Allstate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Navigate the complex external landscape impacting Allstate with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the insurance giant's future. Gain a competitive edge and make informed strategic decisions by downloading the full, actionable report today.

Political factors

Government regulation and oversight are critical for Allstate. In 2024, state-level insurance commissioners continue to be pivotal in shaping Allstate's ability to set premiums and introduce new products, with varying approaches across the U.S. impacting operational flexibility.

For instance, shifts in regulatory priorities, such as increased scrutiny on pricing models or solvency requirements, can directly affect Allstate's profitability and strategic planning. Legislative reforms, like those addressing climate-related risks or data privacy, also present ongoing challenges and opportunities for adaptation.

Shifts in national or state healthcare policies can indirectly impact Allstate's life and health insurance segments. For instance, ongoing debates about the future of the Affordable Care Act (ACA) in 2024 and potential legislative changes in 2025 could influence the demand for private health insurance offerings and employer-sponsored benefits, areas where Allstate has some presence.

Consumer protection laws are a significant political factor for Allstate. Evolving statutes and increased regulatory scrutiny, particularly around data privacy and fair trade, directly shape how Allstate engages with its customers, handles their information, and promotes its offerings. For instance, in 2024, the Federal Trade Commission (FTC) continued to emphasize enforcement actions related to deceptive marketing and unfair data collection practices, which Allstate must navigate.

Compliance with these regulations, including those governing unfair claims practices, is paramount. Failure to adhere can result in substantial penalties and erode customer trust, impacting Allstate's brand reputation and financial performance. The ongoing focus on consumer rights means Allstate must maintain robust internal controls and transparent communication to ensure it meets all legal obligations.

Fiscal and Monetary Policy

Broader governmental fiscal and monetary policies significantly shape the economic landscape for companies like Allstate. Tax reforms, shifts in government spending, and Federal Reserve interest rate decisions directly impact consumer purchasing power and the cost of capital for businesses. For instance, the Federal Reserve's monetary policy decisions, including adjustments to the federal funds rate, influence borrowing costs and investment returns across the financial sector. In late 2024 and into 2025, market observers are closely watching for potential shifts in monetary policy as economic indicators evolve.

These policy actions have a direct bearing on Allstate's operational environment. Higher interest rates, a tool often used to combat inflation, can increase the yield on Allstate's investment portfolio, potentially boosting returns. Conversely, they can also make borrowing more expensive for consumers seeking insurance or financing. Government spending initiatives, such as infrastructure projects or social programs, can stimulate economic activity, leading to increased demand for insurance products. Allstate's financial performance is thus closely tied to the broader economic conditions fostered by these fiscal and monetary levers.

- Federal Reserve Interest Rate Decisions: The federal funds rate, a key benchmark, influences borrowing costs and investment yields across the economy.

- Government Spending Initiatives: Fiscal policies that boost infrastructure or social programs can stimulate economic activity and demand for insurance.

- Tax Reforms: Changes in corporate or individual tax rates can affect disposable income and business investment, impacting insurance demand and Allstate's tax liabilities.

- Inflationary Pressures: Monetary policy responses to inflation, such as rate hikes, directly affect Allstate's investment income and the cost of claims.

Geopolitical Stability and Trade Relations

Geopolitical stability significantly influences global financial markets, directly impacting Allstate's investment portfolio performance. For instance, the ongoing geopolitical shifts and trade disputes observed throughout 2024 have introduced volatility, potentially affecting the returns Allstate generates from its substantial investment assets. These international dynamics can also indirectly influence the cost of reinsurance, a critical component of Allstate's risk management strategy, as global insurers assess and price for increased uncertainty.

Trade relations, in particular, can create ripple effects across the financial sector. Disruptions or improvements in international trade agreements can alter economic growth forecasts and, consequently, consumer confidence. This, in turn, can influence demand for insurance products and the overall economic environment in which Allstate operates. For example, shifts in global supply chains due to trade tensions can lead to increased operational costs for businesses, potentially impacting their ability to purchase insurance or their claims experience.

- Global Economic Outlook: The IMF's April 2025 World Economic Outlook projects a moderate global growth rate, but highlights significant downside risks stemming from ongoing geopolitical conflicts and trade fragmentation.

- Reinsurance Market Trends: As of early 2025, reinsurance pricing continues to reflect elevated catastrophe loss activity and broader geopolitical risks, leading to higher costs for primary insurers like Allstate.

- Investment Portfolio Sensitivity: Allstate's investment income, a key driver of its financial results, is sensitive to market volatility exacerbated by geopolitical events, with significant asset classes like equities experiencing fluctuations.

Governmental regulations continue to be a primary driver of Allstate's operational landscape. In 2024 and projected into 2025, state insurance commissioners wield significant power over premium setting and product approvals, creating a patchwork of compliance requirements across the U.S. Legislative efforts focusing on climate risk disclosure and data privacy are also shaping industry standards, demanding continuous adaptation from Allstate.

What is included in the product

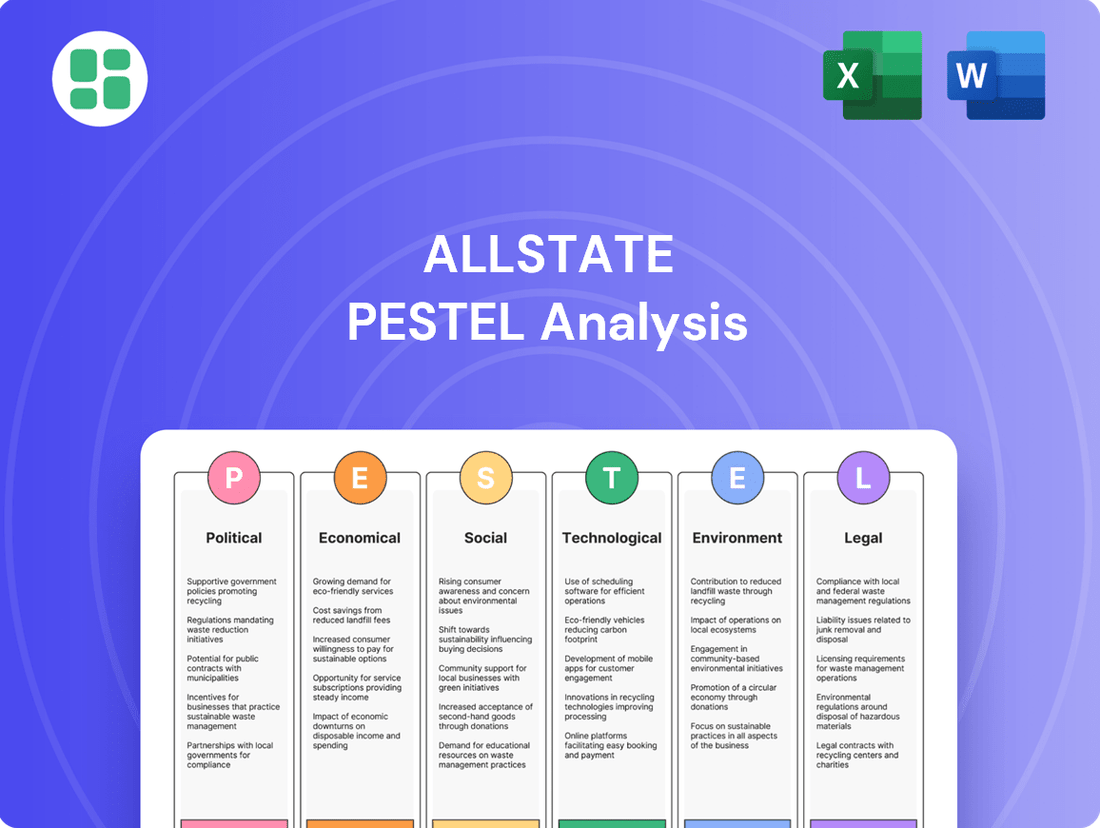

This PESTLE analysis of Allstate provides a comprehensive overview of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Allstate PESTLE Analysis provides a structured framework to identify and understand external factors, thereby alleviating the pain point of uncertainty and enabling more informed strategic decision-making.

Economic factors

Interest rate fluctuations significantly influence Allstate's financial performance. Rising rates, like the Federal Reserve's moves throughout 2022 and 2023, tend to boost investment income for insurers by increasing yields on their substantial fixed-income portfolios. For instance, a higher interest rate environment can lead to greater earnings from Allstate's invested assets, which are crucial for offsetting underwriting costs and contributing to overall profitability.

Conversely, periods of persistently low interest rates, such as those seen in the decade preceding 2022, can pressure Allstate's margins. Lower yields on investments necessitate careful repricing of insurance products to maintain profitability, potentially impacting competitiveness. The Federal Reserve's benchmark rate, which stood at 5.25%-5.50% as of mid-2024, reflects a notable shift from the near-zero rates of the prior decade, directly benefiting Allstate's investment income.

Rising inflation significantly impacts Allstate's operational costs, especially the price of settling claims. For instance, the cost of auto parts and labor for vehicle repairs saw substantial increases throughout 2023 and into early 2024, directly affecting the payouts Allstate makes. Similarly, the cost of construction materials for home repairs and rebuilding has climbed, adding to the expense of property insurance claims.

To counter these escalating expenses and preserve profitability, Allstate must consistently refine its pricing strategies and underwriting practices. This involves carefully adjusting premium rates to reflect the higher cost of claims and ensuring that their investment portfolios are positioned to weather inflationary periods. The company's ability to adapt its financial models is crucial for maintaining a healthy balance sheet amidst these economic pressures.

The overall health of the economy, including GDP growth or recession, directly impacts consumer disposable income and, consequently, the demand for insurance products. For Allstate, this means that a robust economy generally translates to higher spending on insurance, while economic slowdowns can lead to reduced coverage or a shift towards more affordable options.

For instance, the U.S. economy experienced a significant contraction in 2020 due to the pandemic, with GDP falling by 3.4% according to the Bureau of Economic Analysis. While the economy rebounded strongly in 2021, with GDP increasing by 5.9%, the lingering effects of inflation and potential for future slowdowns remain a concern for insurers like Allstate. During economic downturns, consumers often scrutinize their budgets, potentially leading them to reduce coverage levels or switch to lower-premium policies, which can affect Allstate's premium volume and policy retention rates.

Unemployment Rates and Income Levels

Unemployment rates and income levels directly impact Allstate's market. High unemployment, like the 4.0% rate recorded in May 2024, can significantly reduce consumer spending power. This means fewer people can afford or prioritize insurance, potentially leading to a decline in new policy sales and an increase in policy cancellations. Stagnant wage growth further exacerbates this affordability issue.

Conversely, a strong economy with low unemployment and rising incomes generally benefits the insurance sector. For example, the US unemployment rate fell to 3.9% in April 2024, indicating a healthier job market. This economic environment typically allows consumers to purchase more comprehensive coverage and higher policy limits, boosting demand for Allstate's products.

- Impact of Unemployment: A 4.0% US unemployment rate in May 2024 suggests potential headwinds for insurance affordability.

- Income Correlation: Stagnant income levels can suppress demand for insurance, as consumers have less disposable income.

- Economic Boost: A robust job market, evidenced by a 3.9% unemployment rate in April 2024, typically drives higher insurance penetration.

- Coverage Levels: Economic prosperity often leads consumers to opt for higher coverage limits, benefiting insurers like Allstate.

Catastrophe Loss Trends and Reinsurance Costs

The escalating frequency and severity of natural catastrophes, a trend heavily influenced by climate change, directly impact Allstate's financial performance through increased claims payouts. For instance, in 2023, Allstate reported catastrophe losses of $5.7 billion, a significant figure that underscores the economic weight of these events. This surge in losses also drives up the cost of reinsurance, as insurers seek to mitigate their exposure to these volatile risks. Consequently, reinsurance premiums have seen substantial increases, with some sectors experiencing hikes of 20-50% or more in recent renewal cycles, directly affecting Allstate's operational expenses and the affordability of insurance for its customers.

These evolving catastrophe loss trends are a critical economic factor shaping the insurance landscape. They compel insurers like Allstate to reassess their risk models and adjust pricing strategies to reflect the heightened probability of severe weather events. The availability and cost of reinsurance are becoming increasingly challenging, particularly in regions more susceptible to climate-related perils. This dynamic can lead to reduced coverage options or higher deductibles for policyholders in affected areas, impacting market stability and consumer access to essential protection.

Key economic impacts include:

- Increased Claims Payouts: Allstate's 2023 catastrophe losses reached $5.7 billion, highlighting the direct financial burden of natural disasters.

- Rising Reinsurance Costs: The cost of reinsurance has escalated, with some market segments seeing increases of 20-50% or higher.

- Pricing Adjustments: Insurers are forced to raise premiums to account for greater risk, potentially impacting policy affordability.

- Risk Assessment and Availability: Enhanced risk modeling and potential limitations on coverage in high-risk zones are becoming more prevalent.

Interest rate movements directly impact Allstate's investment income. As of mid-2024, the Federal Reserve's benchmark rate at 5.25%-5.50% provides a significant boost to yields on insurers' fixed-income portfolios, a welcome change from the near-zero rates of the previous decade.

Inflationary pressures, particularly in auto repair costs and construction materials, are increasing Allstate's claims expenses. This necessitates ongoing adjustments to pricing strategies and underwriting to maintain profitability amidst these rising operational costs.

Economic growth or contraction influences consumer spending on insurance. A robust economy typically increases demand, while slowdowns can lead to reduced coverage as consumers prioritize essential spending, impacting Allstate's premium volume.

Unemployment and income levels directly affect market demand. High unemployment, like the 4.0% recorded in May 2024, reduces purchasing power, potentially leading to fewer new policies and more cancellations for Allstate.

Preview Before You Purchase

Allstate PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Allstate PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Allstate's strategic landscape.

Sociological factors

The United States is experiencing a significant demographic shift, with the population aged 65 and over projected to reach 80.8 million by 2040, nearly doubling from 2012. This aging demographic directly impacts insurance demand, increasing the need for products such as annuities, life insurance, and long-term care policies. Allstate must strategically adjust its product portfolio and outreach to effectively serve these growing segments.

The surge in remote work and the gig economy significantly alters how people use their vehicles and homes, directly impacting traditional insurance. For instance, a substantial portion of the workforce continues to embrace hybrid or fully remote arrangements, meaning fewer daily commutes. This shift, evident in 2024 data showing continued high remote work participation rates, necessitates a re-evaluation of auto insurance premiums and coverage. Allstate must adapt to these changing work habits.

The growth of shared mobility services and the gig economy further complicates traditional insurance. As more individuals opt for ride-sharing or delivery services, their personal vehicle usage patterns change, and their need for specific commercial coverage might increase. Allstate's analysis of 2024 trends indicates a growing demand for flexible insurance solutions that cater to these diverse and often intermittent usage scenarios, moving beyond static annual policies.

To remain competitive, Allstate is exploring innovative products like usage-based insurance (UBI) and pay-per-mile options. These initiatives directly address the evolving lifestyles where asset utilization is more dynamic. By leveraging telematics data, Allstate can offer policies that more accurately reflect actual driving behavior and mileage, providing fairer pricing for customers whose habits differ from the traditional commuter model prevalent in earlier decades.

Public concern over climate change is intensifying, with a significant majority of Americans expressing worry about its effects. For instance, a 2024 Pew Research Center survey found that 62% of U.S. adults are very concerned about climate change. This heightened awareness translates into consumer expectations for insurers like Allstate to demonstrate environmental responsibility and offer guidance on mitigating climate-related risks, such as extreme weather events.

Consumers are increasingly looking for insurance providers that align with their values, including environmental sustainability. This means Allstate may see a demand for policies that acknowledge or even incentivize climate-resilient practices. Furthermore, transparency regarding how climate change impacts underwriting and pricing is becoming a key differentiator, as customers expect insurers to be upfront about climate-related exposures and their strategies to manage them.

Evolving Consumer Expectations for Digital Services

Modern consumers, across all demographics, now demand frictionless digital experiences, expecting personalized interactions and immediate access to services, whether on a website or a mobile app. This shift is evident in the increasing adoption of digital channels for financial services; for instance, a 2024 report indicated that over 70% of insurance policy inquiries and transactions are now initiated online or via mobile devices.

To stay competitive, Allstate must consistently enhance its digital infrastructure. This includes robust platforms for policy sales, streamlined claims processing, responsive customer service, and intuitive policy management tools. The company's investment in digital transformation is crucial; by mid-2025, it's projected that insurers failing to meet these digital expectations will see a significant decline in customer retention, potentially losing up to 15% of their customer base annually.

Meeting these evolving consumer expectations is not just about convenience; it's about building trust and loyalty in an increasingly digital-first world. Key areas of focus for Allstate include:

- Enhanced Mobile App Functionality: Offering comprehensive self-service options for policy management and claims filing.

- Personalized Digital Communication: Utilizing data analytics to deliver tailored product recommendations and support.

- AI-Powered Customer Support: Implementing chatbots and virtual assistants for instant query resolution.

- Seamless Omnichannel Experience: Ensuring consistent and integrated service across all digital and physical touchpoints.

Social Attitudes Towards Risk and Responsibility

Societal attitudes toward personal responsibility and risk-taking are dynamic, directly impacting the insurance market. As people increasingly prioritize financial security and proactive risk management, the demand for comprehensive insurance solutions grows. For instance, a 2024 survey indicated that 78% of U.S. adults feel a greater responsibility to financially protect their families against unexpected events, a sentiment that fuels demand for life and disability insurance.

Allstate must navigate these evolving views by tailoring its communication and product offerings. A growing segment of consumers, particularly younger demographics, shows a preference for digital-first engagement and personalized coverage options that reflect their individual risk profiles and lifestyles. This shift is underscored by the fact that digital insurance sales in the U.S. are projected to reach $100 billion by the end of 2025.

- Shifting Perceptions of Risk: Consumers are becoming more aware of diverse risks, from cyber threats to climate-related events, leading to a demand for specialized insurance products.

- Emphasis on Financial Resilience: There's a rising societal value placed on building personal financial resilience, making insurance a key component of long-term planning.

- Influence of Digitalization: The expectation for seamless, tech-enabled interactions influences how customers engage with insurers, pushing companies like Allstate to innovate their digital platforms.

- Demand for Transparency: Customers increasingly expect clear, understandable policy terms and transparent pricing, influencing how Allstate designs and markets its products.

Societal attitudes are shifting towards greater personal responsibility for financial security, driving demand for comprehensive insurance. This trend is amplified by a growing awareness of diverse risks, from cyber threats to climate events, prompting a need for specialized coverage. Allstate must adapt its offerings and communication to align with these evolving consumer priorities and expectations for digital engagement.

Technological factors

Allstate's integration of artificial intelligence and machine learning is significantly reshaping its core operations. For instance, AI-driven underwriting models are improving risk assessment accuracy, potentially leading to more competitive pricing and reduced adverse selection. The company is also leveraging machine learning for predictive analytics in areas like fraud detection, aiming to minimize financial losses.

The efficiency gains from these technologies are substantial. Automated claims processing, powered by AI, can expedite payouts and improve customer satisfaction, a critical factor in the insurance industry. In 2024, insurers are increasingly investing in AI to streamline workflows and reduce operational costs, with many reporting significant improvements in processing times.

Telematics technology, which gathers detailed driving behavior data, is fundamentally reshaping how Allstate assesses risk and prices policies. This allows for the expansion of usage-based insurance (UBI) programs, offering customers premiums that more accurately reflect their individual driving habits. For instance, Allstate's Drivewise program leverages telematics to reward safe drivers with potential discounts, a strategy that aligns with the growing consumer demand for personalized financial products.

This technological shift is vital for Allstate's competitive edge, enabling the company to attract and retain safer drivers who are increasingly seeking value through UBI. As transportation habits evolve, with more connected vehicles and a greater emphasis on data-driven insights, telematics positions Allstate to adapt and thrive in a dynamic market. The company's ability to harness this data directly impacts its underwriting accuracy and customer retention strategies.

Allstate is increasingly leveraging big data analytics to understand its customers better, identify market shifts, and refine risk assessments. This allows for more precise pricing strategies and marketing campaigns.

The company's investment in data analytics is crucial for developing new products and services, as well as enhancing fraud detection capabilities. In 2024, Allstate reported a significant increase in data-driven underwriting, leading to a projected 3% improvement in loss ratios for certain auto insurance segments.

Cybersecurity Risks and Data Protection

Allstate's growing reliance on digital channels and its extensive collection of customer data elevate cybersecurity risks. Protecting sensitive information is crucial for maintaining customer trust and adhering to evolving data privacy laws. In 2024, the financial services sector experienced a significant rise in sophisticated cyberattacks, with ransomware incidents alone costing businesses billions globally, underscoring the need for robust defenses.

The company must invest heavily in advanced cybersecurity measures to safeguard its digital infrastructure and customer information. Failure to do so could lead to severe financial penalties, reputational damage, and a loss of competitive advantage. For example, data breaches in the insurance industry can result in millions of dollars in remediation costs and legal fees, impacting profitability and investor confidence.

- Increased Threat Landscape: Cyberattacks targeting financial institutions are becoming more frequent and complex.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA necessitates stringent data protection protocols.

- Customer Trust: A strong cybersecurity posture is vital for retaining and attracting customers who prioritize data security.

- Operational Resilience: Protecting against disruptions from cyber incidents ensures continuity of service and business operations.

Digital Transformation and Automation

Allstate's commitment to digital transformation and automation is a cornerstone of its strategy for 2024 and beyond. The company is actively investing in technologies to streamline operations and elevate customer interactions. This focus is crucial for maintaining a competitive edge in an increasingly digital insurance landscape.

Key initiatives include the expansion of online policy management portals and the simplification of digital claims submission processes. These advancements aim to reduce processing times and enhance convenience for policyholders. Furthermore, Allstate is leveraging automated customer support systems, such as AI-powered chatbots, to provide instant assistance and resolve queries efficiently.

- Digital Claims: Allstate reported a significant increase in digital claims submissions, with over 50% of auto claims processed digitally in 2023, a trend expected to continue growing.

- Operational Efficiency: Automation of underwriting and customer service tasks is projected to yield cost savings of approximately 10-15% in relevant departments by the end of 2024.

- Customer Experience: Investments in digital platforms are designed to improve customer satisfaction scores, with a target of a 5-point increase in Net Promoter Score (NPS) by year-end 2025.

- Data Analytics: Enhanced use of data analytics through digital transformation allows for more personalized product offerings and risk assessment, improving profitability.

Allstate is heavily investing in artificial intelligence and machine learning to refine its underwriting accuracy and fraud detection capabilities. These technologies are driving significant operational efficiencies, with AI-powered claims processing expected to speed up payouts. The company's focus on telematics for usage-based insurance programs, like Drivewise, is also a key technological driver, offering personalized pricing based on driving behavior.

Legal factors

Allstate navigates a fragmented regulatory landscape, primarily governed by individual state insurance departments. These bodies enforce stringent rules on licensing, capital reserves to ensure solvency, and the approval of premium rates. For instance, in 2024, states like California and Florida continued to scrutinize rate increases, impacting Allstate's pricing strategies and profitability in those key markets.

Adherence to market conduct regulations, which cover everything from advertising to claims handling, is paramount. Failure to comply can result in significant fines and reputational damage. Allstate's 2024 annual report highlighted ongoing investments in compliance infrastructure to manage these diverse state-specific requirements effectively.

Allstate navigates a complex web of data privacy and security laws, with the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), setting a high bar. These regulations, impacting how Allstate handles customer information, grant consumers rights regarding their personal data. As of 2024, the landscape continues to evolve with more states enacting similar legislation, increasing compliance burdens and the need for robust data protection measures.

Consumer protection laws, such as the FTC Act and state-specific unfair and deceptive acts and practices statutes, directly shape how Allstate markets its insurance products and handles claims. These regulations mandate transparency in advertising and policy terms, aiming to prevent misleading consumers. In 2024, the Federal Trade Commission continued to emphasize enforcement actions against deceptive advertising in the financial services sector, underscoring the importance of Allstate's robust compliance programs.

Litigation Trends and Class Action Lawsuits

The insurance sector, including Allstate, faces ongoing litigation, from individual claim disputes to significant class-action lawsuits. These legal challenges often stem from disagreements over policy coverage, the claims handling process, or broader business practices. Such litigation can lead to substantial financial penalties and considerable damage to a company's reputation.

In 2024, the insurance industry continued to grapple with a high volume of litigation. For instance, class action filings related to insurance practices remained a significant concern, with particular attention on areas like claims denials and alleged unfair business practices. These lawsuits can impose substantial financial burdens, as seen in settlements and judgments impacting insurers' bottom lines.

- Rising Class Action Filings: Data from 2024 indicated a persistent trend of class action lawsuits targeting insurance companies, often concerning allegations of improper claims adjustments or policy interpretation.

- Financial Impact: Settlements and legal costs associated with these litigations represent a material expense for insurers, with some large class actions resulting in payouts exceeding tens of millions of dollars.

- Reputational Risk: Negative publicity from high-profile lawsuits can erode consumer trust and impact brand perception, a critical factor in the insurance market.

Environmental Regulations and Disclosure Requirements

Emerging environmental regulations, especially those concerning climate change risk disclosure and sustainable finance, are likely to introduce new reporting obligations and operational adjustments for Allstate. For instance, the Securities and Exchange Commission's (SEC) proposed climate disclosure rules, while facing ongoing debate and potential revisions into 2024 and beyond, signal a trend towards greater transparency in how companies manage climate-related risks. These evolving legal frameworks directly impact Allstate's investment strategies and how it assesses risks across its portfolio.

These legal shifts can influence Allstate's underwriting practices and the types of insurance products it offers, particularly in areas exposed to climate-related events. For example, insurers are increasingly scrutinizing their exposure to properties in flood-prone or wildfire-prone regions, which are often exacerbated by climate change. The push for sustainable investing also means Allstate may need to align its investment decisions with environmental, social, and governance (ESG) criteria, potentially divesting from certain high-carbon industries.

- Increased Scrutiny on Climate Risk Reporting: Regulations are pushing for more detailed disclosures on how climate change impacts business operations and financial performance.

- Impact on Investment Strategies: Legal requirements for sustainable finance can steer Allstate towards ESG-compliant investments and away from carbon-intensive assets.

- Underwriting Adjustments: Evolving environmental laws may necessitate changes in how Allstate assesses and prices risks associated with climate-vulnerable assets.

- Compliance Costs: Adhering to new environmental regulations can lead to increased operational and reporting expenses for the company.

Allstate operates within a complex legal framework, heavily influenced by state-specific insurance regulations governing everything from licensing to rate approvals. In 2024, states like Florida and California continued to scrutinize premium adjustments, directly affecting Allstate's pricing power and profitability in these crucial markets. Furthermore, adherence to market conduct rules, encompassing advertising and claims handling, is critical, with non-compliance potentially leading to substantial fines and reputational damage, as Allstate's 2024 report indicated ongoing investments in compliance infrastructure to manage these varied state requirements.

The company also faces evolving data privacy laws, such as California's CCPA and CPRA, which grant consumers more control over their personal information. As of 2024, this trend of increasing state-level data privacy legislation creates a more complex compliance landscape for Allstate, necessitating robust data protection measures. Consumer protection statutes, including the FTC Act, mandate transparency in marketing and policy terms, with the FTC's 2024 enforcement actions against deceptive advertising underscoring the importance of Allstate's compliance programs.

Litigation remains a significant legal factor, with class action lawsuits and individual claim disputes posing financial and reputational risks. In 2024, the insurance sector saw a continued high volume of litigation, with class actions focusing on areas like claims denials and alleged unfair business practices, leading to substantial financial burdens for insurers. For example, some large class actions in 2024 resulted in payouts exceeding tens of millions of dollars, impacting profitability and brand perception.

Emerging environmental regulations, particularly concerning climate change risk disclosure and sustainable finance, are introducing new reporting obligations and operational adjustments. The SEC's proposed climate disclosure rules, debated through 2024, signal a trend towards greater transparency in managing climate-related risks, influencing Allstate's investment strategies and risk assessments. These legal shifts can also impact underwriting practices, prompting insurers to re-evaluate exposure in climate-vulnerable regions and align investment decisions with ESG criteria.

Environmental factors

Climate change is intensifying extreme weather events, directly affecting Allstate's property and casualty insurance business. In 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $92.9 billion in damages, according to NOAA data. This trend of increased frequency and severity, including hurricanes, wildfires, and severe convective storms, translates to higher claims payouts for Allstate and requires constant refinement of risk assessment and pricing strategies to remain profitable.

Allstate faces significant environmental challenges, particularly concerning natural catastrophe risk. The company must continually refine its ability to assess, model, and manage exposure to events like hurricanes, wildfires, and floods. This is crucial given the increasing frequency and severity of such events, with the U.S. experiencing 28 separate billion-dollar weather and climate disasters in 2023 alone, totaling over $92.9 billion in damages.

Sophisticated data analytics and advanced modeling are key to understanding and mitigating these risks. Allstate also relies on geographical diversification of its insurance portfolio to spread risk across different regions. Effective reinsurance strategies are vital to protect the company's financial stability from the substantial payouts that can result from major catastrophes.

Resource scarcity, particularly in materials vital for repairs like lumber and microchips used in vehicles, is a growing concern. Climate-induced disruptions, such as severe weather events, can further exacerbate these issues, leading to significant delays and increased costs in sourcing necessary components for Allstate's claims resolution processes.

ESG (Environmental, Social, Governance) Pressures

ESG pressures are significantly shaping Allstate's strategic direction, driven by increasing demands from investors, regulators, and the public for robust environmental, social, and governance performance. This translates into a heightened focus on sustainable investment practices and minimizing the company's own environmental impact.

Allstate is actively responding to these pressures through concrete actions and disclosures. For instance, in 2023, the company continued its commitment to reducing its operational carbon footprint, aiming for further reductions in its Scope 1 and 2 emissions by 2030. Furthermore, Allstate is enhancing its reporting on climate-related risks and opportunities, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD).

- Sustainable Investing: Allstate is integrating ESG factors into its investment decisions, aiming to align its portfolio with sustainable outcomes.

- Environmental Footprint Reduction: The company is implementing strategies to lower its greenhouse gas emissions and improve energy efficiency across its operations.

- Climate Risk Disclosure: Allstate is committed to transparently reporting on how climate change could impact its business, including physical and transition risks.

- Stakeholder Engagement: Allstate actively engages with investors, employees, and communities to understand and address evolving ESG expectations.

Regulatory Focus on Climate Risk

Regulators globally are intensifying their scrutiny of how insurers, including Allstate, identify and manage financial risks stemming from climate change. This heightened focus is translating into potential new mandates for climate risk disclosure, rigorous stress testing, and specific capital allocation strategies. For instance, the U.S. Securities and Exchange Commission (SEC) proposed rules in 2022 requiring public companies to disclose climate-related risks and greenhouse gas emissions, a move that would directly impact insurers' reporting obligations.

These evolving regulatory expectations are poised to significantly influence Allstate's core operations. Expect stricter guidelines on underwriting practices, potentially leading to adjustments in pricing and coverage for climate-vulnerable areas. Furthermore, investment decisions will likely be shaped by climate risk assessments, pushing for greater allocation towards more sustainable assets and away from those with high carbon footprints. The National Association of Insurance Commissioners (NAIC) has also been actively developing climate-related guidance for state regulators, indicating a coordinated push towards greater oversight in 2024 and beyond.

- Increased Disclosure Requirements: Allstate may need to provide more detailed information on its exposure to climate-related physical and transition risks in its financial reporting.

- Climate Stress Testing: Regulators could mandate that Allstate conduct regular stress tests to assess its resilience against various climate scenarios, such as severe weather events or shifts in energy policy.

- Capital Allocation Adjustments: The company might face pressure to adjust its capital reserves and investment portfolios to better reflect climate risk exposures, potentially impacting profitability and growth strategies.

- Underwriting Practice Evolution: Allstate's approach to pricing insurance policies and determining coverage will likely need to adapt to better account for the increasing frequency and severity of climate-related perils.

Allstate's environmental strategy is increasingly shaped by the escalating impact of climate change on its core insurance business. The company must navigate the rising frequency and severity of extreme weather events, which directly translate into higher claims. For instance, in 2023, the U.S. faced 28 billion-dollar weather and climate disasters, causing over $92.9 billion in damages, a trend that necessitates continuous refinement of risk assessment and pricing models to maintain profitability.

Resource scarcity, particularly for materials used in repairs, presents another environmental hurdle. Climate-induced disruptions can exacerbate these issues, leading to delays and increased costs in claims processing, impacting Allstate's operational efficiency and customer satisfaction.

The company is also responding to growing ESG pressures from investors and regulators by focusing on sustainable investing and reducing its operational environmental footprint. Allstate is committed to transparently reporting on climate-related risks and opportunities, aligning with frameworks like the TCFD.

Regulatory scrutiny regarding climate risk management is intensifying, with potential mandates for enhanced disclosure and stress testing. The SEC's proposed rules on climate-related disclosures, for example, will directly affect insurers' reporting obligations, influencing underwriting practices and capital allocation strategies by 2024 and beyond.

PESTLE Analysis Data Sources

Our PESTLE analysis for Allstate is built on a robust foundation of data from reputable sources including government regulatory bodies, financial market reports, and leading industry publications. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the insurance sector.