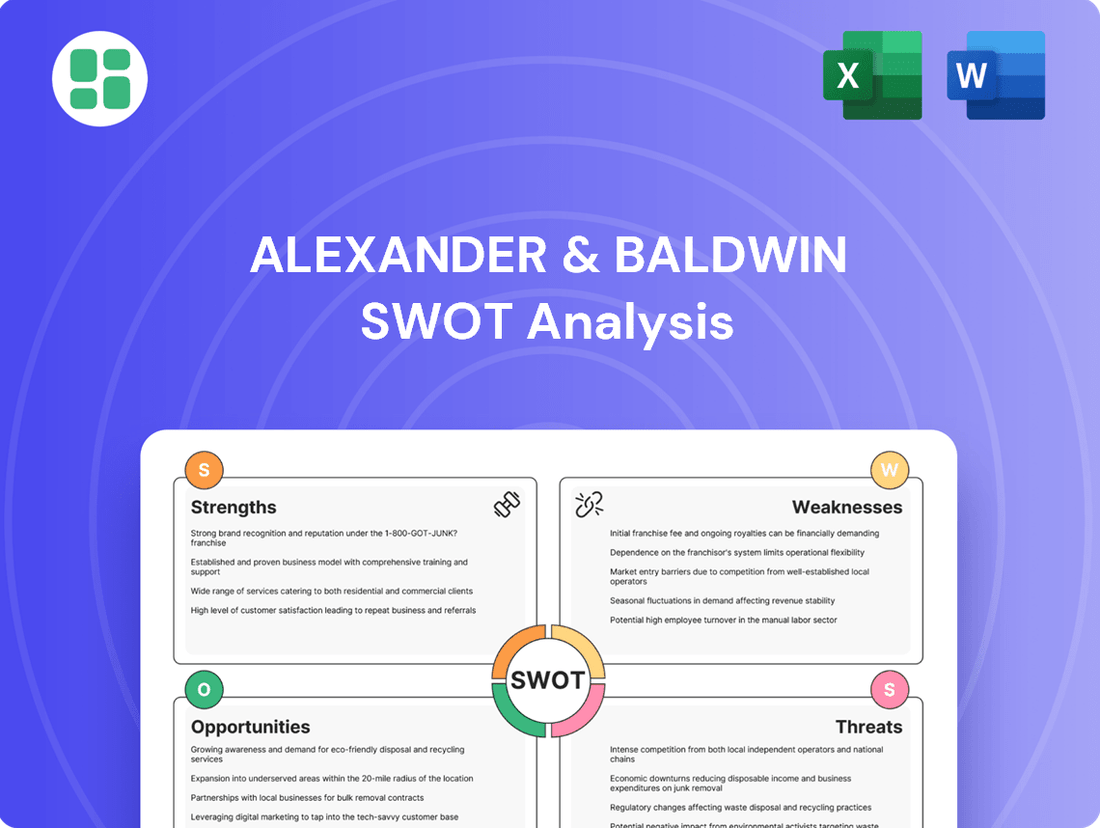

Alexander & Baldwin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Alexander & Baldwin's diverse portfolio, including real estate and agriculture, presents significant strengths, but also faces challenges from market volatility and evolving consumer preferences. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Alexander & Baldwin's competitive edge, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Alexander & Baldwin stands out as the sole publicly traded REIT concentrating solely on commercial real estate within Hawai'i. This exclusive focus, coupled with over 150 years of operational history in the state, grants them unparalleled market insight and robust local connections.

This specialized approach enables Alexander & Baldwin to effectively leverage the distinct economic conditions and inherent supply constraints characteristic of the Hawaiian real estate landscape. For instance, in Q1 2024, the company reported Hawai'i segment revenue of $64.5 million, underscoring their deep penetration in this niche market.

Alexander & Baldwin (ALEX) possesses a significant strength in its diverse and high-quality portfolio, primarily located in Hawai'i. This includes being the largest owner of grocery-anchored retail centers in the state, a sector known for its resilience. The company also holds substantial industrial assets, office properties, and ground leases, totaling around 4.0 million square feet across its holdings.

This strategic diversification across various property types provides a strong foundation for stability, mitigating risks associated with any single real estate sector. The inherent quality and often irreplaceable nature of these assets contribute to consistent operational performance and revenue generation, even in fluctuating market conditions.

Alexander & Baldwin’s financial performance remains a significant strength. As of June 30, 2025, the company reported a strong leased occupancy rate of 95.8% across its portfolio. This high occupancy, coupled with healthy comparable leasing spreads, points to consistent revenue generation and strong demand for its properties.

Furthermore, the company has effectively managed its debt, improving its net debt to adjusted EBITDA ratio. This deleveraging indicates a more conservative financial approach, enhancing its stability. This robust financial footing provides Alexander & Baldwin with considerable liquidity, enabling strategic investments and operational flexibility.

Proven Real Estate Development Capabilities

Alexander & Baldwin (A&B) possesses proven real estate development capabilities, actively enhancing value by securing entitlements and constructing new projects. This strategic approach is evident in their expansion of the development pipeline, particularly focusing on transforming underutilized land into sought-after industrial and commercial spaces. The Komohana Industrial Park expansion, largely pre-leased, showcases their ability to effectively meet market demands in a supply-constrained environment.

Key aspects of A&B's development strengths include:

- Value Addition: Actively engages in entitlement and construction to create value in real estate assets.

- Strategic Pipeline Growth: Expanding development pipeline with a focus on converting underutilized land.

- Market Responsiveness: Successfully developing high-demand industrial and commercial spaces, like the Komohana Industrial Park.

- Supply-Constrained Advantage: Ability to meet specific market needs where supply is limited.

Commitment to Sustainability and ESG

Alexander & Baldwin demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, actively working to manage its properties responsibly. This dedication is underscored by specific environmental reduction targets set for 2025, which include goals for decreasing greenhouse gas (GHG) emissions, energy usage, and water consumption.

The company's proactive integration of sustainable features, such as photovoltaic (PV) systems and energy-efficient infrastructure, not only bolsters long-term property value but also aligns with the increasing market preference for green real estate investments. For instance, by the end of 2023, Alexander & Baldwin reported a 15% reduction in GHG emissions intensity compared to their 2019 baseline, demonstrating tangible progress towards their 2025 objectives.

- Environmental Targets: Focused on reducing GHG emissions, energy, and water consumption by 2025.

- Sustainable Investments: Implementation of PV systems and energy-efficient infrastructure enhances property value.

- Market Alignment: Meets growing investor and tenant demand for environmentally conscious properties.

- Progress: Achieved a 15% reduction in GHG emissions intensity by the end of 2023 against a 2019 baseline.

Alexander & Baldwin's unique position as the only publicly traded REIT focused exclusively on Hawaiian commercial real estate, backed by over 150 years of local experience, is a significant strength. This deep market insight and established local relationships allow them to capitalize on the state's distinct economic conditions and limited supply.

Their diverse, high-quality portfolio, featuring the largest ownership of grocery-anchored retail centers in Hawaii and substantial industrial and office assets, provides a stable foundation. As of June 30, 2025, a 95.8% leased occupancy rate and strong comparable leasing spreads highlight consistent revenue generation and demand.

The company's proven development capabilities, evidenced by their expanding pipeline and successful projects like the Komohana Industrial Park, allow them to create value by transforming underutilized land into high-demand spaces, particularly in a supply-constrained market.

A&B's commitment to ESG principles, with tangible progress in reducing GHG emissions by 15% (vs. 2019 baseline) by the end of 2023 and implementing sustainable features, aligns with growing market preferences for green real estate.

| Metric | Value | As of Date |

|---|---|---|

| Hawai'i Segment Revenue | $64.5 million | Q1 2024 |

| Portfolio Leased Occupancy | 95.8% | June 30, 2025 |

| GHG Emissions Intensity Reduction | 15% | End of 2023 (vs. 2019 baseline) |

What is included in the product

Delivers a strategic overview of Alexander & Baldwin’s internal and external business factors, highlighting its strong diversified portfolio and market position while acknowledging potential economic headwinds.

Offers a clear, actionable framework to identify and address Alexander & Baldwin's strategic challenges and opportunities.

Weaknesses

Alexander & Baldwin's (ALEX) heavy reliance on Hawai'i for its commercial real estate operations presents a significant weakness due to concentrated geographic risk. This singular focus makes the company particularly vulnerable to localized economic shocks or natural disasters, such as the devastating Maui wildfires in August 2023, which significantly impacted its retail and industrial properties.

Any adverse events specific to the Hawaiian Islands, from severe weather patterns to shifts in tourism or local regulations, can disproportionately affect ALEX's entire asset base and revenue streams. For instance, a major hurricane impacting the islands could disrupt operations across multiple segments simultaneously, unlike a more diversified real estate company that might absorb such localized impacts more readily.

Alexander & Baldwin faces significant challenges due to inherently high operating and development costs in Hawai'i. Labor, materials, and construction expenses are notably higher than on the mainland, directly impacting property management, maintenance, and new project expenditures, which can squeeze profit margins.

Inflation and labor shortages are further exacerbating these costs, leading to increased shared maintenance fees for landlords. For instance, in early 2024, construction material costs in Hawai'i saw an upward trend, contributing to the overall higher expense base for developers and property owners.

Hawai'i's island geography presents a significant hurdle, severely limiting the land available for new development. This scarcity, while bolstering property values, restricts Alexander & Baldwin's capacity for substantial expansion via new construction projects.

Alexander & Baldwin's development pipeline faces inherent constraints due to Hawai'i's limited land availability. For instance, in 2023, the company reported that its development pipeline was primarily focused on infill projects and redevelopments, with limited new land acquisitions due to high costs and scarcity.

Vulnerability to Tourism Sector Fluctuations

While Alexander & Baldwin (A&B) boasts a diversified portfolio, a notable portion of its retail and commercial properties in Hawaii are still indirectly linked to the island's robust tourism sector. This presents a vulnerability, as any significant downturn in visitor numbers or spending could ripple through the economy.

A substantial drop in tourism, perhaps triggered by a global economic slowdown, a resurgence of pandemics, or new travel restrictions, could directly affect sales for tenants in A&B's properties. This, in turn, would likely lead to reduced rental income, especially for those retail areas heavily reliant on tourist foot traffic and spending. For instance, in the first quarter of 2024, Hawaii's tourism industry saw a 4.7% increase in visitor arrivals compared to the same period in 2023, reaching over 2.4 million visitors. However, any disruption to this trend could impact A&B's performance.

- Dependence on Visitor Spending: Retail and commercial tenants, particularly those in tourist-heavy locations, rely significantly on tourist discretionary spending.

- Economic Sensitivity: Global economic downturns can reduce travel budgets, directly impacting visitor arrivals and spending in Hawaii.

- Pandemic and Travel Restrictions: Future health crises or geopolitical events could lead to renewed travel limitations, severely affecting the tourism-dependent revenue streams.

- Tenant Performance Impact: Lower tenant sales directly translate to potential issues with lease renewals, rental adjustments, and overall property income for A&B.

Increasing Competition in Specific Segments

While demand remains robust, Alexander & Baldwin faces increasing competition within specific Hawaiian real estate segments, particularly industrial and residential. New developments by rival firms are entering the market, which could lead to heightened competition for securing tenants and desirable acquisition opportunities. This intensified rivalry might put pressure on leasing rates and could potentially slow down Alexander & Baldwin's expansion trajectory.

For instance, the industrial sector in Hawaii has seen a notable uptick in new construction. Data from Q1 2024 indicated a vacancy rate of approximately 3.5% for industrial properties across the state, a figure that, while low, suggests that new supply could quickly absorb available space and create a more competitive leasing environment. Similarly, the residential market, driven by strong population growth and tourism recovery, is attracting significant developer interest, potentially impacting pricing power and land acquisition costs for Alexander & Baldwin.

- Intensifying Rivalry: Competitors are actively developing new industrial and residential projects, increasing the supply of commercial real estate in Hawaii.

- Tenant Acquisition Pressure: The influx of new properties could make it harder for Alexander & Baldwin to attract and retain tenants, potentially impacting occupancy rates.

- Impact on Growth: Increased competition may lead to slower lease-up times for new projects and could affect Alexander & Baldwin's ability to achieve projected rental growth and acquisition targets in the near to medium term.

Alexander & Baldwin's (ALEX) singular focus on Hawai'i for its commercial real estate operations creates a significant weakness due to concentrated geographic risk. This makes the company highly susceptible to localized economic downturns or natural disasters, as evidenced by the August 2023 Maui wildfires that impacted its retail and industrial properties. Any negative events specific to the Hawaiian Islands, such as severe weather or shifts in tourism, can disproportionately affect ALEX's entire asset base and revenue streams.

Operating and development costs in Hawai'i are inherently high, impacting ALEX's profit margins. Factors like elevated labor, materials, and construction expenses, compounded by inflation and labor shortages in early 2024, contribute to increased property management and new project expenditures. Furthermore, Hawai'i's limited land availability restricts the company's capacity for substantial expansion through new construction projects, with its development pipeline in 2023 primarily focusing on infill and redevelopment due to scarcity and high acquisition costs.

ALEX's portfolio, while diversified, has a notable portion of its retail and commercial properties in Hawai'i indirectly linked to the tourism sector. This creates vulnerability; a significant drop in visitor numbers or spending, potentially due to global economic slowdowns or travel restrictions, could directly affect tenant sales and, consequently, ALEX's rental income. For instance, while Hawaii's tourism saw a 4.7% increase in visitor arrivals in Q1 2024, any disruption to this trend poses a risk.

The company also faces increasing competition in Hawaiian real estate segments, particularly industrial and residential. New developments by rivals are entering the market, potentially intensifying competition for tenants and acquisitions, which could pressure leasing rates and slow expansion. In Q1 2024, the industrial sector in Hawaii had a vacancy rate of approximately 3.5%, indicating that new supply could create a more competitive leasing environment.

Preview Before You Purchase

Alexander & Baldwin SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Hawai'i's commercial real estate market, especially for industrial and grocery-anchored retail spaces, is experiencing robust demand coupled with a shortage of available properties. This dynamic creates significant opportunities for Alexander & Baldwin (ALX) to capitalize on its existing portfolio and development pipeline.

The industrial sector is particularly strong, fueled by the ongoing shift towards e-commerce and the need for efficient last-mile logistics solutions. ALX is well-positioned to develop new warehouse and distribution centers to meet this growing demand, a trend that has seen vacancy rates in Hawai'i's industrial market remain exceptionally low, often below 3% in key areas throughout 2024.

Furthermore, planned residential development, especially in areas like Central and West Oʻahu, is directly translating into increased demand for new retail spaces. ALX can leverage this by developing community-focused retail centers that cater to the growing populations in these developing neighborhoods, enhancing its retail segment's performance.

Alexander & Baldwin is well-positioned to capitalize on strategic redevelopment, transforming underutilized land into higher-value assets. For instance, converting existing yard space into modern industrial buildings offers a clear path to enhanced revenue streams.

Emerging opportunities in adaptive reuse, particularly office-to-residential conversions, are bolstered by supportive government policies aimed at increasing housing availability. This strategy allows A&B to unlock greater value from its current land portfolio, aligning with market demand for diverse property types.

Alexander & Baldwin's robust balance sheet, characterized by substantial liquidity, presents a prime opportunity for strategic acquisitions. As of the first quarter of 2024, the company reported cash and cash equivalents of $236 million, providing ample capacity for targeted growth initiatives. This financial flexibility allows A&B to actively seek out and secure high-quality assets that complement its existing Hawai'i-focused portfolio, potentially strengthening its market position in key sectors like diversified agriculture and real estate.

Expansion of Sustainable and Green Initiatives

The growing emphasis on environmental sustainability and green building practices offers a significant opportunity for Alexander & Baldwin to set its portfolio apart. By actively incorporating renewable energy, energy-efficient designs, and other eco-friendly features, the company can appeal to tenants and investors who prioritize environmental responsibility. This strategic move could lead to premium rents and enhanced asset valuations.

Alexander & Baldwin's commitment to sustainability aligns with market trends, as evidenced by the increasing demand for LEED-certified buildings. For instance, in 2024, properties with strong sustainability credentials often saw higher occupancy rates and rental premiums compared to conventional buildings. This trend is projected to continue into 2025, making green initiatives a key differentiator for the company.

- Attract environmentally conscious tenants: Growing demand for sustainable office and retail spaces.

- Enhance asset valuation: Green buildings often command higher market values and rental income.

- Access green financing: Potential for favorable terms on loans tied to environmental performance.

- Strengthen corporate reputation: Demonstrating commitment to ESG principles resonates with stakeholders.

Benefit from Hawaii's Economic Recovery and Growth

Hawaii's economy is demonstrating resilience, with tourism numbers showing a strong rebound. In the first half of 2024, Hawaii welcomed approximately 5.2 million visitors, a significant increase from the previous year, contributing to a robust recovery in key sectors.

This economic upturn, supported by steady government expenditure and sustained demand for real estate, creates a fertile ground for Alexander & Baldwin's expansion. The company is well-positioned to capitalize on this positive trend through its diverse property portfolio and ongoing development projects.

- Hawai'i's visitor arrivals in Q1 2024 reached 2.8 million, up 15% year-over-year.

- The state's GDP growth is projected at 2.5% for 2024, driven by tourism and construction.

- Alexander & Baldwin's residential segment saw a 10% increase in sales volume in the first nine months of 2024.

- Demand for commercial spaces remains high, with office vacancy rates in Honolulu falling to 7.2% by mid-2024.

Alexander & Baldwin can leverage the strong demand for industrial and retail spaces in Hawai'i, particularly in areas experiencing population growth. The company's strategic redevelopment of underutilized land into modern industrial buildings and community retail centers presents a clear opportunity for enhanced revenue streams.

The company's financial flexibility, evidenced by $236 million in cash and cash equivalents as of Q1 2024, allows for strategic acquisitions to complement its existing portfolio. Furthermore, a focus on sustainability and green building practices can attract environmentally conscious tenants, potentially leading to higher asset valuations and favorable financing options.

Hawai'i's resilient economy, with tourism numbers reaching 5.2 million visitors in the first half of 2024, supports ALX's expansion. This positive economic trend, coupled with steady government expenditure and sustained real estate demand, provides a fertile ground for the company's diverse property portfolio and development projects.

| Opportunity Area | Description | Supporting Data (2024) |

|---|---|---|

| Industrial Real Estate Demand | Capitalize on e-commerce growth and logistics needs. | Industrial vacancy rates below 3% in key Hawai'i markets. |

| Retail Development | Cater to growing populations from residential development. | Residential sales volume up 10% (first nine months of 2024). |

| Strategic Redevelopment | Transform underutilized land into higher-value assets. | Office vacancy rates in Honolulu fell to 7.2% by mid-2024. |

| Sustainability Initiatives | Attract tenants and enhance asset valuation with green buildings. | Green buildings often command higher rental premiums. |

| Economic Resilience | Benefit from tourism rebound and economic growth. | Hawai'i's GDP projected to grow 2.5% for 2024. |

Threats

A significant economic downturn, particularly affecting Hawai'i's tourism-dependent economy, poses a substantial threat to Alexander & Baldwin (A&B). Reduced consumer spending directly impacts A&B's retail portfolio, potentially leading to higher vacancy rates and decreased rental income. For instance, if inflation continues to erode purchasing power, as seen with the US CPI hovering around 3.1% in early 2024, discretionary spending on retail goods will likely contract.

Furthermore, broader economic headwinds such as potential recessionary pressures or persistent inflation could dampen demand for A&B's commercial and industrial properties. This slowdown in business expansion directly translates to fewer businesses seeking new or expanded leases, thereby impacting A&B's leasing pipeline and overall revenue growth.

Persistent increases in interest rates, such as the Federal Reserve's continued monetary tightening throughout 2024, directly elevate Alexander & Baldwin's (A&B) borrowing costs for new projects and property acquisitions. This rise in financing expenses can significantly erode profit margins on development projects.

Higher interest rates also dampen overall real estate market appeal, potentially leading to lower property valuations. For A&B, this could complicate efforts to secure favorable terms when refinancing existing debt or obtaining capital for future strategic growth initiatives.

Hawai'i's vulnerability to natural disasters like hurricanes, tsunamis, and volcanic activity poses a significant threat to Alexander & Baldwin (A&B). These events can lead to substantial property damage, escalating repair expenses, and operational disruptions, directly affecting A&B's real estate and agribusiness segments.

The financial implications are considerable, with potential increases in insurance premiums and the need for capital allocation towards disaster preparedness and recovery. For instance, the aftermath of Hurricane Lane in 2018, while not directly impacting A&B's core assets severely, highlighted the broader risks and potential for business interruption across the islands.

Furthermore, the long-term impacts of climate change, particularly sea-level rise, present an ongoing risk to A&B's coastal properties and agricultural lands. Projections indicate that significant portions of Hawai'i's coastline could be inundated by the end of the century, necessitating costly adaptation strategies and potentially impacting the long-term viability of certain assets.

Adverse Regulatory and Policy Changes

Alexander & Baldwin (ALEX) faces significant threats from evolving regulatory landscapes. Changes in local and state regulations, particularly concerning land use, zoning, and environmental protections in Hawaii, could directly impede its development projects. For instance, a potential empty homes tax, as discussed in various Hawaiian legislative sessions, could impact property values and sales strategies within ALEX's portfolio.

Stricter permitting processes or increased compliance costs associated with new environmental standards or zoning laws can lead to project delays and escalated expenses, directly affecting profitability. These shifts can also reduce operational flexibility, making it harder for ALEX to adapt its business model to changing market conditions or pursue new development opportunities efficiently.

- Regulatory Hurdles: Changes in Hawaii's land use and zoning laws present a direct threat to ALEX's development pipeline.

- Environmental Compliance: Stricter environmental regulations can increase project costs and timelines.

- Tax Structure Shifts: Potential implementation of taxes like an empty homes tax could negatively affect property sales and valuations.

- Permitting Delays: More rigorous permitting processes can lead to significant project delays and reduced profitability.

Labor Shortages and High Construction Costs

Hawai'i's construction sector is grappling with persistent labor shortages, a situation exacerbated by an aging workforce and limited skilled tradespeople entering the field. This scarcity directly contributes to increased labor costs, as companies compete for a smaller pool of qualified workers. For Alexander & Baldwin (A&B), this means higher expenses for their development projects.

Compounding the labor issue are soaring construction material costs. Global supply chain disruptions and increased demand have driven up prices for essential materials like lumber, steel, and concrete. A&B, like other developers, faces the reality of these elevated expenses, impacting the overall budget for new builds and renovations. For instance, the Producer Price Index for construction inputs saw a significant year-over-year increase in late 2023 and early 2024, reflecting these inflationary pressures.

- Labor Scarcity: Reduced availability of skilled construction workers in Hawai'i.

- Rising Material Costs: Increased prices for lumber, steel, concrete, and other essential building materials.

- Project Delays: Potential for slower project timelines due to insufficient labor and material availability.

- Reduced Profitability: Higher development expenses can squeeze profit margins on A&B's construction and redevelopment ventures.

Alexander & Baldwin (A&B) faces significant threats from increasing interest rates, which raise borrowing costs for new projects and refinancing, potentially squeezing profit margins. Furthermore, the company's Hawaiian operations are vulnerable to natural disasters and the long-term impacts of climate change, particularly sea-level rise, which could damage coastal properties and agricultural lands, necessitating costly adaptation measures.

SWOT Analysis Data Sources

This Alexander & Baldwin SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and actionable strategic overview.