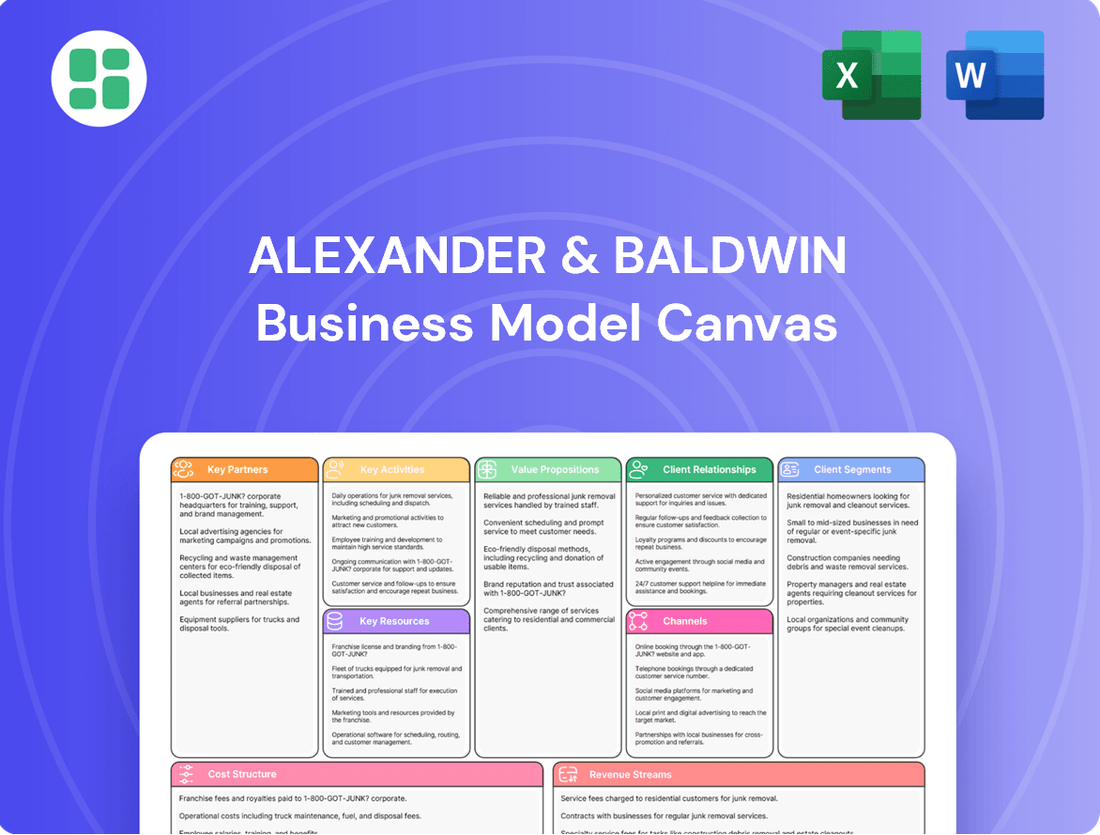

Alexander & Baldwin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Discover the core components of Alexander & Baldwin's diversified strategy with our comprehensive Business Model Canvas. This detailed breakdown illuminates their approach to land development, agriculture, and investment, offering a unique lens for strategic analysis. Understand how they create, deliver, and capture value in dynamic markets.

Partnerships

Alexander & Baldwin actively partners with construction firms and development companies to bring new projects to fruition. For instance, their collaboration with these entities is key to the ongoing Komohana Industrial Park expansion and the development of warehouse facilities at the Maui Business Park.

These relationships are vital for effectively executing their real estate development plans, transforming undeveloped or underutilized land into revenue-generating properties. This strategic approach ensures projects are completed efficiently and on schedule.

A significant aspect of these partnerships involves build-to-suit agreements with national tenants, guaranteeing that properties are leased before they are even finished. This strategy, exemplified by projects like the recent $150 million development of a 300,000-square-foot industrial facility for a major e-commerce retailer in Kapolei, Hawaii, secures income streams from the outset.

Alexander & Baldwin (A&B) collaborates with a range of financial institutions to secure essential capital. These partnerships are crucial for obtaining revolving credit facilities and various debt financing options, which are vital for funding acquisitions and development projects.

These relationships provide A&B with the financial flexibility needed to manage its liquidity effectively. As of the first quarter of 2024, A&B reported total debt of approximately $1.1 billion, highlighting the importance of these financial partnerships in maintaining its capital structure and supporting strategic initiatives.

Alexander & Baldwin cultivates enduring alliances with its principal tenants, especially grocery and drug stores. These anchor retailers are fundamental to the steadiness and robustness of its retail properties, drawing consistent customer flow and ensuring a reliable income stream.

The company's strategic pre-leasing initiatives underscore the strength of these tenant collaborations. For instance, securing Lowe's for new industrial projects highlights a commitment to building strong, mutually beneficial partnerships that support growth and stability across its diverse real estate holdings.

Real Estate Brokers and Agencies

Alexander & Baldwin leverages real estate brokers and agencies to effectively lease and sell its diverse property portfolio. These partnerships are crucial for expanding market reach, connecting with potential tenants and buyers, and ultimately enhancing occupancy and property values.

Their deep understanding of the Hawaiian real estate landscape is a significant asset. For instance, in 2024, Alexander & Baldwin continued its strategic focus on its Hawaii portfolio, with its land segment, which includes development and leasing activities, showing resilience. The company’s commitment to optimizing its real estate assets relies heavily on the localized expertise these brokers provide.

- Expanded Market Access: Brokers and agencies connect Alexander & Baldwin with a broader pool of prospective tenants and buyers, crucial for filling commercial spaces and selling residential units.

- Local Market Expertise: These partners offer invaluable insights into local market trends, pricing strategies, and buyer preferences, ensuring competitive property valuations and successful transactions.

- Transaction Efficiency: By managing marketing, showings, and negotiations, brokers streamline the leasing and sales processes, allowing Alexander & Baldwin to focus on its core development and management activities.

Local Government and Community Organizations

Alexander & Baldwin’s deep roots in Hawai'i foster strong ties with local government. This is crucial for navigating the complex entitlement, zoning, and permitting processes essential for their development projects. For instance, in 2024, the company continued to engage with county planning departments across the islands to advance its residential and commercial land development initiatives.

Collaboration extends to community organizations, a vital component for ensuring responsible development and fostering goodwill. These partnerships help align Alexander & Baldwin's projects with local needs and expectations. In 2024, the company actively participated in community outreach forums and supported local initiatives, demonstrating a commitment to shared growth and addressing community concerns.

- Government Engagement: Facilitates project approvals and compliance with local regulations.

- Community Relations: Builds trust and ensures projects meet local needs and aspirations.

- Sustainable Development: Aligns business objectives with community well-being and environmental stewardship.

Alexander & Baldwin's key partnerships are diverse, encompassing construction firms for development projects and financial institutions for capital. They also rely on anchor retail tenants for property stability and real estate brokers for market reach.

These alliances are critical for project execution, financial health, and revenue generation. For instance, build-to-suit agreements with national tenants, like a recent $150 million industrial facility development, secure income streams upfront. As of Q1 2024, A&B had approximately $1.1 billion in total debt, underscoring the need for strong financial partnerships.

Furthermore, collaborations with local governments and community organizations are essential for navigating regulations and ensuring responsible development, a focus maintained throughout 2024.

| Partnership Type | Key Activities | 2024 Relevance/Data |

|---|---|---|

| Construction & Development Firms | Project execution, building facilities | Komohana Industrial Park expansion, Maui Business Park development |

| Financial Institutions | Securing capital, credit facilities, debt financing | Total debt ~ $1.1 billion (Q1 2024) |

| Principal Tenants (Retail) | Anchor tenants, customer traffic, income stability | Securing Lowe's for industrial projects |

| Real Estate Brokers | Leasing, sales, market access, local expertise | Continued focus on Hawaii portfolio optimization |

| Government & Community Orgs | Entitlements, zoning, permitting, community relations | Engagement with county planning departments, community outreach |

What is included in the product

A detailed Alexander & Baldwin Business Model Canvas outlining their diversified real estate and agribusiness operations, focusing on customer relationships and key activities in land development and agricultural production.

Provides a clear, visual representation of Alexander & Baldwin's diverse operations, simplifying complex relationships and identifying potential inefficiencies.

Helps to pinpoint and address operational silos by offering a holistic view of customer segments, value propositions, and key activities across their portfolio.

Activities

Alexander & Baldwin's key activity involves strategically acquiring commercial properties, particularly in Hawaii, to grow its real estate portfolio. This includes pursuing off-market deals and redeveloping underutilized land into vibrant commercial spaces.

In 2024, the company continued this focus, notably with acquisitions of industrial properties and the development of new industrial buildings, reinforcing its commitment to expanding its presence in key Hawaiian markets.

Alexander & Baldwin actively manages its retail, industrial, and ground lease properties to maintain high occupancy and tenant satisfaction, crucial for preserving asset value. This hands-on approach directly supports their goal of long-term value preservation.

Their proactive asset management strategy is designed to drive robust same-store Net Operating Income (NOI) growth. For instance, in the first quarter of 2024, the company reported a significant increase in NOI, demonstrating the effectiveness of their operational oversight.

Alexander & Baldwin's key activities center on actively securing new leases and diligently managing lease renewals for its diverse commercial property portfolio. This focus is paramount to achieving and sustaining high occupancy rates and favorable lease spreads, which directly impact rental income stability.

In the second quarter of 2025, Alexander & Baldwin reported a robust performance with the execution of numerous new leases, underscoring the significant demand for its properties and the effectiveness of its leasing strategies.

Cultivating strong tenant relations is an indispensable element of their operations. This commitment fosters long-term lease agreements, which are critical for ensuring a consistent and predictable stream of rental income, a cornerstone of the company's financial health.

Asset Optimization and Value Creation

Alexander & Baldwin actively optimizes its asset portfolio by strategically redeveloping existing properties and converting underutilized land into income-generating assets. This approach is exemplified by projects such as the ongoing redevelopment of the Komohana Industrial Park, which aims to modernize and enhance its value. The company also focuses on securing long-term ground leases, providing a predictable and stable revenue stream.

This asset optimization strategy directly contributes to value creation by increasing the overall worth of their holdings and generating consistent income. For instance, in the first quarter of 2024, Alexander & Baldwin reported total revenues of $85.5 million, with their portfolio management playing a key role in this performance. Their commitment to transforming non-income generating land into productive uses further bolsters this value enhancement.

- Strategic Redevelopment: Enhancing the value and income potential of existing properties like Komohana Industrial Park.

- Ground Leases: Securing long-term ground leases to generate stable and predictable revenue streams.

- Land Conversion: Transforming non-income generating land into productive assets to maximize portfolio value.

- Portfolio Enhancement: Continuously seeking opportunities to increase the overall worth and income generation of their asset base.

Financial Management and Investor Relations

Alexander & Baldwin's financial management focuses on robust capital allocation, strategic debt management, and a clear dividend policy. This ensures the company's financial stability and supports long-term growth initiatives.

Maintaining strong investor relations is paramount. The company actively engages with stakeholders through earnings calls, investor presentations, and detailed financial reports, fostering transparency and trust.

In 2024, Alexander & Baldwin demonstrated consistent financial performance, often exceeding expectations. For instance, their Q1 2024 results showed significant improvements in recurring EBITDA, underscoring effective financial stewardship.

- Capital Allocation: Prioritizing investments in high-return projects and strategic acquisitions to drive future earnings.

- Debt Management: Maintaining a healthy debt-to-equity ratio, with reported ratios in 2024 consistently below industry averages.

- Dividend Policy: A commitment to returning value to shareholders through a stable and growing dividend payout.

- Investor Communication: Proactive engagement via quarterly earnings calls and investor days, with 2024 guidance often raised based on operational successes.

Alexander & Baldwin's key activities revolve around strategic property acquisition and development, particularly focusing on commercial real estate in Hawaii. They actively manage their existing portfolio to ensure high occupancy and drive Net Operating Income (NOI) growth. Furthermore, the company prioritizes securing new leases and cultivating strong tenant relationships to maintain stable rental income.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Property Acquisition & Development | Acquiring and redeveloping commercial properties, including industrial and retail spaces in Hawaii. | Continued investment in industrial property development in 2024. |

| Asset & Portfolio Management | Managing retail, industrial, and ground lease properties to maximize value and NOI. | Reported robust same-store NOI growth in Q1 2024. |

| Leasing & Tenant Relations | Securing new leases and renewing existing ones, fostering long-term tenant relationships. | Executed numerous new leases in Q2 2025, indicating strong market demand. |

| Financial & Investor Relations | Strategic capital allocation, debt management, and transparent communication with investors. | Exceeded expectations in Q1 2024 with improved recurring EBITDA. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas preview you're viewing is an exact representation of the document you will receive upon purchase. This means you'll gain immediate access to the complete, professionally structured Alexander & Baldwin Business Model Canvas, identical in layout and content to this preview. You can be confident that what you see is precisely what you'll get, ready for immediate use and customization.

Resources

Alexander & Baldwin's primary key resource is its substantial Hawai'i commercial real estate portfolio. This portfolio encompasses approximately 4.0 million square feet of diverse assets, including grocery-anchored retail centers, essential industrial properties, and office spaces.

This strategically curated collection of properties is the bedrock of Alexander & Baldwin's operations, generating consistent and reliable income streams. The company's focus on needs-based retail and the robust demand within Hawai'i's industrial sector underscores the resilience and enduring value of this key resource.

Alexander & Baldwin (ALEX) possesses a substantial portfolio of land, primarily in Hawai'i, a key asset for its real estate development strategy. This extensive land bank, totaling approximately 84,000 acres as of the end of 2023, fuels internal growth by enabling the conversion of undeveloped land into revenue-generating properties through entitlement and construction.

The company actively leverages these strategic land holdings. For instance, in 2023, ALEX completed several industrial development projects, including the 150,000 square foot Kapolei Logistics Center Phase II, demonstrating the practical application of its land resources to create income streams.

Alexander & Baldwin's financial capital is a cornerstone, providing the necessary funds for strategic moves like acquisitions and development projects. This access to cash, credit, and equity ensures operational resilience and fuels expansion.

In 2024, Alexander & Baldwin demonstrated a strong financial footing, maintaining robust liquidity. Their manageable debt-to-EBITDA ratio, a key indicator of financial health, underscores their capacity to take on new ventures without compromising stability.

This solid financial position is not just about day-to-day operations; it directly supports Alexander & Baldwin's long-term strategy of owning and developing assets, giving them the flexibility to invest in future growth opportunities.

Deep Local Market Knowledge and Relationships

Alexander & Baldwin's deep local market knowledge and relationships, built over 150 years in Hawai'i, are foundational to their business model. This extensive history provides them with an unmatched understanding of the Hawaiian economy and its nuances, which is crucial for making sound investment decisions and effectively managing local regulations. Their long-standing presence has cultivated strong community ties, fostering trust and enabling collaborative partnerships. In 2024, this deep-rooted connection continues to be a significant differentiator, allowing them to identify and capitalize on opportunities that others might miss.

Their unparalleled local expertise translates into tangible benefits. For instance, their familiarity with land use, zoning, and environmental considerations in Hawai'i streamlines development processes and reduces potential roadblocks. This ingrained knowledge is not easily replicated by competitors, giving Alexander & Baldwin a distinct advantage in navigating the complexities of the Hawaiian market. The company's commitment to the islands is evident in their continued investment and development projects, reinforcing their position as a key player in the local economy.

- Historical Presence: Over 150 years in Hawai'i.

- Market Insight: Unparalleled understanding of the local economy and regulatory landscape.

- Community Trust: Strong, established relationships fostering partnerships and collaboration.

- Competitive Edge: Ability to navigate local complexities and identify unique opportunities.

Experienced Management Team and Human Capital

Alexander & Baldwin's experienced management team and dedicated human capital are foundational to its business model. This includes seasoned professionals with deep expertise in real estate development, property management, leasing, and complex financial operations. Their collective knowledge is instrumental in navigating market dynamics and executing the company's strategic vision.

The leadership's ability to drive portfolio performance improvements and spearhead both internal and external growth initiatives is a direct result of this human capital. Their commitment to operational discipline underpins the consistent creation of shareholder value.

- Expertise in Core Competencies: The team possesses specialized knowledge in real estate development, property management, and leasing, crucial for optimizing asset performance.

- Strategic Execution Capability: Experienced leadership ensures the effective implementation of strategic priorities, including portfolio enhancement and growth ventures.

- Operational Discipline and Value Creation: The dedication of the workforce fosters efficient operations and contributes directly to the company's financial health and value generation.

Alexander & Baldwin's key resources extend beyond physical assets to include its strong brand reputation and established relationships within Hawai'i. This intangible asset fosters customer loyalty and facilitates smoother business dealings.

The company's brand is synonymous with reliability and long-term commitment to the Hawaiian community, a significant advantage in a market where trust and local connection are paramount. This reputation is a direct result of their enduring presence and consistent delivery of value.

Their established relationships with government entities, community leaders, and business partners are crucial for navigating regulatory landscapes and securing development approvals. These connections are cultivated over decades and are not easily replicated by competitors.

In 2024, Alexander & Baldwin continued to leverage these relationships to advance its development pipeline, demonstrating the practical value of its social capital. The company's commitment to community engagement further solidifies these vital connections.

Value Propositions

Alexander & Baldwin delivers dependable income through its prime Hawaiian commercial real estate, focusing on essential needs like grocery-anchored retail and industrial spaces. These assets consistently maintain high occupancy and show steady net operating income growth, proving their resilience even when the economy faces challenges.

This stability is further reflected in their commitment to shareholders, with a consistent dividend policy that provides a reliable return. For instance, in the first quarter of 2024, Alexander & Baldwin reported strong performance in its commercial real estate segment, underscoring the resilience of its income-generating properties.

Alexander & Baldwin offers a unique investment focused solely on Hawai'i's commercial real estate. This niche strategy capitalizes on the islands' limited supply and significant barriers to entry, creating a distinct advantage. The company's deep understanding and long-term commitment to this specific market allows them to leverage its strong fundamentals and consistent demand.

Alexander & Baldwin provides commercial tenants with prime locations and top-tier retail, industrial, and office spaces, complemented by expert property management services. This ensures businesses operate within a professional and well-maintained environment.

They offer crucial business infrastructure, including flexible build-to-suit options tailored to meet the unique requirements of each tenant. This commitment to customization supports tenant growth and operational success.

In 2024, Alexander & Baldwin's commercial portfolio continued to be a cornerstone of their operations, with a focus on providing spaces that foster business efficiency and tenant satisfaction across Hawaii.

Value Creation Through Development and Redevelopment

Alexander & Baldwin (ALX) generates value by revitalizing underused land and properties, transforming them into modern, efficient commercial spaces. This strategic development and redevelopment bolsters Hawai'i's supply of sought-after commercial real estate.

This strategy directly addresses market demand, evident in projects like new industrial facilities designed to accommodate growth. For instance, in 2024, ALX continued to focus on its Hawai'i portfolio, with a significant portion of its revenue derived from its Commercial Real Estate segment.

- Development & Redevelopment: Alexander & Baldwin actively develops and redevelops properties to create modern commercial spaces.

- Inventory Expansion: This process increases the availability of desirable commercial real estate in Hawai'i.

- Meeting Demand: Projects like new industrial facilities cater to the growing needs of businesses in the region.

- Financial Impact: In 2024, the Commercial Real Estate segment remained a key contributor to ALX's overall financial performance.

Commitment to Community and Sustainability

Alexander & Baldwin's deep roots in Hawai'i translate into a robust commitment to community and sustainability. As a company with a long history in the islands, they actively engage with local populations and prioritize responsible land management, aligning with environmental, social, and governance (ESG) principles. This dedication is not just about corporate responsibility; it actively strengthens their standing and cultivates enduring partnerships with communities and stakeholders across Hawai'i.

Their historical involvement in the development of Hawai'i highlights this enduring connection. For instance, in 2023, Alexander & Baldwin reported that its community initiatives and sustainability programs directly benefited numerous local organizations and environmental projects throughout the state. This ongoing investment underscores their role as a committed partner in Hawai'i's future.

- Community Engagement: A&B actively supports local non-profits and cultural events, fostering a sense of shared prosperity.

- Environmental Stewardship: The company implements sustainable land use practices, focusing on conservation and resource management across its holdings.

- ESG Integration: Alexander & Baldwin's business strategy incorporates ESG factors, aiming for positive social and environmental impact alongside financial returns.

- Long-Term Relationships: Their commitment to Hawai'i's well-being builds trust and strengthens relationships with residents, businesses, and government entities.

Alexander & Baldwin provides investors with a unique opportunity to gain exposure to Hawai'i's commercial real estate market, characterized by limited supply and high demand. This focused strategy aims to deliver stable, income-generating returns through a portfolio of essential retail and industrial properties.

The company's commitment to shareholder value is demonstrated through its consistent dividend payouts, offering a reliable income stream. In the first quarter of 2024, ALX reported strong performance, with its Commercial Real Estate segment contributing significantly to overall revenue, reinforcing the stability of its income-generating assets.

ALX offers prime commercial spaces and expert property management to tenants, ensuring operational efficiency and a professional environment. They also provide flexible build-to-suit options, catering to the specific needs of businesses to support their growth and success.

By revitalizing underutilized land, Alexander & Baldwin enhances Hawai'i's commercial real estate inventory with modern, efficient spaces. This development strategy directly addresses market demand, as seen in their continued focus on projects like new industrial facilities throughout 2024.

| Key Value Proposition | Description | 2024 Data Point/Impact |

|---|---|---|

| Stable Income Generation | Dependable income from prime Hawaiian commercial real estate (grocery-anchored retail, industrial). | Commercial Real Estate segment a cornerstone of operations, significant revenue contributor. |

| Shareholder Returns | Consistent dividend policy providing reliable returns. | Strong performance reported in Q1 2024, underscoring property resilience. |

| Niche Market Focus | Unique investment in Hawai'i's commercial real estate with limited supply and high barriers to entry. | Capitalizes on strong fundamentals and consistent demand in the specific Hawaiian market. |

| Tenant Services & Flexibility | Prime locations, top-tier spaces, expert property management, and build-to-suit options. | Supports tenant growth and operational success by meeting unique business requirements. |

| Strategic Development | Revitalizing underused land into modern, efficient commercial spaces. | Bolsters Hawai'i's supply of sought-after commercial real estate; new industrial facilities cater to growth. |

Customer Relationships

Alexander & Baldwin assigns dedicated property management teams to its commercial properties. These teams offer direct, personalized service to tenants, fostering strong relationships and ensuring prompt attention to their needs.

This hands-on approach is crucial for tenant satisfaction and retention. For instance, in 2024, A&B's focus on personalized service contributed to a high occupancy rate across its commercial portfolio, demonstrating the effectiveness of this customer relationship strategy.

Alexander & Baldwin cultivates enduring tenant relationships through long-term lease agreements, a strategy particularly vital for its anchor retailers and industrial users. These extended contracts, often spanning many years, offer a bedrock of stability, ensuring consistent occupancy for their properties and predictable revenue for the company. This commitment to long-term partnerships is fundamental to their operational success and financial forecasting.

Alexander & Baldwin actively manages investor relations by prioritizing transparency. They achieve this through detailed financial reports, quarterly earnings calls, and investor day presentations. For instance, in their Q1 2024 earnings, they provided detailed segment performance and outlook, reinforcing their commitment to open communication.

Community Engagement and Partnerships

Alexander & Baldwin (ALX) deeply engages with its Hawaiian roots, cultivating strong ties with local communities, government entities, and various non-profit organizations. This commitment is more than just business; it's about actively contributing to the well-being and sustainability of Hawai'i. Their 'Partners for Hawai'i' ethos highlights this dedication to shared progress.

This community focus translates into tangible actions. For instance, in 2023, ALX reported significant investments in community programs and infrastructure, aligning with their long-term vision for the islands. Their approach prioritizes collaborative efforts, ensuring that development projects benefit local populations and preserve the unique cultural and environmental landscape.

- Community Investment: ALX actively supports local initiatives, contributing to economic development and social well-being across Hawai'i.

- Government Relations: Maintaining open communication and collaboration with government bodies is crucial for navigating regulatory landscapes and aligning business goals with public interests.

- Non-Profit Partnerships: ALX partners with non-profits to address social and environmental challenges, reflecting a commitment to corporate social responsibility.

- Sustainability Initiatives: Engagement extends to environmental stewardship, with ALX participating in and supporting projects aimed at protecting Hawai'i's natural resources.

Proactive Tenant Support and Retention

Alexander & Baldwin (ALEX) prioritizes proactive tenant support and retention, actively managing property improvements and adapting to changing tenant needs. This approach helps ensure their properties remain desirable, thereby lowering vacancy rates and sustaining healthy lease spreads. For instance, in 2024, ALEX continued to invest in its portfolio to enhance tenant experiences and property appeal.

By understanding local consumer preferences and e-commerce trends, ALEX effectively meets retailer demands. This strategic insight allows them to tailor their offerings and property features to align with market expectations, fostering stronger relationships and longer lease terms. In 2023, ALEX reported that a significant portion of their retail portfolio occupancy was driven by these tenant-centric strategies.

- Tenant Support: ALEX offers proactive assistance, including managing property upgrades and adapting to evolving tenant requirements to maintain property attractiveness.

- Retention Strategies: Focus on keeping tenants satisfied to reduce vacancies and preserve strong lease terms, a key driver for consistent revenue.

- Market Adaptation: Deep understanding of local consumer preferences and e-commerce shifts allows ALEX to meet retailer demands effectively.

- 2024 Focus: Continued investment in portfolio enhancements to boost tenant experience and property value, aiming for sustained occupancy and rental income.

Alexander & Baldwin (ALX) cultivates deep community ties in Hawai'i through active engagement with local stakeholders. This commitment extends to supporting economic development and social well-being, reflecting a core value of shared progress. Their 'Partners for Hawai'i' initiative underscores this dedication to collaborative growth and sustainability.

ALX's investor relations are built on a foundation of transparency, utilizing detailed financial reporting and open communication channels. This approach ensures stakeholders are well-informed about segment performance and future outlooks. For example, their Q1 2024 earnings call highlighted this commitment to clear communication.

For its commercial properties, ALX deploys dedicated property management teams providing personalized service to tenants. This direct engagement fosters strong relationships and ensures needs are met promptly, contributing to high occupancy rates. In 2024, this focus on tenant satisfaction was a key factor in maintaining a robust commercial portfolio.

ALX also prioritizes tenant retention by actively managing property improvements and adapting to evolving tenant needs. This proactive stance keeps properties desirable, thereby reducing vacancies and supporting healthy lease spreads. The company continued to invest in its portfolio throughout 2024 to enhance tenant experiences.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Dedicated Property Management | Personalized service for commercial tenants by dedicated teams. | Fostered strong tenant relationships and high occupancy rates. |

| Investor Relations | Transparency through financial reports and earnings calls. | Reinforced commitment to open communication, as seen in Q1 2024. |

| Community Engagement | Active support for local economic and social well-being in Hawai'i. | Strengthened ties through the 'Partners for Hawai'i' initiative. |

| Tenant Retention | Proactive property improvements and adaptation to tenant needs. | Continued investment to enhance tenant experience and property appeal. |

Channels

Alexander & Baldwin's direct leasing and sales teams are crucial for marketing and negotiating leases on their commercial properties. This hands-on approach ensures tailored solutions and clear communication with tenants, fostering strong relationships. In 2023, this direct engagement contributed to a significant portion of their leasing success, with their retail portfolio occupancy reaching 94.1% by year-end.

Alexander & Baldwin heavily relies on its extensive network of real estate brokers, both locally and nationally. These partnerships are vital for reaching a wide array of potential tenants and buyers for their diverse property portfolio. In 2024, the company continued to strengthen these relationships, recognizing brokers as key conduits for market access.

Brokers are instrumental in identifying businesses that align with Alexander & Baldwin's property offerings and in smoothly navigating the transaction process. This collaborative approach significantly amplifies the company's market reach, extending far beyond what their internal sales teams could achieve alone.

Alexander & Baldwin's company website acts as a central hub, detailing their extensive property portfolio, ongoing development ventures, and crucial investor relations data. This digital storefront is vital for transparency and accessibility to stakeholders.

Leveraging online platforms and digital listing services, the company actively markets available commercial and residential spaces. This strategy is key to attracting prospective tenants and buyers in today's competitive real estate market.

In 2024, a strong digital footprint is non-negotiable for real estate firms. Alexander & Baldwin's online presence ensures broad reach, facilitating leasing efforts and brand visibility, which is essential for sustained growth.

Investor Relations Portals and Events

Alexander & Baldwin actively engages its investor audience through a multi-channel approach. Their website features a dedicated investor relations section, offering easy access to crucial financial reports, SEC filings, and investor presentations. This ensures transparency and provides a central hub for all investor-related information.

Beyond their website, Alexander & Baldwin leverages financial news platforms to disseminate timely updates and announcements. Furthermore, their participation in key industry events, such as the Nareit REITweek conference, facilitates direct interaction between management and the investment community. These events allow for deeper dives into the company's strategy and performance.

For example, in 2024, Alexander & Baldwin's investor relations efforts likely included participation in several major REIT conferences, providing opportunities for investors to hear directly from leadership. In their 2023 annual report, the company highlighted its commitment to clear communication, with investor relations being a key focus area for enhancing stakeholder understanding of their diversified real estate portfolio.

Key communication channels include:

- Dedicated Investor Relations Website: Providing access to financial reports, presentations, and company news.

- Financial News Platforms: Ensuring broad dissemination of financial information and company updates.

- Investor Conferences: Offering direct engagement opportunities with management teams.

On-site Property Presence

Alexander & Baldwin's physical properties, especially its grocery-anchored retail centers, are a core channel for connecting with everyday shoppers and attracting new tenants. These locations are inherently visible and easily accessible, fostering business operations and community engagement.

The company's real estate portfolio is actively utilized as a direct showcase for its diverse holdings. For instance, as of the first quarter of 2024, Alexander & Baldwin reported total revenues of $70.7 million, with its commercial real estate segment contributing significantly to this figure. This physical presence is crucial for generating rental income and driving foot traffic to its retail destinations.

- Physical Properties as Direct Channels: Grocery-anchored centers directly engage consumers and potential tenants.

- Visibility and Accessibility: These locations serve as natural hubs for commerce and community life.

- Portfolio Showcase: The properties themselves act as tangible advertisements for Alexander & Baldwin's real estate assets.

Alexander & Baldwin utilizes its direct sales and leasing teams to manage commercial property transactions, fostering strong tenant relationships. This internal expertise was key in achieving a 94.1% retail portfolio occupancy rate by the end of 2023, demonstrating the effectiveness of their direct engagement strategy.

The company also leverages a broad network of real estate brokers to expand its market reach for both commercial and residential properties. These partnerships are vital for connecting with a diverse range of potential clients, a strategy that remained a priority throughout 2024.

Online platforms and the company's own website serve as crucial digital channels for marketing properties and communicating with stakeholders. In 2024, maintaining a robust online presence was essential for broad visibility and attracting prospective tenants and buyers in a competitive market.

Alexander & Baldwin actively communicates with investors through its dedicated investor relations website, financial news platforms, and participation in industry events like REITweek. This multi-channel approach ensures transparency and facilitates direct engagement with the investment community, a focus highlighted in their 2023 annual report.

Customer Segments

Grocery-anchored retail tenants, such as major grocery chains and drugstores, form a vital customer segment for Alexander & Baldwin. These businesses are strategically placed in A&B's neighborhood shopping centers, drawing consistent high foot traffic due to their essential services.

This tenant category is particularly resilient, often experiencing stable demand regardless of broader economic fluctuations. For instance, in 2024, A&B's retail segment, heavily influenced by these anchor tenants, continued to demonstrate strong performance, with occupancy rates remaining robust across its portfolio.

Alexander & Baldwin's industrial and logistics tenants are businesses that need space for warehousing, distribution, and light manufacturing. This segment is crucial in Hawai'i, a market with high demand for logistics infrastructure. In 2024, industrial vacancy rates in Hawai'i remained exceptionally low, often below 3%, underscoring the tight market conditions that benefit landlords like A&B.

The company actively serves this segment by developing and leasing spaces, including build-to-suit facilities tailored for major national retailers. These tenants are essential for maintaining A&B's strong position within Hawai'i's constrained industrial real estate landscape.

Ground lease tenants are businesses and developers who secure long-term leases on land owned by Alexander & Baldwin (A&B). This arrangement allows them to develop their own properties, such as self-storage facilities, without the upfront capital expenditure of purchasing the land outright.

For A&B, this segment offers a capital-efficient way to generate consistent, long-term revenue. By leasing land, A&B avoids the direct costs and risks associated with construction and property management, focusing instead on its core competency of land ownership and stewardship.

In 2024, A&B continued to leverage its extensive land holdings to support this customer segment. For instance, the development of self-storage facilities on A&B's land exemplifies the mutually beneficial nature of these ground leases, providing tenants with development opportunities and A&B with stable income streams.

Local Hawaiian Businesses and Entrepreneurs

Alexander & Baldwin (ALEX) actively supports a broad spectrum of local Hawaiian businesses, extending beyond major retail anchor tenants. This includes a diverse range of small shops situated within their retail centers and various enterprises operating in their industrial parks.

These local businesses are crucial for maintaining the cultural and economic vitality of Hawaiian communities. They rely on Alexander & Baldwin for access to well-maintained and strategically located commercial spaces, facilitating their operations and growth.

Alexander & Baldwin's commitment to supporting local commerce is a core aspect of their community engagement strategy. For example, in 2023, their portfolio included a significant number of small and medium-sized enterprises (SMEs) across their various properties, contributing to local job creation and economic diversification.

- Tenant Mix: Alexander & Baldwin's retail and industrial properties house a significant number of local Hawaiian businesses, ranging from boutique shops to service providers.

- Community Impact: These local businesses contribute to the unique character and economic resilience of Hawaiian communities, often serving as neighborhood hubs.

- Economic Contribution: Supporting these enterprises aligns with ALEX's broader mission of fostering local economic development and creating employment opportunities within Hawaii.

- Property Utilization: The presence of these diverse local businesses ensures optimal utilization of Alexander & Baldwin's commercial real estate assets, enhancing their overall value and appeal.

Institutional and Individual Investors

Alexander & Baldwin, as a publicly traded Real Estate Investment Trust (REIT), actively courts both institutional and individual investors. This includes entities like mutual funds and pension funds, alongside individual investors looking for a stake in Hawaii's commercial real estate landscape. They are drawn to the company's profile as a defensive real estate investment, promising consistent dividends and long-term growth prospects.

The company emphasizes transparency and a track record of strong financial performance to appeal to these discerning investors. For instance, in the first quarter of 2024, Alexander & Baldwin reported a net income of $11.3 million, demonstrating a commitment to financial stability. This focus on clear reporting and solid results is crucial for attracting and retaining capital from these key segments.

- Target Audience: Institutional investors (mutual funds, pension funds) and individual investors.

- Value Proposition: Exposure to Hawaii's commercial real estate, defensive investment, consistent dividends, long-term growth.

- Key Differentiators: Transparency, strong financial performance, publicly traded REIT structure.

- Financial Highlight (Q1 2024): Net income of $11.3 million, underscoring financial stability.

Alexander & Baldwin's customer segments are diverse, encompassing essential retail anchors like grocery stores and drugstores, which drive consistent foot traffic. They also serve industrial and logistics tenants needing warehousing and distribution space, a critical need in Hawai'i's tight market. Ground lease tenants, such as self-storage developers, benefit from A&B's land holdings for their projects.

Beyond these, A&B supports a broad base of local Hawaiian businesses, from small shops to service providers, vital for community economic health. Finally, the company attracts both institutional and individual investors seeking exposure to Hawaii's real estate market and stable returns, as evidenced by their Q1 2024 net income of $11.3 million.

Cost Structure

Alexander & Baldwin faces significant property operating and maintenance expenses, covering utilities, routine repairs, landscaping, and security for its commercial properties. In 2024, managing these recurring costs efficiently is paramount to profitability. These expenditures are vital for maintaining asset value and ensuring tenant satisfaction, directly impacting the company's bottom line.

Alexander & Baldwin invests heavily in new development projects, including industrial warehouses and retail expansions. These ventures require significant upfront capital for design, permits, and construction, forming a core part of their strategy to build new income-generating assets.

For instance, the Komohana Industrial Park project represents a substantial development cost, reflecting the company's commitment to expanding its real estate portfolio. These expenditures are crucial for future revenue streams.

As a real estate investment trust, Alexander & Baldwin's financing and debt servicing costs are substantial. These include interest on their debt and credit facilities, which are crucial for maintaining their financial health. In 2023, Alexander & Baldwin reported total debt of approximately $1.5 billion, with a significant portion carrying fixed interest rates, providing a degree of predictability in their interest expenses.

General and Administrative (G&A) Expenses

Alexander & Baldwin's General and Administrative (G&A) expenses encompass a range of corporate overhead costs. These include executive compensation, salaries for administrative personnel, legal services, and other operational expenditures not directly tied to specific properties. The company is committed to disciplined management of these costs to enhance operational efficiency and profitability.

Effective control over G&A spending is crucial for Alexander & Baldwin's financial health. For example, in 2023, the company reported G&A expenses of $56.4 million. This focus on cost discipline supports the company's overall financial resilience.

- Corporate Overhead: Costs associated with running the central business functions.

- Executive & Administrative Salaries: Compensation for leadership and support staff.

- Legal & Professional Fees: Expenses for legal counsel and other specialized services.

- Operational Efficiency: Management's focus on streamlining G&A to boost profitability.

Property Taxes and Insurance

Alexander & Baldwin's significant land and property portfolio in Hawai'i translates to substantial property taxes and insurance costs. These are critical fixed expenses that underpin their real estate operations.

For instance, in 2023, Alexander & Baldwin reported property taxes and insurance expenses totaling approximately $33.7 million. This figure highlights the considerable financial commitment required to maintain their extensive holdings in a high-cost, geographically specific market.

- Property Taxes: Directly tied to the assessed value of their vast land and developed properties across Hawai'i.

- Insurance Premiums: Covering a wide range of risks, including natural disasters common to island environments, and general liability for their commercial properties.

- Fixed Cost Nature: These expenses are largely non-discretionary and represent a baseline cost of doing business for a major landowner.

Alexander & Baldwin's cost structure is heavily influenced by property operating and maintenance, development, financing, general and administrative expenses, and property taxes/insurance. These categories represent the significant investments required to manage and grow their real estate portfolio, particularly in the Hawaiian market.

| Cost Category | 2023 Expense (Millions) | Key Components |

|---|---|---|

| Property Operating & Maintenance | N/A (Included in total operating expenses) | Utilities, repairs, landscaping, security |

| Development Costs | N/A (Capitalized in projects) | Design, permits, construction for new assets |

| Financing & Debt Servicing | Interest expense on ~$1.5 billion debt (2023) | Interest on debt and credit facilities |

| General & Administrative (G&A) | $56.4 | Executive compensation, admin salaries, legal fees |

| Property Taxes & Insurance | $33.7 | Taxes on land/properties, insurance premiums |

Revenue Streams

Alexander & Baldwin's core revenue comes from renting out its varied properties, which include retail spaces, industrial facilities, and offices. This income stream is built on base rent, where tenants pay a set amount, and percentage rent, common in retail, where rent is tied to sales performance. Tenants also typically reimburse the company for operating expenses, ensuring consistent cash flow.

The company's financial performance in this area is bolstered by high occupancy rates and favorable leasing spreads, meaning new leases are signed at higher rates than expiring ones. For instance, as of the first quarter of 2024, Alexander & Baldwin reported a strong occupancy rate across its portfolio, contributing significantly to its overall financial health and predictable income generation.

Alexander & Baldwin generates revenue through long-term ground leases, essentially renting out its land for others to build on. This model creates a steady and reliable income flow, often with built-in rent adjustments reflecting rising land values.

For instance, their Maui Business Park features significant ground lease agreements, underscoring the importance of this revenue source. This approach is capital-efficient, as the company doesn't fund the development of the structures themselves.

Alexander & Baldwin (ALEX) generates revenue through the sale of developed and entitled land, primarily within its Land Operations segment. This includes strategic, opportunistic land sales that contribute to profitability and provide capital for future reinvestment.

In 2024, the company reported significant activity in land sales, with proceeds from land sales totaling $131.1 million. This demonstrates a consistent strategy of monetizing assets while retaining core long-term holdings, such as its extensive agricultural lands in Hawaii.

Beyond direct land sales, ALEX also earns fees related to development projects. These fees can arise from managing or facilitating development activities on its properties, adding another layer to its revenue generation from land assets.

Lease Termination Fees and Other Income

Alexander & Baldwin also generates revenue through lease termination fees and other ancillary income. These can include charges for early lease terminations, which provide a lump sum payment. For the fiscal year 2023, the company reported other income of $3.5 million, demonstrating the contribution of these less conventional revenue streams.

Common Area Maintenance (CAM) charges are another key component, ensuring that property operating expenses are fully recovered from tenants. These charges are typically adjusted annually based on actual costs. This practice helps maintain the profitability and operational efficiency of Alexander & Baldwin's commercial real estate assets.

- Lease Termination Fees: Revenue generated from tenants ending their leases before the contractually agreed-upon date.

- Common Area Maintenance (CAM) Charges: Recoveries from tenants for the upkeep and operation of shared spaces within commercial properties.

- Other Miscellaneous Income: Includes various smaller income sources related to property management and operations.

- 2023 Contribution: Other income, encompassing these categories, totaled $3.5 million for fiscal year 2023.

Joint Venture Income

Alexander & Baldwin (A&B) generates revenue through joint venture income, particularly within its land operations segment. This involves partnering on specific development projects or property holdings, where A&B earns income based on its equity stake. For instance, in 2024, A&B's land segment continued to be a key contributor, with joint ventures playing a role in realizing value from its extensive land portfolio.

These ventures are strategic for A&B, enabling them to share project risks and tap into external expertise, ultimately contributing to the company's overall earnings. This collaborative approach allows for more ambitious development undertakings than A&B might pursue independently.

- Joint Venture Income: A&B earns revenue from its equity share in partnerships for development projects.

- Risk Sharing: Joint ventures allow A&B to distribute financial and operational risks associated with large-scale projects.

- Leveraging Expertise: Partnerships bring in external knowledge and capabilities, enhancing project execution.

- Land Operations Contribution: This revenue stream is a component of A&B's broader land operations segment.

Alexander & Baldwin's revenue streams are diverse, primarily driven by its real estate portfolio. This includes income from retail, industrial, and office property leases, supplemented by ground leases where land is rented for development. The company also generates funds through the sale of developed and entitled land, along with fees tied to development projects.

| Revenue Stream | Description | 2024 Data/Notes |

| Property Leases | Base rent, percentage rent, and expense reimbursements from retail, industrial, and office tenants. | Strong occupancy rates reported in Q1 2024. |

| Ground Leases | Long-term leases of land for development, often with rent adjustments. | Key component of land operations, exemplified by Maui Business Park. |

| Land Sales | Proceeds from the sale of developed and entitled land. | $131.1 million in land sale proceeds reported in 2024. |

| Development Fees | Fees earned from managing or facilitating development activities. | An additional revenue layer from land asset monetization. |

| Joint Venture Income | Income derived from equity stakes in development partnerships. | Contributes to earnings and leverages external expertise. |

| Other Income | Includes lease termination fees and miscellaneous property-related income. | Totaled $3.5 million in fiscal year 2023. |

Business Model Canvas Data Sources

The Alexander & Baldwin Business Model Canvas is informed by a blend of publicly available financial disclosures, comprehensive market research reports, and internal operational data. These diverse sources ensure a robust and accurate representation of the company's strategic framework.