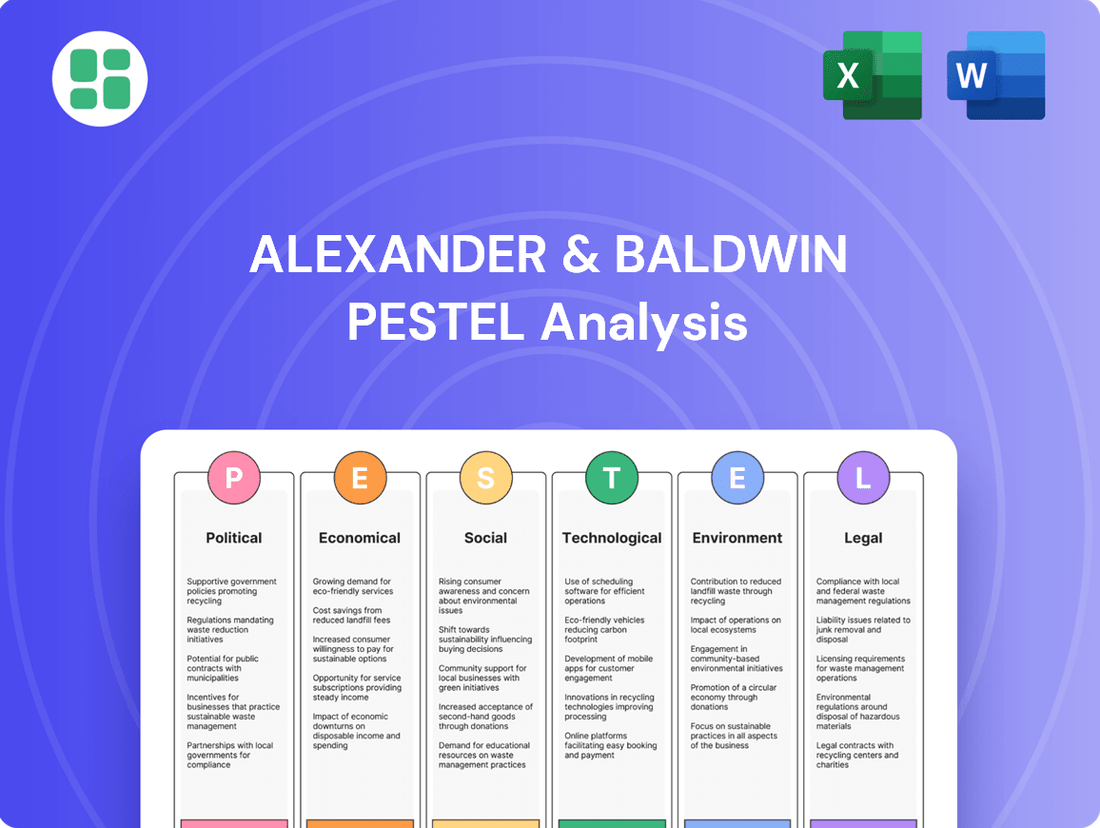

Alexander & Baldwin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Alexander & Baldwin's trajectory. Our meticulously researched PESTLE analysis offers a clear roadmap to understanding these external forces, empowering you to anticipate challenges and seize opportunities. Download the full version now to gain the strategic foresight needed to navigate this dynamic landscape.

Political factors

Hawaii's political environment, characterized by robust land use regulations, directly shapes the real estate development landscape for companies like Alexander & Baldwin. These rules dictate everything from where and what can be built to the density of projects.

Recent policy shifts, such as Honolulu City Council's Bill 64 enacted in December 2024, are designed to update these land use ordinances. This modernization effort is crucial as it can significantly alter the feasibility and nature of construction and redevelopment projects across Oʻahu, influencing Alexander & Baldwin's strategic planning for residential, commercial, and industrial ventures.

State and county governments in Hawaii are prioritizing housing solutions, with Hawaiʻi County's Bill 123, effective October 2024, allowing more Accessory Dwelling Units (ADUs). This political focus on increasing housing supply aims to tackle affordability challenges.

While Alexander & Baldwin's core business is commercial real estate, these housing policies can indirectly impact the company. A more stable and available workforce, a potential outcome of improved housing affordability, could bolster demand for commercial spaces and support overall economic health.

Hawaii's tourism policy directly shapes its economic landscape, influencing demand for commercial real estate. Government initiatives focused on visitor management and infrastructure development are crucial for sectors like retail and hospitality.

While tourism is anticipated to see modest growth in 2025, any policy shifts or reduced government support for the sector could significantly impact Alexander & Baldwin's commercial properties, particularly those tied to visitor spending. For instance, a focus on sustainable tourism could alter development priorities.

Infrastructure Investment and Development Plans

Government decisions on public infrastructure are a significant driver for real estate. Alexander & Baldwin's operations are directly impacted by investments in transportation networks, utilities, and public amenities, which can unlock new development potential or create hurdles.

For instance, the U.S. Department of Transportation's Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, is set to boost infrastructure projects nationwide through 2026. This federal spending can translate into improved accessibility for A&B's properties and stimulate demand in areas benefiting from these upgrades.

- Transportation Upgrades: Federal and state funding for highway improvements, public transit expansion, and port modernization directly affects property accessibility and value.

- Utility Modernization: Investments in grid reliability, broadband expansion, and water infrastructure are vital for supporting new residential and commercial developments.

- Public Facilities: Development of parks, schools, and community centers enhances the desirability of residential areas, positively influencing A&B's housing projects.

Political Stability and Regulatory Environment

Alexander & Baldwin's operations are significantly influenced by the political landscape in Hawaii. A stable political climate, characterized by consistent leadership and predictable policy-making, is crucial for long-term real estate development and agricultural ventures. For instance, Hawaii's consistent focus on environmental protection and land use regulations, while beneficial for sustainability, can also introduce complexities and timelines for new projects.

Changes in state or local government can lead to shifts in regulations affecting land development, zoning laws, and agricultural subsidies. The company's reliance on permits and approvals means that bureaucratic efficiency and clear regulatory pathways are paramount. Any disruption or increased red tape can directly impact project timelines and profitability.

In 2024, Hawaii's legislative session saw continued discussions around affordable housing initiatives and environmental permitting processes, areas that directly touch Alexander & Baldwin's core businesses. Navigating these evolving political priorities requires proactive engagement and adaptability to ensure continued operational success.

Key political factors for Alexander & Baldwin include:

- Consistency in Land Use and Zoning Regulations: Predictable rules are vital for development planning.

- Environmental Policy Stability: Adherence to and understanding of evolving environmental standards.

- Government Support for Agriculture: Potential impacts from subsidies or trade policies.

- Housing Policy Impact: How state and local government approaches to housing development affect the company's real estate portfolio.

Hawaii's political environment significantly influences Alexander & Baldwin's operations, particularly through land use regulations and housing policies. The state's commitment to environmental protection, while fostering sustainability, can also introduce complexities into development timelines.

Government initiatives aimed at increasing housing supply, such as the allowance of more Accessory Dwelling Units (ADUs) as seen in Hawaiʻi County's Bill 123 (effective October 2024), indirectly benefit A&B by potentially stabilizing the workforce and boosting commercial demand.

Furthermore, federal infrastructure investments, like the Bipartisan Infrastructure Law (over $1.2 trillion allocated through 2026), are crucial for improving property accessibility and stimulating demand in areas benefiting from upgrades, directly impacting A&B's real estate development potential.

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Alexander & Baldwin, providing a comprehensive overview of the external forces shaping its business landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Alexander & Baldwin's strategic discussions.

Economic factors

Hawaii's economic trajectory significantly shapes its commercial real estate landscape. The state's real Gross Domestic Product (GDP) is anticipated to see a 1.2% expansion in 2025, a positive sign for sectors like construction, real estate, and the ongoing recovery of tourism.

This projected economic uplift generally correlates with a heightened demand for commercial properties, which is a direct benefit to companies like Alexander & Baldwin that hold substantial real estate assets within the state.

Fluctuations in interest rates directly impact Alexander & Baldwin's real estate ventures. Higher rates, like those experienced through much of 2023 and into 2024, tend to dampen consumer spending and make significant real estate purchases less appealing. This can lead to slower sales and development cycles.

For instance, the Federal Reserve maintained its target range for the federal funds rate at 5.25%-5.50% through early 2024, a level that historically makes borrowing more expensive. This environment can put pressure on property valuations and new development projects.

Looking ahead to 2025, a potential easing of interest rates by central banks could significantly benefit Alexander & Baldwin. Lower borrowing costs would likely stimulate investment in commercial properties and residential developments, potentially boosting demand and project feasibility.

Hawaii's tourism sector significantly influences Alexander & Baldwin's commercial real estate portfolio, especially retail and hospitality properties. In 2024, Hawaii welcomed an estimated 9.6 million visitors, contributing substantially to the state's economy.

Projections for 2025 anticipate a slight dip in visitor arrivals, potentially around 9.5 million. However, this is expected to be offset by an increase in visitor spending, with average daily visitor spending forecasted to rise by approximately 3% in 2025, reaching around $240 per person.

Real Estate Market Trends and Property Values

Hawaii's real estate market continues to show resilience, with property values expected to hold steady or see modest growth through 2025. Limited land availability and persistent demand, especially for desirable coastal and urban properties, are key drivers. This environment directly impacts Alexander & Baldwin's asset valuations and the feasibility of new development projects.

Key trends influencing Alexander & Baldwin include:

- Strong Demand, Limited Supply: Hawaii's unique geography and desirability contribute to a consistently high demand for housing and commercial space, often outstripping available inventory.

- Property Value Appreciation: Projections suggest continued strength in property values, particularly for luxury segments and prime locations, which benefits A&B's portfolio.

- Development Opportunities: While land is scarce, strategic acquisitions and master-planned community developments remain viable avenues for growth.

- Economic Indicators: Factors like tourism recovery and population growth in 2024 and 2025 will further underpin real estate market performance.

Inflation and Construction Costs

Inflation presents a significant headwind for Alexander & Baldwin, directly impacting its operating expenses and, crucially, its construction costs. For 2025, inflation in Hawaii is projected to outpace the U.S. national average, exacerbating these pressures. This means the cost to build new projects and maintain existing properties will likely climb higher than anticipated.

The ripple effect of these rising construction costs, driven by persistent labor shortages and elevated material prices, can significantly dent profitability for Alexander & Baldwin's development pipeline. Furthermore, the upkeep of its extensive portfolio of existing assets will also demand higher capital outlays.

- Inflationary pressures in Hawaii are expected to exceed the U.S. average in 2025.

- Labor shortages and material price increases are key drivers of rising construction costs.

- Higher development and maintenance expenses directly impact Alexander & Baldwin's profitability.

Hawaii's economic growth is projected at 1.2% for 2025, a positive indicator for Alexander & Baldwin's real estate holdings, particularly in construction and tourism-related sectors.

Interest rates, hovering around 5.25%-5.50% in early 2024, increase borrowing costs, potentially slowing real estate transactions, though a potential easing in 2025 could stimulate investment.

Visitor spending in Hawaii is expected to rise by 3% in 2025, reaching approximately $240 per person, which supports Alexander & Baldwin's retail and hospitality properties despite a slight projected dip in visitor numbers.

Inflation in Hawaii is anticipated to be higher than the U.S. national average in 2025, increasing construction and maintenance costs for Alexander & Baldwin.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Alexander & Baldwin |

|---|---|---|---|

| Hawaii Real GDP Growth | (Not specified for 2024) | 1.2% | Positive for real estate demand and development. |

| Federal Funds Rate | 5.25%-5.50% (maintained through early 2024) | Potential easing | Higher rates dampen activity; easing stimulates investment. |

| Hawaii Visitor Arrivals | ~9.6 million (2024) | ~9.5 million | Slight decrease, but spending increase is beneficial. |

| Average Daily Visitor Spending | (Not specified for 2024) | ~3% increase (to ~$240) | Boosts retail and hospitality segments. |

| Hawaii Inflation Rate | (Not specified for 2024) | Exceeds U.S. average | Increases operating and construction costs. |

Same Document Delivered

Alexander & Baldwin PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alexander & Baldwin delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain a clear understanding of the external forces shaping their business landscape.

Sociological factors

Population trends and demographic shifts in Hawaii significantly shape the demand for both commercial and residential real estate. While overall growth has been modest, Oʻahu, in particular, is projected to see an increase in its population. This growth directly fuels the need for more housing, which in turn bolsters demand for local retail and services within Alexander & Baldwin's managed centers.

The ongoing embrace of remote work is significantly reshaping lifestyle choices, drawing more people to Hawaii's tranquil appeal. This migration pattern is directly influencing the real estate market, boosting demand for housing and the commercial spaces that support these new residents.

Alexander & Baldwin can expect this shift to affect their tenant mix, potentially increasing demand for residential leases and services catering to a remote workforce. For instance, in 2024, Hawaii's tourism data indicated a sustained interest in longer-term stays, suggesting a growing population of remote workers choosing the islands.

Consumer spending habits are a significant sociological factor for Alexander & Baldwin (ALEX). Changes in how people spend their money, particularly on groceries and general retail, directly impact the success of their retail centers. For instance, a shift towards online grocery shopping could reduce foot traffic in their physical stores.

Retail trends, such as the preference for experiential retail or the demand for sustainable products, also play a key role. ALEX needs to adapt its tenant mix and offerings to align with these evolving consumer preferences. In 2024, reports indicated continued growth in online retail sales, a trend that retail center operators like ALEX must actively address.

Sustained resident demand in Hawaii, where ALEX primarily operates, is vital. This means ensuring local communities have the disposable income and desire to shop at their centers. Furthermore, the rebound in visitor spending, a key economic driver for Hawaii, directly benefits ALEX's retail properties by increasing overall customer traffic and sales volume.

Community Development and Engagement

Alexander & Baldwin's (A&B) long-term strategy in Hawaii hinges on robust community development and engagement. Their commitment to owning and growing assets across the islands means they must actively listen to and address local needs, cultural sensitivities, and societal values. This approach is crucial for sustainable development and preserving their reputation.

In 2024, A&B continued its focus on community initiatives, contributing to local economies through job creation and support for small businesses. For instance, their agricultural ventures not only provide fresh produce but also foster local employment. In 2023, A&B's diversified operations, including their Hawaii Community Development segment, generated approximately $988 million in revenue, underscoring the economic impact of their community-focused projects.

Key aspects of their community engagement include:

- Support for local agriculture and food security initiatives

- Investment in affordable housing projects

- Preservation of cultural heritage sites

- Partnerships with local non-profits and community organizations

Housing Affordability and Social Equity

The persistent issue of housing affordability in Hawaii significantly impacts social equity and can shape public opinion regarding real estate development. High housing costs create social pressures that may lead to increased demand for policy interventions and influence community attitudes towards developers like Alexander & Baldwin.

For instance, in 2024, Hawaii's median home price remained exceptionally high, often exceeding $900,000, a stark contrast to national averages and a key driver of social concern. This affordability gap fuels discussions about land use, development practices, and the need for more accessible housing options.

- Social Pressure: Rising housing costs in Hawaii, with median home prices consistently over $900,000 in 2024, generate significant public concern and advocacy for affordable housing solutions.

- Policy Influence: Community sentiment and social equity demands can directly influence local and state government policies affecting real estate development and land use.

- Social License: Developers engaging with or investing in Hawaii must consider their role in addressing housing affordability to maintain a positive social license to operate.

- Community Relations: Proactive engagement with community groups and support for affordable housing initiatives can mitigate potential social friction and build trust.

Sociological factors significantly influence Alexander & Baldwin's (ALEX) operations in Hawaii. Population trends, including modest overall growth but increased density on Oʻahu, directly impact real estate demand. The rise of remote work further fuels this, increasing the need for housing and supporting commercial spaces.

Consumer spending habits and retail preferences are critical. ALEX must adapt to trends like experiential retail and the persistent growth of online sales, which can affect foot traffic in their centers. Sustained resident spending and a rebound in visitor spending are vital for ALEX's retail property success.

Community development and engagement are paramount for ALEX's long-term strategy. Their commitment to local economies, job creation, and supporting small businesses, as seen in their agricultural ventures, is crucial for maintaining a positive reputation and social license to operate.

Housing affordability remains a significant social concern in Hawaii, with median home prices consistently exceeding $900,000 in 2024. This pressure influences public opinion and policy, requiring developers like ALEX to consider their role in providing accessible housing solutions.

| Sociological Factor | Impact on Alexander & Baldwin | 2024/2025 Data/Trend |

|---|---|---|

| Population Trends | Drives demand for residential and commercial real estate. | Oʻahu population growth projected; sustained interest in longer-term stays by remote workers. |

| Consumer Spending & Retail Preferences | Affects tenant mix and success of retail centers. | Continued growth in online retail sales; demand for experiential retail. |

| Community Engagement | Crucial for reputation and social license to operate. | Focus on local economies, job creation, and support for small businesses. |

| Housing Affordability | Influences public opinion and policy on development. | Median home prices in Hawaii consistently over $900,000, fueling demand for affordable housing solutions. |

Technological factors

Alexander & Baldwin's commercial real estate operations can significantly benefit from the increasing adoption of proptech and smart building technologies. These advancements offer a pathway to optimizing property management, boosting operational efficiency, and elevating the tenant experience. For instance, smart building systems can automate energy management, leading to reduced utility costs. In 2024, the global smart building market was valued at an estimated $80 billion and is projected to grow substantially, indicating a strong trend towards these integrated solutions.

Alexander & Baldwin's success hinges on its digital marketing and online presence, as property marketing, leasing, and tenant communication increasingly migrate online. In 2024, a significant portion of real estate searches and leasing decisions occur digitally, making a robust online strategy paramount for showcasing their diverse portfolio. Their ability to leverage online channels to connect with potential tenants and investors directly impacts their market reach and leasing velocity.

Advances in construction technologies, like modular building and advanced project management software, are significantly boosting efficiency and cutting costs in real estate. For instance, modular construction can reduce project timelines by up to 30% and lower labor costs by 15-20%, according to industry reports from 2024.

Alexander & Baldwin can leverage these innovations to streamline its new developments and value-add projects. The adoption of sustainable building materials, which are becoming more cost-competitive, also aligns with growing market demand for eco-friendly properties, potentially enhancing brand reputation and long-term asset value.

Data Analytics and Market Intelligence

Alexander & Baldwin (ALEX) is increasingly leveraging data analytics to understand market dynamics and tenant preferences. This allows for more informed decisions on property development and portfolio management, aiming to maximize returns in a competitive real estate landscape. The company's strategic use of big data is crucial for identifying emerging trends and optimizing asset allocation.

The company's focus on data analytics directly impacts its ability to adapt to evolving market demands. By analyzing vast datasets, ALEX can gain granular insights into consumer behavior and economic shifts, which are vital for strategic planning. This technological edge helps in anticipating market needs and identifying lucrative investment opportunities, especially in its core segments like Hawaii's real estate market.

- Tenant Behavior Analysis: ALEX utilizes data to understand how tenants interact with their properties, informing leasing strategies and amenity development.

- Market Trend Identification: Advanced analytics enable the company to spot emerging real estate trends and demand shifts early on.

- Portfolio Optimization: Data-driven insights help in making strategic decisions about property acquisitions, dispositions, and capital improvements.

- Investment Opportunity Screening: The company employs analytical tools to rigorously evaluate potential new developments and acquisitions based on projected market performance.

Cybersecurity and Data Privacy

As Alexander & Baldwin's real estate operations increasingly rely on digital platforms, robust cybersecurity and stringent data privacy measures are essential. Protecting sensitive tenant data, financial transactions, and proprietary operational systems from evolving cyber threats is a critical technological imperative.

The growing sophistication of cyberattacks necessitates continuous investment in advanced security protocols and employee training. For instance, the global average cost of a data breach reached $4.45 million in 2024, highlighting the significant financial and reputational risks associated with security failures.

- Increased reliance on cloud computing for data storage and management.

- Adoption of AI and machine learning for threat detection and prevention.

- Compliance with evolving data privacy regulations like GDPR and CCPA.

- Need for secure remote access solutions for employees and partners.

Technological advancements are reshaping how Alexander & Baldwin (ALEX) operates, from property management to marketing. The integration of proptech and smart building solutions is enhancing efficiency and tenant experience, with the global smart building market valued at approximately $80 billion in 2024. Furthermore, the company's strategic use of data analytics is crucial for understanding market trends and tenant behavior, enabling more informed investment and development decisions.

Legal factors

Hawaii's complex zoning and land use regulations, encompassing state-level land use districts and county-specific ordinances, dictate development possibilities and property utilization. These laws are critical for Alexander & Baldwin's operations, influencing where and what type of projects can be undertaken.

Recent legislative changes are particularly impactful. Honolulu's Land Use Ordinance, updated via Bill 64 in January 2025, and Hawaiʻi County's ADU legislation, enacted as Bill 123 in October 2024, directly affect Alexander & Baldwin's ability to pursue new developments and manage its existing land assets.

Alexander & Baldwin's operations in Hawaii are significantly shaped by stringent environmental protection laws and intricate permitting procedures. Compliance with regulations governing coastal zone management, conservation areas, and environmental impact assessments is paramount, directly affecting project timelines and overall development costs.

Legal frameworks governing commercial leases and tenant-landlord relationships are crucial for Alexander & Baldwin's property operations. These laws dictate lease terms, tenant protections, and landlord responsibilities, impacting rental income and property management strategies. For instance, in 2024, states continue to refine eviction moratoriums and rent relief programs, which can affect cash flow and tenant stability for property owners.

Changes in legal interpretations or new legislation can significantly alter Alexander & Baldwin's operational landscape. For example, updated zoning laws or building codes might necessitate costly upgrades to their commercial properties. Furthermore, evolving tenant rights, such as enhanced disclosure requirements or stricter regulations on security deposits, demand careful adherence to legal standards to avoid penalties and maintain good tenant relations.

Building Codes and Construction Standards

Alexander & Baldwin, like all developers, must navigate a complex web of building codes and construction standards. These regulations are not static; they evolve to incorporate new safety protocols, energy efficiency mandates, and accessibility requirements. For instance, in 2024, many jurisdictions are updating seismic retrofitting standards and introducing stricter requirements for sustainable building materials, directly impacting project timelines and material sourcing.

Compliance with these evolving legal frameworks is a significant operational factor. It influences everything from initial architectural design to the selection of construction materials and labor. Failure to adhere can result in costly delays, fines, and even project shutdowns.

Key areas of legal consideration for Alexander & Baldwin include:

- Adherence to updated seismic building codes: Many regions, particularly in Hawaii, are seeing revisions to earthquake-resistant design standards, impacting foundation and structural requirements.

- Compliance with new energy efficiency standards: Regulations like the 2024 International Energy Conservation Code (IECC) will necessitate more stringent requirements for insulation, window performance, and HVAC systems, potentially increasing initial construction costs but offering long-term operational savings.

- Meeting accessibility mandates (e.g., ADA updates): Ensuring all new constructions and major renovations comply with the Americans with Disabilities Act, including recent clarifications on accessible routes and features, remains a critical legal obligation.

- Sourcing and use of approved construction materials: Legal frameworks often specify or restrict the use of certain materials based on safety, environmental impact, and fire resistance ratings.

Property Rights and Eminent Domain

Alexander & Baldwin's operations are significantly influenced by property rights and eminent domain laws, particularly concerning its substantial landholdings in Hawaii. These legal frameworks dictate how the company can acquire, use, and develop its real estate assets. For instance, in 2023, Hawaii's Land Use Commission continued to review and approve or deny land use changes, directly impacting A&B's development timelines and project feasibility. Navigating these regulations is crucial for safeguarding the company's extensive property portfolio and ensuring the long-term viability of its strategic land development initiatives.

Understanding the intricacies of property ownership and transfer laws is paramount for Alexander & Baldwin. The company's ability to maintain and expand its land assets hinges on compliance with these regulations, which can vary across different jurisdictions within Hawaii. Potential eminent domain actions, while not always directly targeting A&B, can indirectly affect the value and accessibility of surrounding properties, influencing the company's development strategies. In 2024, continued attention to land use policies and property law updates remains a key factor for Alexander & Baldwin's strategic planning.

Key legal considerations for Alexander & Baldwin include:

- Property Ownership and Title: Ensuring clear and defensible titles for all land parcels is fundamental to A&B's asset base.

- Land Use Regulations: Adherence to zoning laws and land use commission approvals is critical for development projects.

- Eminent Domain Procedures: Awareness of potential government takings and compensation procedures protects against unforeseen impacts on land value.

- Leasehold Agreements: Managing and understanding the legal aspects of various leasehold agreements across its properties is essential for long-term revenue streams.

Alexander & Baldwin's operations are deeply intertwined with Hawaii's complex legal landscape, particularly concerning land use and zoning. Recent legislative actions, such as Honolulu's Bill 64 in January 2025 and Hawaiʻi County's Bill 123 in October 2024, directly impact development potential and land asset management. Furthermore, stringent environmental laws and permitting processes, including those for coastal zones and environmental impact assessments, significantly influence project timelines and costs.

Environmental factors

Hawaii's unique geography makes it exceptionally susceptible to climate change, with projections indicating significant sea-level rise and more frequent extreme weather events. Alexander & Baldwin's extensive coastal landholdings in Hawaii face direct physical risks from these changes, including erosion and potential inundation.

These environmental shifts directly impact the company's real estate portfolio, necessitating adjustments in development plans and potentially increasing insurance costs. For instance, the National Oceanic and Atmospheric Administration (NOAA) has projected that some Hawaiian coastlines could see several feet of sea-level rise by the end of the century, directly threatening coastal infrastructure and properties owned by Alexander & Baldwin.

Alexander & Baldwin, operating primarily in Hawaii, faces substantial environmental risks from natural disasters such as hurricanes and wildfires. The state's geographic location makes it susceptible to tropical storms, and recent years have seen an increase in wildfire activity, impacting agricultural lands and communities. For instance, the devastating Maui wildfires in August 2023, while not directly impacting A&B's core real estate holdings, underscored the pervasive threat and the potential for widespread disruption across the islands.

These risks necessitate robust strategies for property design, including resilient construction and land-use planning to mitigate damage. Alexander & Baldwin must also maintain comprehensive insurance coverage to protect its extensive portfolio of agricultural land and real estate developments. Furthermore, effective emergency preparedness plans are crucial for safeguarding employees, assets, and ensuring swift business continuity following any disaster event.

Alexander & Baldwin (ALEX) operates in Hawaii, a region acutely affected by water scarcity. In 2023, Hawaii experienced varying drought conditions across its islands, highlighting the urgent need for robust water management. The company's commitment to sustainable practices, such as implementing water-efficient landscaping at its developments and integrating water-saving technologies in its building systems, is crucial for regulatory compliance and long-term operational viability.

Biodiversity and Ecosystem Protection

Hawaii's unique and fragile ecosystems demand robust biodiversity and ecosystem protection measures. Alexander & Baldwin's extensive land operations and development projects must carefully consider their impact on native species, critical habitats, and vital watershed areas. This often necessitates thorough environmental assessments and the implementation of effective mitigation strategies to preserve the islands' natural heritage.

For instance, Alexander & Baldwin's commitment to sustainability in 2023 included ongoing efforts to manage invasive species and protect native flora and fauna across its agricultural lands and development sites. The company reported investing in watershed restoration projects, recognizing the interconnectedness of healthy ecosystems and water resources, a crucial aspect for both the environment and its agricultural operations.

- Focus on Native Habitats: Alexander & Baldwin's land management practices are designed to minimize disruption to endemic species and their natural environments.

- Watershed Management: Significant resources are allocated to protect and restore watershed areas, ensuring water quality and availability for both ecological and business needs.

- Environmental Impact Assessments: Projects undergo rigorous assessments to identify and address potential impacts on biodiversity, with mitigation plans developed accordingly.

- Invasive Species Control: Active programs are in place to manage and control invasive species that threaten native ecosystems on the company's properties.

Sustainability and Green Building Practices

The growing global focus on environmental sustainability is significantly shaping the real estate and construction sectors. This trend directly impacts companies like Alexander & Baldwin (ALEX), pushing for greener operational and development strategies. In 2023, for instance, the U.S. Green Building Council reported a continued rise in LEED certifications, indicating a strong market preference for environmentally responsible buildings.

Alexander & Baldwin is actively responding to these environmental pressures. Their portfolio increasingly features sustainable elements, such as energy-efficient building systems and the integration of photovoltaic (solar) panels to reduce reliance on fossil fuels. Furthermore, the company is exploring adaptive reuse of existing structures, a practice that minimizes waste and conserves resources, aligning with broader environmental goals.

- Energy Efficiency: Investments in energy-efficient systems aim to lower operational costs and environmental impact.

- Renewable Energy: Integration of photovoltaic panels is a key strategy to increase renewable energy usage.

- Adaptive Reuse: Prioritizing the repurposing of existing buildings over new construction reduces material waste and embodied carbon.

- Market Demand: Consumer and investor demand for sustainable properties continues to grow, influencing development decisions.

Hawaii's vulnerability to climate change, including sea-level rise and extreme weather, poses direct physical risks to Alexander & Baldwin's coastal landholdings. The company must adapt its development plans and manage increased insurance costs due to these environmental shifts. For example, NOAA projections indicate significant sea-level rise by 2100, threatening coastal properties. Alexander & Baldwin is also exposed to natural disasters like hurricanes and wildfires, as evidenced by the 2023 Maui wildfires, which highlighted the potential for widespread disruption across the islands.

PESTLE Analysis Data Sources

Our PESTLE analysis for Alexander & Baldwin draws from official Hawaiian government publications, real estate market reports, and agricultural industry data. We also incorporate economic indicators from the U.S. Bureau of Labor Statistics and environmental impact assessments relevant to the Hawaiian Islands.