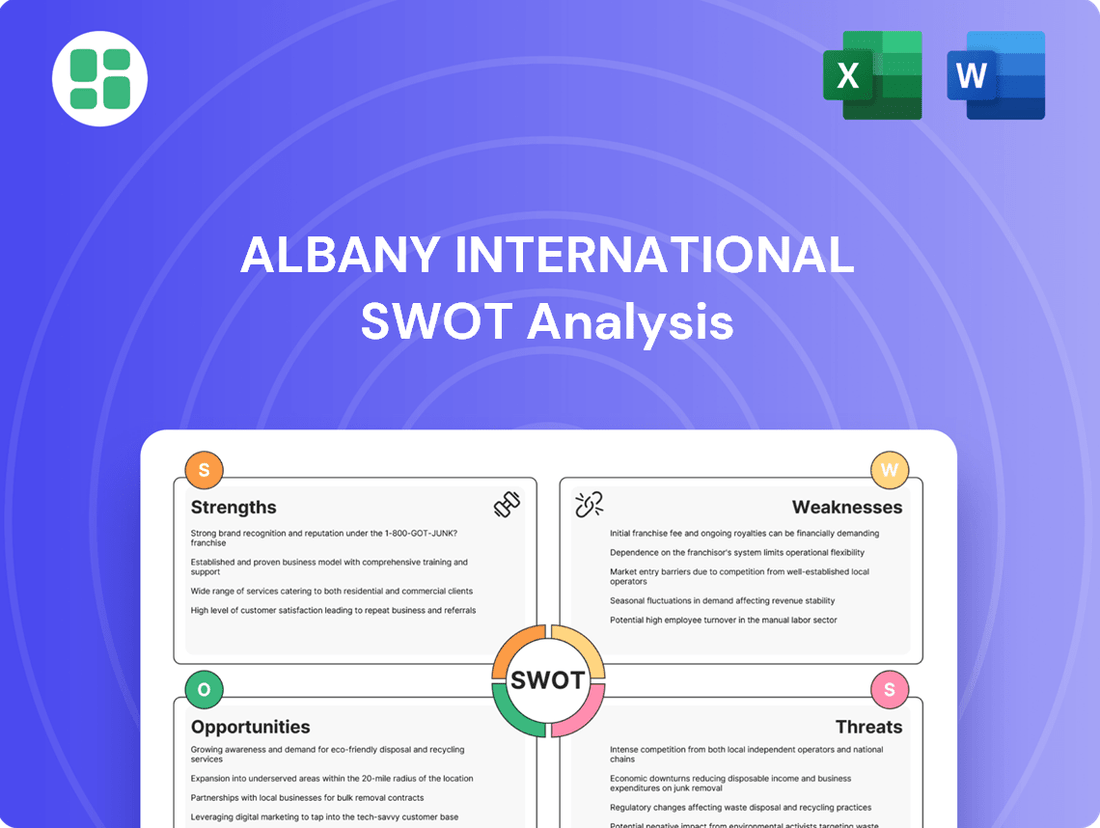

Albany International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albany International Bundle

Albany International boasts strong market positions and innovative product development, but faces challenges from global competition and raw material price volatility. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Albany International's competitive advantages, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Albany International's strength lies in its dual-segment specialization, with Machine Clothing (MC) and Albany Engineered Composites (AEC) leading their respective markets. The MC segment is a global frontrunner in custom fabrics and belts for paper production, a sector that saw continued demand through 2024 driven by packaging needs. AEC, meanwhile, is a significant player in advanced composites for aerospace, benefiting from the aerospace sector's recovery and expansion in 2024 and projected into 2025.

Albany International's deep roots in materials science and engineering, cultivated over 130 years, are a significant strength. This extensive knowledge allows them to create specialized, high-performance materials and components that are essential for their clients' demanding operations.

Their ability to innovate in advanced materials processing translates into tangible benefits for customers, such as improving paper quality or contributing to lighter, more efficient aircraft engines. This technical prowess is a key differentiator in markets requiring sophisticated material solutions.

Albany International boasts a significant global operational footprint, with 30 facilities strategically located across 13 countries and a dedicated workforce of approximately 5,400 employees as of late 2024. This extensive network enables the company to effectively serve a broad and diverse customer base, adapting to varied regional market demands and solidifying its role as a vital supplier within its specialized sectors.

Commitment to Innovation and Sustainability

Albany International demonstrates a strong commitment to innovation, evident in its ongoing research and development. This includes a focus on enhancing raw material sustainability and pioneering new technologies such as 3D woven composites, positioning the company for future growth in advanced materials.

The company's dedication to sustainability is further underscored by its published reports. These reports detail efforts to reduce its carbon footprint, with specific emission reduction targets set for the future. This focus not only aligns with global environmental trends but also creates opportunities for new product applications and market penetration by supporting customer sustainability objectives.

- Innovation in Materials: Albany International is investing in R&D for sustainable raw materials and advanced manufacturing techniques like 3D woven composites.

- Sustainability Reporting: The company actively publishes sustainability reports outlining its commitment to reducing its carbon footprint and setting emission reduction targets.

- Market Opportunities: Albany's sustainability initiatives can drive new product development and open up market avenues by catering to environmentally conscious customers.

Strong Balance Sheet and Shareholder Returns

Albany International exhibits a robust financial position, characterized by a strong balance sheet. Despite navigating recent revenue headwinds, the company has seen its total assets grow, underscoring its financial resilience and capacity to manage its operations effectively.

The company's commitment to shareholder value is evident through its consistent capital return programs. Albany International has a remarkable track record of paying an uninterrupted dividend for 20 consecutive years, a testament to its stable financial performance and dedication to its investors.

Further demonstrating this commitment, Albany International has actively pursued share repurchase initiatives. These buybacks not only reduce the number of outstanding shares, potentially boosting earnings per share, but also signal management's confidence in the company's intrinsic value.

- Financial Resilience: Maintained a strong balance sheet with increasing total assets despite revenue challenges.

- Consistent Dividend Payout: Delivered an uninterrupted dividend for 20 consecutive years.

- Shareholder Capital Return: Actively engaged in share repurchase programs to enhance shareholder value.

Albany International's dual-segment approach, focusing on Machine Clothing and Engineered Composites, provides a solid foundation. The Machine Clothing segment benefits from consistent demand in the paper and packaging industry, a market that showed resilience through 2024. Simultaneously, the Engineered Composites segment is well-positioned to capitalize on the ongoing recovery and expansion within the aerospace sector, with positive projections extending into 2025.

The company's extensive history, spanning over 130 years, has fostered deep expertise in materials science and engineering. This allows Albany International to develop highly specialized, performance-driven materials crucial for their clients' critical applications, setting them apart in competitive markets.

Albany International's global presence, with operations in 13 countries and approximately 5,400 employees as of late 2024, enables efficient service to a diverse international clientele. This widespread network supports adaptability to regional market nuances and reinforces their position as a key supplier.

A commitment to innovation is evident in their R&D efforts, including advancements in sustainable raw materials and pioneering technologies like 3D woven composites, positioning the company for future growth in advanced materials. Furthermore, their dedication to sustainability, detailed in published reports with emission reduction targets, aligns with global trends and can unlock new market opportunities.

Financially, Albany International maintains a robust balance sheet with growing total assets, demonstrating resilience. Their consistent shareholder returns, marked by 20 consecutive years of uninterrupted dividends and active share repurchase programs, underscore financial stability and a commitment to investor value.

| Metric | 2023 (Approx.) | 2024 (Projected/Early Data) | Key Trend |

| Total Assets | $1.5 Billion | Slight Increase | Financial Resilience |

| Dividend Payout Streak | 20 Years | 21 Years (Expected) | Shareholder Commitment |

| Global Facilities | 30 | 30 | Stable Operational Footprint |

What is included in the product

Delivers a strategic overview of Albany International’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical market vulnerabilities.

Weaknesses

Albany International has faced headwinds with revenue declines and margin compression in its recent financial performance. For instance, Q1 and Q2 of 2025 saw net revenue drops, impacting both Machine Clothing and Engineered Composites.

This downturn stems from various issues including softer demand in Asian markets and unexpected production interruptions. Furthermore, adjustments to the projected profitability of long-term contracts within the Engineered Composites segment have also played a role.

These combined factors have resulted in a notable decrease in operating income and a compression of gross margins, signaling a challenging period for the company's profitability.

Albany International's reliance on the paper and aerospace sectors presents a significant weakness. These industries are known for their cyclical nature, meaning their performance can swing widely with broader economic conditions. For instance, a slowdown in manufacturing or travel can directly impact demand for Albany's products.

The company's Machine Clothing segment, crucial for paper production, has experienced recent softness, indicating sensitivity to this industry's cycles. Similarly, challenges within specific commercial and space programs in its Albany Engineered Composites (AEC) division underscore the vulnerability to shifts and downturns in the aerospace market. In 2023, the paper industry faced headwinds, and while aerospace showed resilience, specific program delays can still affect suppliers like Albany.

Albany International's Engineered Composites (AEC) segment has encountered significant operational headwinds. These include underestimating costs for complex aerospace projects, difficulties in scaling up labor effectively, and negative adjustments to their projected profitability on these contracts, known as Estimate-at-Completion (EAC) adjustments. These issues directly affected the AEC segment's profitability projections.

The impact of these program-specific and operational challenges has been substantial. For instance, in the first quarter of 2024, Albany International reported that these AEC operational issues led to a $10 million negative impact on their operating income. This contributed to a wider-than-expected loss for the company during that period, highlighting the financial strain these weaknesses placed on the business.

Exposure to Raw Material Price Volatility and Supply Chain Risks

Albany International, like many manufacturers, faces inherent risks tied to the fluctuating prices of raw materials essential for its advanced materials and textiles. These cost swings can directly impact profitability if not effectively managed. For instance, the price of key inputs like synthetic fibers or specialty chemicals can be highly volatile, influenced by global commodity markets and geopolitical events.

The company's global manufacturing footprint, while offering advantages, also exposes it to potential supply chain disruptions. Events such as natural disasters, trade disputes, or logistical bottlenecks can impede the flow of necessary components, leading to production delays and increased costs. This interconnectedness means that a localized issue can have far-reaching consequences across Albany's operations.

- Raw Material Cost Sensitivity: Fluctuations in the cost of key inputs, such as petrochemical-derived fibers or specialized polymers, can significantly impact Albany's cost of goods sold.

- Supply Chain Vulnerability: Dependence on a global network of suppliers for specialized materials makes Albany susceptible to disruptions from geopolitical instability, transportation issues, or unforeseen events impacting production facilities elsewhere.

- Geographic Concentration of Suppliers: If a significant portion of critical raw materials is sourced from a limited number of suppliers or geographic regions, it amplifies the risk of supply chain interruptions.

Market Perception and Stock Performance Volatility

Albany International's stock has experienced considerable turbulence, with recent earnings misses contributing to a significant decline. For instance, the company's Q1 2024 results fell short of analyst expectations, leading to a notable drop in its share price, which touched a 52-week low in early May 2024. This negative market sentiment suggests investor confidence has been shaken, highlighting concerns about the company's short-term operational performance and its capacity to regain profitability.

The volatility in stock performance directly impacts market perception, creating a challenging environment for the company. Analyst downgrades following these misses further amplify this weakness. For example, several investment firms revised their price targets downwards in response to the Q1 2024 report, signaling a more cautious outlook from the financial community.

- Recent Earnings Misses: Q1 2024 earnings per share (EPS) of $0.45 missed the consensus estimate of $0.52.

- Stock Price Decline: Shares fell approximately 15% following the Q1 earnings announcement, reaching a 52-week low of $42.50 on May 6, 2024.

- Analyst Downgrades: Multiple analysts downgraded Albany International from 'Buy' to 'Hold' or 'Sell' in early May 2024.

- Investor Confidence: The market's reaction indicates a loss of confidence in the company's near-term execution and recovery prospects.

Albany International's reliance on cyclical industries like paper and aerospace creates vulnerability. A downturn in manufacturing or air travel directly impacts demand for its specialized products.

Operational challenges within the Engineered Composites segment, including cost underestimations and labor scaling issues, have led to significant negative impacts on profitability. For example, Q1 2024 saw a $10 million negative impact on operating income due to these AEC issues.

The company is susceptible to fluctuations in raw material costs and potential supply chain disruptions due to its global manufacturing footprint, which can affect production timelines and expenses.

Preview Before You Purchase

Albany International SWOT Analysis

This is the actual Albany International SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt that showcases the depth and structure of the full report. Once purchased, you'll gain access to the complete, detailed analysis.

Opportunities

The aerospace and defense sector is booming, with global defense spending projected to reach $2.4 trillion in 2024, according to recent reports. This surge, coupled with the ongoing recovery in commercial air travel, creates a significant opportunity for companies specializing in advanced materials.

Albany International is strategically positioned to benefit from this growth. Their advanced 3D woven composites are integral to critical defense applications such as hypersonic weapons and next-generation aircraft. Furthermore, the company benefits from a stable revenue stream through long-term contracts, including those for the CH-53K helicopter program, ensuring consistent demand for their innovative composite solutions.

Albany International's commitment to R&D, especially in 3D woven composite technology and sustainable materials, is a key opportunity. This focus allows for the creation of novel products and improved performance, directly addressing customer needs for eco-friendly solutions.

These technological advancements are poised to unlock new market segments, such as the burgeoning advanced air mobility (AAM) sector. By offering innovative materials that meet stringent performance and sustainability criteria, Albany can capture significant market share in these emerging industries.

Albany International has a history of growth through strategic acquisitions, notably the Heimbach Group acquisition in 2018, which significantly boosted its revenue. This demonstrates a clear strategy to expand market share and capabilities.

Future strategic acquisitions and partnerships present a significant opportunity for Albany International to diversify its product offerings and enter new, promising geographic markets. Such moves could also facilitate the integration of cutting-edge technologies, thereby strengthening its overall competitive standing in the global industrial fabrics sector.

Operational Efficiency and Digital Transformation

Albany International is actively pursuing operational efficiencies through digital transformation. A key milestone was the completion of their SAP S/4HANA upgrade in May 2025, designed to bolster analytics and streamline business processes. This initiative is anticipated to reduce operational bottlenecks and foster greater business agility, ultimately supporting margin stability.

Further investments are being channeled into developing their workforce. By focusing on frontline leader coaching and enhanced operator training, Albany International aims to directly impact key performance indicators. These programs are projected to significantly reduce scrap and rework rates, which are critical for improving profitability and securing future financial gains.

- SAP S/4HANA Upgrade: Completed May 2025, enhancing analytics and business agility.

- Frontline Leader Coaching: Targeted investment to improve leadership effectiveness.

- Operator Training Programs: Focused on reducing scrap and rework rates.

- Expected Outcomes: Margin stabilization and improved future profitability.

Sustainability-Driven Market Demand

Albany International is well-positioned to capitalize on the growing consumer and business demand for sustainable products. Their focus on eco-friendly solutions and reducing their carbon footprint directly addresses this trend, offering a clear competitive edge.

Developing more sustainable manufacturing processes and products is a significant opportunity. This aligns with the increasing market preference for environmentally responsible goods and services, allowing Albany International to differentiate itself and partner with clients on their own sustainability initiatives.

- Growing ESG Investment: Global ESG (Environmental, Social, and Governance) assets were projected to reach $50 trillion by 2025, indicating a strong investor appetite for sustainable companies.

- Customer Preference: Surveys in 2024 consistently show that a majority of consumers are willing to pay more for products from sustainable brands.

- Regulatory Tailwinds: Increasing environmental regulations globally create a favorable landscape for companies like Albany International that are already prioritizing sustainability.

Albany International's focus on advanced materials for the booming aerospace and defense sectors presents a significant growth avenue, with global defense spending expected to hit $2.4 trillion in 2024. Their innovative 3D woven composites are crucial for next-generation aircraft and hypersonic weapons, ensuring sustained demand. The company's strategic investments in R&D and sustainable materials are opening doors to emerging markets like advanced air mobility (AAM), positioning them to capture substantial market share.

| Opportunity Area | Key Driver | Albany International's Advantage | Market Data (2024/2025) |

|---|---|---|---|

| Aerospace & Defense Growth | Increased global defense spending | Expertise in 3D woven composites for critical applications | Global defense spending projected at $2.4 trillion (2024) |

| Emerging Markets (AAM) | Demand for lightweight, sustainable materials | R&D in advanced composites and eco-friendly solutions | AAM market expected to reach billions in the coming years |

| Sustainability Focus | Growing ESG investment and consumer preference | Commitment to eco-friendly products and processes | ESG assets projected to reach $50 trillion by 2025 |

Threats

Global economic downturns pose a significant threat to Albany International. A recession can directly reduce demand for their products in both the paper and aerospace sectors, translating to fewer orders and lower revenues. For instance, a slowdown in consumer spending often impacts paper demand, while a contraction in air travel or defense budgets directly affects aerospace component orders.

The inherent cyclicality of Albany's key markets amplifies this risk. Their financial performance is closely tied to broader economic cycles, meaning periods of economic expansion are crucial for growth, while downturns can lead to substantial revenue volatility. This sensitivity to macroeconomic trends requires careful financial planning and risk management.

Albany International faces significant competition in its core markets, especially within aerospace composites. Major rivals such as Hexcel Corporation, Solvay, and Toray Industries are actively developing new materials and processes, creating a dynamic and challenging landscape. This competitive intensity often translates into considerable pricing pressure, directly impacting Albany's profitability, particularly if competitors introduce more cost-effective alternatives or achieve greater production efficiencies.

Rapid advancements in materials science and manufacturing processes present a significant threat to Albany International. For instance, the development of novel composite materials or advanced additive manufacturing techniques could render their current paper machine clothing and technical textile products less competitive or even obsolete. Companies that fail to invest in and integrate these emerging technologies risk falling behind.

A key concern is the potential for product obsolescence if Albany International doesn't maintain a strong pace of innovation. Consider the textile industry's historical shifts; failure to adapt to new weaving technologies or material treatments has historically led to market share erosion. This necessitates continuous research and development to ensure their product portfolio remains relevant and superior to emerging alternatives.

Raw Material Cost Volatility and Supply Chain Vulnerabilities

Albany International faces significant threats from the fluctuating costs of key raw materials like specialty fibers and resins, which are crucial for its advanced textiles and composites. These price swings can directly squeeze profit margins. For instance, the price of key precursor materials can be influenced by global demand and energy costs, sectors that saw considerable volatility in 2024.

Furthermore, the company's reliance on a global supply chain exposes it to vulnerabilities. Geopolitical tensions, trade tariffs, and unexpected events such as natural disasters or port congestion can disrupt the flow of essential materials. This can lead to production delays and impact Albany International's ability to meet customer demand, a risk amplified by ongoing global trade uncertainties.

- Raw Material Price Sensitivity: Fluctuations in the cost of materials like high-performance polymers and specialty fibers directly impact Albany International's cost of goods sold and overall profitability.

- Supply Chain Disruption Risks: Vulnerabilities exist due to reliance on global suppliers for critical inputs, with geopolitical events and logistical challenges posing threats to timely material acquisition.

- Impact on Production and Delivery: Disruptions in raw material availability can lead to production slowdowns and delayed order fulfillment, potentially damaging customer relationships and revenue streams.

Program-Specific Risks and Contract Profitability Adjustments

Albany International's Aerospace & Defense (AEC) segment is particularly vulnerable to risks inherent in long-term contracts. Fluctuations in assumptions about future profitability, labor costs, material inputs, and scrap rates can trigger substantial negative adjustments to the Estimated-at-Completion (EAC) figures. This means that projects initially projected to be profitable could end up costing more than anticipated, directly impacting earnings.

Furthermore, the AEC segment's revenue and profitability are susceptible to disruptions in major aerospace programs. For instance, delays or outright cancellations stemming from critical customer-side issues, such as labor disputes or union negotiations, can significantly curtail expected sales and earnings. These external factors create a layer of uncertainty that management must actively navigate.

- EAC Adjustments: Negative EAC adjustments in the AEC segment can erode previously recognized profits on long-term contracts.

- Program Delays: Delays in key aerospace programs, potentially linked to customer-side labor negotiations, pose a direct threat to revenue streams.

- Input Cost Volatility: Unforeseen increases in labor, material, or scrap costs can negatively impact contract profitability assumptions.

Albany International faces threats from intense competition, particularly in the aerospace sector, where companies like Hexcel and Solvay are innovating. Rapid advancements in materials science, such as new composite technologies, could make Albany's current product offerings less competitive. Furthermore, the company's profitability is vulnerable to raw material price volatility, as seen with specialty fibers and resins, and disruptions to its global supply chain due to geopolitical tensions or logistical issues.

SWOT Analysis Data Sources

This Albany International SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry commentary, ensuring a thorough and reliable assessment.