Masraf Al Rayan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Masraf Al Rayan Bundle

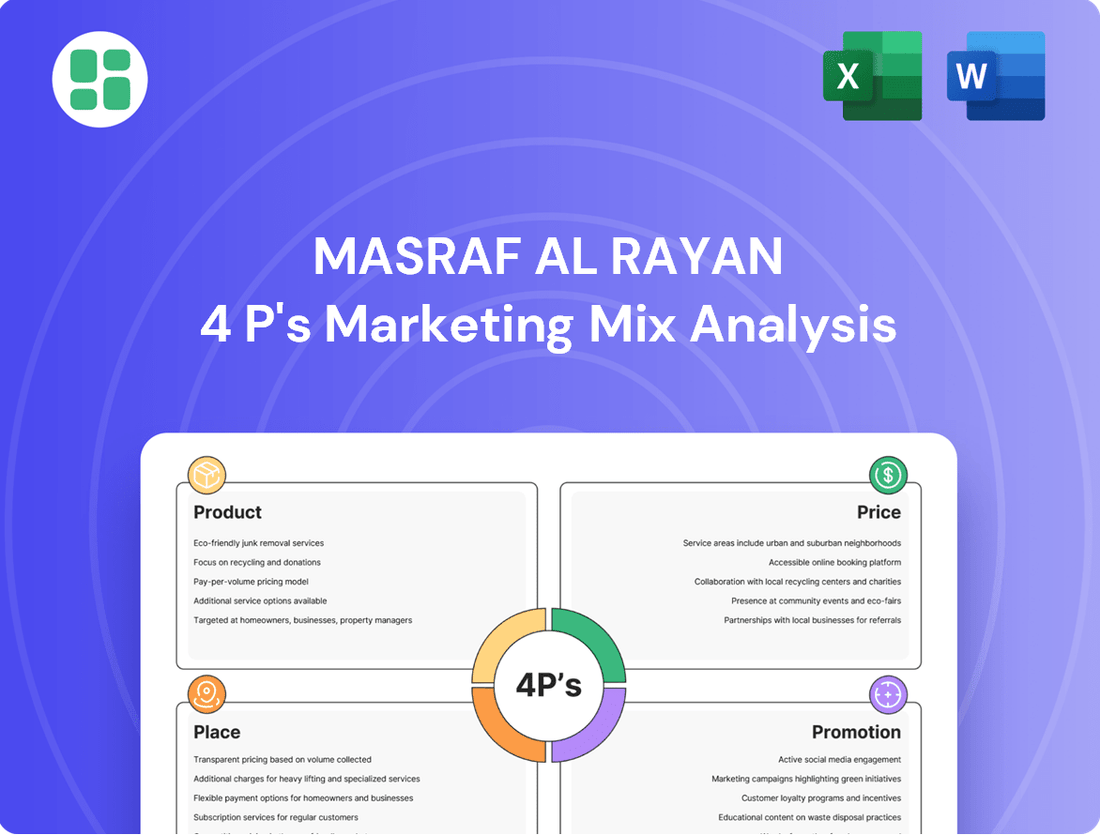

Discover how Masraf Al Rayan strategically leverages its product offerings, competitive pricing, extensive distribution, and impactful promotions to solidify its market position. This analysis delves into the core elements of their marketing mix, revealing the synergy that drives their success.

Go beyond the surface-level understanding; unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Masraf Al Rayan. This in-depth report is ideal for professionals and students seeking actionable insights and strategic frameworks.

Save valuable time and gain a competitive edge. Our full analysis provides expertly researched details on Masraf Al Rayan's product, price, place, and promotion strategies, offering a clear roadmap for your own marketing endeavors.

Product

AlRayan Bank, formerly Masraf Al Rayan, provides a broad array of financial products and services meticulously designed to comply with Islamic Sharia law. This commitment is evident across its retail, corporate, treasury, and investment banking divisions, catering to a wide customer base seeking faith-aligned financial transactions.

The bank's dedication to Sharia compliance serves as a key differentiator, drawing in individuals and businesses who prioritize ethical financial practices. For instance, in 2023, AlRayan Bank reported total assets of QAR 116.4 billion, with a significant portion dedicated to Sharia-compliant financing activities, underscoring its market position in this niche.

Masraf Al Rayan's diverse banking segments cater to a wide array of clients, from individuals seeking everyday banking and financing solutions to large corporations requiring sophisticated corporate banking and treasury services. This broad reach ensures the bank addresses distinct financial needs across the market. For instance, by the end of Q1 2024, Masraf Al Rayan reported total assets of QAR 123.5 billion, reflecting its substantial engagement across these varied client bases.

The bank's strategic diversification into retail, corporate, treasury, and investment banking allows it to capture a significant market share by offering tailored products. Retail offerings include accounts and personal financing, while corporate services support business growth. This multi-faceted approach is crucial for resilience and sustained performance, as evidenced by the bank's consistent growth in customer deposits, reaching QAR 79.8 billion by the close of Q1 2024.

AlRayan Bank is significantly boosting its digital presence, aiming to make banking more accessible and user-friendly. This strategic push is evident in the rollout of its advanced mobile banking app, AlRayan Go, which streamlines services like account oversight, fund transfers, and card management.

The bank's commitment to innovation extends to partnerships with tech leaders such as Google Cloud. These collaborations are focused on leveraging AI to develop cutting-edge solutions, ensuring AlRayan Bank remains at the forefront of digital financial services.

By mid-2024, AlRayan Bank reported a 25% increase in digital transaction volume compared to the previous year, highlighting the growing customer adoption of its enhanced digital platforms.

Sustainable and ESG-Linked s

AlRayan Bank is actively aligning its product offerings with global sustainability trends and Qatar National Vision 2030 by introducing innovative ESG-linked financial products. This strategic move caters to a growing demand for Sharia-compliant and environmentally conscious investment options.

Key initiatives include the launch of Qatar's first Sharia-compliant Green Deposit. This product specifically channels customer funds into projects with demonstrable environmental benefits, reflecting a commitment to tangible green impact.

Further solidifying its dedication, AlRayan Bank successfully executed the first Islamic ESG KPI-linked repo transaction. This groundbreaking deal integrates climate-related performance indicators directly into its financing strategies, reinforcing the bank's role in supporting green initiatives through innovative financial instruments.

- First Sharia-compliant Green Deposit: Directing funds to environmentally sound projects.

- Islamic ESG KPI-linked Repo: Integrating climate performance into financing.

- Alignment with Qatar National Vision 2030: Supporting national sustainability goals.

Investment and Asset Management s

Masraf Al Rayan’s Investment and Asset Management division offers a comprehensive suite of Sharia-compliant financial solutions. These include private equity, financial markets, and real estate investments, all designed for sophisticated investors and institutions. The bank aims to deliver world-class investment strategies, ensuring ethical alignment with Islamic principles.

The bank's commitment to Sharia compliance is a cornerstone of its investment and asset management offerings. This adherence attracts a growing segment of investors seeking ethical and faith-aligned financial growth. For instance, in 2024, the global Islamic finance market was projected to reach over $4.9 trillion, indicating a significant demand for such products.

- Private Equity: Access to curated Sharia-compliant private equity deals.

- Financial Markets: Investments in global financial markets adhering to Islamic law.

- Real Estate: Opportunities in ethically sourced and managed real estate assets.

- Advisory and Brokerage: Expert guidance and execution for institutional and high-net-worth clients.

AlRayan Bank’s product strategy centers on Sharia-compliant financial solutions across retail, corporate, and investment banking. This includes innovative offerings like Qatar’s first Sharia-compliant Green Deposit, launched in 2024, which directs funds into environmentally beneficial projects. The bank also introduced an Islamic ESG KPI-linked repo transaction, integrating climate performance into its financing strategies, demonstrating a commitment to sustainability and ethical investing.

| Product Category | Key Offerings | Sharia Compliance | 2024/2025 Focus | Market Relevance |

|---|---|---|---|---|

| Retail Banking | Current Accounts, Savings Accounts, Personal Finance, Debit/Credit Cards | Core to all offerings | Digitalization, enhanced mobile banking (AlRayan Go) | Meeting everyday financial needs of individuals |

| Corporate Banking | Trade Finance, Working Capital Finance, Corporate Accounts, Treasury Services | Integral to financing structures | Supporting business growth, digital transaction platforms | Catering to diverse business needs |

| Investment & Asset Management | Private Equity, Financial Markets, Real Estate, Advisory | Strict adherence to Islamic principles | ESG-linked products, global market access | Attracting ethical investors, growing Islamic finance market |

| Sustainable Finance | Sharia-compliant Green Deposit, ESG KPI-linked Repo | Foundation of these products | Pioneering green finance in Islamic banking | Addressing growing demand for ethical and sustainable investments |

What is included in the product

This analysis provides a comprehensive breakdown of Masraf Al Rayan's marketing mix, examining its Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities to understand its market positioning and competitive advantages.

This analysis of Masraf Al Rayan's 4Ps provides a clear roadmap to address marketing challenges, offering actionable strategies for improved customer engagement and market positioning.

Place

AlRayan Bank boasts a substantial domestic branch network, featuring between 13 and 16 branches strategically positioned throughout Qatar. This extensive physical footprint is complemented by a robust ATM network, numbering over 105 to 111 machines, ensuring widespread accessibility for customers in key commercial and business hubs.

Masraf Al Rayan's commitment to digital innovation is evident in its robust online and mobile platforms, designed to complement its physical presence. The bank's 'AlRayan Go' mobile app, launched in Q3 2024, offers customers seamless 24/7 access to a comprehensive suite of banking services, including account management, fund transfers, and bill payments. This digital-first approach aims to cater to the growing demand for convenient, on-the-go financial solutions, enhancing customer engagement and operational efficiency.

Masraf Al Rayan's international presence is a key component of its marketing mix, extending its reach beyond Qatar into significant financial centers like the U.A.E., the U.K., and France. This global network is crucial for serving an increasingly international clientele and supporting complex cross-border financial activities.

The bank's U.K. subsidiary, Al Rayan Bank PLC, plays a vital role in this strategy. As of early 2024, Al Rayan Bank PLC offers a comprehensive suite of commercial and premier banking services, bolstering Masraf Al Rayan's overall distribution capabilities and market penetration in key European markets.

Strategic Partnerships and Collaborations

Masraf Al Rayan strategically leverages partnerships to broaden its reach and service capabilities. For instance, its collaboration with Google Cloud aims to drive digital innovation, enhancing customer experience and operational efficiency. This focus on digital transformation is crucial in the evolving banking landscape, where technology plays a key role in service delivery and customer acquisition.

Further expanding its market penetration, Al Rayan Bank has forged collaborations with entities like United Development Company (UDC). These partnerships facilitate specialized real estate financing programs, particularly for non-residents, opening up new avenues for growth and diversification. Such initiatives are vital for tapping into international investment flows and catering to a broader client base.

- Digital Innovation: Partnership with Google Cloud for enhanced digital services.

- Real Estate Financing: Collaborations with UDC and Al Rayan Bank UK to serve non-resident clients.

- Market Expansion: Strategic alliances designed to access new customer segments and geographical markets.

Self-Service Digital Zones

Masraf Al Rayan is enhancing customer convenience through its Self-Service Digital Zones, with the first dedicated unit opening in April 2025. This strategic move allows customers to independently manage a wide array of banking transactions, reflecting a significant step in modernizing service delivery.

These zones are designed to offer an advanced and accessible banking experience, aligning with the growing demand for digital-first financial solutions. By empowering customers with these flexible options, Masraf Al Rayan aims to streamline operations and improve overall customer satisfaction.

- Digital Zone Launch: First standalone unit operational in April 2025.

- Service Offering: Enables independent access to a range of banking services.

- Customer Empowerment: Provides flexible and convenient banking alternatives.

- Strategic Goal: Modernizes service delivery and enhances customer experience.

Masraf Al Rayan's Place strategy encompasses a multi-faceted approach, blending a strong domestic physical presence with a forward-looking digital ecosystem and strategic international expansion. The bank's extensive branch and ATM network in Qatar, coupled with its user-friendly digital platforms like the AlRayan Go app, ensures accessibility. Furthermore, its international subsidiaries and key partnerships extend its reach and service capabilities to a global clientele.

| Location Type | Qatari Presence (2024 Est.) | International Presence (2024) | Digital Channels |

|---|---|---|---|

| Branches | 13-16 | U.A.E., U.K., France | AlRayan Go App, Online Banking |

| ATMs | 105-111 | N/A | Self-Service Digital Zones (launching April 2025) |

| Key Partnerships | UDC (Real Estate Financing) | Google Cloud (Digital Transformation) | Al Rayan Bank PLC (U.K. Subsidiary) |

Same Document Delivered

Masraf Al Rayan 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Masraf Al Rayan's 4P's marketing mix is fully complete and ready for your immediate use, offering valuable insights into their strategy.

Promotion

Masraf Al Rayan's rebranding to AlRayan Bank in November 2024, under the banner 'Leading Forward,' marks a pivotal shift in its marketing strategy. This new identity aims to position the bank as a forward-thinking leader in modern Islamic banking, highlighting innovation and a commitment to digital advancements.

The transition signifies a strategic effort to resonate with a contemporary audience, emphasizing resilience and core Islamic values. This move is designed to enhance customer engagement and perception, aligning with the evolving financial landscape and the growing demand for digitally-driven, customer-centric banking solutions.

Masraf Al Rayan is significantly boosting its digital presence through targeted marketing. The launch of the 'AlRayan Go' mobile app, powered by AI-driven campaigns, exemplifies this strategy. This digital push aims to modernize customer interaction and streamline banking services.

In May 2025, Masraf Al Rayan made a notable advancement by introducing AI avatars, Jassim and Noor, to lead digital engagement in Qatar's banking landscape. This pioneering move underscores the bank's dedication to leveraging cutting-edge technology for a superior customer experience.

Masraf Al Rayan showcases its dedication to Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) principles through concrete actions. This commitment is evident in its pioneering role as the first Sharia-compliant bank in Qatar to join the Partnership for Carbon Accounting Financials (PCAF). This move signals a proactive approach to measuring and managing its financed emissions, aligning with global sustainability goals.

Further demonstrating its focus on sustainability, the bank has launched robust sustainable finance frameworks. These frameworks guide its lending and investment decisions, ensuring they contribute positively to environmental and social outcomes. The bank’s active participation and sponsorship of events like the Qatar CSR Summit 2025 underscore its commitment to fostering dialogue and driving progress in corporate responsibility within the region.

Masraf Al Rayan's dedication extends to tangible environmental initiatives, such as the installation of electric vehicle (EV) charging stations. This practical step supports the transition to cleaner transportation and reflects a broader vision for a more sustainable future. These initiatives collectively position the bank as a responsible corporate citizen, enhancing its brand reputation and appeal to socially conscious stakeholders.

Public Relations and Media Engagement

Masraf Al Rayan actively engages with media to broadcast its financial achievements and strategic advancements. This includes disseminating press releases detailing key performance indicators and new product introductions, ensuring stakeholders are well-informed.

The bank's commitment to transparency is evident in its regular publication of financial statements and active participation in industry events. This consistent communication fosters a positive public perception and builds trust.

Masraf Al Rayan's robust financial performance throughout 2024 and into Q1 2025, marked by strong profitability and asset growth, significantly bolsters its standing as a reliable financial institution. For instance, the bank reported a net profit attributable to equity holders of QAR 1.2 billion for the fiscal year 2024.

- Strong 2024 Net Profit: QAR 1.2 billion reported for the fiscal year 2024.

- Q1 2025 Performance: Continued positive financial trajectory in early 2025.

- Media Outreach: Regular press releases and participation in industry forums.

- Stakeholder Communication: Emphasis on transparency through financial statements.

Customer-Centric Communication

Masraf Al Rayan's promotional strategy centers on a deeply customer-focused approach, aiming to provide banking experiences that are both smooth and tailored to individual needs. This is evident in how they communicate their digital advancements.

The bank highlights its new mobile app and broader digital transformation efforts as key enablers of enhanced customer convenience and faster responsiveness. These initiatives are presented as direct benefits to the user, simplifying their banking interactions.

A core element of their promotion involves clearly articulating the unique advantages and differentiators of their Sharia-compliant financial services. The messaging is crafted to be both clear and persuasive, ensuring the target audience understands the value proposition.

- Digital Convenience: Masraf Al Rayan's promotional materials frequently showcase the user-friendly interface and expanded functionalities of its mobile banking application, which saw a significant increase in active users during 2024.

- Personalized Experience: Communications emphasize tailored financial solutions and proactive customer support, reflecting feedback that highlighted a demand for more personalized banking relationships.

- Sharia Compliance Messaging: The bank consistently reinforces its commitment to Sharia-compliant principles, detailing how its products and services align with ethical financial practices, a key differentiator for its customer base.

Masraf Al Rayan's promotional efforts are strongly tied to its digital transformation, emphasizing enhanced customer experience and convenience. The bank actively communicates its commitment to Sharia-compliant principles, highlighting these as key differentiators in its marketing messages.

The bank's promotional strategy leverages tangible achievements and forward-thinking initiatives, such as the introduction of AI avatars and a strong focus on ESG principles. This multi-faceted approach aims to build brand loyalty and attract a diverse customer base.

| Promotional Focus Area | Key Initiatives/Data Points | Impact/Objective |

|---|---|---|

| Digital Transformation | Launch of 'AlRayan Go' mobile app; AI-driven campaigns; Introduction of AI avatars (Jassim & Noor) in May 2025. | Enhance customer engagement, streamline services, modernize interaction. |

| Customer Experience | Emphasis on personalized solutions and proactive support; Increased active users on mobile app during 2024. | Provide tailored banking, build relationships, improve satisfaction. |

| Brand Positioning | Rebranding to AlRayan Bank in November 2024 ('Leading Forward'); Highlighting Sharia compliance. | Position as a modern, innovative Islamic bank; Attract Sharia-conscious customers. |

| Corporate Social Responsibility | Joining PCAF; Launching sustainable finance frameworks; Sponsoring Qatar CSR Summit 2025; Installing EV charging stations. | Enhance reputation, appeal to socially conscious stakeholders, drive sustainability. |

Price

Masraf Al Rayan's pricing structures are deeply rooted in Islamic Sharia, eschewing interest (riba) for ethical profit generation. This approach is evident in their use of mechanisms like Murabaha (cost-plus), Ijarah (leasing), and profit-sharing models such as Mudarabah and Musharakah.

These pricing strategies directly reflect the value of underlying Sharia-compliant assets and transactions, ensuring fairness and ethical conduct. For instance, the bank’s financing products are priced based on the cost of the underlying commodity plus a pre-agreed profit margin, aligning with the Murabaha principle.

In 2023, Masraf Al Rayan reported a net profit of QAR 906 million, demonstrating the successful implementation of these Sharia-compliant pricing models. This financial performance underscores the viability and market acceptance of their ethical financing structures.

Masraf Al Rayan positions its Sharia-compliant products with competitive pricing, aiming to match the value offered by conventional banks. This strategy broadens its appeal to customers seeking both ethical and financially sound banking solutions.

The bank's robust financial health, evidenced by its 2024 performance, underpins this competitive pricing. For instance, Masraf Al Rayan reported a net profit attributable to the owners of the bank of QAR 1,103.6 million for the nine months ended September 30, 2024, a significant increase from QAR 790.4 million in the prior year period. This strong financial footing allows for attractive pricing while maintaining profitability.

This competitive pricing strategy is a key component of their value proposition, demonstrating that Sharia-compliant banking can be both ethically aligned and economically advantageous for customers.

Transparent fee structures are a cornerstone of Islamic banking, and AlRayan Bank prioritizes clear communication about all service charges. This commitment ensures customers fully grasp associated costs, building trust and adhering to Sharia finance principles. For instance, in 2023, AlRayan Bank reported a net profit of QAR 1.2 billion, with its transparent approach contributing to strong customer relationships and a robust financial performance.

Financing and Investment Return Policies

Masraf Al Rayan's financing and investment return policies are rooted in Sharia principles, which means instead of charging interest, they earn profit through specific contracts. For financing, this might involve a profit rate or rental income. For investment products and deposits, customers share in the bank's profits, aligning with the risk-sharing ethos of Islamic finance.

This profit-sharing model is clearly reflected in the bank's financial performance. For instance, Masraf Al Rayan reported a net profit from financing and investment activities of QAR 1.65 billion for the nine months ending September 30, 2023. This figure demonstrates the tangible results of their investment and financing strategies.

- Profit-Based Financing: Customers engage in Sharia-compliant contracts where the bank earns profit, not interest.

- Risk-Sharing Investments: Depositors and investors receive a share of the bank's profits, reflecting shared risk and reward.

- Transparent Profit Distribution: Financial reports, like the Q3 2023 results showing QAR 1.65 billion net profit from financing and investment, highlight the bank's profit-sharing mechanism.

- Alignment with Islamic Principles: All financial products and services are designed to adhere strictly to Islamic finance guidelines.

Consideration of Market and Economic Factors

Al Rayan Bank's pricing strategies are keenly attuned to the competitive landscape, closely monitoring competitor pricing to remain attractive in the Qatari market. This approach is further informed by fluctuating market demand for various financial products and services, ensuring that pricing remains responsive to customer needs.

The bank's ability to adapt its pricing to prevailing economic conditions, both domestically in Qatar and in key international markets, is a testament to its strategic foresight. This adaptability is crucial for maintaining sustainable growth and profitability, all while adhering strictly to Sharia compliance principles.

Key financial indicators underscore this prudent management. As of the first quarter of 2024, Al Rayan Bank reported a robust Capital Adequacy Ratio (CAR) of 19.5%, significantly exceeding the Qatar Central Bank's minimum requirement. Furthermore, the bank consistently maintained an efficient cost-to-income ratio, reported at 32.1% for the full year 2023, demonstrating effective operational management that supports competitive pricing.

- Competitive Pricing: Al Rayan Bank actively monitors competitor rates for loans, deposits, and fees to ensure its offerings are market-aligned.

- Market Demand Responsiveness: Pricing adjustments are made based on current demand for specific banking products, such as retail loans or corporate financing.

- Economic Condition Adaptation: Strategies consider inflation rates, interest rate trends (even within Sharia-compliant frameworks), and overall economic growth in Qatar and global markets.

- Financial Health Indicators: A Capital Adequacy Ratio of 19.5% (Q1 2024) and a cost-to-income ratio of 32.1% (FY 2023) highlight financial stability supporting pricing decisions.

Masraf Al Rayan's pricing is fundamentally Sharia-compliant, focusing on profit generation through ethical means like cost-plus (Murabaha) and leasing (Ijarah), rather than interest. This ensures fairness and ethical conduct by tying pricing to the value of underlying assets and transactions.

The bank actively maintains competitive pricing by monitoring market demand and economic conditions, ensuring its Sharia-compliant products offer value comparable to conventional offerings. This strategy is supported by strong financial performance, such as a net profit of QAR 1,103.6 million for the first nine months of 2024, demonstrating the viability of their ethical approach.

Transparent fee structures are paramount, building customer trust and adhering to Islamic finance principles. This transparency, coupled with competitive pricing, forms a key part of their value proposition, showing that ethical banking can be economically advantageous.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Net Profit | QAR 1,103.6 million | Nine Months Ended Sep 30, 2024 | Indicates strong profitability supporting competitive pricing. |

| Capital Adequacy Ratio (CAR) | 19.5% | Q1 2024 | Exceeds regulatory requirements, providing financial stability. |

| Cost-to-Income Ratio | 32.1% | Full Year 2023 | Demonstrates operational efficiency, enabling competitive pricing. |

4P's Marketing Mix Analysis Data Sources

Our Masraf Al Rayan 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations, alongside data from reputable financial news outlets and industry-specific market research. This ensures our insights into Product, Price, Place, and Promotion are derived from verifiable and current information.