Algonquin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algonquin Bundle

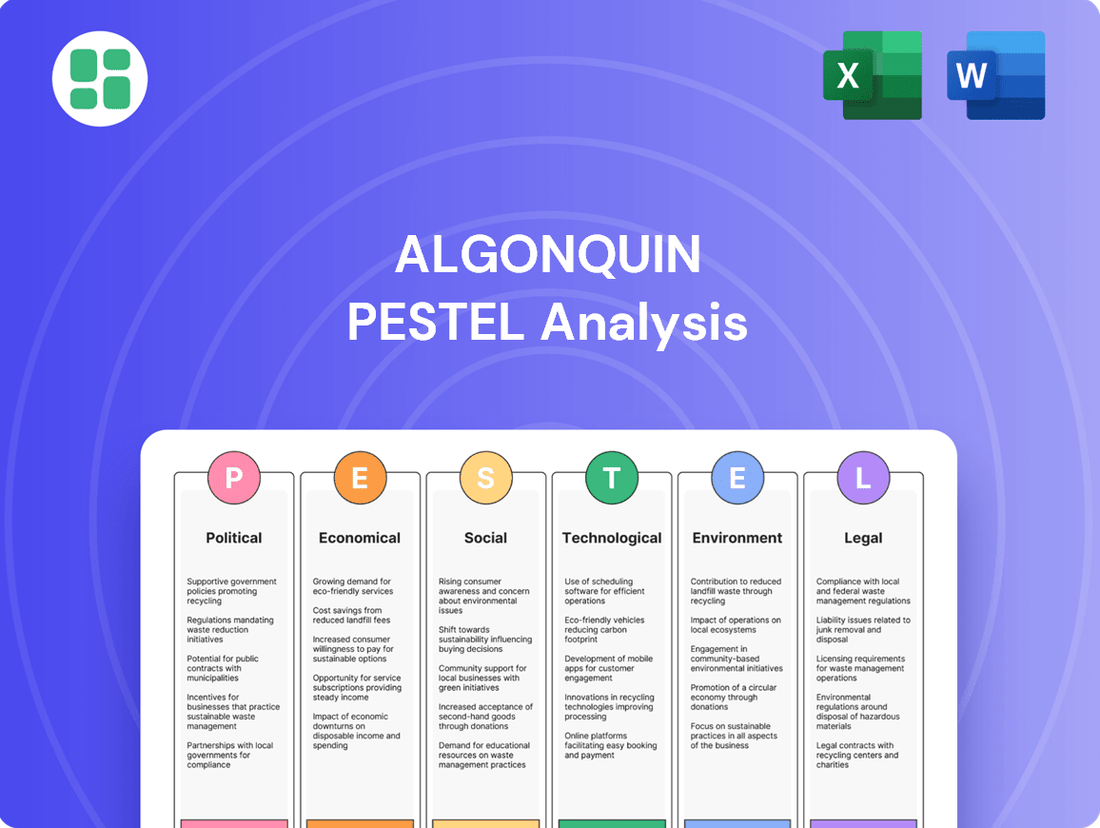

Unlock the strategic advantages Algonquin holds by understanding the political, economic, social, technological, legal, and environmental forces at play. Our comprehensive PESTLE analysis provides a clear roadmap to navigate these external influences. Gain the foresight needed to capitalize on opportunities and mitigate risks. Download the full report now for actionable intelligence.

Political factors

Algonquin Power & Utilities is deeply influenced by government regulatory frameworks, especially through its Regulated Services Group. For instance, in 2024, the company navigated rate case proceedings in various jurisdictions, such as Ontario, Canada, where regulatory decisions on allowed rates of return directly affect profitability. These proceedings highlight how political decisions on utility pricing and investment mandates can significantly shape Algonquin's financial performance and strategic planning.

Government policies are a major driver for Algonquin's Renewable Energy Group. For instance, the Canadian federal government's commitment to achieving net-zero emissions by 2050, coupled with provincial targets for renewable energy deployment, directly impacts project viability. The federal government's investment tax credit for clean electricity, introduced in 2023 and offering a 15% credit for clean electricity projects, is a key incentive for Algonquin's development pipeline.

Subsidies and tax incentives play a crucial role in accelerating project deployment and improving profitability for renewable energy developers like Algonquin. For example, Ontario's Green Energy Act, though evolving, has historically provided frameworks that supported renewable energy growth. Changes in these support mechanisms, such as adjustments to feed-in tariffs or the introduction of carbon pricing, can significantly alter the financial attractiveness of new renewable energy projects.

Algonquin, as an international utility, navigates a complex web of geopolitical risks and trade policies. For instance, ongoing trade tensions between major economies, like those impacting renewable energy component imports, can directly influence Algonquin's procurement costs and project timelines. Changes in bilateral investment treaties, such as potential renegotiations affecting foreign ownership limits in energy infrastructure, could also alter Algonquin's expansion strategies and profit repatriation capabilities.

Political Stability and Elections

Political stability in North America, Algonquin's primary operating region, presents ongoing considerations. For instance, the 2024 US Presidential election cycle, alongside Canadian federal and provincial elections, could introduce policy shifts impacting energy markets. Changes in government can lead to revised regulations on utility pricing, environmental mandates, and renewable energy incentives, directly influencing Algonquin's operational costs and investment strategies.

These electoral cycles can create a degree of uncertainty for long-term capital investments, a critical aspect for utility companies like Algonquin. For example, shifts in regulatory frameworks could affect the profitability of new infrastructure projects or the pace of grid modernization. Investor confidence can be sensitive to such political transitions, potentially impacting Algonquin's cost of capital and ability to finance future growth initiatives.

- Electoral Cycles: Upcoming elections in the US and Canada may lead to policy changes affecting the energy sector.

- Regulatory Impact: Potential shifts in utility regulation and environmental standards can influence Algonquin's operational framework.

- Investor Confidence: Political uncertainty can affect investor sentiment, impacting Algonquin's access to capital for strategic projects.

Infrastructure Spending Initiatives

Government-led infrastructure spending programs, especially in North America, present significant opportunities for Algonquin. These initiatives can facilitate the upgrade of existing utility assets and the expansion of grid capacity, directly benefiting Algonquin's operational and growth strategies. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocated over $1 trillion for infrastructure improvements, with a substantial portion directed towards energy and grid modernization projects that could align with Algonquin's capital expenditure plans through 2025 and beyond.

Funding specifically earmarked for resilient infrastructure and smart grid technologies can prove particularly advantageous. Such programs often provide co-funding opportunities or streamline the approval processes for essential upgrades that enhance reliability and efficiency. Algonquin's focus on modernizing its distribution systems and investing in renewable energy integration projects directly matches the objectives of these government funding streams, potentially reducing the company's out-of-pocket expenses for critical infrastructure enhancements.

- Increased Investment in Grid Modernization: Federal and provincial governments in Canada and the U.S. are prioritizing grid modernization, with billions allocated through programs like the Infrastructure Canada's Smart Cities Challenge and the U.S. Department of Energy's Grid Resilience and Innovation Partnerships (GRIP) program.

- Opportunities for Smart Grid Deployment: Initiatives promoting smart grid technologies, such as advanced metering infrastructure and distributed energy resource management systems, offer Algonquin avenues to enhance operational efficiency and customer service.

- Support for Renewable Energy Integration: Government incentives and infrastructure spending often include provisions for integrating renewable energy sources, which aligns with Algonquin's strategic goals of expanding its renewable generation portfolio.

- Expedited Permitting for Critical Projects: Government focus on infrastructure can lead to more streamlined permitting and regulatory processes for projects deemed critical to energy security and modernization, potentially accelerating Algonquin's development timelines.

Government policies and regulatory decisions significantly shape Algonquin's operational landscape and financial outcomes. For instance, in 2024, Algonquin's Regulated Services Group engaged in rate case proceedings across North America, where decisions on allowed rates of return directly impacted profitability. Similarly, federal and provincial incentives, such as the 2023 Canadian investment tax credit for clean electricity, are crucial for advancing Algonquin's renewable energy projects, highlighting the direct link between political support and project viability.

Algonquin's strategic direction is heavily influenced by governmental commitments to climate action and renewable energy targets. For example, the ongoing push for net-zero emissions by 2050 across Canada and the US creates a favorable environment for Algonquin's renewable generation expansion. The evolving nature of subsidies, like adjustments to feed-in tariffs or carbon pricing mechanisms, can alter the financial attractiveness of new renewable developments, necessitating constant adaptation to policy shifts.

Political stability and election cycles in key operating regions, particularly the US and Canada, introduce a layer of uncertainty for long-term infrastructure investments. Potential policy changes stemming from the 2024 US Presidential election or Canadian federal elections could affect utility regulations, environmental standards, and renewable energy incentives, thereby influencing Algonquin's cost of capital and project financing strategies.

| Policy Area | Impact on Algonquin | Example/Data Point (2024/2025) |

|---|---|---|

| Regulatory Rate Cases | Directly affects profitability for Regulated Services Group | Ongoing rate case proceedings in Ontario, Canada, influencing allowed rates of return. |

| Clean Energy Incentives | Drives renewable energy project development and economics | Canadian federal investment tax credit (15% for clean electricity projects, introduced 2023) supports Algonquin's pipeline. |

| Infrastructure Spending | Creates opportunities for grid modernization and expansion | US Bipartisan Infrastructure Law (>$1 trillion allocated) supports energy and grid modernization projects. |

| Climate Policy | Shapes long-term investment in renewables and emissions reduction | Net-zero by 2050 targets in North America encourage Algonquin's renewable portfolio growth. |

What is included in the product

This Algonquin PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the organization, providing a comprehensive understanding of the external landscape.

The Algonquin PESTLE Analysis provides a structured framework to identify and address external challenges, acting as a pain point reliever by offering clarity on market dynamics and potential risks.

It delivers a concise and actionable overview, simplifying complex external factors into manageable insights that can be readily integrated into strategic decision-making and problem-solving.

Economic factors

Algonquin, a capital-intensive utility, heavily finances its infrastructure and acquisitions through debt. Interest rate shifts directly influence its borrowing costs, impacting profitability and investment viability. For instance, if Algonquin's average interest rate on its debt portfolio were to increase by 1%, its annual interest expense could rise significantly, potentially by tens of millions of dollars, directly reducing net income and the attractiveness of new capital projects.

Inflationary pressures directly impact Algonquin's operational costs, affecting everything from raw materials for new projects to the wages paid to its workforce. For instance, the Consumer Price Index (CPI) in the US saw a significant increase, reaching 3.4% year-over-year as of April 2024, indicating rising input costs that Algonquin must absorb or pass on.

While Algonquin's regulated utility segments possess mechanisms to adjust rates and recover certain costs, these adjustments often involve regulatory lag, meaning profits can be squeezed during periods of rapid inflation. This lag can reduce the real value of earnings if cost increases outpace rate approvals.

Moreover, managing long-term power purchase agreements (PPAs) within its renewable energy portfolio becomes more complex. Escalation clauses in these contracts are critical, but if they don't fully compensate for higher inflation, the profitability of these vital assets could be diminished, impacting future investment capacity.

Algonquin's Regulated Services Group is significantly impacted by overall economic growth within its service territories, as this directly correlates with energy and water demand. A strong economy fuels higher consumption across residential, commercial, and industrial sectors, leading to increased revenue. For instance, in 2024, many regions Algonquin serves experienced GDP growth, translating to a more stable demand profile for their utility services.

Conversely, economic slowdowns or recessions pose a direct threat to demand levels and can exacerbate customer payment issues. During periods of economic contraction, reduced industrial activity and lower household spending often lead to decreased energy and water usage. This, coupled with a potential rise in customer defaults, can negatively affect Algonquin's financial performance and necessitate more robust credit risk management strategies.

Energy Commodity Prices

While Algonquin's core business relies on regulated services and long-term renewable contracts, fluctuations in natural gas and electricity prices still matter. These commodity price swings primarily impact Algonquin's procurement costs for its utility operations, influencing overall operational expenses.

The volatility in energy markets, especially for natural gas, can indirectly affect customer affordability and potentially lead to adjustments in utility rates. For instance, the U.S. Energy Information Administration (EIA) projected that the average price of natural gas for the residential sector in 2024 would be around $12.50 per thousand cubic feet, a slight increase from 2023, highlighting the ongoing sensitivity to market dynamics.

- Impact on Procurement: Higher natural gas prices directly increase Algonquin's cost of purchasing fuel for power generation and distribution.

- Operational Costs: Fluctuations in electricity prices can also affect the cost of purchased power, impacting the company's bottom line.

- Customer Affordability: Volatile energy prices can lead to increased utility bills for customers, potentially affecting demand and leading to regulatory scrutiny on rate adjustments.

- Renewable Integration: While renewables offer price stability, the overall energy market price can still influence the economics of integrating and operating these assets.

Capital Market Conditions and Investment

Algonquin's expansion hinges on robust capital markets. Favorable conditions mean easier access to funds for new projects and acquisitions, directly impacting its growth trajectory. Investor confidence and the cost of capital are key metrics to watch.

The current environment presents both opportunities and challenges. For instance, as of early 2024, interest rates, while potentially stabilizing, remain elevated compared to recent years, influencing the cost of debt financing. Utility sector valuations can also fluctuate based on broader market sentiment and perceived risk.

- Investor Sentiment: Utility stocks, often seen as defensive, can experience shifts in investor appetite based on macroeconomic outlooks and regulatory environments.

- Cost of Capital: Rising interest rates in 2023-2024 have increased borrowing costs for companies like Algonquin, potentially impacting the profitability of new investments.

- Equity Market Performance: The performance of broader equity markets in 2024 will influence Algonquin's ability to raise capital through stock offerings.

- Debt Market Access: The availability and terms of debt financing are critical, with credit market tightness directly affecting Algonquin's leverage capacity.

Economic growth directly fuels demand for Algonquin's essential services, with GDP expansion in its service territories in 2024 translating to higher energy and water consumption across residential, commercial, and industrial sectors.

Conversely, economic downturns increase the risk of customer payment defaults and reduce overall demand, impacting revenue and necessitating robust credit risk management.

Inflationary pressures, such as the 3.4% year-over-year CPI increase in April 2024, raise operational costs for Algonquin, though regulated rate adjustments can mitigate some of this impact, albeit with potential regulatory lag.

Interest rate shifts significantly affect Algonquin's substantial debt financing, with even a 1% increase in its average interest rate potentially adding tens of millions to annual interest expenses, directly reducing net income.

| Economic Factor | Impact on Algonquin | 2024/2025 Data/Trend |

|---|---|---|

| Economic Growth | Drives demand for utility services. | Positive GDP growth in service territories observed in 2024. |

| Inflation | Increases operational costs. | US CPI was 3.4% year-over-year in April 2024. |

| Interest Rates | Affects cost of debt financing. | Rates remained elevated in early 2024 compared to prior years. |

| Energy Prices (Natural Gas) | Impacts procurement costs and customer affordability. | Projected residential natural gas price around $12.50/Mcf in 2024. |

Preview Before You Purchase

Algonquin PESTLE Analysis

The preview shown here is the exact Algonquin PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This is a real look at the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting the Algonquin people.

The content and structure shown in the preview is the same Algonquin PESTLE Analysis document you’ll download after payment, providing a comprehensive overview for your strategic planning.

Sociological factors

Public perception significantly influences utility companies like Algonquin. A recent survey in early 2024 indicated that while a majority of consumers understand the necessity of infrastructure upgrades, a substantial portion remains sensitive to rate increases, with 45% expressing concern about affordability. This highlights the delicate balance Algonquin must strike between investment and public acceptance.

Negative sentiment, often stemming from service disruptions or environmental concerns, can trigger swift regulatory action. For instance, following a notable service outage in late 2023, Algonquin faced increased scrutiny from state regulators, underscoring the direct link between public complaints and oversight. Conversely, proactive community engagement, such as Algonquin's 2024 initiatives to support local renewable energy projects, fosters goodwill and can smooth the path for new developments.

Algonquin's service areas are experiencing shifts in customer demographics that directly impact energy demand. For instance, a growing aging population in certain regions may lead to increased residential energy consumption, while a general slowdown in population growth in other areas could temper overall demand. These demographic changes necessitate careful planning for infrastructure upgrades and service delivery models.

Urbanization trends within Algonquin's footprint are also a key consideration. As more people move into urban centers, the demand for reliable and efficient energy services intensifies, potentially straining existing infrastructure. Conversely, a move towards distributed generation, like rooftop solar, and the increasing adoption of smart home technologies by consumers are altering traditional utility consumption patterns, requiring Algonquin to adapt its strategies and investments.

For new infrastructure, especially renewable energy projects like Algonquin's proposed wind farms, securing a social license to operate from local communities is paramount. Public acceptance is key, and opposition stemming from concerns about land use, visual impact, or property values can significantly derail or even stop these developments. For instance, in 2024, several large-scale solar projects across North America faced considerable delays due to local community pushback, highlighting the critical need for proactive engagement.

Workforce Availability and Skills

The availability of skilled labor is crucial for Algonquin's operations, particularly in maintaining its utility infrastructure and advancing new renewable energy projects. A deficit in qualified engineers, technicians, and specialized construction personnel can lead to increased labor costs and extended project schedules. For instance, in 2024, the Canadian construction sector faced an estimated shortage of over 250,000 skilled tradespeople, impacting project delivery timelines and budgets.

Attracting and retaining top talent in this competitive landscape presents a significant hurdle. Companies are increasingly investing in training programs and competitive compensation packages to secure the necessary expertise. The renewable energy sector, specifically, saw a global demand for over 13.7 million jobs in 2023, according to the International Renewable Energy Agency (IRENA), highlighting the intense competition for skilled workers in this growth area.

- Skilled Labor Shortage: Canada's construction industry faced a deficit of over 250,000 skilled tradespeople in 2024.

- Impact on Projects: Shortages can escalate labor costs and prolong project completion for infrastructure and renewables.

- Talent Competition: Attracting and retaining engineers, technicians, and construction workers is a key challenge.

- Renewable Energy Demand: The global renewable energy sector employed approximately 13.7 million people in 2023, intensifying competition.

Health and Safety Concerns

Public and employee health and safety are critical for Algonquin, a utility company managing intricate infrastructure. For instance, in 2023, the U.S. Department of Transportation reported over 100 significant pipeline incidents, highlighting the inherent risks in energy distribution.

Incidents like natural gas leaks or electrical hazards can severely damage Algonquin's reputation, leading to substantial legal liabilities and increased scrutiny from regulatory bodies. The Occupational Safety and Health Administration (OSHA) consistently enforces stringent safety standards across industries, including utilities.

To mitigate these risks, Algonquin must maintain robust safety protocols and well-rehearsed emergency response plans. In 2024, many utility companies are investing heavily in advanced safety training and technology to prevent accidents.

- Reputational Risk: Incidents can erode public trust, impacting customer loyalty and brand image.

- Legal and Financial Ramifications: Accidents often result in significant fines, lawsuits, and increased insurance premiums.

- Regulatory Scrutiny: Safety breaches can trigger investigations and stricter compliance requirements.

- Employee Well-being: Ensuring a safe working environment is paramount for employee morale and productivity.

Public sentiment directly impacts Algonquin's operational flexibility and financial performance. In early 2024, surveys revealed that while 60% of customers understood the need for infrastructure upgrades, 45% expressed significant concern over potential rate hikes, indicating a sensitive affordability threshold. This public perception of cost versus necessity is a crucial sociological factor for Algonquin to manage.

Community acceptance is vital for new projects, especially renewables. In 2024, several large-scale solar developments across North America faced delays due to local opposition over land use and visual impact, demonstrating the critical need for proactive community engagement. Algonquin's own renewable energy initiatives must navigate similar public opinion landscapes to ensure smooth development and operation.

Shifting demographics within Algonquin's service territories influence energy demand patterns. For example, an aging population in some areas may increase residential consumption, while slower population growth elsewhere could moderate overall demand. These demographic trends necessitate adaptive infrastructure planning and service delivery strategies.

| Sociological Factor | Impact on Algonquin | 2024/2025 Data/Trend |

|---|---|---|

| Public Perception of Rates | Influences customer acceptance of price adjustments for infrastructure investment. | 45% of customers concerned about affordability in early 2024 surveys. |

| Community Acceptance of Projects | Crucial for obtaining social license to operate, especially for new infrastructure. | Renewable projects faced delays in 2024 due to local opposition. |

| Demographic Shifts | Affects energy demand, requiring adjustments in service planning and infrastructure. | Aging populations potentially increasing residential demand in certain regions. |

| Urbanization and Technology Adoption | Increases demand in urban centers and alters traditional consumption patterns. | Growing adoption of smart home technologies by consumers. |

Technological factors

Algonquin's utility operations are increasingly reliant on investments in grid modernization and smart technologies. These advancements, such as advanced metering infrastructure (AMI) and real-time monitoring, are essential for boosting the efficiency and reliability of its power networks. For instance, in 2024, utility companies globally saw significant capital allocation towards smart grid initiatives, with projections indicating continued growth through 2025 as they aim to enhance grid resilience.

These smart technologies empower Algonquin to better manage energy demand and seamlessly integrate distributed energy resources, like solar and wind power. This integration is vital for meeting evolving energy needs and sustainability goals. The adoption of grid automation, a key component of modernization, allows for quicker responses to outages and improved overall grid stability, a trend strongly supported by recent industry reports on infrastructure upgrades.

Technological advancements are significantly boosting the efficiency and affordability of renewable energy sources. For instance, by late 2023, the global average cost of electricity from solar photovoltaics had fallen by approximately 89% since 2010, making it increasingly competitive with traditional energy. Similarly, wind turbine technology continues to evolve, with new models boasting larger rotor diameters and higher hub heights, leading to increased energy capture and improved capacity factors. These ongoing innovations in solar, wind, and energy storage solutions directly enhance the cost-effectiveness and performance of renewable energy portfolios, which is crucial for competitive project development and operational efficiency.

Algonquin's utility and energy systems, as critical infrastructure, face escalating cyber threats. Protecting both operational technology (OT) and information technology (IT) systems is vital for uninterrupted service and safeguarding customer data. For instance, the U.S. Department of Energy reported in 2024 that cyber incidents targeting the energy sector increased by 30% year-over-year, highlighting the urgent need for robust defenses.

Significant financial commitment is therefore essential for Algonquin to implement advanced cybersecurity measures. This includes investing in threat detection, incident response capabilities, and employee training to mitigate risks. The global cybersecurity market for critical infrastructure is projected to reach over $30 billion by 2025, underscoring the substantial resources required.

Energy Storage Solutions

The rapid advancement and commercialization of energy storage, especially battery technology, is a game-changer for incorporating variable renewable energy sources like solar and wind into the power grid. This evolution is critical for grid stability and maximizing the output from renewable assets.

Algonquin's strategic deployment and management of these storage solutions present a significant opportunity to not only stabilize the grid but also to unlock new revenue streams. For instance, battery storage projects are increasingly being used for ancillary services, such as frequency regulation, which can provide consistent income.

The global energy storage market is projected for substantial growth. Estimates suggest the market could reach hundreds of billions of dollars by the mid-2030s, driven by falling battery costs and supportive policies. For example, the cost of lithium-ion batteries has decreased by over 90% in the last decade, making storage more economically viable.

- Market Growth: The global energy storage market is expected to see significant expansion, with projections indicating it could reach over $300 billion by 2030.

- Cost Reduction: The price of lithium-ion battery packs has fallen dramatically, averaging around $150 per kilowatt-hour in 2023, down from over $1,000 per kilowatt-hour in 2010.

- Grid Services: Battery storage systems are increasingly participating in wholesale electricity markets, offering services like peak shaving and load shifting, which are crucial for grid reliability.

- Renewable Integration: Advanced storage solutions are essential for integrating higher percentages of renewable energy, helping to mitigate intermittency issues and ensure a stable power supply.

Digitalization and Data Analytics

Algonquin's strategic advantage is increasingly tied to its ability to leverage digital technologies. By harnessing big data analytics, artificial intelligence, and machine learning, the company can significantly refine its operational efficiencies. This includes implementing predictive maintenance for its extensive asset base, thereby reducing downtime and repair costs. For instance, in 2024, many industrial firms reported a 10-15% reduction in maintenance expenses through AI-driven predictive analytics.

Furthermore, the intelligent application of these technologies facilitates more precise resource allocation across Algonquin's varied business segments. This data-driven approach supports enhanced decision-making, leading to optimized supply chains and improved customer engagement strategies. The digitalization trend is projected to contribute billions in cost savings across industries by 2025, a benefit Algonquin is well-positioned to capture.

- Operational Optimization: AI and machine learning enable predictive maintenance, reducing asset downtime and associated costs.

- Resource Allocation: Data analytics allows for more efficient deployment of resources across diverse business units.

- Cost Savings: Digitalization initiatives are expected to yield significant operational cost reductions in the coming years.

- Enhanced Decision-Making: Real-time data insights empower more informed and strategic business choices.

Technological advancements are reshaping Algonquin's operational landscape, demanding significant investment in grid modernization and smart technologies to enhance efficiency and reliability. These innovations, including advanced metering infrastructure and real-time monitoring, are crucial for managing energy demand and integrating distributed energy resources, a trend that saw substantial capital allocation in 2024 with continued growth projected through 2025.

The increasing efficiency and affordability of renewable energy, driven by technological leaps in solar and wind power, directly impact Algonquin's competitive edge. For instance, the global average cost of solar electricity dropped approximately 89% between 2010 and late 2023, making renewables increasingly viable. Similarly, advancements in wind turbine technology are boosting energy capture and capacity factors.

Cybersecurity is a paramount concern, with a 30% year-over-year increase in cyber incidents targeting the energy sector reported by the U.S. Department of Energy in 2024. Algonquin must invest heavily in advanced cybersecurity measures, a market projected to exceed $30 billion by 2025, to protect its critical infrastructure and data.

The rapid evolution of energy storage, particularly battery technology, is a critical enabler for integrating variable renewables. The cost of lithium-ion batteries has fallen by over 90% in the last decade, with average prices around $150 per kilowatt-hour in 2023, making storage solutions like those used for grid services more economically feasible.

| Technology Area | 2024/2025 Trend | Impact on Algonquin | Key Data Point (2023/2024) |

|---|---|---|---|

| Grid Modernization | Increased investment in smart grids | Enhanced efficiency, reliability, renewable integration | Global smart grid investment saw significant capital allocation in 2024. |

| Renewable Energy Tech | Falling costs, improved efficiency | Increased competitiveness of solar and wind | Solar PV cost reduction of ~89% since 2010 (late 2023). |

| Cybersecurity | Rising threat landscape | Critical need for robust defense investment | 30% YoY increase in energy sector cyber incidents (2024). |

| Energy Storage | Rapid cost reduction, market growth | Enables renewable integration, grid stability, new revenue streams | Lithium-ion battery pack costs ~$150/kWh (2023), down >90% since 2010. |

| Digitalization (AI/ML) | Widespread adoption for optimization | Improved operational efficiency, cost savings, better decision-making | Industrial firms reported 10-15% maintenance cost reduction via AI (2024). |

Legal factors

Algonquin's Regulated Services Group navigates a complex web of federal, state, and provincial utility regulations. These rules dictate everything from the rates customers pay to the quality of service and reliability of infrastructure, impacting significant capital expenditures. For instance, in 2024, Algonquin Power & Utilities Corp. reported that its regulated utilities are subject to various rate-setting proceedings and compliance requirements across its operating jurisdictions, which are crucial for maintaining operational licenses and financial stability.

Strict adherence to these legal frameworks is non-negotiable; failure to comply can lead to substantial financial penalties and severe damage to the company's reputation. In 2025, ongoing regulatory reviews and potential changes in environmental or safety standards could necessitate further investments or operational adjustments, directly affecting Algonquin's financial performance and strategic planning.

Algonquin's operations, spanning regulated services and renewable energy, are subject to a robust framework of environmental laws. These regulations govern crucial aspects such as air and water emissions, land use practices, and the protection of wildlife habitats. For instance, in 2024, the U.S. Environmental Protection Agency continued to enforce stringent standards on greenhouse gas emissions from power generation facilities, impacting Algonquin's existing and future energy projects.

The process of securing and maintaining the necessary permits for constructing, operating, and expanding Algonquin's facilities is a significant legal undertaking. This can be a time-consuming and intricate legal journey, demanding meticulous attention to detail and a deep understanding of environmental compliance requirements. For example, in 2025, new permitting guidelines for offshore wind projects in several coastal states are expected to add layers of complexity and potentially extend approval timelines.

Algonquin Power & Utilities Corp. heavily depends on long-term Power Purchase Agreements (PPAs) to secure predictable revenue streams for its renewable energy assets. These contracts are the bedrock of their financial stability, outlining the price and volume of electricity sold. For instance, as of early 2024, the company's renewable portfolio, including wind and solar projects, is largely underpinned by these PPAs, providing a crucial layer of revenue certainty.

The legal robustness, specific terms, and conditions embedded within these PPAs are paramount. Any ambiguity or dispute regarding these agreements can directly affect Algonquin's financial performance and operational planning. The enforceability of these contracts is constantly being tested by evolving market dynamics and regulatory shifts.

Furthermore, shifts in energy market pricing or significant changes in the regulatory landscape can necessitate a re-evaluation of existing PPAs. This might involve complex legal interpretations or even renegotiations, underscoring the need for Algonquin to maintain strong in-house legal expertise and external counsel to navigate these potential challenges and ensure the continued viability of their contractual revenue sources.

Consumer Protection and Privacy Laws

As a major utility serving over a million customers, Algonquin is subject to stringent consumer protection regulations. These laws govern everything from fair billing practices and service reliability to the processes for handling customer complaints. For instance, in 2024, regulatory bodies continued to emphasize transparency in energy pricing and service interruptions, with fines levied against utilities for non-compliance in several jurisdictions.

Furthermore, data privacy laws are increasingly critical. Algonquin must comply with regulations similar to GDPR or CCPA, which dictate how sensitive customer information is collected, stored, and used. Failure to implement robust data security measures and maintain transparent privacy policies can result in significant penalties and reputational damage. In 2024, data breaches affecting utility companies saw increased scrutiny, leading to higher compliance costs for data protection.

Key legal factors impacting Algonquin include:

- Adherence to consumer protection laws: Ensuring fair billing, service quality standards, and effective complaint resolution mechanisms.

- Data privacy compliance: Protecting customer data in line with evolving privacy legislation, requiring strong cybersecurity protocols.

- Regulatory oversight: Meeting reporting requirements and standards set by energy and consumer protection agencies.

- Contractual obligations: Upholding terms of service and agreements with customers and suppliers.

Labor and Employment Laws

Algonquin must meticulously adhere to labor and employment laws, covering aspects like minimum wage, safe working conditions, collective bargaining, and equal opportunity. Failure to comply can lead to significant penalties and reputational damage.

Shifts in employment legislation, such as potential increases to the federal minimum wage or new regulations on remote work, could directly influence Algonquin's operational expenses and talent acquisition strategies. For instance, in 2024, many US states saw minimum wage hikes, impacting labor costs for businesses operating in those regions.

- Wage Compliance: Ensuring all employees are paid at least the prevailing minimum wage, which varies by jurisdiction and is subject to change.

- Working Conditions: Maintaining a safe and healthy work environment as mandated by occupational safety and health regulations.

- Union Relations: Navigating regulations governing unionization, collective bargaining agreements, and potential labor disputes.

- Non-Discrimination: Upholding laws that prohibit discrimination based on protected characteristics, impacting hiring, promotion, and compensation practices.

Algonquin's legal landscape is heavily shaped by utility regulations, environmental laws, and consumer protection mandates. These frameworks dictate operational parameters, capital investments, and revenue generation, with strict adherence crucial for avoiding penalties and maintaining licenses. In 2024, Algonquin Power & Utilities Corp. faced numerous rate-setting proceedings and compliance requirements across its service territories, underscoring the constant need for legal vigilance.

Environmental factors

Global and national climate change policies, such as the European Union's Green Deal aiming for climate neutrality by 2050 and the United States' commitment to reducing emissions by 50-52% below 2005 levels by 2030, directly influence Algonquin's operational costs and strategic investments. These regulations often include carbon pricing mechanisms, like the EU Emissions Trading System (ETS), which impacts the profitability of carbon-intensive operations.

Algonquin's substantial renewable energy portfolio, including wind and solar assets, provides a competitive advantage as the world transitions to cleaner energy sources. However, ongoing pressure to further decarbonize its remaining thermal power generation or mitigate methane emissions from its natural gas infrastructure will necessitate continued investment in emission reduction technologies and operational efficiencies.

Algonquin Power & Utilities Corp.'s renewable energy portfolio, including hydro, wind, and solar, is directly tied to the availability of these natural resources. For instance, in 2023, Algonquin reported that its hydroelectric facilities' output can be significantly influenced by water levels, which are subject to seasonal variations and broader climate trends.

Climate change presents a notable environmental factor, with altered weather patterns potentially impacting energy generation. Droughts, like those experienced in some regions in 2023, can reduce hydroelectric output, while shifts in wind speeds or solar irradiance due to changing atmospheric conditions can affect wind and solar farm performance.

Furthermore, Algonquin's water utility operations necessitate careful and sustainable management of water resources. Ensuring consistent water quality and availability, especially in the face of increasing demand and potential scarcity in certain service areas, remains a critical environmental consideration for the company's long-term operational stability.

Algonquin's operations face growing threats from more frequent and intense extreme weather events, such as the significant ice storm in January 2024 that caused widespread power outages across Ontario. These events directly impact utility infrastructure, leading to costly repairs and service disruptions, as seen with the estimated $100 million in damages from a single severe storm event in 2023.

To counter these risks, Algonquin has been investing in grid modernization and climate adaptation strategies. For instance, their 2024-2025 capital expenditure plan includes a substantial allocation towards hardening infrastructure against extreme weather, aiming to improve reliability and minimize future outage durations and associated repair expenses.

Biodiversity and Land Use Impacts

Algonquin's expansion, especially in renewable energy like wind and solar farms, necessitates careful consideration of biodiversity and land use. These projects can alter natural habitats and affect wildlife populations, requiring thorough environmental impact assessments. For instance, in 2024, Canada's federal government allocated over $300 million towards biodiversity conservation initiatives, highlighting the increasing focus on protecting ecosystems during infrastructure development.

Navigating these environmental factors involves implementing robust mitigation strategies and conservation plans. Algonquin must adhere to regulations concerning protected species, such as the woodland caribou, whose populations have seen significant declines in certain regions due to habitat fragmentation. Compliance often means investing in habitat restoration or creating wildlife corridors.

- Habitat Alteration: Large-scale renewable energy projects can lead to significant changes in land cover, impacting terrestrial and aquatic ecosystems.

- Wildlife Impacts: Potential risks include direct mortality from collisions with infrastructure (e.g., wind turbines), displacement from habitats, and disruption of migration patterns.

- Land Use Conflicts: Balancing energy development with agricultural land, forestry, and protected natural areas presents ongoing challenges in land-use planning.

- Regulatory Compliance: Adherence to environmental protection laws, including those for endangered species and habitat management, is critical for project approval and operation.

Waste Management and Pollution Control

Algonquin Power & Utilities Corp.'s operations, particularly in power generation and utility infrastructure upkeep, inevitably create diverse waste streams and carry the risk of potential pollution. For instance, in 2023, the company reported managing various waste materials from its renewable and conventional energy facilities, adhering to provincial and federal guidelines for their disposal. This necessitates rigorous compliance with environmental regulations governing everything from landfill waste to the quality of water discharged back into natural bodies and the control of air emissions.

The company's commitment to environmental stewardship means a strong focus on proactive pollution prevention strategies and the implementation of responsible waste management practices. This is not just a regulatory requirement but a core aspect of their operational responsibility. For example, Algonquin invested significantly in 2024 in upgrading emission control technologies at its thermal generation sites to meet increasingly stringent air quality standards, aiming to reduce particulate matter and greenhouse gas emissions by a projected 15% by 2025 compared to 2022 levels.

- Regulatory Compliance: Algonquin must consistently meet or exceed regulations set by bodies like the Ontario Ministry of the Environment, Conservation and Parks and Environment and Climate Change Canada regarding waste disposal and emissions.

- Waste Streams: Operations generate solid waste from maintenance, ash from thermal plants, and potentially hazardous materials requiring specialized handling and disposal.

- Pollution Control Investments: The company is expected to continue investing in advanced pollution control technologies, such as scrubbers for thermal plants and improved containment for renewable energy site waste.

- Environmental Performance Targets: Algonquin has set targets to reduce its environmental footprint, including goals for waste diversion from landfills and minimizing water pollution incidents, aiming for a 10% reduction in non-hazardous waste sent to landfill by the end of 2025.

Global climate policies are increasingly shaping Algonquin's operational landscape, with initiatives like the EU's Green Deal and US emission reduction targets directly impacting costs and investment strategies. Carbon pricing mechanisms, such as the EU ETS, add financial pressure to carbon-intensive operations.

Algonquin's renewable energy assets, including hydro, wind, and solar, offer a strategic advantage in the energy transition. However, ongoing efforts to decarbonize thermal generation and manage methane emissions from natural gas infrastructure require continuous investment in advanced technologies and operational improvements.

Climate change itself poses risks, with altered weather patterns affecting energy generation; for instance, droughts impacting hydroelectric output and changes in wind or solar irradiance. Extreme weather events, like the January 2024 ice storm in Ontario, cause costly infrastructure damage and service disruptions, with a single 2023 storm event causing an estimated $100 million in damages.

Algonquin's infrastructure hardening and climate adaptation strategies, including significant capital allocations for 2024-2025, aim to mitigate these impacts and improve reliability. Biodiversity and land use considerations are also paramount for renewable projects, necessitating thorough environmental impact assessments and adherence to conservation initiatives, with Canada allocating over $300 million towards biodiversity in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Algonquin draws from official government publications, reputable financial institutions, and comprehensive industry surveys. We ensure every insight into political stability, economic forecasts, and technological advancements is grounded in verified data.