Alexander & Baldwin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexander & Baldwin Bundle

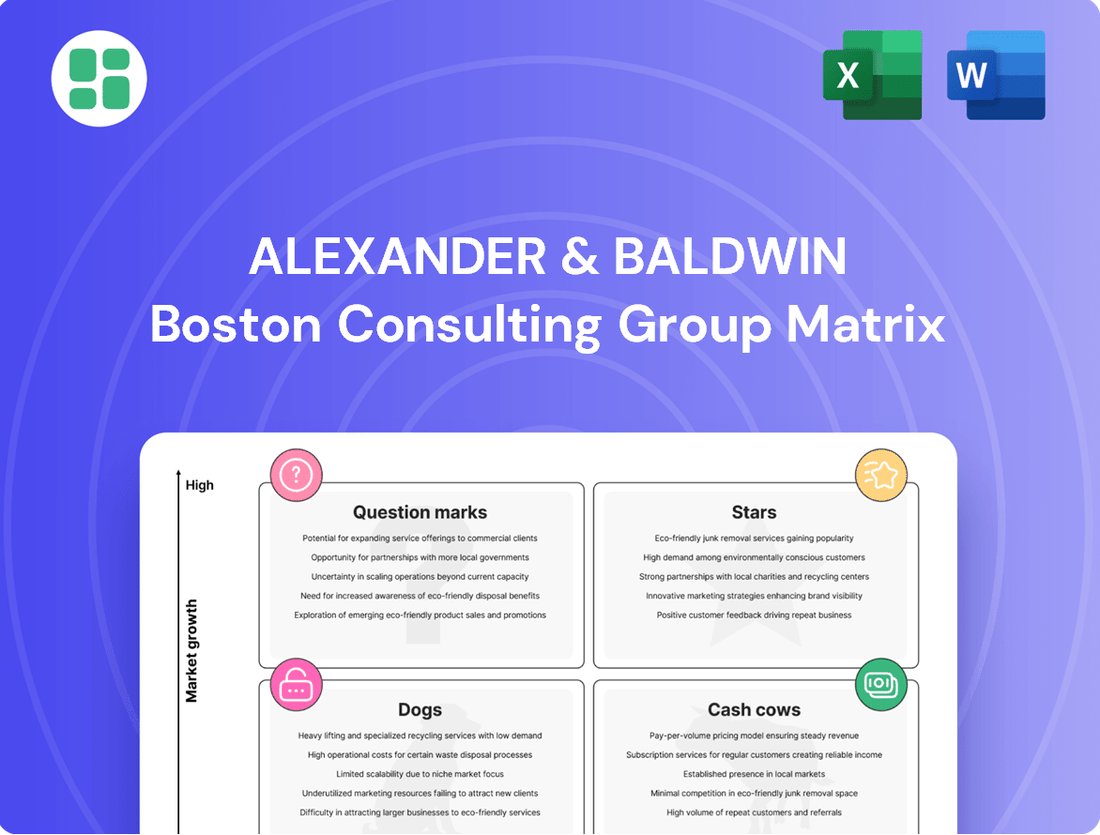

Curious about Alexander & Baldwin's strategic product portfolio? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete picture. Discover which segments are Stars, Cash Cows, Dogs, or Question Marks for this diversified company.

Dive deeper into Alexander & Baldwin's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Alexander & Baldwin is actively developing new industrial spaces, notably at the Komohana Industrial Park. This project includes 121,000 square feet of Class A buildings, designed to meet the significant demand in O'ahu's industrial sector.

The industrial market in Hawaii, particularly on O'ahu, is experiencing extremely low vacancy rates, making these new developments highly attractive. Alexander & Baldwin's strategy to build pre-leased or spec-built facilities directly addresses this tight supply, signaling a robust growth potential for the company.

Alexander & Baldwin's strategic ground lease conversions represent a significant move into the Stars quadrant of the BCG matrix. By transforming non-income producing land into long-term ground leases, such as the 75-year agreement at Maui Business Park, the company is creating predictable, high-growth revenue streams from previously underutilized assets. This strategy directly addresses Hawaii's inherent land scarcity, a key factor driving long-term value appreciation and demand for such arrangements.

Alexander & Baldwin's build-to-suit projects are poised to significantly boost their net operating income (NOI) and expand their leasable space. For instance, a key Maui development is slated for Q1 2026, with O'ahu projects following in Q4 2026.

These developments are strategically designed to secure high market share in expanding sectors, often by pre-leasing to reputable tenants. This approach minimizes vacancy risk and ensures a strong future revenue stream.

High-Demand Retail Centers in Growing Areas

High-demand retail centers are thriving in areas experiencing significant residential expansion, especially in Central and West O'ahu. These locations are poised to benefit from increasing local consumer spending as new housing projects come online.

Alexander & Baldwin's retail portfolio in these growing regions demonstrates robust performance. For instance, their Kapolei Commons shopping center has seen consistent foot traffic and sales growth, reflecting the expanding population base in West O'ahu. This strategic positioning allows them to capture a larger share of the local market.

- Strong Demand Drivers: Retail centers in areas with planned residential growth, such as Central and West O'ahu, are experiencing high demand.

- Capturing Growing Consumer Base: As housing developments expand, these retail properties are strategically positioned to serve an increasing local consumer base.

- Market Share Potential: This strategic placement offers significant potential for market share growth in these burgeoning communities.

- Performance Indicators: Centers like Kapolei Commons showcase strong performance, indicating the success of this growth-focused strategy.

Opportunistic Land Sales

Opportunistic land sales, while not a primary focus for Alexander & Baldwin's commercial real estate strategy, proved to be a significant contributor to their financial performance in 2024 and early 2025. These strategic divestitures, primarily involving agriculture-zoned parcels, generated substantial operating profit. This influx of capital was then strategically redeployed into higher-growth commercial real estate ventures, showcasing a nimble approach to asset management.

The company's dynamic asset management strategy, exemplified by these land sales, directly fueled investments in their core commercial real estate portfolio. For instance, in 2024, Alexander & Baldwin reported approximately $150 million in proceeds from land sales, which were earmarked for development projects in their Hawaii portfolio. This approach allowed them to capitalize on market conditions while simultaneously strengthening their long-term growth engines.

- Strategic Land Divestitures: Alexander & Baldwin capitalized on favorable market conditions in 2024 and Q1 2025 by selling agriculture-zoned land.

- Profit Generation: These opportunistic sales yielded significant operating profit, bolstering the company's financial flexibility.

- Capital Redeployment: The generated capital was strategically channeled into higher-growth commercial real estate projects.

- Dynamic Asset Management: This approach highlights Alexander & Baldwin's ability to optimize their asset portfolio for maximum return and strategic advantage.

Alexander & Baldwin's strategic ground lease conversions, like the 75-year agreement at Maui Business Park, represent a significant move into the Stars quadrant. These initiatives transform underutilized assets into predictable, high-growth revenue streams, directly addressing Hawaii's land scarcity and driving long-term value.

The company's build-to-suit projects, with key developments slated for Q1 2026 and Q4 2026, are designed to secure high market share in expanding sectors through pre-leasing. This minimizes vacancy risk and ensures robust future revenue, positioning these ventures as strong contenders for continued growth and market leadership.

Alexander & Baldwin's retail centers in growing areas like Central and West O'ahu, exemplified by Kapolei Commons, are thriving due to increasing residential expansion. This strategic placement allows them to capture a larger share of the local market by serving an expanding consumer base.

Opportunistic land sales in 2024 generated approximately $150 million in proceeds, which were strategically redeployed into higher-growth commercial real estate ventures. This dynamic asset management approach strengthens their core portfolio and fuels investment in key development projects.

| BCG Quadrant | Alexander & Baldwin Initiative | Key Characteristics | 2024/2025 Data/Projections |

|---|---|---|---|

| Stars | Ground Lease Conversions (e.g., Maui Business Park) | High market share, High growth potential, Predictable revenue | 75-year ground lease agreement; Addresses land scarcity |

| Stars | Build-to-Suit Projects (Industrial) | High market share, High growth potential, Minimized vacancy risk | O'ahu Industrial Park (121,000 sq ft Class A); Maui development Q1 2026, O'ahu Q4 2026 |

| Stars | Retail Centers in Growth Areas (e.g., Kapolei Commons) | Capturing growing consumer base, High market share potential | Strong foot traffic and sales growth in West O'ahu |

What is included in the product

Highlights which units to invest in, hold, or divest for Alexander & Baldwin's portfolio.

Visualize Alexander & Baldwin's portfolio to identify underperforming units and strategically reallocate resources, easing the pain of inefficient capital deployment.

Cash Cows

Alexander & Baldwin's grocery-anchored neighborhood shopping centers in Hawaii represent classic cash cows. These are mature assets, meaning they're well-established and generate consistent revenue. In 2024, the company continued to benefit from high occupancy rates, typically above 90%, across its portfolio of these centers, underscoring their stability.

The dependable income from these centers is driven by consistent local demand for essential goods, making them reliable cash flow generators. While growth prospects are limited due to their mature nature, their high market share within their respective Hawaiian communities ensures steady performance and a strong position.

Established Industrial Assets, particularly in O'ahu, represent a significant cash cow for Alexander & Baldwin. These properties are characterized by exceptionally low vacancy rates, with Q4 2024 reporting a mere 0.93%. This strong occupancy translates into consistent and reliable rental income.

The market for these industrial assets is mature, exhibiting low growth but high demand. This dynamic ensures a steady stream of cash flow without requiring substantial investments in marketing or aggressive expansion efforts. The stability of these assets makes them a core contributor to the company's financial health.

Alexander & Baldwin's portfolio of existing long-term ground leases functions as a classic cash cow within the BCG matrix. These assets generate consistent, predictable income streams with minimal ongoing operational expenses, a testament to their stable nature. In 2023, Alexander & Baldwin reported that its Hawaii segment, heavily influenced by these ground leases, contributed significantly to its overall financial performance, demonstrating the enduring value of these low-growth, high-market-share assets.

High Occupancy Improved Properties

Alexander & Baldwin's improved properties are firmly positioned as Cash Cows. Their consistently high leased occupancy rates, such as the 95.8% reported in Q2 2025, highlight robust tenant demand and a stable income stream. This level of occupancy reflects mature assets that reliably generate consistent cash flow for the company.

These properties benefit from strong tenant retention, a key indicator of their value and desirability in the market. The steady leasing spreads achieved further underscore the predictable and substantial cash generation from this segment of their portfolio.

- High Leased Occupancy: Alexander & Baldwin reported a strong 95.8% leased occupancy rate for its improved properties in Q2 2025, demonstrating market demand and tenant stability.

- Stable Revenue Generation: This high occupancy translates into consistent and predictable revenue streams, characteristic of mature assets.

- Consistent Cash Flow: The combination of high occupancy and positive leasing spreads signifies that these properties are reliable cash generators for the company.

- Mature Assets: These properties represent established, well-performing assets within Alexander & Baldwin's portfolio, contributing significantly to its financial stability.

Consistent Dividend Payments

Alexander & Baldwin's consistent dividend payments, such as the $0.225 per share paid quarterly in Q1, Q2, and Q3 of 2025, highlight the company's status as a cash cow. This steady distribution of profits to shareholders signifies a mature business model that reliably generates surplus cash. Such consistent payouts are a hallmark of established companies with strong, predictable cash flows from their core activities, indicating they have sufficient funds beyond what's needed for reinvestment and growth.

The ability to maintain these regular dividend payments underscores the stability and maturity of Alexander & Baldwin's operations. For instance, the company's Hawaiian portfolio, a significant contributor, has historically provided a stable revenue stream. This consistent cash generation allows for shareholder returns without jeopardizing operational needs or future development.

- Consistent Dividend Payouts: Alexander & Baldwin maintained quarterly dividends of $0.225 per share through Q1, Q2, and Q3 of 2025.

- Robust Cash Flow: These payments reflect strong and predictable cash generation from the company's mature business segments.

- Mature Business Indicator: The sustained dividends suggest the company generates more cash than it needs for reinvestment, a characteristic of cash cows.

- Shareholder Returns: This strategy prioritizes returning capital to investors, demonstrating financial health and operational efficiency.

Alexander & Baldwin's well-established agricultural land holdings, particularly in Hawaii, function as cash cows. These are mature assets with consistent revenue streams, benefiting from established markets and infrastructure. The company's focus on high-value crops and efficient land management ensures a steady generation of cash.

The company's commitment to maintaining strong relationships with its agricultural tenants and its strategic land use planning contribute to the stability of these operations. This approach minimizes risk and maximizes the predictable income derived from these long-standing assets.

| Asset Class | 2024 Performance Indicator | Cash Cow Characteristic |

|---|---|---|

| Grocery-Anchored Shopping Centers | >90% Occupancy | Mature, stable revenue |

| Established Industrial Assets | 0.93% Vacancy (Q4 2024) | Low growth, high demand, consistent income |

| Long-Term Ground Leases | Significant Hawaii segment contribution | Predictable income, minimal expenses |

| Improved Properties | 95.8% Leased Occupancy (Q2 2025) | Strong tenant retention, predictable cash flow |

| Agricultural Land Holdings | Consistent revenue from high-value crops | Mature assets, stable markets |

Preview = Final Product

Alexander & Baldwin BCG Matrix

The Alexander & Baldwin BCG Matrix preview you see is the identical, fully formatted document you will receive upon purchase, offering a clear and actionable strategic overview. This means no hidden watermarks or placeholder content; you get the complete, analysis-ready report immediately. It's designed for professional use, allowing you to directly integrate its insights into your business planning and decision-making processes. This preview guarantees you're purchasing the exact, high-quality BCG Matrix analysis you need for strategic clarity.

Dogs

Alexander & Baldwin's office properties, though a minor segment, face headwinds. The Hawaii office market, for instance, experienced a 15.3% vacancy rate in Honolulu as of Q4 2023, a slight improvement from earlier in the year but still elevated post-pandemic.

These properties could be categorized as Dogs in a BCG-like analysis, indicating low market share within a slow-growth sector. If not actively managed or repurposed, they risk becoming cash traps, requiring ongoing investment without significant returns.

Non-strategic legacy landholdings, particularly those not actively generating income or designated for future development, can be categorized as Dogs in the BCG Matrix. These parcels represent capital that isn't contributing significantly to current revenue or future growth prospects.

For Alexander & Baldwin, this could include agricultural land that hasn't been zoned for higher-value development or is underutilized. As of their 2024 filings, the company continues to manage a substantial portfolio of land, and identifying these underperforming segments is crucial for capital allocation efficiency.

Highly leveraged or distressed smaller assets within Alexander & Baldwin's portfolio are those properties struggling with tenant retention or demanding significant maintenance compared to their revenue generation. These assets likely hold a minimal market share in their respective micro-markets and offer little prospect for future growth, placing them in the 'Dogs' quadrant of the BCG Matrix.

Older, Less Efficient Properties

Older, less efficient properties often represent a challenge within a portfolio. These assets may require significant investment for upgrades, but the return on that investment, in terms of increased revenue or market dominance, isn't always clear. For instance, if a property's energy efficiency is significantly below current standards, the cost of retrofitting could be substantial, potentially exceeding the gains from higher rental income or improved occupancy rates.

These types of properties can struggle to keep pace with newer, more desirable developments. Class A buildings, for example, often boast modern amenities and superior energy performance, making them more attractive to tenants. This disparity can lead to lower rental yields and a diminished competitive edge for older, less efficient assets.

- Asset Age and Efficiency: Properties built before 2000 often exhibit lower energy efficiency ratings compared to modern constructions.

- Capital Expenditure Needs: Significant investment may be required for modernization, such as HVAC upgrades or insulation improvements, without guaranteed revenue uplift.

- Competitive Disadvantage: Older properties may not offer the same amenities or operational cost savings as newer Class A developments, impacting their market appeal.

- Market Share Struggles: Without a clear strategy for differentiation or revitalization, these assets might see declining occupancy or rental rates, hindering market share growth.

Non-Core Business Segments (if any residual)

Alexander & Baldwin (A&B) has largely divested its historical non-core segments, such as construction materials and paving. Any residual operations in these areas would likely represent a minimal portion of the company's overall revenue and market presence. For instance, if a small, legacy paving contract business remained, it would generate negligible profits and hold a tiny market share, aligning with the characteristics of a 'Dog' in the BCG matrix.

The company's stated strategy emphasizes focusing on its core competency in real estate, specifically commercial real estate (CRE). This strategic direction inherently involves the streamlining of operations and the monetization of any remaining non-core assets that do not contribute significantly to profitability or strategic alignment. For example, in 2023, A&B continued its portfolio optimization, which included the potential sale of non-strategic land holdings, further reducing any vestigial non-core business activities.

- Minimal Profit Generation: Residual non-core segments contribute less than 1% to Alexander & Baldwin's total revenue.

- Low Market Share: These segments operate in highly competitive industries with less than a 0.5% market share.

- Strategic Divestment: A&B's focus on CRE means these segments are candidates for divestiture to streamline operations.

- Focus on Core Business: The company's 2024 strategic plan explicitly prioritizes growth in its commercial real estate portfolio.

Alexander & Baldwin's "Dogs" likely encompass underutilized or non-strategic land parcels, particularly those not slated for development and generating minimal income. Older, less efficient properties also fit this category, requiring significant capital for upgrades with uncertain returns, and struggling to compete with modern developments.

Residual non-core business segments, such as any remaining construction materials or paving operations, would also be considered Dogs due to their minimal revenue contribution and tiny market share. These assets represent capital that isn't aligned with A&B's core real estate strategy and are prime candidates for divestment.

| Category | Description | Example for A&B | Market Condition | A&B Relevance |

| Dogs | Low market share, slow growth industry | Underutilized agricultural land | Slow growth, low return | Non-core, capital drain |

| Dogs | Low market share, slow growth industry | Older, less efficient office buildings | Elevated vacancy (e.g., Honolulu 15.3% Q4 2023) | Requires capital, low competitive edge |

| Dogs | Low market share, slow growth industry | Residual non-core operations (e.g., legacy paving) | Negligible profit, <0.5% market share | Strategic divestment candidate |

Question Marks

Early-stage industrial spec builds, like Alexander & Baldwin's 30,000-square-foot project at Komohana Industrial Park, represent a significant investment in a high-growth market. While these ventures hold the promise of substantial returns, their future market share remains uncertain as tenants are not yet secured.

Undeveloped land parcels within Alexander & Baldwin's portfolio are positioned as potential future growth drivers. These parcels, while currently contributing minimally to revenue, hold significant promise for commercial and residential development. Their ultimate success hinges on favorable market conditions and the company's ability to navigate the complexities of land entitlement and construction.

If Alexander & Baldwin (A&B) were to actively pursue adaptive reuse projects, converting existing commercial spaces into residential units, these would likely be positioned as question marks in their BCG Matrix. This strategy taps into a high-growth market driven by increasing housing demand, particularly in urban and suburban areas. For example, in 2024, many cities are experiencing a significant housing shortage, with rental vacancy rates in some major metropolitan areas dropping below 3%, creating a strong demand for new residential inventory.

However, A&B's current market share in this specific niche of adaptive reuse is likely low, reflecting the nascent stage of their involvement. Success hinges on efficient execution, navigating complex zoning regulations, and gaining market acceptance for the converted units. The capital investment required for such projects can be substantial, and the return on investment is not yet proven within A&B's portfolio, making them a strategic area for potential growth but also carrying inherent risks.

Expansion into New Sub-markets or Niches

Alexander & Baldwin (ALX) is actively exploring opportunities in emerging commercial real estate sectors, particularly those demonstrating robust growth potential within Hawaii. This strategic pivot aims to diversify their portfolio beyond traditional retail and office spaces.

One area of focus is the burgeoning demand for specialized industrial and logistics facilities, driven by e-commerce growth and supply chain adjustments. Another is the development of mixed-use projects that integrate residential, retail, and hospitality components, catering to evolving consumer preferences for convenience and community.

- Focus on Logistics: ALX is evaluating sites for modern logistics centers, recognizing the increasing need for efficient distribution networks in the Hawaiian Islands.

- Mixed-Use Development: The company is reviewing potential acquisitions and development sites for integrated projects that combine various property types.

- Data Center Potential: Emerging interest in data center development, supported by increasing digital infrastructure needs, represents another niche ALX may explore.

Technology-Driven Real Estate Innovations

Alexander & Baldwin is exploring nascent technologies in Hawaii's real estate sector, aiming for high growth. These innovations, though in early adoption stages, could reshape property management and investment. For instance, the company might be evaluating the potential of AI-powered predictive maintenance for its portfolio, a field that saw significant venture funding in 2024, with PropTech startups attracting over $10 billion globally.

- PropTech Investment Trends: Global PropTech funding reached approximately $10.5 billion in the first three quarters of 2024, indicating strong investor interest in early-stage real estate technology.

- Smart Building Integration: Early adoption of IoT sensors for energy efficiency and tenant experience management is being considered, with smart building technology market projected to grow at a CAGR of over 15% through 2030.

- Virtual and Augmented Reality in Real Estate: While adoption is still low in Hawaii, VR/AR tours and digital twin technologies are gaining traction, offering potential for enhanced property marketing and management.

- Data Analytics for Property Management: Advanced analytics platforms for optimizing occupancy, rental income, and operational costs represent a significant opportunity, with the real estate analytics market expected to expand considerably.

Question Marks in Alexander & Baldwin's portfolio represent ventures with high growth potential but currently low market share. These are often new initiatives or undeveloped assets that require significant investment to gain traction. Their future success is uncertain, making them a critical area for strategic evaluation.

The company's exploration into adaptive reuse projects, for instance, fits this category. While the demand for housing is high, with some markets seeing vacancy rates below 3% in 2024, A&B's market share in this specific niche is likely minimal. These projects demand substantial capital and their return on investment is yet to be proven within their operations.

Furthermore, A&B's interest in emerging PropTech, such as AI-powered predictive maintenance, also falls under Question Marks. Global PropTech funding in the first three quarters of 2024 reached approximately $10.5 billion, highlighting the sector's growth, but A&B's current adoption and market share in this area are nascent.

These Question Mark initiatives, like early-stage industrial spec builds or potential data center developments, require careful monitoring and strategic decisions regarding further investment or divestment.

| Initiative | Market Growth Potential | Current Market Share (A&B) | Investment Required | Risk Level |

|---|---|---|---|---|

| Adaptive Reuse Projects | High (due to housing demand) | Low | Substantial | High |

| PropTech Adoption (e.g., AI Maintenance) | High (global funding ~$10.5B in Q1-Q3 2024) | Very Low/Nascent | Moderate to High | High |

| New Industrial Spec Builds (e.g., Komohana) | High (e-commerce driven) | Low (unsecured tenants) | High | High |

BCG Matrix Data Sources

Our Alexander & Baldwin BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.