Albany International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Albany International Bundle

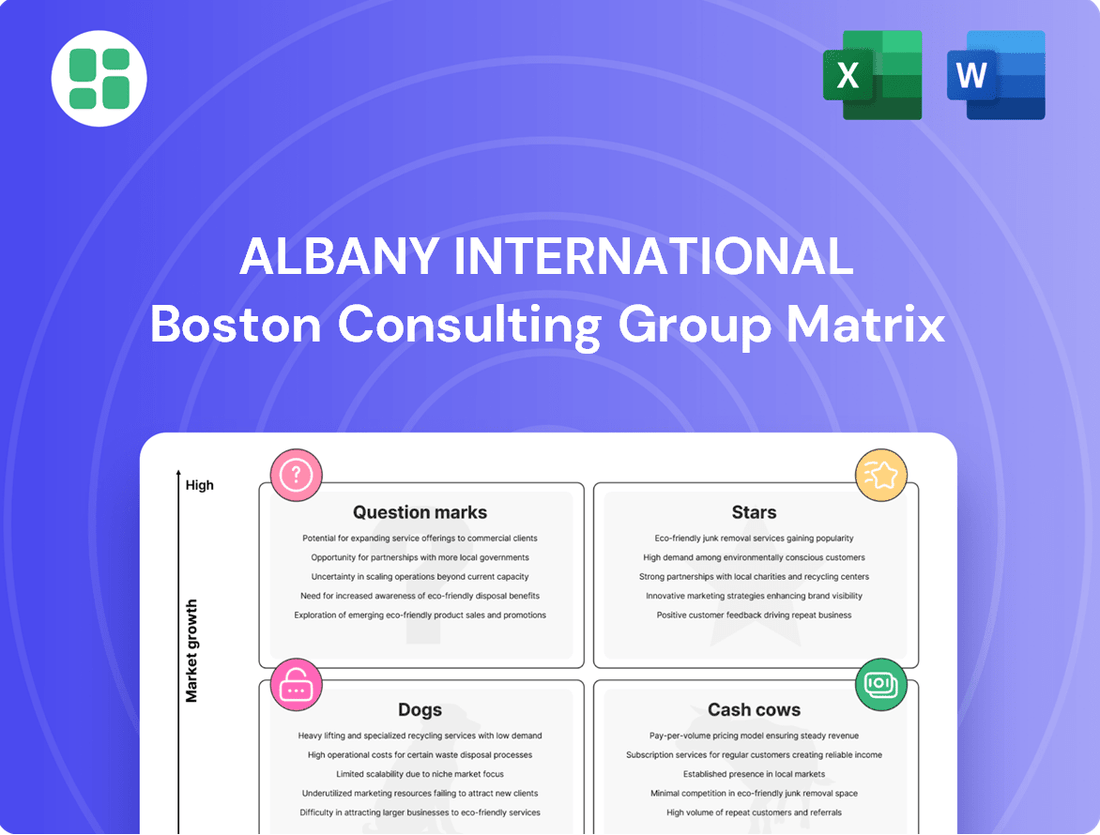

Curious about Albany International's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete BCG Matrix to gain actionable insights and a clear roadmap for optimizing their portfolio.

Stars

Albany Engineered Composites (AEC) is a significant player in the aerospace sector, focusing on high-performance composite structures. This market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) between 9% and 14.7% from 2025 to 2035, driven by the demand for lighter, more fuel-efficient aircraft. AEC's involvement in designing and manufacturing these critical components places it in a rapidly expanding industry.

Albany International's (AEC) involvement in high-profile programs like the CH-53K King Stallion and the recently awarded Bell 525 Relentless highlights its robust market standing. These programs represent significant long-term revenue streams, showcasing AEC's capability to secure and execute on substantial new business in demanding sectors.

The CH-53K, a heavy-lift helicopter for the U.S. Marine Corps, and the Bell 525, a new commercial medium-lift helicopter, both rely on advanced components from AEC. These contracts underscore AEC's critical role in supplying sophisticated materials for both defense and commercial aviation, contributing to a stable revenue base.

AEC is actively increasing production for these flagship programs. This ramp-up signifies a strategic commitment to growth within the aerospace and defense industries, reflecting confidence in the long-term demand for its specialized composite materials and engineered components.

Albany International's proprietary 3D woven composite technology stands out as a significant differentiator, offering a compelling alternative to conventional materials, particularly within the aerospace sector. This advanced capability is poised to address the growing demand for components suitable for emerging applications like hypersonics and Advanced Air Mobility (AAM).

The company's investment in this innovative technology provides a distinct competitive advantage, allowing Albany International to cater to the increasing industry need for components that are not only stronger and lighter but also more durable. For instance, the aerospace industry's push for fuel efficiency and enhanced performance directly benefits from these advanced composite solutions.

Focus on Operational Excellence and Innovation

Albany International's (AEC) focus on operational excellence and innovation is a critical component of its strategy, even amidst recent profitability headwinds. The company is channeling significant resources into improving its manufacturing processes and developing its workforce. These investments are designed to boost efficiency and prepare the company to scale its complex programs effectively.

This strategic push is about transforming how AEC handles its current projects, laying the groundwork for profitable growth as it secures new business. The emphasis on innovation isn't just about new products; it's about finding smarter, more efficient ways to operate. For instance, in 2023, AEC reported a 5.7% increase in capital expenditures, with a notable portion allocated to enhancing manufacturing capabilities and automation, signaling a commitment to long-term operational improvements.

- Investing in workforce development: AEC is enhancing skills to manage complex programs more efficiently.

- Boosting manufacturing capabilities: Investments are being made to improve efficiency and scale operations.

- Transforming execution: The goal is to make current portfolios more profitable and ready for new business.

- Long-term market position: This focus underscores a commitment to strengthening AEC's competitive standing through innovation.

Strong Backlog and Future Growth Potential

Albany International's Applied Engineering & Construction (AEC) segment is a strong contender within the BCG matrix, largely due to its robust backlog and significant future growth potential. The company has been consistently securing substantial new orders, which directly translates to considerable financial upside. For instance, as of the first quarter of 2024, Albany International reported a backlog of $1.2 billion for its AEC segment, a 15% increase year-over-year.

This sustained demand, coupled with proactive strategies to manage market fluctuations, places the AEC segment on a trajectory for accelerated expansion. Management anticipates continued robust growth in its AEC programs, with projections indicating a stronger performance in the latter half of 2025. This forward-looking outlook is supported by several key factors:

- Secured Orders: The AEC segment has a substantial order book, providing visibility into future revenue streams.

- Market Demand: Growing demand for the segment's offerings underpins its strong market position.

- Strategic Navigation: Initiatives are in place to effectively navigate market cycles, ensuring resilience and continued growth.

- Growth Projections: The company expects accelerated growth, particularly in the second half of 2025, driven by ongoing program expansions.

Stars in the Albany International BCG Matrix represent business units with both high market share and high market growth. Albany International's Applied Engineering & Construction (AEC) segment, particularly its aerospace composite solutions, fits this description. The company's proprietary 3D woven composite technology is a key differentiator, driving demand in a rapidly expanding aerospace market.

The aerospace sector is projected to grow significantly, with a CAGR between 9% and 14.7% from 2025 to 2035, fueled by the need for lighter, more fuel-efficient aircraft. AEC's involvement in major programs like the CH-53K King Stallion and the Bell 525 Relentless, coupled with its advanced technology, positions it as a Star.

The substantial backlog of $1.2 billion for the AEC segment as of Q1 2024, representing a 15% year-over-year increase, further solidifies its Star status. This indicates strong demand and a dominant market position, allowing for continued investment and expansion.

Albany International's strategic investments in manufacturing capabilities and workforce development are designed to support the scaling of these high-growth programs. This focus on operational excellence enhances its ability to capitalize on the opportunities presented by its Star position.

| Segment | Market Growth | Market Share | BCG Status |

|---|---|---|---|

| Applied Engineering & Construction (Aerospace Composites) | High (9%-14.7% CAGR 2025-2035) | High (Proprietary technology, major program wins) | Star |

What is included in the product

Albany International's BCG Matrix analyzes its business units by market share and growth, guiding investment decisions.

The Albany International BCG Matrix provides a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Albany International's Machine Clothing (MC) segment stands as the undisputed global leader in custom-engineered fabrics and process belts, vital components for paper, tissue, and paperboard manufacturing. This segment's products are consumables, meaning paper mills require ongoing replenishment to maintain operations, thus ensuring a steady and predictable revenue stream for Albany International.

MC's market dominance translates into a stable financial foundation. For instance, in the first quarter of 2024, Albany International reported that their Machine Clothing segment generated $175.5 million in net sales, highlighting its consistent contribution to the company's overall revenue despite broader market dynamics.

Albany International's paper packaging segment operates within a mature market characterized by stable demand. The global paper and packaging market is projected to grow at a compound annual growth rate (CAGR) of around 4.5% between 2024 and 2030, indicating a solid but not explosive expansion.

Albany's highly engineered fabrics are critical components in the paper production process, ensuring consistent demand for their products. This stability means less need for aggressive marketing or expansion capital, allowing the business to generate consistent cash flow.

The Machine Clothing segment is a cornerstone of Albany International's consistent revenue generation. In Q2 2025, it brought in $180.93 million, following $175 million in Q1 2025. This steady inflow of cash is vital for funding the company's other ventures.

Despite a slight year-over-year dip in Q2 2025, attributed to temporary regional demand softness and planned operational pauses, the core demand for this segment's products in packaging and tissue remains robust. This stability ensures a reliable cash flow, acting as a true cash cow for Albany International.

Resilience Amidst Market Headwinds

Albany International's Machine Clothing segment, a key Cash Cow, has shown remarkable resilience despite facing headwinds. In 2024, this segment continued to navigate challenges like decreased demand in Asia and unexpected equipment downtime at certain manufacturing sites.

Despite these hurdles, management actively optimized the global production footprint. This included strategic facility closures aimed at boosting efficiency and preserving profitability, underscoring the segment's focus on operational excellence.

The segment's performance was bolstered by a robust order flow in North America. Furthermore, early indications of a market recovery in Europe suggest the Machine Clothing division is adept at managing diverse regional economic conditions and maintaining its strong market position.

- Resilience in Machine Clothing: The segment demonstrated strength despite Asian demand dips and equipment downtime.

- Operational Optimization: Facility closures were implemented to improve efficiency and profitability.

- Regional Strength: Strong order flow in North America and recovery signs in Europe supported performance.

Strategic Acquisitions and Integration

Albany International's acquisition and subsequent integration of Heimbach Group significantly bolster its position in the Machine Clothing sector, reinforcing its status as a cash cow. This strategic maneuver is projected to yield substantial benefits, particularly in the latter half of 2025, by enhancing operational efficiencies and broadening the company's global footprint.

The integration is designed to sharpen Albany International's competitive edge, ensuring the Machine Clothing segment continues to be a reliable source of substantial cash flow. By combining forces, the company aims to leverage synergies that will drive profitability and market dominance.

- Market Leadership: Heimbach Group acquisition solidifies Albany International's leading position in the Machine Clothing market.

- Synergistic Benefits: Integration expected to accelerate efficiency gains and expand global reach from the second half of 2025.

- Competitive Advantage: Strategic move enhances the segment's ability to generate robust cash flow and maintain market strength.

Albany International's Machine Clothing segment consistently generates strong, stable cash flow, a hallmark of a Cash Cow. This segment benefits from its leading global position in engineered fabrics and process belts for paper manufacturing, a market with predictable demand for consumables.

The segment's financial performance in 2024 and early 2025 underscores its Cash Cow status, with substantial net sales contributing significantly to Albany International's overall revenue. For example, Q1 2024 saw $175.5 million in net sales from Machine Clothing, and Q2 2025 reported $180.93 million.

Despite facing some regional demand fluctuations and operational adjustments, the core demand for these essential paper production components remains robust. This stability allows the segment to operate with less need for aggressive investment, thereby maximizing its cash generation capabilities.

The strategic acquisition of Heimbach Group further solidifies Machine Clothing's market leadership and is expected to drive synergistic benefits, enhancing its role as a reliable cash generator for Albany International moving forward.

| Segment | 2024 Q1 Net Sales | 2025 Q1 Net Sales | 2025 Q2 Net Sales |

|---|---|---|---|

| Machine Clothing (MC) | $175.5 million | $175.0 million | $180.93 million |

What You See Is What You Get

Albany International BCG Matrix

The Albany International BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report designed for strategic decision-making.

Rest assured, the BCG Matrix report you see now is the exact file that will be delivered to you upon completing your purchase. It's a professionally crafted document, ready for immediate integration into your business strategy or presentations, without any need for further editing or revisions.

Dogs

Albany International's Machine Clothing segment has seen a noticeable dip in demand within the Asian market, directly impacting its overall revenue performance in the first half of 2025. This slowdown, particularly evident in Q1 and Q2, highlights a regional challenge that mirrors the 'Dog' quadrant of the BCG matrix.

While the entire Machine Clothing segment isn't a 'Dog', specific geographic pockets within Asia, characterized by consistently low demand and shrinking market share, are exhibiting these 'Dog' traits. This situation necessitates careful evaluation of resource allocation.

The persistent weakness in these Asian sub-markets, especially within publication and certain tissue/pulp paper grades, raises questions about future investment. Albany International may need to consider reallocating resources or even exploring divestiture options if a significant recovery in market share isn't achieved soon.

Within Albany International's Machine Clothing segment, older product lines catering to diminishing publication paper grades are now considered "Dogs" in the BCG matrix. These offerings, once pillars of the business, now exhibit low growth and low market share, reflecting a shrinking demand in their core markets. For instance, the global printing paper market saw a decline of approximately 4% year-over-year in 2023, impacting the relevance of these specialized machine clothing products.

Operational disruptions and unplanned equipment downtime at some Machine Clothing production facilities have recently hampered Albany International's performance. These issues can lead to increased costs and reduced output, directly impacting profitability.

Facilities that consistently struggle with inefficiencies, outdated technology, or high operational expenses, and are unable to achieve competitive efficiency levels, can be categorized as 'Dogs' within a BCG Matrix framework. These assets may drain resources without generating significant returns.

Albany International's strategic approach to optimizing its global production footprint, which includes commencing facility closures, demonstrates a proactive effort to manage these underperforming assets. This strategy aims to streamline operations and improve overall financial health.

Commercial and Space Programs with Reduced Activity (AEC)

Within Albany Engineered Composites (AEC), some commercial and space programs have seen a slowdown in demand, impacting the segment's revenue. These particular programs, if they hold a small market share in their specific area and are in markets with little growth or facing tougher competition, would fit into the Dogs category of the BCG Matrix. This means they might be using up resources without generating significant returns, suggesting a need to reconsider the investment in them.

For instance, if a specific aerospace component program within AEC, which historically represented a small portion of its overall revenue, now faces declining orders due to a shift in aircraft manufacturing or the emergence of new, more cost-effective materials, it could be a prime candidate for the Dogs quadrant. Such a scenario would reflect a low market share in a maturing or shrinking market segment.

- Reduced Demand: Certain commercial and space programs within Albany Engineered Composites have experienced a decline in customer orders and project pipelines.

- Low Market Share: These specific programs often operate with a relatively small share of their niche markets, making them vulnerable to competitive pressures.

- Limited Growth Prospects: The markets in which these programs compete are characterized by slow or negative growth, further hindering their potential for expansion.

- Resource Drain: Programs in this category may consume capital and management attention without delivering commensurate financial returns, necessitating a strategic review.

Programs with Persistent Negative EAC Adjustments

Albany International's AEC segment faces challenges with programs experiencing persistent negative Estimate-at-Completion (EAC) adjustments. This is particularly evident in complex, long-term aerospace contracts such as the CH-53K and F-35 programs. These adjustments signal higher-than-anticipated costs and a squeeze on profit margins.

If these cost overruns and profitability issues continue without effective mitigation, these programs could become 'cash traps'. This scenario would mean they consume capital without generating adequate returns, potentially hindering the company's overall financial flexibility. For instance, in 2024, the aerospace sector has seen increased material costs and labor shortages impacting project profitability across the industry.

- CH-53K Program: Experienced significant EAC adjustments due to technical complexities and extended development timelines.

- F-35 Program: Faced cost pressures related to production ramp-up and sustainment requirements.

- Impact on Portfolio: These programs, if unresolved, could represent 'cash traps' within Albany International's portfolio, diverting resources from more promising ventures.

- Industry Trend: The broader aerospace industry in 2024 has grappled with supply chain disruptions and inflationary pressures, exacerbating cost management challenges for complex defense contracts.

Within Albany International, specific product lines within the Machine Clothing segment, particularly those serving the declining publication paper market, are classified as Dogs. These offerings are characterized by low market share and low market growth, as evidenced by the global printing paper market's approximate 4% year-over-year decline in 2023.

Similarly, certain underperforming production facilities within Machine Clothing, struggling with inefficiencies and outdated technology, can also be viewed as Dogs. These units may consume resources without generating substantial returns, prompting strategic reviews for potential divestiture or closure.

In the Albany Engineered Composites segment, some commercial and space programs with limited market share in slow-growth sectors also fall into the Dog category. These programs might be resource drains, necessitating a careful assessment of future investment and potential reallocation of capital.

The CH-53K and F-35 programs within AEC, facing persistent negative Estimate-at-Completion adjustments due to cost overruns, could also be considered Dogs if profitability issues are not resolved. Such scenarios represent cash traps, diverting funds from more promising areas, a concern amplified by 2024 industry-wide pressures like supply chain disruptions and inflation.

Question Marks

Albany International views the Advanced Air Mobility (AAM) market as a key growth driver, projecting continued sequential quarterly expansion and robust demand extending through 2025. This sector is characterized by high growth potential, but Albany's current penetration is likely minimal, positioning it as a 'Question Mark' within the BCG matrix.

Significant capital allocation will be necessary for Albany to build its presence and secure a competitive position in this emerging and as yet unproven industry. For instance, the global AAM market was valued at approximately $8.2 billion in 2023 and is projected to reach $40.3 billion by 2030, growing at a CAGR of 25.5% during this period, according to some industry analyses, underscoring the substantial investment opportunity and the need for strategic commitment.

The defense sector's surge, especially in hypersonics and emerging programs, signals robust expansion for Albany International Corporation (AEC). This heightened activity is projected to drive accelerated growth, with defense spending anticipated to reach $886 billion in 2024, a notable increase from previous years.

While these advanced defense segments present significant growth opportunities, AEC's market share in these specialized, cutting-edge fields is likely still in its nascent stages. Developing and securing contracts in these areas demands considerable investment in research and development, alongside substantial capital outlays, indicating ventures with high future promise but uncertain near-term returns.

New space programs and next-generation commercial aircraft represent significant growth avenues for Albany International. The company is strategically targeting these sectors, utilizing its advanced composite materials expertise to secure new contracts.

These initiatives, while promising for future market leadership, require substantial investment and are currently cash consumers. Albany faces the challenge of competing with established aerospace giants for a meaningful share in these dynamic and often highly competitive markets.

Expansion into New Material Applications (Beyond Core)

Albany International's strategic focus on materials science and advanced processing opens doors to venturing into new application areas outside its established aerospace and paper sectors. These emerging opportunities, characterized by high growth potential but a nascent market presence for Albany, are positioned as question marks in the BCG matrix.

Such initiatives necessitate significant investment to assess their market viability and potential for widespread adoption. For instance, exploring advanced composite materials for the burgeoning electric vehicle market or specialized textiles for the medical industry could represent these question mark ventures.

- Exploration of new markets: Albany's R&D in advanced materials could target sectors like renewable energy components or specialized industrial filtration.

- Investment required: Significant capital will be needed to develop and scale production for these unproven applications.

- High growth potential: Success in these new areas could lead to substantial revenue diversification and market share gains.

- Uncertainty of success: The outcome of these ventures remains uncertain, requiring careful market analysis and strategic execution.

Strategic Digital Transformation Initiatives (e.g., SAP S/4HANA)

Albany International's strategic digital transformation, exemplified by its SAP S/4HANA upgrade completed in May 2025, represents a significant investment in operational backbone. This initiative, while not a direct product offering, is a high-cost, high-potential project crucial for future competitiveness.

The SAP S/4HANA implementation is designed to streamline analytics, eliminate operational bottlenecks, and boost overall business agility. These internal investments, though lacking immediate, quantifiable market share gains, are foundational for long-term efficiency and adaptability.

- Investment Focus: Digital transformation, including SAP S/4HANA upgrade (completed May 2025).

- Objectives: Enhanced analytics, reduced bottlenecks, improved business agility.

- ROI Uncertainty: High cost, high potential, but uncertain immediate ROI in market share.

- Strategic Importance: Critical for future operational efficiency and competitiveness.

Albany International's ventures into emerging sectors like Advanced Air Mobility (AAM) and new space programs are classic examples of 'Question Marks' in the BCG matrix. These areas offer substantial future growth potential, evidenced by the AAM market's projected growth to $40.3 billion by 2030. However, Albany's current market penetration is likely minimal, requiring significant upfront investment in research and development to establish a competitive foothold. The success of these initiatives hinges on strategic capital allocation and the ability to navigate nascent, often unproven, industries.

| Emerging Sector | Market Potential (Est. 2030) | Albany's Current Position | Investment Needs | Growth Outlook |

|---|---|---|---|---|

| Advanced Air Mobility (AAM) | $40.3 billion | Nascent/Minimal | High (R&D, production) | Very High |

| New Space Programs | Significant, varied | Nascent/Minimal | High (R&D, specialized materials) | High |

| Next-Gen Commercial Aircraft | Significant, varied | Developing | High (Materials, certifications) | High |

BCG Matrix Data Sources

Our Albany International BCG Matrix is informed by robust data, including company financial statements, industry growth forecasts, and market share analysis to accurately position each business unit.