Masraf Al Rayan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Masraf Al Rayan Bundle

Masraf Al Rayan navigates a competitive landscape shaped by robust buyer power and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder seeking to grasp the bank's strategic positioning.

The complete report reveals the real forces shaping Masraf Al Rayan’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Masraf Al Rayan's key suppliers are its depositors, who provide the essential capital for its lending activities. The bank's success hinges on its capacity to attract and retain a broad and stable base of depositors, offering them competitive interest rates. This directly impacts the bank's cost of funds and, by extension, its overall profitability.

A robust retail deposit base is a significant advantage in the Qatari banking sector, as noted in industry analyses. For Masraf Al Rayan, this means a reduced dependence on less stable wholesale funding sources, thereby enhancing its bargaining power with other capital providers.

Technology and digital infrastructure providers hold significant bargaining power over Masraf Al Rayan, especially in the current digital banking landscape. Core banking systems, advanced cybersecurity, and sophisticated digital platforms are essential for operations and customer engagement. For instance, the global market for digital banking platforms was projected to reach over $20 billion by 2024, highlighting the specialized nature and demand for these services.

Masraf Al Rayan's commitment to digital transformation, including the development of a new mobile banking application and upgrades to its core banking system, directly increases its dependence on these tech suppliers. The high costs and complexity involved in switching these critical systems mean that suppliers can exert considerable influence, potentially impacting pricing and service terms.

Skilled human capital, particularly in Islamic finance, digital banking, and risk management, acts as a crucial supplier for Masraf Al Rayan. The availability of qualified Sharia scholars, IT specialists, and financial experts directly influences the bank's capacity for innovation and operational efficiency.

A global talent shortage within the financial sector, a trend observed in numerous banking reports, could potentially amplify the bargaining power of these specialized employees. For instance, in 2024, demand for cybersecurity professionals in finance significantly outstripped supply, driving up compensation and increasing their leverage.

Regulatory and Compliance Services

Suppliers of regulatory and compliance services, including legal advice on Sharia-compliant structures and auditing, wield significant bargaining power over Masraf Al Rayan. This power stems from the specialized knowledge and critical nature of their services within the heavily regulated Islamic banking environment.

Masraf Al Rayan’s operations are dictated by the Qatar Central Bank (QCB) regulations, which are in a constant state of flux. For instance, recent QCB directives in late 2023 and early 2024 have focused on enhancing digital banking security and integrating Environmental, Social, and Governance (ESG) principles, demanding specialized compliance expertise.

- Specialized Expertise: Compliance and legal service providers possess niche skills essential for navigating complex Sharia and financial regulations.

- Regulatory Dependence: Masraf Al Rayan’s adherence to evolving QCB mandates necessitates reliance on these expert suppliers.

- High Switching Costs: Changing providers for critical compliance functions can be costly and time-consuming due to the need for re-familiarization with the bank's specific operations and regulatory landscape.

Interbank Market and Liquidity Providers

While Masraf Al Rayan benefits from a substantial deposit base, it may still turn to interbank markets and liquidity providers for short-term funding needs or to bridge any liquidity gaps. The cost and availability of these funds are heavily influenced by central bank policies and broader economic conditions, directly affecting the bank's operational agility and its overall cost of capital.

Qatar's banking sector is characterized by robust liquidity, which generally serves to lessen the bargaining power of suppliers for individual institutions like Masraf Al Rayan. As of early 2024, the Qatar Central Bank's foreign exchange reserves and overall liquidity management strategies have contributed to a stable financial environment for local banks.

- Interbank Market Reliance: Even with a strong deposit base, Masraf Al Rayan may utilize interbank markets for managing short-term liquidity.

- Cost of Funds Impact: Central bank policies and global economic factors directly influence the cost of interbank borrowing, affecting the bank's profitability.

- Sectoral Liquidity: Qatar's banking sector generally enjoys strong liquidity, which typically reduces the bargaining power of liquidity providers for individual banks.

- 2024 Outlook: Continued stability in Qatar's financial system in 2024 is expected to maintain manageable reliance on external liquidity sources.

Masraf Al Rayan's primary suppliers are its depositors, providing essential capital, and technology providers crucial for digital operations. While a strong deposit base mitigates reliance on external funding, the bank's dependence on specialized technology and skilled human capital, particularly in areas like cybersecurity and Sharia compliance, grants these suppliers significant bargaining power. Evolving regulatory landscapes, such as those dictated by the Qatar Central Bank, further amplify the influence of compliance service providers.

| Supplier Category | Key Dependencies for Masraf Al Rayan | Bargaining Power Factors | 2024 Context/Data |

|---|---|---|---|

| Depositors | Primary source of capital for lending activities. | Attracting and retaining a broad, stable base through competitive rates. | Robust retail deposit base in Qatar reduces reliance on wholesale funding. |

| Technology Providers | Core banking systems, cybersecurity, digital platforms. | Specialized nature of services, high switching costs, essential for digital transformation. | Global digital banking platform market projected over $20 billion by 2024. |

| Skilled Human Capital | Islamic finance experts, IT specialists, risk managers, Sharia scholars. | Global talent shortages in specialized financial roles, driving up compensation. | High demand for cybersecurity professionals in finance outstripping supply in 2024. |

| Regulatory & Compliance Services | Legal advice on Sharia-compliant structures, auditing. | Niche expertise, critical nature of services in a regulated environment, adherence to QCB mandates. | QCB directives in late 2023/early 2024 focus on digital security and ESG principles. |

What is included in the product

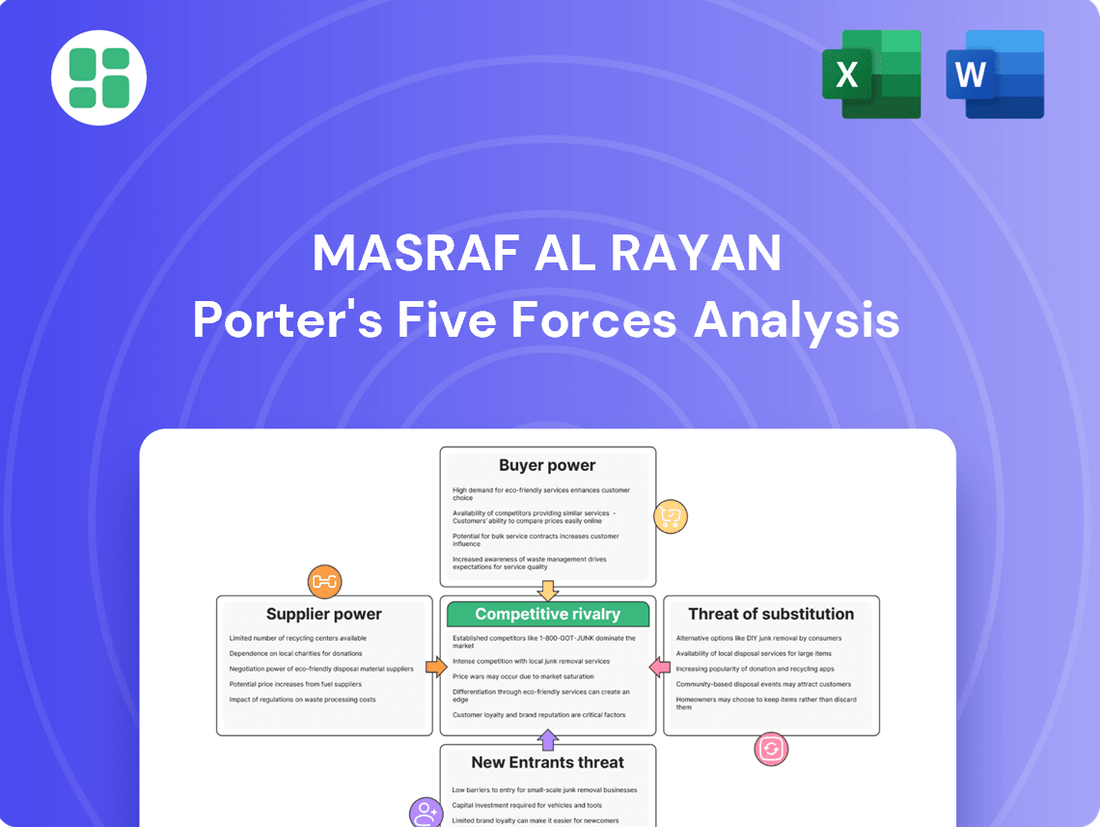

This Masraf Al Rayan Porter's Five Forces Analysis dissects the competitive intensity and profitability potential within its operating environment, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on Masraf Al Rayan's market landscape.

Customers Bargaining Power

Customer switching costs for Masraf Al Rayan are a key factor in their bargaining power. While basic banking transactions might be easy to switch from, Masraf Al Rayan offers a wide array of Sharia-compliant financial products. This includes specialized corporate and investment services, which can make it more difficult and costly for customers to move their business elsewhere if they are heavily invested in these offerings.

Masraf Al Rayan is actively working to increase customer loyalty and reduce the likelihood of customers switching. They are focusing on providing excellent customer-centric services and investing in digital advancements. This strategy aims to make it more appealing for customers to stay with the bank, thereby lowering their incentive to seek out alternative financial institutions.

Masraf Al Rayan's customer base spans retail individuals, corporations, and institutions, each segment exhibiting different levels of bargaining power. While individual retail customers typically have limited sway, larger corporate and institutional clients, particularly those seeking specialized Sharia-compliant financing and treasury solutions, can wield significant influence due to the substantial volume of their transactions and tailored service requirements.

The bank's strategic focus on differentiating its Sharia-compliant products and services inherently reduces the direct substitutability and comparability with conventional banking alternatives. This differentiation strengthens Masraf Al Rayan's position by making it less susceptible to customers switching to competitors based solely on price, thereby mitigating customer bargaining power.

The proliferation of digital platforms and financial aggregators has dramatically increased information availability for Masraf Al Rayan's customers. This transparency makes it simpler than ever for consumers to compare financial products, interest rates, and fees across various institutions. For instance, in 2024, a significant portion of banking customers actively used comparison websites before making financial decisions, a trend that continues to grow.

Masraf Al Rayan's strategic investments in its digital channels and mobile banking applications, while enhancing customer convenience and engagement, also inadvertently amplify customer bargaining power. These platforms provide readily accessible data on competitors' products and services. Reports from 2024 indicate that over 60% of retail banking customers in many developed markets utilize mobile banking apps, which often include features for comparing offers, thus empowering them to seek better deals.

Price Sensitivity of Customers

Customers in the banking sector, especially for straightforward offerings like current accounts or simple loans, often exhibit significant price sensitivity. This means they are likely to switch providers based on better rates or lower fees. Masraf Al Rayan must carefully manage its pricing to remain competitive while safeguarding its profit margins.

The current economic climate, including fluctuating interest rates, directly impacts this sensitivity. For instance, a 0.25% difference in an interest rate on a mortgage can be a deciding factor for many borrowers. Masraf Al Rayan's ability to attract and retain deposits hinges on offering attractive rates, which in turn influences its lending capacity and overall profitability.

- Price Sensitivity Impact: Customers readily compare rates for savings accounts and loans, making them agile in switching financial institutions.

- Competitive Pricing Challenge: Banks like Masraf Al Rayan face pressure to offer competitive interest rates to attract deposits, potentially squeezing net interest margins.

- Deposit Attraction: In 2024, the average savings account interest rate in many developed markets hovered around 1-2%, while promotional rates could be higher, illustrating the need for attractive offers.

- Profitability Balance: Maintaining profitability requires a delicate balance between offering customer-appealing rates and ensuring sufficient income from lending activities.

Regulatory Support for Consumers

The Qatar Central Bank (QCB) plays a significant role in bolstering the bargaining power of Masraf Al Rayan's customers through its regulatory framework. These regulations are designed to foster transparency and ensure customers receive fair treatment when engaging with financial products and services. By mandating clearer terms and conditions, the QCB empowers customers with a better understanding of their rights and obligations, thereby increasing their ability to negotiate and make informed choices.

Furthermore, recent advancements like the implementation of electronic Know Your Customer (e-KYC) regulations indirectly enhance customer leverage. While primarily focused on streamlining onboarding and bolstering security, these measures make accessing financial services more efficient for customers. This increased ease of access can lead to a more competitive market, where customers can more readily switch providers if they are not satisfied, thus amplifying their bargaining power.

- Enhanced Transparency: QCB regulations mandate clear and understandable terms for financial products, reducing information asymmetry.

- Fair Treatment: Rules are in place to protect customers from predatory practices, giving them more confidence.

- Streamlined Access: e-KYC initiatives simplify customer onboarding, making it easier to compare and switch financial institutions.

- Increased Competition: Efficient onboarding can foster a more competitive environment, giving customers more options and leverage.

Masraf Al Rayan's customers, particularly large corporate clients, possess significant bargaining power due to the substantial volume of their transactions and the specialized nature of Sharia-compliant financial solutions they require. This leverage is amplified when these clients can easily compare offerings, a trend intensified by digital platforms and increased information availability. For instance, in 2024, a notable percentage of banking customers actively used comparison tools, making price sensitivity a key factor in their decisions.

| Customer Segment | Bargaining Power Drivers | Masraf Al Rayan's Mitigation Strategies |

|---|---|---|

| Retail Individuals | Price sensitivity, ease of switching for basic services | Digital engagement, loyalty programs, competitive pricing |

| Corporations & Institutions | Transaction volume, need for specialized Sharia-compliant products, tailored services | Relationship management, customized solutions, value-added services |

| Overall Customer Base | Information transparency via digital platforms, regulatory influences | Product differentiation, enhanced customer service, digital investment |

Same Document Delivered

Masraf Al Rayan Porter's Five Forces Analysis

This preview showcases the comprehensive Masraf Al Rayan Porter's Five Forces Analysis, detailing the competitive landscape of its industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises. You can trust that the professional quality and content displayed are precisely what you'll be able to download and utilize for your strategic planning.

Rivalry Among Competitors

The competitive rivalry within Qatar's Islamic banking sector is notably high, largely due to its concentrated nature. In 2024, Qatar Islamic Bank (QIB) and Masraf Al Rayan (now AlRayan Bank) together commanded over 68% of the sector's assets, with Masraf Al Rayan holding the position of the second largest player. This oligopolistic landscape intensifies competition among these dominant entities, driving a focus on securing market share through innovation and superior service.

Competitive rivalry in the banking sector, particularly for institutions like Masraf Al Rayan, is intense. While the core offering of Islamic banking provides a unique Sharia-compliant value proposition, differentiation increasingly hinges on the quality of services, the sophistication of digital platforms, and the overall customer experience.

Masraf Al Rayan's strategic rebranding to 'Leading Forward' underscores its commitment to innovation and digital excellence. This move is a direct counter to the escalating rivalry, as other banks are also making substantial investments in technology to capture market share and enhance customer engagement.

In 2024, digital banking adoption continued to surge, with many customers preferring online and mobile channels for their transactions. Banks that can offer seamless, intuitive, and secure digital experiences are better positioned to attract and retain clients, making digital capabilities a critical battleground for competitive advantage.

The Islamic banking sector in Qatar is experiencing significant expansion, with Islamic banking assets growing at a compound annual growth rate of 6.8% since 2020. This robust growth outpaces the conventional banking sector, signaling a strong demand for Sharia-compliant financial products and services.

This rapid expansion naturally fuels competitive rivalry. As the market for Islamic finance grows, more institutions are drawn to it, leading to increased competition among existing Islamic banks and potentially new entrants aiming to capture a share of this lucrative market. Banks are actively competing for customers and market share within this expanding segment.

Furthermore, Qatar's Third Financial Sector Strategic Plan explicitly supports and encourages further growth in Islamic finance. This governmental backing is likely to attract more investment and participants, potentially intensifying the competitive landscape as various entities strive to align with and benefit from these strategic objectives.

Regulatory Landscape and Strategic Direction

The regulatory environment, particularly initiatives from the Qatar Central Bank (QCB), significantly influences competitive rivalry. The QCB's Third Financial Sector Strategic Plan (2023-2030) and its FinTech Strategy are actively pushing for greater innovation and digital adoption within the banking sector. This creates a dynamic where banks must compete not only on traditional metrics but also on their ability to integrate new technologies and offer digital-first services.

Banks are responding by aligning their strategies with these national objectives, leading to increased competition in areas like Environmental, Social, and Governance (ESG) financing and the development of advanced digital banking solutions. For instance, in 2023, Qatari banks saw a notable increase in their commitment to sustainable finance, with several institutions launching new ESG-focused products and reporting frameworks. This strategic alignment means that firms that are slower to embrace digital transformation or sustainable practices risk falling behind their more agile competitors.

- QCB's Strategic Plans: The Third Financial Sector Strategic Plan (2023-2030) and the FinTech Strategy are key drivers of change.

- Focus on Innovation: These plans encourage digital transformation and sustainable finance, intensifying competition.

- Competitive Response: Banks are actively investing in ESG financing and digital service offerings to align with national priorities.

- Market Impact: This regulatory push fosters a more dynamic and competitive landscape, rewarding forward-thinking institutions.

Mergers and Acquisitions Activity

The merger between Al Rayan Bank and Al Khalij Commercial Bank, finalized in 2017, was a pivotal event that reshaped Qatar's banking landscape. This consolidation created Masraf Al Rayan, significantly bolstering its market share and competitive standing. The combined entity now commands a larger asset base, leading to greater economies of scale and enhanced operational efficiency, which in turn intensifies rivalry for other market participants.

This strategic move by Masraf Al Rayan has directly influenced competitive rivalry by creating a more formidable player. Smaller banks or those with less robust financial footing may find it increasingly challenging to compete on price, service, or technological innovation against this larger, merged institution. The pressure is on for these entities to either consolidate themselves or find niche markets to thrive.

- Masraf Al Rayan's market position strengthened post-merger, increasing competitive intensity.

- Consolidation leads to larger, more efficient entities, pressuring smaller competitors.

- The merger reshaped the competitive dynamics within the Qatari banking sector.

Competitive rivalry in Qatar's Islamic banking sector is fierce, driven by a concentrated market structure and a strong push for digital innovation. In 2024, the top two Islamic banks held over 68% of sector assets, creating an oligopoly that compels institutions like Masraf Al Rayan to constantly enhance services and digital offerings. This intensified competition is further fueled by the sector's robust growth, with Islamic banking assets growing at a 6.8% CAGR since 2020, attracting more players and sharpening the focus on customer acquisition and retention through technological advancements and superior customer experiences.

| Metric | Value (2024 Estimate) | Source/Note |

| Market Share of Top 2 Islamic Banks | > 68% | Estimated based on asset concentration |

| Islamic Banking Asset CAGR (2020-2024) | 6.8% | Qatar Central Bank data |

| Digital Banking Adoption | Rising Trend | Industry observation |

SSubstitutes Threaten

For customers not strictly adhering to Sharia principles, conventional banks offer a direct substitute for many financial services. While Masraf Al Rayan serves a Sharia-compliant client base, the broader banking sector in Qatar, which includes large conventional banks, still represents an alternative for some segments. For instance, as of Q1 2024, conventional banks held a significant majority of the total banking sector assets in Qatar, indicating their substantial market presence and the availability of a wide range of non-Sharia compliant products.

The burgeoning fintech sector, especially in digital payments, peer-to-peer lending, and robo-advisory services, presents a substantial threat of substitution for Masraf Al Rayan. These innovative financial technologies offer alternative ways for consumers and businesses to manage their money, often with greater convenience and lower fees.

Qatar's Islamic fintech market is experiencing robust growth, with projections indicating continued expansion. The emergence of new digital-only Islamic banks, which are inherently more agile and cost-effective, directly challenges traditional institutions by providing competitive, Sharia-compliant alternatives.

Sophisticated clients increasingly bypass traditional banking by directly investing in equities, real estate, or other asset classes. This direct investment trend, coupled with participation in the sukuk market, offers viable alternatives to conventional bank financing and deposit products, thereby posing a significant threat of substitution.

The sukuk market in Qatar has seen substantial growth, with issuances reaching QAR 16.8 billion in the first half of 2024, according to the Qatar Central Bank. This expansion provides alternative investment avenues, potentially diverting substantial funds away from traditional bank deposits and impacting Masraf Al Rayan's deposit base.

Alternative Islamic Finance Instruments

Beyond conventional banking, a growing array of Sharia-compliant financial products and entities serve as viable substitutes for traditional Islamic finance offerings. These include Takaful, which functions as Islamic insurance, and various Islamic investment funds that cater to investors seeking Sharia-adherent vehicles. The burgeoning Takaful sector in Qatar, for instance, provides an alternative avenue for risk management and financial planning, directly competing for customer engagement.

The competitive landscape for Masraf Al Rayan is further shaped by the availability of these alternative Sharia-compliant instruments. Customers have choices that extend beyond direct banking services.

- Takaful: Islamic insurance products offer an alternative to conventional insurance and certain banking services related to risk pooling.

- Islamic Investment Funds: These funds provide Sharia-compliant investment opportunities, acting as substitutes for direct equity or fixed-income investments offered by banks.

- Growth in Takaful Market: The expanding Takaful market in Qatar indicates a growing customer preference for Sharia-compliant alternatives in insurance and potentially other financial areas.

Internal Corporate Financing

Large corporations, a significant client base for Masraf Al Rayan's corporate banking services, possess the capacity to tap into internal corporate financing. This means they can utilize retained earnings or access capital markets directly through instruments like corporate sukuk, thereby lessening their reliance on traditional bank lending. For instance, in 2024, many large Qatari corporations reported robust retained earnings, providing a substantial internal capital pool.

This ability to self-finance or secure funding through alternative means directly impacts Masraf Al Rayan by reducing the demand for its loan products. When corporations can fund their operations and growth internally or via direct market access, their bargaining power with banks like Masraf Al Rayan increases. This can lead to pressure on interest margins and fees for corporate banking services.

The availability of internal corporate financing acts as a significant substitute for traditional bank loans.

- Reduced Dependence: Corporations can fund expansion or operational needs using their own profits, diminishing the need for external bank financing.

- Market Access: Issuing corporate sukuk or bonds allows companies to raise capital directly from investors, bypassing banks.

- Bargaining Power: Greater financing options empower corporations to negotiate more favorable terms with banks.

- Cost Efficiency: In certain market conditions, internal financing or direct market borrowing can be more cost-effective than bank loans.

The threat of substitutes for Masraf Al Rayan is multifaceted, encompassing both conventional financial institutions and emerging Sharia-compliant alternatives. Conventional banks, holding a significant share of Qatar's banking assets as of Q1 2024, offer a broad range of services that can substitute for Islamic banking products for customers not strictly adhering to Sharia principles.

The rise of fintech, particularly in digital payments and alternative lending, presents a growing challenge, offering convenience and potentially lower costs. Furthermore, sophisticated clients increasingly opt for direct investments in equities, real estate, or sukuk, bypassing traditional banking channels altogether. The sukuk market's growth, with QAR 16.8 billion issued in H1 2024, exemplifies this trend, diverting funds from bank deposits.

Beyond direct banking, Sharia-compliant substitutes like Takaful (Islamic insurance) and Islamic investment funds are gaining traction, offering alternative avenues for risk management and investment. Large corporations also pose a threat by leveraging retained earnings or accessing capital markets directly through sukuk issuances, reducing their reliance on bank financing.

| Substitute Category | Examples | Impact on Masraf Al Rayan |

|---|---|---|

| Conventional Banking | Traditional banks, diverse product offerings | Loss of customers not strictly adhering to Sharia; competition for market share. |

| Fintech | Digital payments, P2P lending, robo-advisors | Disintermediation; pressure on fees and convenience standards. |

| Direct Investment | Equities, real estate, sukuk market | Reduced deposit base; lower demand for lending products. |

| Sharia-Compliant Alternatives | Takaful, Islamic investment funds | Competition for customer engagement and capital. |

| Corporate Self-Financing | Retained earnings, corporate sukuk | Reduced demand for corporate loans; increased bargaining power for corporations. |

Entrants Threaten

Establishing a new bank in Qatar, particularly an Islamic one, demands significant capital infusion. For instance, in 2024, the minimum paid-up capital requirement for new banks in Qatar remained substantial, acting as a formidable barrier for potential entrants seeking to compete with established institutions like Masraf Al Rayan.

These high capital requirements, mandated by the Qatar Central Bank, ensure financial stability and solvency, thereby limiting the number of new players that can realistically enter the market. This financial hurdle directly impacts the threat of new entrants.

The stringent regulatory framework in Qatar acts as a significant barrier to new entrants in the banking sector. The Qatar Central Bank (QCB) actively enforces a robust and continuously updated set of regulations, such as those pertaining to digital banking and electronic Know Your Customer (e-KYC) processes, making compliance a complex undertaking.

Securing a banking license, especially for institutions aiming to operate under Sharia-compliant principles, is an arduous process. It demands meticulous adherence to strict compliance standards and subjects applicants to ongoing scrutiny, thereby deterring many potential new players from entering the market.

Masraf Al Rayan, like other incumbent banks, benefits significantly from its established brand recognition and the deep trust it has cultivated with its customers over years of operation. This loyalty, built through consistent service and financial stability, presents a formidable barrier to new banks entering the market.

New entrants face the daunting task of not only matching Masraf Al Rayan's brand appeal but also overcoming the inertia of existing customer relationships. For instance, in 2024, the Qatari banking sector saw continued strong customer retention for established institutions, with major banks reporting high levels of account stability, underscoring the difficulty for newcomers to gain substantial market share quickly.

Attracting and retaining customers requires new banks to invest heavily in marketing and customer acquisition strategies, a process that is both time-consuming and capital-intensive. The sheer effort and cost involved in building a comparable level of brand loyalty and a significant customer base are substantial deterrents, making the threat of new entrants moderate in this regard.

Access to Sharia-Compliant Expertise and Infrastructure

New Islamic banks face a significant hurdle in establishing the necessary Sharia-compliant infrastructure. This includes building robust Sharia boards, implementing specialized audit mechanisms, and developing a deep understanding of Sharia-compliant product innovation. For instance, the Islamic finance sector globally saw substantial growth, with assets reaching an estimated USD 4.9 trillion in 2023, indicating a large but complex market to penetrate.

A critical barrier for new entrants is the scarcity of highly qualified Sharia scholars and experienced Islamic finance professionals. This talent gap can impede the ability to offer genuinely Sharia-compliant products and services, a cornerstone of Islamic banking. The demand for such expertise often outstrips supply, driving up recruitment costs and potentially slowing down operational setup.

- Talent Acquisition Costs: High demand for Sharia scholars and Islamic finance experts leads to increased recruitment and compensation expenses for new Islamic banks.

- Infrastructure Development: Building a comprehensive Sharia-compliant operational framework, from governance to product design, requires significant initial investment and specialized knowledge.

- Regulatory Compliance: Navigating and adhering to diverse Sharia interpretations and evolving regulatory landscapes adds complexity and cost for market entrants.

Digital Transformation and Fintech Integration

The threat of new entrants in the banking sector, particularly concerning digital transformation and fintech integration, is significant. New players must make substantial investments in advanced technology to rival established institutions like Masraf Al Rayan, which are already deeply integrated with digital solutions. The Qatar Central Bank's (QCB) strong emphasis on fintech innovation mandates that any new entrant must immediately provide sophisticated digital offerings, demanding considerable initial capital outlay and specialized technical knowledge.

This landscape presents a high barrier to entry for new digital-first banks or fintech companies aiming to disrupt the market. For instance, the global fintech market was valued at approximately $11.2 trillion in 2023 and is projected to grow substantially. New entrants must not only match the digital capabilities of incumbents but also innovate rapidly to gain market share. This requires significant investment in areas such as:

- Cybersecurity infrastructure to protect customer data and transactions.

- AI and machine learning for personalized customer experiences and fraud detection.

- Robust mobile banking platforms offering seamless user interfaces and a wide range of services.

The threat of new entrants in Qatar's banking sector, particularly for Islamic banks like Masraf Al Rayan, is considerably low. High capital requirements, stringent regulatory oversight from the Qatar Central Bank, and the established brand loyalty of incumbents present substantial barriers.

New entrants must also overcome the complexity of building Sharia-compliant infrastructure and acquiring specialized talent, which adds significant costs and time to market entry. Furthermore, the need for substantial investment in advanced digital technologies to compete with existing players further elevates the entry barriers.

In 2024, the Qatari banking sector continued to demonstrate strong customer retention for established institutions, making it difficult for newcomers to gain significant market share. The global Islamic finance market, while growing, requires specialized knowledge and infrastructure to penetrate effectively.

The significant investment needed in cybersecurity, AI, and mobile banking platforms means that only well-capitalized and technologically adept firms can realistically challenge incumbents like Masraf Al Rayan.

Porter's Five Forces Analysis Data Sources

Our Masraf Al Rayan Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Masraf Al Rayan's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific data from financial news outlets and market research reports to provide a robust understanding of the competitive landscape.