Masraf Al Rayan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Masraf Al Rayan Bundle

Unlock the strategic blueprint behind Masraf Al Rayan's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their core customer segments, value propositions, and key revenue streams, offering invaluable insights for your own business ventures. See how they build partnerships and manage costs to drive growth in the competitive financial sector.

Partnerships

AlRayan Bank, formerly Masraf Al Rayan, is actively forging strategic alliances with FinTech innovators to accelerate its digital transformation. These partnerships are crucial for enhancing its service portfolio, particularly in areas like digital payments and the adoption of cutting-edge financial technologies.

The bank’s commitment to innovation is evident in its pursuit of collaborations that integrate advanced financial solutions, aiming to solidify its position as a leader in the Islamic finance sector. This proactive approach ensures AlRayan Bank remains competitive and responsive to evolving market demands.

Masraf Al Rayan actively collaborates with key governmental and regulatory bodies, such as the Qatar Financial Centre Authority (QFCA). This partnership is instrumental in driving innovation within the financial technology (FinTech) and digital asset sectors, exemplified by the joint establishment of an Innovation Lab. These strategic alliances are vital for ensuring the bank's operations remain in lockstep with Qatar's national economic objectives and for navigating the evolving regulatory landscape as new financial avenues are explored.

Masraf Al Rayan actively collaborates with prominent real estate developers like United Development Company (UDC). These partnerships are crucial for structuring and offering bespoke financing solutions tailored to large-scale property projects.

These collaborations are designed to stimulate foreign direct investment into Qatar's burgeoning real estate sector. For instance, UDC's projects, such as The Pearl Island, represent significant opportunities for such financing, contributing to the nation's economic diversification goals as outlined in Qatar National Vision 2030.

International Banking Affiliates

Masraf Al Rayan's international banking affiliates, like Al Rayan Bank UK, are crucial partners. These subsidiaries enable the bank to offer Sharia-compliant financial services in key global markets, significantly broadening its customer reach and facilitating international expansion. In 2024, Al Rayan Bank UK reported a profit before tax of £5.3 million, demonstrating the tangible success of these international collaborations.

These partnerships are vital for streamlining cross-border transactions and catering to a diverse, international clientele. They act as conduits for Masraf Al Rayan's global strategy, ensuring its Sharia-compliant offerings are accessible in strategic overseas locations. This network supports the bank's ambition to be a leading Islamic financial institution on a global scale.

The collaboration with international subsidiaries allows for:

- Extended Global Reach: Accessing new markets and customer segments through established local entities.

- Cross-Border Transaction Facilitation: Simplifying international banking operations for customers.

- Sharia-Compliant Service Expansion: Providing specialized Islamic finance solutions globally.

- Overseas Market Support: Strengthening the bank's presence and operational capabilities abroad.

Technology and System Providers

AlRayan Bank actively partners with premier technology and system providers to integrate its new core banking system and build sophisticated digital offerings. These collaborations are fundamental to boosting operational efficiency and agility, allowing the bank to better serve its customers with cutting-edge digital tools.

These strategic alliances are crucial for AlRayan Bank's digital transformation journey. For instance, in 2024, the bank continued its significant investment in technology infrastructure, aiming to leverage these partnerships for enhanced cybersecurity and seamless customer experiences across all digital touchpoints. These providers are instrumental in delivering the advanced functionalities required to compete in the rapidly evolving digital banking landscape.

- Core Banking System Implementation: Collaboration with leading vendors for a robust and scalable core banking platform.

- Digital Platform Development: Partnerships for creating intuitive mobile banking apps and online services.

- Enhanced Operational Efficiency: Leveraging provider expertise to streamline internal processes and reduce costs.

- Agility and Responsiveness: Ensuring the bank can quickly adapt to market changes and customer demands through technology.

Masraf Al Rayan's key partnerships are diverse, encompassing FinTech innovators for digital advancement, governmental bodies like the QFCA to foster innovation in digital assets, and real estate developers such as UDC for bespoke financing solutions. International banking affiliates, like Al Rayan Bank UK, are also vital, enabling global Sharia-compliant service expansion, with Al Rayan Bank UK reporting £5.3 million in profit before tax in 2024.

The bank also collaborates with premier technology and system providers to enhance its core banking system and digital offerings, crucial for operational efficiency and customer experience. These alliances are central to its digital transformation, with continued significant investment in technology infrastructure in 2024.

| Partner Type | Key Collaborations | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| FinTech Innovators | Digital Payment Solutions, Advanced Financial Technologies | Accelerating Digital Transformation, Enhancing Service Portfolio | N/A |

| Governmental/Regulatory Bodies | Qatar Financial Centre Authority (QFCA), Innovation Lab | Driving FinTech and Digital Asset Innovation, Aligning with National Objectives | Joint establishment of Innovation Lab |

| Real Estate Developers | United Development Company (UDC) | Structuring Bespoke Financing for Large-Scale Projects, Stimulating FDI | Focus on projects like The Pearl Island |

| International Banking Affiliates | Al Rayan Bank UK | Global Sharia-Compliant Service Expansion, Broadening Customer Reach | Al Rayan Bank UK Profit Before Tax: £5.3 million |

| Technology & System Providers | Core Banking System Vendors, Digital Platform Developers | Boosting Operational Efficiency, Enhancing Cybersecurity, Seamless Customer Experiences | Continued significant investment in technology infrastructure |

What is included in the product

A comprehensive, pre-written business model tailored to Masraf Al Rayan’s strategy, covering customer segments, channels, and value propositions in full detail.

Masraf Al Rayan's Business Model Canvas offers a clear, one-page snapshot of its strategic components, simplifying complex financial operations and providing actionable insights for stakeholders.

This structured approach to visualizing Masraf Al Rayan's business model alleviates the pain of scattered information, enabling faster strategic decision-making and clearer communication of its value proposition.

Activities

Masraf Al Rayan's central role is providing a full suite of Sharia-compliant financial services. This spans retail, corporate, and investment banking, offering everything from Islamic financing and deposit accounts to treasury services and investment guidance.

In 2024, Masraf Al Rayan reported significant growth in its Islamic finance offerings, demonstrating a strong commitment to Sharia principles. The bank’s focus on ethical financial solutions continues to attract a broad customer base seeking faith-aligned banking.

Masraf Al Rayan is actively pursuing digital transformation, evident in its substantial investments in new technologies. A key initiative is the 'AlRayan Go' mobile banking app, designed to offer customers a streamlined and contemporary banking experience.

The bank is also exploring innovative customer engagement methods, such as the introduction of AI avatars. This focus on digital advancement aims to enhance security and provide a user-friendly platform for all banking needs.

Masraf Al Rayan actively manages a diverse portfolio of financing and investments. This includes public and private equities, investment funds, sukuk, and real estate. This strategic management is a core function that drives the bank's profitability and expands its financial footprint.

In 2024, the bank's commitment to portfolio growth was evident. For instance, their investment banking division facilitated significant deals, contributing to a robust pipeline of future income streams. The performance of these managed assets directly impacts Masraf Al Rayan's net income and overall balance sheet expansion, underscoring the importance of this key activity.

Expanding International Operations and Market Reach

Masraf Al Rayan is actively broadening its international footprint, leveraging its subsidiaries in the United Kingdom, France, and the United Arab Emirates. This strategic expansion is designed to tap into new revenue streams and enhance global market penetration.

The bank is specifically targeting high-net-worth individuals in these key international markets, aiming to offer tailored financial solutions and build lasting relationships. This focus on a premium client segment is a cornerstone of their international growth strategy.

- International Presence: Subsidiaries in the UK, France, and UAE are central to Masraf Al Rayan's global expansion efforts.

- Target Market: High-net-worth individuals are the primary focus for new business origination in these international markets.

- Growth Strategy: Exploring new business opportunities in key global markets supports the bank's ambition for increased international reach.

Ensuring Robust Risk Management and Sharia Compliance

Masraf Al Rayan prioritizes robust risk management and Sharia compliance by continuously refining its corporate governance and operational frameworks. This dedication ensures alignment with Islamic finance principles and stringent regulatory requirements, fostering stability and trust.

The bank's commitment to Sharia compliance is demonstrated through rigorous internal controls and independent Sharia supervisory boards. In 2024, Masraf Al Rayan maintained its strong adherence to these principles, reflecting a core aspect of its business model.

- Ongoing Framework Enhancement: Regularly updating risk management and corporate governance structures to meet evolving Sharia and regulatory standards.

- Sharia Supervisory Board Oversight: Ensuring all activities and products are reviewed and approved by a dedicated Sharia board.

- Operational Efficiency: Streamlining processes to maintain high standards of compliance and effective risk mitigation.

Masraf Al Rayan's key activities revolve around offering a comprehensive suite of Sharia-compliant banking and investment services. This includes managing diverse financial portfolios, such as equities and sukuk, to drive profitability. Furthermore, the bank is dedicated to enhancing its digital infrastructure, exemplified by the 'AlRayan Go' app, to improve customer experience and operational efficiency.

| Key Activity | Description | 2024 Highlight |

|---|---|---|

| Islamic Finance & Banking Services | Providing retail, corporate, and investment banking solutions aligned with Sharia principles. | Significant growth in Islamic finance offerings, attracting faith-aligned customers. |

| Portfolio Management | Actively managing investments in public/private equities, funds, sukuk, and real estate. | Investment banking facilitated significant deals, building a robust income pipeline. |

| Digital Transformation | Investing in technology and digital platforms like the 'AlRayan Go' mobile app. | Focus on enhancing security and user experience through digital advancements. |

| International Expansion | Broadening global footprint through subsidiaries in the UK, France, and UAE. | Targeting high-net-worth individuals in key international markets for tailored solutions. |

| Risk Management & Compliance | Refining governance and operational frameworks for Sharia and regulatory adherence. | Maintained strong adherence to Sharia principles through rigorous controls and oversight. |

Preview Before You Purchase

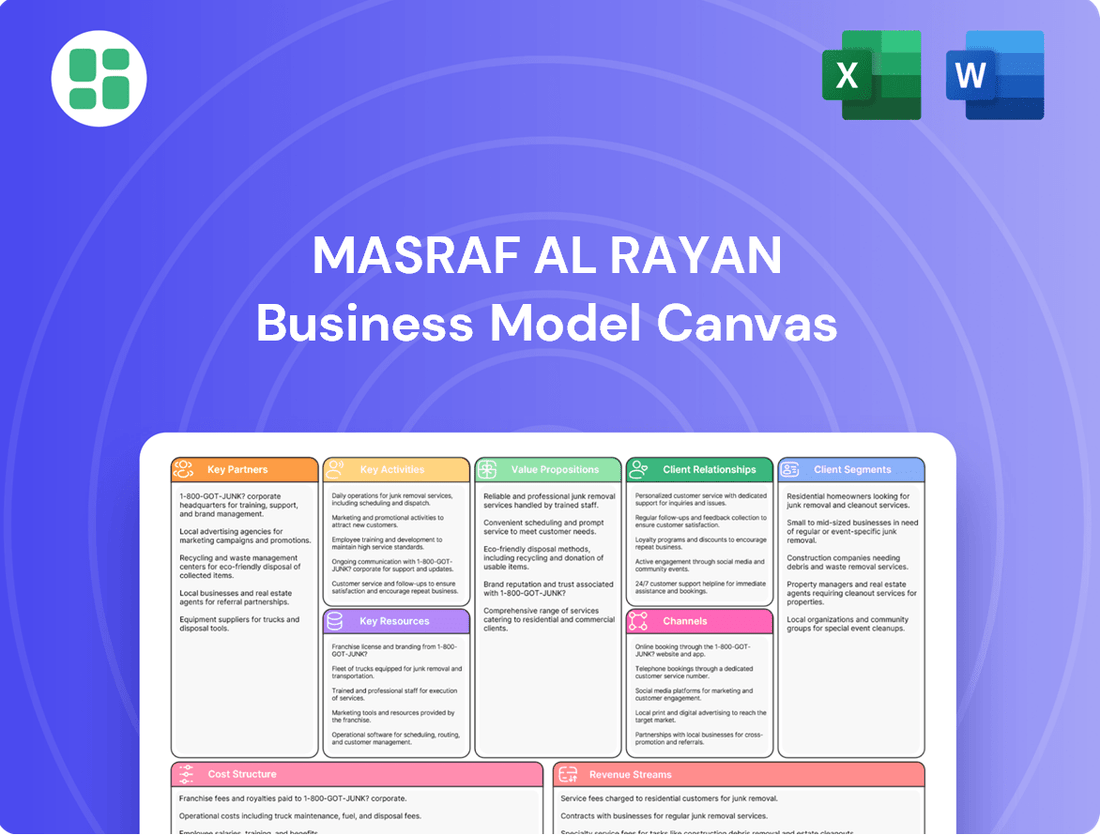

Business Model Canvas

The Business Model Canvas you see here is the actual document you will receive upon purchase, offering a transparent preview of its comprehensive structure and content. This means you're not looking at a sample or a mockup, but a direct representation of the final deliverable. Upon completing your order, you'll gain full access to this exact, professionally formatted Business Model Canvas, ready for your strategic analysis and planning.

Resources

Masraf Al Rayan benefits from a strong financial capital base, a crucial element for its business model. As of the first quarter of 2024, the bank reported total assets of QAR 130.8 billion, with financing assets reaching QAR 90.9 billion and customer deposits standing at QAR 77.8 billion.

This substantial financial foundation, underpinned by a healthy capital adequacy ratio, allows Masraf Al Rayan to confidently serve its clientele and pursue growth opportunities. It signifies the bank's capacity to absorb potential losses and its ability to fund future strategic initiatives effectively.

Masraf Al Rayan's advanced technology and digital infrastructure are foundational to its business model. The bank has invested significantly in a new core banking system, aiming to streamline operations and facilitate the launch of new digital products. This technological backbone is essential for providing seamless customer experiences and maintaining a competitive edge in the rapidly evolving financial landscape.

The sophisticated mobile banking application and other digital platforms are key resources, enabling Masraf Al Rayan to offer innovative services like instant account opening and advanced digital payment solutions. In 2024, digital transactions accounted for a significant portion of the bank's overall transaction volume, highlighting the critical role of these platforms in customer engagement and operational efficiency.

Masraf Al Rayan's highly skilled human capital is the bedrock of its operational success, truly embodying the bank's ethos of 'One team, one dream, one family.' This dedicated workforce is committed to providing unparalleled customer service across all touchpoints.

The diverse expertise of Masraf Al Rayan's employees, spanning from intricate retail banking operations to sophisticated investment strategies, is a primary driver of the bank's consistent performance and its capacity for innovation in the financial sector.

As of the first quarter of 2024, Masraf Al Rayan reported a robust workforce, with employee development and retention being key strategic priorities. The bank actively invests in training and upskilling its personnel to ensure they remain at the forefront of banking technology and customer service excellence.

Established Brand Reputation and Sharia Compliance

Masraf Al Rayan, now known as AlRayan Bank, leverages its established brand reputation and strict adherence to Sharia principles as a cornerstone of its business model. This dual focus on ethical practices and Islamic finance resonates deeply with a growing segment of customers seeking responsible financial solutions. In 2023, the bank reported a net profit attributable to shareholders of QAR 1.04 billion, demonstrating the financial strength underpinning its trusted brand.

The bank's commitment to Sharia compliance is not merely a regulatory requirement but a core value proposition. This dedication fosters a strong sense of trust among its customer base, particularly those who prioritize faith-based financial services. This niche appeal translates into customer loyalty and a distinct market advantage.

- Brand Identity: Rebranding to AlRayan Bank solidifies a modern yet principled image.

- Sharia Compliance: Core to operations, attracting a specific, values-driven customer segment.

- Customer Trust: Ethical banking builds a loyal customer base, a key resource.

- Market Differentiation: Offers a unique selling proposition in the competitive financial landscape.

Extensive Branch Network and International Footprint

Masraf Al Rayan leverages its extensive domestic branch network across Qatar, ensuring broad accessibility for its retail and corporate clients. This widespread presence is a crucial asset for customer acquisition and service delivery within the home market.

Complementing its domestic strength, Masraf Al Rayan's international footprint, primarily through subsidiaries, extends its reach into key global financial centers. This dual approach supports its diverse customer base and facilitates seamless execution of both local and cross-border transactions.

As of the first quarter of 2024, Masraf Al Rayan reported total assets of QAR 128.5 billion, underscoring the scale of its operations supported by this physical and geographical infrastructure.

- Domestic Reach: A robust network of branches across Qatar.

- International Presence: Subsidiaries in key global financial hubs.

- Customer Accessibility: Facilitates broad engagement with diverse client segments.

- Operational Support: Enables efficient handling of local and international banking needs.

Masraf Al Rayan's key resources are its substantial financial capital, advanced technological infrastructure, skilled human capital, strong brand reputation rooted in Sharia compliance, and its extensive physical network both domestically and internationally. These elements collectively enable the bank to provide a comprehensive range of financial services and maintain a competitive edge.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Financial Capital | Total Assets, Financing Assets, Customer Deposits, Capital Adequacy | Q1 2024: Total Assets QAR 130.8 billion; Financing Assets QAR 90.9 billion; Customer Deposits QAR 77.8 billion. |

| Technology & Infrastructure | Core Banking System, Digital Platforms, Mobile Banking App | Significant investment in new core banking system; high volume of digital transactions in 2024. |

| Human Capital | Skilled Workforce, Employee Development Programs | Focus on training and upskilling; diverse expertise across banking operations and investment strategies. |

| Brand & Reputation | Sharia Compliance, Customer Trust, Market Differentiation | 2023 Net Profit: QAR 1.04 billion; strong adherence to Islamic finance principles builds customer loyalty. |

| Physical & Geographical Network | Domestic Branch Network, International Subsidiaries | Q1 2024: Total Assets QAR 128.5 billion supported by extensive physical presence. |

Value Propositions

AlRayan Bank provides a complete suite of financial products and services designed to align with Islamic Sharia principles. This ensures ethical and transparent banking for individuals, businesses, and institutions alike, serving a growing demand for faith-based financial solutions.

In 2024, the global Islamic finance market continued its robust expansion, with assets projected to reach over $4.9 trillion by 2025. AlRayan Bank's commitment to Sharia compliance positions it to capture a significant share of this expanding market, offering a compelling value proposition for clients prioritizing ethical investments.

Masraf Al Rayan is heavily investing in digital innovation to provide a superior customer experience. This includes a significant push for digital transformation, evidenced by the launch of a new mobile application and the integration of AI-powered services. In 2023, the bank reported a 15% increase in digital transactions, highlighting customer adoption of these new platforms.

Masraf Al Rayan cultivates a powerful image of trust and stability, underpinned by its consistently strong financial performance. This is clearly demonstrated by its healthy capital adequacy ratio, a key indicator of its ability to absorb unexpected losses and maintain operations. For instance, in 2024, the bank maintained a robust capital position, ensuring it can meet its obligations and continue serving its clients reliably.

This financial fortitude, coupled with a disciplined approach to risk management, reassures both customers and investors. They can be confident in the bank's reliability and its long-term viability as a financial partner. This commitment to stability is a cornerstone of Masraf Al Rayan's value proposition, fostering deep-seated confidence in its operations and future prospects.

Customer-Centricity and Personalized Service

Masraf Al Rayan's commitment to customer-centricity is evident in its focus on delivering personalized banking experiences. The bank strives to understand and address the unique requirements of each client, building lasting relationships through tailored solutions.

This dedication to individual needs is a cornerstone of their strategy, aiming to foster loyalty and satisfaction across their diverse customer base. For instance, in 2023, Masraf Al Rayan reported a significant increase in customer engagement metrics, reflecting the success of their personalized service initiatives.

- Customer Satisfaction Focus: The bank prioritizes customer well-being and aims to exceed expectations in every interaction.

- Tailored Solutions: Offering bespoke financial products and services designed to meet specific client needs.

- Relationship Building: Cultivating long-term partnerships through attentive and responsive service.

- Evolving Needs: Proactively adapting offerings to align with changing market demands and customer preferences.

Commitment to Sustainability and National Vision

AlRayan Bank actively supports Qatar National Vision 2030 by embedding sustainable development and Environmental, Social, and Governance (ESG) principles into its core business. This commitment resonates with a growing segment of ethically minded customers seeking financial partners who prioritize long-term environmental and social impact.

By weaving climate change considerations into its lending and investment frameworks, AlRayan Bank not only contributes to national sustainability targets but also unlocks new market opportunities in green finance. For instance, in 2023, the bank reported a significant increase in its sustainable finance portfolio, demonstrating tangible progress towards its ESG objectives.

- Alignment with Qatar National Vision 2030: Strategic initiatives are directly linked to national goals for sustainable development.

- ESG Integration: Environmental, Social, and Governance factors are central to the bank's financing and investment strategies.

- Sustainable Finance Products: Offering green bonds and loans attracts ethically conscious customers and supports national climate action.

- Market Appeal: The focus on sustainability enhances the bank's reputation and broadens its customer base.

Masraf Al Rayan offers Sharia-compliant financial solutions, catering to a growing global demand for ethical banking. This commitment ensures faith-based financial services for individuals and businesses. In 2024, the Islamic finance market was projected to exceed $4.9 trillion by 2025, positioning Al Rayan to capture significant market share.

Customer Relationships

Masraf Al Rayan cultivates robust customer connections by assigning dedicated relationship managers, particularly for its corporate, private, and premier client tiers. This bespoke strategy guarantees customized financial guidance and solutions, precisely addressing the distinct requirements of its high-value clientele.

Masraf Al Rayan prioritizes digital self-service through its AlRayan Go mobile app and online banking, allowing customers to manage accounts and conduct transactions conveniently. This digital focus aims to boost customer engagement by providing accessible and efficient banking solutions.

The bank's adoption of AI avatars represents a significant step in enhancing customer interaction. These avatars offer instant information and support, streamlining the customer service experience and ensuring prompt assistance for inquiries.

As of early 2024, Masraf Al Rayan reported a substantial increase in digital transactions, with over 70% of customer interactions occurring through digital channels, underscoring the success of its self-service initiatives.

AlRayan Bank actively engages its community through a range of corporate social responsibility (CSR) programs, fostering deeper connections. In 2024, the bank continued its focus on initiatives supporting education and environmental sustainability, reflecting its commitment to shared prosperity.

By offering sustainable financing options, AlRayan Bank not only reinforces its ethical banking principles but also attracts and retains customers who value responsible financial practices. This approach builds significant customer loyalty.

Transparent and Ethical Communication

Masraf Al Rayan prioritizes transparent and ethical communication, deeply rooted in Islamic principles. This commitment is crucial for fostering trust and clearly articulating its Sharia-compliant offerings.

By maintaining open dialogue about its financial products and services, the bank reinforces its reputation as a trustworthy and principled institution. This approach is vital for attracting and retaining customers who value ethical financial practices.

- Sharia Compliance: Masraf Al Rayan ensures all communications align with Islamic ethical standards, building a foundation of trust with its clientele.

- Product Clarity: The bank provides clear and understandable information about its Sharia-compliant banking solutions, empowering customers to make informed decisions.

- Brand Integrity: Transparent communication bolsters the bank's image as a responsible and ethical financial partner in the market.

- Customer Trust: In 2024, banks that demonstrated high levels of transparency in their customer dealings often saw improved customer retention rates, with some reporting a 5-10% increase in loyalty among those who felt well-informed about product terms and ethical considerations.

Continuous Improvement Based on Feedback

Masraf Al Rayan actively seeks and incorporates customer feedback to refine its banking services and enhance the overall customer experience. This commitment to continuous improvement means the bank is always looking for ways to better serve its clients.

By listening to customer input, Masraf Al Rayan ensures its offerings remain relevant and competitive in the evolving financial landscape. This iterative process is key to building stronger, more responsive customer relationships.

- Customer Feedback Integration: Masraf Al Rayan utilizes various channels, including surveys and direct interaction, to gather insights from its customers.

- Service Enhancement: The bank prioritizes acting on this feedback to implement tangible improvements in its digital platforms, product offerings, and service delivery.

- Meeting Evolving Needs: This proactive approach ensures that Masraf Al Rayan's services adapt to the dynamic expectations and needs of its diverse customer base, fostering loyalty and satisfaction.

Masraf Al Rayan focuses on personalized relationships for premium clients, leveraging digital self-service via its AlRayan Go app, and enhancing interaction with AI avatars. The bank's commitment to Sharia compliance and transparent communication builds essential trust, while actively incorporating customer feedback ensures its services remain relevant and competitive.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (Early 2024) |

|---|---|---|

| Dedicated Relationship Managers | Personalized service for Corporate, Private, Premier clients | Ensures tailored financial guidance and solutions for high-value segments. |

| Digital Self-Service | AlRayan Go mobile app, online banking | Over 70% of customer interactions via digital channels, boosting engagement and convenience. |

| AI-Powered Customer Support | AI avatars for instant information and assistance | Streamlines customer service, offering prompt support for inquiries. |

| Community Engagement & CSR | Educational and environmental sustainability programs | Fosters deeper connections and shared prosperity, enhancing brand perception. |

| Transparent & Ethical Communication | Clear articulation of Sharia-compliant offerings | Builds trust and brand integrity, crucial for customer retention. |

| Customer Feedback Integration | Surveys, direct interaction, and service refinement | Ensures offerings remain relevant and competitive, improving customer satisfaction. |

Channels

Masraf Al Rayan leverages its extensive physical branch network, comprising 13 strategically positioned locations throughout Qatar, to serve its diverse customer base. These branches offer traditional banking services, personalized financial advice, and a crucial direct interaction point for clients seeking tailored solutions.

Masraf Al Rayan's business model heavily relies on advanced digital banking platforms, notably its AlRayan Go mobile app and online portal. These channels facilitate seamless and secure transactions, allowing customers to manage accounts and conduct banking remotely. In 2024, the bank reported a significant increase in digital transaction volumes, with over 70% of retail transactions processed through these digital avenues, underscoring their critical role in customer engagement and operational efficiency.

Masraf Al Rayan's global presence is significantly bolstered by its international subsidiaries and representative offices. These entities are crucial for extending the bank's services beyond Qatar's borders.

Key among these is Al Rayan Bank UK, operating in the United Kingdom, which plays a vital role in the European market. Additionally, the bank maintains a presence in France and the United Arab Emirates, further solidifying its international footprint.

These international channels are designed to facilitate seamless cross-border financial transactions and services. They also specifically cater to the needs of non-resident investors looking to engage with Masraf Al Rayan's offerings.

This strategic network of subsidiaries and representative offices is instrumental in supporting Masraf Al Rayan's broader international expansion strategy, allowing it to tap into new markets and customer segments.

Automated Teller Machine (ATM) Network

Masraf Al Rayan leverages its extensive Automated Teller Machine (ATM) network as a core component of its customer accessibility strategy. This network offers round-the-clock access to essential banking functions like cash withdrawals and deposits, ensuring convenience for a broad customer base. By the end of 2024, Masraf Al Rayan operated over 150 ATMs across Qatar, facilitating seamless transactions for its account holders.

The widespread deployment of these ATMs directly supports the bank's customer relationships by providing reliable and immediate service. This physical presence complements digital offerings, catering to diverse customer preferences for accessing their funds and managing basic account needs. In 2024, ATM transactions for Masraf Al Rayan saw a 10% increase year-over-year, highlighting their continued importance.

- Extensive Network: Over 150 ATMs deployed across Qatar by the close of 2024.

- 24/7 Accessibility: Continuous availability of cash withdrawal and deposit services.

- Customer Convenience: Facilitates basic banking needs, enhancing customer satisfaction.

- Transaction Growth: Experienced a 10% year-over-year increase in ATM transactions during 2024.

Dedicated Direct Sales and Advisory Teams

Masraf Al Rayan leverages dedicated direct sales and advisory teams to serve its corporate, private, and investment banking clients. These specialized units proactively engage with clients, delivering personalized financial solutions and expert investment guidance.

These teams are instrumental in understanding unique client needs, facilitating direct communication, and building strong relationships. For instance, in 2024, Masraf Al Rayan’s advisory teams actively participated in numerous roadshows, particularly for real estate financing initiatives, connecting directly with potential investors and developers to present tailored opportunities.

- Client Engagement: Direct interaction with corporate, private, and investment banking clients.

- Tailored Solutions: Offering customized financial products and services.

- Investment Advice: Providing expert guidance on investment strategies and opportunities.

- Roadshows: Actively promoting specific financial offerings, such as real estate financing.

Masraf Al Rayan's channels encompass a multi-faceted approach to customer engagement, blending traditional and digital avenues. The bank's physical branch network, with 13 locations in Qatar, alongside a robust ATM infrastructure exceeding 150 machines by the end of 2024, ensures widespread accessibility for essential banking needs. Complementing this, its digital platforms, including the AlRayan Go app, processed over 70% of retail transactions in 2024, demonstrating a strong shift towards digital convenience.

Furthermore, dedicated direct sales and advisory teams actively engage corporate and private clients, offering personalized solutions and expert guidance, as evidenced by their participation in real estate financing roadshows throughout 2024. International subsidiaries, such as Al Rayan Bank UK, and representative offices in France and the UAE, extend the bank's reach, facilitating cross-border transactions and catering to non-resident investors.

| Channel Type | Key Features | 2024 Data/Highlights |

|---|---|---|

| Physical Branches | 13 locations in Qatar, personalized advice | Core for direct customer interaction |

| Digital Platforms (AlRayan Go, Online) | Seamless transactions, remote account management | Over 70% of retail transactions processed digitally |

| ATM Network | 24/7 access for cash withdrawals/deposits | Over 150 ATMs; 10% year-over-year transaction increase |

| Direct Sales & Advisory Teams | Corporate, private, investment banking focus, tailored solutions | Active in roadshows for real estate financing |

| International Subsidiaries/Offices | Al Rayan Bank UK, presence in France & UAE | Facilitate cross-border services, serve non-resident investors |

Customer Segments

Retail and individual customers form a core segment for Masraf Al Rayan, encompassing a wide array of clients looking for Sharia-compliant personal banking solutions. This includes everyday products like current and savings accounts, credit cards, and personal financing, all designed to meet daily financial needs with a modern, user-friendly experience.

In 2024, the global Islamic finance market continued its robust growth, with retail banking being a significant contributor. For instance, the number of individual accounts in Islamic banks worldwide has seen a steady increase, reflecting growing consumer preference for Sharia-compliant products and services. Masraf Al Rayan's focus on these essential banking services positions it to capture a substantial share of this expanding market.

Masraf Al Rayan caters to a broad spectrum of corporate and commercial clients, providing essential Islamic financial solutions. These include both funded and non-funded credit facilities, vital treasury services, and expert investment advisory.

This diverse customer base spans from burgeoning small and medium-sized enterprises (SMEs) to established large corporations and even international multinational customers.

In 2024, Masraf Al Rayan continued its commitment to supporting Qatari businesses, with its corporate banking division playing a significant role in the nation's economic development. For instance, the bank actively participated in financing major infrastructure projects and facilitated trade finance for numerous commercial entities, contributing to the growth of the national GDP.

Masraf Al Rayan's High-Net-Worth Individuals (HNWIs) and Premier Clients segment is built upon offering sophisticated wealth management and private banking. This includes bespoke investment portfolios and exclusive financial advisory services designed to preserve and grow substantial assets.

These premier clients receive dedicated relationship managers who provide personalized attention and access to a suite of tailored financial solutions. This focus on exclusive service ensures that the unique needs of affluent individuals are met with precision and discretion.

In 2024, the global HNWI population grew by an estimated 4.8%, reaching 6.3 million individuals, with their collective wealth increasing by 5.1% to $26.1 trillion, underscoring the significant market opportunity for specialized banking services.

Institutional Clients

Masraf Al Rayan actively serves a crucial segment of institutional clients, including governmental bodies, public sector organizations, and other substantial entities. These clients rely on the bank for sophisticated banking solutions and comprehensive treasury management services, underscoring Masraf Al Rayan's role as a key financial partner.

The bank offers robust financial support and expert advisory services tailored to the unique needs of these major institutional players. This commitment ensures that governmental and public sector entities receive the necessary resources and guidance to manage their finances effectively and achieve their strategic objectives.

- Governmental and Public Sector Focus: Masraf Al Rayan's institutional client base includes a significant portion of Qatar's governmental and public sector entities, demonstrating strong ties within the nation's core institutions.

- Treasury Management Solutions: The bank provides advanced treasury services designed to optimize cash flow, manage liquidity, and mitigate financial risks for large organizations.

- Financial Advisory: Masraf Al Rayan offers specialized financial advisory, assisting institutional clients with complex financial planning, investment strategies, and capital management.

- Economic Contribution: By supporting these key institutions, Masraf Al Rayan contributes directly to the stability and growth of the national economy, facilitating major public projects and initiatives.

International and Non-Resident Investors

Masraf Al Rayan actively seeks to attract international investors, especially those keen on opportunities within Qatar's burgeoning real estate sector. This strategic focus allows the bank to tap into a global pool of capital and expertise.

To cater to this segment, the bank offers tailored financing solutions specifically designed for non-residents. These programs aim to simplify the investment process and encourage foreign capital inflow.

In 2024, Qatar's real estate market saw significant activity, with foreign direct investment playing a crucial role. Masraf Al Rayan's initiatives in this area directly support this trend.

- Targeting Global Capital: Actively pursuing international investors interested in Qatar's economic growth.

- Specialized Financing: Providing dedicated financing programs for non-resident clients.

- Real Estate Focus: Emphasizing opportunities within Qatar's dynamic property market.

Masraf Al Rayan serves a diverse clientele, from individual retail customers seeking Sharia-compliant banking to large corporations and SMEs needing comprehensive financial solutions. The bank also targets High-Net-Worth Individuals with specialized wealth management and caters to institutional clients, including government bodies, by offering advanced treasury and advisory services. Furthermore, it actively attracts international investors, particularly those interested in Qatar's real estate market, by providing tailored financing for non-residents.

| Customer Segment | Key Offerings | 2024 Market Insight |

|---|---|---|

| Retail & Individual | Current/Savings Accounts, Credit Cards, Personal Financing | Global Islamic finance market growth, increasing individual account numbers. |

| Corporate & Commercial | Credit Facilities, Treasury Services, Investment Advisory | Significant role in financing Qatari infrastructure and trade. |

| High-Net-Worth Individuals (HNWIs) | Wealth Management, Private Banking, Bespoke Portfolios | Global HNWI population grew 4.8% in 2024, wealth up 5.1%. |

| Institutional Clients | Treasury Management, Financial Advisory, Banking Solutions | Key financial partner for Qatari governmental and public sector entities. |

| International Investors | Real Estate Financing, Non-Resident Programs | Qatar's real estate market saw significant activity driven by foreign investment. |

Cost Structure

Masraf Al Rayan's cost structure heavily relies on operational and administrative expenses. These include essential costs like staff compensation, branch network upkeep, and utility payments, which are fundamental to daily banking operations.

The bank's efficiency ratio, a key performance indicator, is directly impacted by how well these operational and administrative costs are managed. For instance, in 2023, Masraf Al Rayan reported a cost-to-income ratio of 31.2%, indicating effective control over these expenses relative to its income.

Masraf Al Rayan dedicates significant resources to its technology and digital transformation initiatives. These investments are vital for modernizing operations and enhancing customer experience, reflecting a strategic commitment to future competitiveness.

Key expenditures include the rollout of a new core banking system, the continuous development of user-friendly mobile banking applications, and the integration of artificial intelligence solutions to streamline processes and personalize services. These technological advancements are foundational for sustained growth.

In 2023, Masraf Al Rayan reported significant investments in technology, with digital transformation efforts being a primary focus. For instance, the bank's commitment to innovation is demonstrated by its ongoing projects aimed at improving digital service delivery, which are expected to continue driving costs in 2024 and beyond.

Masraf Al Rayan allocates significant resources to marketing, branding, and communication. In 2024, the bank invested heavily in advertising campaigns and public relations to solidify its new brand identity, aiming to attract a broader customer base and enhance market presence. These expenditures are crucial for differentiating Masraf Al Rayan in a competitive financial landscape.

Compliance and Regulatory Costs

Masraf Al Rayan dedicates significant resources to ensure strict adherence to Sharia principles, Qatar Central Bank regulations, and various other financial compliance mandates. These costs are essential for maintaining its operating license and robust reputation in the financial sector.

Key expenditures within this cost structure include the upkeep of internal audit functions, which rigorously review operations for compliance. Furthermore, substantial amounts are allocated to legal fees, particularly those related to navigating complex regulatory landscapes and ensuring all financial dealings meet established standards. Reporting obligations to regulatory bodies also represent a continuous cost, vital for transparency and continued operation.

- Internal Audit Functions: Costs associated with personnel, technology, and processes for internal compliance checks.

- Legal Fees: Expenses for legal counsel to interpret regulations, draft policies, and manage regulatory interactions.

- Reporting Obligations: Costs for data collection, analysis, and submission of required reports to the Qatar Central Bank and other authorities.

- Compliance Technology: Investment in software and systems to automate and monitor compliance processes.

Financing and Investment Account Returns

Masraf Al Rayan's cost structure prominently features the returns disbursed to holders of its unrestricted investment accounts. These payouts are a significant expense, directly influencing the bank's net profit margins. For instance, in 2024, financial institutions globally experienced varying return rates on such accounts, influenced by central bank policies and market liquidity. Effectively managing these finance expenses, including the competitive rates offered on investment accounts, is crucial for sustaining profitability.

The bank must meticulously manage its finance expenses and the returns provided to investment account holders. This involves balancing the need to attract and retain depositors with the imperative to maintain healthy profit margins.

- Finance Expenses: Costs associated with interest paid on deposits and other borrowings.

- Investment Account Returns: Profit-sharing or interest paid to holders of unrestricted investment accounts.

- Profitability Impact: Higher returns paid to account holders directly reduce net profit.

- Strategic Management: Optimizing these returns is key to financial health.

Masraf Al Rayan's cost structure is significantly influenced by its commitment to Sharia compliance and regulatory adherence. These essential costs ensure the bank operates within legal and ethical frameworks, safeguarding its reputation and license. Key expenditures include robust internal audit functions, legal counsel for navigating complex financial regulations, and the continuous reporting required by authorities like the Qatar Central Bank.

The bank also incurs substantial costs related to finance expenses, primarily the returns paid to holders of its unrestricted investment accounts. Managing these payouts effectively is crucial for profitability, as they directly impact net profit margins. In 2024, the competitive landscape for attracting deposits meant that managing these finance costs remained a strategic priority for Masraf Al Rayan.

Operational and administrative expenses form the backbone of Masraf Al Rayan's cost structure, encompassing staff compensation, branch network maintenance, and utility payments. The bank's efficiency ratio, a key indicator of its operational health, is directly tied to the effective management of these day-to-day costs. In 2023, Masraf Al Rayan demonstrated strong cost control with a cost-to-income ratio of 31.2%, highlighting its ability to manage these fundamental expenses efficiently.

Investments in technology and digital transformation represent another significant component of Masraf Al Rayan's cost structure. These outlays are strategic, aimed at modernizing operations and enhancing customer experience. Projects like core banking system upgrades and mobile application development are foundational for future growth and competitiveness, with continued investment anticipated throughout 2024.

| Cost Category | Key Expenditures | 2023 Impact/Focus | 2024 Outlook |

|---|---|---|---|

| Operational & Administrative | Staff compensation, branch upkeep, utilities | Cost-to-income ratio of 31.2% | Continued focus on efficiency |

| Technology & Digital Transformation | Core banking system, mobile apps, AI integration | Significant investment in innovation | Ongoing development and rollout |

| Compliance & Regulatory | Internal audit, legal fees, reporting obligations | Essential for license and reputation | Maintaining adherence to evolving regulations |

| Finance Expenses | Returns on investment accounts | Direct impact on net profit margins | Strategic management of deposit rates |

Revenue Streams

Masraf Al Rayan's core revenue generation stems from its Sharia-compliant financing operations. This includes profit earned through Murabaha, a cost-plus financing arrangement, Ijarah, which is akin to leasing, and Musharakah, a partnership-based financing model. These activities form the bedrock of the bank's income.

In 2024, Masraf Al Rayan reported a net profit from financing activities that significantly contributed to its overall financial performance. For instance, the bank’s net income attributable to shareholders for the first nine months of 2024 reached QAR 1.51 billion, showcasing the substantial contribution of its financing streams.

Masraf Al Rayan generates substantial revenue through its diverse investment activities. This includes income derived from its holdings in listed and private equities, various investment funds, sukuk, and strategic real estate ventures.

The bank’s financial reports for 2024 highlight the importance of this revenue stream. For instance, in the first half of 2024, Masraf Al Rayan reported a net profit from its investment portfolio that significantly contributed to its overall earnings, demonstrating the success of its strategic asset management.

Masraf Al Rayan generates substantial revenue from fee and commission income, reflecting its diverse banking services. This income stream is crucial, encompassing charges for everyday banking transactions, specialized advisory services for both individual and corporate clients, and fees associated with digital payment processing.

In 2024, the bank reported significant non-financing income, highlighting the importance of these fee-based activities. For instance, fees from digital transactions and wealth management advisory services contributed positively to its overall financial performance, demonstrating a robust demand for its non-interest income generating products.

Treasury and Foreign Exchange Operations

Masraf Al Rayan generates revenue through its treasury and foreign exchange operations. This includes income from currency exchange services and profit rate swaps, which are integral to its corporate banking offerings.

These treasury activities are crucial for diversifying the bank's revenue streams. For instance, in 2024, global foreign exchange trading volumes continued to be robust, with major financial centers reporting significant daily turnover, directly impacting the profitability of such operations for institutions like Masraf Al Rayan.

- Currency Exchange: Providing facilities for converting one currency to another, earning on the bid-ask spread.

- Profit Rate Swaps: Facilitating agreements to exchange interest rate payments, generating fees and potential trading profits.

- Treasury Services: Offering liquidity management and investment solutions for corporate clients.

- Revenue Diversification: Reducing reliance on traditional lending by tapping into international financial markets.

Returns from Investment Accounts and Funds Management

Masraf Al Rayan generates revenue by managing investment accounts and various funds, acting as both a manager and a partner. This involves sharing in the profits derived from these financial arrangements, directly supporting its investment product development and asset management functions.

In 2024, the global asset management industry continued its robust growth, with assets under management (AUM) projected to reach significant new highs. For Masraf Al Rayan, this translates to increased fee-based income from advisory services, performance fees, and management charges on the portfolios it oversees.

- Management Fees: A percentage of the total assets managed within investment accounts and funds.

- Performance Fees: A share of the profits generated above a certain benchmark for actively managed funds.

- Advisory Fees: Charges for providing expert financial advice and portfolio construction services.

- Distribution Fees: Income earned from distributing investment products managed by the bank or its partners.

Masraf Al Rayan's revenue streams are multifaceted, built upon Sharia-compliant financing, diverse investments, fee-based services, and treasury operations.

In 2024, the bank's net income from financing activities and its investment portfolio showed strong performance, with net income attributable to shareholders reaching QAR 1.51 billion for the first nine months, underscoring the effectiveness of these core revenue drivers.

Fee and commission income, alongside treasury and foreign exchange operations, further diversify its earnings, demonstrating a robust strategy for generating non-interest income and capitalizing on global market dynamics.

| Revenue Stream | Description | 2024 Performance Indicator |

|---|---|---|

| Financing Activities | Murabaha, Ijarah, Musharakah | Net income from financing activities significantly contributed to overall performance. |

| Investment Activities | Equities, funds, sukuk, real estate | Net profit from investment portfolio showed strong contribution to earnings. |

| Fee & Commission Income | Banking transactions, advisory, digital payments | Fees from digital transactions and wealth management boosted financial performance. |

| Treasury & FX Operations | Currency exchange, profit rate swaps | Capitalized on robust global foreign exchange trading volumes. |

| Asset & Fund Management | Management fees, performance fees | Benefited from strong growth in global assets under management. |

Business Model Canvas Data Sources

The Masraf Al Rayan Business Model Canvas is informed by comprehensive financial reports, detailed market analysis of the Qatari banking sector, and strategic insights from industry experts. These sources ensure each component, from value propositions to cost structures, is grounded in accurate and relevant data.