Masraf Al Rayan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Masraf Al Rayan Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Masraf Al Rayan's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to navigate these external forces effectively. Download the full report now to gain a competitive edge and make informed decisions.

Political factors

Qatar's stable political landscape provides a bedrock for Masraf Al Rayan's operations, with the government actively fostering the Islamic finance sector. This consistent policy support, aligned with national development goals such as Qatar National Vision 2030, creates a predictable and encouraging environment for the bank's long-term growth and strategic planning.

Government initiatives, including substantial investments from the Qatar Investment Authority, directly benefit Masraf Al Rayan's corporate banking and investment arms. For instance, the QIA's significant global and domestic investments create opportunities for the bank to participate in and finance major projects, enhancing its deal flow and revenue generation capabilities.

Regional geopolitical dynamics significantly influence Masraf Al Rayan's international operations. Qatar's diplomatic relations, particularly with neighboring GCC countries, can impact cross-border transactions and investor confidence. For instance, the resolution of the Qatar diplomatic crisis in early 2021, which saw the reopening of borders and restoration of ties with Saudi Arabia and the UAE, likely eased some operational complexities and potentially boosted investor sentiment towards Qatari financial institutions.

These shifting regional alliances and any potential disputes directly affect trade flows and the bank's international client base. A stable geopolitical environment fosters greater cross-border investment and facilitates smoother international banking services. Conversely, regional tensions can introduce complexities, requiring Masraf Al Rayan to navigate political sensitivities across its diverse operational territories and manage potential impacts on its foreign direct investments and correspondent banking relationships.

The Qatar Central Bank (QCB) plays a pivotal role in shaping the political and regulatory environment for banks like Masraf Al Rayan. Its policies on capital adequacy, liquidity, and governance are fundamentally political decisions aimed at safeguarding financial stability and ensuring compliance within the nation's banking sector.

For instance, QCB's adherence to Basel III standards, which dictates minimum capital requirements, directly influences how Masraf Al Rayan must structure its balance sheet and manage risk. These regulatory directives, often influenced by global financial trends and domestic economic priorities, can impact the bank's profitability and strategic growth initiatives.

The government's overall approach to financial regulation, including its stance on anti-money laundering (AML) and combating the financing of terrorism (CFT) measures, directly affects Masraf Al Rayan's operational freedom. Stricter enforcement of these regulations, as seen in increased compliance scrutiny in recent years, necessitates significant investment in robust systems and processes, thereby shaping the bank's strategic planning and operational costs.

Government's Role in Economic Diversification

Qatar's commitment to economic diversification, as outlined in its National Vision 2030, significantly shapes the operating environment for Masraf Al Rayan. The government's strategic investments in non-hydrocarbon sectors, such as tourism, logistics, and technology, are creating new avenues for financial services. For instance, the substantial infrastructure development, including major projects like the Lusail City development and expansion of Hamad International Airport, directly fuels demand for corporate banking and project finance services.

These government-led initiatives are designed to foster a more robust private sector. By supporting Small and Medium-sized Enterprises (SMEs) through various programs and incentives, the state aims to broaden the economic base. Masraf Al Rayan can capitalize on this by offering tailored financial products and advisory services to these growing businesses. The bank's alignment with these national objectives is crucial for its long-term growth and relevance.

Masraf Al Rayan's corporate banking and investment strategies are increasingly mirroring these diversification efforts. The bank actively participates in financing key infrastructure projects and has been expanding its offerings in areas like trade finance and capital markets to support the growth of non-oil industries.

Key government initiatives impacting Masraf Al Rayan include:

- Investments in infrastructure: Qatar's continued spending on mega-projects, aiming to enhance connectivity and logistics, provides significant opportunities for project finance and related banking services.

- SME support programs: Government backing for SMEs creates a growing client base for retail and corporate banking, requiring specialized financial solutions.

- Promotion of non-oil sectors: Initiatives targeting tourism, education, and healthcare development open new markets for Masraf Al Rayan's investment banking and wealth management divisions.

- Regulatory framework: Government policies promoting foreign investment and ease of doing business indirectly benefit financial institutions like Masraf Al Rayan by attracting capital and business activity.

International Political Agreements and Sanctions

International political agreements and sanctions significantly shape Masraf Al Rayan's global operations. For instance, the bank must navigate evolving trade pacts and sanctions regimes, such as those impacting regions with significant geopolitical tension, to maintain its international business activities. Compliance with international financial regulations, including anti-money laundering (AML) frameworks like those enforced by the Financial Action Task Force (FATF), is paramount and directly influenced by global political dynamics.

Potential sanctions or shifts in international political relations could restrict Masraf Al Rayan's access to crucial global markets and affect its vital correspondent banking relationships. In 2023, global geopolitical instability led to increased scrutiny of financial institutions' compliance with sanctions lists, impacting cross-border transactions for many banks. The bank's ability to adapt to these changes is critical for its continued international presence and financial stability.

- Geopolitical Risk Impact: Geopolitical events can disrupt international trade flows and capital markets, directly affecting a bank's profitability and operational continuity.

- Regulatory Compliance: Adherence to evolving international AML and counter-terrorism financing (CTF) regulations, often driven by political consensus, is essential for maintaining access to global financial systems.

- Sanctions Evasion: Banks must implement robust systems to prevent facilitating transactions that violate international sanctions, as penalties for non-compliance can be severe, including hefty fines and reputational damage.

- Correspondent Banking: The availability and cost of correspondent banking services can be directly impacted by a bank's country of domicile and its adherence to international financial standards, especially in light of sanctions.

Qatar's political stability and strategic economic diversification initiatives, particularly those outlined in Qatar National Vision 2030, create a favorable operating environment for Masraf Al Rayan. Government investments in infrastructure and support for non-oil sectors directly translate into increased demand for the bank's financial services, from project finance to SME lending. For instance, the Qatar Investment Authority's substantial global investments in 2023 and early 2024 provide further opportunities for Masraf Al Rayan to participate in lucrative deals.

The regulatory framework, managed by the Qatar Central Bank, is a key political factor. Adherence to international standards like Basel III, and robust anti-money laundering measures, directly influence the bank's risk management and operational costs, impacting its strategic planning and profitability. In 2024, the QCB continued its focus on strengthening financial sector resilience and compliance.

International political relations and trade agreements significantly affect Masraf Al Rayan's global operations. Navigating evolving sanctions regimes and ensuring compliance with global anti-money laundering standards, as emphasized by the Financial Action Task Force, remains critical. Geopolitical events in 2023 and early 2024 highlighted the need for banks to maintain robust compliance systems to avoid penalties and maintain access to international markets.

The resolution of regional diplomatic issues, such as the normalization of ties with neighboring GCC countries, has eased operational complexities and potentially boosted investor confidence in Qatari financial institutions. This improved regional stability in 2023 onwards facilitates smoother cross-border transactions and strengthens correspondent banking relationships.

What is included in the product

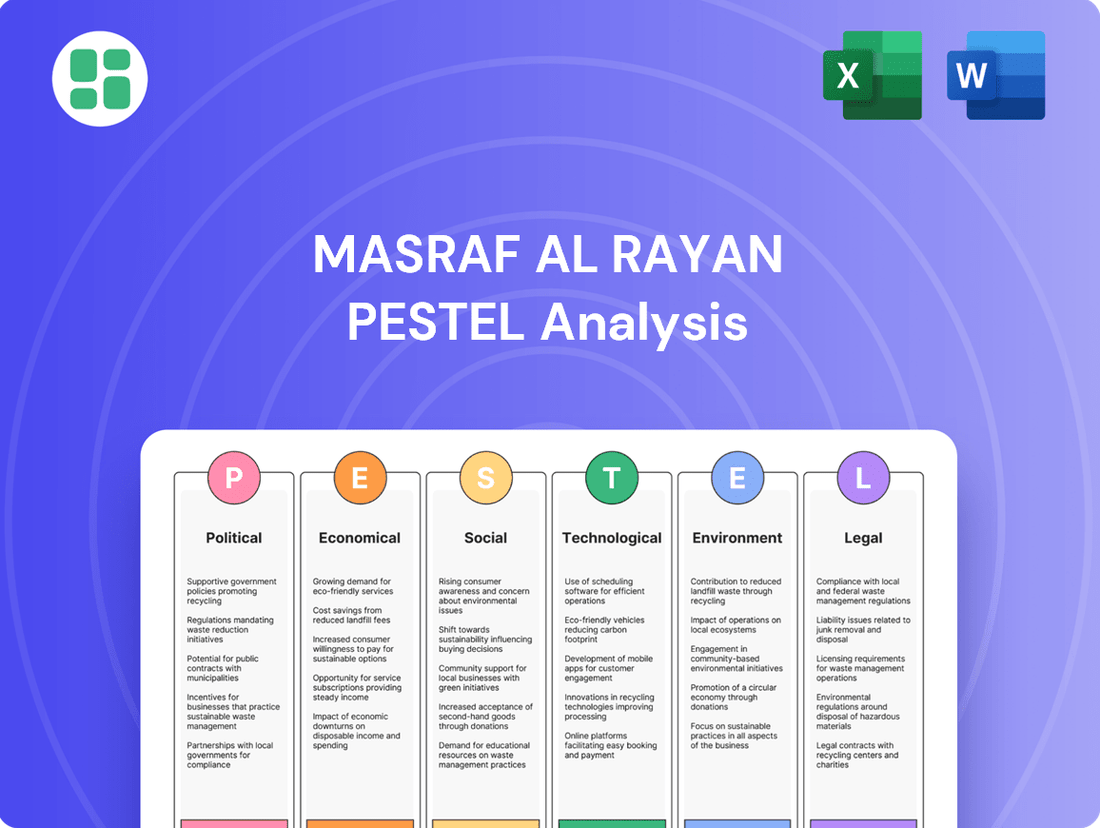

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Masraf Al Rayan, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights by detailing specific threats and opportunities, supported by current trends and data relevant to the financial sector in Masraf Al Rayan's operational regions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of Masraf Al Rayan's external environment to proactively address potential challenges.

Economic factors

Fluctuations in global oil and gas prices significantly impact Qatar's economy, as these commodities are its main revenue source. For Masraf Al Rayan, this volatility directly shapes its operating environment. For instance, during periods of high energy prices, such as the strong performance seen in early 2024 driven by geopolitical tensions and supply concerns, Qatar experiences increased government spending and a subsequent boost in liquidity within the banking system. This can translate to higher customer deposits and potentially increased loan demand.

Conversely, periods of lower energy prices, like those experienced in late 2023 due to global demand moderation, can lead to tighter liquidity. This tightening can affect corporate and retail spending, potentially reducing loan demand and impacting the overall investment landscape for banks like Masraf Al Rayan. The banking sector's health is intricately linked to these commodity price swings, influencing everything from deposit growth to the quality of loan portfolios.

Qatar's commitment to economic diversification away from hydrocarbons is a significant tailwind for Masraf Al Rayan. The nation's GDP growth, projected to be around 3.5% in 2024 and 4.0% in 2025, is increasingly driven by non-oil sectors. This expansion in areas like tourism, logistics, and technology directly translates into new business opportunities for the bank, offering avenues for lending and investment.

Masraf Al Rayan can strategically leverage these diversification efforts by tailoring its financial products and services to support burgeoning industries. For instance, financing for new tourism infrastructure projects or technology startups can capture market share. The bank's ability to adapt and offer specialized solutions will be key to capitalizing on Qatar's evolving economic landscape.

The Qatar Central Bank's (QCB) monetary policy, particularly its profit rate decisions, significantly impacts Masraf Al Rayan's financial performance. For instance, a higher profit rate environment, as seen with the QCB's benchmark rate adjustments in 2023, generally increases the bank's cost of funds, potentially squeezing net profit margins if financing product pricing cannot keep pace.

Changes in profit rates directly influence Masraf Al Rayan's liquidity management. When rates rise, the cost of borrowing from the central bank or interbank market increases, affecting the bank's ability to offer competitive financing and manage its balance sheet effectively. Conversely, lower rates can reduce funding costs, boosting profitability.

Global interest rate trends also shape Qatar's domestic liquidity. In 2024, continued global monetary tightening could lead to capital outflows from emerging markets like Qatar, potentially reducing overall liquidity and increasing funding costs for Qatari banks, including Masraf Al Rayan, impacting their lending capacity and profitability.

Inflation and Consumer Purchasing Power

Domestic inflation directly impacts Masraf Al Rayan's retail banking segment by influencing consumer purchasing power. When inflation rises, the real value of money decreases, meaning consumers can buy less with the same amount of income. This can lead to reduced demand for discretionary retail banking products like personal loans or credit cards.

High inflation can strain household budgets, potentially affecting consumers' ability to service existing loans and impacting deposit growth as individuals may dip into savings to cover rising costs. For instance, if inflation significantly outpaces wage growth, loan repayment delinquency rates could climb. Conversely, stable and predictable inflation, ideally within a central bank's target range, fosters a more confident economic environment. This predictability allows consumers to plan their spending and saving more effectively, supporting a healthier demand for retail banking services and a more stable deposit base for Masraf Al Rayan.

Recent data highlights the sensitivity of purchasing power to inflation. For example, in Qatar, inflation figures for 2024 and early 2025 are closely monitored by financial institutions. If inflation is running at, say, 3% while wage growth is only 1%, consumers experience a 2% decline in real purchasing power. This erosion directly affects their capacity to engage in new credit or maintain savings levels, posing a challenge for banks like Masraf Al Rayan.

- Inflationary pressures in Qatar during 2024 and early 2025 are expected to influence consumer spending patterns.

- A sustained increase in inflation above wage growth can reduce disposable income, impacting demand for retail credit.

- Stable inflation environments are conducive to predictable consumer behavior and sustained deposit growth for banks.

- Masraf Al Rayan's retail segment performance is closely tied to the real income levels of its customer base.

Global Economic Trends and Investment Climate

Global economic trends significantly shape the investment climate for Masraf Al Rayan. A robust global economy often translates to increased international investment flows into Qatar, boosting demand for corporate banking services and positively impacting the bank's treasury operations and investment portfolio performance. For instance, the IMF projected global growth to reach 3.2% in 2024, a slight uptick from 2023, suggesting a generally supportive environment for emerging markets like Qatar.

Conversely, global economic slowdowns or recessions can dampen foreign direct investment into Qatar. This directly affects Masraf Al Rayan by potentially reducing deal flow for corporate banking and impacting the valuation of its investment holdings. The confidence of international investors in Qatar's financial market is also closely tied to global economic stability; any widespread instability can lead to capital flight or reduced appetite for emerging market assets.

- Global Growth Outlook: The IMF's forecast of 3.2% global growth for 2024 provides a baseline for potential international investment into Qatar.

- Impact on FDI: A stable global economy encourages Foreign Direct Investment into Qatar, directly benefiting demand for Masraf Al Rayan's corporate banking services.

- Investment Portfolio Sensitivity: Masraf Al Rayan's investment portfolio is susceptible to global market volatility, with downturns potentially leading to reduced asset values.

- Investor Confidence: International investor sentiment towards Qatar's financial market is heavily influenced by broader global economic stability and perceived risk.

Qatar's economic performance, heavily influenced by global energy prices, directly impacts Masraf Al Rayan. While high oil prices in early 2024 boosted liquidity, lower prices in late 2023 led to tightening. The nation's diversification efforts, with non-oil GDP growth projected at 3.5% in 2024 and 4.0% in 2025, are creating new opportunities for the bank.

Monetary policy from the Qatar Central Bank, including profit rate decisions, is crucial. Higher rates in 2023 increased funding costs for Masraf Al Rayan, potentially squeezing margins. Global interest rate trends also affect domestic liquidity, with continued tightening in 2024 potentially leading to capital outflows.

Inflation affects consumer spending and loan demand. For instance, if inflation in 2024-2025 outpaces wage growth, purchasing power erodes, impacting retail banking. Stable inflation fosters consumer confidence and deposit growth.

Global economic trends influence investment flows into Qatar. The IMF's 3.2% global growth forecast for 2024 suggests a supportive environment for investment, benefiting Masraf Al Rayan's corporate banking and treasury operations. Conversely, global slowdowns can reduce foreign direct investment and impact portfolio valuations.

| Economic Factor | 2024 Projection/Trend | Impact on Masraf Al Rayan |

|---|---|---|

| Global Oil Prices | Volatile; strong in early 2024 | Influences liquidity and economic activity in Qatar |

| Qatar GDP Growth (Non-Oil) | 3.5% (2024), 4.0% (2025) | Creates new business and lending opportunities |

| Qatar Central Bank Profit Rates | Adjusted based on global trends | Affects funding costs and net profit margins |

| Domestic Inflation | Monitored closely for 2024-2025 | Impacts consumer spending and loan repayment capacity |

| Global Economic Growth | 3.2% projected for 2024 (IMF) | Shapes investment flows and portfolio performance |

Preview Before You Purchase

Masraf Al Rayan PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Masraf Al Rayan covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into the external forces shaping Masraf Al Rayan's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a detailed examination of each PESTLE element relevant to Masraf Al Rayan's operations and future growth.

Sociological factors

Qatar's population is experiencing significant growth, driven by a large expatriate workforce, which reached approximately 2.4 million by the end of 2023. This demographic trend directly impacts Masraf Al Rayan's retail banking strategy by increasing demand for a wide range of financial services. The growing number of young Qatari nationals, entering the workforce and forming households, also presents a key segment with distinct needs in areas like personal loans, mortgages, and digital banking solutions.

The bank must cater to the diverse financial needs and preferences of both expatriate and local populations. For instance, expatriates may prioritize remittance services and short-term savings products, while young Qatari nationals might focus on wealth management and long-term investment opportunities. Masraf Al Rayan's ability to adapt its product portfolio and digital offerings to serve these varied segments is crucial for maintaining its competitive edge in the retail banking sector.

The deep-seated cultural and religious adherence to Sharia-compliant financial products is a cornerstone for Masraf Al Rayan, particularly within Qatar and the wider Middle East. This preference directly fuels the bank's core business model, as customers actively seek ethical and religiously aligned banking services.

Societal trust in Islamic banking principles is a significant driver of demand, with Masraf Al Rayan leveraging its Islamic identity to foster strong customer relationships and loyalty. This trust is cultivated through consistent adherence to Islamic principles in all operations and community engagement initiatives.

Consumer behavior is rapidly shifting towards digital channels, with a growing preference for mobile banking and online transactions. This trend directly impacts Masraf Al Rayan, as customers increasingly expect seamless, convenient digital banking experiences. For instance, a significant portion of banking activities, estimated to be over 70% by some industry reports in early 2024, are moving online, highlighting the urgency for banks to bolster their digital infrastructure.

Masraf Al Rayan must invest in robust digital platforms to cater to this demand for convenience and efficiency. This includes developing user-friendly mobile apps and secure online portals that support a wide range of banking services, from account management to digital payments. The bank's ability to innovate in this space will be crucial for retaining and attracting customers in the competitive Qatari market.

Educating and encouraging clients to adopt these digital channels is also paramount. Masraf Al Rayan can achieve this through targeted campaigns, tutorials, and personalized support to help customers navigate new technologies. Maintaining a balance between digital efficiency and personalized service, perhaps through hybrid models that offer both online convenience and human interaction for complex needs, will be key to customer satisfaction and loyalty.

Financial Literacy and Education Levels

The general level of financial literacy in Qatar significantly impacts Masraf Al Rayan's strategic approach to product development and customer engagement. A higher financial literacy rate would allow for the introduction of more sophisticated financial products, while a lower rate necessitates simpler offerings and robust educational campaigns. For instance, a 2023 survey indicated that while a majority of Qataris expressed interest in financial planning, a substantial portion still relied on basic banking services, highlighting a need for tailored educational content.

Masraf Al Rayan can leverage this understanding by developing products that cater to varying levels of financial sophistication. This includes offering easily understandable savings accounts and investment funds alongside more complex Sharia-compliant wealth management solutions. Initiatives focused on improving financial literacy, such as workshops and online resources, can foster a more informed and engaged customer base, potentially increasing uptake of the bank's diverse financial instruments.

The bank's commitment to enhancing financial literacy aligns with its social responsibility mandate and can cultivate a more loyal and active customer segment. By providing clear, accessible information about financial concepts and products, Masraf Al Rayan can empower individuals to make better financial decisions. This proactive approach can lead to a stronger financial ecosystem within Qatar, benefiting both the institution and its clientele.

Workforce Dynamics and Talent Pool

Qatar's workforce dynamics present both challenges and opportunities for Masraf Al Rayan. The demand for specialized skills in Islamic finance, risk management, and digital banking is growing, and the availability of a deep local talent pool in these niche areas remains a key consideration. For instance, while Qatar's nationalization efforts (Qatarization) aim to increase local employment, the rapid expansion of the financial sector means that attracting and retaining highly specialized talent, both domestically and internationally, is crucial for Masraf Al Rayan's strategic objectives.

Masraf Al Rayan faces the ongoing task of developing and retaining its workforce to meet evolving market demands. This includes investing in training programs that enhance expertise in areas like fintech and Sharia-compliant digital services. By 2024, there's a continued emphasis on upskilling the existing workforce and attracting international expertise to fill critical skill gaps, ensuring the bank remains competitive.

The cultural diversity within Masraf Al Rayan's workforce is a significant asset, fostering innovation and a broader understanding of global financial markets. The bank's commitment to creating an inclusive environment is vital for employee engagement and retention. This focus on diversity aligns with Qatar's broader vision of becoming a regional hub for finance and talent, supporting the bank's long-term growth and operational excellence.

Key considerations for Masraf Al Rayan's workforce include:

- Talent Acquisition: Balancing Qatarization goals with the need for specialized international expertise in Islamic finance and digital banking.

- Skill Development: Continuous investment in training for areas such as AI, cybersecurity, and advanced risk analytics to stay ahead of industry trends.

- Talent Retention: Implementing competitive compensation, career development paths, and fostering an inclusive work culture to retain skilled employees.

- Digital Transformation: Ensuring the workforce is equipped with the necessary digital skills to support the bank's ongoing digital transformation initiatives.

Qatar's growing population, fueled by expatriates, presents a dynamic customer base for Masraf Al Rayan, requiring tailored retail banking strategies. The increasing number of young Qatari professionals also highlights a demand for specialized financial services like wealth management and digital banking solutions.

The strong cultural and religious adherence to Sharia-compliant finance is a primary driver for Masraf Al Rayan, underpinning its core business and fostering customer loyalty. This trust is built on consistent adherence to Islamic principles across all operations.

Consumer behavior is rapidly shifting towards digital channels, with mobile banking and online transactions becoming the norm, necessitating robust digital platforms from Masraf Al Rayan to meet customer expectations for convenience and efficiency.

Technological factors

The global banking sector's swift digital transformation directly influences Masraf Al Rayan's operational efficiency and competitive standing. The bank's strategic investments in upgrading its digital platforms, mobile banking applications, and online services are crucial for meeting evolving customer expectations in a digitally-driven market.

Innovation in cloud computing, big data analytics, and artificial intelligence is being actively leveraged by Masraf Al Rayan to streamline internal processes and significantly enhance the overall customer experience. For instance, by Q3 2024, the bank reported a 15% year-over-year increase in digital transactions, underscoring the growing reliance on these technological advancements.

Cybersecurity and data protection are paramount for Masraf Al Rayan, safeguarding sensitive customer information and preserving trust in an increasingly digital banking environment. The bank invests heavily in advanced security infrastructure to counter evolving cyber threats, which saw global banking sector losses from cybercrime estimated to be over $3 trillion by 2023, according to some industry reports.

Masraf Al Rayan's commitment extends to rigorous compliance with data protection regulations, such as those stemming from the Qatar Financial Centre Regulatory Authority, and proactive employee and customer education on best practices to mitigate risks. Failing to do so carries significant reputational damage and direct financial penalties; a major data breach could cost millions in recovery, fines, and lost business.

The increasing adoption of FinTech and RegTech presents both opportunities and challenges for Masraf Al Rayan. FinTech innovations in payments, lending, and wealth management are reshaping customer expectations and competitive dynamics. For instance, the global FinTech market was projected to reach over $300 billion by 2024, indicating a significant shift in financial services delivery.

Masraf Al Rayan's strategy likely involves collaborating with or integrating select FinTech solutions to enhance its service offerings and operational efficiency. This could include partnerships for digital payment gateways or AI-driven wealth management platforms, aiming to capture a larger market share in these evolving segments.

Simultaneously, RegTech is crucial for navigating complex regulatory environments. By leveraging RegTech for automated compliance, risk assessment, and reporting, Masraf Al Rayan can significantly reduce operational costs and mitigate compliance risks. The global RegTech market was estimated to grow substantially, with projections suggesting it could reach tens of billions of dollars in the coming years, underscoring its importance for financial institutions.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for Masraf Al Rayan to streamline operations and innovate. The bank is actively exploring DLT for applications in cross-border payments and trade finance, aiming to boost transaction transparency and security. By leveraging these technologies, Masraf Al Rayan can potentially reduce operational costs and develop new Sharia-compliant financial products, such as tokenized assets.

The adoption of DLT could lead to substantial efficiency gains. For instance, a report by Grand View Research projected the global blockchain in banking market to reach $12.5 billion by 2027, indicating a strong trend towards adoption. Masraf Al Rayan's strategic engagement with DLT aligns with this growth, positioning it to capitalize on:

- Enhanced Security: DLT's immutable ledger reduces the risk of fraud and errors in financial transactions.

- Improved Efficiency: Automating processes through smart contracts can significantly speed up settlement times for payments and trade finance.

- Cost Reduction: Eliminating intermediaries and manual reconciliation can lead to lower transaction costs.

- New Product Development: Tokenization of Sharia-compliant assets opens avenues for novel investment and financing solutions.

Artificial Intelligence (AI) and Data Analytics

Masraf Al Rayan is actively integrating artificial intelligence (AI) and sophisticated data analytics to sharpen its competitive edge. By analyzing vast datasets, the bank gains deeper insights into customer preferences, enabling the creation of highly personalized financial products and services. This data-driven approach extends to bolstering fraud detection mechanisms and refining risk assessment models, ensuring greater security and financial stability.

The bank is deploying AI across various functions. For instance, AI-powered chatbots are enhancing customer service by providing instant support and resolving queries efficiently. Predictive analytics are being used to anticipate market trends, allowing for more agile strategic planning. Furthermore, automated credit scoring systems are speeding up loan application processes and improving accuracy, a critical factor in the current financial landscape.

These technological advancements are crucial for informed decision-making at Masraf Al Rayan. The ability to leverage AI and data analytics contributes significantly to a stronger competitive position in the evolving financial sector. The bank’s investment in these areas underscores a commitment to innovation and operational excellence.

- AI-driven personalization: Enhancing customer experience through tailored product offerings.

- Fraud detection: Utilizing advanced analytics to identify and prevent fraudulent activities.

- Risk management: Improving the accuracy of risk assessment for better financial planning.

- Operational efficiency: Streamlining processes like credit scoring and customer service with AI.

Masraf Al Rayan's technological strategy centers on digital transformation, leveraging AI, blockchain, and FinTech to enhance customer experience and operational efficiency. The bank's investment in these areas is crucial for maintaining a competitive edge in the rapidly evolving financial landscape. By Q3 2024, digital transactions saw a 15% year-over-year increase, reflecting the growing adoption of these technologies.

The bank is actively exploring blockchain for applications in cross-border payments and trade finance, aiming to improve transparency and security. The global blockchain in banking market is projected to reach $12.5 billion by 2027, highlighting the potential for significant efficiency gains and cost reductions through DLT adoption.

AI is being integrated across functions, from customer service chatbots to fraud detection and credit scoring. This data-driven approach allows for personalized financial products and more accurate risk assessment. The global FinTech market's projected growth to over $300 billion by 2024 further emphasizes the need for Masraf Al Rayan to embrace these innovations.

| Technology | Impact on Masraf Al Rayan | Market Growth/Data |

|---|---|---|

| Digital Transformation | Enhanced customer experience, operational efficiency | 15% YoY increase in digital transactions (Q3 2024) |

| AI & Data Analytics | Personalized products, improved fraud detection, risk management | AI-driven personalization, fraud detection, risk management, operational efficiency |

| Blockchain & DLT | Streamlined payments, trade finance, new product development | Global blockchain in banking market projected at $12.5 billion by 2027 |

| FinTech | New service offerings, competitive dynamics | Global FinTech market projected over $300 billion by 2024 |

Legal factors

Masraf Al Rayan's operations are intrinsically tied to Islamic banking regulations, demanding strict adherence to Sharia laws across all its financial products and services. This commitment is crucial for maintaining its reputation and customer trust within the Islamic finance sector.

The bank's Sharia Supervisory Board plays a pivotal role in ensuring all activities align with Sharia principles, acting as a cornerstone of its compliance framework. This internal oversight is complemented by the robust legal structures established by the Qatar Central Bank and other Islamic finance regulatory bodies, which set the standards for the industry.

In 2024, the global Islamic finance market continued its growth trajectory, with assets reaching an estimated $4.7 trillion, underscoring the significance of regulatory compliance for institutions like Masraf Al Rayan. Navigating these legal and religious guidelines is not just a requirement but a fundamental aspect of the bank's business model and its ability to attract both domestic and international Sharia-conscious investors.

Masraf Al Rayan operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, both within Qatar and across international jurisdictions. These laws mandate rigorous customer due diligence, transaction monitoring, and suspicious activity reporting to combat financial crime.

The bank implements robust internal controls, including advanced transaction monitoring systems and comprehensive know-your-customer (KYC) procedures, to prevent illicit financial activities. In 2023, Qatari banks, including Masraf Al Rayan, continued to invest heavily in technology and training to enhance their AML/CTF capabilities, aligning with international standards set by bodies like the Financial Action Task Force (FATF).

Failure to comply with AML/CTF laws can result in severe legal penalties, including substantial fines, operational restrictions, and significant reputational damage. For instance, global financial institutions have faced billions in penalties for AML lapses, underscoring the critical importance of proactive compliance for Masraf Al Rayan.

Masraf Al Rayan operates under stringent Qatari data protection laws, requiring robust measures to safeguard customer information. Compliance with these regulations, which often mirror principles found in international frameworks like GDPR concerning consent and transparent data handling, is paramount for the bank's legal standing and operational integrity.

The bank's legal responsibilities extend to implementing strong data security protocols to prevent breaches, a critical factor in maintaining customer trust and avoiding significant penalties. Failure to comply can result in substantial fines and reputational damage, impacting its ability to attract and retain clients in the competitive financial sector.

Consumer Protection and Fair Practices Legislation

Consumer protection laws are critical for financial institutions like Masraf Al Rayan. These regulations ensure that customers receive clear, accurate information about financial products and services, preventing deceptive practices. For instance, regulations often mandate transparent disclosure of fees, interest rates, and contract terms, fostering trust and enabling informed decision-making.

Masraf Al Rayan must adhere to stringent legal frameworks designed to safeguard consumer interests. This includes robust dispute resolution mechanisms and responsible lending policies, which are vital for maintaining customer confidence and mitigating legal risks. Compliance with these consumer protection statutes is not just a legal obligation but a cornerstone of ethical banking practices.

The Qatari Central Bank, for example, oversees consumer protection in the financial sector. Their guidelines emphasize fair treatment of customers, clear communication, and accessible complaint procedures. Failure to comply can result in significant penalties and reputational damage, underscoring the importance of diligent adherence.

- Disclosure Requirements: Laws mandate clear and comprehensive disclosure of all terms, conditions, fees, and risks associated with financial products.

- Fair Practices: Regulations prohibit unfair, deceptive, or abusive acts and practices in consumer financial transactions.

- Dispute Resolution: Financial institutions must have effective mechanisms for handling customer complaints and resolving disputes efficiently.

- Responsible Lending: Legislation often dictates responsible lending practices, including assessing a borrower's ability to repay and avoiding predatory lending.

International Financial Regulations and Sanctions Regimes

Masraf Al Rayan, like any global financial institution, must navigate a complex web of international financial regulations and sanctions regimes. This necessitates stringent compliance with rules set by entities such as the Financial Action Task Force (FATF) and various national regulatory bodies, including those in Qatar, the UK, and the US, which can impact its cross-border transactions and partnerships. The bank's legal and compliance teams are tasked with meticulously interpreting and adhering to these often-conflicting international laws, ensuring that all operations, including those involving correspondent banking relationships, meet global standards for anti-money laundering (AML) and counter-terrorist financing (CTF).

The evolving landscape of sanctions, particularly those imposed by the US Treasury's Office of Foreign Assets Control (OFAC) and the European Union, presents significant legal challenges. For instance, in 2023, OFAC continued to update its Specially Designated Nationals (SDN) list, requiring constant vigilance from financial institutions to avoid engaging with sanctioned entities or jurisdictions. Masraf Al Rayan's commitment to robust compliance frameworks is therefore crucial for maintaining its international market access and reputation.

- Regulatory Alignment: Ensuring adherence to diverse international financial regulations, including those from QCB, FCA, and US banking regulators.

- Sanctions Compliance: Implementing rigorous screening processes to comply with OFAC, EU, and UN sanctions lists, which are updated frequently.

- Cross-Border Partnership Scrutiny: Conducting thorough legal due diligence on international partners to mitigate risks associated with conflicting legal frameworks and sanctions.

- Global Standards: Maintaining compliance with international best practices in financial crime prevention, as advocated by the FATF.

Masraf Al Rayan's legal framework is deeply rooted in Qatari law and Islamic finance principles, necessitating strict adherence to Sharia for all operations. This includes rigorous compliance with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, which are critical for preventing financial crime and maintaining international trust. The bank must also uphold stringent data protection and consumer protection laws, ensuring transparency, fair practices, and robust security for customer information.

Environmental factors

Masraf Al Rayan, like other financial institutions, faces growing pressure from regulators and stakeholders to integrate and report on Environmental, Social, and Governance (ESG) principles. This includes navigating evolving legal requirements for sustainability reporting and climate risk disclosure, which are becoming more stringent globally.

The bank is actively working to embed ESG considerations into its core operations and decision-making processes. This involves aligning investment strategies with sustainability goals and enhancing public communications to reflect its commitment to responsible finance, aiming to meet the increasing expectations for transparency and accountability in ESG performance.

Qatar's commitment to its National Climate Change Action Plan 2023-2030, focusing on emissions reduction and renewable energy, directly impacts Masraf Al Rayan's strategic focus. The bank is increasingly involved in financing green projects, such as the development of solar power plants and sustainable infrastructure, aligning with national environmental goals and global sustainable finance trends.

Global sustainable finance initiatives, including the growth of green sukuk and demand for ESG-compliant investments, are shaping Masraf Al Rayan's product development. The bank is exploring opportunities to offer more sustainable investment products and has seen a growing interest from clients in Sharia-compliant financing for environmentally friendly ventures.

Masraf Al Rayan is seeing a growing demand for green and sustainable financial products. This trend presents a significant opportunity for the bank to expand its Sharia-compliant offerings. For instance, the global sustainable finance market was projected to reach over $50 trillion by 2025, indicating a strong client preference for environmentally conscious investments.

The bank can capitalize on this by developing and promoting green financing solutions, such as loans for renewable energy projects, and by launching sustainable investment funds that align with environmental, social, and governance (ESG) principles. By meeting this demand, Masraf Al Rayan can not only attract a wider client base but also bolster its brand reputation as a forward-thinking and responsible financial institution.

Operational Environmental Footprint

Masraf Al Rayan's operational environmental footprint primarily stems from its extensive network of branches and offices, encompassing energy consumption, waste generation, and water usage. The bank is actively engaged in initiatives to mitigate these impacts, focusing on reducing its carbon footprint through energy-efficient practices and promoting responsible resource management across its facilities. These internal environmental efforts are integral to its broader sustainability objectives.

Key initiatives include:

- Energy Efficiency: Implementing smart lighting systems and optimizing HVAC usage in its buildings to lower electricity consumption.

- Waste Reduction: Promoting digital document management to minimize paper waste and establishing recycling programs for office materials.

- Resource Management: Encouraging water conservation measures within its premises and exploring sustainable procurement practices for office supplies.

- Carbon Footprint Tracking: While specific 2024/2025 figures for Masraf Al Rayan's direct operational emissions are not yet publicly detailed, the bank's commitment to sustainability frameworks indicates a growing focus on quantifying and reducing these impacts.

Reputational Risk from Environmental Controversies

Masraf Al Rayan faces reputational risks if its financing activities are linked to projects with negative environmental consequences, such as those contributing to pollution or deforestation. For instance, in 2024, global financial institutions faced scrutiny for their continued investment in fossil fuel projects, leading to public backlash and calls for divestment. A perceived lack of commitment to environmental stewardship by Masraf Al Rayan could erode stakeholder trust and diminish its brand value, impacting customer loyalty and investor confidence.

Implementing rigorous environmental due diligence for all lending and investment decisions is crucial to mitigate these risks. This involves assessing the environmental impact of proposed projects and ensuring alignment with sustainability principles. For example, by early 2025, many leading banks have integrated ESG (Environmental, Social, and Governance) criteria into their credit assessment processes, with some reporting improved portfolio resilience.

Public perception of environmental responsibility significantly influences stakeholder trust and brand value. A strong commitment to sustainability can enhance Masraf Al Rayan's reputation, attracting environmentally conscious investors and customers. Conversely, negative publicity surrounding environmental controversies, such as those seen in 2024 regarding greenwashing accusations against some financial entities, can lead to substantial damage to a financial institution's image and market standing.

- Reputational Damage: Financing environmentally damaging projects can lead to negative media coverage and public criticism, impacting Masraf Al Rayan's brand image.

- Stakeholder Trust: A lack of demonstrable commitment to environmental sustainability can erode trust among customers, investors, and regulators.

- Investor Scrutiny: Growing investor focus on ESG factors means Masraf Al Rayan could face divestment pressure if its portfolio is perceived as unsustainable.

- Brand Value Erosion: Negative environmental associations can devalue the Masraf Al Rayan brand, potentially affecting market share and profitability.

Masraf Al Rayan is increasingly focused on environmental factors, driven by Qatar's National Climate Change Action Plan 2023-2030 and global sustainable finance trends. The bank is actively financing green projects, such as solar power and sustainable infrastructure, aligning with national environmental goals.

The growing demand for green and sustainable financial products, projected to exceed $50 trillion globally by 2025, presents a significant opportunity for Masraf Al Rayan to expand its Sharia-compliant offerings and attract environmentally conscious clients.

The bank is also working to reduce its own operational environmental footprint through energy efficiency, waste reduction, and resource management initiatives across its facilities.

Masraf Al Rayan faces reputational risks if its financing activities are linked to environmentally damaging projects, as seen with global institutions facing scrutiny in 2024 for fossil fuel investments. Implementing rigorous environmental due diligence is crucial to mitigate these risks and maintain stakeholder trust.

| Environmental Factor | Impact on Masraf Al Rayan | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Climate Change Action Plans | Shapes strategic focus, drives green financing | Qatar's National Climate Change Action Plan 2023-2030 |

| Sustainable Finance Market Growth | Opportunity for Sharia-compliant green products | Global market projected >$50 trillion by 2025 |

| Operational Footprint | Requires mitigation through efficiency and resource management | Focus on energy, waste, and water reduction |

| Reputational Risk | Linked to financing environmentally damaging projects | Increased scrutiny on fossil fuel investments in 2024 |

PESTLE Analysis Data Sources

Our Masraf Al Rayan PESTLE Analysis is informed by a comprehensive blend of data sources, including official Qatari government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape impacting the bank.