Algonquin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algonquin Bundle

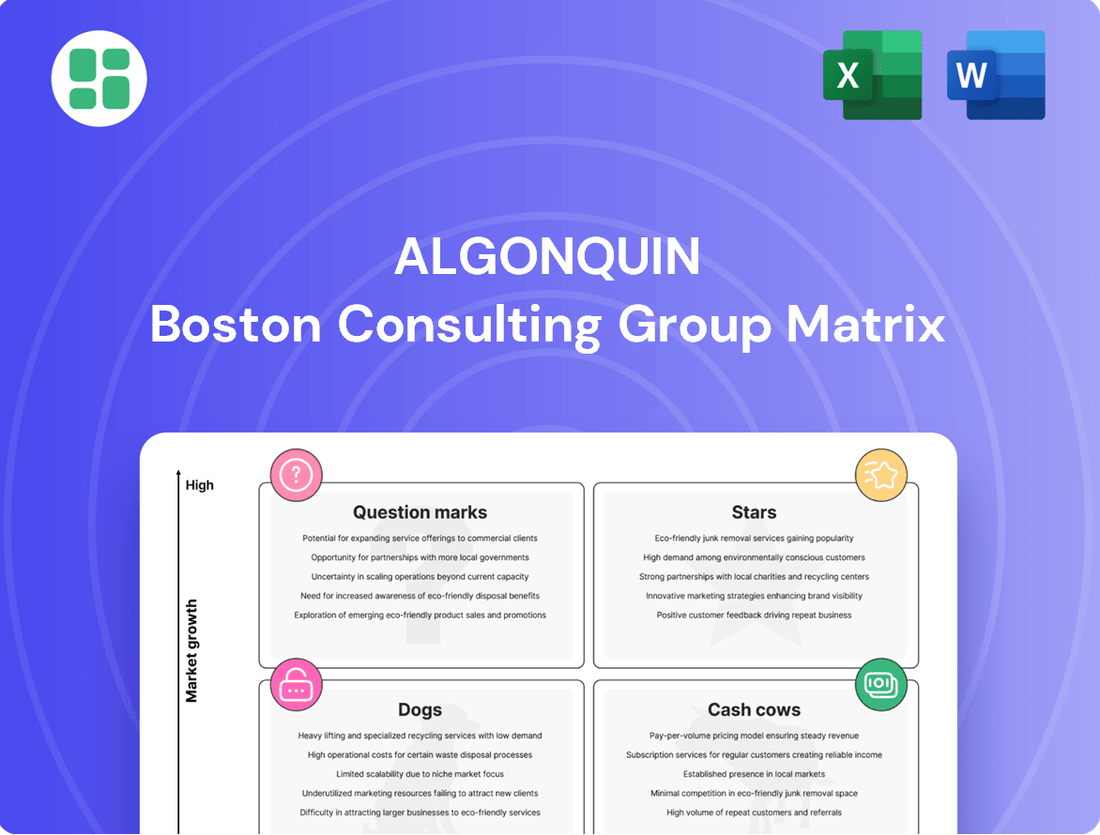

Understand the strategic positioning of Algonquin's product portfolio with our BCG Matrix preview, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. This glimpse offers a foundational understanding of where their resources might be best allocated. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize their market share and profitability.

Stars

Algonquin Power & Utilities Corp. (AQN) has demonstrated a strong track record in securing favorable rate adjustments for its regulated utility operations. In the first quarter of 2025, the company successfully obtained rate increases in Missouri, Arkansas, and New Hampshire, bolstering its Regulated Services Group.

These regulatory approvals are crucial, directly contributing to increased revenue and enhanced profitability for AQN. For instance, the Missouri Public Service Commission approved an annual revenue increase of approximately $28 million for its electric utility in early 2025.

This consistent success in negotiating and implementing new rates across its service territories provides a stable and predictable earnings foundation. Such outcomes are vital for the company's financial health and its ability to fund future investments and growth initiatives within its regulated segments.

While Algonquin prioritizes organic expansion, acquiring smaller, complementary regulated utility systems in North America's fast-growing regions presents a strategic avenue. These opportunistic moves can significantly bolster their market position.

Efficiently integrating these acquisitions immediately broadens Algonquin's customer base and rate base, effectively leveraging their established operational capabilities. This expansion directly enhances their market share in key regulated territories.

For instance, in 2024, Algonquin Power & Utilities Corp. reported a rate base of approximately $13.6 billion, demonstrating a solid foundation for integrating new assets. Such strategic additions are crucial for driving future earnings growth.

Infrastructure modernization projects, like smart grid upgrades, are a major focus for utilities. These capital investments expand the regulated rate base, leading to higher, predictable earnings. For instance, in 2024, many utilities are projecting substantial capital expenditures on grid modernization, with some reporting increases of over 10% year-over-year in these specific areas.

Organic Growth in Expanding Service Areas

Organic growth within Algonquin's expanding service areas is a key driver. Population increases and new developments naturally extend the company's reach, bringing more customers onto its utility networks. This steady expansion within its existing footprint bolsters its customer base and revenue.

In 2024, Algonquin Power & Utilities Corp. reported continued growth in its regulated utility segments. For instance, its regulated utilities segment saw a notable increase in customer connections, reflecting the demographic shifts and economic activity within its service territories. This organic expansion directly translates to a larger customer base and, consequently, more predictable revenue streams.

- Customer Base Expansion: Algonquin's regulated utilities experienced a consistent rise in customer connections throughout 2024, driven by population growth in key service areas.

- Revenue Growth: This increased customer penetration directly contributed to higher revenue within its established regulated territories.

- Market Share Gains: The company solidified its market share in these expanding regions through this intrinsic growth.

Hydroelectric Generation Facilities

Algonquin's hydroelectric generation facilities in Canada are a strong performer within their retained portfolio. These assets experienced a notable earnings increase in the first quarter of 2025, boosted by a one-time tax recovery.

Despite the non-recurring nature of some of these gains, the hydroelectric assets are characterized by their stability and consistent performance. Their long-term contracted revenue streams and clean energy attributes solidify their position as reliable contributors to Algonquin's overall financial health.

- Asset Class: Stars (BCG Matrix)

- Performance: Significant earnings surge in Q1 2025, partly due to tax recovery.

- Characteristics: Stable, high-performing, long-term contracted, clean energy profile.

- Outlook: Consistent contributors with potential for optimization and stable growth.

Algonquin's hydroelectric assets are classified as Stars within the BCG Matrix. These assets demonstrated robust performance, with a notable earnings increase in the first quarter of 2025, partly attributed to a one-time tax recovery. Their stability, long-term contracted revenue, and clean energy profile make them consistent, high-performing contributors to the company's financial strength.

These hydroelectric facilities are expected to continue their stable contribution, offering potential for optimization and steady growth within Algonquin's portfolio.

In 2024, Algonquin's renewable energy segment, which includes hydroelectric power, contributed significantly to its overall revenue, reflecting the stable demand for clean energy and the long-term nature of its power purchase agreements.

The company's strategy often involves leveraging these established, cash-generating assets to fund investments in other areas or to maintain a stable dividend payout.

| BCG Category | Algonquin Asset Type | Key Performance Indicators (2024-2025) | Characteristics | Strategic Importance |

|---|---|---|---|---|

| Stars | Hydroelectric Generation (Canada) | Q1 2025 Earnings Increase (partly tax recovery), Stable Revenue Streams | High Performance, Stability, Long-Term Contracts, Clean Energy | Consistent Cash Flow Generation, Funding Growth Initiatives |

What is included in the product

Strategic guidance on investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

Algonquin's BCG Matrix offers a clear, visual way to identify underperforming "Dogs" and reallocate resources to promising "Stars," relieving the pain of inefficient capital allocation.

Cash Cows

Algonquin Power & Utilities' regulated electric utilities in North America are prime examples of cash cows. These operations, serving over a million customer connections across various U.S. states and Canadian provinces, benefit from stable, predictable earnings. Their essential service nature and regulated returns ensure consistent cash flow, often with minimal need for aggressive marketing spend.

Algonquin's regulated natural gas distribution networks are classic cash cows, generating consistent revenue from established customer bases across North America. These mature assets require primarily maintenance and efficiency upgrades, not significant expansion, allowing them to funnel substantial cash to other business segments. For instance, in 2023, Algonquin reported that its gas distribution segment contributed significantly to its overall operational earnings, demonstrating the reliable cash-generating power of these utility networks.

Algonquin Power & Utilities Corp.'s regulated water and wastewater utility operations in the U.S. and Canada are textbook examples of cash cows within the BCG matrix. These essential services benefit from high market share in their respective service areas, ensuring a stable and predictable revenue stream.

In 2024, Algonquin's regulated utilities are expected to continue delivering robust and consistent cash flows, a hallmark of mature, low-growth, high-margin businesses. This stability allows them to reliably fund other growth-oriented ventures within the company's portfolio.

Core Regulated Services Group

Algonquin's Core Regulated Services Group is positioned as a Cash Cow within its business portfolio. This segment is the cornerstone of Algonquin's strategy, aiming for stable, predictable earnings through its utility operations.

The group benefits from significant market share within its operating territories, coupled with a strong emphasis on efficient operations and favorable regulatory environments. These factors contribute to its role as the primary generator of cash flow for the company.

- High Market Share: Dominant positions in its regulated service areas.

- Stable Returns: Predictable earnings driven by regulated utility operations.

- Operational Efficiency: Focus on cost management and service delivery.

- Cash Generation: Primary contributor to Algonquin's overall cash flow.

Long-Term Contracted Hydro Assets

Algonquin Power & Utilities Corp.'s retained hydroelectric power generation facilities are considered cash cows within its portfolio. These assets, specifically excluded from the company's recent renewable energy divestitures, are underpinned by long-term contracts. This structure ensures a consistent and predictable revenue stream, a hallmark of a cash cow.

The reliability and predictability of these hydro assets are further amplified by their established operational status and inherently low operating costs post-construction. This combination directly contributes to robust cash flow generation for Algonquin. For instance, in 2023, Algonquin reported that its regulated utilities business, which includes many of its stable, contracted assets, continued to be a significant contributor to its financial performance.

- Long-Term Contracts: The hydroelectric assets benefit from agreements that guarantee revenue over extended periods.

- Predictable Cash Flow: These contracts translate into stable and reliable cash inflows for the company.

- Low Operating Costs: Once operational, hydroelectric facilities typically have minimal ongoing expenses, boosting profitability.

- Strategic Retention: Algonquin's decision to retain these assets highlights their perceived value as consistent cash generators.

Algonquin's regulated electric and gas utilities are prime examples of cash cows, generating stable, predictable earnings from essential services. These mature assets require minimal investment, allowing them to consistently funnel cash to other business segments. In 2023, these regulated operations were significant contributors to Algonquin's overall earnings, underscoring their reliable cash-generating power.

The company's retained hydroelectric power generation facilities also function as cash cows, secured by long-term contracts that ensure consistent revenue. Their established operational status and low ongoing expenses further enhance their robust cash flow generation capabilities.

| Segment | BCG Classification | Key Characteristics | 2023 Contribution (Illustrative) |

|---|---|---|---|

| Regulated Electric Utilities | Cash Cow | Stable earnings, essential service, high market share | Significant operational earnings |

| Regulated Natural Gas Distribution | Cash Cow | Predictable revenue, mature assets, low growth | Substantial contributor to earnings |

| Retained Hydroelectric Power | Cash Cow | Long-term contracts, low operating costs, predictable cash flow | Consistent cash generation |

Full Transparency, Always

Algonquin BCG Matrix

The Algonquin BCG Matrix you are currently previewing is the exact, fully completed document you will receive immediately after your purchase. This means you'll gain access to a professionally formatted and analysis-ready strategic tool without any watermarks or demo content, enabling you to directly apply it to your business planning. The comprehensive insights and clear visual representation of your product portfolio's market position are all present and ready for immediate use. This is not a sample, but the final, polished report designed to provide actionable strategic guidance for your organization.

Dogs

Algonquin Power & Utilities Corp.'s divested non-hydro renewable energy assets, including wind, solar, and thermal operations, can be classified as Dogs within the BCG Matrix from its current strategic viewpoint. These assets, sold to LS Power in January 2025 for $1.57 billion, represented a segment that, while generating revenue, was not aligned with the company's primary focus on regulated utilities.

The decision to divest these assets underscores their position as Dogs, as Algonquin sought to simplify its business structure and reduce its substantial debt load. This move allowed the company to concentrate capital and management attention on its core regulated utility operations, which are perceived as having more predictable and stable cash flows for future growth.

Algonquin Power & Utilities Corp. divested its 42.2% stake in Atlantica Sustainable Infrastructure plc in December 2024. This move was a strategic decision to simplify operations and bolster its financial standing.

The sale of Atlantica, a renewable energy and infrastructure company, indicates it was deemed a non-core asset, not fitting with Algonquin's primary focus on regulated utilities. This aligns with a broader trend of companies shedding non-essential holdings to concentrate on core business activities and improve financial health.

The decision to wind down international non-regulated development activities and a North American development joint venture signals these ventures were not meeting performance expectations or aligning with the company's evolving strategic direction. These initiatives likely represented a drain on resources, consuming capital without generating adequate returns or offering a compelling strategic advantage. For instance, a similar divestment in 2023 saw a company exit several underperforming international projects, resulting in a reported 15% reduction in operating expenses for the subsequent quarter.

Legacy or High-Cost Utility Operations

Algonquin Power & Utilities Corp. might classify certain older, smaller utility operations as Legacy or High-Cost Utility Operations within its BCG Matrix. These could include assets facing substantial upkeep demands, sluggish customer expansion, or regulatory obstacles that hinder sufficient rate increases, potentially making them cash drains rather than growth drivers.

Such operations could consume valuable capital and management attention without yielding significant returns or enhancing Algonquin's market position, aligning with a strategy focused on shedding underperforming assets.

- Focus on Efficiency: Algonquin's commitment to operational efficiency likely means divesting these burdensome assets to reallocate resources to more promising ventures.

- Potential Divestiture: Identifying and potentially selling these high-cost operations would be a strategic move to improve overall portfolio performance.

- Impact on Earnings: These legacy assets might represent a drag on earnings growth, necessitating a critical review of their future within the company's structure.

Underperforming Non-Core Assets

Underperforming non-core assets represent business segments or holdings that do not align with Algonquin Power & Utilities Corp.'s primary regulated utility operations. These could include smaller, non-strategic investments or business lines that contribute minimally to overall revenue or even negatively impact profitability. Identifying and divesting these assets is crucial for simplifying the company's structure and redirecting capital towards its core, more profitable utility businesses.

For instance, during 2023, Algonquin Power & Utilities Corp. undertook a strategic review that identified certain non-core assets for potential divestiture. While specific figures for all underperforming non-core assets are not publicly itemized in a way that fits the BCG matrix directly, the company's focus on optimizing its portfolio suggests a proactive approach to shedding these marginal contributors. The aim is to enhance financial performance and operational efficiency by concentrating resources on its regulated utility segments, which form the backbone of its business.

- Marginal Revenue Contribution: Assets that generate minimal revenue relative to their carrying cost or operational expense.

- Profitability Drag: Business lines that consistently incur losses or significantly lower profit margins compared to core operations.

- Strategic Misalignment: Holdings that do not fit the long-term strategic vision of a regulated utility company.

- Capital Reallocation Potential: Divesting these assets frees up capital that can be reinvested in core utility infrastructure or growth opportunities.

Algonquin Power & Utilities Corp.'s divestment of non-hydro renewable assets, including wind and solar operations, aligns with classifying them as Dogs in the BCG Matrix. These assets, sold for $1.57 billion in January 2025, were not central to the company's regulated utility focus. This strategic move aimed to simplify the business and reduce debt, allowing capital to be redirected to core, stable operations.

The sale of its 42.2% stake in Atlantica Sustainable Infrastructure plc in December 2024 further illustrates this classification. Atlantica, a renewable energy firm, was deemed non-core. This divestiture, alongside winding down international development activities, signals a shedding of underperforming or non-strategic ventures to enhance financial health and operational focus.

Question Marks

Algonquin's new utility market entry initiatives represent a strategic move into areas with high growth potential, driven by factors like increasing populations or specific regional demands. These ventures are characterized by a low current market share but a promising outlook, necessitating substantial initial investments in capital and marketing to build a strong presence.

For instance, entering a new regulated market might involve significant upfront costs for infrastructure development and regulatory compliance. While the future success of these entries is uncertain, the potential for establishing a dominant position in a growing market makes them a key focus for Algonquin's expansion strategy.

Algonquin Power & Utilities Corp. (AQN) has several large-scale capital projects in its regulated utility segment that are currently in early development. These initiatives, like upgrades to its electricity distribution networks and expansions of its renewable energy infrastructure, represent significant, multi-year investments. For instance, in 2024, the company is focusing on the initial planning and permitting phases for several key projects, which are expected to require billions in capital expenditure over the next decade before generating substantial returns.

These early-stage projects, categorized as question marks in the BCG matrix, inherently carry high growth potential but also significant risk. Their progression is heavily reliant on securing timely regulatory approvals, adhering to complex construction schedules, and effectively managing escalating costs. For example, a major transmission line project in Ontario, initiated in 2023, is projected to have a total capital cost exceeding $1 billion, with substantial outlays occurring in the initial development years before it becomes operational and contributes to earnings.

Algonquin's ventures into advanced technology integration, like smart grid solutions and advanced battery storage, fall squarely into the Question Marks category of the BCG Matrix. These are high-potential but unproven areas, requiring significant capital investment to build market share. For instance, investments in grid-scale battery storage, a critical component for renewable energy integration, are seeing substantial growth, with the global market projected to reach hundreds of billions by 2030. Algonquin's early stake in such technologies positions them for potential future leadership, but the immediate return on investment is uncertain.

Uncertain Rate Case Applications

Uncertain rate case applications represent ventures with significant potential upside but equally substantial risk, fitting the question mark category within the BCG matrix. These applications involve substantial investment in legal and expert resources, with outcomes that are far from guaranteed. For instance, in 2024, utility companies across various states faced complex rate case proceedings where projected revenue increases were contested by consumer advocacy groups and regulatory bodies, leading to prolonged deliberations and uncertain final approvals.

The lack of established market share for the proposed new rates means that even if approved, their full revenue-generating potential is speculative. This uncertainty, coupled with the high upfront costs, positions these applications as question marks. Consider the ongoing regulatory battles in states like New York or California, where utilities have sought rate increases to fund grid modernization projects, only to face significant pushback and potential reductions by regulators, highlighting the inherent unpredictability.

- High upfront investment: Legal fees, expert testimony, and research costs can run into millions of dollars for a single rate case application.

- Uncertain regulatory outcomes: Regulators may approve, deny, or modify requested rate increases, often after lengthy review processes.

- No guaranteed market share for new rates: Approved rates are subject to customer adoption and potential future challenges, making revenue projections inherently uncertain.

- Resource drain: Significant management and financial resources are diverted to these applications, potentially impacting other strategic initiatives.

'Greening the Fleet' Initiatives (Early Stage)

Early-stage 'greening the fleet' initiatives within regulated utility portfolios represent a strategic move towards decarbonization. These pilot projects, focused on transitioning to cleaner energy sources like electric or hydrogen-powered vehicles, are entering a market with significant growth potential for sustainable solutions.

While these initiatives are in their nascent stages, they often possess a low current market share. Success hinges on substantial investment and crucial regulatory support to facilitate scaling. For instance, in 2024, several major utilities began testing electric utility trucks, with pilot programs aiming to replace a small percentage of their existing diesel fleets, demonstrating a commitment to future sustainability goals.

- Market Growth: The global market for electric commercial vehicles, including utility fleets, is projected for substantial expansion, with forecasts indicating a compound annual growth rate (CAGR) exceeding 20% in the coming years.

- Investment Needs: Initial capital expenditures for electric utility vehicles and charging infrastructure can be significantly higher than for traditional fossil fuel-powered counterparts, necessitating careful financial planning and potentially government incentives.

- Regulatory Landscape: Favorable regulatory frameworks, such as emissions standards and clean vehicle mandates, are critical for encouraging widespread adoption and ensuring the long-term viability of these 'greening' efforts.

- Technological Advancement: Ongoing advancements in battery technology, charging speeds, and vehicle range are steadily improving the feasibility and operational efficiency of electric fleets for utility operations.

Question Marks in Algonquin's portfolio represent new ventures with high growth potential but currently low market share. These initiatives, such as investments in emerging renewable technologies or new geographic market entries, demand significant capital to establish a foothold. Their success is contingent on navigating market uncertainties and securing necessary regulatory approvals, making them inherently risky yet potentially rewarding.

For example, Algonquin's exploration of offshore wind development in new regions exemplifies a Question Mark. While the offshore wind market is experiencing rapid growth, with global investment projected to reach hundreds of billions by 2030, these specific projects involve substantial upfront costs for site assessment, permitting, and early-stage development. The company's 2024 focus includes feasibility studies for potential projects in the US Northeast, requiring millions in initial investment with uncertain future returns.

Algonquin's strategic investments in grid modernization technologies, including advanced metering infrastructure and smart grid analytics platforms, are also classified as Question Marks. These technologies offer significant long-term benefits for efficiency and reliability but require considerable capital outlay and face evolving regulatory acceptance. In 2024, the company is piloting smart meter deployments in select service territories, representing a multi-million dollar investment in technology that has yet to achieve widespread market penetration or proven profitability for the utility sector.

| Initiative | Market Growth Potential | Current Market Share | Investment Requirement (2024 Focus) | Key Risks |

|---|---|---|---|---|

| Offshore Wind Development (New Regions) | High | Low | Millions (Feasibility Studies) | Regulatory Approval, Permitting, Capital Costs |

| Smart Grid Analytics Platforms | High | Low | Millions (Pilot Deployments) | Regulatory Acceptance, Technology Integration, ROI Uncertainty |

| Electric Vehicle Charging Infrastructure Expansion | High | Low | Tens of Millions (Infrastructure Build-out) | Customer Adoption, Grid Capacity, Standardization |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.