Allstate Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

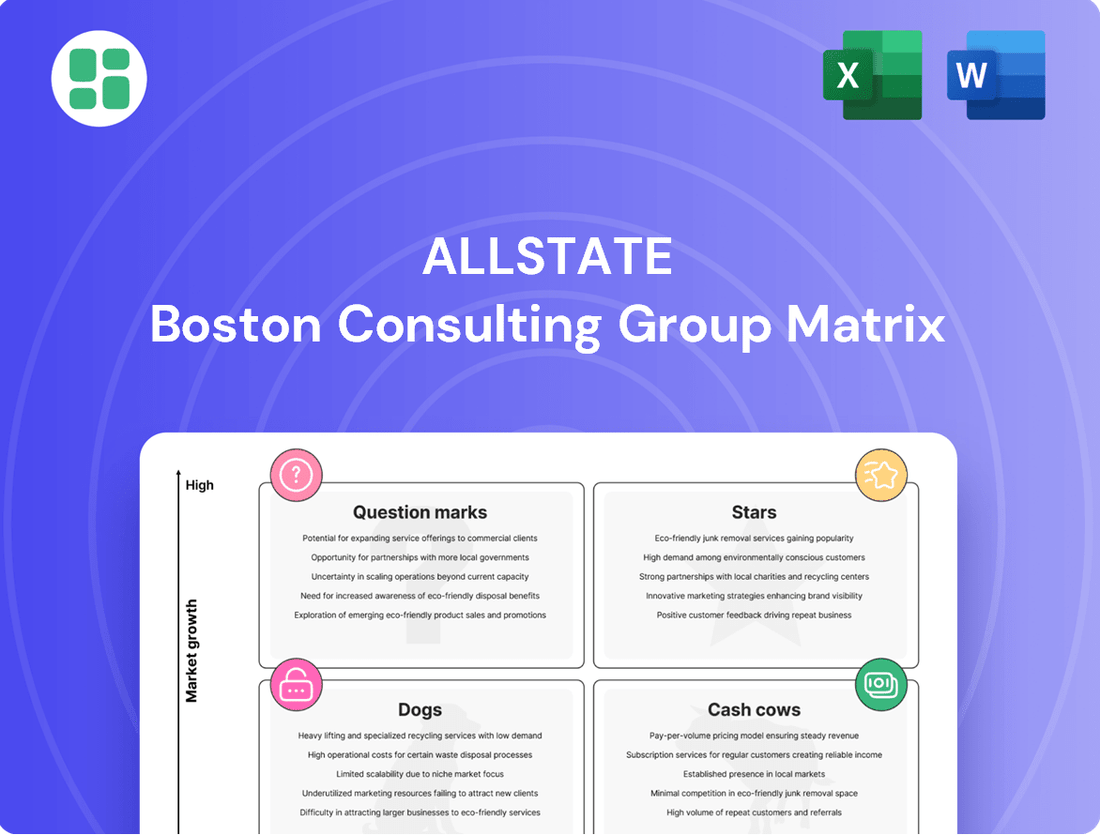

Curious about Allstate's strategic product portfolio? Our preview of their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear path to optimizing Allstate's market position.

Stars

Allstate Protection Plans are a shining example of a Star in the BCG Matrix for Allstate. This segment is experiencing robust growth, with revenues jumping 20.3% in the fourth quarter of 2024. The company's commitment to this area is evident in the impressive 60% increase in policies in force since 2019, reaching a substantial 160 million.

This strong performance positions Allstate Protection Plans as a key growth driver for the company. It suggests a dominant market share within the expanding market for extended warranties and protection solutions, a category that continues to see increasing consumer demand.

The acquisition of National General has significantly boosted Allstate's presence in the independent agency channel. National General saw a 12% rise in policies in force during the second quarter of 2024. This acquisition underpins Allstate's strategic expansion within this key distribution network for personal insurance lines.

Allstate is making significant strides in AI-powered underwriting and claims, with a substantial investment of roughly $900 million earmarked for AI systems in 2025. This strategic allocation is designed to sharpen pricing accuracy and expedite the claims handling process.

This focus on AI is a clear indicator of Allstate's ambition to lead in the rapidly expanding insurtech sector, aiming to boost profitability and cut operational expenses. By refining underwriting models and automating assessments, the company is solidifying its position in this high-growth market.

Direct Channel Auto and Home Growth

Allstate is making significant strides in expanding its direct-to-consumer digital channels for both auto and home insurance. This strategic push aims to capture a larger share of the market by offering a seamless online experience for customers. The company believes this is a key avenue for future growth and customer acquisition.

A key indicator of this success is the substantial increase in direct channel applications. In the second quarter of 2024, Allstate reported a remarkable 92% surge in these applications. This demonstrates a clear shift in consumer preference towards digital purchasing and Allstate's ability to meet that demand.

Allstate sees particularly strong potential in leveraging the web for homeowners insurance sales. The company's ambition is to become a frontrunner in this evolving distribution landscape, recognizing the efficiency and reach that digital platforms offer. This focus aligns with broader industry trends towards digital transformation.

- Direct Channel Application Growth: 92% increase in Q2 2024.

- Strategic Focus: Expanding digital reach for auto and home insurance.

- Homeowners Insurance Potential: Aiming for industry leadership in web-based sales.

- Customer Acquisition: Targeting high-growth paths beyond traditional agents.

Usage-Based Insurance (UBI) through Arity

Allstate's subsidiary, Arity, is a significant player in the rapidly expanding usage-based insurance (UBI) sector. Arity leverages data analytics to offer personalized insurance solutions, tapping into a growing consumer demand for policies tailored to driving habits. This focus on telematics and data-driven insights positions Allstate favorably in a high-growth market.

Arity's performance underscores the potential of UBI. In 2024, Arity saw a remarkable surge in lead sales, increasing by an impressive 155%. This substantial growth highlights the increasing acceptance and adoption of telematics technology and data-informed approaches within the auto insurance industry.

- Arity's Role: Arity, an Allstate subsidiary, specializes in data-driven insights and usage-based insurance (UBI).

- Growth Metric: Arity experienced a 155% surge in lead sales in 2024, indicating strong market traction.

- Market Trend: This growth reflects the increasing adoption of telematics and data-driven solutions in auto insurance.

- Strategic Position: Arity's success positions Allstate in a high-growth niche that aligns with modern consumer preferences for personalized policies.

Allstate Protection Plans and Arity, its data analytics subsidiary, are prime examples of Stars within Allstate's BCG Matrix. Protection Plans saw a 20.3% revenue increase in Q4 2024, with policies in force growing 60% since 2019 to 160 million. Arity, focusing on usage-based insurance, experienced a 155% surge in lead sales in 2024, demonstrating significant traction in the telematics market.

| Business Segment | BCG Category | Key Growth Metric (2024) | Allstate's Strategic Focus |

|---|---|---|---|

| Allstate Protection Plans | Star | 20.3% Revenue Growth (Q4 2024) | Expanding protection solutions, increasing policy count |

| Arity (UBI) | Star | 155% Lead Sales Growth (2024) | Leveraging data analytics for personalized insurance |

What is included in the product

The Allstate BCG Matrix provides a strategic framework for analyzing its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides decisions on investment, divestment, and resource allocation across Allstate's diverse business units.

The Allstate BCG Matrix provides a clear, visual roadmap to identify underperforming units, relieving the pain of resource misallocation.

Cash Cows

Allstate's Core Personal Auto Insurance is a classic Cash Cow. They hold a significant 10.4% market share in the U.S., making them the fourth-largest player in this mature but essential market.

The company has demonstrated strong performance, implementing successful rate increases and enhancing underwriting practices, which contributed to a 'broadly profitable' auto business in the second quarter of 2025. This segment is a reliable generator of substantial cash flow, a vital resource for funding Allstate's other strategic ventures.

Allstate's core homeowners insurance business is a significant cash cow, reflecting its position as the second-largest provider in the U.S. with an 8.9% market share in 2024.

This segment delivered a substantial $1.3 billion in underwriting income for the full year 2024, underscoring its consistent profitability within a well-established market.

The company is experiencing continued policy growth and maintaining stable profit margins in this essential area of its operations.

Allstate's investment portfolio operates as a classic Cash Cow. Its consistent and significant income generation is a cornerstone of the company's financial strength. In 2024, net investment income saw a robust increase of 24.8%, reaching $3.1 billion. This growth was primarily fueled by a strategic shift towards fixed-income securities offering higher yields, demonstrating effective management of this stable, high-generating asset class.

Established Exclusive Agent Distribution

Allstate's exclusive agent distribution network is a prime example of a cash cow within its business portfolio. This channel, built over many years, is mature but continues to be a significant revenue generator.

The company's strategic focus on enhancing agent productivity has yielded impressive results, with a reported 29% increase in agent productivity since 2018. This growth directly translates into stronger cash flows from this established segment.

This mature distribution channel offers a stable foundation of customer relationships and a high rate of policy renewals. This consistency is vital for generating reliable cash flow from a loyal customer base.

- Established Distribution Channel: Allstate's exclusive agent network is a long-standing and productive asset.

- Productivity Gains: Agent productivity has seen a substantial 29% increase since 2018.

- Stable Cash Flow: The channel benefits from strong customer loyalty and high policy renewal rates.

- Mature but Profitable: Represents a consistent source of reliable income for Allstate.

Standard Property-Liability Products

Allstate's standard property and liability products, including auto and homeowners insurance, are its foundational cash cows. These mature offerings are the primary drivers of the company's revenue and profitability, demonstrating consistent operational performance. In 2024, these segments collectively generated a substantial $64.1 billion in total revenues, underscoring their role as reliable cash generators.

- Core Revenue Driver: Auto and homeowners insurance are Allstate's primary revenue sources.

- Profitability Engine: These mature products consistently contribute to the company's overall profitability.

- Market Stability: They represent a stable and predictable income stream for Allstate.

- 2024 Revenue Contribution: Total revenues from these standard offerings reached $64.1 billion in 2024.

Allstate's investment portfolio serves as a significant cash cow, consistently generating substantial income. In 2024, net investment income surged by 24.8%, reaching $3.1 billion, largely due to a strategic pivot towards higher-yielding fixed-income securities. This demonstrates effective management of a stable, high-generating asset class that underpins the company's financial strength.

| Business Segment | BCG Category | 2024 Performance Indicator | Significance |

| Core Personal Auto Insurance | Cash Cow | 10.4% U.S. Market Share | Reliable cash flow for strategic funding. |

| Core Homeowners Insurance | Cash Cow | $1.3 billion underwriting income (2024) | Consistent profitability in a mature market. |

| Investment Portfolio | Cash Cow | $3.1 billion net investment income (2024) | Strong income generation, bolstering financial strength. |

| Exclusive Agent Distribution | Cash Cow | 29% increase in agent productivity (since 2018) | Stable revenue from loyal customer base. |

Full Transparency, Always

Allstate BCG Matrix

The Allstate BCG Matrix preview you are currently viewing is the identical, fully polished document you will receive immediately after purchase. This means you'll get the complete strategic analysis, free from any watermarks or placeholder content, ready for immediate integration into your business planning processes.

Rest assured, the Allstate BCG Matrix you see now is the exact file that will be delivered to you upon completing your purchase. It's a comprehensive, professionally formatted report designed to provide clear insights into Allstate's product portfolio, ensuring you receive a high-quality, actionable tool for strategic decision-making.

Dogs

Allstate has strategically reduced its footprint in states with high catastrophe loss potential. For instance, its market share in California, a state frequently impacted by severe weather, decreased by 15.7% between 2023 and 2024.

This move reflects a broader strategy to restrict business in states where regulatory hurdles and weather-related events negatively impact targeted returns. Such geographic exposures are characterized by low market share and declining or negative profitability.

Allstate's Individual Health business, which reported adjusted net income of $30 million in 2024, is currently under strategic review for potential divestiture. This segment exhibits limited synergy with Allstate's primary insurance operations, suggesting a position within the Dogs quadrant of the BCG Matrix.

Allstate has successfully divested its Group Health business and is actively selling its Employer Voluntary Benefits business, a move that has generated billions in cash. These were identified as low-margin operations.

The strategic decision to sell these segments allows Allstate to free up capital and simplify its business structure. This divestiture clearly places the health and benefits operations as Dogs in the BCG Matrix, as they were consuming resources without offering significant strategic advantage or future growth potential.

Underperforming Niche Programs (Pre-Restructuring)

Before its recent restructuring, Allstate Roadside Assistance had identified and shed an unprofitable account. This action demonstrates how niche programs, even within a larger service like roadside assistance, can quickly become underperformers if they don't meet profitability goals. For instance, if a specific regional contract or a specialized service offering consistently incurred higher costs than revenue generated, it could be classified as a 'Dog' in a BCG matrix context.

Allstate's strategic decision to divest from such specific, low-margin ventures underscores the importance of active portfolio management. These types of niche operations, if not carefully monitored, can easily turn into cash traps, draining resources without providing adequate returns. For example, a program requiring specialized equipment or personnel that isn't utilized efficiently could quickly become a financial burden.

The proactive removal of these underperforming segments is crucial for overall business health. It allows the company to reallocate capital and focus on areas with higher growth potential or stronger profitability. This approach is common in industries where service contracts can vary significantly in their profitability based on operational efficiency and market demand.

- Niche Program Profitability: Low-margin ventures can become cash traps if not managed efficiently.

- Active Management: Allstate's divestment of unprofitable accounts shows a strategy to prune underperformers.

- Resource Reallocation: Shedding 'Dog' segments frees up capital for more promising business areas.

- Industry Trend: Proactive portfolio management is key in service-based industries with diverse contract profitability.

Outdated Legacy Systems and Processes

Allstate's commitment to its Transformative Growth strategy, which includes deploying a new technology ecosystem, highlights a recognition of outdated legacy systems and processes. These older systems and methods were likely hindering efficiency and innovation, consuming valuable resources without driving market share or competitive advantage.

These legacy elements are prime candidates for the Dogs quadrant in the BCG matrix. They represent areas that require significant investment to modernize or phase out, freeing up capital for more promising growth initiatives within Allstate's portfolio. For instance, in 2023, Allstate reported significant investments in technology modernization as part of its broader strategic overhaul.

- Legacy IT systems and inefficient operational methods drain resources.

- These "Dogs" do not contribute to market share growth or competitive advantage.

- Allstate's strategy necessitates investment to move these out of the Dogs quadrant.

Allstate's Individual Health business, showing limited synergy and a $30 million adjusted net income in 2024, is a prime example of a 'Dog' segment. This is due to its underperformance and potential for divestiture, aligning with the BCG matrix definition of low market share and low growth potential.

The company's strategic divestment of its Group Health and Employer Voluntary Benefits businesses, which were low-margin operations, further illustrates the classification of these segments as 'Dogs'. These moves freed up billions in cash and simplified the business structure.

Niche programs within Allstate Roadside Assistance that become unprofitable, such as a specific regional contract with higher costs than revenue, can also be categorized as 'Dogs'. Allstate's proactive shedding of such accounts demonstrates a strategy to manage these underperformers.

Legacy IT systems and inefficient operational methods identified as hindering efficiency and innovation are also considered 'Dogs'. Allstate's investment in technology modernization in 2023 aims to address these resource-draining elements.

Question Marks

Allstate launched new cyber protection products in 2024, targeting both individuals and small businesses. This move taps into a rapidly expanding market driven by escalating digital threats. The cyber insurance sector is projected to reach $20.5 billion in premiums by 2025, a significant jump from previous years.

While the overall cyber insurance market is booming, Allstate's share in this emerging product category is likely modest. These offerings represent a high-growth opportunity, but achieving significant market penetration will necessitate substantial investment in product development, marketing, and customer education to build brand recognition and trust in this relatively new space.

Allstate's new 'Affordable, Simple and Connected' auto and home insurance products, slated for a nationwide rollout in 2025, represent a strategic pivot to gain traction in the highly competitive personal lines market. This initiative targets customer value with significant growth potential, aiming to attract a broader demographic seeking streamlined insurance solutions.

These products are designed to be accessible and user-friendly, leveraging technology to enhance the customer experience. In 2024, the personal insurance market saw continued growth, with direct premiums written for private passenger auto insurance reaching an estimated $340 billion, highlighting the substantial opportunity for innovative offerings.

While the projected market adoption and subsequent share capture for these new products are currently unproven, their focus on affordability and simplicity directly addresses key consumer demands. This strategy positions Allstate to potentially disrupt established market dynamics by appealing to value-conscious policyholders.

Allstate Strategic Ventures is actively deploying capital into climate technology through new investment funds. These initiatives target long-term growth, embracing novel technologies like quantum computing to secure Allstate's future. This positions these investments within the 'Question Marks' quadrant of the BCG Matrix, signifying high growth potential coupled with low current market share.

Emerging Digital Platform Partnerships

Allstate is actively forging partnerships with a variety of digital platforms to broaden its customer reach. These collaborations are designed to tap into new segments and enhance accessibility for potential policyholders. For instance, by integrating with popular financial comparison sites or embedded insurance providers within e-commerce ecosystems, Allstate aims to capture a wider audience.

While these digital channels represent a high-growth avenue for customer acquisition, Allstate's market share directly attributable to these emerging, diverse partnerships is likely still in its nascent stages. Compared to the established and significant market share held by its traditional agent networks, the contribution from these newer digital alliances is expected to be relatively lower as they mature. This positions these partnerships within the 'Question Marks' category of the BCG matrix, indicating potential for future growth but requiring further investment and strategic development to capture significant market share.

- Digital Partnerships as a Growth Area: Allstate's strategy involves leveraging digital platforms to access new customer demographics, a key driver for future expansion.

- Developing Market Share: While these channels show promise, the market share derived from these newer digital partnerships is currently developing and remains lower than established distribution methods.

- Strategic Investment Required: As 'Question Marks', these partnerships necessitate ongoing investment and strategic refinement to convert their growth potential into substantial market share.

Virtual Care and Wellness Programs (Allstate Benefits)

Allstate Benefits, despite its strategic exit from larger health insurance markets, maintains a focused offering in virtual care and wellness programs. These services, including virtual urgent care and counseling, represent a significant growth area within the employee benefits landscape. For example, the telehealth market was projected to reach $150.4 billion by 2027, showcasing the immense potential.

This strategic positioning suggests Allstate is targeting high-potential service models within the evolving healthcare sector. While these virtual offerings are in rapidly expanding segments, their contribution to Allstate's overall revenue was relatively modest in recent reports, placing them in a position of potential growth rather than current market dominance within the company's broader portfolio.

- Virtual Urgent Care: Continues to be offered, tapping into a growing demand for convenient medical access.

- Virtual Counseling: Addresses the increasing need for accessible mental health support.

- Wellness Programs: Focuses on preventative health and employee well-being initiatives.

- Growth Potential: These segments are identified as high-growth areas within the broader healthcare and employee benefits market.

Allstate's investments in climate technology and its expansion into new digital partnerships exemplify 'Question Marks' in the BCG matrix. These ventures operate in high-growth sectors but currently hold a low market share. For instance, the climate tech market is expected to grow significantly, with some projections indicating it could reach trillions of dollars globally by 2050, yet Allstate's current stake is minimal.

Similarly, while Allstate is actively pursuing collaborations with various digital platforms to broaden its customer reach, the market share derived from these newer digital alliances is still developing. The company's strategic focus on these nascent areas highlights a commitment to future growth, acknowledging that substantial investment and strategic refinement are necessary to convert their potential into dominant market positions.

| BCG Category | Allstate's Ventures | Market Growth | Current Market Share | Strategic Implication |

| Question Mark | Climate Technology Investments | High | Low | Requires significant investment to capture market share. |

| Question Mark | Digital Platform Partnerships | High | Low | Needs strategic development and customer acquisition focus. |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of Allstate's financial disclosures, internal performance metrics, and external market research to accurately assess product portfolio positions.