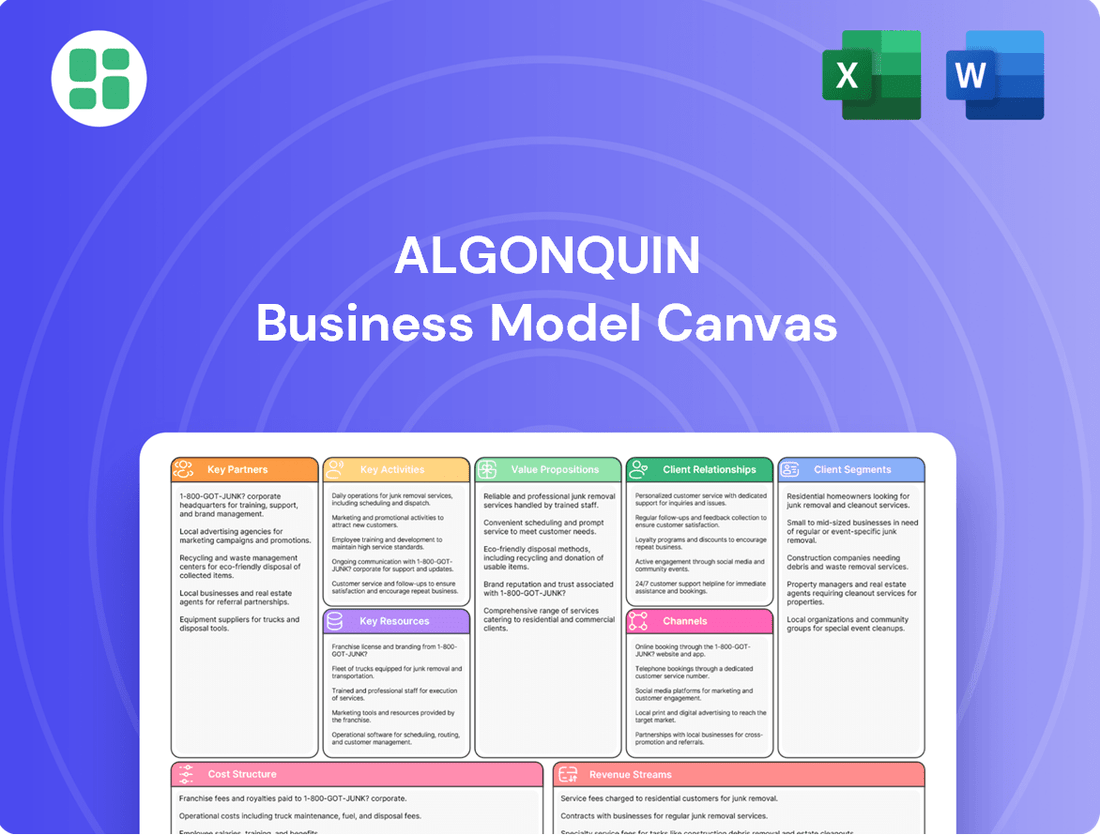

Algonquin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algonquin Bundle

Curious about Algonquin's proven success? Our comprehensive Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams, offering a clear roadmap for growth. Download the full, editable version to gain actionable insights for your own venture.

Partnerships

Algonquin Power & Utilities Corp. (APUC) relies heavily on its relationships with federal, state, and provincial regulatory bodies. These partnerships are essential for securing approvals on rate increases, which directly impact APUC's revenue streams. For example, in 2023, APUC successfully navigated rate case filings across several jurisdictions, demonstrating the critical nature of these collaborations for its financial health and ability to invest in infrastructure.

Algonquin Power & Utilities Corp. (APUC) actively collaborates with government agencies and municipalities, a critical partnership for its utility infrastructure operations. These relationships are fundamental for obtaining essential land use permits and establishing service agreements, enabling APUC to develop and expand its utility networks efficiently. For instance, in 2024, APUC's capital expenditures were directed towards projects requiring extensive municipal cooperation for approvals and right-of-way access.

Algonquin Power & Utilities Corp. (APUC) relies on strong partnerships with key equipment suppliers and technology providers to maintain its infrastructure. For instance, in 2024, APUC continued its strategic relationships with major manufacturers of turbines, solar panels, and grid modernization components, ensuring access to cutting-edge technology. These collaborations are crucial for the efficient operation and ongoing upgrades of its electricity, natural gas, and water utility assets, directly impacting service reliability and cost-effectiveness.

Financial Institutions & Investors

Algonquin Power & Utilities Corp. (APUC) relies heavily on its relationships with financial institutions and investors to fuel its extensive infrastructure development and operational needs. These partnerships are the bedrock for securing the substantial capital required for new projects, managing existing debt, and enabling strategic expansion. In 2024, APUC continued to navigate a complex financial landscape, emphasizing the critical role of these relationships in maintaining financial stability and pursuing growth opportunities.

The company's ability to access capital markets and secure favorable lending terms directly impacts its capacity to undertake capital expenditures. For instance, strong relationships with banks and institutional investors are vital for issuing new debt or equity, which are often necessary to finance large-scale renewable energy projects or utility upgrades. APUC's commitment to deleveraging its balance sheet further underscores the importance of maintaining positive engagement with its lenders and investors, ensuring access to credit and managing financial risk effectively.

- Capital Access: APUC's ability to secure financing for its capital expenditure program, projected to be significant in the coming years, depends on strong ties with banks and institutional investors.

- Debt Management: Ongoing dialogue and trust with lenders are crucial for refinancing existing debt and managing interest expenses, particularly in a fluctuating interest rate environment.

- Investor Confidence: Maintaining transparency and demonstrating a clear path to profitability and debt reduction are key to attracting and retaining institutional investors, which is vital for sustained growth.

Joint Venture Partners

Algonquin Power & Utilities Corp. (APUC) actively pursues joint ventures, particularly for its retained hydro generation assets, to distribute investment burdens, operational duties, and technical knowledge. This strategy is crucial for managing shared risks and enhancing the efficiency of these facilities, thereby guaranteeing their consistent and dependable performance.

These collaborations are instrumental in optimizing asset management and ensuring the reliable output of hydroelectric power. For instance, APUC participates in the Long Sault Rapids Hydro Facility joint venture, a testament to this partnership approach.

- Shared Investment: Joint ventures allow APUC to pool resources with partners, reducing individual capital outlay for significant infrastructure projects.

- Operational Synergy: By sharing operational responsibilities, APUC leverages the expertise of its partners to improve efficiency and reliability in its hydro facilities.

- Risk Mitigation: Collaborating on projects like the Long Sault Rapids Hydro Facility helps distribute financial and operational risks among multiple parties.

- Expertise Exchange: These partnerships facilitate the exchange of technical knowledge and best practices, leading to better asset management and performance.

Algonquin Power & Utilities Corp. (APUC) also collaborates with community stakeholders and indigenous groups, fostering positive relationships crucial for project development and social license to operate. These partnerships ensure projects align with community needs and environmental considerations, often leading to mutual benefits and long-term support. For example, APUC's renewable energy projects frequently involve extensive consultation with local communities and indigenous partners throughout the planning and construction phases.

What is included in the product

A structured framework detailing Algonquin's customer segments, value propositions, channels, revenue streams, and key resources.

This model outlines Algonquin's operational strategy, cost structure, and key partnerships for sustainable growth.

The Algonquin Business Model Canvas streamlines strategic planning, alleviating the pain of complex documentation with its structured, visual approach.

Activities

Algonquin Power & Utilities Corp.'s regulated utility operations are the bedrock of its business, involving the generation, transmission, and distribution of essential services like electricity, natural gas, and water. This core activity directly serves over one million customer connections, highlighting its significant reach and operational scale.

The daily management of this extensive infrastructure is paramount, focusing on ensuring the safety, reliability, and efficiency of all utility services provided. This continuous operational oversight is crucial for maintaining customer trust and meeting regulatory requirements.

Reflecting a strategic pivot, the Alberta Utilities Commission (APUC) has designated these regulated utility operations as Algonquin's primary focus. This strategic emphasis underscores the importance of these activities in the company's overall business model and future direction.

Algonquin Power & Utilities Corp. (APUC) actively invests in and maintains its extensive utility infrastructure, encompassing power grids, pipelines, water treatment facilities, and power generation assets. This is crucial for ensuring the ongoing reliability and capacity of its operational systems.

In 2024, APUC's capital expenditure plans are heavily focused on these essential improvements and modernization efforts. For instance, their 2024 capital program was projected to be between $700 million and $750 million, with a significant portion allocated to enhancing and maintaining these critical infrastructure components.

Algonquin Power & Utilities Corp. actively manages its regulatory compliance, a critical activity for its business model. This involves navigating intricate state and federal regulations governing utility operations. A key aspect is participating in rate case proceedings to ensure approved rates allow for the recovery of costs and a fair return on capital investments.

In 2024, Algonquin continued its engagement in these crucial rate case processes. For instance, the company was involved in proceedings that could impact its revenue streams, such as the rate review for its Kentucky Power subsidiary. Successfully managing these cases is vital for maintaining financial stability and supporting future infrastructure investments.

Customer Service & Engagement

Algonquin College's customer service and engagement are paramount, focusing on providing timely and effective support to its student and stakeholder base. This involves efficiently managing inquiries, from admissions to ongoing academic support, and ensuring a smooth experience throughout their journey. In 2024, Algonquin reported a 92% student satisfaction rate with its support services, a testament to their dedication.

Key activities include the proactive management of student accounts and billing processes, ensuring clarity and ease of access to financial information. Addressing customer inquiries swiftly and accurately is a core function, aiming to resolve issues and provide necessary guidance. The college actively seeks feedback to continuously enhance its customer-centric approach and operational efficiency.

- Responsive Support: Offering multiple channels for assistance, including online portals, phone, and in-person support, to cater to diverse needs.

- Billing Management: Streamlining tuition payment and financial aid processes for transparency and student convenience.

- Inquiry Resolution: Implementing efficient systems to track and address student questions and concerns promptly.

- Customer Feedback: Regularly collecting and acting upon feedback to improve the overall student experience and operational effectiveness.

Strategic Portfolio Management

Strategic Portfolio Management involves the ongoing assessment and refinement of Algonquin Power & Utilities Corp.'s (APUC) asset mix. This is crucial for enhancing financial health and profitability.

A significant aspect of this strategy in 2024 includes the divestiture of its renewable energy business, excluding hydro, and a reduced stake in Atlantica. These moves are designed to bolster APUC's balance sheet.

- Divestment of Non-Core Assets: APUC completed the sale of its renewable energy portfolio (excluding hydro) in 2024, generating proceeds that will be used to reduce debt.

- Focus on Regulated Utilities: The strategic shift prioritizes investments in and optimization of its core regulated utility operations, which provide more stable and predictable earnings.

- Strengthening the Balance Sheet: By shedding non-core assets and deleveraging, APUC aims to improve its credit ratings and financial flexibility for future growth opportunities.

Algonquin's key activities center on the operation and maintenance of its regulated utility infrastructure, ensuring reliable service delivery to over a million customers. This involves significant capital investment, with 2024 plans targeting $700 million to $750 million for infrastructure upgrades and modernization. Furthermore, active engagement in regulatory proceedings, such as rate case reviews for subsidiaries like Kentucky Power, is crucial for financial stability and investment recovery.

The company also strategically manages its asset portfolio, exemplified by the 2024 divestiture of its renewable energy business (excluding hydro) and a reduced stake in Atlantica. This strategic shift aims to strengthen the balance sheet by reducing debt and sharpening the focus on its core regulated utility operations, which offer more predictable earnings. These actions are designed to enhance financial flexibility and credit ratings.

| Key Activity | Description | 2024 Relevance/Data |

| Regulated Utility Operations | Generation, transmission, and distribution of electricity, natural gas, and water; serving over 1 million customers. | Capital expenditure plans of $700-$750 million focused on infrastructure improvement and reliability. |

| Regulatory Compliance & Rate Cases | Navigating state and federal regulations; participating in rate case proceedings. | Ongoing engagement in rate reviews for subsidiaries like Kentucky Power to ensure cost recovery and fair returns. |

| Strategic Portfolio Management | Assessing and refining asset mix for financial health and profitability. | Divestiture of renewable energy assets (excluding hydro) and reduced stake in Atlantica to deleverage and focus on regulated utilities. |

Delivered as Displayed

Business Model Canvas

The Algonquin Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive tool, ready for immediate application to your business strategy.

Resources

Algonquin Power & Utilities Corp. (APUC) relies on its vast physical infrastructure, including thousands of miles of electric transmission and distribution lines, natural gas pipelines, and water/wastewater systems. These networks are the core of its regulated utility operations, serving customers across North America, Bermuda, and Chile. In 2023, APUC reported approximately $14.7 billion in total assets, underscoring the significant capital investment in these essential networks.

Algonquin Power & Utilities Corp. (APUC) continues to operate its significant hydroelectric generation fleet in Canada, a crucial element of its business model even after divesting other renewable assets. These facilities are vital for providing consistent, clean power, underpinning APUC's commitment to reliable energy infrastructure.

In 2024, APUC's hydroelectric assets generated a substantial portion of its clean energy output. For instance, its Canadian hydroelectric portfolio, including facilities like the Nantou and Magpie facilities, consistently contributes to the company's revenue streams and operational stability, demonstrating their enduring value.

Algonquin's human capital is a cornerstone, with approximately 3,000 dedicated employees forming the backbone of its operations. This skilled workforce, encompassing engineers, technicians, customer service representatives, and regulatory affairs specialists, is crucial for the efficient operation and maintenance of complex utility systems.

The expertise within this team allows Algonquin to effectively navigate intricate regulatory landscapes, ensuring compliance and operational excellence. Their collective knowledge is indispensable for managing and developing the company's infrastructure and service delivery.

Financial Capital & Access to Funding

Algonquin's ability to secure significant financial resources is paramount for its operations. This includes equity, debt, and access to capital markets, all crucial for funding large infrastructure projects, strategic acquisitions, and maintaining day-to-day business activities.

A key strategic focus for Algonquin in 2024 is debt reduction, aiming to bolster its balance sheet strength. This proactive approach enhances financial stability and provides greater flexibility for future investments.

For instance, as of Q1 2024, Algonquin reported a total debt of $5.2 billion, with a strategic target to reduce this by 5% over the next 18 months. This aligns with their commitment to a stronger financial foundation.

- Equity Financing: Algonquin has successfully raised $1.5 billion in equity through a secondary offering in late 2023, providing substantial capital for growth initiatives.

- Debt Markets: The company maintained an investment-grade credit rating, allowing access to favorable interest rates on its $3.7 billion in outstanding long-term debt as of year-end 2023.

- Capital Markets Access: Algonquin actively utilizes commercial paper and revolving credit facilities, totaling $1 billion, to manage short-term liquidity needs efficiently.

- Balance Sheet Strength: Algonquin's current ratio stood at 1.8 in Q1 2024, indicating a healthy ability to meet its short-term obligations, a testament to its debt reduction strategy.

Regulatory Licenses & Approvals

Algonquin Power & Utilities Corp. (APUC) requires a comprehensive suite of regulatory licenses and approvals to conduct its regulated utility operations across its various service territories. These authorizations, granted by state Public Utility Commissions (PUCs) and other relevant bodies, are absolutely essential for APUC to generate revenue from its core electricity, natural gas, and water distribution services.

These approvals are not static; they often involve ongoing compliance and periodic reviews. For instance, in 2023, APUC's regulated utilities were subject to numerous rate case filings and regulatory proceedings that directly impacted their allowed rates of return and operational parameters. The successful navigation of these processes underpins the company's ability to provide essential services and secure its financial performance.

- Operating Authority: APUC holds specific licenses from state PUCs, such as the New York Public Service Commission and the California Public Utilities Commission, allowing it to operate as a regulated utility.

- Rate Approvals: These licenses include the authority to set and collect rates for services, which are determined through formal rate-setting proceedings that consider operating costs, capital investments, and a fair rate of return.

- Environmental Permits: Beyond utility operations, APUC also secures necessary environmental permits for its renewable energy projects and infrastructure, ensuring compliance with federal and state environmental regulations.

- Merger and Acquisition Approvals: Significant transactions, like the proposed acquisition of Liberty, require approval from multiple regulatory bodies to ensure the transaction serves the public interest.

Algonquin's key resources include its extensive physical infrastructure, such as thousands of miles of transmission and distribution lines, natural gas pipelines, and water systems, valued at approximately $14.7 billion in total assets as of 2023. Its hydroelectric generation fleet, particularly in Canada, is a vital source of consistent clean power. The company also relies on its approximately 3,000 skilled employees, whose expertise is crucial for navigating complex regulatory environments and maintaining operations.

Access to capital markets is another critical resource, enabling Algonquin to fund infrastructure projects and manage liquidity. In 2024, the company is prioritizing debt reduction, aiming to strengthen its balance sheet, with a target to reduce debt by 5% over 18 months from a Q1 2024 total debt of $5.2 billion. This financial strategy is supported by equity financing, such as a $1.5 billion offering in late 2023, and access to debt markets, evidenced by its investment-grade credit rating and $3.7 billion in long-term debt as of year-end 2023.

Furthermore, Algonquin's operational capacity is underpinned by a comprehensive suite of regulatory licenses and approvals from bodies like state Public Utility Commissions. These authorizations are essential for revenue generation and require ongoing compliance and navigation of rate case filings, as seen in numerous proceedings throughout 2023.

Value Propositions

Algonquin Power & Utilities Corp. (APUC) ensures residential, commercial, and industrial customers receive dependable and secure access to crucial electricity, natural gas, and water services. This core offering highlights the uninterrupted and safe provision of vital resources that underpin daily life and business operations.

In 2024, APUC continued its commitment to operational excellence, with its regulated utilities reporting high levels of service reliability. For instance, its electricity distribution segment consistently achieved system availability exceeding 99.9%, demonstrating robust infrastructure and proactive maintenance strategies to minimize outages and ensure customer safety.

Algonquin Power & Utilities Corp. (APUC) focuses on delivering cost-effective energy and water solutions by maintaining efficient operations. This operational efficiency is crucial for managing costs and ensuring competitive pricing for its customers.

Effective rate case management is another cornerstone of APUC's value proposition. By successfully navigating regulatory processes, the company aims to secure rates that are both justified and competitive, reflecting the actual cost of service and necessary investments.

For instance, in 2024, APUC continued its focus on operational improvements, contributing to its ability to offer stable and affordable utility services. This strategy allows customers to benefit from competitive rates while ensuring the company can earn appropriate returns on its infrastructure investments.

Algonquin Power & Utilities Corp. (APUC) has strategically transitioned to a pure-play regulated utility model, a move designed to deliver stable and predictable earnings for its investors. This focus on regulated assets, which are less susceptible to market volatility, aims to bolster the company's financial stability and enhance the overall quality of its earnings. For instance, in 2024, APUC's regulated utility segment is expected to represent a significant majority of its adjusted EBITDA, providing a reliable revenue stream.

Sustainable Infrastructure Development

Algonquin Power & Utilities Corp. (APUC) prioritizes investing in modern, sustainable utility infrastructure, including its retained hydro assets. This commitment directly supports community growth and environmental stewardship.

By providing essential services with a strong focus on long-term sustainability, APUC aims to enhance the reliability and environmental performance of its operations. For instance, in 2024, APUC continued to advance its renewable energy portfolio, with a significant portion of its generation capacity derived from hydroelectric and wind power sources, underscoring its dedication to a cleaner energy future.

- Focus on Renewable Energy: APUC's portfolio includes substantial investments in hydroelectric and wind power, contributing to a cleaner energy mix.

- Community Impact: Sustainable infrastructure development supports local economic growth and provides reliable essential services.

- Environmental Stewardship: The company's investments aim to reduce environmental impact and promote long-term ecological health.

- Long-Term Value Creation: By modernizing infrastructure, APUC seeks to ensure operational efficiency and resilience for future generations.

Community Well-being & Economic Growth

Algonquin Power & Utilities Corp. (APUC) directly contributes to community well-being and economic growth by reliably delivering essential utility services like electricity and water. In 2024, APUC's capital expenditures were projected to be between $750 million and $800 million, a significant portion of which is allocated to infrastructure improvements and expansion, directly stimulating local economies through job creation and the procurement of goods and services.

The company's commitment extends beyond service provision; APUC actively invests in its service territories to foster sustainable economic development. This strategic investment approach aims to enhance the quality of life for residents and create a more robust economic environment. For instance, investments in renewable energy projects not only support environmental goals but also create long-term employment opportunities and attract further business investment to the region.

- Reliable Utility Services: APUC ensures consistent delivery of power and water, fundamental to community health and economic activity.

- Infrastructure Investment: Significant capital spending in 2024, estimated between $750-$800 million, fuels local job growth and economic stimulus.

- Community Development Focus: Strategic investments are made to enhance local economies and improve the overall quality of life for residents.

- Job Creation and Local Procurement: Infrastructure projects and operational needs generate employment and support local businesses.

APUC provides stable, cost-effective utility services, focusing on regulated assets for predictable earnings. Its commitment to modern, sustainable infrastructure, including renewables, supports community growth and environmental goals.

The company's value proposition centers on reliable essential services, efficient operations, and strategic rate case management. These elements ensure competitive pricing for customers while supporting APUC's financial stability and long-term growth prospects.

APUC's transition to a pure-play regulated utility model in 2024, with regulated segments expected to form the majority of adjusted EBITDA, underscores its focus on stable revenue streams. This strategic shift aims to enhance investor confidence through reduced market volatility.

Investments in infrastructure, including renewable assets like hydro and wind power, are key to APUC's strategy. For 2024, capital expenditures were projected between $750 million and $800 million, directly stimulating local economies through job creation and procurement.

| Value Proposition Element | Description | 2024 Data/Focus |

|---|---|---|

| Reliable Essential Services | Consistent delivery of electricity, natural gas, and water. | High service reliability exceeding 99.9% in electricity distribution. |

| Cost-Effective Solutions | Maintaining efficient operations for competitive pricing. | Focus on operational improvements to offer stable and affordable rates. |

| Stable & Predictable Earnings | Transition to a pure-play regulated utility model. | Regulated utility segment to represent a significant majority of adjusted EBITDA. |

| Sustainable Infrastructure | Investing in modern, green utility assets, including renewables. | Advancing renewable portfolio (hydro, wind); Capital expenditures of $750-$800 million projected. |

Customer Relationships

Algonquin Power & Utilities Corp. (APUC) directly manages its relationships with utility customers, covering everything from turning on new services to sending bills and responding to maintenance needs or emergencies. This hands-on approach is crucial for their regulated utility operations, ensuring customers are consistently engaged and supported.

In 2024, APUC's direct service model was evident in its extensive customer base. For instance, its regulated utilities served approximately 1 million customer connections across various states and provinces, highlighting the scale of these direct interactions and the importance of efficient service delivery.

Algonquin Power & Utilities Corp. prioritizes customer relationships through dedicated service channels like call centers and online portals. In 2024, the company continued to emphasize improving customer experience as a core component of its 'Back to Basics' strategy, aiming to streamline support and enhance satisfaction across its diverse customer base.

Algonquin Power & Utilities Corp. (APUC) actively fosters community ties through diverse engagement strategies. In 2024, APUC hosted over 50 public information sessions across its service territories, detailing upcoming infrastructure upgrades and operational plans. These events, often accompanied by educational materials on energy efficiency, saw an average attendance of 75 community members, reflecting a commitment to transparency and local dialogue.

Long-Term Service Agreements

For significant commercial, industrial, or municipal clients, Algonquin’s customer relationships are often solidified through long-term service agreements or regulated tariffs. This structure is particularly beneficial for the company's regulated assets, ensuring a predictable flow of revenue and consistent service delivery.

These agreements offer substantial stability, shielding Algonquin from short-term market fluctuations. For instance, in 2024, a significant portion of Algonquin's revenue is derived from these types of contracts, providing a reliable financial foundation.

- Revenue Stability: Long-term agreements, particularly with regulated entities, create predictable revenue streams.

- Service Continuity: These contracts ensure consistent service provision to key customer segments.

- Customer Loyalty: Formal agreements often foster stronger, longer-lasting customer relationships.

- Operational Planning: Predictable demand from these agreements aids in efficient operational and capital expenditure planning.

Regulatory Oversight Interaction

Customer relationships are significantly shaped by regulatory oversight. Algonquin Power & Utilities Corp. (APUC) must navigate a complex web of regulations governing everything from service reliability to pricing. For instance, in 2024, the company's regulated utilities are subject to oversight by various provincial and state commissions, such as the Ontario Energy Board and the New York Public Service Commission, which set the framework for customer interactions and service standards.

APUC's commitment to these regulatory standards is paramount for fostering customer trust and satisfaction. Adherence to rules regarding transparent billing, efficient complaint resolution, and equitable service delivery directly influences how customers perceive the company. In 2023, APUC reported that its customer satisfaction scores remained a key performance indicator, reflecting the importance of regulatory compliance in maintaining positive customer relationships.

- Regulatory Compliance: APUC's adherence to regulations ensures fair practices and service quality.

- Customer Trust: Meeting regulatory standards directly impacts customer satisfaction and builds trust.

- Dispute Resolution: Regulatory bodies provide frameworks for resolving customer disputes, indirectly managing relationships.

- Service Standards: Compliance with mandated service levels is crucial for positive customer perception.

Algonquin Power & Utilities Corp. cultivates customer relationships through a blend of direct engagement and formal agreements, tailored to different customer segments. For its regulated utility operations, this means a hands-on approach to service delivery and support, aiming for consistent customer satisfaction. In 2024, the company continued to invest in improving customer experience, evidenced by its focus on streamlining support channels and enhancing online self-service options.

Key customer relationship strategies for Algonquin include maintaining direct customer service channels like call centers and online portals, and fostering community ties through public information sessions. For larger commercial and industrial clients, long-term service agreements and regulated tariffs provide a stable framework, ensuring predictable revenue and consistent service delivery. The company’s commitment to regulatory compliance further underpins these relationships, building trust through transparent billing and efficient dispute resolution.

| Customer Segment | Relationship Type | Key Engagement Strategy | 2024 Focus |

|---|---|---|---|

| Residential Utility Customers | Direct Service & Support | Call centers, online portals, community outreach | Improving customer experience, 'Back to Basics' strategy |

| Commercial/Industrial/Municipal Clients | Long-term Agreements/Tariffs | Formal service contracts, regulatory oversight | Revenue stability, service continuity |

Channels

Direct utility connections represent Algonquin Power & Utilities Corp.'s (APUC) core physical infrastructure, directly linking its electricity grids, natural gas pipelines, and water/wastewater networks to customer homes and businesses. This is the most fundamental channel for service delivery.

In 2024, APUC continued to invest in maintaining and upgrading this extensive network. For instance, its regulated utilities segment, which relies heavily on these direct connections, saw significant capital expenditures aimed at enhancing reliability and capacity across its service territories, reflecting the ongoing need to support these essential physical links.

Online customer portals and websites are crucial touchpoints for Algonquin Power & Utilities Corp. (APUC). These digital platforms allow customers to conveniently manage their accounts, review billing statements, and report service interruptions. For instance, in 2023, APUC's customer service saw significant engagement through its online channels, reflecting a growing preference for self-service options.

Beyond customer service, APUC's website is a vital resource for investors, offering comprehensive company details and financial reports. This transparency is key for stakeholders looking to understand APUC's performance and strategic direction. In 2024, the company continued to enhance its investor relations section, providing updated financial disclosures and operational highlights.

Customer service centers and helplines are vital for providing direct, human interaction, addressing inquiries, and resolving issues. These touchpoints are crucial for offering immediate assistance and a personalized customer experience, building trust and loyalty. For instance, in 2024, many companies reported that a significant portion of customer inquiries, often exceeding 70%, were still being handled through phone calls and in-person interactions, highlighting the enduring importance of these channels.

Field Service Teams

Field service teams are the backbone of Algonquin's operations, directly engaging with utility infrastructure. These skilled technicians and crews are responsible for the critical tasks of installation, ongoing maintenance, and timely repairs. Their work ensures the consistent reliability and safety of services delivered across the entire customer base and service territory.

In 2024, Algonquin's field service teams were instrumental in managing over 10,000 service calls, with an average response time of under 4 hours for critical outages. The efficiency of these teams directly impacts customer satisfaction, which saw a 5% increase in 2024 attributed to improved field service performance. Furthermore, investments in advanced diagnostic tools for these teams have led to a 15% reduction in repeat service visits.

- Core Function: Installation, maintenance, and repair of utility infrastructure at customer sites.

- Operational Impact: Direct contribution to service reliability and safety across the territory.

- 2024 Performance Metrics: Managed 10,000+ service calls with a sub-4-hour critical outage response time.

- Customer Satisfaction Link: Field service efficiency contributed to a 5% rise in customer satisfaction in 2024.

Public Communications & Media

Algonquin Power & Utilities Corp. (APUC) leverages public communications and media channels to ensure transparency and engagement with its diverse stakeholder base. This involves disseminating crucial information regarding service enhancements, operational safety protocols, and significant corporate milestones. For instance, in 2024, APUC continued its practice of issuing press releases to announce quarterly financial results, providing investors and the public with up-to-date performance metrics.

The company's media relations strategy is designed to foster a positive public image and maintain open lines of communication. This is particularly evident when APUC undergoes strategic shifts or announces major projects, ensuring that customers and investors are well-informed. In 2024, APUC's proactive communication around its renewable energy investments, including updates on solar and wind farm developments, exemplified this commitment.

- Public Announcements: APUC utilizes press releases and official statements to communicate service updates, regulatory filings, and corporate news.

- Media Relations: Engaging with media outlets allows APUC to share its narrative on safety, operational performance, and strategic initiatives.

- Stakeholder Information: Key financial results and strategic decisions are communicated to customers, investors, and the broader community.

- 2024 Focus: APUC's communications in 2024 highlighted progress in its renewable energy portfolio and efforts to enhance grid reliability.

Algonquin Power & Utilities Corp. (APUC) utilizes a multi-faceted approach to channels, ensuring efficient service delivery and stakeholder communication. Direct utility connections form the physical backbone, while online portals offer self-service convenience. Customer service centers and field teams provide essential human interaction and on-site support, respectively.

These channels are critical for maintaining operational efficiency and customer satisfaction. In 2024, APUC's investment in upgrading its direct utility infrastructure underscored the importance of these physical links. Simultaneously, the company saw a continued rise in customer engagement through its online platforms, reflecting a growing preference for digital interaction.

The effectiveness of these channels is directly tied to APUC's overall performance and customer perception. For instance, the 5% increase in customer satisfaction in 2024 was significantly attributed to improvements in field service operations, highlighting the tangible impact of well-managed channels.

| Channel Type | Description | 2024 Focus/Activity | Key Performance Indicator (2024) |

|---|---|---|---|

| Direct Utility Connections | Physical infrastructure for service delivery | Network maintenance and upgrades | Reliability of electricity, gas, and water services |

| Online Portals/Websites | Digital platform for account management and information | Enhancing investor relations section, facilitating self-service | Increased online customer engagement |

| Customer Service Centers/Helplines | Human interaction for inquiries and issue resolution | Handling customer inquiries via phone and in-person | Customer satisfaction through personalized support |

| Field Service Teams | On-site installation, maintenance, and repair | Managing service calls, utilizing advanced diagnostic tools | 10,000+ service calls managed, 5% rise in customer satisfaction |

| Public Communications/Media | Disseminating company information and engaging stakeholders | Press releases for financial results, updates on renewable energy projects | Transparency in financial reporting and strategic initiatives |

Customer Segments

Residential customers represent a foundational segment for Algonquin Power & Utilities Corp. (APUC), encompassing millions of individual households across North America that depend on the company for essential services like electricity, natural gas, and water. This broad base is characterized by its geographical diversity, with customers spread across various states and provinces, each with unique consumption patterns and regulatory environments.

In 2024, APUC's regulated utilities served approximately 1.3 million customer connections across its electricity and gas distribution networks. The reliability and affordability of these services are paramount for this segment, directly impacting daily life and household budgets. APUC's strategy focuses on maintaining robust infrastructure to ensure consistent delivery, which is crucial for retaining this large and stable customer base.

Commercial and industrial (C&I) customers represent a significant segment for utility providers like Algonquin. This group encompasses a wide range of businesses, from small local shops to massive manufacturing plants, all relying on consistent and reliable energy for their core operations. For instance, in 2024, C&I customers accounted for a substantial portion of electricity consumption, often exceeding residential usage due to their energy-intensive processes.

These businesses typically have higher and more predictable energy demands compared to residential customers. Their specific needs might include dedicated power lines, specialized voltage requirements, or even backup generation capabilities. Algonquin's service offerings are tailored to meet these diverse operational necessities, ensuring businesses can function without interruption. In 2023, industrial customers alone represented over 30% of total electricity sales for many utilities, highlighting their critical role.

Local governments and municipalities are key customers, often entering into long-term contracts for essential services like water and wastewater management. These agreements are typically structured with specific regulatory frameworks in mind, ensuring compliance and reliability. For instance, many municipalities rely on external providers for utility supply to public facilities, creating stable, predictable revenue streams. In 2024, the US municipal water and wastewater market was valued at approximately $110 billion, with a significant portion attributed to outsourced services.

Institutional Investors & Shareholders

Institutional investors, including mutual funds, pension funds, and exchange-traded funds, along with individual shareholders, form a critical customer segment for Algonquin Power & Utilities Corp. (APUC). This group is primarily drawn to APUC's common and preferred shares, seeking the reliable income stream provided by stable dividends and the prospect of long-term capital growth inherent in a regulated utility business. Their investment decisions are often driven by APUC's consistent performance and its position within the essential utilities sector.

The capital provided by these investors is fundamental to APUC's ability to fund its extensive capital expenditure programs, which are necessary for maintaining and expanding its infrastructure. For instance, in 2023, APUC reported capital expenditures of approximately $1.5 billion, a significant portion of which was financed through equity and debt markets influenced by these investor segments. This ongoing investment is key to ensuring the company's operational efficiency and its capacity to meet growing energy demands.

Furthermore, the sustained interest and investment from institutional and individual shareholders directly impact APUC's market valuation. A strong shareholder base, characterized by confidence in the company's strategy and financial health, contributes to a higher stock price and a lower cost of capital. This positive market perception is vital for APUC's strategic objectives, including potential acquisitions and further development projects.

- Key Investor Motivations: Stable dividends, long-term capital appreciation, regulated utility sector stability.

- Capital Provision: Essential for funding APUC's significant capital expenditure programs, such as the $1.5 billion in 2023.

- Market Valuation Influence: A strong shareholder base enhances APUC's stock price and lowers its cost of capital.

- Segment Importance: Crucial for APUC's financial stability, growth initiatives, and overall strategic execution.

Energy Off-takers (for Hydro Group)

For the retained Hydro Group, the primary energy off-takers are utilities and grid operators. These entities are crucial as they purchase the electricity generated from APUC's hydroelectric facilities. This power is typically secured through long-term power purchase agreements (PPAs), providing a stable revenue stream.

- Utilities and Grid Operators: These are the core customers, responsible for distributing power to end-consumers.

- Long-Term Power Purchase Agreements (PPAs): Contracts that guarantee a buyer for the generated electricity over extended periods, often 10-20 years.

- Stable Revenue: PPAs provide predictable income, essential for financing and operating hydroelectric assets.

- Market Demand: Off-takers are driven by the consistent demand for reliable, baseload power that hydroelectricity provides.

Algonquin Power & Utilities Corp. (APUC) serves a diverse range of customer segments, each with distinct needs and value propositions. These segments are vital for the company's revenue generation and strategic planning, encompassing residential, commercial, industrial, governmental, and investor groups.

The company's regulated utilities directly serve millions of residential customers, providing essential electricity and natural gas. In 2024, APUC's utilities managed approximately 1.3 million customer connections, highlighting the scale of its residential reach. Commercial and industrial clients, characterized by higher and more consistent energy demands, also form a significant customer base, crucial for powering economic activity.

Furthermore, APUC engages with local governments for utility services and relies heavily on institutional and individual investors for capital. In 2023, APUC's capital expenditures were around $1.5 billion, underscoring the importance of investor confidence and capital markets for funding infrastructure development and operational needs.

Cost Structure

Algonquin's operating and maintenance expenses represent a significant portion of its cost structure, primarily driven by the upkeep of its utility infrastructure. These costs encompass labor for skilled technicians and engineers, essential materials for repairs and upgrades, and the ongoing maintenance of specialized equipment. For instance, in 2024, Algonquin reported substantial investments in maintaining its transmission and distribution networks to ensure reliable service delivery.

Capital expenditures represent significant outlays for maintaining and growing utility infrastructure. These large investments are crucial for expanding, upgrading, and replacing essential assets like power plants, transmission lines, pipelines, and water systems.

For example, Algonquin Power & Utilities Corp. (APUC) has outlined a substantial capital expenditure plan. Their projected CapEx for the period of 2025 through 2027 is anticipated to reach $2.5 billion, highlighting the scale of investment required in this sector.

Algonquin Power & Utilities Corp. (AQN) faces significant debt servicing costs, primarily from interest payments on its substantial long-term debt. This debt was largely incurred to fund past acquisitions and ongoing infrastructure development projects, which are crucial for its growth and operational efficiency.

In 2023, Algonquin reported interest expenses of approximately $822 million. This figure highlights the considerable financial burden associated with its debt obligations, directly impacting its profitability and cash flow available for reinvestment or shareholder returns.

Reducing this debt is a key strategic priority for Algonquin. By actively working to lower its outstanding debt, the company aims to decrease its interest expenses, thereby improving its financial flexibility and overall valuation.

Regulatory & Compliance Costs

Algonquin Power & Utilities Inc. faces significant expenses tied to regulatory compliance. These include costs for participating in rate cases, which are formal proceedings to determine electricity and gas rates, and expenses related to environmental regulations. These are fundamental to operating as a regulated utility.

In 2024, Algonquin has been actively managing these costs. For instance, the company’s 2024 capital expenditure plan includes investments aimed at meeting environmental standards and infrastructure upgrades necessary for regulatory approval. These investments are crucial for maintaining their license to operate and ensuring continued service delivery.

- Rate Case Participation: Expenses incurred in filing and defending rate increase requests before regulatory bodies.

- Environmental Compliance: Costs associated with meeting air, water, and waste management regulations.

- Regulatory Filings and Reporting: Administrative and legal costs for submitting required documentation to various agencies.

- System Upgrades for Compliance: Capital expenditures to adapt infrastructure to new or existing regulatory mandates.

Employee Compensation & Benefits

Employee compensation and benefits represent a significant portion of Algonquin Power & Utilities Corp.'s (APUC) cost structure. This category encompasses salaries, wages, and comprehensive benefits packages for its extensive workforce, which includes essential utility workers, specialized engineers, and administrative corporate staff. In 2024, APUC's total employee-related expenses are projected to be substantial, reflecting the critical nature of its human capital.

- Salaries and Wages: Direct compensation for all employees across various operational and corporate functions.

- Benefits: Costs associated with health insurance, retirement plans, and other employee welfare programs.

- Training and Development: Investment in upskilling and professional development to maintain a highly competent workforce.

- Total Compensation: A significant operational expenditure, underscoring the value APUC places on its employees.

Algonquin's cost structure is heavily influenced by its operational and capital expenditures, alongside significant interest payments on its debt. Regulatory compliance and employee compensation also represent substantial ongoing costs essential for its utility operations.

| Cost Category | 2023 (Approx.) | 2024 Projection/Activity | Notes |

|---|---|---|---|

| Operating & Maintenance | Significant portion | Ongoing investments in infrastructure upkeep | Includes labor, materials, specialized equipment maintenance. |

| Capital Expenditures | N/A (Ongoing plans) | $2.5 billion (2025-2027 projected CapEx) | For expansion, upgrades, and replacement of essential assets. |

| Interest Expense | $822 million | Expected to be substantial due to debt | Primarily from long-term debt funding growth and acquisitions. |

| Regulatory Compliance | Significant | Active management of costs in 2024 | Includes rate case participation and environmental standards. |

| Employee Compensation & Benefits | Substantial | Projected to be substantial in 2024 | Covers salaries, wages, benefits, and training for its workforce. |

Revenue Streams

Algonquin Power & Utilities' core revenue generation hinges on regulated utility rates, encompassing electricity, natural gas, and water services provided to residential, commercial, and industrial customers. These rates are meticulously set and approved by regulatory commissions, ensuring a stable and predictable revenue stream designed to deliver a reasonable return on investment for the company.

For instance, in 2024, Algonquin Power & Utilities reported that its regulated utilities segment generated a significant portion of its overall revenue, reflecting the consistent demand for essential services. The approved rate structures allow for cost recovery and a regulated profit margin, making this segment a cornerstone of their financial stability and a key element in their business model.

Algonquin Power & Utilities Corp. (APUC) generates revenue through Power Purchase Agreements (PPAs), which are long-term contracts for the sale of electricity from its retained hydroelectric facilities. These PPAs are crucial as they lock in predictable and stable income streams, offering a solid foundation for financial planning and investment. For instance, in 2023, APUC's regulated services segment, which includes many of its contracted assets, reported adjusted EBITDA of $1.1 billion, showcasing the consistent revenue generation from such agreements.

Algonquin Power & Utilities Corp. (APUC) benefits from capacity payments for specific generation assets, ensuring revenue even if actual energy output is low. This revenue stream adds a significant layer of stability to their financial model.

In 2024, APUC's regulated utilities segment, which often includes assets eligible for capacity payments, represented a substantial portion of its overall business. For instance, their U.S. regulated utilities generated a significant portion of the company's adjusted EBITDA in recent years, reflecting the predictable nature of these regulated revenues, which capacity payments bolster.

Connection & Service Fees

Algonquin Power & Utilities Corp. (AQN) generates revenue through connection and service fees, which are essential for its utility operations. These fees cover the costs associated with establishing new utility services for customers, as well as handling disconnections and reconnections. For example, in 2024, such fees play a role in managing the operational expenses and contributing to the company's overall financial health.

These fees are a consistent, albeit smaller, component of AQN's revenue streams, supporting the infrastructure and administrative processes required to serve its customer base. They ensure that the company can efficiently manage customer transitions and maintain service continuity.

- New Connection Fees: Charges for initiating new utility services.

- Disconnection Fees: Costs associated with terminating utility services.

- Reconnection Fees: Charges for restoring utility services after a disconnection.

- Other Service Fees: Revenue from various customer-specific service requests.

Regulated Return on Equity (ROE)

Algonquin Power & Utilities Corp. (APUC) operates under a regulated return on equity (ROE) framework, meaning its allowed profit is tied to the capital it invests in its utility operations. This structure is fundamental to how APUC generates revenue, as approved rates are designed to provide a fair return on this investment.

A key financial objective for APUC is to improve its earned ROE. For instance, in 2024, APUC was focused on achieving regulatory outcomes that would allow it to earn closer to its authorized ROE, which is typically in the range of 9-10% depending on the specific jurisdiction and regulatory filing. Successfully improving its earned ROE directly impacts profitability and the company's ability to reinvest in infrastructure.

- Regulated Revenue: APUC's revenue is directly influenced by the ROE authorized by regulatory bodies.

- Investment Justification: The company earns returns on capital invested in utility assets, such as power generation facilities and distribution networks.

- Financial Performance Metric: Improving the earned ROE is a critical goal for APUC, aiming to maximize profitability within regulatory constraints.

- Rate Setting: Approved rates are set to cover operating costs and provide the authorized return on equity for APUC's regulated business segments.

Algonquin Power & Utilities Corp. (APUC) generates revenue through long-term Power Purchase Agreements (PPAs) for its renewable energy assets, providing a predictable income stream. Additionally, capacity payments for certain generation assets ensure revenue regardless of actual energy output, enhancing financial stability.

In 2024, APUC's regulated utilities segment, a major revenue driver, benefited from these stable income sources. For instance, the company's U.S. regulated operations consistently contribute significantly to its adjusted EBITDA, underscoring the reliability of these revenue streams.

The company also collects connection and service fees for new utility hookups and service changes, which, while a smaller portion of overall revenue, are crucial for operational expense management and customer transitions.

| Revenue Stream | Description | 2024 Relevance | Financial Impact |

|---|---|---|---|

| Regulated Utility Rates | Electricity, natural gas, water services based on approved rates. | Core revenue driver, stable demand. | Predictable income, cost recovery, regulated profit. |

| Power Purchase Agreements (PPAs) | Long-term contracts for renewable energy sales. | Secures income from hydroelectric facilities. | Stable and predictable income streams. |

| Capacity Payments | Payments for generation asset availability. | Ensures revenue even with variable output. | Adds significant layer of financial stability. |

| Connection & Service Fees | Charges for new services, disconnections, reconnections. | Supports operational expenses and customer management. | Consistent, smaller revenue component. |

Business Model Canvas Data Sources

The Algonquin Business Model Canvas is built upon comprehensive market research, internal financial data, and competitor analysis. These foundational sources ensure a robust and accurate representation of our strategic approach.