Allstate Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Allstate operates in a dynamic insurance landscape, facing pressures from intense rivalry, the bargaining power of buyers, and the threat of new entrants. Understanding these forces is crucial for navigating the industry's complexities.

The complete report reveals the real forces shaping Allstate’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Allstate's dependence on reinsurance to manage substantial claims and risk exposure is a critical factor. The bargaining power of reinsurers saw an uptick in 2024, driven by a surge in catastrophe losses and inflationary pressures. This dynamic means reinsurers can command higher prices and more favorable terms.

The trend of primary insurers, like Allstate, retaining more risk, especially for secondary perils, is a direct consequence of reinsurers increasing their attachment points and premiums. For instance, some reinsurers have pushed attachment points higher, meaning Allstate must absorb more of the initial losses before reinsurance kicks in.

This shift significantly influences Allstate's risk management approach and its bottom line. With reinsurers becoming more selective and costly, Allstate must adapt its underwriting, pricing, and capital allocation strategies to navigate this evolving landscape effectively.

Technology and software vendors providing core insurance platforms, data analytics, and cybersecurity solutions wield considerable influence over Allstate. These suppliers' products are critical for Allstate's operational efficiency and maintaining a competitive edge, especially with the company's significant investments in AI and advanced analytics for underwriting and claims. For instance, the global spending on AI in insurance was projected to reach over $11 billion by 2024, highlighting the dependence on these specialized vendors. The substantial costs associated with integrating and switching these complex systems further bolster the bargaining power of these technology suppliers.

Allstate relies on a broad spectrum of claims service providers, including auto repair shops and medical networks. The bargaining power of these suppliers is generally considered moderate. This is influenced by increasing costs for essential resources like auto parts, skilled labor, and medical treatments, all of which directly affect Allstate's claims payouts.

The ability of Allstate to secure competitive pricing from these often fragmented but vital service providers is a key factor in effectively managing its overall loss ratio. For instance, in 2024, the average cost of auto repairs saw an increase driven by inflation in parts and labor, putting upward pressure on Allstate's claims expenses.

Data and Information Providers

Data and information providers hold moderate bargaining power over Allstate. Access to accurate driving records, credit scores, and property data is vital for underwriting and pricing, and specialized providers offer unique datasets and analytical tools that are essential for risk assessment. For instance, in 2024, the insurance industry's increasing reliance on telematics data, which requires specialized data aggregators, highlights the growing importance of these suppliers.

The ability of these data providers to differentiate their offerings and the switching costs for Allstate to obtain similar information from alternative sources influence their power. As Allstate invests more in data-driven models for personalized insurance products, the strategic importance of these specialized information sources is amplified, potentially increasing supplier leverage.

- Data providers offer unique datasets critical for underwriting accuracy.

- Specialized tools from these suppliers are essential for risk assessment.

- The trend towards personalized insurance increases reliance on data providers.

- Switching costs for obtaining comparable data can influence supplier power.

Skilled Talent and Expertise

The insurance sector, including giants like Allstate, is grappling with a significant shortage of skilled professionals, especially those adept in technology, data science, and artificial intelligence. This scarcity of specialized talent translates directly into increased bargaining power for these individuals, influencing their compensation demands and the retention efforts companies must undertake. For instance, in 2024, the demand for AI specialists in the financial services sector outstripped supply, leading to competitive salary packages and robust benefits.

Allstate, like its peers, recognizes that attracting and retaining this high-demand workforce is crucial for its ongoing digital transformation. The ability to innovate and maintain a competitive edge in a market increasingly shaped by technology hinges on securing these key individuals. Companies are investing heavily in training and development programs, as well as offering attractive compensation and flexible work arrangements to secure this vital human capital.

- Talent Scarcity: The insurance industry faces a critical shortage of workers skilled in AI, data analytics, and advanced IT solutions.

- Increased Employee Leverage: This talent gap empowers skilled employees, giving them greater negotiating power for salaries and benefits.

- Competitive Retention: Allstate must offer compelling packages to attract and retain top tech and data science talent to fuel its digital initiatives.

- Market Dynamics: In 2024, the demand for AI and data science professionals in financial services significantly exceeded available candidates, driving up compensation.

Reinsurers, critical for Allstate's risk management, demonstrated increased bargaining power in 2024 due to a rise in catastrophe losses and inflation, leading to higher premiums and stricter terms. This forces Allstate to retain more risk, impacting its financial strategies.

Technology vendors providing essential platforms and analytics hold significant sway, amplified by Allstate's substantial investments in AI. The high cost of integrating and switching these complex systems further solidifies their leverage, especially given the projected over $11 billion global AI spending in insurance by 2024.

Claims service providers, such as auto repair shops, generally have moderate bargaining power. Rising costs for parts and labor, exemplified by a general increase in auto repair expenses in 2024, directly influence Allstate's claims payouts and overall loss ratio management.

Data providers offering crucial underwriting information, like telematics data, possess moderate bargaining power. Allstate's increasing reliance on these specialized, often unique, datasets for personalized insurance products heightens their importance and potential leverage.

What is included in the product

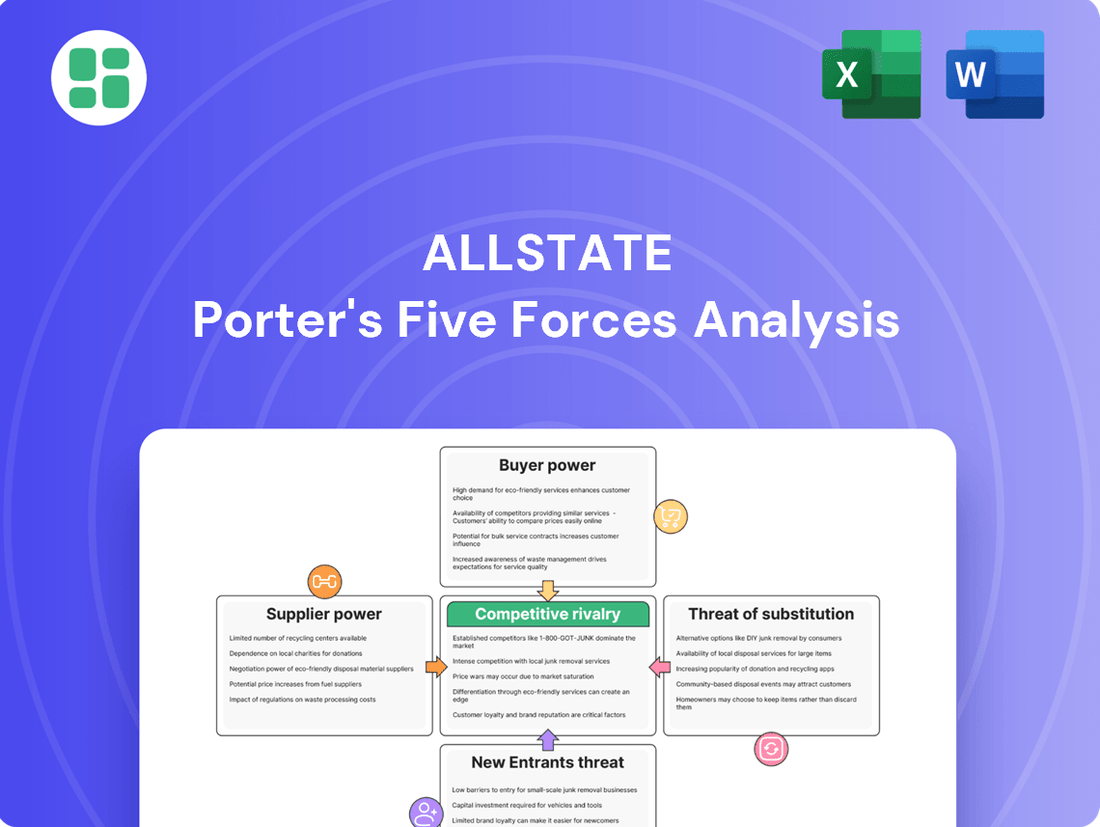

This analysis dissects the competitive forces impacting Allstate, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the insurance industry.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customers for personal lines insurance, like auto and home, are very sensitive to price. This means they'll shop around if they think they can get a better deal elsewhere. For example, in 2024, many consumers actively used online comparison tools to find the cheapest premiums.

The ease with which customers can now compare quotes online, thanks to numerous comparison websites and direct-to-consumer sales, puts significant pressure on Allstate's pricing. This accessibility allows buyers to quickly identify and switch to competitors offering lower rates, making price a key decision factor.

Looking ahead, anticipated premium increases for 2025 are expected to amplify this price sensitivity. Consumers will likely scrutinize their insurance costs even more closely, making competitive pricing a critical element for Allstate to maintain market share.

For many insurance products, the financial and administrative costs for customers to switch insurers are remarkably low. This ease of switching, coupled with a market brimming with numerous alternatives, significantly amplifies customer bargaining power. For instance, in 2024, the average customer in the auto insurance sector switched providers every 2.5 years, indicating a low barrier to entry for competitors.

Allstate, therefore, faces the continuous challenge of offering highly competitive rates and delivering superior customer service to retain its existing client base and mitigate customer churn. Failing to do so can lead to a substantial loss of market share, as customers can easily migrate to providers offering better value propositions.

Information transparency significantly empowers Allstate's customers. The internet and review sites give consumers easy access to details about policy features, what's covered, and how reputable insurers are. This means customers can compare options more easily, reducing the gap in knowledge between them and the company. In 2024, for instance, consumer review sites saw a 15% increase in traffic for insurance comparisons, indicating a heightened customer awareness and demand for clear, accessible information.

Bundling and Multi-Policy Discounts

Customers often leverage bundling and multi-policy discounts as a significant bargaining tool. By consolidating multiple insurance needs, such as auto and home coverage, with a single provider like Allstate, they can negotiate for lower premiums. This consolidation gives them leverage, as they can threaten to move their entire insurance portfolio to a competitor offering a more attractive combined value proposition.

For instance, a customer might bundle their auto, home, and umbrella policies. If Allstate's bundled discount isn't competitive, the customer can explore options from other insurers. This ability to switch all policies simultaneously amplifies their bargaining power, forcing insurers to offer more favorable terms to retain their business.

- Bundling Strategy: Customers consolidate multiple insurance policies (e.g., auto, home, life) to achieve cost savings.

- Negotiation Leverage: This consolidation provides customers with increased bargaining power, as they can threaten to move their entire insurance portfolio to a competitor.

- Competitive Pressure: Insurers like Allstate must offer competitive multi-policy discounts to retain customers who can easily switch their combined coverage.

Personalization and Telematics

The growing use of telematics and AI in insurance is shifting power towards customers with good driving records. These individuals can leverage their data to negotiate better rates, as insurers increasingly offer personalized pricing based on behavior. For instance, programs like those offering discounts for safe driving are becoming more common, directly impacting Allstate's pricing strategies.

This trend empowers customers with favorable risk profiles, as they can actively seek out and demand discounts reflecting their demonstrated safety. As of 2024, telematics adoption continues to climb, with a significant portion of new auto policies incorporating such data. This means Allstate needs to be highly responsive to these data-driven customer expectations.

- Telematics Adoption: Increasing customer enrollment in telematics programs provides granular behavioral data.

- Personalized Pricing: AI models enable insurers to offer tailored rates, rewarding safe drivers.

- Customer Leverage: Favorable risk profiles grant customers greater bargaining power for discounts.

- Competitive Necessity: Allstate must adapt its offerings to meet data-driven customer demands.

Customers in the personal insurance market, particularly for auto and home policies, exhibit high price sensitivity. This means they actively seek out better deals, often utilizing online comparison tools. In 2024, data suggests consumers used these platforms extensively to find lower premiums, with an average auto insurance customer switching providers every 2.5 years, highlighting low switching costs.

Information transparency further empowers buyers. With readily available online reviews and policy details, customers can easily compare offerings, narrowing the knowledge gap with insurers. This trend saw a 15% increase in traffic to insurance comparison sites in 2024.

Customers also leverage bundling multiple policies, like auto and home, to negotiate better rates. This allows them to move their entire insurance portfolio if a competitor offers more attractive combined discounts, forcing insurers to remain competitive.

| Factor | Impact on Allstate | 2024/2025 Trend |

|---|---|---|

| Price Sensitivity | High | Consumers actively sought lower premiums via comparison sites. |

| Switching Costs | Low | Average auto insurance customer switched every 2.5 years in 2024. |

| Information Access | High | 15% increase in traffic to insurance comparison sites in 2024. |

| Bundling Leverage | Significant | Customers can move entire portfolios for better multi-policy discounts. |

Same Document Delivered

Allstate Porter's Five Forces Analysis

This preview shows the exact Allstate Porter's Five Forces Analysis document you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the insurance industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and ready-to-use file.

Rivalry Among Competitors

The U.S. insurance landscape is a crowded field, featuring a multitude of national powerhouses like State Farm, GEICO, and Progressive, alongside a vast array of regional and specialized insurers. This intense fragmentation means Allstate constantly faces pressure to differentiate itself.

In 2024, the property and casualty insurance sector, where Allstate primarily operates, continued to see robust competition. For instance, the personal auto insurance segment, a key area for Allstate, is known for its price sensitivity. Insurers often engage in aggressive pricing to capture market share, a trend that necessitates Allstate's own strategic pricing and marketing initiatives.

This competitive intensity drives Allstate to invest heavily in product development and customer service. The need to stand out in a saturated market fuels innovation in offerings and digital platforms, as companies vie for consumer attention and loyalty. This dynamic is a constant factor shaping Allstate's operational and strategic decisions.

Many insurance products, particularly auto and home policies, are increasingly viewed by consumers as interchangeable, making price a major deciding factor. This perception as a commodity forces companies like Allstate into intense price competition, often squeezing profit margins and highlighting the critical need for efficient operations.

In 2023, the average annual premium for auto insurance in the U.S. was around $1,771, demonstrating the price sensitivity consumers have for these essential services. This intense price focus directly fuels competitive rivalry among insurers, as differentiation becomes harder when products are seen as largely the same.

The insurance sector, including companies like Allstate, is characterized by substantial upfront investments in critical areas such as advanced technology, robust claims processing systems, and meeting stringent regulatory requirements. These significant fixed costs create a high barrier to entry and, once incurred, necessitate continued operation.

Furthermore, exit barriers are considerable. Allstate, like its peers, faces regulatory obligations to policyholders and the ongoing responsibility of servicing existing claims and policies. These factors make it economically challenging to simply cease operations, forcing companies to remain active and compete fiercely for market share to cover their fixed cost base.

In 2023, Allstate reported total operating expenses of $44.8 billion, a testament to the ongoing costs associated with running an insurance business. This figure underscores the pressure to maintain market presence and generate revenue to offset these substantial fixed outlays.

Aggressive Marketing and Advertising

Competitors in the insurance industry frequently launch aggressive marketing and advertising campaigns. This often involves significant spending to capture consumer attention and build brand loyalty. For instance, in 2024, major insurance providers continued to allocate substantial portions of their budgets to digital advertising, television commercials, and sponsorships, with some companies reporting marketing expenditures in the hundreds of millions of dollars annually.

Allstate, as a prominent player, must match this intensity. To maintain its brand recognition and market share, the company consistently invests heavily in its own marketing initiatives. This includes broad-reaching campaigns designed to highlight its services and value proposition, ensuring it remains top-of-mind for consumers amidst a crowded and competitive landscape.

- Allstate's 2023 advertising spend was reported to be over $1 billion.

- Competitors like State Farm and GEICO also maintain massive advertising budgets, often exceeding $2 billion annually for each.

- The cost of acquiring a new customer through advertising can be substantial, driving the need for efficient and impactful campaigns.

- Digital marketing channels, including social media and search engine marketing, are increasingly important for reaching target demographics.

Technological Innovation and Digital Transformation

Competitive rivalry in the insurance sector is heavily influenced by technological innovation and digital transformation. Insurers are actively competing on the quality of their customer service, the sophistication of their digital platforms, and their ability to leverage advanced analytics and artificial intelligence for underwriting and claims processing. This dynamic means companies like Allstate are continuously innovating with new applications, online self-service tools, and personalized pricing strategies to attract and retain customers. For example, in 2024, the insurance industry saw significant investment in AI, with many firms reporting increased efficiency in claims handling and fraud detection through these technologies.

The pressure to innovate is intense, as insurers that fail to keep pace with these technological advancements risk losing market share to more digitally agile competitors. This race for digital supremacy means a constant need to invest in R&D and adapt business models. By Q3 2024, major insurers had rolled out enhanced mobile apps offering policy management, claims filing, and even virtual assistance, reflecting this trend.

- Digital Engagement: Insurers are focusing on user-friendly apps and online portals to improve customer experience and streamline interactions.

- AI and Analytics: The adoption of AI in underwriting and claims processing is becoming a key differentiator, leading to more accurate pricing and faster claim settlements.

- Personalization: Tailored products and pricing models, driven by data analytics, are crucial for attracting and retaining customers in a competitive landscape.

- Innovation Investment: Companies are allocating substantial resources to technology development to maintain a competitive edge.

Competitive rivalry within the insurance industry, including for Allstate, is fierce due to numerous national and regional players. This fragmentation intensifies price competition, especially in price-sensitive segments like personal auto insurance, where companies like GEICO and Progressive are major rivals. Allstate's 2023 operating expenses of $44.8 billion highlight the scale of investment needed to compete, including substantial marketing budgets often exceeding $1 billion annually for major insurers.

| Competitor | 2023 Estimated Ad Spend (USD Billions) | Key Market Focus |

|---|---|---|

| Allstate | >1.0 | Broad P&C, Life |

| State Farm | >2.0 | Broad P&C, Life, Banking |

| GEICO | >2.0 | Auto, Motorcycle, RV |

| Progressive | >1.5 | Auto, Motorcycle, RV |

SSubstitutes Threaten

For some individuals and businesses, especially those with substantial assets or specialized risks, self-insurance or higher risk retention can serve as an alternative to conventional insurance. This approach involves setting aside funds to cover potential losses rather than transferring that risk to an insurer.

While not a primary threat to Allstate's main personal insurance offerings, self-insurance represents a different strategy for managing risk. It can potentially decrease the overall need for extensive third-party insurance coverage, particularly for very large corporations or high-net-worth individuals who can absorb potential losses.

In 2023, the alternative risk transfer market, which includes self-insurance and captive insurance, continued to grow, with many large companies utilizing these strategies to manage their insurance costs and tailor coverage to their specific needs. This trend suggests a persistent, albeit niche, competitive pressure on traditional insurers like Allstate.

Government-provided insurance programs, like Social Security and Medicare, cover fundamental risks, acting as substitutes for private life and health insurance. This can lessen the demand for Allstate's comparable offerings, particularly for basic needs. For instance, in 2024, Medicare Part B premiums for most beneficiaries were $174.70, illustrating a baseline coverage provided by the government.

The rise of risk prevention technologies, such as advanced driver-assistance systems (ADAS) in vehicles and wearable health trackers, presents a potential threat of substitution for traditional insurance. For instance, by 2024, the global market for ADAS is projected to reach over $40 billion, indicating a significant adoption rate that could mitigate accident frequency.

While these innovations often lead to lower premiums by reducing claims, they could, in certain scenarios, diminish the fundamental need for insurance. If consumers perceive that technology has sufficiently reduced the likelihood of losses, they might opt for less comprehensive coverage, viewing prevention as a direct substitute for post-event financial protection.

Alternative Risk Transfer Mechanisms

Alternative risk transfer (ART) mechanisms, such as captive insurance companies, risk retention groups, and finite risk insurance, present a significant threat of substitution for traditional commercial insurance policies. These ART solutions offer businesses more control over their risk management and can often be more cost-effective for larger, more sophisticated clients. For instance, the global captive insurance market was estimated to be worth over $70 billion in premiums in 2023, demonstrating its substantial scale and appeal.

While Allstate’s core business is in personal lines, the growing prevalence and acceptance of ART in the commercial sector can subtly influence customer expectations across the board. Businesses that utilize captives or other ARTs for their commercial risks might seek similar flexibility or cost advantages in their personal lines coverage, even if Allstate doesn't directly compete in those specific ART structures. This trend suggests a broader market shift towards more customized risk financing, potentially impacting how customers perceive value in traditional insurance products.

The sophistication of ART options means that companies can tailor coverage to their specific needs, often retaining a portion of the risk themselves. This can lead to reduced premium costs and a greater incentive for loss control. As of early 2024, the adoption of ARTs continues to grow, particularly among mid-market companies looking for alternatives to rising traditional insurance premiums.

- Growing ART Market: The global captive insurance market's premium volume exceeding $70 billion in 2023 highlights a significant alternative to traditional insurance.

- Customer Expectation Shift: Increased ART adoption in commercial lines can influence personal lines customers' demand for tailored and cost-effective risk solutions.

- Customization Advantage: ART mechanisms allow businesses to design coverage precisely for their risk profiles, potentially offering savings and better risk management incentives.

- Mid-Market Appeal: The mid-market segment is increasingly turning to ARTs as a response to rising premiums in the conventional insurance market.

Choosing to Go Uninsured

The most fundamental substitute for Allstate's insurance products is the decision by consumers to simply not purchase insurance. This is particularly true for individuals facing financial strain. For instance, during economic downturns, like the one experienced in 2023 where inflation remained a concern, some households may defer or forgo coverage to save money, viewing it as a discretionary expense.

While legally mandated for auto insurance in most jurisdictions, and incredibly risky for home or life insurance, this uninsured choice represents a significant threat. In 2024, a substantial portion of the population might still be sensitive to premium costs, especially with rising living expenses. This directly impacts Allstate's addressable market, as the decision to remain uninsured removes a potential customer entirely.

This threat is amplified when individuals perceive their risk of loss as low. For example, a young, healthy individual might feel less compelled to purchase life insurance, or a homeowner in a low-disaster-prone area might question the necessity of comprehensive home coverage. This perception, whether accurate or not, directly substitutes for the need for Allstate's protection.

Consider these factors influencing the threat of going uninsured:

- Cost Sensitivity: Rising inflation in 2023 and continued economic uncertainty in early 2024 likely increased the number of consumers prioritizing essential spending over insurance premiums.

- Perceived Risk: A significant segment of the population may underestimate their personal risk of events like natural disasters or premature death, leading them to opt out of coverage.

- Legal Mandates: While auto insurance is legally required, other forms of insurance are not, creating a larger pool of potential uninsured individuals for those specific products.

- Economic Conditions: During periods of economic contraction or high unemployment, the threat of consumers choosing to go uninsured naturally increases as disposable income shrinks.

The decision by individuals to forgo insurance altogether, particularly during economically challenging times, represents a significant substitute. In 2023, persistent inflation and economic uncertainty meant some households prioritized essential spending over insurance, viewing it as a discretionary cost. This threat is amplified when individuals perceive their personal risk as low, such as a young, healthy person opting out of life insurance.

Government programs like Medicare and Social Security offer foundational risk coverage, acting as substitutes for private life and health insurance. For example, Medicare Part B premiums for most beneficiaries were $174.70 in 2024, indicating a baseline of government-provided protection. Furthermore, advancements in risk prevention technologies, such as ADAS in vehicles, projected to exceed $40 billion globally by 2024, could reduce accident frequency and thus the perceived need for comprehensive insurance.

| Substitute Type | Description | 2023/2024 Impact/Data |

|---|---|---|

| Going Uninsured | Consumers choosing not to purchase insurance due to cost or perceived low risk. | Inflation in 2023 and economic uncertainty in early 2024 increased cost sensitivity. |

| Government Programs | Publicly provided insurance (e.g., Medicare) covering basic risks. | Medicare Part B premium was $174.70 for most beneficiaries in 2024. |

| Risk Prevention Tech | Technologies that reduce the likelihood of losses (e.g., ADAS). | Global ADAS market projected to exceed $40 billion by 2024. |

| Alternative Risk Transfer (ART) | Mechanisms like captive insurance for businesses. | Global captive insurance market exceeded $70 billion in premiums in 2023. |

Entrants Threaten

Entering the insurance sector, particularly for a company like Allstate, demands immense financial resources. Think about the sheer amount of money needed to handle potential claims, set aside necessary reserves, and comply with all the intricate government regulations. This is a massive hurdle for anyone looking to start a new insurance company.

For instance, in 2024, the U.S. property and casualty insurance market saw premium volumes exceeding $700 billion. New entrants would need to secure a significant portion of this capital just to establish a credible presence and absorb initial operating costs, let alone compete with established giants.

These high capital requirements act as a formidable barrier, effectively shielding incumbent firms like Allstate. It makes it incredibly challenging for new, smaller players to gain traction and compete on the same scale, reinforcing the competitive advantage of those already entrenched in the market.

Extensive regulatory hurdles significantly deter new entrants in the insurance industry. Companies must navigate a complex web of federal and state regulations, including stringent licensing requirements, capital solvency rules, and consumer protection mandates. Allstate, having operated for decades, has established the infrastructure and expertise to manage these compliance demands, a costly and time-consuming undertaking for newcomers.

Brand recognition and trust are significant barriers to entry in the insurance industry, a sector inherently built on customer confidence. Allstate, for instance, has cultivated a strong reputation over many years, making it difficult for newcomers to attract customers who prioritize established reliability for their financial protection.

New entrants must overcome the substantial investment required to build brand awareness and foster trust, a process that can take considerable time and resources. In 2024, the insurance market continues to favor well-known brands, with consumer surveys consistently showing a preference for insurers with a long track record and positive customer reviews.

Developed Distribution Networks

Allstate's robust distribution strategy, encompassing exclusive agents, independent agents, and direct-to-consumer channels, presents a formidable barrier to new entrants. Establishing a comparable reach and customer engagement capability requires substantial investment in time and capital. For instance, as of the first quarter of 2024, Allstate reported approximately 10,000 exclusive agencies and a vast network of independent agents, underscoring the scale of this advantage.

The sheer density and established relationships within Allstate's distribution networks make it exceedingly difficult for newcomers to gain market traction quickly. This entrenched infrastructure, built over decades, provides Allstate with a significant competitive edge in customer acquisition and retention.

- Established Agent Network: Allstate's approximately 10,000 exclusive agencies and numerous independent agents offer widespread customer access.

- Multi-Channel Approach: Combining exclusive, independent, and direct sales channels diversifies reach and customer preference accommodation.

- Cost and Time Investment: Replicating Allstate's extensive distribution infrastructure would demand significant financial resources and years of development for any new competitor.

Data and AI Capabilities

The insurance industry's increasing reliance on data and artificial intelligence presents a substantial hurdle for new entrants. Established players, including Allstate, leverage decades of proprietary data and advanced analytical models for underwriting, pricing, and fraud detection. For instance, in 2024, many leading insurers continued to invest heavily in AI-driven analytics, with some reporting significant improvements in claims processing efficiency and risk assessment accuracy.

New companies entering the market struggle to replicate the depth and breadth of data that incumbents possess. This data asymmetry directly impacts their ability to develop competitive pricing and underwriting strategies. Without comparable historical data and sophisticated AI algorithms, new entrants face higher operational costs and a greater risk of adverse selection.

- Data Advantage: Established insurers possess vast historical datasets that are crucial for training accurate AI models.

- Algorithmic Expertise: Developing and refining sophisticated analytical models requires significant investment and specialized talent, which new entrants may lack.

- Competitive Pricing: Superior data and AI capabilities allow incumbents to offer more precise and competitive pricing, making it difficult for newcomers to attract customers.

- Fraud Detection: Advanced analytics significantly enhance fraud detection, reducing losses for established insurers and creating a cost disadvantage for new entrants.

The threat of new entrants in the insurance sector, especially for a company like Allstate, is generally low. This is primarily due to the substantial capital required to enter the market, with the U.S. property and casualty insurance market exceeding $700 billion in premium volumes in 2024. Navigating complex regulatory environments, including stringent licensing and solvency rules, also presents a significant challenge for newcomers. Furthermore, established brands like Allstate benefit from decades of built trust and extensive distribution networks, which are costly and time-consuming for new players to replicate.

Porter's Five Forces Analysis Data Sources

Our Allstate Porter's Five Forces analysis utilizes data from Allstate's annual reports and SEC filings, alongside industry research from sources like AM Best and S&P Global Market Intelligence, to assess competitive dynamics.