitment to digital enhancement is evident in its focus on integrating cutting-edge solutions. This strategic pivot aims to solidify its competitive position within the rapidly evolving digital banking sector.

- Digital Transformation Focus: Rebranding to AlRayan Bank and launching 'AlRayan Go' mobile app in late 2024.

- Customer Experience Enhancement: Integrating advanced digital tools to improve user interaction and service delivery.

- Operational Efficiency: Leveraging technology to streamline internal processes and reduce operational costs.

- Future Growth Positioning: Adapting to the digital banking landscape to capture future market opportunities.

Strong Credit Rating and Alignment with National Vision

Masraf Al Rayan benefits from a robust credit profile, evidenced by Moody's reaffirmation of its A2/P-1 credit rating with a stable outlook in May 2024. This strong financial standing provides a solid foundation for its operations and growth initiatives.

The bank's strategic importance is further highlighted by the significant ownership stake held by Qatari government entities, exceeding 30% of its shares. This backing signifies alignment with national economic priorities and provides a degree of stability.

Furthermore, Masraf Al Rayan's strategic direction is closely integrated with Qatar National Vision 2030 and the Third Financial Sector Strategic Plan. This alignment ensures its activities contribute directly to the nation's broader economic and social development goals.

- Strong Credit Rating: Moody's confirmed A2/P-1 rating with a stable outlook in May 2024.

- Government Backing: Over 30% shareholding by Qatari government entities.

- National Alignment: Strategic direction supports Qatar National Vision 2030 and the Third Financial Sector Strategic Plan.

Masraf Al Rayan's financial performance is a key strength, demonstrated by its Q1 2025 capital adequacy ratio of 25.5%, significantly above regulatory requirements. This robust capitalization, coupled with a net profit of QR1,507 million in 2024, up 3.8% from the prior year, highlights its stability and capacity for growth.

The bank's deep specialization in Sharia-compliant finance is a major advantage, appealing to a growing segment of the market that values ethical investments. This focus aligns well with global ESG trends, further enhanced by its role as the first Sharia-compliant bank in Qatar to join the Partnership for Carbon Accounting Financials (PCAF).

Masraf Al Rayan offers a comprehensive range of Sharia-compliant products across retail, corporate, and investment banking, serving a diverse client base. This broad product and customer diversification, reflected in its Q1 2024 net profit of QAR 550 million, contributes to its financial resilience.

The bank's strategic digital transformation, including its rebranding to AlRayan Bank and the late 2024 launch of the 'AlRayan Go' mobile app, positions it strongly in the evolving digital banking landscape and aims to significantly enhance customer experience.

| Metric | 2024 | Q1 2025 |

| Net Profit (QR millions) | 1,507 | 789 (H1 2024) |

| Capital Adequacy Ratio (%) | 23.92 | 25.5 |

What is included in the product

Delivers a strategic overview of Masraf Al Rayan’s internal and external business factors by identifying its strengths, weaknesses, opportunities, and threats.

Uncovers hidden strengths and weaknesses in Masraf Al Rayan's strategy, proactively addressing potential market challenges.

Weaknesses

Masraf Al Rayan's significant concentration within the Qatari market presents a notable weakness. Despite having international operations, a substantial portion of its business and assets remain anchored in Qatar. This geographical focus exposes the bank to heightened sensitivity to domestic economic shifts, regulatory changes, and specific market conditions prevalent within the nation.

For instance, as of the first quarter of 2024, Masraf Al Rayan's total assets stood at QAR 123.5 billion, with a significant majority of its financing and investment activities likely concentrated within Qatar's borders. This reliance on a single, albeit strong, domestic market limits the bank's ability to broadly diversify its geographical risk, making its overall financial performance more susceptible to Qatari-specific challenges.

Masraf Al Rayan faces significant pressure in Qatar's banking landscape, contending with both conventional banks offering Islamic services and robust Islamic banking competitors. This fierce rivalry can hinder customer growth, squeeze profit margins, and necessitate consistent innovation in offerings. For instance, as of Q1 2024, the total assets of Qatar's banking sector grew by 4.3% year-on-year, indicating a dynamic but crowded market where differentiation is key.

Masraf Al Rayan's share price experienced a 7% drop in 2024, lagging behind competitors. This underperformance signals investor concern and a potential disconnect between the bank's valuation and its market perception.

The bank's tangible Return on Equity (RoE) for fiscal year 2024 was reported at 6.5%. This figure is considerably lower than the approximately 16% RoE observed before its merger, indicating that profitability relative to shareholder equity has not yet reached prior levels despite reported profit increases.

Ongoing Asset Quality Management Requirements

While Masraf Al Rayan demonstrated positive movement in asset quality during 2024, evidenced by a reduction in Stage 2 loans, the bank continues to proactively strengthen its provisioning for Stage 3 loans. This ongoing effort highlights the persistent need for diligent management of non-performing assets and the maintenance of adequate loan loss reserves.

The bank's cost of risk (CoR) is projected to stay elevated through the near to medium term, reflecting the continued focus on asset quality and potential economic headwinds. This suggests that profitability may be impacted by increased provisioning expenses.

- Asset Quality Focus: Masraf Al Rayan is actively building buffers for Stage 3 loan coverage, indicating a strategic emphasis on managing impaired assets.

- Stage 2 Loan Reduction: The bank saw a decrease in Stage 2 loans in 2024, a positive sign for asset quality improvement.

- Elevated Cost of Risk: The cost of risk is expected to remain high in the short to medium term, requiring ongoing attention to provisioning.

Potential for Slower Technology Adoption Pace

Masraf Al Rayan, like many established financial institutions, may experience a slower pace in adopting new technologies compared to nimble FinTech startups. This can create a digital divide, potentially hindering its capacity to roll out the most advanced digital financial services as swiftly as its more tech-centric competitors. For instance, while Masraf Al Rayan reported significant investments in digital transformation in its 2023 financial statements, keeping pace with the relentless innovation cycle in the financial technology sector demands ongoing, substantial capital outlay.

This challenge is exacerbated by the need to integrate new technologies with legacy systems, a common hurdle for traditional banks. The agility of FinTechs, unburdened by extensive existing infrastructure, allows them to pivot and implement cutting-edge solutions more readily. Consequently, Masraf Al Rayan might find itself playing catch-up in offering certain state-of-the-art digital banking features.

- Digital Divide: Traditional banks may lag behind agile FinTechs in offering the latest digital solutions.

- Integration Challenges: Legacy systems can slow down the adoption of new technologies.

- Investment Demands: Keeping pace with rapid technological advancements requires continuous and significant financial investment.

Masraf Al Rayan's profitability metrics present a weakness, with its tangible Return on Equity (RoE) for fiscal year 2024 standing at 6.5%. This figure is notably lower than the approximately 16% RoE observed before its merger, indicating that shareholder equity is not yet generating returns at prior levels despite reported profit increases.

The bank's share price performance in 2024 also signals concern, having experienced a 7% drop and lagging behind competitors. This underperformance suggests potential investor apprehension or a disconnect between the bank's valuation and market perception.

Furthermore, the cost of risk (CoR) is projected to remain elevated through the near to medium term. This sustained high CoR reflects ongoing efforts to manage asset quality and potential economic headwinds, which could continue to impact profitability through increased provisioning expenses.

The bank's tangible RoE for FY2024 was 6.5%, a significant drop from pre-merger levels. Its share price fell 7% in 2024, indicating market underperformance. The cost of risk is expected to stay elevated, requiring continued focus on provisioning.

| Metric | FY2024 Value | Pre-Merger Comparison |

|---|---|---|

| Tangible RoE | 6.5% | ~16% |

| Share Price Performance (2024) | -7% | Lagging competitors |

| Cost of Risk (Projected) | Elevated (Near-to-Medium Term) | Ongoing provisioning impact |

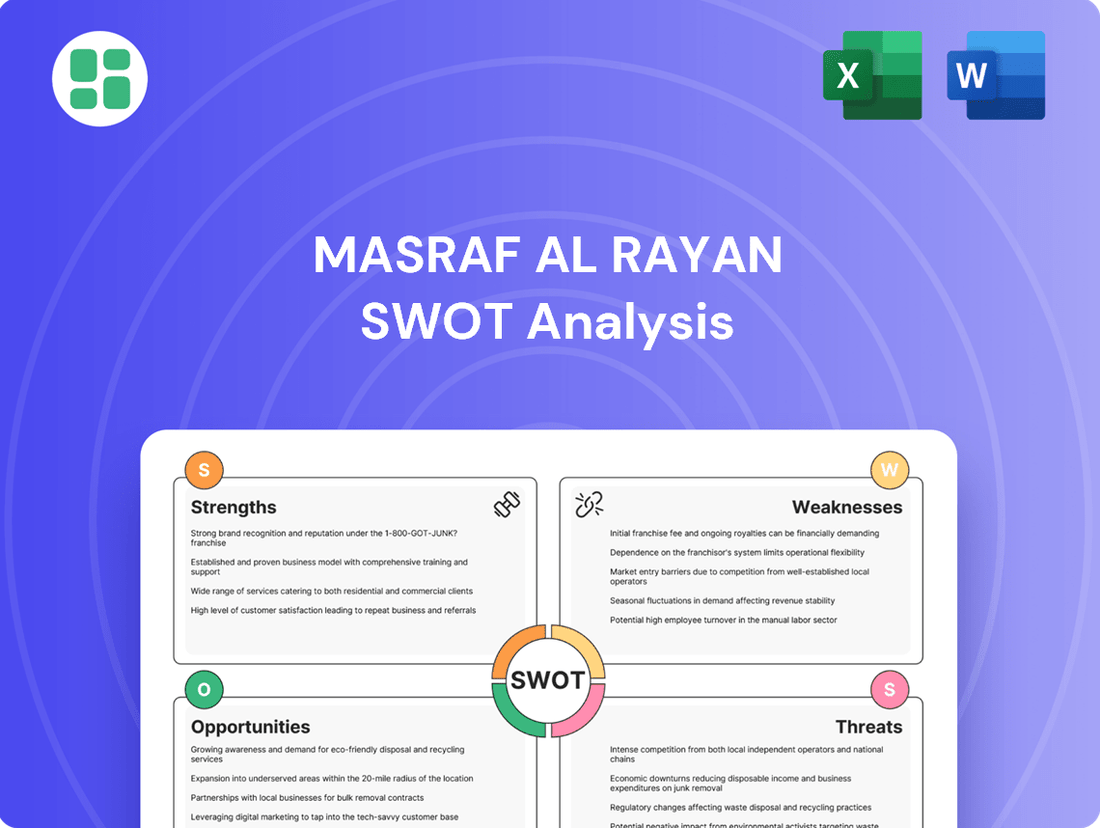

Preview Before You Purchase

Masraf Al Rayan SWOT Analysis

The preview you see is the actual Masraf Al Rayan SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Masraf Al Rayan SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for strategic planning.

You’re viewing a live preview of the actual Masraf Al Rayan SWOT analysis file. The complete, in-depth version becomes available immediately after checkout.

Opportunities

The global Islamic finance sector is on a significant upward trajectory, with projections indicating assets could reach between $4.94 trillion and $5 trillion by 2025. This expansion, coupled with an anticipated 9-10% growth rate in 2025, offers Masraf Al Rayan a prime opportunity to broaden its reach. The increasing global appetite for Sharia-compliant financial solutions presents a fertile ground for the bank to capture new market share.

The financial sector's relentless digital transformation, bolstered by Qatar Central Bank's forward-thinking FinTech Strategy, presents a fertile ground for Masraf Al Rayan. This environment is ripe for innovation, with a particular emphasis on leveraging technology to improve customer interactions and operational efficiency.

Masraf Al Rayan's established 'Innovation Lab' and its collaboration with the Qatar Financial Centre Authority (QFCA) are key assets. These initiatives can be instrumental in developing cutting-edge digital products and services, thereby enhancing the overall customer journey and exploring the potential of digital assets.

By strategically adopting emerging technologies such as artificial intelligence and blockchain, Masraf Al Rayan can unlock significant gains in operational efficiency and create novel revenue streams. For instance, the global FinTech market was valued at over $2.4 trillion in 2023 and is projected to grow substantially, indicating a vast opportunity for early adopters.

Masraf Al Rayan is well-positioned to benefit from the expanding sustainable and green Islamic finance sector. The core principles of Islamic finance naturally align with Environmental, Social, and Governance (ESG) criteria, a trend gaining significant global traction. By focusing on and promoting green sukuk and other environmentally conscious investment products, the bank can attract a growing segment of socially responsible investors.

Leveraging Qatar's Economic Diversification and Strategic Plans

Qatar's commitment to economic diversification, as outlined in the Third Financial Sector Strategic Plan (2023-2030) and Qatar National Vision 2030, presents a significant opportunity. The plan specifically targets the growth of the financial services sector, with a keen eye on Islamic finance, an area where Masraf Al Rayan is a key player. This national focus translates into a supportive environment for growth initiatives.

Masraf Al Rayan can capitalize on this by aligning its strategies with these national objectives, potentially attracting government backing and increased investment in non-hydrocarbon industries. This strategic alignment fosters a stable and expansionary operating landscape for the bank.

- Government Support: Qatar's national plans actively promote financial sector development, creating a favorable climate for institutions like Masraf Al Rayan.

- Islamic Finance Focus: The emphasis on Islamic finance within national strategies directly benefits Masraf Al Rayan's core business model and growth potential.

- Non-Hydrocarbon Growth: Diversification efforts mean increased investment and activity in sectors beyond oil and gas, opening new avenues for financial services.

- Stable Operating Environment: National economic planning provides a predictable and growth-oriented framework, reducing uncertainty for strategic planning.

Attracting International Investment into Qatar

Masraf Al Rayan's proactive engagement in attracting international investment presents a compelling opportunity. The bank's specialized financing program for non-residents investing in Qatar's real estate, coupled with international roadshows, notably in the UK, demonstrates a clear strategy to tap into foreign capital. This initiative is particularly timely, as Qatar aims to diversify its economy and attract foreign direct investment (FDI) into key sectors.

Facilitating these international capital flows directly benefits Masraf Al Rayan by expanding its financing activities and bolstering its overall asset base. For instance, Qatar's FDI inflows reached an estimated $10.0 billion in 2023, according to the UN Conference on Trade and Development (UNCTAD), indicating a receptive environment for such initiatives. By acting as a conduit for this capital, Masraf Al Rayan can enhance its market position and profitability.

- Targeted Financing Programs: Masraf Al Rayan's specialized financing for non-resident real estate investors directly addresses a key market segment.

- International Outreach: Roadshows in markets like the UK are crucial for building awareness and trust among foreign investors.

- Economic Diversification Alignment: The bank's efforts align with Qatar's national vision to attract FDI and reduce reliance on hydrocarbons.

- Asset Growth Potential: Successful attraction of international capital will lead to increased lending and a larger, more diversified asset portfolio for the bank.

The global Islamic finance market is projected to reach between $4.94 trillion and $5 trillion by 2025, with an expected 9-10% growth rate in 2025, presenting a substantial opportunity for Masraf Al Rayan to expand its market share and cater to the increasing demand for Sharia-compliant financial products worldwide.

Leveraging Qatar Central Bank's FinTech Strategy, Masraf Al Rayan can drive innovation in digital banking, enhancing customer experience and operational efficiency through its 'Innovation Lab' and collaborations, tapping into the growing FinTech market valued at over $2.4 trillion in 2023.

Masraf Al Rayan is well-positioned to benefit from the growth in sustainable and green Islamic finance, as its principles align with ESG criteria, allowing it to attract socially responsible investors by offering green sukuk and environmentally conscious products.

Qatar's national economic diversification plans, particularly the Third Financial Sector Strategic Plan (2023-2030) and Qatar National Vision 2030, create a supportive environment for Masraf Al Rayan to grow its Islamic finance offerings and contribute to non-hydrocarbon sector development, potentially attracting government support.

The bank's efforts to attract international investment, including specialized financing for non-residents and international roadshows, align with Qatar's goal to boost FDI, which reached an estimated $10.0 billion in 2023, offering Masraf Al Rayan opportunities to expand its asset base and market position.

Threats

Masraf Al Rayan is increasingly threatened by large conventional banks that are actively developing Sharia-compliant offerings. These established institutions leverage their substantial financial muscle and widespread branch networks, often with existing customer loyalty, to compete directly. For instance, many global and regional conventional banks have launched dedicated Islamic banking windows or subsidiaries, aiming to capture a share of the growing Islamic finance market, which reached an estimated USD 4.9 trillion globally in 2023, with projections for continued growth.

This intensified competition means conventional banks can offer competitive pricing and a broader range of Islamic financial products, potentially drawing customers away from dedicated Islamic banks like Masraf Al Rayan. The challenge for Masraf Al Rayan is to continuously innovate its product suite and maintain competitive pricing strategies to retain and grow its market share against these well-resourced rivals.

The global Islamic finance sector continues to face challenges due to a fragmented regulatory environment, with differing interpretations of Sharia principles across various countries. This inconsistency can elevate compliance burdens and complicate cross-border activities for institutions like Masraf Al Rayan. For instance, the Islamic Financial Services Board (IFSB) actively works on standardization, but the pace of adoption varies significantly.

The evolving nature of regulations, coupled with the potential introduction of new standards like Sharia Standard 62, poses a threat by potentially disrupting established markets, particularly the sukuk sector. Such changes could necessitate significant adjustments in product offerings and operational strategies, impacting revenue streams and market competitiveness for Masraf Al Rayan.

Masraf Al Rayan's international operations are particularly vulnerable to global economic shifts, such as unpredictable oil price movements and varying interest rate landscapes. For instance, a significant drop in oil prices, a key economic driver in Qatar, could dampen overall economic activity and impact the bank's asset quality.

Heightened geopolitical tensions within the MENA region pose a substantial threat, potentially eroding investor sentiment and triggering economic slowdowns. Such instability can directly translate into higher non-performing loans for the bank, as businesses and individuals face increased financial strain.

These external economic and political uncertainties directly challenge Masraf Al Rayan's profitability and limit its potential for expansion. For example, a projected global GDP growth slowdown in 2025, as forecasted by the IMF, could further exacerbate these risks for banks with international exposure.

Disruption from Rapid Technological Advancements

The financial sector is experiencing a significant shake-up due to fast-paced technological progress. New FinTech firms and digital banks are challenging established players like Masraf Al Rayan by offering more efficient and cheaper services, often with a better user experience. This is particularly concerning as these new players tend to attract younger, digitally-minded customers.

For instance, the global FinTech market was valued at approximately $2.5 trillion in 2023 and is projected to grow substantially. This growth highlights the increasing adoption of digital financial services. Masraf Al Rayan must contend with this evolving landscape, where customer expectations for digital interaction are constantly rising.

Key challenges include:

- Staying competitive: Adapting to new technologies like artificial intelligence (AI) and blockchain is crucial to avoid falling behind.

- Customer acquisition: Attracting and retaining younger, tech-savvy demographics who may prefer digital-only banking solutions.

- Cybersecurity: The increasing reliance on digital platforms also amplifies the risk of cyber threats, requiring continuous investment in security measures.

Challenges in Maintaining Profitability Amid Market Dynamics

Islamic banks, like Masraf Al Rayan, face profitability pressures even without interest. Competition for deposits, influenced by global profit rate trends, affects the cost of funds. For instance, in 2024, rising global benchmark rates likely increased the cost of acquiring and retaining customer deposits.

Managing increasing investment account returns presents another challenge. As market conditions necessitate higher returns to attract and retain investor funds, these increased payouts can directly erode the net profit margins derived from financing activities. This dynamic requires careful balancing of revenue generation and cost management.

- Deposit Competition: Global profit rate shifts in 2024 likely intensified the competition for customer deposits, impacting Masraf Al Rayan's cost of funds.

- Investment Account Returns: Rising payouts on investment accounts in 2024 could have offset gains from financing, squeezing net profit margins.

Masraf Al Rayan faces significant threats from conventional banks launching Sharia-compliant products, leveraging their established infrastructure and customer bases. The global Islamic finance market, valued at approximately USD 4.9 trillion in 2023, presents a lucrative but increasingly competitive landscape. This intensified rivalry necessitates continuous innovation and competitive pricing to retain market share.

Regulatory fragmentation across different jurisdictions complicates cross-border operations and compliance for Islamic banks. Evolving standards, such as potential changes to Sharia Standard 62, could disrupt existing markets like sukuk, requiring strategic adjustments. Furthermore, rapid technological advancements are fueling the rise of FinTech firms and digital banks, challenging traditional players with more efficient and user-friendly services, particularly attracting younger demographics. The global FinTech market's significant growth, reaching an estimated $2.5 trillion in 2023, underscores this disruptive trend.

Profitability pressures arise from competition for deposits, influenced by global profit rate trends. For example, rising global benchmark rates in 2024 likely increased the cost of funds for Masraf Al Rayan. Simultaneously, managing increasing investment account returns to attract funds can erode net profit margins from financing activities, demanding careful financial management.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Masraf Al Rayan's official financial statements, comprehensive market research reports, and expert analyses of the banking sector. These sources provide a robust understanding of the bank's performance and its operating environment.