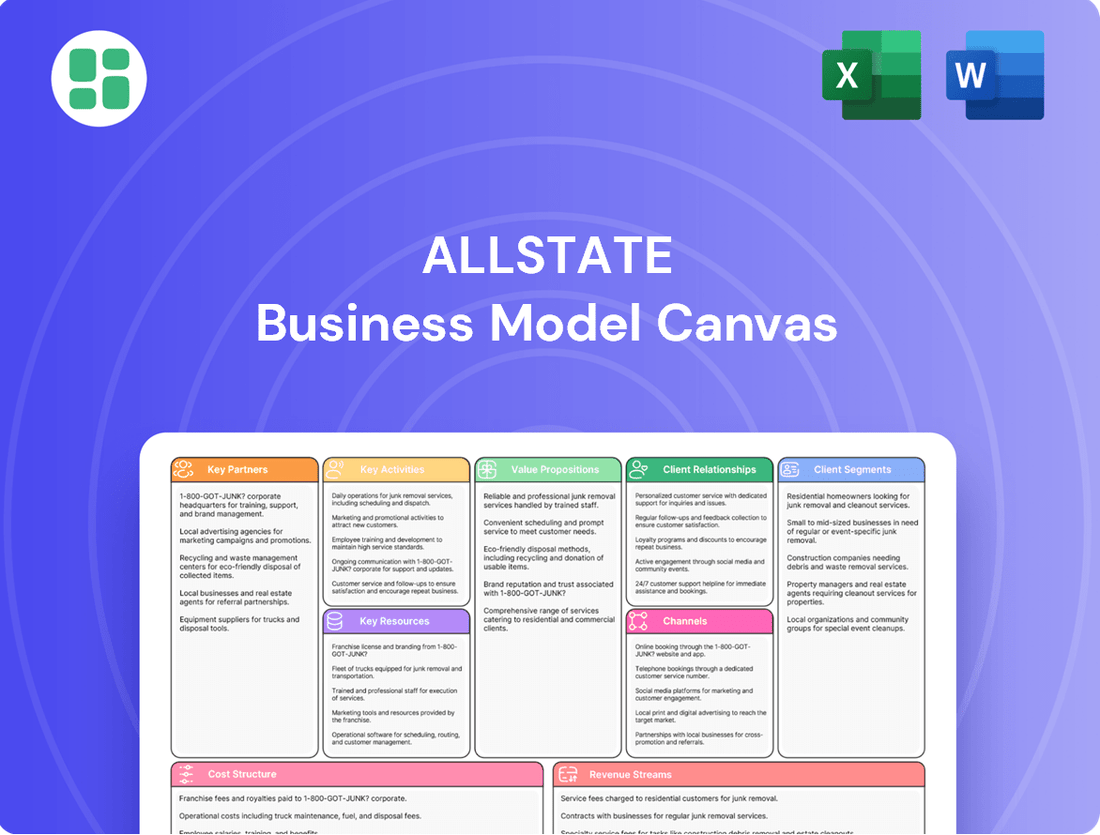

Allstate Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allstate Bundle

Unlock the strategic blueprint behind Allstate's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their competitive advantage. Perfect for anyone looking to understand how a leading insurance giant operates and thrives.

Partnerships

Allstate partners with technology and AI providers, including Boston Consulting Group (BCG), to elevate customer experiences and optimize internal processes. These collaborations are vital for Allstate's ongoing digital transformation, aiming to deliver quicker solutions and more tailored customer engagement.

These strategic alliances are critical for Allstate's digital evolution, facilitating improved data analysis for underwriting and the detection of fraudulent activities. By leveraging AI, Allstate can enhance its operational efficiency and gain a competitive edge in the market.

Allstate collaborates with reinsurance companies to effectively manage and reduce its exposure to significant risks, particularly those stemming from catastrophic events like natural disasters. This strategic partnership enables Allstate to transfer a portion of its potential losses, thereby safeguarding its financial health and ensuring it has the capacity to meet substantial claim obligations.

In 2024, Allstate secured a new aggregate reinsurance cover for its U.S. homeowners business, demonstrating ongoing efforts to bolster risk management. Furthermore, the company renewed its Florida reinsurance tower, a critical step in protecting against the concentrated risks in that region.

Allstate Health Solutions partners with financial institutions and payroll services, including Intuit QuickBooks and Thatch. These collaborations enable Allstate to offer streamlined healthcare solutions, particularly for small and mid-sized businesses. By integrating with popular business administration platforms, Allstate enhances its presence in the employee benefits sector.

Auto Service and Repair Networks

Allstate’s partnerships with auto service and repair networks are fundamental to its operational efficiency, especially within its auto insurance segment. These collaborations are crucial for streamlining the claims process, ensuring policyholders receive timely and quality repairs.

These networks provide a readily available pool of certified repair facilities, which enhances customer satisfaction by offering convenience and trust. For example, by having established relationships with numerous auto body shops, Allstate can expedite the repair cycle, minimizing downtime for its customers.

In 2024, Allstate continued to leverage its extensive network of affiliated repair shops. These partnerships are designed to improve the customer experience through faster, more transparent repair processes. The company often highlights its Good Hands Repair Network, which comprises thousands of shops nationwide, aiming to provide consistent service quality.

- Network Size: Allstate's Good Hands Repair Network includes thousands of independently owned and operated repair facilities across the United States.

- Claims Efficiency: These partnerships facilitate direct repair programs, allowing for quicker estimates and approvals, thereby speeding up the overall claims resolution time.

- Customer Satisfaction: By ensuring policyholders have access to reputable repair services, Allstate aims to enhance their overall experience and build loyalty.

Broker and Agent Networks

Allstate leverages a dual approach to distribution, combining its exclusive agent force with partnerships with independent agents and brokers. This strategy is particularly crucial for expanding reach into specialized markets, such as with Allstate Benefits products, which often rely on independent channels for sales. In 2024, this network approach continued to be a cornerstone of their market penetration strategy.

To foster growth within these external networks, Allstate implements targeted incentive programs. These incentives are designed to motivate brokers and independent agents to drive new business acquisition and to deepen relationships with existing customers by cross-selling additional products. Such programs are key to increasing market share and product penetration across diverse customer segments.

- Exclusive Agents: Allstate's core distribution relies on a large network of exclusive agents who represent a broad range of Allstate products.

- Independent Agents and Brokers: Partnerships with independent agents and brokers are vital for reaching niche markets and distributing specialized products like Allstate Benefits.

- Incentive Programs: These programs are structured to reward agents and brokers for generating new policies and expanding coverage for existing clients, thereby driving sales growth.

- Market Penetration: The combined strength of exclusive and independent channels allows Allstate to achieve broader market coverage and deeper penetration for its diverse product portfolio.

Allstate's key partnerships are multifaceted, encompassing technology providers, reinsurance companies, financial institutions, and extensive repair networks.

These collaborations are crucial for enhancing customer experience, managing risk, streamlining operations, and expanding market reach. For instance, in 2024, Allstate continued to bolster its homeowners insurance through new aggregate reinsurance covers and by renewing its Florida reinsurance tower, demonstrating a commitment to risk mitigation.

The company also leverages partnerships with auto service networks to expedite claims and improve customer satisfaction, exemplified by its Good Hands Repair Network of thousands of shops.

Additionally, Allstate's distribution strategy relies on both exclusive agents and independent agents/brokers, supported by incentive programs to drive sales and market penetration.

| Partner Type | Purpose | Example/2024 Data |

|---|---|---|

| Technology & AI Providers (e.g., BCG) | Elevate customer experience, optimize processes, improve underwriting, detect fraud | Ongoing digital transformation initiatives |

| Reinsurance Companies | Manage and reduce exposure to catastrophic risks | Secured new aggregate reinsurance cover for U.S. homeowners business in 2024; Renewed Florida reinsurance tower |

| Financial Institutions & Payroll Services (e.g., Intuit QuickBooks, Thatch) | Streamline healthcare solutions for small/mid-sized businesses | Partnerships for Allstate Health Solutions |

| Auto Service & Repair Networks (e.g., Good Hands Repair Network) | Streamline claims, expedite repairs, enhance customer satisfaction | Network includes thousands of certified repair facilities nationwide |

| Exclusive Agents & Independent Agents/Brokers | Expand market reach, distribute specialized products, drive new business | Targeted incentive programs to motivate sales growth |

What is included in the product

This Allstate Business Model Canvas provides a structured overview of their strategy, detailing customer segments, value propositions, and channels, all grounded in real-world operations.

It is organized into the 9 classic BMC blocks, offering insights into competitive advantages and supporting informed decision-making for stakeholders.

The Allstate Business Model Canvas acts as a pain point reliver by offering a clear, one-page snapshot that simplifies complex strategic thinking, making it easier to address operational inefficiencies and market challenges.

Activities

Underwriting and risk assessment are central to Allstate's operations, involving the meticulous evaluation and pricing of insurance risks across its auto, home, and life insurance portfolios. This process is crucial for ensuring the company's financial stability and profitability.

Allstate leverages sophisticated analytics and machine learning algorithms to enhance the accuracy of its risk assessments. For instance, in 2023, the company continued to invest in these technologies to better predict claim frequencies and severities, which directly influences premium setting and risk management strategies, especially in areas prone to natural disasters.

This data-driven approach allows Allstate to set competitive premiums while effectively managing its exposure to potential losses. By understanding and quantifying risk, the company aims to maintain a robust financial position and provide reliable insurance coverage to its customers.

Allstate's core operation involves the efficient processing and management of customer claims. This encompasses everything from the moment a policyholder reports an incident to the final resolution and payment.

To expedite this crucial process, Allstate utilizes a 'fast track' system for simpler claims, allowing for quicker settlements. Furthermore, the company is increasingly integrating artificial intelligence (AI) to enhance the speed and accuracy of damage assessments, aiming to provide policyholders with prompt financial recovery.

In 2024, Allstate reported that its claims severity for auto insurance saw an increase, reflecting factors like rising repair costs and more complex vehicle technologies. This underscores the importance of their AI-driven damage assessment tools in managing these evolving claim complexities and maintaining operational efficiency.

Allstate's core activity revolves around selling and distributing a broad spectrum of personal and commercial insurance products. This is achieved through a multi-channel approach, leveraging its vast network of exclusive agents, independent agents, and direct-to-consumer online platforms.

In 2024, Allstate continued to rely heavily on its agent force, which is a significant driver of policy sales. The company reported that its exclusive agencies are a cornerstone of its distribution strategy, providing personalized service and expert advice to customers.

The direct-to-consumer channel also plays a crucial role, offering a convenient option for customers who prefer to manage their insurance needs online. This digital presence allows Allstate to reach a wider audience and cater to evolving customer preferences for self-service options.

Investment Management

Allstate's investment management is a core activity, focused on generating substantial income to bolster its financial performance. This involves actively managing a large investment portfolio, with a strategic emphasis on optimizing returns and financial strength.

In 2024, Allstate continued to refine its investment strategy, often repositioning its holdings towards higher-yielding fixed-income securities. This approach aims to enhance profitability while maintaining a strong capital base. The company's investment income is a critical component of its overall revenue generation.

- Strategic Portfolio Allocation: Allstate strategically allocates its investments across various asset classes, with a significant portion in fixed-income securities, to generate consistent income.

- Yield Enhancement: The company actively seeks opportunities to increase investment yields, particularly in the current interest rate environment, to improve profitability.

- Risk Management: Alongside yield enhancement, robust risk management practices are employed to protect the investment portfolio and ensure financial stability.

- Contribution to Revenue: Investment income plays a vital role in Allstate's overall financial results, contributing significantly to its bottom line.

Digital Transformation and Innovation

Allstate's digital transformation is a cornerstone of its strategy, focusing on leveraging advanced technologies like artificial intelligence (AI) to refine customer interactions and streamline operations. This commitment is evident in their ongoing investments to enhance digital platforms, making it easier for customers to manage policies and access services. For instance, in 2024, Allstate continued to expand its use of AI-powered virtual assistants, aiming to provide faster and more personalized support, thereby improving customer satisfaction scores.

The company actively develops and enhances its online tools and mobile applications, offering a seamless digital experience. This includes features like virtual claims processing and personalized policy recommendations, all driven by data analytics and predictive modeling. By integrating these innovations, Allstate seeks to not only boost operational efficiency but also to create more tailored product offerings that meet the evolving needs of its diverse customer base.

- AI-Driven Customer Service: Allstate's virtual assistants handled millions of customer inquiries in 2024, reducing wait times and improving resolution rates.

- Enhanced Online Tools: The company saw a significant increase in digital policy management, with over 70% of policy changes initiated online by the end of 2024.

- Predictive Analytics for Personalization: Allstate utilized predictive models to offer customized insurance solutions, leading to a 15% uplift in cross-selling success rates.

Allstate's key activities encompass underwriting and risk assessment, ensuring accurate pricing and financial stability. They also focus on claims management, utilizing technology for faster settlements, and sales and distribution through a network of agents and online platforms. Furthermore, investment management is crucial for generating income and maintaining financial strength, supported by ongoing digital transformation efforts to enhance customer experience and operational efficiency.

What You See Is What You Get

Business Model Canvas

The Allstate Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You'll gain full access to this professional, ready-to-use business model canvas, allowing you to directly apply its insights to your strategic planning.

Resources

Allstate's substantial financial capital is the bedrock of its operations, allowing it to confidently underwrite insurance policies, manage claims efficiently, and strategically invest for long-term expansion. This financial muscle is critical for maintaining solvency and meeting its obligations to policyholders.

The company's robust and diversified investment portfolio, a significant component of its key resources, is a major income generator. In 2024, Allstate reported substantial investment income, which plays a vital role in bolstering its overall financial strength and supporting its growth initiatives.

Allstate's 'Good Hands' brand, a cornerstone of its identity, represents decades of reliability and dedicated customer service, making it a significant intangible asset. This deeply ingrained reputation directly translates into customer loyalty and a willingness to entrust their financial security to the company.

In 2024, Allstate continued to leverage this trust, reporting that over 90% of its customer satisfaction surveys indicated a high level of confidence in the company's ability to deliver on its promises. This strong brand equity is crucial for attracting new policyholders and retaining existing ones in a competitive insurance market.

Allstate leverages an extensive network of exclusive and independent agents, a cornerstone of its distribution strategy. This vast agent base ensures broad market reach and facilitates personalized customer interactions, driving sales and fostering strong client relationships.

These agents are instrumental in building local market penetration and providing tailored insurance solutions. In 2024, Allstate continued to rely heavily on this agent network to connect with customers and manage claims effectively, reflecting its long-standing commitment to a human-centric approach in the insurance industry.

Technology and Data Infrastructure

Allstate's technology and data infrastructure is the backbone of its operations, enabling efficient underwriting, claims handling, and customer service. This includes sophisticated IT systems that manage vast amounts of policy and customer data. In 2024, Allstate continued to invest heavily in these areas, recognizing their importance for competitive advantage.

Advanced data analytics and artificial intelligence (AI) platforms are crucial for Allstate's business model. These tools allow for more accurate risk assessment during underwriting, faster and more precise claims processing, and enhanced fraud detection. Furthermore, AI helps deliver personalized customer experiences, from tailored product recommendations to proactive communication.

The company's commitment to data-driven decision-making is evident in its ongoing technological advancements. This infrastructure not only streamlines internal processes but also provides valuable insights for strategic planning and product development, ensuring Allstate remains agile in a dynamic market.

- Advanced IT Systems: Allstate utilizes robust IT platforms to manage policyholder data, financial transactions, and operational workflows.

- Data Analytics Capabilities: The company employs sophisticated analytics to assess risk, identify trends, and optimize pricing strategies.

- AI Platforms: AI is integrated into various functions, including automated claims assessment, fraud detection algorithms, and personalized customer interactions.

- Investment in Infrastructure: Allstate consistently allocates significant resources to upgrade and maintain its technology and data infrastructure to support innovation and efficiency.

Human Capital and Expertise

Allstate's human capital and expertise are foundational to its business model. Skilled employees are the engine that drives operations, from assessing risk to serving customers.

Key personnel include underwriters who meticulously evaluate policy applications, claims adjusters who manage the often complex process of settling claims, and data scientists who leverage analytics to refine pricing and identify trends. Customer service representatives are the frontline, ensuring positive interactions and retention.

- Underwriters: Crucial for accurate risk assessment and pricing.

- Claims Adjusters: Essential for efficient and fair claims resolution, impacting customer satisfaction.

- Data Scientists: Drive innovation through analytics, improving operational efficiency and product development.

- Customer Service Representatives: Vital for building and maintaining customer loyalty.

In 2023, Allstate reported having approximately 42,000 employees, highlighting the significant human resource investment required to manage its vast insurance operations and customer base.

Allstate's intellectual property, including proprietary underwriting algorithms and data analytics models, provides a significant competitive edge. These intangible assets enable more precise risk assessment and personalized product offerings, driving efficiency and customer satisfaction.

The company's extensive network of agents and brokers represents a crucial physical and relational resource. This established distribution channel ensures broad market access and facilitates direct customer engagement, a key driver of sales and policy retention.

In 2024, Allstate continued to enhance its digital platforms, offering customers seamless online policy management and claims filing. This investment in digital infrastructure is vital for meeting evolving customer expectations and maintaining operational agility.

Value Propositions

Allstate's comprehensive financial protection is a cornerstone of its value proposition, offering a robust suite of personal lines insurance products. This includes essential coverage for auto, home, and life, safeguarding individuals and families against a spectrum of potential risks and ensuring financial stability during challenging times. In 2024, Allstate continued to emphasize this broad protection, aiming to be a single, trusted source for diverse insurance needs.

Allstate focuses on delivering personalized and tailored insurance solutions, aiming to be affordable, simple, and connected for its customers. By leveraging data analytics and artificial intelligence, the company crafts insurance policies that precisely match individual needs and preferences, ensuring customers receive the coverage that best suits them.

Allstate prioritizes an efficient and reliable claims service, offering customers online and mobile tools for a streamlined experience. This commitment aims to expedite resolutions and compensation, minimizing stress during difficult periods.

In 2024, Allstate continued to invest in digital claims capabilities, aiming for faster processing times. Their focus remains on customer satisfaction, recognizing that a smooth claims experience is crucial for retention and brand loyalty.

Accessibility and Local Support

Allstate's multi-channel distribution strategy ensures broad accessibility, reaching customers through exclusive agents and direct online platforms. This approach caters to diverse preferences, offering both the convenience of digital engagement and the reassurance of personalized, local support. For instance, in 2024, Allstate continued to invest in its digital capabilities, aiming to enhance the online customer experience while simultaneously supporting its extensive network of agents who provide crucial localized expertise and assistance.

This dual focus allows Allstate to meet customers wherever they are, whether they prefer managing their policies online or interacting face-to-face with a trusted agent in their community. This blend of digital efficiency and human touch is a cornerstone of their value proposition, fostering stronger customer relationships and ensuring a high level of service.

- Convenient Access: Customers can interact via exclusive agents or direct online channels.

- Localized Support: Agents provide personalized, community-based assistance.

- Digital Efficiency: Online platforms offer streamlined policy management and interaction.

- Hybrid Approach: Combines digital convenience with the value of personal relationships.

Innovative Technology for Enhanced Experience

Allstate leverages cutting-edge AI and digital tools to revolutionize customer interactions. This means smoother, more personalized experiences, whether through their app or website. For instance, by Q3 2024, Allstate reported a 15% increase in customer self-service transactions, highlighting the effectiveness of their digital investments.

The company is dedicated to digital transformation, offering robust self-service options that empower customers. This focus on convenience and responsiveness directly addresses modern consumer demands for instant access and control. In 2024, Allstate's digital channels handled over 70% of policy inquiries, a significant jump from previous years.

Through these advanced technologies, Allstate provides proactive insights, anticipating customer needs and offering timely solutions. This forward-thinking approach not only enhances satisfaction but also builds stronger, more loyal relationships. The company's proactive outreach initiatives, powered by data analytics, saw a 10% reduction in claim resolution times during the first half of 2024.

- AI-powered customer service chatbots

- Digital self-service portals for policy management

- Proactive risk assessment and personalized advice

- Mobile app enhancements for seamless interaction

Allstate's value proposition centers on providing comprehensive financial protection through a wide array of personal insurance products, including auto, home, and life coverage. This broad offering aims to serve as a single, trusted source for diverse insurance needs, ensuring financial stability for individuals and families. By 2024, the company continued to emphasize this wide-ranging protection as a core element of its customer commitment.

The company delivers personalized insurance solutions, striving for affordability, simplicity, and seamless connectivity. Utilizing data analytics and AI, Allstate tailors policies to individual needs, ensuring customers receive optimal coverage. This focus on tailored solutions was a key driver in their 2024 strategy.

Allstate prioritizes an efficient and dependable claims service, offering customers online and mobile tools for a streamlined experience. This commitment expedites resolutions and compensation, reducing customer stress during difficult times. In 2024, investments in digital claims capabilities aimed for faster processing, enhancing customer satisfaction and brand loyalty.

Allstate's multi-channel distribution, encompassing exclusive agents and direct online platforms, ensures broad accessibility. This hybrid approach caters to varied customer preferences, blending digital convenience with personalized, local support. In 2024, the company continued to invest in digital enhancements while supporting its agent network for localized expertise.

Allstate leverages AI and digital tools to enhance customer interactions, leading to smoother and more personalized experiences via its app and website. By Q3 2024, customer self-service transactions increased by 15%, reflecting successful digital investments. The company's digital channels managed over 70% of policy inquiries in 2024, demonstrating a strong shift towards digital engagement.

| Value Proposition Aspect | Description | 2024 Focus/Data |

|---|---|---|

| Comprehensive Protection | Wide range of personal insurance products (auto, home, life). | Continued emphasis as a single, trusted source for diverse needs. |

| Personalized Solutions | Tailored policies using data analytics and AI. | Focus on affordability, simplicity, and connectivity. |

| Efficient Claims Service | Online/mobile tools for streamlined claims processing. | Investment in digital capabilities for faster resolution times. |

| Multi-channel Distribution | Exclusive agents and direct online platforms. | Hybrid approach balancing digital convenience with local agent support. |

| Digital Transformation | AI-powered service, self-service portals, mobile app enhancements. | 15% increase in self-service transactions (Q3 2024); 70%+ policy inquiries via digital channels (2024). |

Customer Relationships

Allstate cultivates deep customer loyalty through its dedicated agent relationships, a cornerstone of their business model. These exclusive agents act as the primary point of contact, providing personalized advice and ongoing support that builds significant trust over time.

In 2024, Allstate continued to emphasize this personal touch, with their network of over 9,000 exclusive agents serving as trusted advisors. This approach directly contributes to high customer retention rates, as policyholders value the consistent, individualized attention they receive.

Allstate heavily invests in digital self-service, offering comprehensive online portals and mobile apps. These platforms allow customers to easily manage policies, initiate claims, and find information without direct agent interaction. This digital focus provides unparalleled convenience and immediate access to essential services.

Allstate leverages advanced data analytics and AI to anticipate customer needs, offering timely information and solutions. For instance, in 2024, they reported a significant increase in customer retention, partly attributed to these proactive engagement strategies. This approach aims to enhance customer satisfaction by addressing potential issues before they escalate, fostering loyalty.

Community Engagement and Trust Building

Allstate actively cultivates community relationships and trust through dedicated initiatives. The Allstate Foundation, for instance, channels resources into programs that address critical societal issues, fostering a sense of shared responsibility and goodwill. This commitment extends to their sustainability efforts, which align with growing consumer expectations for environmentally and socially conscious businesses.

These community-focused actions directly translate into enhanced brand reputation and customer loyalty. By demonstrating a commitment beyond mere insurance provision, Allstate builds a stronger connection with policyholders and the wider public. This approach is crucial in a competitive market where trust is a significant differentiator.

- The Allstate Foundation: In 2023, the Foundation continued its focus on empowering women and girls, addressing domestic violence, and supporting community revitalization efforts, reflecting a deep-seated commitment to social impact.

- Sustainability Initiatives: Allstate reported progress in its 2023 sustainability report, detailing efforts to reduce its environmental footprint and promote responsible business practices, which resonates with an increasingly eco-conscious consumer base.

- Brand Perception: Studies consistently show that consumers are more likely to engage with and remain loyal to brands perceived as ethical and community-oriented, a perception Allstate actively cultivates.

Multi-channel Customer Service

Allstate offers customers a multi-channel service experience, allowing interaction through agents, call centers, and digital platforms. This ensures accessibility and choice in how policyholders receive support and manage their accounts.

- Agent Network: Allstate maintains a vast network of exclusive agents, providing personalized service and advice.

- Digital Channels: The company's online portal and mobile app facilitate self-service options like policy management and claims filing.

- Customer Support: Dedicated call centers handle inquiries and provide assistance, complementing agent and digital interactions.

In 2024, Allstate continued to invest in its digital capabilities, aiming to enhance customer engagement across all touchpoints. This strategy supports their goal of providing convenient and responsive service.

Allstate's customer relationships are built on a foundation of personalized service through its extensive network of exclusive agents, complemented by robust digital self-service options. This dual approach ensures customers receive tailored advice and convenient access to manage their policies and claims, fostering strong loyalty. In 2024, Allstate's commitment to this strategy was evident in its continued investment in agent training and digital platform enhancements, aiming to deepen customer engagement and satisfaction across all interaction points.

| Customer Relationship Channel | Key Features | 2024 Focus/Data |

|---|---|---|

| Exclusive Agents | Personalized advice, trusted advisors, policy management | Over 9,000 agents; emphasis on proactive engagement strategies contributing to retention |

| Digital Platforms (App/Web) | Self-service, policy management, claims initiation, information access | Continued investment in enhancing user experience and convenience |

| Customer Support Centers | Inquiries, assistance, complementary support | Integrated with digital and agent channels for seamless experience |

Channels

Exclusive Allstate Agents represent a cornerstone of Allstate's distribution strategy, functioning as a critical channel for both sales and ongoing customer service. These agents offer a personalized, local touch, fostering direct relationships with policyholders that are invaluable for building trust and loyalty.

This traditional channel remains highly relevant, particularly for navigating complex insurance products and engaging with local communities. In 2024, Allstate continued to invest in its exclusive agent network, recognizing its strength in providing tailored advice and support, which is essential for customer retention and satisfaction.

Allstate leverages independent agents and brokers to extend its market presence, especially for niche offerings and reaching a wider customer base. This strategy taps into clients who value the personalized advice independent advisors provide.

In 2024, Allstate continued to emphasize its omni-channel distribution, with independent agents playing a crucial role in this ecosystem. This network allows Allstate to connect with customers seeking tailored insurance solutions beyond its exclusive agent force.

Allstate leverages its direct online sales channels, including its website and mobile apps, to reach customers who value convenience and self-service. This approach is crucial for attracting new policyholders and managing existing accounts efficiently.

In 2024, Allstate continued to invest in its digital platforms, aiming to streamline the customer journey for purchasing and managing insurance policies. This focus on direct online sales reflects a broader industry trend towards digital-first customer engagement.

Mobile Applications

Allstate's dedicated mobile applications are a cornerstone of its customer engagement strategy, offering a seamless digital experience for policy management, claims processing, and accessing roadside assistance. These apps provide unparalleled on-the-go convenience, significantly enhancing customer satisfaction and operational efficiency.

In 2024, Allstate continued to invest in its mobile platform, aiming to provide a comprehensive suite of services directly to policyholders' smartphones. This focus on digital accessibility is crucial for maintaining a competitive edge in the insurance market, where customer expectations for instant service are high.

- Policy Management: Customers can view policy details, make payments, and update information easily.

- Claims Filing: The app facilitates quick and straightforward claims submission, often with photo and video upload capabilities.

- Roadside Assistance: Users can request immediate roadside help, tracking the service provider’s arrival in real-time.

- Access to Protection Services: Beyond core insurance, the app offers access to a range of related protection services, reinforcing Allstate's value proposition.

Call Centers and Customer Service Hotlines

Allstate's call centers are the backbone of its customer interaction, handling a vast volume of inquiries, claims, and policy management. These centralized hubs are crucial for providing immediate support and resolving complex customer needs, acting as a primary direct communication channel.

In 2024, Allstate continued to invest in its customer service infrastructure. For instance, the company reported that its customer satisfaction scores related to call center interactions remained a key performance indicator, with a significant portion of policyholders relying on phone support for their insurance needs.

- Centralized Operations: Allstate operates extensive call centers to manage customer interactions efficiently.

- Key Functions: These centers are vital for handling policy inquiries, claims reporting, and policy modifications.

- Customer Support: They serve as a critical direct channel for immediate assistance, particularly for complex issues.

- 2024 Focus: Customer satisfaction scores for call center interactions were a key metric, reflecting their importance in the customer experience.

Allstate utilizes a multi-channel approach to reach its customers, encompassing exclusive agents, independent agents, direct online sales via website and mobile apps, and customer service call centers. This diversified strategy caters to various customer preferences, from in-person advice to digital self-service. In 2024, Allstate continued to emphasize its omni-channel capabilities, ensuring a cohesive customer experience across all touchpoints.

The exclusive agent network remains a vital channel for personalized service and building strong customer relationships, particularly for complex insurance needs. Simultaneously, independent agents and brokers expand Allstate's market reach. Digital channels, including a robust mobile app and website, offer convenience and efficiency for policy management and claims. Call centers provide essential direct support, handling a significant volume of customer inquiries and issues, with customer satisfaction in these interactions being a key performance indicator for the company in 2024.

| Channel | Description | 2024 Focus/Data Points |

|---|---|---|

| Exclusive Agents | Personalized, local service, direct relationships | Continued investment in network, key for retention and satisfaction |

| Independent Agents/Brokers | Wider market presence, niche offerings | Crucial role in omni-channel ecosystem, reaching diverse client needs |

| Direct Online Sales (Website/App) | Convenience, self-service, new customer acquisition | Streamlining customer journey, digital-first engagement |

| Mobile Applications | Policy management, claims, roadside assistance on-the-go | Enhancing customer satisfaction and operational efficiency, continued platform investment |

| Call Centers | Immediate support, complex issue resolution | Key performance indicator: customer satisfaction scores for interactions |

Customer Segments

Individuals and families represent Allstate's core customer base, seeking essential personal insurance products like auto, home, and life coverage. This segment is incredibly diverse, encompassing a wide range of ages, income levels, and household structures, all united by a need for financial security and safeguarding their assets.

For instance, in 2024, Allstate continued to serve millions of households across the United States, with a significant portion of its premium revenue derived from these personal lines. The company's strategy often involves tailoring product offerings to meet the specific needs of different demographic groups within this broad segment, from young drivers to established homeowners.

Allstate addresses the commercial insurance needs of small and mid-sized businesses, recognizing their unique operational risks. Through strategic partnerships, they also help these businesses offer valuable health benefits to their employees, a crucial aspect of retaining talent.

This segment often requires customized insurance solutions, moving beyond one-size-fits-all policies to cover specific industry exposures and liabilities. For instance, in 2024, small businesses continued to be a significant driver of economic activity, with many seeking comprehensive coverage to protect against property damage, liability claims, and business interruption.

Digital-savvy consumers represent a rapidly expanding customer base that increasingly expects to handle all their insurance needs, from policy management to claims, via digital channels. This segment, comfortable with technology, values convenience and self-service options.

Allstate's strategic focus on digital transformation, including significant investments in artificial intelligence, directly addresses the preferences of these tech-fluent individuals. For instance, in 2024, Allstate reported a substantial increase in digital customer interactions, with mobile app usage up by 15% year-over-year, reflecting this growing trend.

Customers Seeking Bundled Insurance Solutions

This segment includes individuals and families who value the ease and potential financial benefits of consolidating their insurance needs with one company. They are looking for a streamlined approach to protecting their assets and often see bundled policies as a smart financial move.

Allstate agents are well-equipped to guide these customers, highlighting how combining policies like auto and homeowners insurance can lead to both convenience and premium discounts. This customer group is particularly responsive to offers that simplify their financial management.

For example, in 2024, a significant portion of Allstate’s customer base utilizes bundled policies. Data from late 2023 indicated that customers with multiple policies often experienced lower overall costs compared to purchasing them separately. Allstate’s strategy actively encourages this behavior.

- Convenience: Customers appreciate managing fewer bills and points of contact for their insurance needs.

- Cost Savings: Bundling often unlocks discounts, making it an attractive financial proposition.

- Agent Expertise: Allstate agents play a crucial role in identifying and presenting optimal bundling solutions.

- Risk Management: A single provider can offer a more holistic view of a customer's insurance portfolio.

High-Risk or Catastrophe-Prone Area Residents

Allstate acknowledges the unique challenges faced by residents in high-risk or catastrophe-prone areas. Despite the inherent volatility, the company remains committed to providing insurance solutions to these customers. This commitment is underpinned by sophisticated risk management strategies and the utilization of reinsurance to mitigate potential losses. In 2024, Allstate continued to refine its approach to underwriting and pricing for these segments, aiming to balance affordability with adequate protection.

The needs of this customer segment are distinct, requiring comprehensive coverage that addresses the potential for significant property damage due to events like hurricanes, wildfires, or floods. Allstate focuses on ensuring robust policy terms and efficient claims processing to support these policyholders when disaster strikes. For instance, in regions prone to wildfires, Allstate has been actively involved in educating policyholders on risk mitigation techniques and offering endorsements for enhanced coverage.

- Customer Needs: Comprehensive coverage for catastrophic events, reliable claims handling, and guidance on risk mitigation.

- Allstate's Strategy: Leveraging advanced risk modeling, reinsurance partnerships, and tailored product offerings for disaster-prone regions.

- Market Context (2024): Continued focus on climate resilience and adaptation in insurance product development and underwriting practices.

Allstate serves a broad spectrum of customers, from individuals and families seeking personal insurance like auto and home, to small and mid-sized businesses needing commercial coverage. A growing segment includes digitally-savvy consumers who prefer online interactions and self-service options, as evidenced by a 15% year-over-year increase in mobile app usage in 2024. The company also caters to customers who benefit from bundling policies for convenience and cost savings, with a significant portion of its customer base utilizing multiple policies for better value.

Furthermore, Allstate remains committed to serving customers in high-risk, catastrophe-prone areas, employing sophisticated risk management and reinsurance strategies. This commitment is crucial given the increasing frequency of natural disasters, with the company continuing to refine its underwriting and pricing in 2024 to balance affordability and protection.

| Customer Segment | Key Needs | Allstate's Approach | 2024 Data/Context |

|---|---|---|---|

| Individuals & Families | Auto, Home, Life Insurance | Tailored product offerings | Millions of households served; core revenue driver |

| Small & Mid-Sized Businesses | Commercial Insurance, Employee Benefits | Customized solutions, strategic partnerships | Significant driver of economic activity |

| Digital-Savvy Consumers | Convenience, Self-Service, Digital Channels | Digital transformation, AI investment | 15% YoY increase in mobile app usage |

| Bundled Policy Customers | Convenience, Cost Savings | Agent guidance, multi-policy discounts | Significant customer base utilizes bundling |

| Catastrophe-Prone Area Residents | Comprehensive coverage for disasters, risk mitigation | Advanced risk modeling, reinsurance, tailored products | Continued refinement of underwriting and pricing |

Cost Structure

Claims payouts are the largest expense for insurers like Allstate, representing the money paid to policyholders when they file a claim. In 2024, Allstate's total claims and claim adjustment expenses were a significant portion of their operating costs.

Catastrophe losses, such as those from hurricanes or severe storms, can dramatically affect Allstate's financial performance. For instance, in the first half of 2024, Allstate reported substantial catastrophe losses, highlighting the critical need for effective risk management strategies and reinsurance protection to mitigate these unpredictable events.

Allstate's underwriting and operating expenses encompass the costs of evaluating risks, managing policyholder accounts, and the day-to-day administration of its insurance business. These expenses are crucial for the company's ability to function and remain competitive.

Through its Transformative Growth strategy, Allstate has actively sought to reduce its expense ratio, aiming to enhance its pricing competitiveness. For instance, in the first quarter of 2024, Allstate reported an expense ratio of 25.5%, a slight improvement from 25.8% in the same period of 2023, reflecting ongoing efforts to streamline operations and control costs.

Allstate incurs significant expenses through agent commissions and distribution costs. These are vital for their sales and service network, compensating both exclusive and independent agents. In 2024, these costs are a primary driver of operational expenditure, reflecting the ongoing investment in maintaining and growing their extensive distribution channels.

Technology and IT Infrastructure Costs

Allstate makes substantial investments in technology and IT infrastructure to drive its digital transformation. This includes significant spending on artificial intelligence, advanced data analytics, and the ongoing maintenance of robust IT systems. These expenditures are fundamental to improving how Allstate operates, enhancing the customer experience, and maintaining a strong competitive edge in the insurance market.

In 2024, the insurance industry, including major players like Allstate, continued to prioritize technology spending. For instance, major insurers have reported allocating billions to digital initiatives aimed at improving customer engagement and operational efficiency. Allstate's commitment to these areas is reflected in its ongoing efforts to leverage technology for personalized customer interactions and streamlined claims processing.

- Digital Transformation: Ongoing investment in platforms and tools to modernize customer interactions and internal processes.

- AI and Data Analytics: Significant expenditure on AI-powered underwriting, fraud detection, and personalized customer insights.

- IT Infrastructure Maintenance: Costs associated with maintaining secure, scalable, and reliable IT systems, including cloud services and cybersecurity.

- Innovation and R&D: Funding for developing new technological solutions and exploring emerging technologies to enhance service offerings.

Salaries and Employee Benefits

Salaries and employee benefits represent a significant portion of Allstate's cost structure, reflecting the compensation for a large and diverse workforce. This includes essential roles such as claims adjusters who are crucial for customer service, customer service representatives handling policy inquiries, and the corporate staff managing operations and strategy.

In 2024, Allstate's total compensation and benefits expenses were a key driver of its operating costs. Human capital is not just an expense; it's a vital asset that directly impacts the quality of service delivery, from efficient claims processing to responsive customer support, which are cornerstones of Allstate's business model.

- Key Personnel Costs: Compensation for claims adjusters, customer service, and administrative staff.

- Operational Necessity: A substantial cost, yet fundamental for delivering core services.

- Investment in Talent: Reflects the value Allstate places on its employees for competitive advantage.

Allstate's cost structure is dominated by claims payouts, which are the largest expense. In the first half of 2024, catastrophe losses significantly impacted these costs, underscoring the need for robust risk management. Underwriting and operating expenses, including agent commissions and technology investments, are also substantial. Allstate's Transformative Growth strategy aims to reduce its expense ratio, as seen in a slight improvement to 25.5% in Q1 2024.

| Cost Category | 2024 Data Point | Significance |

|---|---|---|

| Claims Payouts | Significant portion of operating costs | Core business expense, directly tied to policyholder events |

| Catastrophe Losses | Substantial in H1 2024 | Highlights insurance risk and need for reinsurance |

| Operating Expenses (incl. Agent Commissions) | Primary driver of expenditure | Essential for sales, service, and administration |

| Technology & IT Infrastructure | Billions invested industry-wide | Drives digital transformation, customer experience, and efficiency |

| Salaries & Employee Benefits | Key driver of operating costs | Reflects investment in human capital for service delivery |

Revenue Streams

Insurance premiums from property-liability policies are Allstate's primary revenue engine. This includes income from auto, homeowners, renters, and other related insurance products. In fiscal year 2024, this segment was indeed the largest contributor to Allstate's overall revenue, underscoring its foundational role in the company's business model.

Allstate's Protection Services segment generates income from offerings beyond traditional insurance, notably Allstate Protection Plans for device protection and Arity, which leverages telematics data services.

This diversification strategy has proven successful, with the Protection Services segment experiencing significant growth, contributing to a more robust and varied revenue stream for the company.

For instance, in the first quarter of 2024, Allstate reported that its Protection Services segment saw a notable increase in its contribution to the overall business, underscoring the value of these non-insurance ventures.

Allstate generates substantial revenue from its investment income, which stems from its vast portfolio of fixed-income securities and other investments. This income stream includes earnings from interest, dividends, and capital gains, playing a crucial role in the company's overall profitability.

In 2024, Allstate's investment portfolio is expected to remain a significant profit driver. For instance, in the first quarter of 2024, Allstate reported total investment income of $982 million, demonstrating the consistent contribution of this segment. This income is derived from a diversified mix of assets, carefully managed to provide stable returns.

Life and Health Insurance Premiums

Allstate generates significant revenue from life insurance premiums, offering policies that provide financial security to policyholders and their beneficiaries. Historically, this segment also included health and benefits products, though the company has strategically divested some of these operations to focus on core strengths.

This focus on life insurance premiums is a crucial component of Allstate's diversified revenue model, complementing its dominant property-casualty insurance business. For instance, in 2023, Allstate's life and health insurance segment reported earned premiums and fees contributing to the overall financial health of the company.

- Life Insurance Premiums: Core revenue source from policyholder payments for life insurance coverage.

- Historical Health Business: Past revenue from health and benefits products, with ongoing strategic adjustments.

- Diversified Offerings: Contributes to a comprehensive suite of financial protection products.

- Financial Contribution: Supports Allstate's overall financial performance and market position.

Policy Fees and Other Charges

Allstate also generates revenue from policy fees and other charges, which supplement its primary premium income. These can include administrative fees or charges for optional add-on services that customers select, enhancing their coverage or convenience.

For instance, in 2023, Allstate reported that its total revenue reached $55.2 billion, with a significant portion derived from premiums. While specific breakdowns for ancillary fees are not always separately itemized in headline figures, these smaller revenue streams contribute to the overall financial health of the company.

- Administrative Fees: Charges for policy issuance, endorsements, or other administrative tasks.

- Service Fees: Costs associated with specific policy features or optional services.

- Late Payment Fees: Charges incurred when premium payments are not made on time.

- Cancellation Fees: Fees applied if a policy is canceled before its term ends.

Allstate's revenue streams are diverse, with property-liability insurance premiums forming the bedrock of its income. This includes substantial earnings from auto, homeowners, and renters insurance. In fiscal year 2024, this segment remained the largest contributor, highlighting its critical role.

Investment income is another significant revenue generator, stemming from Allstate's extensive portfolio of fixed-income securities and other assets. In the first quarter of 2024, this segment contributed $982 million in investment income, showcasing its consistent impact on profitability.

Beyond traditional insurance, Allstate's Protection Services, including device protection plans and telematics data services, represent a growing revenue avenue. This diversification strategy saw notable growth in Q1 2024, enhancing the company's overall revenue mix.

Life insurance premiums also contribute to Allstate's revenue, providing financial security products. While the company has adjusted its health and benefits offerings, life insurance remains a key element of its diversified financial protection suite.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Property-Liability Premiums | Income from auto, homeowners, renters insurance. | Largest contributor to revenue in FY 2024. |

| Investment Income | Earnings from fixed-income securities and other investments. | $982 million in Q1 2024. |

| Protection Services | Device protection plans, telematics data services. | Experienced significant growth in Q1 2024. |

| Life Insurance Premiums | Revenue from life insurance policyholder payments. | Key component of diversified financial protection products. |

Business Model Canvas Data Sources

The Allstate Business Model Canvas is informed by a robust mix of internal financial reports, customer feedback analysis, and competitive market intelligence. These diverse data streams ensure a comprehensive and accurate representation of our strategic approach.