Algonquin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algonquin Bundle

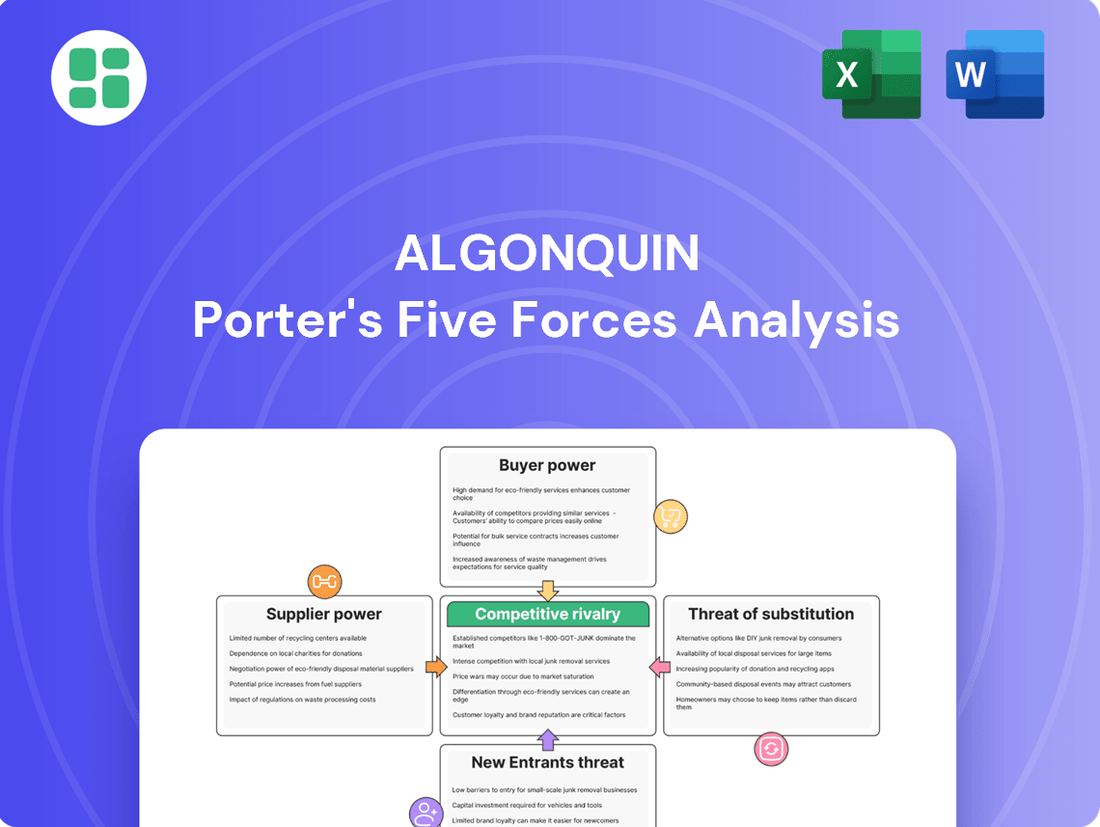

Algonquin's competitive landscape is shaped by the interplay of buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Algonquin’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of critical inputs such as natural gas, specialized utility infrastructure equipment, and renewable energy components like wind turbines and solar panels can wield considerable bargaining power. This is particularly true when their respective markets are highly concentrated, meaning a few dominant players control supply, or when there are limited acceptable substitutes available. For instance, Algonquin Power & Utilities Corp. (APUC), with its recent strategic pivot towards regulated utilities, faces increased dependence on specific suppliers for grid modernization and maintenance technologies, potentially amplifying supplier leverage.

The heavily regulated utility sector, where Algonquin Power & Utilities Corp. (APUC) operates, significantly shapes supplier dynamics. While regulators don't typically set supplier prices directly, APUC's ability to recover fuel and infrastructure costs from customers, contingent on regulatory approval, can temper supplier leverage. For instance, in 2024, APUC's rate filings often include detailed justifications for fuel costs, allowing for negotiation with suppliers to ensure reasonableness.

Suppliers providing highly specialized technology, particularly for advanced grid systems or intricate renewable energy installations, can leverage their unique offerings to command higher prices. For instance, companies specializing in advanced battery storage solutions for grid stabilization, a crucial component even after a renewables business sale, might see their bargaining power increase due to the proprietary nature of their technology. The significant investment required to switch such specialized infrastructure, often running into millions for utility-scale projects, further solidifies their advantageous position.

Labor and Service Providers

The bargaining power of labor and specialized service providers for Algonquin Power & Utilities Corp. (APUC) is a significant factor. The availability and cost of skilled labor are crucial for utility operations, maintenance, and the development of new infrastructure, such as transmission lines. Shortages in these specialized skill sets can directly inflate operational expenses for APUC.

In 2024, the demand for skilled trades in the energy sector remained robust. For instance, the U.S. Bureau of Labor Statistics projected a 4% growth for electricians between 2022 and 2032, a rate faster than the average for all occupations. Similarly, the demand for power line installers and distributors was expected to grow by 5% during the same period. This sustained demand, coupled with potential retirements within the existing workforce, can empower labor suppliers and specialized contractors to negotiate higher wages and fees.

- Skilled Labor Shortages: Persistent demand for electricians and power line technicians can increase labor costs.

- Increased Operational Expenses: Higher wages and contractor fees directly impact APUC's operating budget.

- Project Delays: A lack of available skilled labor could lead to delays in critical infrastructure projects, incurring additional costs.

- Competitive Bidding: Specialized service providers can leverage market demand to command premium pricing for their expertise.

Financing and Capital Markets

The bargaining power of suppliers in the Financing and Capital Markets for utility companies like APUC is significant, primarily due to the industry's capital-intensive nature. Access to capital is not just a convenience; it’s a fundamental requirement for operations and growth. Lenders and investors, therefore, act as critical suppliers of this essential resource.

Factors influencing this supplier power include prevailing interest rates and the overall economic climate. For instance, in mid-2024, interest rates remained a key consideration for utilities seeking to finance new projects or refinance existing debt. A strong credit rating is paramount; APUC's commitment to maintaining an investment-grade rating, such as BBB+ or higher, directly mitigates the bargaining power of capital providers. This focus ensures more favorable borrowing terms and access to a wider pool of investors.

- Interest Rate Environment: As of early 2024, benchmark interest rates, like the Federal Reserve's target range, influence the cost of capital for all utilities.

- Credit Ratings: APUC's investment-grade credit rating is a key lever in negotiating terms with lenders and bondholders.

- Market Liquidity: The availability and demand for utility bonds in capital markets can shift supplier leverage.

Suppliers of specialized equipment and critical inputs hold significant sway, especially when few alternatives exist or when their markets are concentrated. For Algonquin Power & Utilities Corp. (APUC), this translates to potential leverage for providers of advanced grid technology or unique renewable energy components. The cost and complexity of switching these specialized suppliers, often involving millions in utility-scale projects, further solidify their advantageous position.

The bargaining power of suppliers is amplified when they offer unique or highly specialized products, particularly in areas like advanced grid modernization or sophisticated renewable energy technology. For APUC, companies providing proprietary battery storage solutions, for example, can command higher prices due to the limited availability of comparable alternatives and the substantial investment required for switching, which can run into millions for large-scale utility projects.

Labor suppliers and specialized service providers can exert considerable bargaining power, especially given the current demand for skilled trades in the energy sector. In 2024, projected growth for electricians and power line installers remained robust, indicating a tight labor market. This sustained demand, coupled with potential workforce retirements, empowers these suppliers to negotiate higher wages and fees, directly impacting APUC's operational expenses and project timelines.

| Supplier Type | Key Factors Influencing Power | Impact on APUC | 2024 Data/Trends |

|---|---|---|---|

| Specialized Equipment Providers | Concentrated markets, limited substitutes, proprietary technology | Higher equipment costs, potential project delays | Demand for advanced grid tech remains strong |

| Skilled Labor & Contractors | Labor shortages, high demand for specialized skills | Increased labor costs, potential project delays | Projected 4-5% growth for electricians/power line installers (BLS) |

| Capital Markets (Lenders/Investors) | Interest rates, credit ratings, market liquidity | Higher cost of capital, restricted access to funding | Benchmark interest rates influencing borrowing costs |

What is included in the product

Analyzes the competitive intensity within Algonquin's industry by examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Instantly visualize competitive pressures with a dynamic, interactive dashboard that highlights key threats and opportunities.

Customers Bargaining Power

For Algonquin Power & Utilities Corp. (APUC), the bargaining power of customers is notably constrained because it operates in highly regulated markets for essential services like natural gas, water, and electricity. Regulatory bodies, not individual consumers, primarily determine the pricing for these services. This means customers have very little leverage to negotiate lower rates directly with APUC.

Furthermore, the indispensable nature of utility services significantly reduces customers' ability to switch providers or forgo the service altogether. For instance, in 2024, residential electricity consumption remained a necessity across APUC's service territories, with customers relying on consistent supply for daily operations. This inherent demand, coupled with regulatory price controls, effectively neutralizes much of the potential bargaining power customers might otherwise wield.

While individual residential customers typically wield little bargaining power due to the essential nature of electricity and limited alternatives, large industrial or commercial clients can exert more influence. These significant customers, especially those with substantial energy consumption or the capacity for on-site generation, might negotiate for more favorable terms. However, even for these larger entities, electricity rates are often constrained by regulatory bodies, limiting their ultimate leverage.

For regulated utility services, switching costs for customers are exceptionally high, primarily due to being tethered to existing infrastructure like gas lines, water pipes, and electricity grids. This inherent lock-in significantly curtails customer power, as transitioning to an alternative provider is often impractical or outright impossible.

In 2024, the average household in the United States spent approximately $2,500 on utility services, encompassing electricity, natural gas, water, and waste management. The substantial investment in physical infrastructure connecting homes to utility networks creates a formidable barrier to switching, effectively cementing customer dependence on incumbent providers.

Regulatory Oversight of Customer Service

Regulatory bodies play a significant role in shaping customer service standards and billing procedures for utilities like Algonquin Power & Utilities Corp. (APUC). These commissions act as a check on the company's practices, giving customers an indirect but powerful avenue to voice concerns.

While customers typically cannot directly negotiate their utility rates, they can leverage regulatory complaints to influence service quality and billing transparency. For instance, investigations into billing irregularities experienced by APUC customers in states such as Missouri, Arkansas, and New Hampshire in recent years demonstrate this dynamic. Such regulatory scrutiny can result in financial penalties or mandates for operational improvements, effectively increasing the bargaining power of customers through the regulatory channel.

- Regulatory Oversight: Commissions set and enforce customer service standards.

- Complaint Mechanism: Customers can file complaints, influencing company practices.

- Impact of Investigations: Past issues in Missouri, Arkansas, and New Hampshire highlight regulatory intervention potential.

Demand Management and Efficiency

Customers can indirectly influence Algonquin's power by cutting back on their energy use through efficiency upgrades or conservation efforts. For instance, in 2023, residential electricity consumption per customer in Ontario saw a slight decrease compared to 2022, reflecting a growing trend in demand management.

While these actions don't immediately affect current rates, a consistent drop in overall demand can significantly impact Algonquin's long-term revenue forecasts. This, in turn, can lead to adjustments in their planned capital expenditures for infrastructure and generation capacity.

- Demand Reduction Impact: Lowered consumption by customers can signal a need for revised revenue projections.

- Capital Expenditure Influence: Sustained demand decreases may prompt a reevaluation of future investment plans.

- Efficiency as a Tool: Customer adoption of energy-saving technologies indirectly pressures utilities to adapt their business models.

- 2023 Data Point: Residential electricity consumption per customer in Ontario showed a marginal decline in 2023, indicating a potential shift in demand patterns.

The bargaining power of customers for Algonquin Power & Utilities Corp. (APUC) is generally low due to the essential nature of utility services and strict regulatory oversight. While large commercial clients might have some leverage, their ability to negotiate is still constrained by regulated pricing structures.

Customers can indirectly exert influence through conservation efforts and by utilizing regulatory channels for complaints, which can lead to operational adjustments by APUC. For example, a continued trend of reduced energy consumption, as seen in slight declines in residential usage in some regions in 2023, can impact a utility's long-term revenue forecasts and investment strategies.

| Customer Influence Factor | Impact on APUC | 2023/2024 Data/Observation |

|---|---|---|

| Essential Service Nature | Low switching capability, high reliance | Residential electricity consumption remains a necessity. |

| Regulatory Pricing | Limits direct customer negotiation power | Commissions set rates, overriding individual customer demands. |

| Switching Costs | High due to infrastructure lock-in | Customers are physically connected to existing networks. |

| Conservation/Efficiency | Can impact long-term revenue forecasts | Marginal decline in residential electricity consumption per customer in Ontario in 2023. |

Preview the Actual Deliverable

Algonquin Porter's Five Forces Analysis

This preview showcases the complete Algonquin Porter's Five Forces Analysis, detailing competitive rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ready for your strategic planning needs.

Rivalry Among Competitors

Algonquin Power & Utilities Corp. (APUC) operates in a highly regulated utility sector, which inherently limits direct competitive rivalry. The company's focus on electricity generation and distribution, along with water and wastewater services, means it often functions within established geographic monopolies or duopolies. This structure means that competition isn't primarily driven by price wars, but rather by operational efficiency and the ability to secure favorable regulatory approvals.

In 2024, the utility industry's competitive landscape is shaped by these regulatory frameworks rather than aggressive market share battles. For instance, APUC's regulated utilities, like its operations in New York and Illinois, are subject to rate-setting processes that allow for cost recovery and a reasonable rate of return. This stability, while limiting intense rivalry, necessitates a focus on maintaining high service quality and demonstrating operational excellence to regulators and customers alike.

Algonquin Power & Utilities Corp. (APUC) has strategically positioned itself as a pure-play regulated utility following the divestiture of its renewable energy assets, excluding hydro. This focus sharpens its competitive edge on operational excellence and customer satisfaction.

The competitive landscape for APUC now centers on attracting investment capital and securing more favorable regulatory decisions compared to its utility peers. For instance, in 2023, APUC reported a return on equity of 8.5%, a figure investors will scrutinize against industry averages when allocating capital.

The North American utility sector is dominated by significant, long-standing companies such as Fortis. These entities vie for crucial resources like capital, skilled labor, and avenues for expansion, including the acquisition of smaller utility operations. For instance, Fortis, with its substantial asset base, actively pursues growth, impacting the competitive dynamics for all market participants.

Capital Investment and Infrastructure Development

Competitive rivalry in the capital investment and infrastructure development sector for utilities is intense. Companies vie for opportunities in grid modernization, transmission, and distribution projects, which are essential for future growth and maintaining service reliability. For instance, in 2024, significant investments are being channeled into upgrading aging infrastructure and expanding renewable energy integration. Utilities must also navigate complex regulatory landscapes to gain approval for these large-scale projects and ensure cost recovery mechanisms are favorable.

This rivalry extends to securing the necessary capital and executing these complex projects efficiently. Successful project execution directly impacts a utility's ability to meet demand, integrate new energy sources, and maintain competitive operational costs. The pressure to innovate and adopt new technologies, such as smart grid solutions and advanced metering infrastructure, further fuels this competition. Utilities are increasingly focused on demonstrating the economic and operational benefits of their proposed investments to regulators and stakeholders.

- Grid Modernization Investment: Utilities are committing billions to modernize their grids, with projected spending in the US alone reaching hundreds of billions by the late 2020s to accommodate distributed energy resources and enhance resilience.

- Transmission Expansion Needs: The demand for new transmission lines is critical for connecting renewable energy sources, with estimates suggesting a need for thousands of miles of new high-voltage lines in the coming decade to meet decarbonization goals.

- Regulatory Hurdles: Gaining approval for major infrastructure projects can be a lengthy process, with utilities often facing scrutiny over cost-effectiveness and environmental impact, influencing the pace and scale of development.

- Competition for Capital: Utilities compete not only with each other but also with other infrastructure-heavy industries for access to capital markets, making a strong financial standing and clear investment case paramount.

Regulatory Rate Cases and Approvals

Competitive rivalry in the utility sector is heavily influenced by regulatory rate cases, where companies like Algonquin Power & Utilities Corp. must demonstrate their need for adjusted pricing and returns. Success here directly impacts financial health and investor perception.

Algonquin Power, for instance, actively engages in these processes. In 2023, the company was involved in numerous rate filings across its service territories. For example, its Kentucky Power subsidiary filed for a rate increase that, if approved as requested, would impact customer bills. The outcomes of these cases, often involving negotiations and public hearings, are critical for Algonquin's ability to fund infrastructure upgrades and maintain profitability.

- Rate Case Performance: Utilities compete on their ability to secure favorable rate adjustments from regulators, directly affecting revenue and profitability.

- Return on Equity (ROE): Regulatory bodies set allowed ROEs, which are key metrics for utility competitiveness and attractiveness to investors.

- 2023 Filings: Algonquin Power was actively involved in multiple rate case filings across its operating regions in 2023, seeking to adjust rates for services.

Competitive rivalry in the utility sector, while less direct than in other industries, is intensely focused on operational efficiency and securing favorable regulatory approvals. Companies like Algonquin Power & Utilities Corp. (APUC) compete by demonstrating strong financial performance and the ability to manage costs effectively within regulated frameworks.

In 2024, the battle for capital investment and the ability to execute large-scale infrastructure projects, such as grid modernization and transmission expansion, defines much of the rivalry. Utilities must also contend with the need to integrate renewable energy sources, requiring significant innovation and strategic planning.

The primary arena for competition remains the regulatory process, where utilities present their cases for rate adjustments and investment recovery. APUC's success in these rate cases, like those in 2023, directly influences its financial health and its standing against peers like Fortis, which also actively seeks growth opportunities.

Utilities are also in a continuous competition to attract investment capital, with a strong emphasis on demonstrating a reliable return on equity. For instance, APUC's 2023 reported ROE of 8.5% is a key metric investors will compare against industry benchmarks.

| Competitor | 2023 Reported ROE (Approx.) | Key Competitive Focus |

|---|---|---|

| Algonquin Power & Utilities Corp. (APUC) | 8.5% | Operational efficiency, regulatory approvals, capital investment execution |

| Fortis Inc. | ~8.0% - 9.0% (estimated based on industry averages) | Asset acquisition, infrastructure development, diversification |

SSubstitutes Threaten

The rise of distributed energy resources (DERs) like rooftop solar and battery storage poses a significant threat. Customers can increasingly generate their own power, lessening their dependence on traditional utility providers. This shift is fueled by falling technology costs and supportive government policies, with residential solar installations in the US alone seeing a substantial increase in recent years, reaching new records in 2024.

The threat of substitutes for Algonquin Power & Utilities Corp. (APUC) is notably influenced by energy efficiency and conservation efforts. Customers can significantly reduce their reliance on natural gas, water, and electricity through adopting energy-efficient appliances, enhancing home insulation, and modifying their daily habits. For instance, in 2023, the U.S. Department of Energy reported that energy-efficient appliances alone can reduce household energy consumption by up to 20%.

While these actions don't replace the fundamental need for utility services, they directly impact APUC's revenue streams and future growth potential by lowering overall demand. This trend is expected to continue as awareness and technological advancements in energy conservation accelerate, presenting a persistent challenge to traditional utility models.

The threat of substitutes for natural gas utility services is growing, primarily driven by the increasing adoption of electrification. Heat pumps and other electric heating and cooling systems are emerging as viable alternatives, directly competing with natural gas furnaces. For instance, in 2023, the U.S. Department of Energy reported a significant uptick in heat pump installations, with sales increasing by approximately 15% year-over-year.

Government policies are further accelerating this substitution trend. Many regions are implementing incentives and mandates aimed at promoting cleaner energy sources and reducing reliance on fossil fuels. For example, several U.S. states have set targets to achieve 100% clean electricity by 2030 or 2035, which indirectly encourages the switch to electric heating and cooling solutions over natural gas.

Water Conservation Technologies

The threat of substitutes for water utility services is growing as water conservation technologies become more sophisticated and accessible. These innovations directly address the volume of water consumed, presenting a long-term challenge to traditional demand patterns.

Advanced water-saving fixtures, such as low-flow toilets and showerheads, can significantly reduce residential water usage. For instance, the U.S. Environmental Protection Agency (EPA) estimates that installing EPA WaterSense labeled fixtures can save households thousands of gallons of water per year. Drought-resistant landscaping, often referred to as xeriscaping, also offers a substantial substitute for high-water-demand lawns and gardens, particularly in arid regions. In 2024, many municipalities are incentivizing or mandating the adoption of these practices.

- Water-Saving Fixtures: EPA WaterSense labeled toilets use 1.28 gallons per flush or less, compared to older models that could use 3.5 gallons or more.

- Drought-Resistant Landscaping: Xeriscaping can reduce outdoor water use by up to 50-70% in many areas.

- Industrial Process Optimization: Industries are increasingly adopting closed-loop water systems and water recycling technologies, reducing their reliance on fresh municipal water supplies.

Technological Advancements in Energy Storage

Technological advancements, particularly in energy storage, present a significant threat of substitutes for traditional energy providers. Innovations in battery technology, both for large-scale utility applications and smaller, behind-the-meter systems for individual consumers, are making energy independence more attainable. This means customers can increasingly rely on stored energy, especially during peak demand periods, reducing their need for grid-supplied electricity. For instance, by mid-2024, the global energy storage market was projected to reach hundreds of billions of dollars, with battery technologies like lithium-ion leading the charge. This growth directly translates to a stronger substitute offering for conventional power sources.

These emerging storage solutions can act as direct substitutes for grid services by providing power when it's most expensive or unavailable. Consider the increasing adoption of residential solar coupled with battery storage. In 2024, the number of homes with solar and storage systems continued to climb, offering a compelling alternative to purchasing power from the utility. This shift diminishes the captive customer base for traditional energy suppliers, forcing them to compete with these increasingly viable and cost-effective substitutes.

The threat is amplified by the falling costs associated with these technologies. As battery production scales up, prices continue to decrease, making energy storage more accessible to a wider range of consumers and businesses. This trend is expected to accelerate, further strengthening the position of substitutes in the energy market.

- Battery Storage Market Growth: Projections indicated the global energy storage market could exceed $300 billion by 2025, driven by battery advancements.

- Residential Adoption: The number of U.S. homes with solar and storage systems saw significant year-over-year increases in 2023 and early 2024.

- Cost Reduction Trends: Lithium-ion battery pack prices, a key component of storage, have fallen by over 90% in the last decade, making them increasingly competitive.

- Grid Service Substitution: Advanced storage systems can provide ancillary services like frequency regulation, directly competing with grid-based solutions.

The threat of substitutes for Algonquin Power & Utilities Corp. (APUC) is multifaceted, encompassing energy efficiency, distributed generation, and electrification. Customers can reduce their reliance on traditional utility services through various means, impacting revenue and growth potential.

Energy efficiency measures, such as upgrading to energy-efficient appliances and improving home insulation, can significantly lower household consumption. For example, the U.S. Department of Energy reported in 2023 that efficient appliances can cut energy use by up to 20%. Similarly, the increasing adoption of distributed energy resources like rooftop solar and battery storage allows customers to generate their own power, lessening dependence on utilities. Residential solar installations in the U.S. reached record levels in 2024.

Electrification, particularly the shift towards heat pumps and electric heating systems, poses a direct substitute threat to natural gas services. U.S. heat pump sales saw an approximate 15% year-over-year increase in 2023. Furthermore, advancements in water conservation technologies, including low-flow fixtures and xeriscaping, are reducing demand for water utility services. EPA WaterSense labeled fixtures can save thousands of gallons annually, and xeriscaping can cut outdoor water use by up to 70% in arid regions, with municipalities increasingly incentivizing these practices in 2024.

| Substitute Category | Specific Example | Impact on Demand | Key Data Point (2023-2024) |

|---|---|---|---|

| Energy Efficiency | Energy-Efficient Appliances | Reduces overall energy consumption | Up to 20% reduction in household energy use (DOE, 2023) |

| Distributed Generation | Rooftop Solar + Battery Storage | Decreases reliance on grid electricity | Record residential solar installations in U.S. (2024) |

| Electrification | Heat Pumps | Direct substitute for natural gas heating | ~15% year-over-year increase in U.S. heat pump sales (2023) |

| Water Conservation | Low-Flow Fixtures | Reduces water utility consumption | Thousands of gallons saved annually per household (EPA) |

| Water Conservation | Xeriscaping | Reduces demand for landscape watering | Up to 50-70% reduction in outdoor water use (various regions) |

Entrants Threaten

The sheer scale of investment needed to establish operations in the utility sector, particularly in areas like renewable energy generation or grid modernization, presents a formidable barrier. For instance, building a new utility-scale solar farm can cost hundreds of millions of dollars, and that's just for one project.

These extensive capital requirements, encompassing everything from power plants to transmission lines and distribution networks, mean that only well-established entities or those with substantial backing can realistically consider entering the market. This inherent capital intensity significantly deters new competitors from challenging incumbent utilities.

New entrants into the utility sector, like Algonquin Power & Utilities Corp. (APUC), confront significant regulatory hurdles. These include obtaining numerous licenses, permits, and rate approvals from various state and federal agencies, a process that can be both complex and time-consuming. For instance, in 2023, APUC navigated a multitude of regulatory filings across its service territories, demonstrating the ongoing nature of compliance.

This extensive regulatory landscape acts as a substantial barrier to entry, effectively protecting established players like APUC. The sheer volume and intricacy of compliance requirements demand considerable resources and expertise, making it difficult for new companies to enter and compete on a level playing field. The capital and time investment needed to clear these regulatory obstacles are substantial.

Established infrastructure and economies of scale present a formidable barrier to new entrants in the utility sector. Incumbent utilities possess vast, existing networks for power generation, transmission, and distribution, along with established customer service operations. For instance, in 2024, the U.S. electric utility industry's capital expenditures were projected to exceed $150 billion, largely for maintaining and upgrading these extensive physical assets.

Replicating this intricate and costly infrastructure represents a significant hurdle for any new player. The sheer capital investment required to build out comparable networks, coupled with the ongoing operational and maintenance expenses that benefit from existing scale, makes entry exceptionally challenging. This inherent advantage for incumbents significantly dampens the threat of new entrants.

Public Utility Status and Legal Monopolies

Algonquin Power & Utilities Corp. (APUC) benefits significantly from its public utility status, which often translates into legal monopolies or quasi-monopolies in its service territories. This regulatory structure, designed to ensure consistent and reliable energy delivery, acts as a substantial deterrent for potential new entrants aiming to directly challenge APUC's core regulated operations.

These exclusive rights mean that new companies cannot simply set up competing infrastructure without extensive regulatory approval, which is rarely granted for established utility services. For instance, in 2024, many of APUC's regulated operating subsidiaries, like those in Ontario, Canada, function under long-term, government-sanctioned service agreements that effectively block direct competition.

- Legal Monopolies: APUC's regulated utilities often hold exclusive rights to serve specific geographic areas, a primary barrier to entry.

- Regulatory Hurdles: New entrants face significant legal and regulatory challenges in establishing competing infrastructure for essential utility services.

- Service Reliability Mandate: The focus on ensuring reliable service, a key public utility function, further solidifies the position of incumbent providers like APUC.

Access to Fuel and Water Resources

Securing reliable and cost-effective access to natural gas supply or water sources, along with the associated transportation and distribution rights, presents a substantial barrier for potential new entrants into Algonquin Power & Utilities Corp.'s (APUC) core utility services.

For instance, in 2024, the energy sector continues to grapple with supply chain complexities and geopolitical factors that influence natural gas pricing and availability. APUC's established infrastructure and long-term contracts for fuel sourcing provide a significant competitive advantage, making it difficult for newcomers to match these terms.

- Infrastructure Investment: New entrants would need to make massive capital investments in pipelines and distribution networks, mirroring APUC's extensive existing assets.

- Supply Contracts: Securing favorable, long-term fuel supply agreements, similar to those APUC holds, is a major hurdle due to established relationships and volume commitments.

- Regulatory Hurdles: Gaining the necessary permits and rights-of-way for resource transportation and distribution is a time-consuming and capital-intensive process, often favoring incumbents.

- Water Rights: For water utilities, securing and maintaining water rights, especially in water-scarce regions, is a critical and often legally complex barrier to entry.

The threat of new entrants for Algonquin Power & Utilities Corp. (APUC) is significantly mitigated by the immense capital requirements and established infrastructure. Building new power generation facilities, transmission lines, and distribution networks demands hundreds of millions, if not billions, of dollars, a sum that deters most potential competitors.

Furthermore, the utility sector is heavily regulated, requiring new companies to navigate a complex web of licenses, permits, and rate approvals. This regulatory labyrinth, coupled with the need to replicate APUC's extensive and costly existing assets, creates substantial barriers to entry.

APUC's status as a regulated utility often grants it legal monopolies in its service territories, meaning new entrants cannot simply build competing infrastructure without extensive and rarely granted regulatory approval. Securing essential resources like natural gas supply and water rights also presents considerable hurdles due to established contracts and complex permitting processes.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Intensity | High cost of building and maintaining utility infrastructure | Prohibitive for most new companies | U.S. electric utility capex projected > $150 billion |

| Regulatory Hurdles | Complex licensing, permits, and rate approvals | Time-consuming and resource-intensive | Ongoing regulatory filings across multiple jurisdictions |

| Economies of Scale | Incumbents benefit from existing, large-scale operations | Difficult for new entrants to match cost efficiency | Established networks for generation, transmission, distribution |

| Legal Monopolies/Quasi-Monopolies | Exclusive rights in service territories | Direct competition is often legally blocked | Long-term service agreements for regulated subsidiaries |

| Resource Access & Contracts | Securing fuel supply and water rights | Favors incumbents with established relationships and volume | Supply chain complexities and geopolitical factors affecting natural gas |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Algonquin Power & Utilities Corp. is built upon a robust foundation of data, including the company's annual reports, investor presentations, and filings with regulatory bodies like the SEC. This ensures a comprehensive understanding of their financial health and strategic positioning.