Algonquin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algonquin Bundle

Algonquin's unique brand recognition and loyal customer base present significant strengths, while their reliance on specific geographic markets could be a vulnerability. Understanding these dynamics is crucial for any investor or strategist. Want the full story behind Algonquin's market position and future growth drivers?

Strengths

Algonquin Power & Utilities Corp. draws significant stability from its rate-regulated utility operations, encompassing natural gas, water, and electricity services across North America. This core business generates a predictable revenue flow, bolstered by long-term rate approvals and successful rate cases. For instance, recent rate increases in New Hampshire and favorable outcomes in Q1 2025 rate cases underscore the consistent earnings potential from these essential services.

Algonquin Power & Utilities Corp. has strategically repositioned itself as a pure-play regulated utility by divesting its non-hydro renewable energy assets and its interest in Atlantica Sustainable Infrastructure. This move, completed in late 2023 and early 2024, simplifies the company's operational structure and significantly reduces its debt burden. For instance, the sale of its renewable energy business was a key component in deleveraging efforts, aiming to improve financial flexibility.

This strategic shift is designed to bolster the predictability and quality of Algonquin's earnings. By focusing solely on its regulated utility operations, the company anticipates a more stable revenue stream, which is attractive to investors seeking lower-risk, income-generating assets. This focus is expected to enhance its credit profile and potentially lower its cost of capital going forward.

Algonquin's financial health has markedly improved, evidenced by its Q1 2025 performance. Net earnings and adjusted net earnings from continuing operations saw substantial gains, largely due to the implementation of new rates and a reduction in interest expenses following strategic debt repayment.

Looking ahead, the company anticipates an enhanced Earned Return on Equity (ROE), projecting it to reach 8.5% by 2027. This positive outlook is further supported by the expectation of no equity issuance through 2027, which helps maintain its BBB investment grade credit rating.

Geographic and Service Diversification

Despite divesting some renewable assets, Algonquin Power & Utilities Corp. (APUC) effectively leverages its geographic and service diversification. The company provides essential electricity, natural gas, and water services across North America, with operations extending to the U.S., Canada, Bermuda, and even Chile. This wide reach across different utility types and international markets significantly reduces the risk tied to any single service or geographic area, offering a more stable revenue base.

This diversified approach is a key strength for APUC. For instance, as of the first quarter of 2024, APUC reported that its regulated utilities segment, which benefits from this diversification, continued to be a stable contributor to its overall financial performance. The company's commitment to maintaining a broad portfolio of regulated services across multiple jurisdictions in 2024 and 2025 underscores its strategy to build resilience against localized economic downturns or regulatory changes.

- Broad Service Portfolio: APUC offers electricity, natural gas, and water, reducing reliance on a single utility sector.

- Geographic Spread: Operations in the U.S., Canada, Bermuda, and Chile mitigate regional economic and regulatory risks.

- Regulated Utility Stability: The regulated segment, a core part of its diversified strategy, provides consistent revenue streams.

- Risk Mitigation: Diversification across services and locations enhances overall business stability and reduces vulnerability.

Commitment to Operational Excellence and Customer Experience

Algonquin's commitment to operational excellence is evident in its 'Back to Basics' plan, specifically targeting enhanced customer satisfaction and improved efficiencies. This strategic focus aims to streamline operations and leverage new technology to boost service reliability and affordability.

Key initiatives include cost reduction efforts, with a target to lower operating expenses as a percentage of revenue by 5-7% by the end of 2027. This financial discipline is designed to bolster profitability and improve the customer value proposition.

- Focus on Customer Satisfaction: The 'Back to Basics' plan prioritizes improving the customer experience.

- Operational Efficiency Drive: Streamlining operations and deploying new technology are central to this strategy.

- Cost Reduction Target: Aiming to reduce operating expenses by 5-7% of revenue by 2027 demonstrates a commitment to financial health.

- Service Reliability and Affordability: Technological investments are geared towards making services more dependable and cost-effective.

Algonquin's strengths are rooted in its stable, rate-regulated utility operations which provide a predictable revenue stream. The company's strategic divestment of non-core renewable assets in late 2023 and early 2024 has significantly reduced its debt, enhancing financial flexibility and focusing operations on its core utility business. This repositioning is expected to improve earnings quality and predictability, making it an attractive prospect for investors seeking stable income. Algonquin's commitment to operational excellence through its 'Back to Basics' plan, targeting cost reductions and improved customer satisfaction, further solidifies its operational strengths.

| Strength Category | Specific Strength | Impact/Benefit | Supporting Data/Example |

|---|---|---|---|

| Operational Stability | Rate-regulated Utility Operations | Predictable revenue, consistent earnings | Recent rate increases in New Hampshire; favorable Q1 2025 rate cases |

| Financial Strategy | Divestment of Non-Core Assets | Reduced debt, simplified structure, improved financial flexibility | Sale of renewable energy business completed late 2023/early 2024 |

| Strategic Focus | Pure-play Regulated Utility | Enhanced earnings predictability, improved credit profile | Anticipated 8.5% ROE by 2027; no equity issuance through 2027 |

| Operational Improvement | 'Back to Basics' Plan | Cost reduction, enhanced customer satisfaction, improved efficiency | Target of 5-7% reduction in operating expenses as a percentage of revenue by 2027 |

What is included in the product

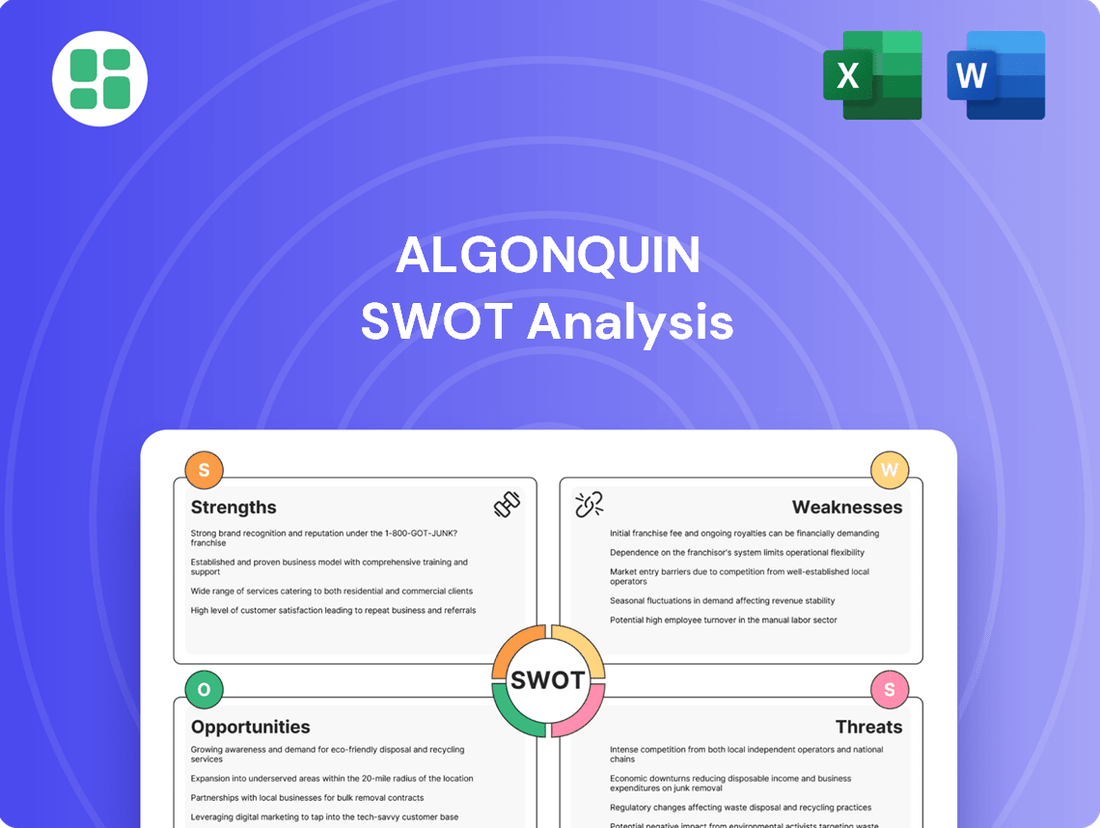

Analyzes Algonquin’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Algonquin's SWOT analysis simplifies complex strategic planning, offering a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Algonquin has a history of financial underperformance and volatility. For instance, the company reported a significant decrease in adjusted net earnings per common share in 2024, a clear indicator of past struggles. This trend has been accompanied by declining revenues and negative cash flow in prior periods.

The company's stock performance has also reflected these challenges, with analysts pointing to increased uncertainty. This uncertainty is often linked to the difficulties Algonquin has experienced in effectively managing its costs during periods of strategic transition.

Algonquin continues to manage a substantial debt load, reported at $6.32 billion in March 2025, despite proceeds from asset sales. This significant leverage can limit its ability to pursue new growth opportunities or weather economic downturns.

While debt reduction is a key focus, ongoing capital expenditure requirements for utility infrastructure upgrades and maintenance, estimated to be in the billions annually, can still strain financial flexibility. These necessary investments compete with debt servicing and shareholder returns, creating a delicate balancing act.

Algonquin's profitability is significantly tied to regulatory approvals and the success of its rate cases. While some recent rate cases have seen positive outcomes, ongoing delays and the possibility of lower-than-expected returns on its rate base can directly hurt earnings and strain the company's financial health.

Operational Inefficiencies and Customer Service Issues

Algonquin Power & Utilities Corp. has been transparent about ongoing challenges with operational inefficiencies, particularly concerning customer service and billing systems across several states. These issues have led to customer complaints and, in some instances, required significant investment to rectify. For example, in late 2023 and early 2024, the company highlighted efforts to improve its customer information system, acknowledging that legacy technology contributed to these service disruptions.

These operational shortcomings pose a direct threat to Algonquin's reputation and financial performance. Customer dissatisfaction can erode brand loyalty and make it more difficult to gain regulatory approval for necessary rate increases. Furthermore, the cost of addressing these inefficiencies, including potential fines or remediation efforts, can divert capital from growth initiatives. The company's 2024 guidance has factored in some of these ongoing improvement costs.

- Customer Service Deficiencies: Algonquin is actively addressing reported issues impacting customer satisfaction in key operating regions.

- Billing System Vulnerabilities: Inefficiencies in billing processes have been identified as a significant area for improvement.

- Regulatory Scrutiny Risk: Operational failures can attract regulatory attention, potentially leading to penalties and impacting rate adjustment approvals.

- Reputational Impact: Persistent service issues can damage Algonquin's public image and investor confidence.

Impact of Renewable Energy Business Divestiture

While the divestiture of its non-hydro renewable energy assets, such as solar and wind, in late 2023 and early 2024 for approximately $2.4 billion helps Algonquin Power & Utilities Corp. manage its debt and streamline operations, it simultaneously removes the company from a sector experiencing significant expansion.

This strategic move, aimed at improving its financial footing, could cap Algonquin's growth trajectory. By exiting the high-potential renewable energy market, the company risks becoming a more conventional, potentially lower-return regulated utility compared to peers aggressively pursuing green energy development.

The sale of these assets means Algonquin is foregoing participation in a market that saw substantial investment and policy support throughout 2024, with global renewable energy capacity additions projected to increase significantly. For instance, the International Energy Agency (IEA) reported a record 510 GW of renewable capacity added globally in 2023, a trend expected to continue into 2024 and 2025, driven by climate goals and energy security concerns.

- Divestment from High-Growth Sector: Algonquin sold its non-hydro renewable assets, a key driver of future energy market growth.

- Debt Reduction Strategy: The sales, totaling around $2.4 billion, are intended to strengthen the company's balance sheet.

- Potential for Average Returns: Exiting renewables may limit Algonquin to the more stable, but potentially less dynamic, returns of a regulated utility.

- Foregone Upside: The company misses out on the substantial growth and investment anticipated in the global green energy market through 2025.

Algonquin's financial performance has been hampered by a history of underperformance and volatility, evidenced by a significant drop in adjusted net earnings per common share in 2024 and declining revenues in prior periods. This instability is compounded by difficulties in cost management during strategic shifts, leading to increased investor uncertainty.

The company's substantial debt of $6.32 billion as of March 2025, even after asset sales, constrains its ability to invest in new growth or withstand economic downturns. Furthermore, ongoing capital expenditure needs for essential infrastructure maintenance compete with debt servicing obligations, creating financial strain.

Algonquin's profitability is heavily reliant on regulatory approvals and favorable outcomes in rate cases. Delays or less favorable decisions in these cases can directly impact earnings and the company's financial stability.

Operational inefficiencies, particularly in customer service and billing systems, have led to customer complaints and necessitated significant investment for remediation. These issues, acknowledged by the company in late 2023 and early 2024, can damage reputation, hinder regulatory approvals, and divert capital from growth opportunities.

The divestiture of non-hydro renewable assets for approximately $2.4 billion in late 2023 and early 2024, while aimed at debt reduction, removes Algonquin from a rapidly expanding sector. This strategic move may limit future growth potential and position the company as a more conventional utility with potentially lower returns compared to peers investing heavily in green energy, a market that saw record global capacity additions in 2023 and is projected for continued strong growth through 2025.

Same Document Delivered

Algonquin SWOT Analysis

This is the actual Algonquin SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the Algonquin's strategic position.

This is a real excerpt from the complete Algonquin SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

Algonquin's strategic shift toward its regulated utility segment unlocks substantial opportunities for organic capital investment. The company anticipates deploying roughly $2.5 billion in utility capital expenditures between 2025 and 2027. These planned investments are designed to upgrade aging infrastructure, bolster service dependability, and foster consistent rate base expansion.

Algonquin Power & Utilities Corp. is benefiting from a more supportive regulatory climate, which is crucial for its utility operations. The company secured approximately $21.2 million in authorized rate increases toward the end of 2024. This success in rate cases directly translates to improved revenue streams and greater financial stability.

The appointment of a new Chief Regulatory and External Affairs Officer is a strategic move to foster better relationships with regulatory bodies. This focus aims to enhance the company's ability to achieve its target earned returns on equity, a key metric for investor confidence and future investment.

Algonquin can capitalize on the significant need for transmission infrastructure upgrades. A prime example is their involvement in a substantial project with the Southwest Power Pool, carrying an estimated cost of $750-$800 million, highlighting the scale of investment opportunities in modernizing the grid.

Furthermore, broader government initiatives, such as the financial aid allocated for water infrastructure under the Bipartisan Infrastructure Law, create additional avenues for Algonquin to pursue growth and secure new investments in essential utility modernization.

Technological Advancements and Operational Efficiencies

Algonquin's strategic push into new customer solution technology platforms presents a significant opportunity. By integrating these advanced systems, the company can unlock greater operational efficiencies, directly contributing to a leaner cost structure. This technological adoption is a key driver for improving overall service delivery and customer satisfaction.

A core objective is to reduce operating expenses as a percentage of revenue, with a target of 5-7% by 2027. This ambitious goal is achievable through the focused implementation of these new technologies and a commitment to operational excellence across all business units. Such a reduction would bolster profitability and competitive positioning.

- Streamlined Processes: New technology platforms are expected to automate and simplify existing workflows, reducing manual intervention and potential errors.

- Reduced Operating Expenses: Initiatives aimed at lowering the operating expense ratio by 5-7% by 2027 are directly supported by these technological advancements.

- Enhanced Service Delivery: Improved operational efficiencies translate into faster, more reliable service for customers, a critical factor in today's market.

- Cost Optimization: The focus on operational excellence provides a framework for continuous improvement and cost management, ensuring long-term financial health.

Potential for Strategic Acquisitions in Core Utility Assets

Algonquin Power & Utilities Corp., as a pure-play regulated utility, is well-positioned to pursue strategic acquisitions within the electricity, natural gas, and water sectors. This focus on core utility assets allows for expansion of its customer base and rate base, directly contributing to its regulated earnings. The company's recapitalized balance sheet provides the financial flexibility needed to execute these accretive growth opportunities.

These potential acquisitions could significantly bolster Algonquin's market presence. For instance, in 2024, the regulated utility sector saw continued investment, with utilities across North America reporting substantial capital expenditure plans to modernize infrastructure and meet growing demand. Algonquin's ability to integrate and operate these assets efficiently, leveraging its existing expertise, presents a clear path to enhanced shareholder value.

- Acquisition Focus: Targeting accretive opportunities in electricity, natural gas, and water utilities.

- Growth Driver: Expanding customer base and regulated rate base through strategic M&A.

- Financial Strength: Utilizing a recapitalized balance sheet to fund strategic growth initiatives.

- Sector Trends: Aligning with the broader industry trend of infrastructure investment and modernization in 2024 and beyond.

Algonquin's strategic focus on its regulated utility segment is a significant opportunity, with plans to invest approximately $2.5 billion in utility capital expenditures between 2025 and 2027. The company is also benefiting from a more favorable regulatory environment, evidenced by approximately $21.2 million in authorized rate increases secured in late 2024. Furthermore, Algonquin is positioned to capitalize on the substantial need for transmission infrastructure upgrades, such as its involvement in a project estimated at $750-$800 million with the Southwest Power Pool.

The company's push into new customer solution technology platforms offers a chance to enhance operational efficiencies and reduce operating expenses, targeting a 5-7% reduction as a percentage of revenue by 2027. Additionally, Algonquin, as a pure-play regulated utility, is well-positioned for strategic acquisitions in the electricity, natural gas, and water sectors, supported by a recapitalized balance sheet to fund accretive growth.

Threats

Algonquin's operations are susceptible to shifts in regulatory landscapes. For instance, unfavorable rate case decisions, as seen in past proceedings impacting utility companies, could directly reduce revenue streams. The company's financial health in 2024 and 2025 hinges on navigating these evolving policy environments.

Political winds also present a threat. A government less supportive of renewable energy development, even after Algonquin's strategic divestitures, could dampen investor confidence and limit future growth opportunities. This sentiment can influence capital availability and the overall market perception of the company's long-term viability.

Rising interest rates present a significant challenge for Algonquin, as they directly increase the cost of borrowing for both existing debt and any new capital investments. This can make future projects less financially attractive.

While Algonquin has strategies to minimize its reliance on external funding, its existing debt load means it remains susceptible to the impact of interest rate swings. Higher borrowing costs can erode profitability and strain cash flow.

For instance, if interest rates were to climb by 1% in 2024, it could add tens of millions to Algonquin's annual interest expenses, depending on the proportion of variable-rate debt and upcoming refinancing needs.

Algonquin faces significant competition, not just from traditional utilities but also from independent power producers and renewable energy developers. This rivalry intensifies the pressure to maintain operational efficiency and secure favorable project terms. For instance, in 2024, the renewable energy sector saw record investment, with solar and wind projects increasingly competing for grid interconnection and incentives, directly impacting Algonquin's growth opportunities.

Economic Downturns and Customer Demand Sensitivity

Economic downturns present a significant threat to Algonquin. A recession or even a slowdown could dampen customer demand for essential utility services, impacting revenue streams. While utilities are typically considered inelastic, prolonged economic hardship can still strain financial performance.

For instance, a widespread economic contraction in 2024 or 2025 could lead to increased customer delinquencies and payment deferrals. This could manifest as:

- Reduced discretionary spending by customers, potentially leading to slower adoption of new energy-efficient programs or upgrades.

- Increased write-offs for uncollectible accounts, directly impacting profitability.

- A potential need for more aggressive cost-cutting measures to maintain financial stability amidst falling revenues.

Environmental Regulations and Climate-Related Risks

Algonquin's operations face growing threats from stricter environmental regulations, which can lead to increased compliance costs and potential penalties. For instance, the push for decarbonization in the utility sector, evidenced by various government mandates and incentives for renewable energy adoption, could necessitate significant capital investments in cleaner technologies for Algonquin.

Furthermore, the physical impacts of climate change, such as more frequent and intense extreme weather events, pose a direct risk to Algonquin's infrastructure and service reliability. In 2023, the utility sector experienced disruptions due to severe storms and heatwaves, leading to increased repair costs and potential revenue losses. These events can strain operational budgets and impact customer satisfaction.

- Increased Capital Expenditures: Anticipated investments in grid modernization and emission reduction technologies to meet evolving environmental standards.

- Operational Disruptions: Potential for service interruptions and increased maintenance costs due to climate-related events like severe storms or wildfires.

- Regulatory Compliance Costs: Expenses associated with adhering to new or updated environmental laws and emissions targets.

Algonquin's financial performance is vulnerable to increasing interest rates, which inflate borrowing costs for existing debt and new projects, potentially impacting profitability and cash flow. For example, a 1% rate hike in 2024 could add tens of millions to annual interest expenses. Intense competition from independent power producers and renewable energy developers also pressures operational efficiency and project terms, especially as the renewable sector saw record investment in 2024, intensifying competition for grid access and incentives. Economic downturns pose a risk through reduced customer demand and increased payment delinquencies, potentially leading to higher uncollectible account write-offs and necessitating cost-cutting measures. Stricter environmental regulations and the physical impacts of climate change, such as extreme weather events, also threaten operations, requiring significant capital investment in cleaner technologies and potentially causing infrastructure damage and service disruptions.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data/Context |

|---|---|---|---|

| Interest Rate Risk | Increased borrowing costs | Reduced profitability, strained cash flow | Federal Reserve maintained interest rates through early 2024, with expectations of potential cuts later in the year, but the cost of capital remains elevated compared to prior years. |

| Competitive Landscape | Pressure on project terms and growth | Slower market penetration, reduced margins | Renewable energy sector attracted over $300 billion in investment globally in 2023, with continued strong investment projected for 2024, increasing competition for Algonquin. |

| Economic Conditions | Reduced customer demand, payment defaults | Lower revenue, increased bad debt | Inflation remained a concern in early 2024, impacting consumer spending power, though recessionary fears eased slightly. |

| Environmental & Regulatory | Higher compliance costs, infrastructure damage | Increased capital expenditures, operational disruptions | Governments globally continued to set ambitious decarbonization targets, leading to evolving regulations and potential for increased compliance burdens on utilities. Extreme weather events in 2023 caused billions in damage to infrastructure across various sectors. |

SWOT Analysis Data Sources

This Algonquin SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market research reports, and expert industry commentary to ensure a thorough and actionable assessment.