Alexander & Baldwin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Alexander & Baldwin's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants into its diverse markets. Understanding these dynamics is crucial for grasping the company's strategic positioning and potential profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alexander & Baldwin’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hawai'i's finite land supply, a natural consequence of its island geography and ongoing conservation initiatives, significantly bolsters the bargaining power of landowners. This scarcity compels companies like Alexander & Baldwin to engage in intense competition for developable parcels, often leading to inflated acquisition costs and restricted development options. In 2024, the median price for a single-family home in Honolulu, a key market for A&B, remained exceptionally high, reflecting this land scarcity and its impact on input costs.

Suppliers of construction materials and skilled labor in Hawai'i hold significant sway over companies like Alexander & Baldwin (A&B). This is largely due to persistently high costs and the ongoing scarcity of essential resources. For example, in 2024, the cost of key building materials in Hawai'i continued to reflect global supply chain pressures and local transportation expenses, often remaining at elevated levels compared to the mainland.

The tight labor market for specialized construction trades further amplifies this bargaining power. A shortage of skilled workers, such as experienced carpenters, electricians, and plumbers, can force A&B to offer higher wages and more attractive benefits to secure necessary talent. This directly translates into increased project expenses and the potential for costly delays, impacting A&B's development timelines and overall profitability in its real estate and agricultural segments.

In Hawai'i, the complex entitlement and permitting processes are a significant factor in the bargaining power of specialized service providers. Navigating these intricate regulatory landscapes demands expertise in legal, environmental, and consulting fields. These professionals hold considerable sway because Alexander & Baldwin, like other developers, absolutely needs their specialized knowledge to move projects forward.

These expert suppliers are essential for Alexander & Baldwin to overcome regulatory hurdles in Hawai'i. Their services represent critical, and often substantial, cost components for any new development. For instance, in 2024, the average timeline for securing major development permits in Hawai'i could extend well over a year, underscoring the value and leverage held by those who can expedite or successfully manage these processes.

Access to Capital and Financing

Financial institutions that offer development loans and capital for acquisitions wield considerable influence, particularly when interest rates are volatile. Alexander & Baldwin (A&B), while possessing a robust balance sheet and a history of fixed-rate debt, is still subject to the broader capital markets' conditions and prevailing interest rate trends, which can impact their borrowing costs and access to funds for new ventures.

For instance, if interest rates rise significantly, the cost of capital for A&B's real estate development projects could increase, potentially affecting project profitability and the feasibility of new acquisitions. Conversely, a stable or declining interest rate environment can lower financing costs, making it more attractive to secure capital for expansion.

- Supplier Power Factor: Access to Capital and Financing

- Impact on A&B: Fluctuating interest rates and capital market conditions directly influence the cost and availability of financing for A&B's development and acquisition activities.

- A&B's Financial Position (as of Q1 2024): A&B reported total debt of approximately $1.2 billion, with a significant portion being fixed-rate, providing some insulation from immediate rate hikes.

- Market Context: The Federal Reserve's monetary policy and overall economic health are key determinants of interest rate trends, thereby affecting the bargaining power of lenders.

Government Regulations and Infrastructure Providers

Government bodies and utility providers function as crucial, albeit indirect, suppliers for Alexander & Baldwin, controlling essential elements like permits, zoning approvals, and vital infrastructure such as water, electricity, and transportation networks. Their influence is substantial, as these are de facto requirements for any development project. For instance, in 2023, the average time for obtaining major building permits in Hawaii, Alexander & Baldwin's primary operating region, could extend several months, directly impacting project launch schedules and associated costs.

Delays stemming from these regulatory or infrastructure providers can have a pronounced effect on Alexander & Baldwin's project timelines and, consequently, its profitability. For example, a six-month delay in securing necessary zoning changes for a planned residential development could push back revenue generation, increase financing costs, and potentially lead to a reduction in the project's overall net present value. This dependency highlights the significant bargaining power these entities hold.

- Regulatory Hurdles: Government agencies control permits and zoning, creating potential bottlenecks.

- Infrastructure Dependence: Access to water, power, and transport is dictated by utility providers.

- Timeline Impact: Delays in approvals directly affect project schedules and revenue recognition.

- Profitability Squeeze: Extended timelines can increase financing costs and reduce overall project profitability.

The bargaining power of suppliers for Alexander & Baldwin (A&B) is significantly influenced by Hawai'i's unique market dynamics. Landowners, construction material providers, skilled labor, specialized consultants, and financial institutions all wield considerable leverage due to scarcity, high costs, and regulatory complexities. In 2024, these factors continued to exert upward pressure on A&B's operational expenses and project timelines.

Hawai'i's limited land supply directly benefits landowners, driving up acquisition costs for developers like A&B. Similarly, persistent high costs for construction materials and a shortage of skilled labor in 2024 amplified the power of these suppliers. The need for specialized expertise to navigate Hawai'i's intricate permitting processes also grants significant leverage to consultants and legal professionals.

Financial institutions' influence is tied to capital market conditions and interest rates, impacting A&B's borrowing costs. Government bodies and utility providers, by controlling permits and essential infrastructure, also act as powerful indirect suppliers. Delays in approvals from these entities, which averaged several months in 2023 for major permits in Hawai'i, can significantly affect A&B's project schedules and profitability.

| Supplier Type | Key Leverage Factors | Impact on A&B (2024 Context) | Data Point/Example |

|---|---|---|---|

| Landowners | Finite land supply, island geography | Increased acquisition costs, restricted development options | Median single-family home price in Honolulu remained exceptionally high. |

| Material & Labor Suppliers | High costs, scarcity of resources, tight labor market | Elevated project expenses, potential for delays | Building material costs reflected global supply chain pressures and local transport expenses. |

| Specialized Consultants (Permitting) | Complex entitlement and permitting processes | Essential for project progression, increased cost component | Average major permit timeline in Hawai'i could exceed one year. |

| Financial Institutions | Capital market conditions, interest rate volatility | Affects borrowing costs and access to funds | A&B's total debt was approx. $1.2 billion (Q1 2024), with fixed-rate debt offering some insulation. |

| Government/Utility Providers | Control over permits, zoning, infrastructure | De facto requirements for development, potential for delays | Average major building permit times in Hawai'i could extend several months in 2023. |

What is included in the product

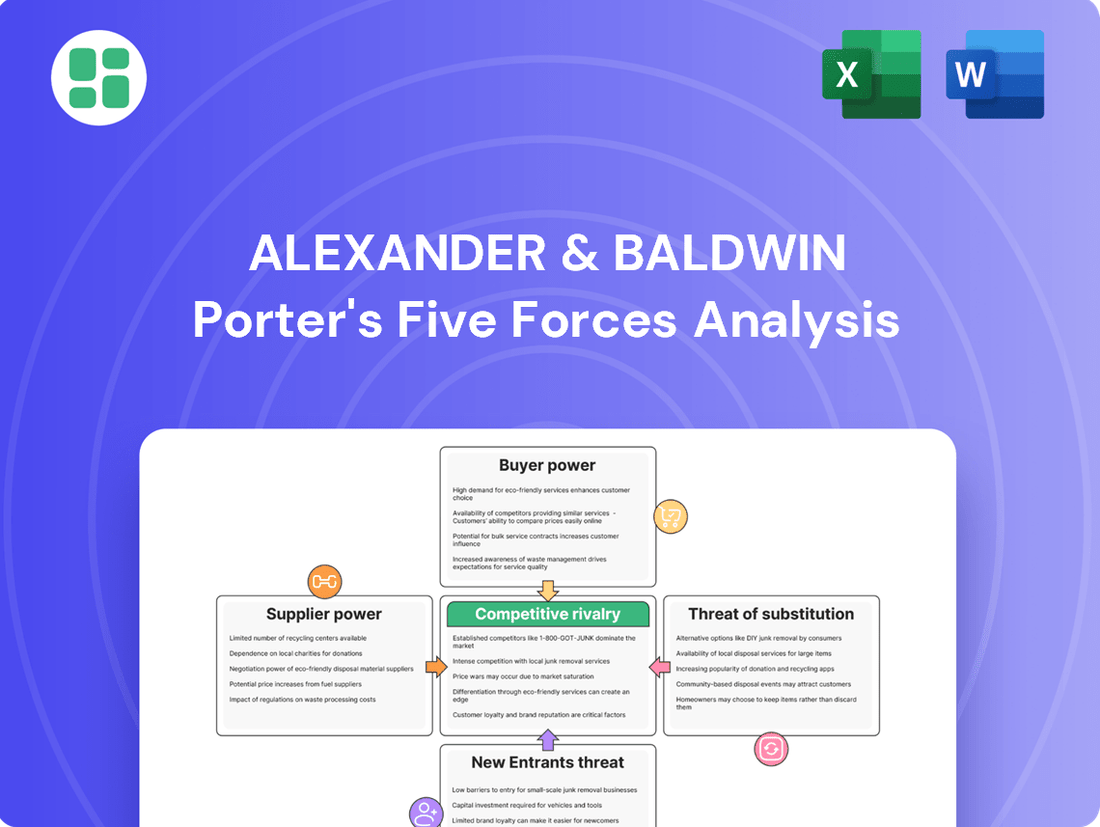

This Porter's Five Forces analysis for Alexander & Baldwin dissects the competitive landscape, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its operating industries.

Visualize competitive intensity with a dynamic Porter's Five Forces model, allowing for rapid assessment of Alexander & Baldwin's strategic landscape.

Customers Bargaining Power

Alexander & Baldwin's (A&B) diverse portfolio, encompassing grocery-anchored retail, industrial assets, and ground leases, significantly dilutes the bargaining power of any single customer segment. This broad tenant base means that the loss of one or a few tenants would not disproportionately impact A&B's overall revenue streams, thereby limiting individual customer leverage.

The essential nature of grocery-anchored retail, a key component of A&B's holdings, provides a degree of inherent resilience against customer demands. Furthermore, the exceptionally tight industrial market in Hawai'i, a market A&B actively participates in, strengthens its negotiating position with industrial tenants. As of the first quarter of 2024, Hawai'i's industrial vacancy rate hovered around 2.5%, a historically low figure that favors property owners like A&B.

Alexander & Baldwin's (A&B) properties are experiencing high occupancy rates, especially in their industrial and strategically located retail segments. This robust demand signifies a tight market for rental spaces.

For instance, A&B reported a 96.9% occupancy rate across its portfolio in the first quarter of 2024, with industrial properties reaching 98.5%. This high demand translates to reduced bargaining power for customers, as options are limited and competition for available space is fierce.

The low vacancy rates, particularly in the industrial sector which saw vacancy drop to 2.5% by the end of 2023, empower A&B. Tenants find it difficult to negotiate favorable lease terms or significant rent reductions when faced with such limited alternatives.

For commercial tenants, the decision to relocate is often weighed down by substantial switching costs. These can include the expense of fitting out a new space to meet specific business needs, the inevitable disruption to ongoing operations during the move, and the potential loss of a loyal customer base built over time in a familiar location. These financial and operational hurdles significantly limit a tenant's ability to easily jump to a competitor's property.

These high switching costs directly translate into reduced bargaining power for commercial tenants. When it's costly and inconvenient to leave, tenants are less likely to demand lower rents or more favorable lease terms, as the alternative of moving presents a greater risk. For instance, in 2024, the average cost of commercial tenant improvements in major metropolitan areas often exceeded $50 per square foot, making a simple lease renewal a more attractive option than a costly relocation.

Limited Commercial Space Alternatives in Hawai'i

The scarcity of commercial real estate in Hawai'i, particularly for specialized uses like industrial properties, significantly restricts the options for potential tenants. This limited availability means businesses have fewer alternatives when seeking suitable locations.

This constrained supply directly bolsters Alexander & Baldwin's bargaining power. With fewer competing spaces, the company is better positioned to command competitive rental rates and secure favorable lease agreements, as tenants have limited leverage to negotiate.

For instance, as of early 2024, the industrial vacancy rate in Honolulu remained exceptionally low, often hovering around 1-2%, a stark contrast to mainland averages. This tight market dynamic underscores the limited alternatives for businesses needing warehousing or distribution facilities.

- Limited Tenant Alternatives: The overall scarcity of commercial space in Hawai'i, especially for industrial assets, reduces the number of viable options for businesses.

- Strengthened Landlord Position: This scarcity empowers landlords like Alexander & Baldwin to maintain higher rental prices and more advantageous lease terms.

- Reduced Price Sensitivity: Tenants facing few alternatives are less likely to be price-sensitive, allowing Alexander & Baldwin to sustain profitability.

- Favorable Lease Structures: The market conditions enable Alexander & Baldwin to negotiate leases with longer terms and fewer concessions.

Long-Term Ground Lease Commitments

Alexander & Baldwin's extensive ground lease portfolio is a cornerstone of its business, generating predictable and enduring revenue. Tenants in these long-term agreements face substantial hurdles, including significant upfront investments and the operational disruption associated with relocating, effectively locking them into their current locations. This inherent stickiness dramatically diminishes their ability to exert downward pressure on lease terms as the contracts mature.

The company's commitment to securing these long-term ground leases, often spanning decades, creates a powerful barrier against customer price negotiation. For instance, as of the first quarter of 2024, Alexander & Baldwin reported a robust occupancy rate of 97.7% across its Hawaiian portfolio, underscoring the stability and low churn inherent in its ground lease model. This high occupancy reflects the strong tenant commitment and the limited options available for lessees seeking alternative sites, thereby curtailing their bargaining power.

- Tenant Commitment: Long-term ground leases, often 55 years or more, embed tenants with high switching costs, limiting their leverage.

- Revenue Stability: These commitments provide Alexander & Baldwin with highly predictable, long-term income streams, insulating it from short-term market fluctuations.

- Reduced Bargaining Power: The extended duration and associated tenant investments significantly weaken customers' ability to negotiate lease rates downwards over time.

Alexander & Baldwin's (A&B) diverse property holdings, particularly its essential grocery-anchored retail and tightly held industrial assets in Hawaii, significantly limit customer bargaining power. High occupancy rates, such as the 96.9% portfolio-wide occupancy reported in Q1 2024, coupled with extremely low industrial vacancy rates around 2.5% in Hawaii, mean tenants have few alternatives.

High switching costs for commercial tenants, including fit-out expenses and operational disruption, further reduce their leverage. For example, average commercial tenant improvement costs in 2024 often exceeded $50 per square foot, making relocation a costly proposition. The scarcity of specialized industrial space in Honolulu, with vacancy rates around 1-2% in early 2024, strengthens A&B's negotiating position.

A&B's extensive ground lease portfolio, often with terms of 55 years or more, locks in tenants with substantial upfront investments and operational commitments. This long-term commitment, reflected in a 97.7% occupancy rate for its Hawaiian portfolio in Q1 2024, minimizes tenant ability to negotiate lease rates downwards.

| Metric | Value (Q1 2024) | Implication for Customer Bargaining Power |

|---|---|---|

| Overall Portfolio Occupancy | 96.9% | Limited tenant alternatives, strengthening landlord position. |

| Industrial Vacancy Rate (Hawaii) | ~2.5% | Scarcity of industrial space empowers A&B. |

| Honolulu Industrial Vacancy Rate (Early 2024) | ~1-2% | Extremely limited options for industrial tenants. |

| Average Commercial Tenant Improvement Costs (2024) | >$50/sq ft | High switching costs deter tenant relocation and negotiation. |

| Ground Lease Portfolio Occupancy (Hawaii) | 97.7% | Long-term commitments reduce tenant leverage. |

Same Document Delivered

Alexander & Baldwin Porter's Five Forces Analysis

This preview shows the exact, comprehensive Alexander & Baldwin Porter's Five Forces Analysis you'll receive immediately after purchase. You're looking at the actual, professionally formatted document, meaning no surprises or placeholders will be present in your downloaded file. Once you complete your purchase, you’ll get instant access to this complete, ready-to-use analysis, allowing you to leverage its insights without delay.

Rivalry Among Competitors

Alexander & Baldwin (A&B) operates within a Hawai'i commercial real estate market that, while dominated by its position as the largest publicly traded REIT focused on the state, is still quite fragmented. This means A&B faces competition not only from other local developers and private investors but also from smaller national players looking for opportunities in the islands.

This competitive landscape necessitates A&B to actively compete for tenants across its diverse portfolio, which includes retail, office, and industrial spaces. For instance, in 2023, A&B reported a portfolio occupancy rate of 95.2%, highlighting their success in tenant retention and acquisition amidst this competition.

Furthermore, the fragmentation extends to acquisition and development opportunities. A&B must contend with various entities vying for prime land and existing properties, making strategic acquisitions and successful development projects crucial for maintaining its market leadership and growth trajectory.

Hawai'i's unique geography creates a significant hurdle for real estate companies like Alexander & Baldwin. With land being a scarce resource, the competition to acquire developable plots or existing, well-positioned properties is fierce. This scarcity naturally drives up prices, as multiple firms vie for the same limited opportunities.

In 2024, the intense demand for prime Hawaiian real estate, particularly in sought-after areas like Oahu, has led to aggressive bidding wars. For instance, transactions for commercial properties in Honolulu have frequently seen offers exceeding initial asking prices by substantial margins, directly reflecting the limited supply and high competition among developers and investors.

This elevated competition directly impacts Alexander & Baldwin's ability to expand its portfolio through acquisitions. The increased cost of acquiring land and assets means that the potential return on investment for new projects must be carefully calculated, making it more challenging to secure profitable development sites.

Competitive rivalry in the commercial real estate sector, particularly in Hawaii, hinges significantly on the quality and strategic placement of properties. Alexander & Baldwin (ALX) leverages this by focusing on owning and managing premium, necessity-driven retail centers and industrial properties in prime Hawaiian locations. This approach directly addresses tenant needs and consumer demand, setting their assets apart from those with less desirable locations or lower quality offerings.

For instance, in 2024, ALX continued to emphasize its portfolio's resilience, with its retail segment demonstrating strong performance driven by essential retail tenants. The company's strategic development projects, such as the ongoing expansion and modernization of key centers, further enhance their competitive edge by providing modern amenities and attracting high-caliber tenants, thereby commanding stronger lease rates and occupancy.

Impact of Economic Cycles and Interest Rates

Competitive rivalry within Alexander & Baldwin's sector can intensify as economic cycles shift and interest rates fluctuate. These macroeconomic factors directly impact transaction volumes and the feasibility of new development projects.

Hawaii's real estate market, while generally resilient, experiences periods where elevated interest rates can dampen demand for larger transactions. This slowdown often leads to fiercer competition among developers and investors vying for a more limited number of available deals.

- Economic Sensitivity: Real estate development and sales are highly sensitive to economic cycles. In 2024, while many markets showed recovery, rising interest rates presented a headwind for large capital expenditures, potentially increasing competition for Alexander & Baldwin.

- Interest Rate Impact: Higher interest rates, which remained a concern throughout much of 2024, increase the cost of borrowing for developers and buyers. This can reduce the number of feasible projects and buyer demand, thereby intensifying competition for existing opportunities.

- Transaction Volume: Periods of economic uncertainty or rising rates typically see a decrease in the volume of significant real estate transactions. This contraction forces companies like Alexander & Baldwin to compete more aggressively for a smaller pool of active buyers and sellers.

High Barriers to Exit for Developers

Alexander & Baldwin (ALEX) faces high barriers to exit for developers in Hawai'i. The substantial capital required for large-scale projects, coupled with lengthy development timelines, makes it difficult for companies to quickly sell off assets. For instance, commercial real estate in Hawai'i, particularly large land parcels or developed properties, is often illiquid, meaning it can take a considerable amount of time to find a buyer and complete a sale.

This illiquidity and the significant upfront investment mean that developers are often locked into their projects for extended periods. Consequently, companies like ALEX are incentivized to focus on maximizing returns from their existing Hawai'i portfolio rather than seeking rapid divestment. This can intensify competitive rivalry as firms work to extract value from their long-term holdings.

Consider these factors contributing to high exit barriers:

- Significant Capital Outlay: Large commercial real estate developments demand millions, if not billions, in upfront capital, making quick exits financially prohibitive.

- Extended Development Cycles: From planning to completion, Hawai'i real estate projects can take many years, increasing the commitment and reducing flexibility.

- Illiquidity of Hawai'i Assets: The unique market dynamics and limited buyer pool for large commercial properties in Hawai'i mean selling quickly is often not feasible.

Alexander & Baldwin (ALX) operates in a Hawaii commercial real estate market characterized by fragmentation, meaning it competes with numerous local and national players. This intense rivalry is evident in their need to actively secure and retain tenants across their retail, office, and industrial portfolios. For instance, ALX maintained a strong 95.2% occupancy rate in 2023, showcasing their competitive success.

The scarcity of prime land in Hawaii further fuels competition, driving up acquisition costs and making strategic development crucial. In 2024, this was highlighted by aggressive bidding wars for commercial properties in Honolulu, with offers frequently exceeding asking prices.

This competitive pressure is amplified by economic sensitivities; while Hawaii's market is generally resilient, rising interest rates in 2024 increased borrowing costs and potentially reduced transaction volumes, intensifying competition for available deals.

High exit barriers, due to significant capital requirements and long development cycles in Hawaii, also contribute to rivalry. Companies like ALX are incentivized to maximize returns from existing holdings rather than quick divestments, fostering sustained competition for valuable assets.

| Metric | 2023 | 2024 (Projected/Early Data) |

|---|---|---|

| Portfolio Occupancy Rate | 95.2% | Likely to remain strong, given strategic leasing efforts. |

| Hawaii Commercial Property Transactions (Honolulu) | Competitive bidding observed. | Continued aggressive bidding, with offers often exceeding asking prices. |

| Interest Rate Environment | Elevated, impacting borrowing costs. | Continued elevated rates, posing a headwind for large capital expenditures. |

SSubstitutes Threaten

The growing prevalence of e-commerce presents a significant substitute threat to traditional retail properties. While certain sectors, like grocery-anchored centers which are a core part of Alexander & Baldwin's portfolio, demonstrate greater resilience, the broader shift towards online purchasing and direct-to-consumer channels is undeniably diminishing the demand for physical retail footprints.

In 2024, e-commerce sales are projected to reach $2.7 trillion in the U.S. alone, a substantial portion of total retail. This trend directly impacts the necessity of physical stores, forcing property owners to adapt by focusing on experiential retail or mixed-use developments to remain competitive.

The increasing adoption of remote and hybrid work models poses a significant threat of substitution for traditional office spaces. While Alexander & Baldwin's (A&B) office portfolio is relatively modest, this trend could still influence demand. Companies are increasingly exploring options to reduce their physical office footprint or embrace flexible co-working arrangements, directly impacting the need for conventional office leases.

In 2024, the commercial real estate market continued to grapple with the persistent effects of remote work. Reports indicated that office vacancy rates in major U.S. markets remained elevated, with some cities experiencing double-digit percentages. This sustained shift suggests a lasting preference for flexible work arrangements, which directly substitutes the need for dedicated, long-term office leases that traditional landlords like A&B rely on.

Advances in logistics technology, like improved route planning and automated warehousing, can reduce the need for physical industrial space. For example, by mid-2024, many companies were investing heavily in supply chain visibility tools, aiming to cut down on buffer stock and thus the square footage required for storage.

While Hawaii's industrial market, with vacancy rates hovering around 2-3% in 2024, is currently tight, these efficiency gains offer a subtle substitute. Businesses focused on just-in-time inventory and streamlined distribution might find they can operate with less dedicated warehouse space, even in a constrained market.

Direct Property Ownership

For certain businesses, particularly larger enterprises with substantial capital reserves, the direct purchase of commercial property can act as a substitute for leasing from Alexander & Baldwin (A&B). This alternative allows companies to own their operational space outright, potentially offering long-term cost savings and greater control over their assets.

However, the threat of direct property ownership as a substitute is significantly tempered by the unique economic landscape of Hawai'i. The high cost of land acquisition and the inherent scarcity of available commercial real estate in the state act as considerable barriers to entry for many potential buyers.

In 2024, Hawai'i continued to face some of the highest real estate prices in the United States. For instance, commercial property values in prime locations on Oahu, where A&B has a significant presence, often exceed millions of dollars per acre, making direct purchase a less feasible option for a broad range of businesses compared to leasing.

- High Capital Outlay: Direct property purchase requires a substantial upfront investment, often in the millions of dollars, which many businesses cannot afford.

- Limited Land Availability: The scarcity of developable commercial land in Hawai'i restricts the options for direct acquisition.

- Transaction Costs: Purchasing property involves significant closing costs, including legal fees, title insurance, and transfer taxes, adding to the overall expense.

- Opportunity Cost: Capital tied up in real estate could potentially be invested in core business operations or other revenue-generating activities.

Alternative Investment Vehicles

From an investor's standpoint, numerous alternatives exist to investing in commercial real estate, which directly impacts Alexander & Baldwin (A&B). These substitutes include traditional assets like stocks and bonds, as well as other alternative investment classes such as private equity or commodities. For instance, in 2024, the S&P 500 experienced significant gains, potentially diverting capital that might otherwise flow into real estate.

While A&B's strategic focus is on Hawai'i-centric real estate, the broader investment landscape offers a vast array of choices. Investors are not confined to a single market or asset type. A strong performance in other sectors or geographic regions can easily draw capital away from A&B's core offerings. For example, the bond market in 2024 saw yields fluctuate, making it a competitive alternative for income-seeking investors.

- Stocks: In 2024, the technology sector, a common substitute, continued its upward trend, with the Nasdaq Composite showing robust year-over-year growth.

- Bonds: Treasury yields in 2024 presented attractive income opportunities, competing with the yield expectations from real estate investments.

- Other Asset Classes: The commodities market, particularly gold, saw increased investor interest in 2024 due to global economic uncertainties, offering diversification benefits.

- Real Estate Alternatives: Real Estate Investment Trusts (REITs) that focus on different property types or geographical areas also serve as substitutes, providing liquidity and diversification not always present in direct property ownership.

The threat of substitutes for Alexander & Baldwin's (A&B) real estate assets is multifaceted, ranging from evolving consumer behaviors to alternative investment vehicles. The growing e-commerce trend, with U.S. sales projected to hit $2.7 trillion in 2024, directly challenges traditional retail property demand, though A&B's grocery-anchored centers show resilience.

Remote work models also substitute for office spaces, contributing to elevated vacancy rates in major U.S. markets during 2024, a trend that impacts demand for conventional office leases.

Advances in logistics technology offer a subtle substitute by potentially reducing the need for industrial space, even in tight markets like Hawaii where vacancy rates were around 2-3% in 2024.

For businesses, direct property ownership can substitute leasing, but high land costs in Hawaii, with commercial property values often exceeding millions per acre in 2024, limit this threat.

Investors also have numerous substitutes for real estate, including stocks like the S&P 500, which saw significant gains in 2024, and bonds offering competitive yields, diverting capital from property investments.

Entrants Threaten

Entry into Hawai'i's commercial real estate market demands immense financial resources. Acquiring land, developing properties, and managing construction costs can easily run into tens or hundreds of millions of dollars, creating a formidable hurdle for newcomers.

Alexander & Baldwin, with its deep financial reserves and established credit lines, possesses a significant advantage. This access to capital allows them to undertake large-scale projects that are simply out of reach for smaller or less capitalized potential competitors, effectively limiting the threat of new entrants.

The extreme scarcity of developable land in Hawai'i acts as a significant barrier to new entrants, making it both difficult and costly to secure suitable sites for commercial development. This inherent geographic constraint effectively shields incumbent businesses, such as Alexander & Baldwin (A&B), which possess substantial existing landholdings.

Hawai'i's regulatory landscape presents a formidable hurdle for newcomers in the real estate development sector. The state's stringent and often lengthy entitlement processes are designed to protect its unique environment and cultural heritage, but they significantly increase the cost and time required for new projects. For instance, projects can face years of reviews and approvals, adding substantial carrying costs and uncertainty for any new entrant.

Successfully navigating these complex requirements necessitates deep local expertise, considerable financial resources, and a significant time commitment. Many new firms simply lack the established relationships and understanding of the intricate local political and administrative systems that are crucial for progress. This creates a substantial barrier, effectively shielding established players like Alexander & Baldwin from direct competition by those without such specialized local knowledge and patience.

Established Local Relationships and Market Knowledge

Established local relationships and market knowledge act as significant barriers to entry for new competitors. Companies like Alexander & Baldwin have cultivated deep, long-standing connections with Hawai'i's government agencies, essential contractors, and real estate brokers. This network provides them with invaluable insights and preferential access that newcomers would struggle to replicate quickly.

New entrants must overcome the considerable hurdle of building trust and understanding the intricate local landscape. Without this established rapport and nuanced market intelligence, new players are at a distinct disadvantage. For instance, in 2024, the Hawai'i real estate market continued to show resilience, with median home prices in Honolulu reaching approximately $950,000, underscoring the importance of local expertise in navigating such a complex environment.

- Established Networks: Alexander & Baldwin benefits from decades of working with local stakeholders, facilitating smoother project approvals and operations.

- Market Nuances: Deep understanding of Hawai'i's specific economic cycles, regulatory environment, and consumer preferences is a key differentiator.

- Barriers to Entry: Newcomers face significant time and resource investment to build comparable relationships and knowledge bases.

- Competitive Advantage: This local advantage translates into operational efficiencies and a more predictable business environment for incumbents.

Brand Recognition and Tenant Relationships

Alexander & Baldwin's (ALEX) long-standing presence in Hawai'i, dating back to 1870, has cultivated significant brand recognition. This deep-rooted history, combined with a portfolio of strategically located, necessity-driven properties, fosters strong relationships with existing tenants. New entrants face a considerable hurdle in replicating this established trust and market familiarity, making it challenging to attract and retain tenants away from ALEX's proven track record.

For instance, in 2024, Alexander & Baldwin's Hawaiian portfolio continued to demonstrate resilience, with occupancy rates in its retail segment holding steady. This stability is a direct testament to the enduring tenant relationships built over decades. Any new competitor would need substantial investment to build comparable brand equity and secure a similar level of tenant loyalty.

- Established Brand Equity: ALEX benefits from decades of operation and brand building in Hawai'i.

- Tenant Loyalty: Existing relationships with a diverse tenant base provide a significant competitive advantage.

- Market Familiarity: New entrants must overcome ingrained consumer and business familiarity with ALEX's properties.

- High Barrier to Entry: Replicating ALEX's established trust and market penetration requires substantial time and resources.

The threat of new entrants into Hawai'i's commercial real estate market is significantly mitigated by substantial capital requirements, the scarcity of developable land, and complex regulatory hurdles. Alexander & Baldwin (ALEX) benefits from its deep financial reserves, extensive landholdings, and established relationships with local government and contractors. These factors create high barriers to entry, protecting ALEX's market position.

Newcomers must also contend with ALEX's strong brand recognition and tenant loyalty, built over decades of operation. In 2024, ALEX's Hawaiian retail portfolio maintained stable occupancy rates, highlighting the enduring strength of these relationships. Overcoming this established trust and market familiarity demands considerable time and resources from any potential competitor.

| Barrier Category | Description | Impact on New Entrants | ALEX Advantage |

| Capital Requirements | High costs for land acquisition and development. | Significant financial hurdle. | Deep financial reserves and credit lines. |

| Land Scarcity | Limited availability of developable land in Hawai'i. | Difficult and costly site acquisition. | Substantial existing landholdings. |

| Regulatory Environment | Stringent and lengthy entitlement processes. | Increased costs, time, and uncertainty. | Deep local expertise and established relationships. |

| Brand Equity & Tenant Loyalty | Established trust and market familiarity. | Challenging to attract and retain tenants. | Decades of operation and proven track record. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alexander & Baldwin leverages data from their annual reports, investor presentations, and public SEC filings to understand their financial health and strategic positioning.

We supplement this with industry-specific research from reputable sources like IBISWorld and market intelligence reports to gauge competitive intensity and buyer power within their operating sectors.