Allstate SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Allstate's strengths lie in its established brand recognition and diverse product offerings, while its opportunities include leveraging technology for enhanced customer experience. However, the company faces threats from increasing competition and evolving regulatory landscapes.

Want the full story behind Allstate's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Allstate's brand is a powerful asset, with its iconic 'Good Hands' slogan deeply ingrained in consumer minds, fostering significant trust and loyalty. This strong brand recognition translates into a solid market position, evidenced by its status as the second-largest homeowner insurer and fourth-largest auto insurer in the United States.

Allstate boasts a wide array of insurance products, covering personal needs like auto and home, as well as life and financial services for both individuals and businesses. This broad offering ensures they can serve a diverse customer base with varied needs.

The company's strength lies in its multi-channel distribution strategy. By utilizing exclusive agents, independent agents, and direct-to-consumer channels, Allstate effectively reaches millions of customers, demonstrating adaptability to different purchasing preferences.

In 2023, Allstate's diversified product portfolio and distribution network contributed to its robust market presence, with total revenues reaching $52.7 billion, highlighting the effectiveness of this strategy in capturing market share and maintaining customer accessibility.

Allstate showcased robust financial performance in Q1 2025, reporting significant revenue growth and improved profitability, building on a strong full year 2024. The company achieved an impressive return on equity, underscoring its operational efficiency and strategic execution.

Strategic capital management is a key strength, exemplified by the successful divestiture of its Employer Voluntary Benefits and Group Health businesses. This move not only streamlined operations but also bolstered Allstate's capital position, enabling enhanced shareholder returns through increased dividends and substantial share repurchase programs.

Commitment to Digital Transformation and Innovation

Allstate is making significant investments in digital transformation, pouring resources into areas like data analytics and customer experience. This commitment is evident in their strategic allocation of capital towards modernizing operations and developing innovative insurance products. For instance, in 2023, Allstate reported significant progress in its digital initiatives, aiming to streamline processes and enhance customer engagement through technology.

The company's forward-thinking strategy is demonstrated by its adoption of AI-driven tools, particularly in claims processing, which aims to improve efficiency and accuracy. Furthermore, Allstate is expanding its product portfolio to include offerings like cyber protection and usage-based insurance. These new products are designed to address the evolving needs of consumers in a rapidly changing digital landscape, reflecting a proactive approach to market trends.

- Digital Investment: Allstate continues to prioritize technology spending to enhance data capabilities and customer interactions.

- AI Integration: The company is leveraging artificial intelligence to optimize claims handling and other core operational functions.

- Product Innovation: Introduction of cyber protection and usage-based insurance products showcases a response to emerging market demands.

- Customer Experience Focus: A key driver of digital transformation is the commitment to improving the overall customer journey.

Underwriting Discipline and Expense Management

Allstate's commitment to underwriting discipline has yielded tangible results, with significant improvements observed in its Property-Liability and auto segments. This focus on effective risk selection and pricing strategies contributed to a notable reduction in the combined ratio, a key indicator of profitability in the insurance industry. For instance, in the first quarter of 2024, Allstate reported a combined ratio of 96.4%, a marked improvement from prior periods, demonstrating enhanced underwriting performance.

Furthermore, the company has demonstrated a strong grasp on expense management, successfully lowering its underwriting expense ratio. This reflects a disciplined approach to cost control and operational efficiencies across the organization. In 2023, Allstate's expense ratio for its Property-Liability business was 27.5%, down from 28.1% in 2022, showcasing a consistent effort to streamline operations and improve profitability.

- Improved Underwriting Results: Allstate has seen a positive trend in its underwriting performance, particularly in its core Property-Liability and auto insurance lines.

- Reduced Combined Ratio: The company's combined ratio improved to 96.4% in Q1 2024, indicating better profitability from its insurance operations.

- Effective Expense Management: Allstate has successfully lowered its underwriting expense ratio, achieving 27.5% in 2023, a decrease from the previous year.

- Operational Efficiency: These improvements highlight a disciplined approach to cost control and a focus on operational efficiency throughout the business.

Allstate's robust brand recognition, anchored by its trusted 'Good Hands' slogan, provides a significant competitive advantage, solidifying its position as a leading insurer in the US. This strong brand equity, combined with a diversified product portfolio and a multi-channel distribution strategy, allows Allstate to effectively reach and serve a broad customer base across various insurance needs.

The company's strategic capital management, including business divestitures, has strengthened its financial foundation, enabling increased shareholder returns. Furthermore, Allstate's substantial investments in digital transformation and AI integration are positioning it for future growth by enhancing operational efficiency and customer engagement.

Allstate's commitment to underwriting discipline and expense management has led to improved profitability, evidenced by a reduced combined ratio. For example, the company reported a combined ratio of 96.4% in Q1 2024, a positive indicator of its operational performance.

The company's focus on innovation, such as introducing cyber protection and usage-based insurance, demonstrates its adaptability to evolving market demands and consumer needs.

| Metric | 2023 Value | Q1 2024 Value |

|---|---|---|

| Total Revenues | $52.7 billion | N/A |

| Combined Ratio (Property-Liability) | N/A | 96.4% |

| Underwriting Expense Ratio (Property-Liability) | 27.5% | N/A |

What is included in the product

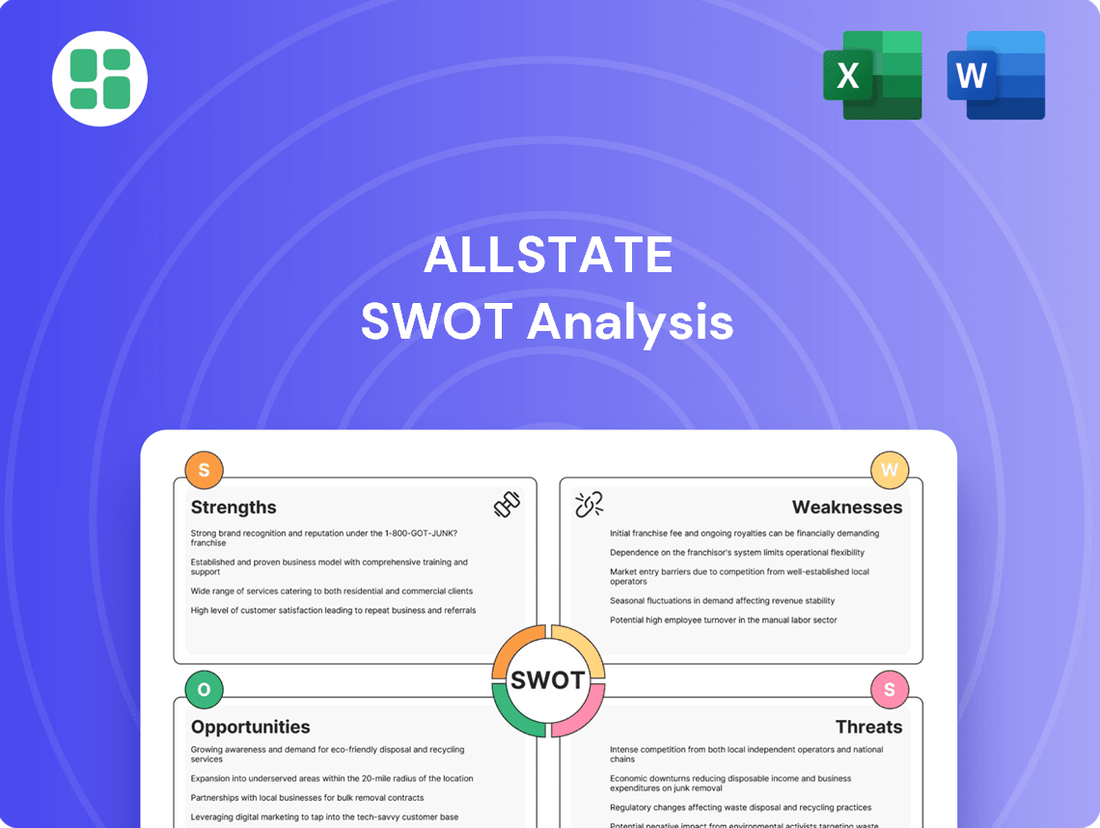

Delivers a strategic overview of Allstate’s internal and external business factors, highlighting its strengths in brand recognition and market share, while also addressing weaknesses in technology adoption and opportunities in digital transformation and emerging markets.

Provides a clear, actionable roadmap by identifying Allstate's core strengths and weaknesses to mitigate risks and capitalize on opportunities.

Weaknesses

Allstate's profitability is significantly impacted by its high exposure to catastrophe losses. The company reported record gross catastrophe losses for both the first quarter of 2025 and the full year 2024. These severe weather events, such as hurricanes and wildfires, necessitate substantial claims payouts, which directly reduce net income and strain underwriting margins.

Allstate has faced difficulties keeping existing customers, especially in their auto insurance business. In 2024, the number of active auto policies saw a slight decrease, indicating a challenge in retaining policyholders.

This retention issue is partly linked to necessary rate hikes aimed at improving profitability. While essential for financial health, these price adjustments have created a drag on customer loyalty, making it harder to hold onto policy counts.

Allstate's Net Promoter Score (NPS) registered at 13 in the first quarter of 2025, a figure that falls considerably short of the broader insurance industry average. This metric suggests a notable deficit in cultivating customer loyalty and encouraging positive word-of-mouth referrals.

A substantial segment of Allstate's clientele falls into the passive or outright dissatisfied categories. This indicates a clear need for enhanced customer experience initiatives to boost overall satisfaction and mitigate customer attrition rates.

Geographic Concentration Risk

Allstate's significant concentration in North America, particularly the United States, exposes it to considerable geographic risk. This means that economic downturns, shifts in consumer behavior, or adverse regulatory changes within this region can disproportionately impact its financial performance. For instance, a severe hurricane season in Florida or Texas, where Allstate has substantial exposure, could lead to significant claims and financial strain.

This lack of geographic diversification limits Allstate's ability to offset losses in one area with gains in another, a common strategy for global insurers. As of the first quarter of 2024, Allstate reported that property-liability premiums written in the U.S. constituted the vast majority of its total written premiums, underscoring this concentration.

- Geographic Concentration: Allstate's operations are heavily weighted towards North America, primarily the United States.

- Vulnerability to Regional Events: Susceptible to localized economic downturns, regulatory shifts, and catastrophic events impacting specific U.S. states.

- Limited Diversification: Lacks the global diversification benefits enjoyed by competitors with a broader international presence, increasing exposure to regional risks.

Dependency on Allstate Protection Segment

Allstate's significant reliance on its Protection Segment, primarily auto and homeowners insurance, presents a notable weakness. If these core markets experience downturns, such as increased claims frequency due to severe weather events or intense price competition in auto insurance, Allstate's overall financial health can be severely impacted. For instance, in the first quarter of 2024, Allstate reported a combined ratio of 102.1% for its Property-Liability segment, indicating underwriting losses. This highlights the vulnerability when these primary lines of business face headwinds.

This concentration means that Allstate must meticulously manage the inherent risks within personal lines insurance. A substantial portion of their revenue and profitability is tied to these specific insurance products. Consequently, any adverse shifts in these markets, whether regulatory changes, economic pressures affecting policyholders, or unexpected spikes in claim costs, can have a magnified effect on the company's performance. The company's ability to diversify its revenue streams or mitigate these concentrated risks is crucial for long-term stability.

- Concentrated Market Risk: A heavy dependence on auto and homeowners insurance exposes Allstate to the volatility of these specific markets.

- Impact of Catastrophic Events: Increased frequency and severity of natural disasters directly affect the profitability of the Protection Segment.

- Competitive Pressures: Intense competition within the personal auto and homeowners insurance sectors can lead to pricing challenges and reduced margins.

- Regulatory Environment: Changes in insurance regulations, particularly concerning pricing and claims handling in key states, can disproportionately affect Allstate due to its segment concentration.

Allstate's profitability is heavily influenced by its substantial exposure to catastrophe losses, with record gross catastrophe losses reported for both Q1 2025 and the full year 2024. This vulnerability to severe weather events directly impacts net income and underwriting margins.

Customer retention, particularly in the auto insurance segment, remains a challenge. A slight decrease in active auto policies in 2024, coupled with necessary rate increases to improve profitability, has negatively affected customer loyalty.

The company's Net Promoter Score (NPS) of 13 in Q1 2025 lags behind the industry average, indicating a need to improve customer experience and foster greater loyalty.

Allstate's significant geographic concentration in the United States exposes it to substantial regional risks, including economic downturns and regulatory shifts. Property-liability premiums written in the U.S. constituted the vast majority of its total written premiums as of Q1 2024, limiting diversification benefits.

A heavy reliance on the Protection Segment, primarily auto and homeowners insurance, makes Allstate susceptible to market downturns and intense price competition. The Property-Liability segment reported a combined ratio of 102.1% in Q1 2024, signaling underwriting losses.

Full Version Awaits

Allstate SWOT Analysis

This is the actual Allstate SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report. Unlock the complete, detailed insights by completing your purchase.

Opportunities

Allstate can significantly boost its operational efficiency and customer satisfaction by further embedding AI and advanced data analytics. Imagine claims processing that's not just faster, but more accurate due to predictive AI, potentially reducing claim cycle times by a notable percentage. This technological push also opens doors for hyper-personalized customer engagement, offering tailored insurance solutions that resonate with individual needs.

Allstate is actively pursuing an increase in its property-liability market share and overall policy count. This strategy is bolstered by the phased introduction of new auto and home insurance products designed to be affordable, simple, and connected. For instance, as of the first quarter of 2024, Allstate reported approximately 14.4 million auto policies and 9.5 million homeowners policies in force, demonstrating the scale of its existing customer base.

By implementing aggressive marketing campaigns and competitive pricing strategies in key geographic areas, Allstate aims to attract new customers and broaden its reach. The company's focus on product innovation, such as its new usage-based auto insurance programs, is expected to resonate with a wider demographic, potentially driving significant new business acquisition throughout 2024 and into 2025.

Allstate has a significant opportunity to bolster its Protection Services segment, which has already demonstrated robust revenue increases. This area offers a chance to grow beyond traditional auto and home insurance.

Furthermore, there's considerable untapped potential in expanding its reach within specialized insurance markets. This includes accelerating growth in renters insurance and developing a stronger presence in commercial insurance products. These moves would diversify Allstate's revenue streams and allow it to capture new customer segments.

Strategic Acquisitions and Partnerships

Allstate can bolster its market position through strategic acquisitions, mirroring the success seen with the National General purchase, which significantly expanded its customer base and product offerings. This approach allows for the integration of new technologies and talent, enhancing competitive advantages.

Forming strategic partnerships, like the one with the Chicago Quantum Exchange, offers a pathway to leverage advanced research and development, particularly in areas like AI-driven risk assessment and fraud detection. These collaborations are crucial for staying ahead in a rapidly evolving insurance landscape.

- Acquisition Synergies: The National General acquisition, completed in 2021 for $4 billion, added approximately $5 billion in annual premium volume, demonstrating the potential for significant growth and operational efficiencies through targeted M&A.

- Innovation Access: Partnerships provide access to emerging technologies and intellectual property, enabling Allstate to develop next-generation insurance products and services.

- Market Expansion: Strategic moves can open new geographic markets or customer segments, diversifying revenue streams and reducing reliance on existing channels.

Personalization and Usage-Based Insurance Expansion

The drive for personalized insurance is a major opportunity. Customers increasingly want policies tailored to their specific needs and driving habits. Allstate's Arity platform is key here, enabling the development of advanced usage-based insurance (UBI) programs. This allows for more accurate risk assessment and customized pricing, which can attract a wider customer base. For instance, in 2024, the UBI market was projected to reach over $100 billion globally, highlighting the significant potential for growth.

Leveraging telematics data through Arity allows Allstate to offer competitive incentives for safe driving. This not only appeals to price-conscious consumers but also helps Allstate refine its underwriting processes. By understanding individual driving behaviors, the company can better predict losses and offer more attractive rates to lower-risk drivers. This data-driven approach is crucial for staying competitive in the evolving insurance landscape.

The expansion of usage-based insurance presents a clear path to increased customer engagement and loyalty. Allstate can create dynamic pricing models that reward responsible behavior, fostering a stronger relationship with policyholders. This strategic focus on personalization and data utilization is expected to be a significant driver of Allstate's growth in the coming years.

Allstate is poised to expand its market share by introducing innovative, customer-centric products and leveraging advanced data analytics. The company's focus on enhancing its Protection Services segment, which saw substantial revenue growth, presents a significant avenue for diversification beyond traditional auto and home insurance offerings.

Threats

The increasing frequency and severity of catastrophic events, amplified by climate change, present a significant threat to Allstate's financial stability. For instance, 2023 saw insured losses from natural catastrophes estimated at $110 billion globally, a substantial figure that directly impacts insurers like Allstate.

These escalating losses necessitate higher reinsurance costs, directly affecting Allstate's bottom line. Furthermore, the company may be compelled to limit coverage or substantially increase premiums in vulnerable regions, potentially diminishing its competitive edge and restricting customer access to insurance.

Allstate faces significant competitive headwinds, not just from established giants like State Farm and GEICO, but increasingly from nimble insurtechs. These digital-first companies, leveraging advanced analytics and streamlined online processes, are chipping away at market share by offering competitive pricing and a more convenient customer experience. For instance, the insurtech sector has seen substantial venture capital investment, with companies like Lemonade reporting rapid customer growth in recent years, demonstrating the disruptive potential of these new entrants.

Evolving insurance regulations, particularly at the state level, present a significant threat to Allstate. For instance, the ongoing challenges in California's homeowners insurance market, where rate increases have been heavily scrutinized, directly impact profitability and the ability to offer competitive products. This regulatory environment can stifle operational flexibility.

Furthermore, increasing scrutiny over data privacy, driven by new legislation and consumer expectations, adds another layer of complexity. Allstate must navigate these evolving rules, ensuring compliance while managing the costs associated with data protection. Failure to adapt can lead to fines and reputational damage.

The burden of compliance, coupled with potential delays in implementing necessary rate adjustments, creates substantial regulatory risk. This can directly affect Allstate's financial performance, as seen in the industry-wide struggle to keep pace with rising claims costs through adequate pricing, a challenge that persisted through 2024 and into 2025.

Economic Volatility and Inflationary Pressures

Rising inflation, especially in crucial sectors like auto parts and construction materials, directly escalates Allstate's claims expenses, thereby squeezing underwriting profit margins. This inflationary environment presents a significant challenge to maintaining profitability in the property-casualty insurance sector.

Economic downturns or sustained high interest rates can dampen consumer discretionary spending, potentially leading to higher insurance policy cancellations or increased price sensitivity among Allstate's customer base. This could impact premium growth and customer retention efforts.

- Inflationary Impact on Claims: Allstate's Q1 2024 results indicated that elevated inflation in repair costs, particularly for auto and property, contributed to a higher combined ratio. For instance, the cost of auto parts saw an approximate 15% year-over-year increase in early 2024.

- Consumer Spending Sensitivity: Economic uncertainty and rising interest rates, with the Federal Reserve maintaining a hawkish stance through much of 2024, could lead consumers to re-evaluate insurance coverage, potentially opting for lower-tier plans or reducing coverage levels.

- Interest Rate Environment: While higher interest rates can boost investment income for insurers, the simultaneous pressure on underwriting margins from inflation creates a complex balancing act for Allstate's financial performance.

Cybersecurity Risks and Data Privacy Concerns

Allstate's growing reliance on digital platforms and data analytics exposes it to significant cybersecurity threats, including potential data breaches and system disruptions. In 2023, the financial services sector experienced a substantial increase in cyberattacks, with ransomware and phishing attempts being particularly prevalent.

Concerns regarding data privacy, especially with the increasing use of telematics data from vehicles, pose a threat to customer trust. A significant data breach could lead to substantial regulatory fines and severe reputational damage, impacting customer retention and acquisition efforts. For instance, the General Data Protection Regulation (GDPR) in Europe, and similar regulations globally, carry penalties that can reach millions of dollars.

- Increased threat landscape: Cybercriminals are constantly evolving their tactics, making it challenging for companies to stay ahead.

- Customer trust erosion: Data privacy violations can significantly damage a company's reputation and customer loyalty.

- Regulatory penalties: Non-compliance with data protection laws can result in substantial fines and legal repercussions.

- Operational disruption: System breaches can halt operations, leading to financial losses and service interruptions.

Allstate faces intensified competition, not only from established insurers but also from agile insurtechs leveraging advanced analytics and digital-first approaches. These disruptors, backed by significant venture capital, are capturing market share through competitive pricing and enhanced customer experiences, a trend that continued to accelerate through 2024.

The company must also navigate a complex and evolving regulatory landscape, particularly concerning data privacy and rate adjustments. Challenges in securing timely and adequate rate increases, as seen in key markets like California's homeowners insurance sector, directly impact Allstate's profitability and competitive positioning, a situation that persisted through early 2025.

Escalating inflation in critical areas like auto parts and construction materials continues to drive up claims costs, squeezing underwriting margins. For instance, auto repair costs saw an approximate 15% year-over-year increase in early 2024, directly affecting insurers like Allstate.

Furthermore, the increasing frequency and severity of natural catastrophes, exacerbated by climate change, pose a substantial financial threat. Insured losses from natural catastrophes globally were estimated at $110 billion in 2023, a figure that directly impacts the industry's profitability and necessitates higher reinsurance costs.

SWOT Analysis Data Sources

This Allstate SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive industry market research, and expert commentary from reputable insurance sector analysts to ensure a well-informed strategic assessment.